MARKET OVERVIEW

The global mobility-as-a-service (MaaS) market is poised to undergo change that far exceeds transportation ease of use. As the industry moves increasingly into digital integration, its impact will reach deep into the manner in which city planning, data utilization, and infrastructure policy are decided in the near future. The idea is no longer present merely as a mechanism to bundle ride-hailing, public transport, and bike-sharing into one platform; instead, it is shifting towards redefining mobility's perception, consumption, and regulation on a worldwide level.

In the course of the next ten years, the global mobility-as-a-service (MaaS) market will start to shape choices that affect city design, green compliance, and personal habits. Mobility will no longer be regarded as a linear journey from point A to point B but will be a fluid aspect of everyday life an experience maximized by real-time information, user choice, and environmental objectives. The emphasis will move from vehicle ownership to time ownership because people will require solutions that minimize mobility friction and align with lifestyle values and environmental values.

The global mobility-as-a-service (MaaS) market will start to overlap more intensely with industries historically outside of transportation as well. Insurance, retail, adverting, and even healthcare could become integrated into future MaaS platforms, providing users not just with mobility but also with value-added services wrapped around habits and individual needs. Picture a platform that not just traces your path but also optimizes travel times based on your state of health or incorporates loyalty programs that reward green mode of transport. These changes will transform mobility into an individualized digital environment that behaves as a lifestyle concierge, intensely interconnected with behavior data and artificial intelligence.

Policy making will also embark on a new journey. Governments and regulatory authorities will increasingly work with private mobility providers to overcome the challenges of congestion, emissions, and accessibility. The MaaS global market will no longer function at the margin of policy but instead become part of the policy-molding center. Local transportation systems will maybe be replaced by dynamic and data-driven models that change pricing, traffic patterns, and service levels in response to demand and sustainability objectives. This collaboration between private innovation and public regulation will enable cities to respond more quickly to population increases and changing demographics.

Another path the industry will evolve on is the repurposing of physical space. Parking lots, fueling stations, and traditional transit centers could be replaced by multi-use mobility stations with electric charging, package delivery lockers, and real-time transit information. The global mobility-as-a-service (MaaS) market will be responsible for turning underutilized or inefficient land into intelligent infrastructure zones dedicated to meeting broader community needs beyond merely travel.

As technology continues to advance in digital wallets, blockchain, and decentralized identity verification, these will further reinforce the security and trust aspects of the MaaS experience. This would promote adoption in even more areas, especially where technology trust is an impediment. Briefly, the global mobility-as-a-service (MaaS) market will become a driving force for society redesign redefining not only how we travel, but how we live, interact, and co-create for a sustainable and efficient tomorrow.

Global mobility-as-a-service (MaaS) market is estimated to reach $67,480.86 Million by 2032; growing at a CAGR of 31.8% from 2025 to 2032.

GROWTH FACTORS

The global mobility-as-a-service (MaaS) market is constantly progressing towards the future of market facility, connectivity, and user empowerment. With the expansion of cities and migrating to urban areas, the demand for smarter, more efficient transport systems becomes rapidly important. The answer is coming in the form of MAAS platforms that are obtaining favor by providing consumers with a smooth means of planning, booking and paying for various methods of transport using single platforms to consumers. These systems integrate various services such as ride-sharing, public transport, bike sharing, and others in a single, streamlined experience that is today compatible with the rhythm of life.

One of the strong drivers for this change is smart city planning. Governments and city planners are trying to produce houses that reduce less crowds, reduce emissions, and increase transportation. MAAS integrates comfortably with these purposes, especially individuals themselves seek the option of the owner of personal transport. On-demand dynamics feature especially appeal to passengers, students and tourists who prefer more flexibility than fixed routes or timetables. As a result, the MAAS platforms are not only becoming a luxury, but an essential reply to the daily travel problem.

