MARKET OVERVIEW

The global fraud detection and prevention market and industry assure protection for businesses and individuals against fraudulent activities that impinge upon financial stability and data security. Digitalization has started to take over various industry landscapes, and consequently, fraud has become much more sophisticated, requiring advanced solutions capable of identifying and mitigating risks. This market provides the tools, technologies, and methodologies needed in the detection of unauthorized activities and preventing possible losses within industries, such as banking, insurance, healthcare, e-commerce, and government institutions.

The global fraud detection and prevention market also encompasses many broad services and solutions applicable to different types of fraudulent behaviour. Some of these can apply to areas like identity theft, payment fraud, cyberattacks, and account takeover. All these technologies-such as AI, machine learning, big data analytics, biometrics verification-have now become core methods in investigating anomalies and spotting suspicious activities. Using historical data analysis and user behavior modeling, the solutions now have remedial capabilities to notify organizations about potential threats swiftly, minimize damage, and prevent some financial losses.

This market is present and diversified along regional and industry lines to answer various questions raised by evolving fraudulent methods. Financial institutions are among the first to adopt fraud detection and prevention systems, given the volume of transactions they deal with and the sensitive nature of the data fit for fraud. E-commerce enterprises, too, count on these solutions to resolve payment fraud and protect their customers' information. The healthcare sector oftentimes is calculated as a target for its rich bounty of personal data, thus requiring very strong systems to avert the occurrence of data breaches and to curtail insurance fraud. All the systems of protection put in place, on another hand, are the ones through which government agencies take care of public funds and confidential information.

Real-time monitoring and proactive risk management have initiated an evolution within this global fraud detection and prevention market. This market remains well positioned to fight off emerging types of cybercrime, giving organizations the opportunity to counter rising threats well in advance of the technical innovations that could compromise their safety. Adoption of cloud solutions, with their scalable and affordable nature, is rising among organizations independently of their firm size. Integration of fraud detection tools into existing enterprise systems will enable organizations to consolidate their security measures while driving their business operations forward tactically.

Though possible, if we try to intertwine the concepts of the markets in digital fraud detection and prevention, one would be led down a path of barely gray recognition. The larger portion of this interconnection continues to develop with regard to AI programs and the algorithms running them being more sophisticated along with the introduction of faster techniques of real-time data analysis, enhancing identification accuracy and timely delivery of services on the threat horizon. The merging of interests involving private firms and concerned regulators will further tighten the noose around all kinds of fraud at the international level by fostering information sharing and coordinating responses to large-scale attacks.

Visits to the global fraud detection and prevention market will expand through pathways illuminated by technology and the increasing complexity of fraudulent activities. Wherever linkage or connectivity develops, businesses realize that they must develop sophisticated and adjustable security solutions to protect their interests. Innovations will keep on flowing into the market, putting companies across a spectrum of industries in a position to monitor, predict, identify, and respond to every threat so that their properties and names remain well-guarded. The frenzy for this subject reflects the significance behind a secured digital environment in this ever-connected world.

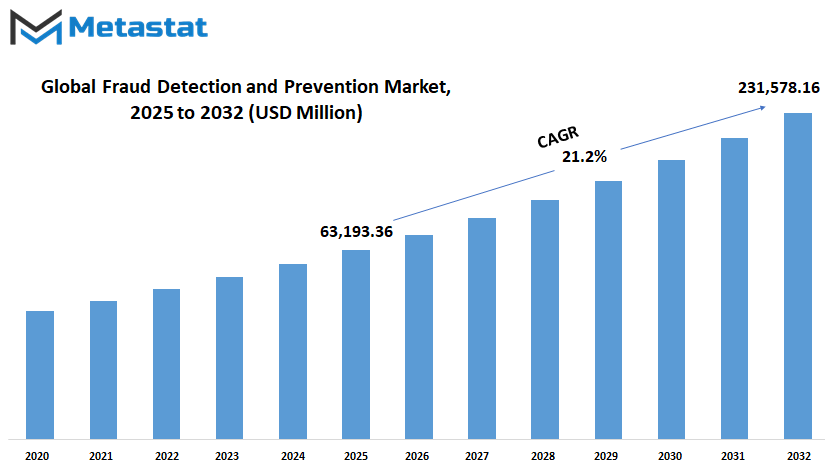

global fraud detection and prevention market is estimated to reach $231,578.16 Million by 2032; growing at a CAGR of 21.2% from 2025 to 2032.

