MARKET OVERVIEW

The global Fire Fighting Chemicals market and its industry will witness an extensive transformation over the next several years. Technologies would keep changing as will the ever-changing safety requirements of society, increasing demand for such efficient and friendly environment solutions and changing the scenario in the field towards next-generation fire suppression chemicals. These innovations will target not only performance aspects of fire-fighting agents but also their environment, human health, and the overall effectiveness of various fire situations.

Eco-friendly fire fighting chemicals will form one of the most important market trends. Rising concerns about damage to the environment due to fire-fighting agents have prompted industry players to adopt more sustainable products. These new chemicals will be formulated to provide efficient fire suppression without posing significant risks to the environment. Manufacturers are likely to opt for formulations that are biodegradable, non-toxic, and can suppress fires faster and more efficiently with no harmful residues left behind.

This way, developments in the fields of chemical engineering and science would ultimately yield improved sophisticated firefighting chemicals engineered specifically to attack and subdue metal-related, oil-specific, electrical device types, amongst other specialized combustions. Advances by expanding industry concerns into aviating transport energy fields shall see demand and deployment levels increasing multifold to answer every scenario's firefighting challenge uniquely tailored for effective efficiency in extinction activities. As a result, markets will have chemicals specifically developed for high-risk industries in which conventional firefighting techniques might not be as effective or safe.

The demand for fire fighting chemicals will also be shaped by stronger regulations and better safety standards. The governments across the world will impose stricter regulations for fire safety and encourage various industries to choose safer and more efficient fire suppression systems. All these regulations would spur the application of advanced fire-fighting chemicals, which can ensure compliance with the safety standard while protecting lives and property across diverse environments.

With further growth in the market, manufacturers will be focused on improving the production processes of fire-fighting chemicals to maintain product quality and scalability. Economical and better manufacturing techniques will facilitate cheaper chemicals, meaning both large industrial use and limited firefighting requirements will have access to these cheaper chemicals. More investment in research and development will yet further speed up the pace of innovation, thereby making it quicker for the market to respond to emerging needs of firefighters.

In the future, global use of fire fighting chemicals is likely to include a higher extent of intelligent systems involving fire detection and suppression technology. These intelligent systems will have more real-time information to provide accurate deployment of fire-fighting agents, and consequently, effective results in combating fire. The integration into an Internet of Things (IoT) infrastructure combined with intelligence for the response should be included into smart solutions while firefighting autonomous responses by offering the minimized intrusion of firefighters along with efficiency through safety.

The market will see a change in the delivery and application of fire-fighting chemicals. The development of drones and robotic systems that can deploy fire suppression agents to inaccessible areas such as high-rise buildings or wildland fires is going to be a game changer. These innovations will not only bring efficiency but will also reduce risks associated with the direct involvement of humans in hazardous fire-fighting operations.

Looking ahead, the Global Fire Fighting Chemicals market is likely to become a much more crucial industry with the focus on sustainability, specialization, and innovation. As the world faces new challenges in fire safety, the fire-fighting chemical industry will evolve further to offer more advanced, environmentally responsible, and efficient solutions to combat fires worldwide.

