MARKET OVERVIEW

The Global Hardware Wallet market has turned out to be one of the financial technology industry's winners, positioned at the very core of digital asset security with the use of physical devices. These wallets ensure that there is intensive security for cryptocurrencies, which promise to assume main field dominance in the financial spectrum. Further integration of digital currencies into the contemporary financial systems in the near future is envisioned to skyrocket in demand for strong security solutions, rendering hardware wallets critically important to this ecosystem.

Hardware wallets store the private keys offline, thus drastically saving them from cyber-attacks and unauthorized access in order to access and manage cryptocurrency assets. Unlike software wallets that are vulnerable to malware and other hacking attempts, a hardware wallet is immune and thus protects your digital assets much better. This increased security assumes paramount importance when the number of transactions and the value of digital currencies grow.

Improvements in technology and growing concerns about cyber threats set the base for a very competitive market of hardware wallets. Given that blockchain technology underpinning cryptocurrencies is ever-evolving, the manufacturers of hardware wallets must equally evolve to thwart any possible security breaches. Future development regarding hardware wallet technology is supposed to involve advanced interfaces, high versatility with digital assets, and increased convenience without jeopardizing safety.

This would imply that the confidence of consumers in digital currencies will depend on how secure the underlying infrastructures are considered; thus, providers of hardware wallets are key to driving the level of trust in the cryptocurrency market. The more individuals and institutions adopt, the greater growth opportunities that can be felt directly in the hardware wallet market. Extensionally, financial institutions could adopt hardware wallets as part of the service package in a bid to woo clients who are interested in digital assets.

Equally, regulatory developments will continue to have an impact on the Global Hardware Wallet market. With governments and financial regulators beginning to prepare frameworks for digital currencies, so too will hardware wallets have to comply with new standards in this environment to safeguard the user and the stability of the markets. The regulatory environment will drive the design and functionality of hardware wallets going forward, in many instances requiring manufacturers' collaboration with regulatory bodies.

The future of the hardware wallet market is characterized by increasing competition and innovation. Fledgling contenders, just like well-established companies, will fight to give their products differentiation through unique features and more robust security features. Strategic partnerships or acquisitions could be sought by firms to further capabilities and reach larger markets.

Consumer education is another major driver in the hardware wallet market. With the growing audience in digital currencies, it becomes increasingly important to let users know how to keep their assets safe with hardware wallets. Effective marketing strategies and ease of use are very much required to be Rollie on rookie and experienced cryptocurrency users' radar.

The Hardware Wallet market seems to be in remarkable evolution because of technological development, movement of consumer demand towards secure storage of the digital asset, and a regulatory change stimulus in the market. Hardware Wallet providers are going to shape the future of the cryptocurrency space by putting security and user experience at the heart of their value proposition. It is hard to imagine there won't be a market for such devices in the development of an increasingly digital world for any individual to safeguard his digital wealth.

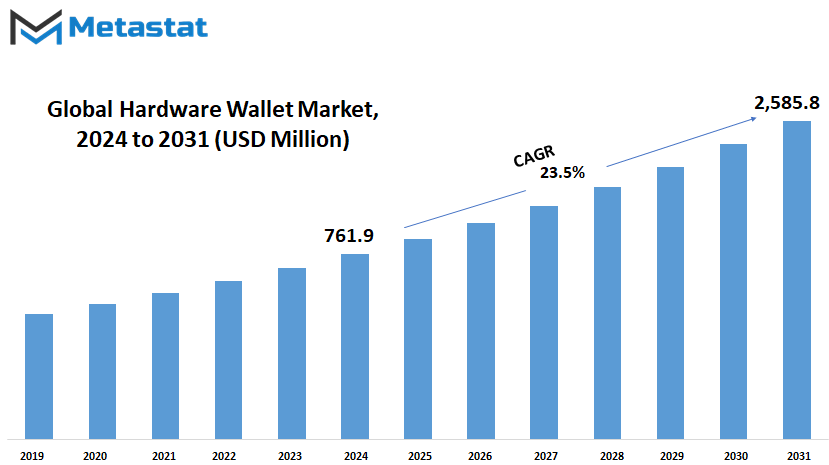

Global Hardware Wallet market is estimated to reach $2,585.8 Million by 2031; growing at a CAGR of 23.5% from 2024 to 2031.