GROWTH FACTORS

The global fraud detection and prevention market shall grow much larger in some upcoming years due to the technological changes and business requirements. An effective mass fraud detection system would require quite an extensive investigation with the increasing volumes of digital transactions. With the increase in the use of online payments and e-commerce, there is thus an increase in business risks relating to fraudulent activities. The urgency has arisen in solutions that can detect suspicious behavior rapidly and accurately along with safeguarding companies and customers from possible losses.

Advancements in AI and Machine Learning have provided yet another driving force for the growth of the global fraud detection and prevention markets. These technologies have entirely changed the manner in which businesses work towards defrauding them. AI systems employ complex algorithms to analyze the patterns and anomalies in tons of data in real-time, rapidly and accurately. Machine-learning algorithms then improve upon these experiences by detecting and responding to newer threats while minimizing false positives. Therefore, these fraud prevention techniques continue to be effective even amidst the change towards the evolving fraud tactics.

But they create some challenges as well with regard to which the market might experience a hindrance in growth. Shortage of funds required for the procurement, provision, and maintenance of high-end fraud detection solutions has been based as one of the biggest hurdles on which the market has been running. Considerable investments on development and deployment are usually the prerequisites for these high-tech systems, hence the barrier that they pose to some small and medium enterprises. Regulatory requirements around the countries have added another distraction for organizations. The costs and time needed to comply with such varied regulations would further impede the adoption of fraud detection technologies.

However, the above trends create a very positive opening through which the market can grow in future. The rapid increase in the adoption of blockchain technology is expected to create enormous improvements in anti-fraud security and transparency. Thanks to its decentralized architecture, blockchain stands as a technological wall that prevents malicious entities from forging or backtracking any data, thus making safe and dependable verification of transactions possible. If combined with the current fraud detection systems, blockchain could effectively eliminate data tampering and unauthorized transaction risks. Such progress is expected to energize more organizations seeking robust and reliable fraud prevention solutions.

The future global fraud detection and prevention market will progress with businesses atstrategizing to get effective methods of protecting their operations. Such drives of growth will include among other things the incrementation of online transactions and the sophisticated nature of fraud tactics, which will keep urging companies into adopting more progressive technology even when high costs and regulations remain a concern. However, the loss in terms of not investing in fraud prevention would still be much higher when weighted against the lower cost and longer response time. As the world turns increasingly towards various technologies such as artificial intelligence, machine learning, and blockchain, the growth of the market is seen to proliferate to open up new opportunities for innovative solutions and advancements for better protection against fraudulent behavior.

MARKET SEGMENTATION

By Component

The environment of the global fraud detection and prevention market will become very important in determining the future of security services and trust across industries all over the globe. As the business world faces digital expansion, transactions are going online from where fraud is becoming more sophisticated and rampant. To counter these evolving threats, businesses are implementing advanced systems that can identify potential fraudulent activity before it gets out of control and cause serious harm. Therefore, the growing need for such security has rapidly grown and invested in technologies for fraud detection and prevention.

Among the foremost and basic trends about this market are component-wise categorizations; these are solutions and services. Solutions bring technological life into the whole process of fraud detection and prevention. Solutions include advanced software using artificial intelligence, machine learning, and data analytics. These technologies help find odd patterns, carry on transactions in real time, and discover suspected threats with a very high degree of accuracy. In the face of even more sophisticated cyber threats, the solutions are destined to counterwith improved sophistication that will efficiently respond to the challenges at hand.

