Global Automotive Foam Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global automotive foam market evolved from a small part of the auto industry to one of its most innovative and sophisticated industries. In the early years of automobile production, foam products were confined to basic cushioning of seats, which was mainly in the form of natural rubber or latex. With the more advanced automobile fueled by developing customer requirements, comfort, safety, and fuel efficiency started to influence new material technologies. Polyurethane foam emerged as the ubiquitous seating, insulation, and sound-proofing material by the end of the 20th century, a grand success for the industry.

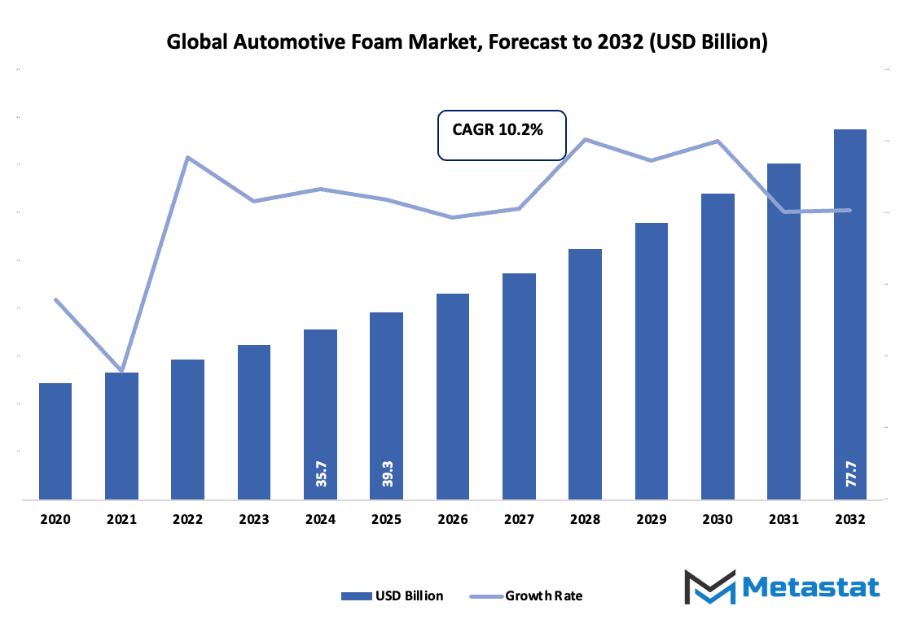

- Global automotive foam market value of around USD 39.3 Billion in 2025 at a growth rate of around 10.2% from 2032 with the prospect to cross USD 77.7 Billion.

- Polyurethane (PU) Foam is a market size of close to 69.0%, and growth is driven by increased research and innovation and application growth.

- Key drivers of growth: Increased use of light-weight materials to improve fuel efficiency and lower emissions, Greater passenger comfort and reduction of noise, vibration, and harshness (NVH)

- Opportunities: Innovation in environmentally friendly, bio-based, and recyclable automobile foams to address the trend towards sustainability

- Key takeaway: The sector will develop exponentially in terms of value over the decade ahead with huge opportunities for growth.

Since it began in the mid-1900s, the global automotive foam market has mirrored changing consumer and manufacturer priorities. The age of the lightweight car led to efforts to test out novel, unique high-performance foams, which would keep overall weight down without sacrificing strength and durability. Environmental issues of the 1990s and the early 2000s compelled business organizations to locate alternatives that were more environmental-friendly, and it resulted in the development of recyclable and biodegradable foams. The transformation did not just remain consistent with international sustainability objectives but also transformed the competitive landscape, as the manufacturing base began to use cleaner production techniques and better material recovery technology. Technology has also redesigned the application of foam in cars. In addition to comfort, modern applications involve impact absorption, vibration and noise damping, and heat control.

As development continues with electric and hybrid cars, the auto foam market worldwide will shift with the specialty style and performance requirements of these automobiles. Foams will be designed with enhanced fire retardance, improved battery system insulation, and enhanced acoustics to counter the virtual quietness of electric powertrains. Customer lifestyles will also shape the design of this industry. Increased focus on customization, interior design minimalism, and urban agriculture will drive the automotive industry to incorporate innovative foam technologies that balance comfort, design, and environmental stewardship. The global automotive foam industry in the future will be increasingly directed towards smart materials—those reacting dynamically to heat, pressure, or energy need—indicating an industry which started from mere cushioning and which now will determine the automotive look and feel of tomorrow.

Market Segments

The global automotive foam market is mainly classified based on Type , Application, End-Use, .

By Type is further segmented into:

- Polyurethane (PU) Foam: Polyurethane foam would be the biggest growth driver of the global automotive foam market due to its increased flexibility and cushioning quality. It is widely used in automotive interiors, which is providing protection and comfort, and is also very versatile when it comes to acceptance of various shapes and sizes, thereby being appropriate for an extremely large number of automotive uses.