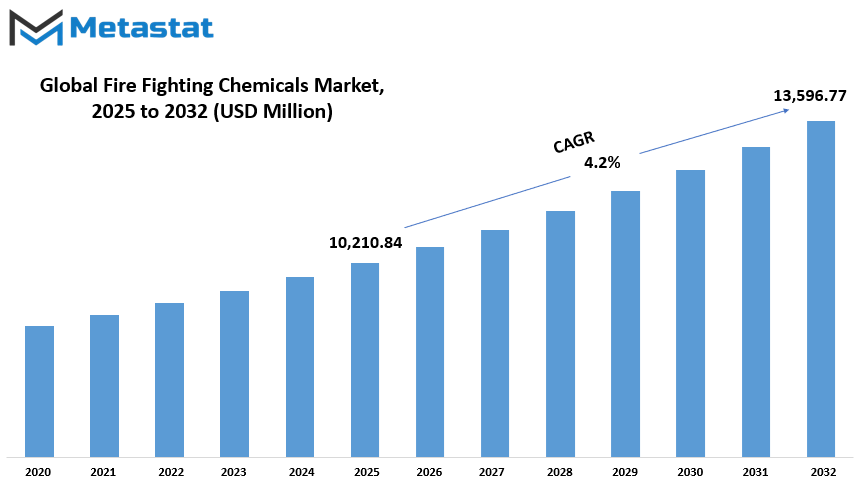

Global Fire Fighting Chemicals market is estimated to reach $13,596.77 Million by 2032; growing at a CAGR of 4.2% from 2025 to 2032.

GROWTH FACTORS

The global fire fighting chemicals market is growing due to several factors, but the most significant driving factor is the increasing fire safety regulations and stricter standards in various industries. As industries grow and expand, the demand for advanced fire fighting systems has increased, especially in the commercial and industrial sectors. These systems require specialized chemicals that can efficiently manage fire hazards, thus increasing the need for innovative fire fighting solutions.

However, environmental issues are creating obstacles for the market. Many of the fire fighting chemicals used in the systems traditionally are harmful to the ecosystem and raise red flags for environmental groups and regulatory bodies. The awareness for sustainability is causing a growing concern, thus asking for more environment-friendly and safe alternatives. Greener solutions are not just the result of environmental concerns but also because of increasing regulation.

Other hindrances include a high price, as well as the scarcity of some special extinguishing agents used in the fight against fire, which in itself restricts growth in the market. For example, the price of producing high-end chemicals makes them hard to access and be available for everybody in every locality, thus presenting hindrances for enterprises that seek advanced fire protection and safety measures with the unreasonably high expenses involved.

Nonetheless, brighter prospects are within reach. Amongst other opportunities that will gain massive mileage in the next few years are environment-friendly fire fighting chemicals. As a way of increasing sustainability, both companies and industries need to reduce their impact on the environment; the demand for effective yet environmentally sustainable fire fighting agents is likely to grow. This focus on innovation could well lead to a safer alternative that might maintain or surpass the effectiveness of fire suppression and minimize environmental impact.

The fire fighting chemicals market will continue to experience growth due to increased safety requirements and the heightened need for state-of-the-art systems. Meanwhile, environmental impacts and the costs of specialized chemicals are significant factors that hinder such growth. However, the quest for green alternatives will be a promising future for the industry, both in solving the current problems and opening up new avenues for growth. As sustainability becomes increasingly important, the market for fire fighting chemicals will most likely change to meet these demands, balancing safety, effectiveness, and environmental responsibility.

MARKET SEGMENTATION

By Type

The global market for fire fighting chemicals is a critical industry within the total fire safety market. This is estimated to be valued at around $2,998.41 million. It is further classified into various types which serve specific requirements in the fire control processes. The key ones include dry chemicals, wet chemicals, dry powder, and foam-based fire fighting agents.

Dry chemicals are often used for extinguishing fires in various settings. They can counter flammable liquids and gases in any setting to make them more potent in the use of industries, automotive, or chemical applications. It acts to disrupt the combustion reaction which helps fuel the flame and thereby deprives it from propagating or flaring again. This type of fire fighting chemical is widely recognized for its fast action and effectiveness.

Wet chemicals have, however dominated use in fires occurring in kitchen facilities, with their primary usages being kitchen oils and grease. These form a foam which extinguishes a fire by cool-suffocating it especially if the fire involves oils and other such flammable material. Wet chemical has been mainly selected for eliminating any flare-up effects. This makes their importance in places of commercial cookery and industrial food processing activities high.

Dry powder chemicals are used to extinguish a large variety of fire types, which include metal fires. Once these powders smother the fire and absorb all heat, oxygen is cut off from the fire. Dry powder agents have been used widely within industrial environments to fight fires that may involve combustible metals or other hazardous materials. This makes dry powder one of the most important agents for fire control in specialized environments.