On the flip side of the picture, services hold an equally paramount importance in ensuring the effectiveness of these solutions. Services include consulting, system integration, and support that help organizations adopt and maintain fraud detection systems. Skilled professionals help guide organizations in making the appropriate tool selections, customizing it to the needs of the company, and keeping it upgraded against the latest threats. As fraud techniques are in a constant state of evolution, ongoing support and assistance will remain critical in helping businesses stay ahead of the game.

The trend in the global fraud detection and prevention market is set to continue on an upward growth path, as more organizations recognize the necessity of safeguarding operations. Digital banking, e-commerce, and online services expediting the transfer of data across the Internet gives the criminals an avenue of opportunity to exploit. It has now become paramount that fraud detection measures are robust. Cloud solutions and automated systems would probably drive the growth of this market, offering faster investment options to businesses regardless of size.

The combination of cutting-edge solutions and expert services will continue to enhance fraud prevention methodologies. Businesses will increasingly invest in technologies that not only detect suspicious activity but also predict potential threats before they arise. The expansion of this market will also push for collaboration between technology vendors and enterprises to create more potent and adaptable security systems.

Finally, the global fraud detection and prevention market will greatly assist in developing a safe digital environment. The blend of cutting-edge technologies with professional services ensures that businesses can conduct their affairs confidently, knowing their data and transactions stand protected against constantly evolving threats.

By Deployment Mode

With regard to the global fraud detection and prevention market, its significance will amplify as the pace of digitalization continues to increase. In fact, it is evident from the fact that the markets have evolved, and online transactions have generated a large amount of data sharing, thereby increasing fraudulent activities. Indeed, companies worldwide are already gearing themselves up to strengthen their systems in identification and prevention against the threats posed by these forms of transactions. As technology has become more advanced, so too have the skills employed by frauders, meaning it will keep creating a continuous demand for businesses with more innovative solutions. The global fraud detection and prevention market looks set to expand as companies invest in security and trust.

One of the major factors driving the growth of the market is the versatility in application deployed mode. Organizations can select the deployment based on their requirements of budget, infrastructure, and security needs. Still, the prevalent at this time for on-premises deployment option is mostly for organizations that want to have full control of their security systems. On-premise means the installation and maintenance of software within the company's servers, which would normally offer greater protection of data with customization features. However, one may need to invest quite heavily in real-time hardware and IT resources.

Flexible and cost-efficient, the Cloud has ever-increasing acceptance. Through this option, users can access security tools through the internet instead of having physical infrastructure. Hence, costs get reduced, and scaling becomes easier when there is an urgent need for additional services. Of course, there are different types of options under this category of cloud-based solutions. Software as a Service, a concept in which fraud prevention software is available as hosted by a third-party provider altogether responsible for updates and maintenance, is one example of such options. In general, private clouds offer special environments for one organization-only hosting, thus supplying better control and security. Public, on the other hand, offers wider usage of services shared with many businesses making them cheaper but less secure.

The hybrid model thus unifies the principles of on-premises and cloud-based systems. This allows companies to keep critical data on their own servers and use cloud-based databases for the remainder of their applications, thereby optimizing control, security, and scalability. Another alternative is hosted solutions, which include outsourcing the management of fraud detection systems to specialized providers.

As digital threats become more prevalent, the requirements for advanced fraud detection and prevention technologies will grow. Businesses will have to implement smarter, faster, and more flexible systems to keep up with evolving tactics. The global fraud detection and prevention market is expected to play a vital role in this area for companies in protecting their operations while maintaining customer trust. Various options are available for businesses to adopt their most effective way of deployment according to their specific needs. Security is an ever-growing market in a connected world, and consumption will stay on in the terms of salve demand that continues to growth.