- Polyolefin (PO) Foam: Polyolefin foam will be part of the global market of car foam because it has strength and is water- and chemical-resistant. Polyolefin foam generally applies to protective cushioning and insulation, as it satisfies structural vehicle needs and sustains lightweight characteristics that result in fuel efficiency and vehicle performance overall.

- Others: Others among the diverse range of foams will occupy a comparatively smaller but still significant proportion in the global automotive foam market. They find application in specialty markets with specific features like thermal insulation, damping of vibration, or resistance to chemicals that allow custom vehicle parts and solve certain regulation or comfort issues well.

By Application the market is divided into:

- Seating: Seating would be the biggest application in the global automotive foam market. Seating foam offers comfort, support, and shock absorption that enhances passenger protection and convenience. Various density foams are utilized to achieve best ergonomics and serve long-term durability for durable usage in autos.

- Door Panels: Door panels will be favored by foam in the worldwide market for automotive foam due to foam increasing sound insulation and cushioning. Foam components in door panels dampen vibrations, enhance interior comfort, and simplify shaping and assembly, which is all about ensuring cars' functionality and appearance enhancement.

- Bumpers: Foam will be used by bumpers for greater energy absorption and safety in the market. Bumpers of foam offer shock resistance, cutting damage on light crashes and helping to make cars safer without adding weight sufficiently for fuel-saving purposes.

- Headliners: Headliners will experience greater foam to improve comfort and noise reduction in the market. Thermal insulation, sound absorption, and interior appearance retention are advantages realized from the use of foam on headliners, resulting in a quieter and more comfortable vehicle interior for occupants.

- Headrests: Headrests will incorporate foam for enhanced safety and convenience in the market. Foam headrests cushion impact during an accident, minimize the risk of whiplash, and enhance ergonomic seating, which accommodates passenger comfort and protection during long or short journeys.

- Armrests: Armrests will be used to incorporate foam in the market to add to the comfort of automotive interiors to the utmost. Foam supports with care, enhances user ergonomics, and is durable, providing passengers an improved sitting experience alongside making other interior design elements better.

- Acoustic Insulation: Acoustic insulation will be depending on foam to cut down on vibration and sound in the global automotive foam market. Sound transmission is cut down by foam products to ensure a quiet cabin, improve the comfort of riders, and satisfy increasingly stringent requirements for interior vehicle noise ratings.

- Carpet Padding: Carpet padding will employ tap foam to offer cushioning and insulation in the worldwide market for car foam. Foam under carpet is cushioned, dampens vibrations, and gives thermal and acoustic advantage, leading to improved passenger comfort and safeguards automobile interiors against wear and tear.

- Others: Others will employ foam for specialty use in the worldwide car foam market. Foam is useful in specialty fitments, protective coverings, or insulation requirements, offering solutions for single vehicle components and allowing manufacturers to achieve levels of performance, safety, and comfort at reasonable prices.

By End-Use the market is further divided into:

- Passenger Cars: Passenger cars will dominate the global automotive foam market due to high production volumes and demand for comfort, safety, and interior features. Foam is applied in seating, panels, insulation, and other interior components, improving passenger experience and meeting modern design and regulatory standards.

- Light Commercial Vehicles (LCV): Light commercial vehicles will use foam to balance comfort, safety, and durability in the market. Foam in LCVs improves driver and passenger comfort, supports cargo protection, and contributes to vehicle weight reduction for better fuel efficiency.

- Heavy Commercial Vehicles (HCV): Heavy commercial vehicles will rely on foam to enhance durability and comfort in the global automotive foam market. Foam is applied in driver cabins, seats, and panels to absorb vibrations, reduce fatigue, and maintain safety, supporting long-distance transportation efficiency and performance.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$39.3 Billion |

|

Market Size by 2032 |

$77.7 Billion |

|

Growth Rate from 2025 to 2032 |

10.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

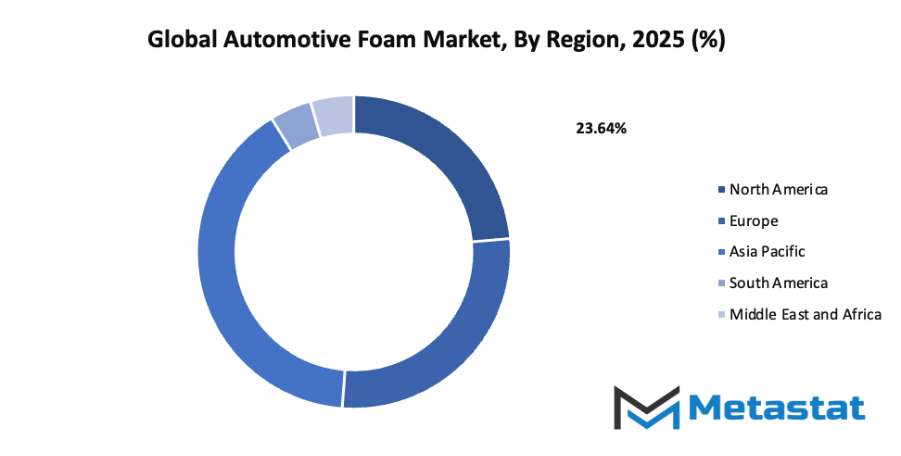

By Region:

- Based on geography, the global automotive foam market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Rising demand for lightweight materials to improve fuel efficiency and reduce emissions: The global automotive foam market will see growth as manufacturers focus on materials that reduce vehicle weight. Lighter materials help vehicles consume less fuel and produce fewer emissions, meeting regulatory requirements and consumer expectations for efficient performance.