Even with this promising trajectory, the global mobility-as-a-service (MaaS) market is confronted with a few setbacks. Data privacy is a major issue. Users tend to be unwilling to provide third-party apps with their location and travel history, particularly when transport operators are multiple. Regulated regulatory rules also differ between regions, leading to a patchwork of policies that can make it challenging for providers to scale rapidly. These problems can also impede movement, particularly in regions where coordination among private operators and public transport authorities is poor.

The other challenge is minimal public infrastructure integration. For MaaS to function seamlessly, modes of transport need to be properly connected something that most cities are still far from delivering. If bus networks and metro services, as well as last-mile connectivity, are not integrated, the consumer experience is short of what MaaS has to deliver. Without such options at each point during the journey, such that they are efficient and accessible, the system becomes disjointed, driving users to old ways of movement.

Nevertheless, growth opportunities are robust, particularly with new technologies coming into play. Self-driving cars are set to have a significant impact on remaking MaaS with affordable and reliable mobility solutions not reliant on human motorists. Their eventual inclusion is likely to enhance operating efficiency and create opportunities where human-driven fleets won't be viable. Developing markets, meanwhile, offer vast possibilities. Such areas are mostly without established transportation networks, and as a result, MaaS operators can implement flexible systems from the beginning without the necessity of revamping aging infrastructure.

In the next few years, the fortunes of the global mobility-as-a-service (MaaS) market will be a function of how effectively it evolves to satisfy users while solving issues of trust, regulation, and coordination. With more players moving in and technology advancing, the sector will probable transition from a niche idea to an integral component of city transportation systems globally.

MARKET SEGMENTATION

By Type

The global mobility-as-a-service (MaaS) market is constantly progressing towards the future of market facility, connectivity and user empowerment. With the expansion of cities and migrating to urban areas, the demand for smarter, more efficient transport systems becomes rapidly important. The answer is coming in the form of MAAS platforms that are obtaining favor by providing consumers with a smooth means of planning, booking and paying for various methods of transport using single platforms to consumers. These systems integrate various services such as ride-sharing, public transport, bike sharing, and others in a single, streamlined experience that is today compatible with the rhythm of life.

One of the strong drivers for this change is smart city planning. Governments and city planners are trying to produce houses that reduce less crowds, reduce emissions, and increase transportation. MAAS integrates comfortably with these purposes, especially individuals themselves seek the option of the owner of personal transport. On-demand dynamics feature especially appeal to passengers, students and tourists who prefer more flexibility than fixed routes or timetables. As a result, the MAAS platforms are not only becoming a luxury, but an essential reply to the daily travel problem.

Even with this promising trajectory, the global mobility-as-a-service (MaaS) market is confronted with a few setbacks. Data privacy is a major issue. Users tend to be unwilling to provide third-party apps with their location and travel history, particularly when transport operators are multiple. Regulated regulatory rules also differ between regions, leading to a patchwork of policies that can make it challenging for providers to scale rapidly. These problems can also impede movement, particularly in regions where coordination among private operators and public transport authorities is poor.

The other challenge is minimal public infrastructure integration. For MaaS to function seamlessly, modes of transport need to be properly connected something that most cities are still far from delivering. If bus networks and metro services, as well as last-mile connectivity, are not integrated, the consumer experience is short of what MaaS has to deliver. Without such options at each point during the journey, such that they are efficient and accessible, the system becomes disjointed, driving users to old ways of movement.

Nevertheless, growth opportunities are robust, particularly with new technologies coming into play. Self-driving cars are set to have a significant impact on remaking MaaS with affordable and reliable mobility solutions not reliant on human motorists. Their eventual inclusion is likely to enhance operating efficiency and create opportunities where human-driven fleets won't be viable. Developing markets, meanwhile, offer vast possibilities. Such areas are mostly without established transportation networks, and as a result, MaaS operators can implement flexible systems from the beginning without the necessity of revamping aging infrastructure.