Foam-based fire fighting agents commonly find applications in large fires involving flammable liquids such as petroleum products. Foam covers the top of the liquid, depriving the fire of oxygen. It is a perfect means of controlling fires at airports, fuel storage facilities, and chemical plants because foam acts as a cut-off cover for oxygen to the fires. The foam-based agents most find application in fighting fast spreading fires across liquid surfaces, and thus find their place in the usage in risk-prone fields.

Each of these types of fire fighting chemicals plays an important role in ensuring safety and controlling fires properly in different sectors. The high demand for such chemicals is created by the rising requirement for advanced fire safety solutions both in residential and commercial sectors. As fire safety standards are upgraded globally, fire fighting chemicals would continue to sustain growth and innovation, thereby promising greater protection from the devastating impact of fires.

By Chemicals

The Global Fire Fighting Chemicals market has been a growing market for several years now. This is attributed to the need for fire suppression solutions that are effective and reliable. These chemicals find applications in all industries where there is a prominent risk of fire, including manufacturing and aviation. The chemicals fall into various types, which play different roles in controlling fires.

Some of the main products include Monoammonium Phosphate, widely used in the extinguishment of chemical fires. Due to its efficacy in fire extinction, it finds extensive application in dry chemical extinguishers of fires caused by flammable liquids, gases, and electrical equipment. Its characteristic properties make it an important additive in various systems of fire extinguishment.

Another important market segment is Halon, which has been a long-standing fire extinguishing agent. Although its use has decreased due to environmental concerns, it remains important in specific areas like aviation and computer equipment. Halon is effective in quickly suppressing fires without causing damage to sensitive equipment, making it a preferred choice in certain industries.

Another vital ingredient in extinguishing fires is carbon dioxide. It is employed where water is not used, owing to the existence of electrical risks or the assets are too expensive to be harmed. Carbon dioxide works by removing oxygen, therefore strangling the fire. Carbon dioxide is heavily applied in various industries, like data centers, oil rigs, and factories that have a potential fire hazard, but water is not used due to the dangers it poses.

Potassium Bicarbonate and Potassium Citrate also take on a variety of roles during the fire-fighting process. The Potassium Bicarbonate, for example is known for effectiveness in suppressing flammable liquid fires and gaseous fires while Potassium Citrate combines other chemicals together in order to optimize the extinguishing efficiency and most of which come in a form of a dry chemical in an extinguisher.

Sodium Chloride, also known as table salt, is sometimes used in fire fighting, especially in certain industrial processes. It is most effective in combating metal fires. This makes it a valuable agent in industries dealing with metalworking or other high-temperature processes.

Besides these, other chemicals are being used for specific needs in fire suppression. The market is still constantly evolving with new and more efficient fire fighting chemicals designed to target a wide array of fire hazards.

By Application

The global fire fighting chemicals market is a core sector in the safety and protection industry, concentrating on a vast range of applications that focus on preventing and controlling fire risks. Among the leading applications in this market are portable fire extinguishers, which are the essential tools for the fight against small fires at an early stage. There are different kinds of extinguishers each sort putting out a different risk for fire-a chemical, electrical equipment, or simple combustibles, which are wood and paper. Portable fire extinguishers are often installed in houses, offices, cars, and all other places where the possibility for break-out can be seen at any time. Another common application is the automatic fire sprinkler. The system is installed in most residential and commercial buildings.

These systems have been designed to automatically activate when the system detects a fire's heat, spraying water to help manage the spread of the flames. Demand for automatic sprinklers has therefore increased with greater stringency placed on fire safety requirements, especially within large public and commercial buildings. The ease with which these systems function and their reliability have made it an integral component of modern strategies in fire protection. Another important part of the fire fighting chemicals market is fire retardant bulkheads. They are essentially used in construction and industrial settings to prevent one section of a building or facility from igniting the adjacent part when a fire breaks out in the former. Fire retardant materials give a fire less space to spread because it slowly spreads and allows people to escape or for firefighters to control the fire.