- Increasing focus on passenger comfort and noise, vibration, and harshness (NVH) reduction: Automotive foams will be increasingly used to enhance passenger comfort. Reducing noise, vibration, and harshness inside vehicles improves the overall driving experience, making foam applications more critical in seats, interiors, and cabin components.

Challenges and Opportunities

- High production costs of specialized automotive foams: The high costs associated with producing advanced foams will limit widespread adoption. Manufacturers will need to balance quality with cost-effectiveness, making strategic choices in material selection and manufacturing processes to remain competitive in the global automotive foam market.

- Environmental concerns related to foam production and disposal: Environmental issues will pose challenges as traditional foam materials are often difficult to recycle and dispose of. Regulations and sustainability trends will push the industry to consider the environmental impact of production and end-of-life disposal.

Opportunities

- Development of eco-friendly, bio-based, and recyclable automotive foams to meet sustainability trends: Innovation in green foams will offer growth opportunities. Eco-friendly, bio-based, and recyclable foams will attract manufacturers aiming to reduce environmental impact while maintaining performance, aligning with consumer demand and regulatory requirements in the global automotive foam market.

Competitive Landscape & Strategic Insights

The global automotive foam market is positioned to witness remarkable growth in the coming years, driven by increasing demand for lightweight, durable, and sustainable materials in vehicle manufacturing. The industry is a mix of both international industry leaders and emerging regional competitors. Important competitors include Johnson Controls, Lear Corporation, Adient PLC, Woodbridge Foam Corporation, Recticel, BASF SE, The Dow Chemical Company, Saint-Gobain, Rogers Corporation, Armacell International S.A., Zotefoams PLC, Bridgestone Corporation, Vita (Holdings) Limited, Borealis AG, SEKISUI CHEMICAL CO., LTD., Huntsman Corporation, Freudenberg Performance Materials, Foamcraft, Inc., Sonoco Products Company, and INOAC Corporation. These companies have established strong global networks, research capabilities, and innovative solutions that will shape the market landscape.

In the future, the automotive foam industry will continue to evolve with a focus on sustainability and efficiency. Materials will become lighter and more resilient, helping manufacturers reduce vehicle weight and improve fuel efficiency. Emerging regional competitors will also play a significant role, as they introduce cost-effective solutions and specialized products that meet specific local demands. Collaboration between global leaders and regional innovators will drive technological advancements, including the development of foams with enhanced thermal and acoustic properties.

The market will increasingly adopt advanced production methods, such as automation and digital monitoring, to ensure higher quality and consistent output. Sustainability will remain a central concern, with companies investing in recyclable foams, eco-friendly materials, and processes that reduce environmental impact. Furthermore, the integration of smart technologies in automotive foams will open new opportunities for customized applications, providing vehicles with better comfort, safety, and performance.

Market size is forecast to rise from USD 39.3 Billion in 2025 to over USD 77.7 Billion by 2032. Automotive Foam will maintain dominance but face growing competition from emerging formats.

Overall, the global automotive foam market is set to become more competitive and dynamic. Established companies and new entrants alike will focus on innovation, sustainability, and efficiency to meet the growing demands of the automotive sector. This combination of international experience and regional innovation will ensure that the market not only grows in size but also evolves in sophistication, offering solutions that will meet the challenges of future mobility.

Report Coverage

This research report categorizes the global automotive foam market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global automotive foam market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global automotive foam market.

Automotive Foam Market Key Segments:

By Type

- Polyurethane (PU) Foam

- Polyolefin (PO) Foam

- Others

By Application

- Seating

- Door Panels

- Bumpers

- Headliners

- Headrests

- Armrests

- Acoustic Insulation

- Carpet Padding

- Others

By End-Use

- Passenger Cars

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

Key Global Automotive Foam Industry Players

- Johnson Controls

- Lear Corporation

- Adient PLC

- Woodbridge Foam Corporation

- Recticel

- BASF SE

- The Dow Chemical Company

- Saint-Gobain

- Rogers Corporation

- Armacell International S.A.

- Zotefoams PLC

- Bridgestone Corporation

- Vita (Holdings) Limited

- Borealis AG

- SEKISUI CHEMICAL CO., LTD.

- Huntsman Corporation

- Freudenberg Performance Materials

- Foamcraft, Inc.

- Sonoco Products Company

- INOAC Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383