Global Fog Light Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

the global fog light market has progressed from being a minor segment of automotive lighting to a separated industry that mirrors changing driving habits, safety and aesthetic expectations. At the beginning of the development of automotive fog lights, these accessories were not recognized as a regular feature in vehicles. Then in the middle of the 20th century, car drivers living in the very foggy and poorly visible areas started to put aftermarket lamps under the front bumper to penetrate the fog and light the road surface. These earlier overtaking lamps made use of primitive halogen bulbs and most of the time they needed manual installation, wiring, and adjustment. They were more of a do-it-yourself solution than a safety appliance for the public.

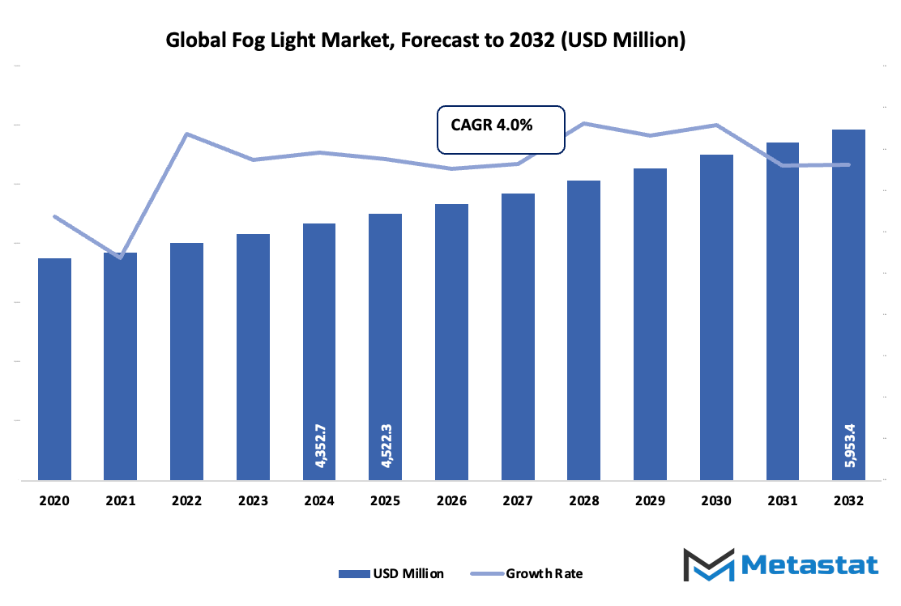

- The global fog light market is forecasted to be valued at around USD 4522.3 million by the year 2025 with a growth rate of about 4.0% CAGR through 2032 and even exceeding USD 5953.4 million in potential.

- The LED technology continues to be the dominant player in the fog light industry and its market share is close to 52.0%. the Rapid development and expansion of the applications through Dr.

- Rising vehicle safety standards and demand for better night-time visibility are among the main trends that are influencing the market and hence, the growth of the sector. Also, the production and sale of vehicles both passenger and commercial throughout the world is continuously increasing thus contributing to the growth.

- The use of environment-friendly LED and laser-based fog lighting technologies is one of the opportunities that will drive the market.

- The market is poised to undergo a rapid transformation in terms of value over the next ten years and, thus, it would be a great time to invest in the right place.

The gradual integration of car design into factories led to automakers adding these lights to specific trims, along with the enforcement of stricter visibility and road-safety standards in Europe and some parts of Asia. This was the turning point when fog lighting went from being an optional accessory to that of a safe driving requirement. By the late 1990s, manufacturers had started to work with new materials and compact housings, thus making it possible for the lights to be fitted into the bumpers without interfering with the vehicle's aesthetic aspect.

The advent of LED technology marked yet another change in the industry. LEDs, besides being power-efficient, longer-lasting, and cooler than incandescent lamps, also promised high brightness. With the new technology, designers were able to create the light beams with the utmost precision, thus ensuring good illumination without causing discomfort to drivers coming from the opposite direction. Besides, the car owners demanded that the fog lights be in sync with the trendy look of the DRLs, so the fog lamps changed from being just a functional part to being that which also supports styling.

The future market will be totally moved into adaptive lighting. Lighting control via sensors and cameras is already being done with headlights, and soon similar technology will be used to adjust fog lights according to weather data or driving speed. Regulators are still advocating for better safety measures, particularly in the countries that have a high incidence of accidents during the night or in low-visibility situations. The brands will keep on being pushed by consumer demands to come up with lights that not only offer visibility but also provide the possibility of customization, for instance, the choice of color temperature or control via an app.

From a mere aftermarket solution, the whole journey has come to a point where fog lights are now seen not just as a safety feature but also as a design element. The factors that contributed to this are regulations, technology, and driver demand. The transition from halogen add-ons to smart lighting marks the path of fog lights in the future, i.e., they will keep evolving as vehicles turn smarter and we do too.

Market Segments

The global fog light market is mainly classified based on Technology Type, Vehicle Type.