GROWTH FACTORS

Below are several key important factors likely to boost the growth of the global hardware wallet market. One of the key important driving factors is the rising concern for cybersecurity and hence a reason for securely storing solutions. One will want these investments secured as the prevalence of digital assets in recent years has been high, and ownership can definitely be costly. Besides these, with digital investment, the digital currencies, in general, are seeing an increase in acceptance. People are getting increasingly aware of the need to safeguard their digital wealth, and hardware wallets provide a reliable method to do so. High initial cost may repel entry-level cryptocurrency users who are not fully ready to commit a decent amount of investment into security measures such as hardware wallets. In addition to these challenges, compatibility with several cryptocurrencies and sometimes usability can be a barrier to mass adoption. In these ways, there are several disadvantages to market growth, especially among users searching explicitly for more polished and indigenous solutions.

However, a hardware wallet has various possible opportunities for improvement and innovation, with one of the reasons being for creation in the user-friendly interface. Technological advancement should make hardware wallets more user-intuitive, with significantly enhanced ease of use, which will bring in a more extensive user base. Inclusion of additional features like biometric checks will help to make hardware wallets much more secure and user-friendly, thus covering the fronts of concern.

Over the next few years, we expect developments on the hardware wallets side to meet the abovementioned requirements: by upgrading integrated technology of advanced security and further simplifying user interfaces to ensure that hardware wallet use increases significantly. New users will flow in, and existing users of hardware wallets will also move to upgrade their devices; this will lead to an expansion of the market.

As this marketplace evolves further, security will have to be well balanced with usability. Users want strong protection for their digital assets without dealing with too much of an operational hassle. Manufacturers will be able to address both new and experienced investors in cryptocurrency by reaching this balance.

Going forward, the hardware wallet market is likely to experience competition amongst firms in their offerings of the best merging of security and user experience. This competition will lead to innovation in the production of more effective and user-friendly product ingenuity. Subsequently, hardware wallets will form a part of the indispensable digital asset ecosystem providing owners with confidence and security when interacting with digital assets.

Though there will be hurdles, the future of hardware wallets is really bright. The emphasis on the improvement of security features and usability will ensure that the market grows with the rapid adoption of cryptocurrencies and the overall demand for secure storage solutions. The development toward hardware wallets will keep them as an integral tool for the protection of digital assets during the proceeding digitalization of the world.

MARKET SEGMENTATION

By Type

As wide application of cryptocurrency is beginning, a huge market for global hardware wallets is about to be born. Hardware wallets refer to the wallets used for storing private keys, which are always offline and thus play a huge role in keeping digital assets safe from the internet. Fundamentally, digital wallets could be divided into two: hot wallets and cold wallets. Basically, the internet connection in a hot wallet allows easy access during transactions and thus is more suitable for everyday uses. At the same time, cold wallets are always offline to be safely used in cases of long-term storage with a considerable amount of cryptocurrency involved. As the digital currency continues to increase in terms of its adoption, so also will the demand for reliable and secure storage solutions continue unabated. Improved safety features are increasingly going to be more prevalent since every user of the wallet wants to be assured that their assets are safe from any cyber attack volatility. Hardware wallets will fill this gap.

Meanwhile, hardware wallet startups will focus on easier interaction interfaces and huge compatibility spectra including many cryptocurrencies. More manufacturers will add some extra thrilling features to make their products look appealing for more users, like biometrics-based authentication and integration with DeFi systems. All of the above-mentioned trends will bring cryptocurrency wallets easily accessible to people unfamiliar with the technology, which is going to boost the adoption of digital money.

Hardware wallets will also branch into products that raise a very strong issue with the need to fit all categories of clients. Hot wallets will progress further in mobile applications and real-time transactions integration. Cold wallets will become more compact, more user-friendly, and won't lose their characteristics in terms of safety, ensuring that different segments of users are catered for regarding security and convenience needs.