A critical application of fire dampers controls the flow of smoke and heat in ventilation systems. These automatically close when sensing a fire and therefore prevent the spread of fire and smoke through air ducts. This is particularly critical in buildings having complex ventilation systems, such as hospitals, airports, and shopping malls, which have to maintain high standards of air quality and safety.

Fire-resistant coatings and materials, for instance, are meant to treat the building surfaces, machinery, or even transportation vehicles for an added resistance to fire. The products used for such application help prevent the outbreak of fire while controlling the smoke and its movement within different buildings.

The global fire fighting chemicals market can be divided into different applications that serve as the main pillars of fire prevention and protection. Among them, portable fire extinguishers, automatic fire sprinklers, fire retardant bulkheads, fire dampers, and many more products are very critical to efforts at reducing risks from fires and the resulting damage.

By End-use Industry

This industry holds a major portion of the global market of fire fighting chemicals since these products play a pivotal role in the firefighting process as well as ensuring security within the diversified range of industries. Various segments have the potential to cause huge fires if their needs and demand for chemicals were not adequately managed. However, one such huge industry contributing the most is chemicals and petrochemicals. The industry demands fire suppressant agents specifically because of the combustible nature of the material involved. The chemicals are typically applied in refineries, chemical plants, and storage facilities, which are usually hazardous to fire outbreaks due to volatile substances processed within.

Another major industry that applies fire fighting chemicals is aviation. The aviation industry applies fire fighting chemicals in airports and aircraft to counter the challenges of fires that may arise from accidents involving aviation. The chemicals used in aviation should be of a high standard that can ensure the control of ground and aerial fires. Airports apply several types of firefighting agents, which include foam-based agents. Foam-based agents are very effective in extinguishing fires resulting from fuel spills and problems with the engines.

Mining industry is also another major end-user of fire fighting chemicals. Operations in mining always involve hazardous materials and environments and are prone to fires, especially when handling flammable materials or operating machinery. Fire fighting chemicals in this area are used for the protection of workers and from damage to expensive equipment and resources. These chemicals help to control fires in underground and open-pit mining operations, where the risk of fire can be higher due to the combination of machinery, fuel, and natural resources.

Construction, transportation, and manufacturing are among the industries using fire fighting chemicals. These industries need fire suppression agents to maintain safety in areas with potential fire hazards. However, specific needs and types of chemicals used may differ from one another, depending on the materials used and the risk level.

In conclusion, this global fire fighting chemicals market services a broad scale of industries requiring different fire suppression requirements. From chemicals to petrochemicals, into aviation, mining, and any other sector involved, fire fighting chemicals play the most crucial roles in safeguarding people, properties, and investments from the force of fire's destruction. So, the requirements for these chemicals would continue to mushroom as the expansions of industries need effective fire protection measures.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$10,210.84 million |