By Technology Type is further segmented into:

- LED: LED technology is capable of delivering bright light while consuming very little energy. Long life and lesser maintenance are often the key factors during the production of LED fog lights. Gradually and steadily, the automotive industry is coming to a reliance upon LEDs for energy saving and better visibility on roads. LED usage paves the way for constant output even in extreme weather conditions, hence taking the lighting up a notch in safety standards.

- Halogen: Halogen fog light systems are still very much existent in the market, mainly due to low-cost manufacturing and the ease of getting replacements. One of the reasons why many car owners want halogen bulbs is direct light coverage and quick service work. The strong market presence continues because the networks supporting the automotive service are familiar with halogen parts which will lead to rapid maintenance and thus ensuring reliable lighting on the roads at night during fog or heavy moisture.

- HID: HID fog light systems bring about a high level of brightness through gas-discharge technology. With such strong illumination, drivers are easily able to see road markers during very dense fog or storms. HID lighting captures the market of performance-oriented buyers to a large extent who are prepared to pay for the highest quality of visibility. The high cost of the products is a barrier to mass market adoption but still HID lighting is pulling attention in the premium automotive segments where sharper guidance on the road is of utmost importance.

By Vehicle Type the market is divided into:

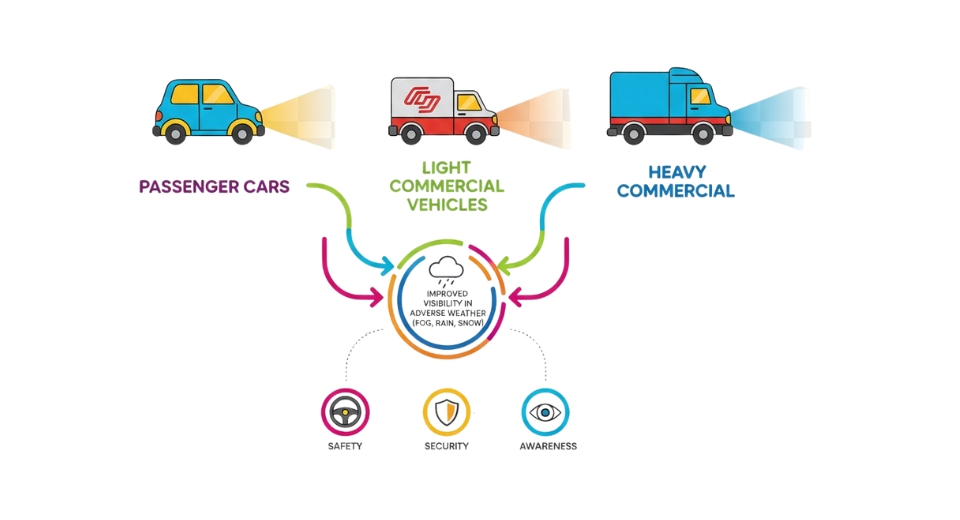

- Passenger Cars: Demand for fog lamps in passenger cars is increasing owing to the fact that consumers are more and more concerned about safety when traveling in rain or mist. To enhance the driver’s confidence, car manufacturers are equipping their latest passenger car models with state-of-the-art lighting. Also, an increasing number of sales, driven by everyday replacement cycles, are providing a steady contribution towards lighting upgrades in the automobile markets of different regions around the globe.

- Light Commercial Vehicles: Light commercial vehicles are frequently used for delivery at early or late hours, when the visibility is low. Thus, fog lighting becomes a means to ensure the cargo's safety by enabling the visibility of the road during such low-visibility times. Fleet owners select dependable lighting that has a long-lasting and trouble-free performance. Because of the wide area covered by the roads, lighting is more likely to be adopted in different regions where transportation activity is frequently taking place and is characterized by cycles across the globe.

- Heavy Commercial Vehicles: The operations of heavy commercial vehicles require exceptional road awareness over long distances. In adverse weather conditions such as snow, rain, or very thick fog, the heavy vehicle gets better maneuverability thanks to fog lights. The robust build quality of the lights makes them capable of performing for long periods even in harsh environments. The use of bright lights not only lowers the chances of accidents but also facilitates safe transportation of goods through highways, industrial areas, and along international trade routes worldwide.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$4522.3 Million |