By Application Area

The global fraud detection and prevention market is expected to see immense growth in the coming years owing to the increasing security measures demand ahead. Moving fairly ahead with technology, in terms of rapid development, the number of people carrying out online activities and making digital interactions has gradually increased; thus, both individuals and businesses are more vulnerable to different fraud types. Thus, the increasing demand to deliver these organizations and end-users with useful fraud detection and prevention systems has never been more focused. Different business sectors are realizing the vital importance of securing their systems, data assets, and finances, as well as customer trust.

One of the major application areas for this market is identity fraud. The online distribution of personal information is increasingly opening more doors to identity theft. Cybercriminals employ and develop newer and more sophisticated methods to steal sensitive information such as social security numbers, credit card details, and login credentials. There are a variety of ways by which these data can be misused for financial loss or damage to an individual's reputation. In line with this, new advanced setups with artificial intelligence and machine learning technologies are being developed to prevent all unnecessary access by identifying unusual activity.

Payment frauds are another of the major factors in the growth of this market. The much-famous e-commerce and digital payments expansion has proportionately increased the fraudulent transaction opportunities as well. Business institutions are investing in tools that identify fraudulent behaviors in real-time, analyzing transaction patterns. These would safeguard consumers and companies from monetary damage while sieving unauthorized purchases.

Money laundering is still viewed as a big issue in today's world, and fraud detection cannot be ignored in its fight against such crimes. By tracing and monitoring suspicious or sizeable transfers in financial transactions, the organization would detect attempts of camouflaging illegal-origin funds. advanced analytics supported by the automated monitoring system stand crucial in recognizing and sending alerts regarding such incidents before any damage occurs.

The area of insurance claims fraud is one of the examples where these solutions really come in handy. False claims and inflated reports can cause insurance companies to lose millions. By applying predictive analytics and automated verifying processes, companies can identify discrepancies in claims while minimizing the chances of fraudulent payouts.

Widening the scope of electronic payment fraud and banking transaction fraud goes side by side with innovations in the digital world. With the emergence of mobile payments and online banking, the prospect of further exploiting areas of vulnerability is heightened for cybercriminals. Behavioral analysis and biometric authentication help fraud detection systems to protect digital platforms evolved by Institutions. The early detection of computer system breaches is crucial, in which Cyber fraud is one of the biggest threats. Phishing attacks, malware, and ransomware are used to gain access to networks and steal data. A proactive approach to cybersecurity strengthens early breach detection and thus prevents expensive recoveries. The higher-tech the threats become, the market will need to keep jostling innovative developments for fraud detection and prevention to protect businesses and consumers.

By Industry Vertical

The global fraud detection and prevention market is expected to gain significant traction in the near future on account of increasing requirements regarding more security across different industries. Increased advancement in technology entails that the fraud taking place has devised more sophisticated approaches that impel companies and organizations to provide better tools and strategies to safeguard their operations from risks in this regard. Demand in the market is triggered by the need for innovative solutions that can be used quickly to identify and prevent fraudulent activities for both organizations and customers as a safeguard against potential losses.

Fraud detection and prevention assume different faces in different sectoral areas, depending on the nature of the specific problem confronting that sector. An example of this is the Banking, Financial Services, and Insurance (BFSI) sector, which shall primarily need fraud detection systems with a high margin of competence. This industry deals with huge volumes of sensitive financial data as well as high-valued transactions; thus, this sector is a prime target to commit fraudulent activities. Given the emergence of digital banking and onlines, the likelihood of cyber fraud usually increases. Hence, the demand rise in such advanced tools as real-time monitoring, behavioral analytics, and biometric verification is on the rise. Such technologies facilitate the identification of suspicious behavior and debar any possible breaches of financial institutions quite early.

The Retail and Consumer Packaged Goods sector is vital to the global fraud detection and prevention market. With e-commerce and digital payment methods coming into play, the retailers are faced with issues such as payment fraud, identity theft, and counterfeit products. Fraud detection systems help businesses monitor transactions, verify customer identity, and ensure product authenticity and therefore assure safety for shoppers.

