MARKET OVERVIEW

The global automotive aftermarket market today relies heavily on behavioral subtleties that extend beyond traditional maintenance and repair. As newer cars become loaded with sophisticated features, the infrastructure of replacement and value-added services has expanded both in breadth and depth. The added complexity in car architecture today demands that aftermarket players stretch their abilities, modifying not just their inventories but also their delivery infrastructures. This transition is a sign of greater maturity in the market where longevity, performance, and digital integration come together. The data presented in the context of Metastat Insight's report introduces this shift with candor, observing how players within the industry are coming to terms with the evolution.

The latest report issued by Metastat Insight reveals the broad scope and dynamic currents of the global automotive aftermarket market. This thorough research casts a broad net over the various aspects of the business, inferring relationships between consumer culture, local trends, and technology adoption within an ever-growing supply environment. With increasing pressure on manufacturers and service providers alike to move to accommodate changes in ownership patterns of vehicles and replacement intervals for parts, the report rises to the challenge of reducing these advances to a readable account. It is not only a question of who's selling and who's buying, but what they're seeking, how it's being brought to them, and why some segments are outperforming others in ways that go against historical norms.

Demand from consumers increasingly hinges on convenience, personalization, and digitally facilitated transactions. The garage is no longer an exclusive keeper of the importance it once held in ensuring vehicle health. Rather, Web sites, mobile diagnostic capabilities, and in-home service products are emerging to fill the needs of a population increasingly accustomed to instant solutions. Behind this revolution is the manner in which product availability is being reengineered. Warehouses are merging predictive logistics. Retailers are adopting data-driven inventory management. Manufacturers, for their part, have to project requirements not months but moments down the road. These changes, though subtle, are carefully recorded in the new perspective set by Metastat Insight on the global automotive aftermarket market.

Regional factors also have a powerful tug on the form and responsiveness of the aftermarket. The buying habits in highly urbanized areas do not reflect those of regions where car ownership is still a function of utility rather than comfort. Likewise, the lifespan of vehicles on the road changes widely, determining the frequency and nature of aftermarket services needed. The larger socio-economic context determines the pace at which or at which rate such tendencies spread between borders. The report in question deftly outlines these variations without flattening them to generalizations, evoking a textured image of how diverse and locale-dependent the market really is.

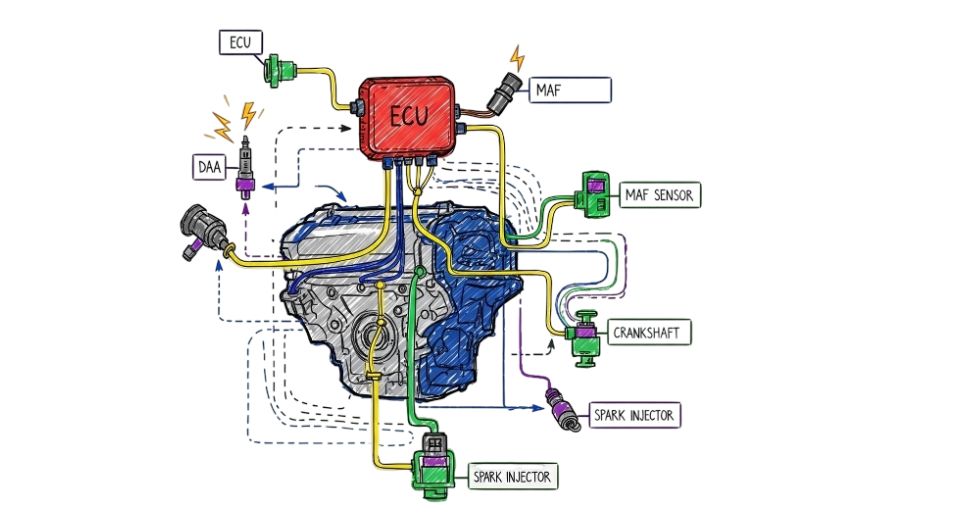

Innovation within the aftermarket seldom heralds itself in glory. It rather infiltrates workflows, value chains, and the consumer facing interface silently but convincingly. The report's methodology in recording these subtle changes is to be appreciated as it provides insights into topics such as additive production of spare parts, telematics integration for forecasting services, and AI usage for failure mode understanding. In the process, it brings the discussion from mere analysis of supply and demand to meaningful consideration of how intelligence is transforming intervention.

