MARKET OVERVIEW

The global filling equipment market, which occupies the front line of the packaging industry, is crucial in maximizing efficiencies, precision, and reliability in the filling processes. The industry undergoes an enormous transformation with multiple applications-from filling food and beverage to pharmaceuticals, cosmetics, and chemicals, where any error in dispensing liquids, powders, or granules can have an adverse effect. These advancements reshape the view of manufacturers towards filling operations as production lines become more modernized with further automation and robotics.

Automation is predicted to be one such area that will help in enhancing productivity with the least human intervention and least wastage. Increased demand for such systems will enhance accuracy since the industries look towards even more yield and cost-effective solutions. Innovations in machine learning and sensor-based technology will provide more intelligent and flexible equipment that can easily accommodate a difference in product viscosity and even adjustment of container-type design with little manual recalibration. The benefits of this change would not only translate into better operational efficiency but also into support for environmental sustainability through reduced material wastage.

A secondary factor with regards to the future of this sector would be customization. Industry diversification will create more demand for filling systems that can accommodate multitudes of packaging configurations and sizes. Equipment makers will come up with modular designs allowing quick changeovers that would fit into the growing trend towards personalization or limited edition production runs. For companies that are investing in new machinery, a primary consideration will be to what extent the time-consuming changeovers between different fills and container shapes or product consistencies reduce down-time

Filling equipment will be developed along lines dictated by regulatory compliance, especially in industries where hygiene and safety are paramount. The pharmaceutical and food industries will increasingly focus on contamination control, leading manufacturers to adopt aseptic and clean-in-place (CIP) systems. Machines that support tamper-evident packaging and minimize exposure to external contaminants will gain traction. Furthermore, the increasing capability of data tracking and real-time monitoring will empower businesses to implement strict quality control measures while adapting to the changing regulatory environment.

Sustainability will continue to be an aspect central to the global filling equipment market, influencing choice of materials and energy consumption. The shift towards eco-friendly packaging solutions will raise demand for machines that process biodegradable and recyclable materials but not at the expense of preventing efficient operation. Energy-efficient will also be the name of the game, and manufacturers will want to lead in this area by seeking ways to curb their carbon footprint while running at high speeds. Designing smart sensors for energy optimization and waste reduction will be a key focus area of development to come.

The geopolitical climate and the dynamics of the supply chain will continue to weigh down industry considerations that will influence the availability of raw materials and components required to manufacture filling equipment. Companies will be exploring avenues to mitigate risks such as reshoring production or diversifying the supplier network. The idea is in practice; predictive maintenance solutions will help companies manage surges in unexpected downtimes to ensure production timelines are unaffected by disruptions.

Consumer trends and technological advancements will continue to chart the way forward for the global filling equipment market. Those that choose to invest in adaptive sustainable and regulatory-compliant filling solutions will have a competitive advantage. As automation, customization, and regulatory demand continue to limit the industry, manufacturers are bound to direct attention toward efficiency and environmental development and quality rather. An industry set for dramatic change, innovation will act as the stimulus for a new era of filling equipment designed with the contemporary production environment in mind.

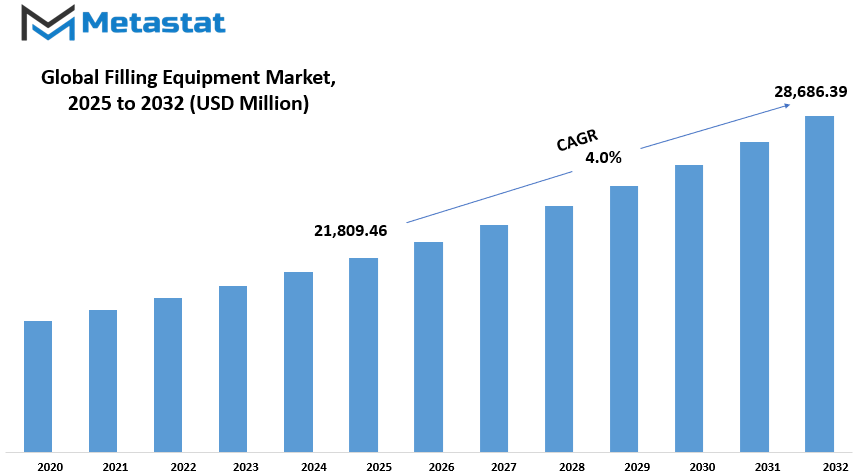

Global filling equipment market is estimated to reach $28,686.39 Million by 2032; growing at a CAGR of 4.0% from 2025 to 2032.