By Connection Type

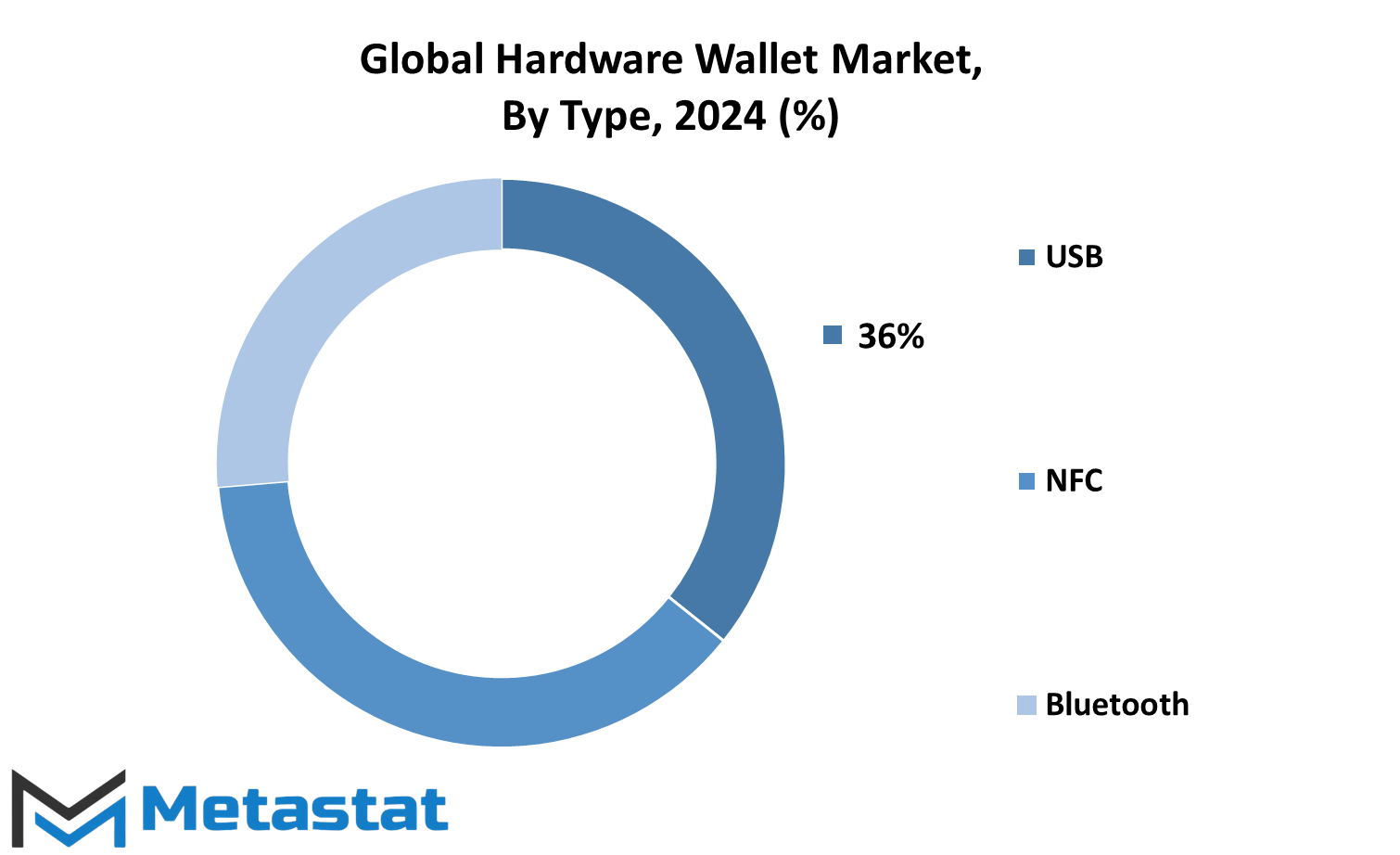

Because of new technology and increasing concerns for security in digital transactions, the global hardware wallet market is likely to grow at a fast pace in the next few years. Hardware wallets have earned a reputation through their tough-security features lately among cryptocurrency users. Further, it finds division into Near-field Communication, Bluetooth, and USB, based on the type of connection.

Bright prospects apparently exist for the hardware wallet market because of the emerging NFC technology. NFC-enabled hardware wallets are going to provide users with an easy and secure way of digital asset management. Tapping an NFC-enabled device for transaction authentication will be convenient and attractive to the tech-savvy, improving user experience and hastening adoption. NFC technology, with its fast and secure data transmission, has a vital role in the hardware wallet roadmap.

The other huge growth area will be hardware wallets with Bluetooth connectivity. The ability to go wirelessly with any device provides flexibility and usability for the users. With an increasing number of people wanting to be mobile and on-the-go with their digital assets management, this feature will soon become a necessity. It aids easy synchronization with mobile apps and offers real-time cryptocurrency portfolio access to the user. Increased innovation in Bluetooth-enabled hardware wallets to make them easier to use and more secure will be seen in the market.