Brand loyalty, previously a bedrock of auto service choice, is changing. User experience and accessibility are taking over long-term allegiances. A customer today is less likely to go back to a particular service provider out of habit and more likely to pick based on current value. This evolving attitude is an expression of wider societal shifts towards openness, online participation, and speed of delivery. It also compels service providers to reconsider how trust and continuity are established and sustained. Metastat Insight view of this transformation is based on hard facts, presenting an investigation of what strategies vendors are embracing to stay relevant.

No less interesting is the evolving composition of the aftermarket workforce. As systems grow more sophisticated and diagnostics increasingly digitized, the set of skills needed to succeed in this market is changing significantly. The positions that were previously the purview of hands-on technicians increasingly require hybrid skills, where mechanical skill is coupled with software proficiency. Models of training are also changing, with modular learning and micro-certification gaining traction. The report provides an inside glimpse at how companies are adapting internal capacity to address such demands without compromising the spirit of their service culture.

Lastly, the cultural and emotional aspect of car ownership continues to shape the global automotive aftermarket market in subtle but unmistakable ways. Whether through vehicle customization or environmentally responsible modifications, consumers increasingly seek to align transportation decisions with personal values. This behavioral observation puts a human twist on the technical and economic considerations made throughout the report, reminding readers that behind this business is a person looking for reliability, identity, and expression through their automobile decisions.

In conclusion, the comprehensive report issued by Metastat Insight on the global automotive aftermarket market not only captures the operational and structural nature of the industry but also relates those observations to wider narratives of transformation. It transcends statistical abstraction, providing readers with a rooted understanding of where the industry is and how it is going forward to meet the forces at work both internally and at large. From this perspective, the report is an essential guide for anyone trying to comprehend this business not in snapshots but as part of a dynamic unfolding.

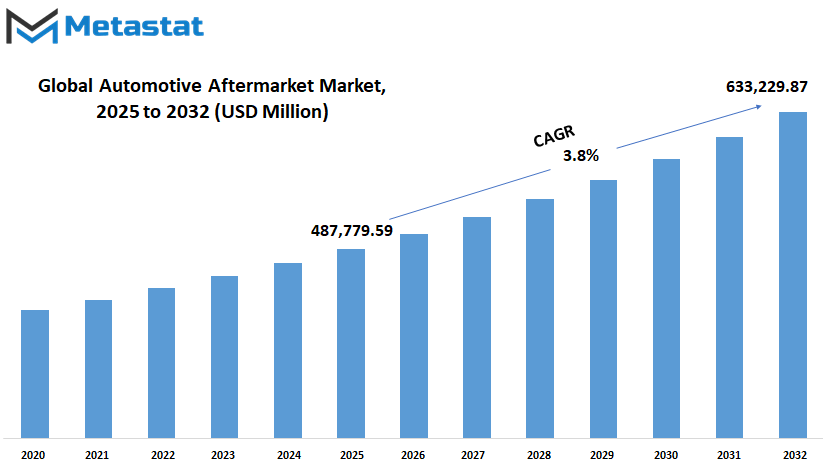

Global automotive aftermarket market is estimated to reach $633,229.87 Million by 2032; growing at a CAGR of 3.8% from 2025 to 2032.

GROWTH FACTORS

The global automotive aftermarket market is expected to see steady growth in the years ahead. This growth will be driven by several key factors. First, the rising number of vehicles on the road, especially in developing countries, will increase the demand for replacement parts and maintenance services. As more people own cars, the need to repair and maintain them regularly also grows. Alongside this, the average age of vehicles is increasing. Many people are keeping their cars for longer periods, which naturally leads to a higher need for parts, tires, batteries, and other components that wear out over time.

Another important growth factor is the growing awareness among car owners about the importance of regular maintenance. With better access to information and more online platforms offering auto services, customers are more likely to invest in their vehicles' upkeep. E-commerce is also playing a major role. The ability to buy auto parts and accessories online, often at lower prices and with easy delivery, has changed how people interact with the aftermarket. This has made it easier for small garages and even individual car owners to find and buy what they need quickly.

However, there are a few challenges that could slow this market’s growth. One of them is the rise of electric vehicles. EVs generally have fewer moving parts and require less maintenance compared to traditional gas-powered cars. As more people switch to electric cars, the demand for certain parts may decline. Another challenge is the increasing use of advanced technology in cars. Newer models often have complex systems that can only be serviced by authorized centers, which limits opportunities for independent repair shops and small businesses.