GROWTH FACTORS

The global filling equipment market is driven by packaged food and beverage demand growth. The demand for convenience and ready-to-eat products has pushed manufacturers to automate production lines. Automation enhances filling equipment efficiency, consistency, speed, and hygiene, making it an integral aspect of modern manufacturing. Companies investing in automation can raise productivity levels while satisfying higher consumer demand.

Technological advancement has favored improved fillings. The newer generations of machines are capable of great precision and thereby reduce wastage of the product in filling accurately. Slightest errors in filling can greatly affect products in the pharmaceutical and cosmetic industries. Manufacturing processes can be more efficient with minimizing downtimes and maximizing outputs due to innovations in sensor technology, robotics, and artificial intelligence.

Nevertheless, there are many challenges related to the adoption of filling equipment. High capital investment stands out as the major obstacle. Small to medium-sized businesses usually bear the brunt of purchasing and maintaining advanced machines. The filling machinery can be a long-term investment in a return on efficiency; hence, the up-front expense becomes slightly off-putting for the majority of these businesses. On top of that, regulatory requirements in the food, beverage, and pharmaceutical industries add a layer of complexity. Once installed, conformity to safety and quality standards requires regular monitoring and adjustments, thereby putting the operational cost under duress.

However, there are opportunities in the global filling equipment market that could accelerate future growth. The move towards sustainable and eco-friendly packaging offers new opportunities for filling equipment manufacturers. As companies worldwide seek to reduce plastic waste and take on biodegradable materials, demand is rising for equipment that is able to handle these materials with ease. Manufacturers that are able to design machines that will accept sustainable packaging will have an edge over others.

An expansion of pharmaceutical and cosmetic industries is another welcomed opportunity. Rising healthcare demands and increased attention to personal care will pour more requests for precise and efficient filling equipment. Filling in the pharmaceutical field really requires machines that allow for sterile and contamination-free filling, which guarantees the safety of the products. In the same way, the cosmetic field needs filling machines that provide speed for different types of products, ranging from creams to liquid formulations.

As filling equipment manufacturers grow and evolve, they will ponder their constantly changing market needs. Companies that invest in innovation, sorely address cost barriers, and design solutions consistent with sustainability trends will be in an advantageous position for sustainable growth. The global filling equipment market sustains good growth, and brand names that catch the pace of technological movements and industry restructuring shall enjoy the most gains.

MARKET SEGMENTATION

By Equipment Type

As industries across the board continue to demand efficient and accurate packaging applications, the global filling equipment market undergoes a sustained period of growth. This market is particularly engaged in the workings of the food and beverage, pharmaceuticals, cosmetics, and chemicals industries, where it vouches for accurate and secure packaging. The spotlight on manufacturers has shifted towards automation and advanced technologies, thus generating tremendous demand for high-performance filling equipment. Added to that is the need for packaged goods that has led to the creation of many advanced filling solutions that enhance productivity and reduce wastage because of stringent regulations dictating how a particular industry carries out its activities.

Heavy investments in research and development are made by the companies to create machines that will deliver more efficiency, accuracy, and versatility. The global filling equipment market consists of different kinds of machines meant for various applications. Under Equipment Type, Aseptic $5,004.02 million, Rotary, Net Weight, Volumetric, and Others is the dissection. Aseptic filling machines prevent contamination and thereby preserve product integrity and are always required in the food and pharmaceutical sectors.

Rotary filling machines make filling faster and are best for plants that produce huge volumes. Net weight filling machines supply exact amounts of content to each and every product, therefore preventing loss of products and ensuring uniformity. Volumetric fillers measure products with liquid or semi-liquid characteristics, dispense them in very specific volume amounts that are used in the beverage and personal care industries.