In the next few years, the fortunes of the global mobility-as-a-service (MaaS) market will be a function of how effectively it evolves to satisfy users while solving issues of trust, regulation, and coordination. With more players moving in and technology advancing, the sector will probable transition from a niche idea to an integral component of city transportation systems globally.

By Application

The global mobility-as-a-service (MaaS) market is slowly transforming the way people and merchandise are moved between two points. Since smartphones have become an essential gadgets in people's lives, users now demand transport to be more integrated, comfortable and flexible. MAAS consolidates various methods of transport-such as riding-sharing, public transport, bicycle rental, and car rent-in a single digital platform. This allows consumers to reserve and organize schedule, reserve and organize for various methods of transport by using an app. With more urbanization and traffic jams, more individuals will resort to MAAS as a sensible option that is time and effort.

Daily commuting will be one of the most practical applications of Maas. Whether he is going to college or is a professional title to work, many people will use the MAAS platforms to find the fastest, the cheapest, or the most comfortable way to travel. Depending on just one mode of transport, users suit the best on any day. For example, one can reserve a shared car at the metro stop and then travel by train in the office. All this will be taken care of in the same platform, including real-time information and alternative routes in the event of a delay.

MaaS will also make travel to and from airports smoother. Airport transport generally involves switching between buses, taxis, or having someone drive you in. With MaaS, passengers will have a more structured method of scheduling their trips in advance or receiving instant choices as per their arrival or departure time. It would benefit tourists as well, who can receive local modes of transport without any confusion, even in unfamiliar cities. This would ensure passengers feel secure enough to venture out without fear of being lost or paying exorbitant charges.

In transport-scarce regions, particularly at the first or last part of a trip, MaaS will fill the gap. For example, after removing a train, a user may still need a short journey to go home. Using MAAS, they can find an on-demand shared rickshaw, e-bike or shuttle that serves the last mile. This easy solution will make public transport more effective and available to all, especially in areas where stand-alone solutions have not worked well.

Long-distance intercity transportation will also be achieved, in which people are looking for more economical and trouble -free means to move themselves from the city to the city. Instead of toggling between various websites to reserve buses, trains, or taxis, the users will use a platform that offers joint booking and customized traveling journey. This will eliminate the stress of coordinating different transport timings for users and make cross-city journeys easier to manage. Companies will make use of this as well, particularly logistics.

Another area of significant growth within the global mobility-as-a-service (MaaS) market will be freight and parcel delivery. Companies are constantly seeking quicker and more dependable means to transport merchandise. Streaming freight capabilities into MaaS systems will allow for real-time management of deliveries as well as enhanced route optimization. Whether it's a neighborhood shop providing groceries or a delivery company handling same-day deliveries, MaaS will provide greater control and avoid delays that are not necessary. It will also provide greater opportunities to small vendors and gig workers by connecting them to an expanded system of demand and supply.

Leisure travel and tourism will also shift. Guests simply prefer to explore an area without the hassle of driving or determining public transportation. With MaaS, they are able to view local sites, reserve guided transport, or view accessible eco-friendly rides all from a single app. It will promote sustainable tourism and decrease traffic pressure in areas visited by tourists.

As cities become smarter and more connected, the global mobility-as-a-service (MaaS) market will significantly determine how individuals will move. Not only will it provide smoother modes of transport but also decrease congestion on the roads, pollution, and carbon emissions. In the future, it will be less about vehicle ownership and more about having access to secure transport when necessary. With convenience, flexibility, and well-planning, MaaS will facilitate the transformation of daily travel behavior.

By End User

The global mobility-as-a-service (MaaS) market is progressively defining the mindset regarding transportation. With the perception of ownership of individual cars, it is no longer attractive to many, especially urban inhabitants, the increasing number of individuals is moving towards flexible and accessible methods of travel. At the forefront of this change, there is a growing demand for user-centered services that support convenience, strength and stability. MAAS platforms are being created to provide bundle solutions where customers can plan, book and pay for different methods of transport using single app. This is not just a technical change; It is about reconsideration of people's role in daily life.