Still, there are several promising opportunities. One of the most exciting possibilities lies in the use of smart technology. As cars become more connected, service alerts and part replacement notifications can be sent directly to the owner or service center. This can improve efficiency and encourage timely repairs, benefiting the entire market. In addition, rising disposable incomes in some parts of the world will allow more people to invest in premium parts and custom accessories for their cars.

Looking ahead, the global automotive aftermarket market is likely to keep evolving to meet the demands of a more connected and informed customer base. As technology and vehicle use continue to shift, the market will adapt, creating new chances for growth and innovation.

MARKET SEGMENTATION

By Replacement Parts

The global automotive aftermarket market is expected to grow steadily over the coming years. This market includes all products and services used in vehicles after the original sale, mainly focused on keeping cars running smoothly and safely. As more people depend on vehicles for daily transportation, and as car ownership increases worldwide, the demand for replacement parts and vehicle maintenance continues to rise. Drivers are keeping their cars longer than before, which leads to more frequent repairs and part replacements, creating a strong need for reliable aftermarket support.

In the future, the market will be shaped by both technology and the habits of car owners. Replacement parts remain the most active segment. These include tires, batteries, brake parts, filters, body parts, lighting and electronic components, wheels, and other essentials. Each of these parts plays a key role in the overall performance and safety of a vehicle. As vehicle designs become more advanced, especially with the growth of electric and hybrid models, these replacement parts will also need to adapt. For example, batteries will likely become more powerful and long-lasting, while lighting and electronic components will need to support smarter, connected systems.

Tires will remain one of the most frequently replaced parts, especially as driving conditions and weather vary widely around the world. As electric vehicles gain popularity, brake parts will evolve too, with systems that recover energy during braking requiring different designs and materials. Filters will be improved to handle newer engines and environmental standards, while body parts may shift toward lighter but stronger materials. Wheels will also keep changing to support new driving styles and road conditions. All these shifts will require aftermarket suppliers to stay ahead by producing reliable, easy-to-install, and cost-effective options.

Technology will not only change the parts themselves but also how they are purchased and installed. Many customers will choose to buy parts online, comparing prices and reviews before visiting a mechanic or doing it themselves. This means the global automotive aftermarket market will likely see more direct-to-consumer models and mobile services. In addition, data from vehicles will help both car owners and service providers better predict which parts need replacing and when, reducing breakdowns and improving safety.

Looking forward, the market will continue to grow as vehicles become more complex and last longer. With a wide range of parts needing constant updates, the demand will remain strong, driven by innovation, convenience, and the global push for safer and cleaner transportation.

By Certification

The global automotive aftermarket market will continue to change as new technology shapes the way vehicles are maintained and repaired. As cars become more advanced, the demand for replacement parts and services will grow in different ways. This shift will not only influence what kinds of parts are used but also how people choose them. In the coming years, there will be a stronger focus on quality and safety, which will play a major role in how buyers make decisions.

By certification, the market is divided into Genuine Parts, Certified Parts, and Uncertified Parts. Genuine Parts are made by the original vehicle manufacturer, so they are often trusted more because they are seen as reliable and made to match a vehicle’s exact needs. In the future, as cars become more connected and software-driven, using genuine parts will likely be seen as even more important. People will want parts that do not interfere with the car’s systems and that keep warranty terms intact. This trust will keep demand for these parts steady or even growing.

Certified Parts are those made by other companies but tested and approved to meet certain standards. These parts often offer a balance between cost and quality. As digital tools give buyers better access to information, people will be more aware of the value these parts bring. They might not carry the same brand as the original, but they still follow set safety and performance guidelines. In the future, the demand for certified parts will rise, especially in markets where people want reliable performance without paying premium prices.

Uncertified Parts are cheaper but come with greater risks. They may not follow any official quality checks, which can affect the safety or performance of a vehicle. Over time, stricter laws and smarter vehicle systems will make it harder for uncertified parts to stay in demand. As cars use more sensors and electronics, low-quality parts might cause errors or damage. This will push more people to avoid uncertified options.