Today, the least automatable filling equipment and intelligent technological advancement have ushered the industry in a new territory. Manufacturers are using advanced sensors, real-time monitoring, and AI to help in increasing efficiencies while limiting human efforts. These technologies increase accuracy in filling while also conserving on maintenance and downtime costs. The green packaging solutions being demanded in the global filling equipment market have also induced the designs of machines with low requirement performance on the eco-friendly materials.

When preferences change among consumers, these enterprises invest further in flexible filling solutions that administer a variety of packaging formats and materials. The increased concern for hygiene and safety in the pharmaceutical and food sectors has intensified the need for aseptic and hygienic filling technology in this day and age more than ever. Product safety and quality control regulations continue to influence the industry, forcing manufacturers to develop equipment designed by and to the highest standards.

The forecast of the global filling equipment market looks very encouraging in terms of automation, precision, and sustainability going forward. Demand for filling machines of superior quality will persist as industries continue to seek out innovations that improve efficiencies while at the same time retaining product integrity. Winning in this fierce competitive turf will depend on companies that innovate and adapt to ever-changing market demands.

By Mode of Operation

And so, because of that, the global filling equipment market will continue to grow as industries continue to find better ways in which to perform their packaging and production operations. Machines such as these have been very instrumental in reducing processes, waste, and maintaining product consistency in companies. Some of the factors affecting global filling equipment market include technically improved filling machines, the speed with which packaged goods are offered, and the increased need for automation in manufacturing.. Companies are continuously looking for productivity enhancement solutions hence the increase in adoption of modern filling equipment.

By mode of operation, automatic filling machines are those devices that include automating all or part of the filling procedure, while the second class is the setup of semi-automatic filling machines. Automatic filling machines tend to be more in demand since they help to increase output, minimize errors, and even reduce labor costs. These types of machines are ideal for very fast production processes that need to be employed in industries such as food and beverages, pharmaceuticals, and cosmetics. By incorporating advanced process sensors and control systems, automatic installation guarantees count accuracy and efficiency; therefore, proves to be a good investment for large-scale manufacturers.

Semi-automatic filling machines have criteria for their nomenclature. They therefore favored flexibility and economics on smaller scales for differing types of activity. Some manual input is involved, while some degree of intervention has been accomplished, subjectively improving the efficiency of the process from completely manual methods. They generally operate when production volumes are measured to judge a balance point between automation with human supervision.

Future developments in the filling industry will increasingly depend on the availability of reliable and efficient filling equipment. The manufacturers have been developing machines to improve their performance by infusing modern technologies, such as robotics and AI-driven controls, in order to deliver speed and precision at a great level. Sustainability is fast emerging as a major parameter that might shape the design or construct minting of energy-efficient machines, if not eco-friendly machines but machines that will not have an adverse effect in terms of pollution.

Consumer preferences drive the demand for filling equipment. Because of the growing trend in favorite single serving or convenience products, they have forced many companies to install filling equipment that can process many different shapes and sizes of containers. Regulations required by the strictest markets such as the pharmaceutical and food safety create a demand for a filling process that is very accurate, which is another driving factor towards investing in such machines.

In all probability, the coming years will see gains in the global filling equipment market, as they keep striving to improve efficiency in tune with the current changing employees' attitudes. Be it totally automatic or semi-automatic, businesses would always benefit from increased productivity, continuity of quality, and customer satisfaction. Industrial demands, further progress in technologies, and developments are certainly going to play an important role in the future of the manufacturing and packaging world with this very industry in it.

By Product Type

Filling equipment is found in scores of industries and is very important for filling and packing a wide variety of products. The more types of packaged goods there are, the more the companies search for advanced equipment that will ensure accuracy, speed, and quality. The presence of technological advances, regulatory standards, and consumer preferences underlies the present dynamics that define changes in the global filling equipment market.

Filling machines are further classified based on their use according to class of the product they fill. The different categories of the products include solid, semi-solid, and liquid types, with each product requiring different machines for effective filling and packaging. Filling equipment for solids is usually meant for filling products like granules, powders, and tablets with an accurate weight of the product and reduced wastage.