Important components of fraud protection for the IT and Telecommunications sector include the protection of data and communication from interferences by fraud. Data breaches, network intrusions, and identity fraud are some of the threats that these companies are facing due to the intensifying digital networks and cloud-based systems. In such domains, the contribution of fraud detection tools by monitoring networks, spotting anomalies, and protecting user data cannot be overstated for the continued provision of secure and trustworthy services.

The Government and Public Sector has equally played a part in creating the demand for fraud prevention solution. Public institutions are dealing with enormous amounts of personal and financial data, rendering them susceptible to identity theft, benefits fraud, and cyber-attack. Fraud detection systems are implemented by governments to protect the information of their citizens and ensure the integrity of public service delivery.

Fraud is a concern in the Healthcare and Life Sciences sector. This sector deals with sensitive patient information and financial transactions, making it prone to schemes of insurance fraud, identity theft, and billing fraud. The advanced systems for detection will monitor claims, identity verification, and validation of the authenticity of medical services rendered.

The Travel and Transportation and Energy and Utilities industries also realize the importance of fraud detection and prevention. Digitalization threatens sectors with sabotage of infrastructure, ticket fraud, and unauthorized access to systems. Protecting these services with modern fraud prevention tools preserves their efficiency and safety.

As firms undergo digital transformation, the global fraud detection and prevention market will keep changing. The need for increasingly intelligent, rapid, and flexible solutions will spur innovation, thereby creating a pathway for industries to stay ahead of potential threats and provide secure environments for their customers and operations.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$63,193.36 million |