Looking forward, the global automotive aftermarket market will continue to grow as vehicles stay in service longer and owners look for affordable maintenance. However, how parts are chosen will shift. Certification will become a key factor. People will want more peace of mind, especially as vehicles rely more on software, sensors, and updates. This means that parts not only need to fit but also need to work well with modern systems.

By Service Channel

The global automotive aftermarket market is expected to grow steadily as vehicles continue to become more advanced and widely used. With increasing demand for personal and commercial transportation, the need for replacement parts, maintenance services, and vehicle enhancements will rise. As more people rely on vehicles for daily commuting, travel, and business, there will be a greater need for accessible and efficient service options. This will shape how automotive parts and services are offered, especially when it comes to how people choose to maintain their vehicles.

By service channel, the global automotive aftermarket market is divided into three categories: DIY (Do it Yourself), DIFM (Do it for Me), and OE (Delegating to OEMs). Each of these channels plays a unique role in how consumers and businesses handle vehicle maintenance. The DIY segment appeals to those who prefer working on their own vehicles, often to save money or because they enjoy the process. While it has a loyal customer base, it might grow more slowly in the future as vehicles become more complex and difficult for non-professionals to service. On the other hand, DIFM is becoming more popular, especially among drivers who want convenience or lack the tools and knowledge to fix their own cars. This segment will likely continue to expand as lifestyles get busier and more people turn to professionals for help.

The OE or original equipment route, where work is done by manufacturers or their approved service centers, is also becoming important. With new technology being introduced in vehicles such as sensors, software, and electric systems many owners trust original manufacturers to handle upgrades and repairs. As vehicles grow smarter and include more features, customers may feel more confident relying on experts who have direct knowledge of the systems involved.

Looking ahead, the global automotive aftermarket market will not just be about replacing parts it will be about improving safety, boosting performance, and keeping up with changing driving habits and technologies. Electric vehicles, in particular, will push the industry to adapt. Service providers, whether independent or connected to manufacturers, will need to train staff, update tools, and offer new services to stay relevant. Consumers will expect faster, more reliable, and personalized service. As a result, the way people interact with the aftermarket sector will change, driven by both innovation and a growing focus on convenience and trust.

By Distribution Channel

The global automotive aftermarket market is expected to grow steadily in the coming years, influenced by several ongoing trends and future possibilities. As vehicles continue to evolve with more advanced features and systems, the need for maintenance, repair, and replacement parts will also increase. This market supports car owners after they buy a vehicle, offering everything from replacement parts to tools and accessories. As more people keep their cars for longer periods, especially in regions where buying a new vehicle is expensive, the demand for these products and services will likely remain strong.

Looking ahead, the way people buy automotive products is changing. By distribution channel, the global automotive aftermarket market is divided into retailers, wholesalers, and distributors. Retailers play a direct role, offering parts and services to everyday customers. Many are shifting to online platforms, making it easier for people to find what they need without visiting a physical store. This convenience is expected to attract even more customers in the future. Wholesalers and distributors are key links in the supply chain, helping to get parts from manufacturers to retailers or repair shops. Their role will likely become more efficient with the help of better logistics and technology that can predict demand and manage inventory.

Technology is another major factor that will shape this market. Cars are becoming smarter, with more electronic systems that need special tools and knowledge for repair. This means the aftermarket will need to adapt, offering products and services that match these newer systems. At the same time, electric vehicles are gaining popularity. These vehicles have fewer moving parts than traditional ones, which may reduce the need for some types of replacements but increase the need for others, such as batteries and software updates.

Global trends like urban growth, rising incomes in developing countries, and a stronger focus on vehicle safety and performance are also expected to support the market. People are more aware of how their vehicles perform and how they can improve them, which helps drive demand. In the future, the global automotive aftermarket market will likely keep changing, shaped by shifts in technology, consumer habits, and supply methods. While the core idea remains the same helping people keep their vehicles in good shape how that help is delivered will keep evolving with the times.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$487,779.59 million |