Filling machines for semi-solids are meant for the filling of products that are more viscous, such as creams, pastes, and gels; these machines must ensure that air pockets do not form, thus maintaining the integrity of the product. Filling machines for liquids are commonly used across industries, whether food and beverage, pharmaceutical, or cosmetic, as it provides solutions for filling bottling, pouches and containers with different viscosities.

There are a number of factors that propel the global filling equipment market. Automation and digitalization improve production processes with severe reduction of human errors and increased outputs. Invest in custom machine installations for the companies to adapt to diverse packaging needs. Regulatory stipulations concerning hygiene and safety have been responsible for equipment product design that conforms to stringent industry standards. Regarding the environment, with growing awareness of sustainability issues, filling takes that into consideration: making end-use specific solutions that reduce material wastage as well as energy consumption.

The competitive environment of the global filling equipment market takes both established and emerging companies using innovative technologies into account. Research and studies regarding the enhancement of their equipment's performance and reliability have engaged companies' attention. Partnerships and collaborations among manufacturers and end-users are becoming more and more common as companies look to incorporate advanced filling solutions seamlessly into their production lines.

The demand by consumers for a convenient and high-quality packaging has made industries invest in modern filling equipment that is capable of producing a product with the required precision and consistency. With the growing development of e-commerce, the needs of consumers for more effective and efficient packaging have also grown, thus prompting businesses to develop automated systems that speed up the process.

The global filling equipment market will most likely continue evolving as a result of advances in technology, regulations imposed on the industry, and innovative approaches coming up from consumers. Innovative and adaptable companies then will be best in creating a competitive edge to safeguard their long-term success in this vital segment.

By End-user Industry

Succeeding in filling equipment can be an absolute challenge due to the varied demands of the industries that require exact and efficient packaging solutions. While quality remains the utmost necessity, demand for advanced filling machines is thus growing in order to enhance productivity.

Filling machinery is important to packaging products such as sauces, dairy items, and ready-to-eat meals in the food industry. Due to this importance, these companies need to plant a strong focus on each filling machine's capability for precise portioning while minimizing wastage; this ensures profitability and compliance with hygiene standards. These machines streamline packaging for beverages, which are also filling through high-speed systems, filling juices, carbonated drinks, and alcoholic beverages. Attention toward sustainable packaging is another emerging trend, with manufacturers doing their best to minimize material consumption.

Precise and compliant with stringent safety standards is the demand that is extolled in the pharmaceutical industry. Filling equipment for medicines, syrups, and other liquid drugs ought to avoid one-time contamination and ensure accurate dosages. Advanced technologies, including aseptic filling systems, have been made a staple in the respect to retaining final product integrity.

In this sector, the filling machines stay incredibly flexible with regards to container shapes and viscosities of products such as shampoos, lotions, and cosmetics. The capricious nature of the industry with brands regularly launching new packaging designs implies flexibility is a key requirement for their machinery.

Chemical manufacturers use filling equipment to handle substances ranging from household cleaning products to industrial chemicals. These machines must be designed to withstand corrosive materials while maintaining accuracy and efficiency. Safety is a major concern in this sector, as improper handling of chemicals can lead to serious hazards. Meanwhile, other industries, including automotive and agricultural businesses, also depend on specialized filling solutions to package lubricants, pesticides, and fertilizers.

The global filling equipment market is calling for a shift toward automation and smart technologies. Many manufacturers introduce reduced performance monitoring and improvement inefficiency, including artificial intelligence and Internet of Things (IoT) capabilities. Investments in automation allow companies to save any downtime and save on operating costs. Sustainable end-of-process management is yet another trend that is birthing inventions in their energy-efficient and biodegradable packing solutions.