|

Market Size by 2032 |

$13,596.77 Million |

|

Growth Rate from 2024 to 2031 |

4.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

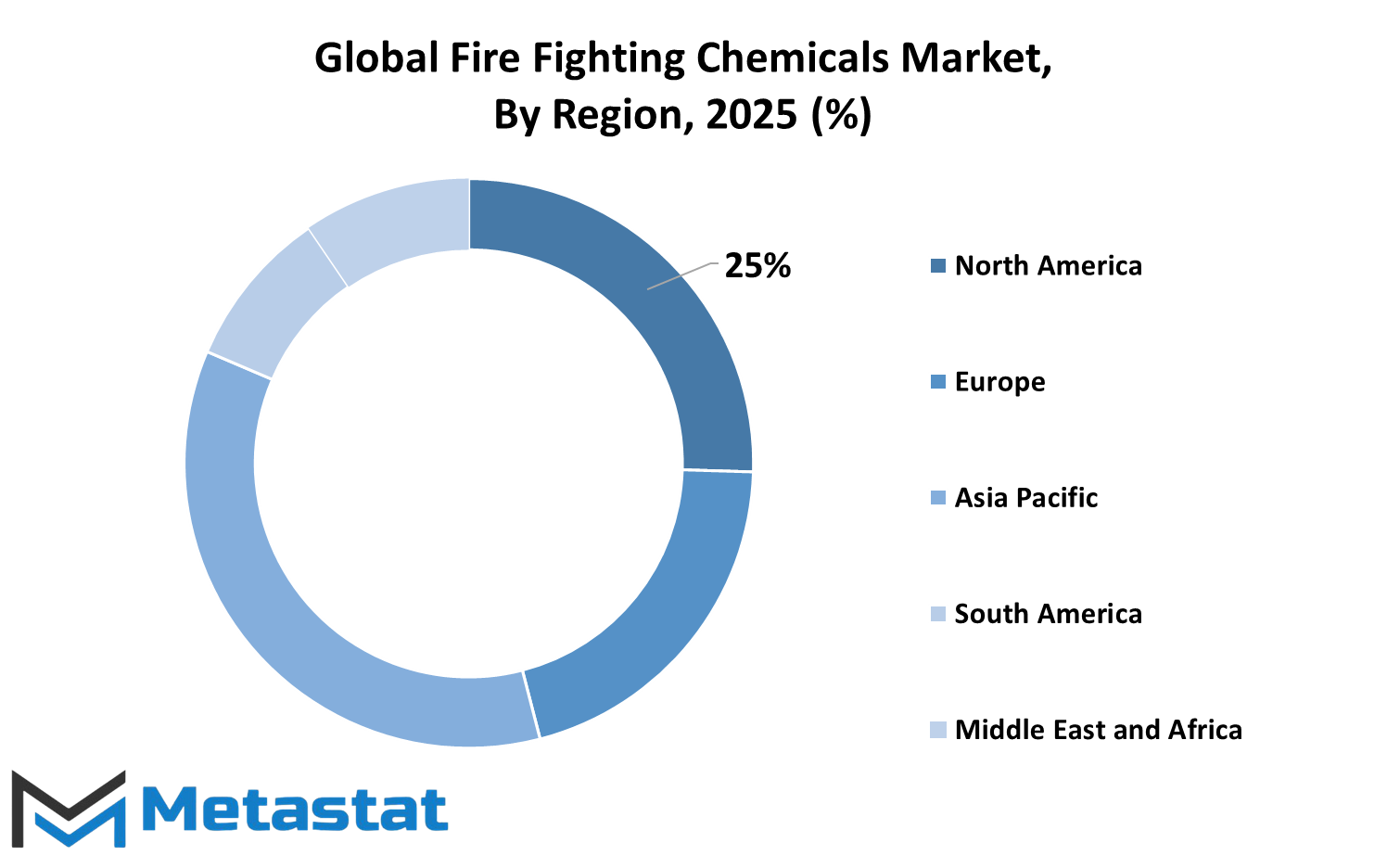

Based on geography, the international market for Fire Fighting Chemicals has been segmented into regions. Regions that have been included in the geographic segmentation are North America, Europe, Asia-Pacific, South America, and Middle East & Africa. These individual regions are bifurcated to further bifurcate them to provide distribution analysis in an extensive manner.

The market has been bifurcated under North America further classified into three leading countries, that is, U.S., Canada, and Mexico. Demand for fire fighting chemicals in these countries is found based on the industrial development, urbanization, and implementation of fire safety regulations. Major countries in Europe are the UK, Germany, France, Italy, and others in the European region. These countries are in much demand for fire fighting chemicals as they need large-scale industries, stiff laws on safety, and frequent operations of firefighting.

The market for fire fighting chemicals in Asia-Pacific is considered the largest as well as a rapidly growing segment. The entire market is subdivided into prime nations such as India, China, Japan, South Korea, and the rest of the Asia Pacific region. Within this region are countries that see rapid urbanization and industrialization, which correspondingly increases its level of consciousness and adoption pertaining to fire safety measures. The demand for fire fighting chemicals is expected to surge in this region as more and more countries here are now focusing on the development of infrastructure and fire prevention.