|

Market Size by 2032 |

$231,578.16 Million |

|

Growth Rate from 2025 to 2032 |

21.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

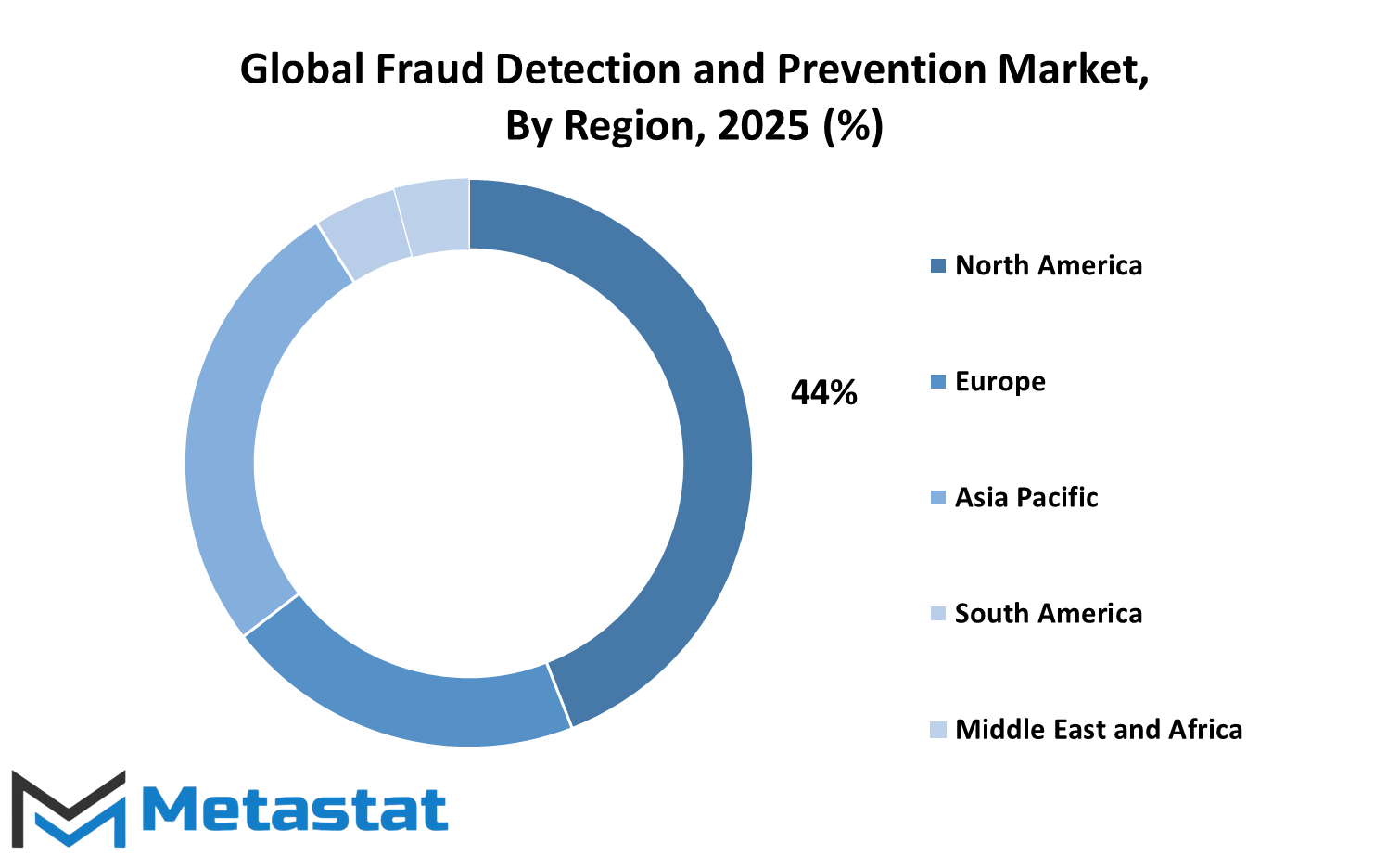

The global fraud detection and prevention market is in high demand because companies worldwide increasingly feel an urgent need to protect themselves from fraudulent activities. Technology develops and digital transactions proliferate, and fraud risk is gradually increasing, resulting in frequent upgrades of preventive measures. When examining the market from a geographic standpoint, the conclusion is that regions play divergent roles in mapping out its future. Technological advancement levels, regulatory environments, and economic conditions vary by region to impact the demand for innovation in fraud detection and prevention.

North America represents an important market growth factor. The advanced safety solutions uptake is growing in the U.S., Canada, and Mexico due to high digital transaction volume and strong regulatory frameworks. In this regard, the U.S. is particularly important because the presence of major technology and financial corporations encourages the establishment and deployment of advanced fraud prevention tools. Canada on the whole also supports the growing demand for these solutions through its emphasis on cyber-security and data protection laws. Mexico is now modernizing its digital infrastructure, creating an avenue for the adoption of fraud-detection technologies.

Europe also constitutes a major customer for such solutions, with countries such as the UK, Germany, France, and Italy still leading the market. The EU has given a major push with its stringently regulated data protection laws, such as the GDPR, which compel businesses to have better security and hence become a source of demand for fraud detection and prevention systems. Germany is more concerned with security because of its advanced industry sector and financial institutions, while fraud prevention systems in the UK require stronger tools around e-commerce itself. Furthermore, the growth of France's and Italy's digital economies and the rising awareness of threats to cybersecurity also factor into the demand dynamics.

In the Asia-Pacific region, enormous potential remains for further development in the global fraud detection and prevention market. Countries including India, China, Japan, and South Korea quickly digitalize their economies and expand online payment systems. Working against fraudulent activities, the rapid expansion of the e-commerce industry from China and the fintech sector from India calls for rigorous measures; on the other hand, technological advancement from Japan and high internet penetration from South Korea will bolster the adoption of such solutions. As digital transformation sweeps through this region, the need for advanced fraud detection tools will only intensify.

Brazil and Argentina lead the pack within South America regarding fraud detection solutions. With the growing applicability of mobile banking and digital payment solutions, these markets are also particularly prone to cybercrime, propelling companies to seek better security measures.