With ever-changing industries, manufacturers of filling equipment must stay ahead of constantly shifting regulations and technology. Any entities focused on precision, flexibility, and sustainability remain strong in this competitive market. Demand for advanced filling equipment will increase as industries search for reliable and cost-effective packaging solutions, ultimately influencing the face of automated production lines across these and many other industries.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$21,809.46 million |

|

Market Size by 2032 |

$28,686.39 Million |

|

Growth Rate from 2024 to 2031 |

4.0% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

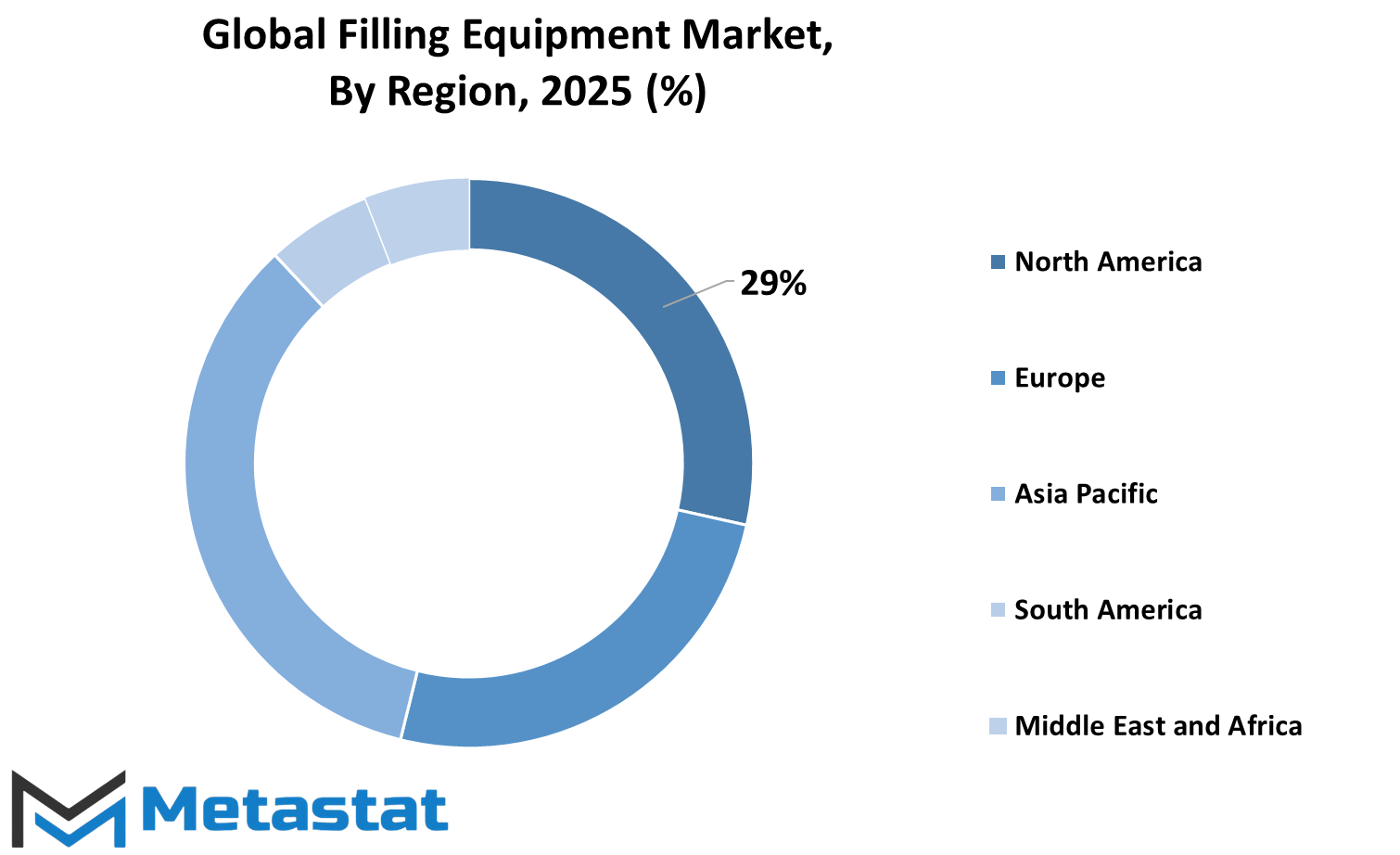

The global filling equipment market on the global scale is thrust by several regional segments, each contributing towards its overall growth and expansion. North America can therefore be considered one of the major players within the global filling equipment market, with the U.S., Canada, and Mexico serving as primary markets. Some of the factors driving demand here are advancement in manufacturing, increased automation, and need for efficient packaging solutions. The growth of the market is further aided by the presence of well-established industries, particularly in food and beverage, pharmaceutical, and chemical industries.