|

Market Size by 2032 |

$633,229.87 Million |

|

Growth Rate from 2025 to 2032 |

3.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

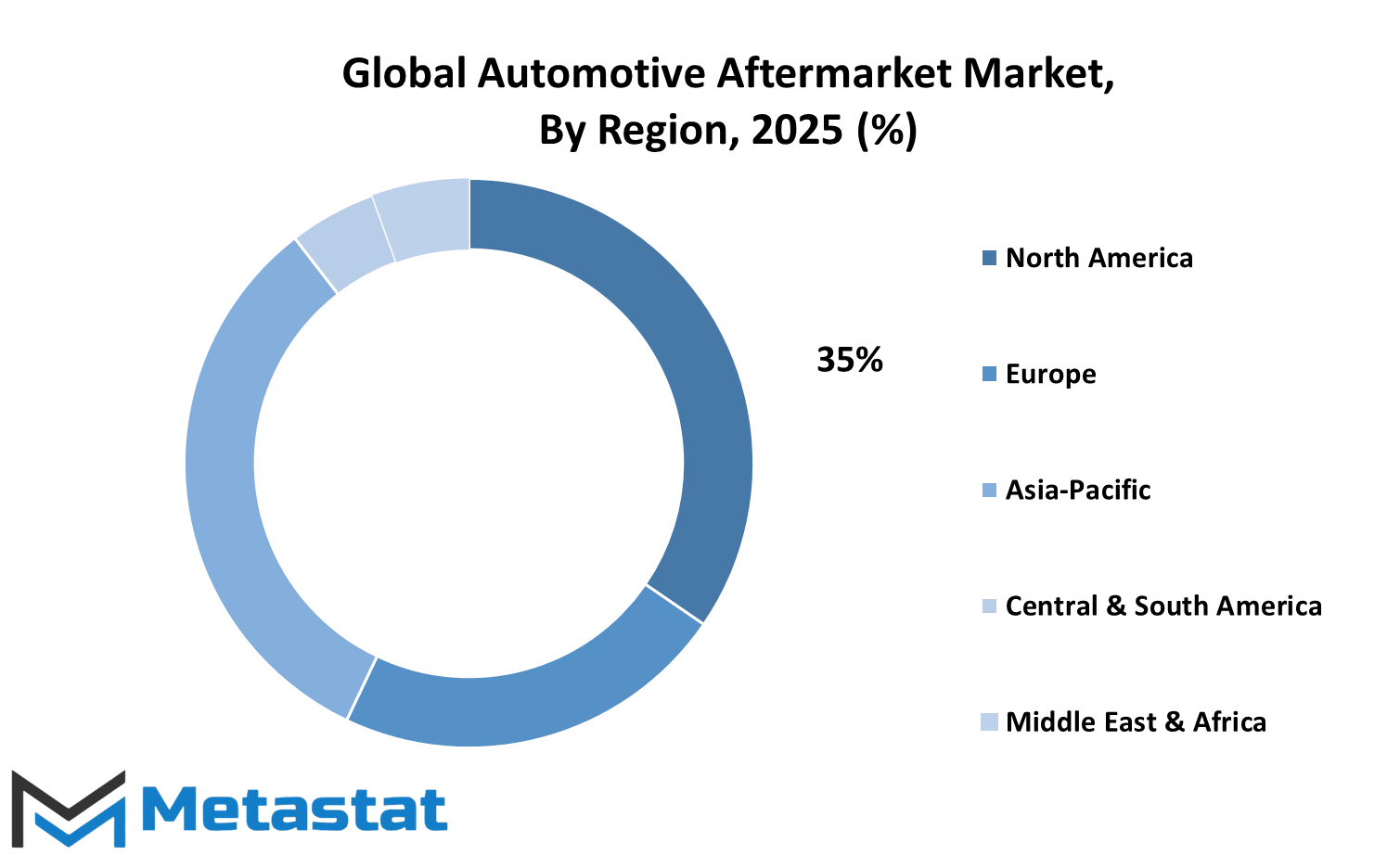

REGIONAL ANALYSIS

The global automotive aftermarket market is growing steadily and is expected to see even more transformation in the future. This market refers to the services, parts, and equipment that come into play after a vehicle is sold by the original manufacturer. It supports the repair, maintenance, and customization of vehicles across the world. As vehicles become more advanced, with rising interest in electric and hybrid models, the demand for smarter and more adaptable aftermarket products and services will also increase.

Looking ahead, the market is likely to be shaped by technology and regional demand shifts. North America, especially the U.S., plays a leading role due to its strong automotive base and wide acceptance of advanced technologies. Canada and Mexico are also contributing through manufacturing strength and rising customer needs. In Europe, countries like Germany, the UK, France, and Italy are showing consistent growth due to their long-established car industries and increasing preference for performance upgrades and green mobility. The rest of Europe follows closely, catching up in terms of new trends and consumer demand.