South America, which includes Brazil, Argentina, and the rest of South America, is another important market for fire fighting chemicals. Though the region is not as much advanced as compared to other regions, with industrial development and advancing fire hazards, investment in fire safety systems is increasing.

The Middle East & Africa region is further divided into GCC countries, Egypt, South Africa, and the rest of the Middle East & Africa. This region has a diversified market for fire fighting chemicals, driven by the construction boom, oil and gas industries, and the need for advanced fire protection systems in high-risk areas. The market in this region will also grow steadily over the next couple of years with various sectors and industries in this region requiring more special fire-fighting solutions.

All these regions have played a significant role in the global Fire Fighting Chemicals market, and with the different demand patterns due to regional needs, economic growth, and safety regulation, the markets expand in association with the increase in the significance of fire safety and efforts made by governments and industries to safeguard people and properties.

COMPETITIVE PLAYERS

It is a very crucial area for ensuring people, property, and the environment remain safe from the stringent effects of fire. With a demand for systems that suppress fires strongly, the market for fire fighting chemicals has grown proportionately. Among these, a few dominant players dominate this very market by offering their expertise and innovation for the betterment of advanced fire-fighting solutions.

Some of the leading companies in the fire fighting chemicals industry are DuPont, National Foam, and SFFECO Global. DuPont is famous for its state-of-the-art technology and high-performance products supporting all kinds of fire-fighting operations from industrial to residential applications. National Foam, another leader, is involved in producing a variety of fire fighting foams offering reliable and environmentally safe solutions for the quick and effective control of fires.

SFFECO Global has made a strong presence in the industry with its wide portfolio of fire fighting equipment and chemicals, which are used globally. Companies like Bioex, KV Fire Chemicals Pvt. Ltd., and Dafo Fomtec AB are also known for their contribution to fire safety, which is environmentally friendly but does not compromise on performance. Bioex, for instance, focuses on using biodegradable ingredients in its foam concentrates to minimize environmental impact.

Other significant players in the market include Chemguard, Vizag Chemical, and Angus Fire, who focus on providing specialized fire fighting chemicals for various industries, such as aviation, oil and gas, and chemical manufacturing. These companies are known for their robust products designed to tackle challenging fire situations, ensuring that fires are contained quickly, preventing further damage.

Other players in the fire fighting chemicals market include Vimal Fire, FireChem, and Foamtech Antifire Company, all of which offer products that are specific to different sectors. The relatively newer players in the industry, Ai Group and Reacton Fire Suppression Limited, have gained a lot of recognition for their modern fire suppression solutions and commitment to safety.

The market for fire fighting chemicals will further increase with the increased demand for safety measures in the construction, oil and gas, and aviation sectors. Companies within this market will focus on designing more efficient and environmentally friendly products to meet changing needs in fire protection. By continued research and innovation, the key players within this market will shape the future of fire safety as they provide the world with safe solutions for preventing and suppressing fires.

Fire Fighting Chemicals Market Key Segments:

By Type

- Dry chemicals

- Wet chemicals

- Dry Powder

- Foam-based

By Chemicals

- Monoammonium Phosphate

- Halon

- Carbon Dioxide

- Potassium Bicarbonate

- Potassium Citrate

- Sodium Chloride

- Others

By Application

- Portable Fire Extinguishers

- Automatic Fire Sprinklers

- Fire retardant Bulkhead

- Fire Dampers

- Others

By End-use Industry

- Chemicals & Petrochemicals

- Aviation

- Mining

- Others

Key Global Fire Fighting Chemicals Industry Players

- DuPont

- National Foam

- SFFECO Global

- Bioex

- KV Fire Chemicals Pvt. Ltd.

- Dafo Fomtec AB

- Chemguard

- Vizag chemical

- Angus Fire

- Vimal Fire

- FireChem

- Foamtech Antifire Company

- Ai Group

- Reacton Fire Suppression Limited

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252