|

Market Size by 2032 |

$5953.4 Million |

|

Growth Rate from 2025 to 2032 |

4.0% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

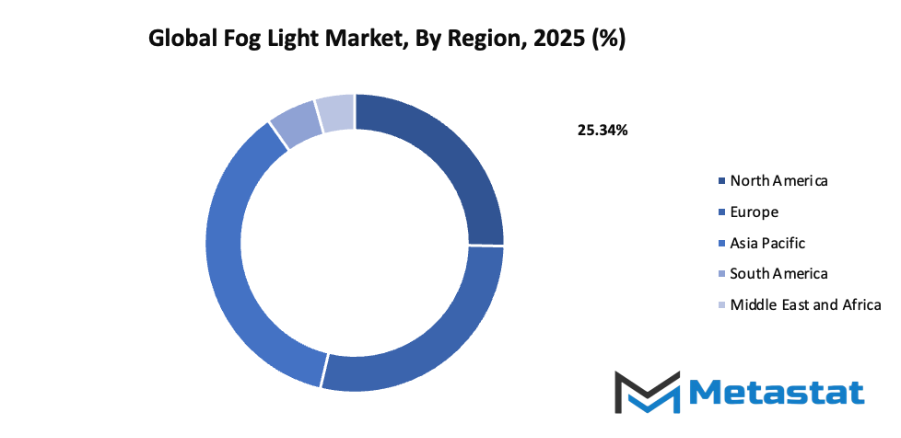

- Based on geography, the global fog light market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Rising vehicle safety standards and growing demand for enhanced night-time visibility:

Stronger safety rules and growing attention toward clearer vision during low-light travel support steady expansion within the global fog light market. Better road lighting encourages quicker reaction to sudden obstacles. Many roadway authorities support improved lighting performance, creating consistent demand for dependable fog lighting products across multiple vehicle categories. - Increasing production and sales of passenger and commercial vehicles globally:

A larger number of vehicles on highways encourages greater installation of fog lighting systems. More new vehicles require dependable lighting equipment during factory assembly, leading to steady orders from automotive manufacturers. Expanding transportation needs across different regions continue to raise the requirement for fog lighting products within new vehicle lineups.

Challenges and Opportunities

- High cost of advanced LED and adaptive fog lighting systems:

Modern fog lighting designs often include sensors and complex hardware. Higher production expenses lead to increased purchase prices, reducing adoption among budget-focused buyers. Manufacturing facilities need specialized equipment to develop advanced features, which raises expenses and slows wider availability across lower-cost vehicle models. - Strict government regulations on aftermarket lighting modifications:

Many authorities restrict unapproved lighting changes to maintain road safety. Sales of certain aftermarket fog lighting products face limitations when products fail to meet certified standards. Compliance with technical rules slows market entry for smaller suppliers and raises development expenses for fog lighting products designed for post-purchase installation.

Opportunities

- Growing adoption of energy-efficient LED and laser-based fog lighting technologies:

LED and laser technology use lower power, deliver stronger visibility during harsh weather, and last longer than older lighting designs. Automotive designers prefer these solutions for reduced energy use and simplified maintenance. Continuous progress in lighting technology encourages broader interest from vehicle manufacturers and service centers.

Competitive Landscape & Strategic Insights

The global fog light market, including modern fog light systems, shows strong activity due to demand for better visibility during challenging weather. The sector features established international corporations along with growing regional competitors. Well-known participants such as OSRAM GmbH, HELLA GmbH & Co. KGaA, Philips Lighting, Koito Manufacturing Co., Ltd., Stanley Electric Co., Ltd., Valeo SA, Magneti Marelli S.p.A., ZKW Group, Hyundai Mobis, Lumileds Holding B.V., and Warn Industries Inc. guide progress through research, dependable production standards, and partnerships with automotive manufacturers. Advanced lighting increases driver confidence during heavy rain, snow, or mist.

Growing interest in safer driving encourages development of energy-efficient lighting technology. Manufacturers focus on strong brightness, reduced power consumption, and compact design. Strong emphasis on durability and longer service life supports the shift from older halogen products toward newer LED options. LED technology supports sharper focus on the roadway, which assists drivers during difficult conditions while reducing maintenance. Rapid progress in automotive design encourages suppliers to create smaller but stronger lighting units.

Competition encourages each corporation to search for better materials and higher quality control. Leading corporations explore new ways to reduce heat, strengthen waterproofing, and expand compatibility with different vehicle models. Partnerships with automotive brands help ensure smooth integration with new vehicle designs. Regional competitors enter the field by offering affordable solutions, encouraging international corporations to refine manufacturing efficiency and pricing.

Market size is forecast to rise from USD 4522.3 million in 2025 to over USD 5953.4 million by 2032. Fog Light will maintain dominance but face growing competition from emerging formats.

Continuous demand for visibility support during bad weather suggests a steady future for this sector. Interest from consumers, automotive brands, and transportation services supports ongoing research and encourages suppliers to introduce improved features at regular intervals. Quality, reliability, and consistent brightness remain central expectations for buyers across many countries. As more drivers value strong performance and low maintenance, corporations delivering dependable lighting solutions will likely gain a strong position in the market.

Report Coverage

This research report categorizes the global fog light market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global fog light market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global fog light market.

Fog Light Market Key Segments:

By Technology Type

- LED

- Halogen

- HID

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Key Global Fog Light Industry Players

- OSRAM GmbH

- HELLA GmbH & Co. KGaA

- Philips Lighting

- Koito Manufacturing Co., Ltd.

- Stanley Electric Co., Ltd.

- Valeo SA

- Magneti Marelli S.p.A.

- ZKW Group

- Hyundai Mobis

- Lumileds Holding B.V.

- Warn Industries Inc

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252