Given how the global mobility-as-a-service (MaaS) market segments are used, it is clear that Maas is not exclusive to a particular type of user. Individual consumers are an important group, especially living in cities where the owner of the car is often more troublesome than it is worth it. They look for options that are quick, accessible, and do not require maintenance or parking responsibilities. For corporate customers, MAAS employees open new ways to manage transportation, reduce the cost of the company and support stability targets. This benefits large outfits that want to reduce their carbon footprints but provide reliable transport solutions to employees.

Government departments and cities are also adopting MaaS platforms for enhanced urban mobility as well as minimizing traffic problems. As climate change and congestion become an increasing concern, public authorities are discovering benefits in promoting shared mobility, more efficient public transportation integration, and decreased car dependency. Travelers constitute a significant segment since they typically need to move around easily without knowing the local area. MaaS apps provide hassle-free travel, particularly to unknown cities where language or system variations can be a hindrance.

Students and schools are a younger, technology-oriented group that appreciates convenient, value-for-money travel. Because this demographic is budget-conscientious, easy access to public transportation, bike-sharing, or ride-hailing from one portal is not only convenient but frequently a necessity. Lastly, the elderly and mobility-impaired are becoming increasingly taken into account as MaaS solutions expand. Accessibility options or door-to-door assistance tailored for their requirements are becoming increasingly prevalent. This flexibility not only extends the potential user group but also indicates how mobility systems will keep evolving in response to actual human needs.

The global mobility-as-a-service (MaaS) market will not remain static. As cities grow and citizens demand greater convenience, demand for intelligent, connected transport services will increase. The emphasis will be placed more on personalization and fairness, so that no user group will be left behind. For daily commutes, special needs, or trip planning, the future of MaaS will probably be dictated by how effectively it can cater to a broad spectrum of users in useful, practical terms.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$10,358.26 million |