Asia-Pacific is set to be one of the most active zones for the global automotive aftermarket market in the coming years. With countries like China, India, Japan, and South Korea investing heavily in automotive innovation, this region offers both production and consumption growth. As middle-class populations grow and car ownership becomes more common, the need for parts, repair services, and upgrades will rise rapidly. These nations are also quick to embrace new vehicle technologies, which will drive fresh demand for software-driven aftermarket solutions.

South America shows promise as well, particularly Brazil and Argentina, where increasing numbers of older vehicles on the roads mean more frequent maintenance and repair. The growing economic activities in these countries are likely to support the expansion of local automotive aftermarket services. Meanwhile, the Middle East & Africa, led by the GCC countries, Egypt, and South Africa, will see growth based on the rising need for reliable transport solutions and increasing interest in vehicle personalization.

In the years to come, this market will not just grow in numbers but also in value. It will focus more on digital tools, automated services, and customer convenience. As vehicles become more connected and software-driven, the aftermarket will shift to include smart diagnostics, predictive maintenance, and even remote servicing. Regional needs will vary, but each part of the world will add to the overall strength of the global automotive aftermarket market, making it one of the key areas to watch in the automotive industry.

COMPETITIVE PLAYERS

The global automotive aftermarket market is heading into a period of notable transformation, influenced by shifting consumer behavior, rising technological integration, and a stronger focus on sustainability. As vehicles become more advanced, the demand for maintenance, replacement parts, and upgrades is expected to grow steadily. This is creating new opportunities for companies that can keep up with the changes. Customers are holding on to their cars for longer periods, which means that the need for quality aftermarket products and services is on the rise. Rather than buying new cars, more people are turning to service providers for repairs and enhancements that keep their vehicles running efficiently and looking modern.

In the coming years, this market will become even more competitive. Companies will not only compete on the basis of product quality and pricing but also on how well they can adapt to smart technology, digital platforms, and electric vehicle demands. The rise of electric and hybrid vehicles is especially shaping the future, as traditional engine parts give way to high-tech systems. Suppliers that are ready to shift their focus to meet these new requirements will have a clear advantage. The move towards automation and self-diagnosing vehicle systems will also change the kind of services customers expect. This means the industry will likely see a stronger connection between software and hardware in vehicle repair and maintenance.

Several key players are already setting the pace. Companies like Continental AG, Delphi Automotive PLC, and Denso Corporation continue to lead through innovation, regularly introducing advanced technologies aimed at improving vehicle performance and customer convenience. Others like 3M Company and Federal-Mogul Corporation (now part of DRiV) are investing in product development to stay relevant in a market that rewards constant progress. Major tire manufacturers such as Bridgestone Corporation, Michelin, and Cooper Tire & Rubber Company are also shaping aftermarket trends with their focus on durability and safety.

Meanwhile, firms including Robert Bosch GmbH, Valeo Group, and ZF Friedrichshafen AG are embracing automation and electric mobility. Shell plc and Corning Inc. are contributing through cleaner and more efficient materials, while BorgWarner Inc., Faurecia, and Magna International Inc. are focusing on performance and comfort features. With global demand rising and customer expectations shifting, the global automotive aftermarket market will see tough but exciting competition ahead, driven by innovation and the ability to adapt.

Automotive Aftermarket Market Key Segments:

By Replacement Parts

- Tire

- Battery

- Brake Parts

- Filters

- Body parts

- Lighting & Electronic Components

- Wheels

- Others

By Certification

- Genuine Parts

- Certified Parts

- Uncertified Parts

By Service Channel

- DIY (Do it Yourself)

- DIFM (Do it for Me)

- OE (Delegating to OEM’s)

By Distribution Channel

- Retailers

- Wholesalers & Distributors

Key Global Automotive Aftermarket Industry Players

- Continental AG

- Delphi Automotive PLC

- 3M Company

- Cooper Tire & Rubber Company

- Denso Corporation

- Federal-Mogul Corporation (DRiV)

- HELLA KGaA Hueck & Co.

- Robert Bosch GmbH

- Valeo Group

- ZF Friedrichshafen AG

- Magna International Inc.

- Aisin Seiki Co.

- Lear Corp.

- Bridgestone Corporation

- Faurecia

- Shell plc

- Corning Inc.

- BorgWarner Inc.

- Michelin

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252