USB-connected hardware wallets will not be phased out but will exist together as a trusted and convenient method to secure one's digital assets. This would appeal to users who seek simplicity and direct connectivity between the wallet and their computer. Even as wireless technologies make inroads, the share for USB wallets will remain substantial due to their tested security features and wide adoption rate.

With time, as the market begins to evolve rapidly, the emphasis will turn towards enhancing the security features. State-of-the-art encryption technologies will be embedded in the new generation of hardware wallets. This will safeguard its users from advanced cyber threats. Biometric authentication will grow in both fingerprint and facial recognition, therefore providing an extra layer of security. These innovations instill faith in users and facilitate further adoption of hardware wallets.

By End User

The global hardware wallet market will experience substantial growth in the coming years, driven by advancements in technology and increasing awareness about digital security. These wallets, which store private keys for cryptocurrencies offline, provide a higher level of security compared to other storage methods. As digital currencies become more mainstream, both commercial and individual users will increasingly adopt hardware wallets to safeguard their assets.

For commercial users, the future looks particularly promising. Businesses, especially those involved in cryptocurrency transactions, will prioritize secure storage solutions to protect their investments. As companies expand their digital asset portfolios, the demand for reliable hardware wallets will rise. The integration of these wallets into corporate systems will also become more seamless, allowing for smoother transactions and enhanced security protocols. Businesses will likely seek hardware wallets that offer multi-signature support, enabling more than one person to approve a transaction, thus adding an extra layer of security.

On the individual front, the appeal of hardware wallets will grow as more people invest in cryptocurrencies. With increasing reports of cyber-attacks and digital thefts, individuals will prioritize securing their digital assets. User-friendly interfaces and additional features, such as biometric authentication and enhanced recovery options, will attract a broader audience. Moreover, the trend of decentralization and self-custody will encourage individuals to take control of their financial security, further driving the adoption of hardware wallets.

By Distribution Channel

Hardware wallets are devices that provide a secure physical medium for storing digital assets such as cryptocurrencies. With a continuously evolving technology and increasing consumer demand for cryptocurrency storage solutions that are secure, the global hardware wallet market has a few changes in store. The broad distribution channels of these devices include online and offline channels, both having their unique benefits and long-term prospects. The online distribution channel of hardware wallets is expected to grow comprehensively in the near future.

Considering the trend of e-commerce and digital transaction, the online buying process of a hardware wallet provides ease and complete access to international customers. It enables consumers to compare different products sitting at home, read various reviews, and make informed decisions. Moreover, online sales are usually accompanied by constant promotions and discounts which may be more attractive for the buyers. Due to the necessity of hardware wallets for storing cryptocurrencies, it may be assumed that their online market will expand; users will receive a wider choice and improved buying experience. The other offline distribution channel, involving physical retail stores, is equally přesvědčne. In the event that a customer was to buy a hardware wallet in a brick-and-mortar shop, he would have the ability to take it home immediately and receive hands-on assistance from staff on the ground.

This could therefore be especially desirable for those who like hands-on experience or people that are new to cryptocurrency and have questions or concerns about a hardware wallet. As more and more people get educated with regard to securing their digital assets, demand for the wallet in-store increases, hence making more retailers wanting to carry these devices.

REGIONAL ANALYSIS

The geographical segmentation of the hardware wallet market makes up a vast, diversified landscape of growth and innovation. One of the prominent regions is North America, including the USA, Canada, and Mexico. North America, dominated by the United States itself, has the most solid technological infrastructure, coupled with a high early adoption rate for cryptocurrencies. The reason this region is expected to continue domination in the future is that the well-established and strong financial ecosystem is coupled with interest in secure digital asset storage. These key geographies in Europe include the UK, Germany, France, and Italy. This region is going to show growth with the help of a strong regulatory framework and wide-scale acceptance of blockchain technology. Further, the emphasis on data security and privacy regulations is likely to boost demand for hardware wallets, which places the region as an important market in the future.

It encompasses countries like India, China, Japan, and South Korea, which are the fastest-growing markets. Improving technology and high growth in the number of cryptocurrency users shall definitely lead to exponential growth in the hardware wallet market across such countries. With huge populations of tech-savvy people, China and Japan have already become huge markets for this method. Government initiatives aimed at promoting blockchain will further enhance its prospects for growth under this channel. Hardware wallets will also be significantly adopted in South America, largely in Brazil and Argentina. The instability of the economy and uncertain currencies in this respect will attract people to digital currencies, further raising their demand for facilities providing safe storage facilities.