|

Market Size by 2032 |

$67,480.86 Million |

|

Growth Rate from 2025 to 2032 |

31.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

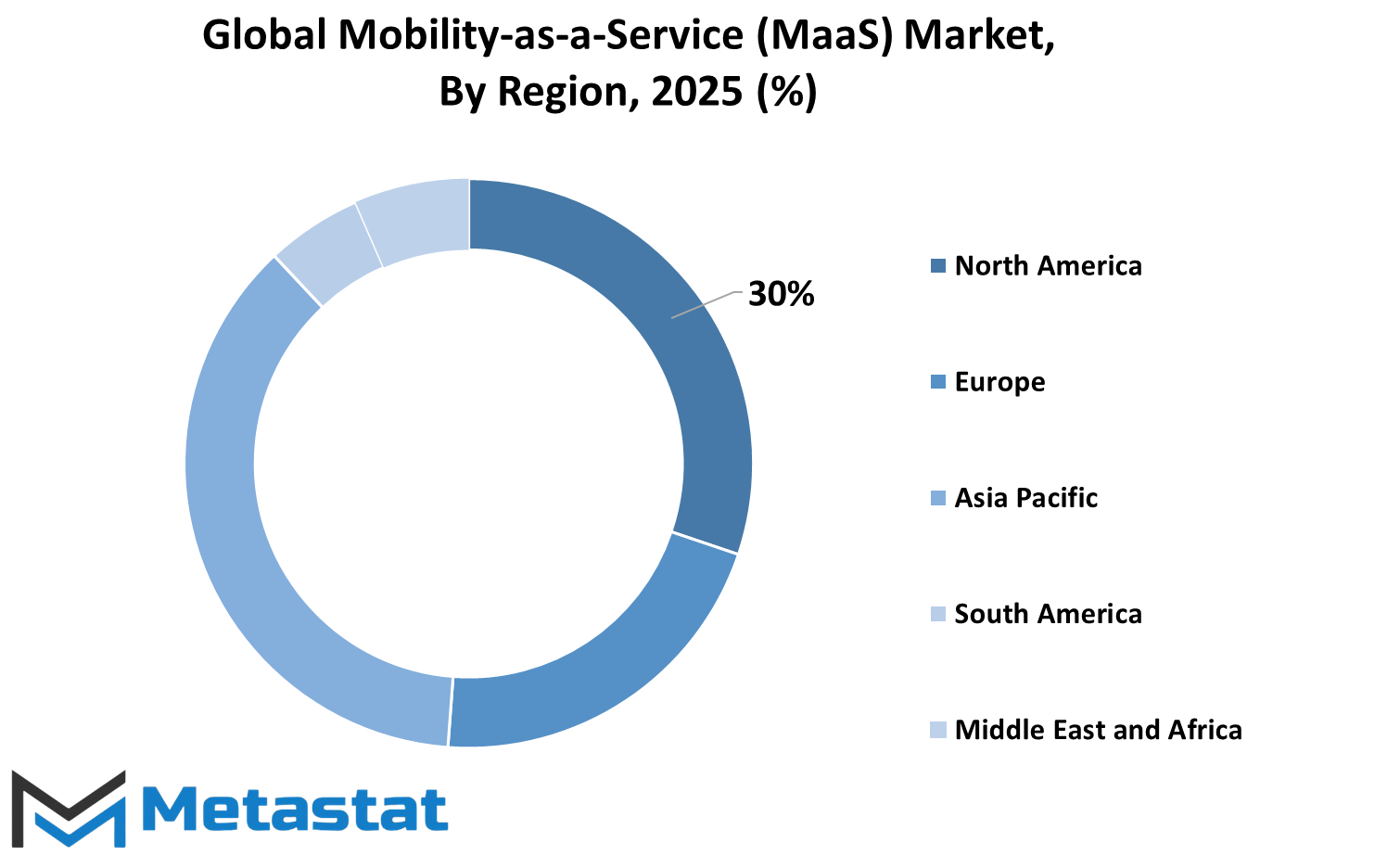

The global mobility-as-a-service (MaaS) market continues to grow in various regions of the globe, influenced by local advancements, user trends, and transport infrastructure. Geographically, the market is segmented into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. The role of each of these regions differs in the way MaaS solutions are embracing and emerging.

In North America, the mobility-as-a-service (MaaS) market is divided further into the U.S., Canada, and Mexico. The U.S. is likely to continue being a driving force behind MaaS expansion because of its increasing urban populations, technological innovation, and smart city project investment. Canada is also gradually adopting MaaS platforms, and its cities are increasingly taking an interest in integrated transport systems. Mexico, as yet emerging in this area, has potential as demand increases for making daily journeys more convenient and affordable.

The UK, Germany, France, Italy, and the Rest of Europe make up Europe. It has led the way with MaaS development, particularly in nations with well-developed public transport networks. The UK and Germany are among the prominent ones, backing policy that encourages sustainability and minimizes car use. France and Italy are also busily consolidating several transport services into one integrated digital platform to enable commuters to plan, book, and pay in one seamless motion across modes. The rest of Europe is following suit, particularly as environmental objectives gain increasing urgency.

Asia-Pacific includes India, China, Japan, South Korea, and the Rest of Asia-Pacific. The mobility-as-a-service (MaaS) market indicates some of the most rapidly expanding demand for MaaS, with drivers in population density and a very strong emphasis on innovation. China and Japan are top with their high-tech environment and urban mobility issues, which lead governments and private sector companies to launch scalable MaaS models. India is expected to adopt flexible and inexpensive models to address demand from growing middle class, with its quick urbanization. South Korea is also actively embrace technology within its public transport, increasing access and ease of use.

In South America, the mobility-as-a-service (MaaS) market includes Brazil, Argentina and the rest of South America. In this region, the city is beginning to look at the MAAS solutions to deal with traffic congestion and disabilities in the public transport system. Brazil has started a head with pilot programs in main urban areas, and Argentina is carefully looking at a similar way. Although infrastructure and investment can still be underdeveloped, growth capacity is strong, especially mobile penetration.