The Middle East and Africa region is also becoming promising in terms of future growth. Countries such as the GCC countries, Egypt, and South Africa are boosting their digital infrastructure and financial systems, enhancing the need for technologies to prevent fraud. The more the technology improves, the more security solutions would be increased as it already had a modern approach to evolving.

The very evolution of the global fraud detection and prevention market would rely on each region's actions against the growing threat of fraud propelled by technological innovations and by regulatory support in various areas of the globe.

COMPETITIVE PLAYERS

In the years to come, the global fraud detection and prevention market is on an escalating path toward growth as businesses and organizations keep prioritizing protecting their activities against fraudulent behaviors. Technology has advanced, and now with digital transformation, the fraud risk has increased. There are more financial transactions, data exchanges, and delivery of services into the digital realm. Therefore, the need for fraud detection and prevention, which calls for more advanced solutions, has grown. Companies worldwide are investing in innovations to be able to counter and adapt to the new threats evolving in their environment to identify suspicious activity early and intervene before damage occurs.

Sophistication in the various facets of emerging cybercrimes is a major contributor towards the growth of this market. Fraudsters always devise new ways of circumventing the vulnerabilities of systems, thus creating an important niche for businesses that need to employ the latest safety mechanisms. This has consequently led to a rapid growth in the demand for more on-demand solutions for real-time monitoring, analysis of the data per se, and risk assessment. AI and machine learning-based techniques are being used increasingly in this very domain, and their development brings a significant enhancement regarding the correctness and efficiency of fraud detection systems. Such technologies even provide an opportunity to recognize patterns and misalignments that would be an indication of certain fraudulent activities, which gives a higher chance for a rapid response to loss minimization.

The global fraud detection and prevention market can be expected to have tough competition as all major industry players will continue to innovate and ramp up their capabilities. Such companies include IBM Corporation, SAP SE, SAS Institute Inc., and ACI Worldwide Inc. as the top players in this industry providing advanced solutions for different verticals. These companies are heavily investing in research and development to improve their software as well as services making sure that their clients get all the tools covering types of fraud risks-to-problem. The expertise as well as advances in technology enables organizations to conduct business while protecting their environs and hence regulatory compliance.

Other exemplary market players include Fiserv Inc., Experian Information Solutions, Inc., and Fair Isaac Corporation (FICO). These enterprising companies contribute to the strong growth of the market with their rich experience focused on delivering data-centric solutions. By deploying data analytics and predictive modeling, they help firms in the fine detection of impending threats. In turn, other companies growing in risk management and financial security include LexisNexis Risk Solutions, NICE Actimize, Thales Group, and TransUnion. The confluence of their specialized methodologies and innovative tools helps tackle some segments of the many varied business challenges of various industries.

As the processes take place in this digital economy, the global fraud detection and prevention market would hold even more importance, i.e., with the changing face of cyber threats. Cooperation among competitive players and technology advancement will map the future of fraud prevention to ensure businesses run safely and confidently.

Fraud Detection and Prevention Market Key Segments:

By Component

- Solutions

- Services

By Deployment Mode

- On-Premises

- Cloud-Based

- Hybrid

- Hosted

- Software as a Service (SaaS)

- Private Cloud

- Public Cloud

By Application Area

- Identity Theft

- Payment Fraud

- Money Laundering

- Insurance Claims Fraud

- Electronic Payment Fraud

- Banking Transactions Fraud

- Cybersecurity Fraud

By Industry Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Retail and Consumer Packaged Goods

- IT and Telecommunications

- Government and Public Sector

- Healthcare and Life Sciences

- Energy and Utilities

- Travel and Transportation

Key Global Fraud Detection and Prevention Industry Players

- IBM Corporation

- SAP SE

- SAS Institute Inc.

- ACI Worldwide Inc.

- Fiserv Inc.

- Experian Information Solutions, Inc.

- Uplexis

- FICO (Fair Isaac Corporation)

- LexisNexis Risk Solutions

- NICE Actimize

- Thales Group

- TransUnion

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252