With more and more people looking out for solutions to manage digital assets reliably, the hardware wallet market in this region would grow manifold. Gradual growth to be seen in Middle East & Africa region including GCC Countries, Egypt, South Africa itself. The adoption of blockchain technology and cryp-tocurrencies is nascent but is expected to gather momentum. Countries in the GCC have invested massively in technology innovation and diversification of their economies, and this will turn out to be one of the major drivers for the market. South Africa also shows growth in terms of awareness and adoption rates of digital currencies, hence providing impetus to the growing demand for hardware wallets.

Each region of the global Hardware Wallet market would be showing different opportunities and challenges during the forecast period while exhibiting optimistic growth prospects. Optimization of technology, further growing awareness, and adoption of cryptocurrencies, would help boost the market growth. As more people and institutions start to look toward secure and reliable digital asset storage solutions, the demand for hardware wallets will grow, thus securing their role in shaping the future of digital security and asset management. Geographic diversity secures wide spectrum growth, making the hardware wallet market one of the most essential constituents of the global financial ecosystem.

COMPETITIVE PLAYERS

The global hardware wallets market is expected to grow at a rapid rate in the coming future, with the market impetus coming from growing cryptocurrency adoption and the consequent demand for safe storage. Key players in this industry, including Ledger SAS, Satoshi Labs SRO, ShapeShift, Coinkite Inc., Coolbitx Ltd., Shift Crypto AG, Penta Security Systems Inc., ARCHOS, BitLox, ELLIPAL Limited, OPOLO SARL, Sugi, Trezor, KeepKey, SecuX, D'CENT, Keystone, formerly Cobo Vault, SafePal, Eidoo, and Taurus, have pointed activities toward technology strengths and market expansion opportunities.

One of the industry pioneers, Ledger SAS, is forecasted to continue ruling the market owing to its innovative line of products and strong security features. Since users are slowly turning to cryptocurrency, it is likely that Ledger will increase its hardware wallet offerings by meeting developing security standards and user needs.

This will also be contributed to significantly by Satoshi Labs SRO with its very well-recognized wallets riding on a reputation for reliability and user-friendly interfaces under the brand Trezor.

This competition will further drive both companies to even better and much more secure hardware wallets. Another important market player, ShapeShift, will probably make good use of the wallet integration feature in order to provide frictionless experiences between different cryptocurrency platforms, thus ensuring high interoperability. This, therefore, is expected to be one of the major selling points in the near future as people seek more convenience in the management of their digital assets. Coinkite Inc. and Coolbitx Ltd. are also likely to continue innovating aggressively in respect of improving wallets' resilience—both physically and in the form of better security features to sustain physical and cyber threats. Very likely, Shift Crypto AG and Penta Security Systems will focus more on the security provisions that wallets can provide in order to give users a feel-good factor while storing their assets and using them in everyday life.

ARCHOS and BitLox serving niche markets with specialized solutions for different segments of users. ELLIPAL Limited and OPOLO SARL will increase their global presence to effectively carry the products to the fingertips of users worldwide. Sugi and SafePal will just be pocket-friendly with the security angle intact, thus attracting a far bigger audience from among the new users of cryptocurrencies.

Differentiation in the offerings will further come out in terms of unique features and user experience created by KeepKey, SecuX, D'CENT, Keystone, formerly Cobo Vault, Eidoo, and Taurus to get various tastes and requirements within the market. It is through this competitive nature of players that innovation and adoption in HW wallet market can be accelerated. This will be a way of boosting safety, manageability, and the user-friendliness of cryptocurrency. Hardware wallets are several decades away from being a standard component of daily financial transactions; these few but key players will keep supporting everyday transactions with new innovations. Therefore, consumers are going to benefit by having a wide range of secure, reliable, and user-oriented choices for hardware wallet options.

Hardware Wallet Market Key Segments:

By Type

- Hot Wallet

- Cold Wallet

By Connection Type

- Near-field Communication

- Bluetooth

- USB

By End User

- Commercial

- Individual

By Distribution Channel

- Online

- Offline

Key Global Hardware Wallet Industry Players

- Ledger SAS

- Satoshi Labs SRO

- ShapeShift

- Coinkite Inc.

- Coolbitx Ltd.

- Shift Crypto AG

- Penta Security Systems Inc.

- ARCHOS

- BitLox

- ELLIPAL Limited

- OPOLO SARL

- Sugi (zSofitto NV)

- Trezor

- KeepKey

- SecuX

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252