The Middle East and Africa sections include GCC country, Egypt, South Africa and the rest of the Middle East and Africa. GCC countries such as UAE and Saudi Arabia are aggressively running smart city programs that adjust MAAS integration. Egypt and South Africa are also considering the benefits of MAAS as the issues of urban mobility become rapidly clear. Although the adoption rate may vary between different regions of this continent, but there is a ever increasing demand for contemporary transport solutions.

Each region provides its own unique combination of challenges and opportunities for the global Maas market. Europe has a comprehensive spectrum of preferences and levels of progress in the International MAAS map, from the developed transport infrastructure of Europe to the rapidly developed urban environment of Asia-Pacific. This variety of geography will affect the way the market development is affecting the development of the market, in which providers must tailor their services to accommodate and expect local requirements.

COMPETITIVE PLAYERS

The global mobility-as-a-service (MaaS) market is slowly redefining the concept of transportation. Rather than depending on private cars or independent modes of transport, MaaS consolidates several transport services in one simple-to-use platform. It aims to simplify commuting by integrating public and private transportation modes such as buses, trains, ride-hailing, and bike-sharing into a unified service that users can navigate through an app. As technology is increasingly woven into the fabric of everyday life, so too will the appeal for such effortless travel grow.

Behind this revolution are a number of companies forging the future of urban mobility. Among the leading players are Moovit, Free Now, PaymentGenes, SkedGo, IRU, Transdev, Siemens Mobility, Mobimeo, myCicero Srl, SYSTRA, and T-Systems International GmbH. These companies are not merely providing transportation they're building platforms that allow individuals to better plan, reserve, and pay for their trips on various modes of transport. Through the emphasis on convenience and connectivity, they're eliminating the daily commuting irritations.

One cannot overlook the contribution of data, artificial intelligence, and intelligent infrastructure in this evolution. These technologies will keep making the planning of trips quicker and more dependable. As an example, users can get real-time recommendations for the fastest route, considering traffic, service disruptions, or even individual taste. This level of customization, driven by technology, will define how users engage with transport systems.

Even though private cars remain ubiquitous in most areas, newer generations are demonstrating a desire for more convenient, affordable, and sustainable means of transport. It will motivate cities and organizations to spend more on MaaS platforms. It's not about eliminating cars it's about simplifying transport, making it more integrated, and more in tune with contemporary lifestyles.

As MaaS develops, government, private sector, and local transport operator collaboration will become increasingly vital. Regulations will probably have a significant role to play in determining the range and benefits of such services, making them accessible, safe, and reasonable for everyone. The transport future will not be constructed by one business or one solution, but through collaborative activity to accommodate shifting travel needs.

Over the next few years, the global mobility-as-a-service (MaaS) market will be transitioning from being an idea to being a day-to-day service. With leadership from companies and increased public enthusiasm, MaaS is poised to revolutionize how we travel in cities and beyond fewer worries, more choices, and better decisions.

Mobility-as-a-Service (MaaS) Market Key Segments:

By Type

- Public MaaS Platforms

- Private MaaS Platforms

- Hybrid MaaS Platforms

- OEM-led MaaS Platforms

- Aggregator-based Platforms

- Transport Authority-led MaaS Platforms

By Application

- Daily Commuting

- Airport Transfers

- First & Last Mile Connectivity

- Tourism & Leisure Travel

- Long-distance Intercity Travel

- Freight & Parcel Delivery Integration

By End User

- Individual Consumers

- Corporate Clients

- Government Agencies & Municipalities

- Tourists

- Students & Educational Institutions

- Elderly & Mobility-Impaired Users

Key Global Mobility-as-a-Service (MaaS) Industry Players

- Moovit

- Free Now

- PaymentGenes

- SkedGo

- IRU

- Transdev

- Siemens Mobility

- Mobimeo

- myCicero Srl

- SYSTRA

- T-Systems International GmbH

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252