Europe constitutes about one-third of the total global filling equipment market, with the UK, Germany, France, and Italy at the forefront. These countries have strong industrial bases and advanced packaging technologies to drive the demand for filling equipment. The stringent regulations concerning packaging and product safety in Europe give corporations the extra incentive to invest in quality equipment. The other European countries also help the market trends as the companies attempt to enhance efficiency in production processes and satisfy the demands and ever-changing preferences of consumers.

Asia-Pacific is another fast-growing region in which India, China, Japan, and South Korea are fast booming markets. The demand for advanced filling equipment is triggered mainly by the expansion of food and beverage, pharmaceuticals, and cosmetics industries. With the expansion of manufacturing sectors and the modernization of production facilities, the need for automation and precision in packaging increase. With population growth and greater disposable incomes, demand for packaged goods is increasing, therefore supporting the growth of the global filling equipment market. The rest of Asia-Pacific is also supporting the market, as smaller economies match global trends with advanced technologies.

In South America, Brazil and Argentina lead the way in the global filling equipment market. The demand of this region is said to be driven primarily by the food and beverage sector, where packaging plays a vital role in preservation and distribution. With these focuses on efficiency and international quality standards, investment in filling equipment has been consistently growing. The rest of South America, in turn, also contributes to the expansion of the market as industries try to bring new technologies into their production processes.

Middle East & Africa consists of the GCC countries, Egypt, and South Africa - all major contributors to the global filling equipment market. Food, beverage, pharmaceutical, and personal care industries are some that have been boosting the demand for filling equipment. Efficient and reliable filling equipment is in great demand due to rapid industrial development and movement towards automation. The rest of Middle East & Africa is equally contributing towards the market as businesses search for innovative packaging solutions to enhance product integrity and distribution efficiency.

COMPETITIVE PLAYERS

The demand for global filling equipment market has increased by leaps and bounds by sectors such as pharmaceuticals, food and beverage commodities, and cosmetics in search of the best, efficient, and precise packaging. They continue to invest in modern, advanced technologies that promote accurate, less wasted, and more efficient production. The transformation of this industry brought in by automation has allowed manufacturers to massively improve the overall production speed of processes without compromising any quality of product output. Companies have now invested in equipment eventually providing maximum reliability and compliance with safety standards, given the growing consumer demands and strict regulations.

There are many companies engaged in the innovative manufacturing of modern filling equipment. For example, Krones AG and Tetra Pak International S.A. are some of the household names in their cutting-edge technology and tailor-made solutions for their respective industries. Pneumatic Scale Angelus, GEA Group AG, and Serac Group have added significant efforts in providing machines that improve efficiency with minimum downtime. ProMach Inc. and Coesia S.p.A. works with flexible, readily customizable solutions for packaging from different angles. A well-known example of commitment to sustainability is KHS GmbH and Synerlink.

Filling high-performance solutions for high-speed accurate and consistent applications are from IMA Group and Ronchi Mario S.p.A. Applicated by Accutek Packaging Equipment Companies, Inc. and SIG, this adaptability has made them stand out to serve diverse industries. Advanced machinery continues to develop without interruption provided by E-PAK Machinery, Inc. and SACMI Group integrated into existing production lines. Two stars capturing public attention with their abilities to meet high production events but, in the same sense, metering township levels are OPTIMA packaging group GmbH and All-Fill Inc.

APACKS and Feige Filling GmbH work primarily on forms that will enable users to simply operate and maintain the equipment. On the other hand, Fogg Filler Company LLC and AiCROV - Smart Filling underline both high innovative features that actually make things better and reduce human resources for the handling of operations. Filling Equipment Co., Inc. and Filamatic provide machines that cater to specific industry needs to ensure optimum performance. Also among the frontline players is Inline Filling Systems, which would once again be able to offer equipment strong and reliable enough for a variety of applications.

Competition in the global filling equipment market pushes companies to make continuous improvements in the filling process, which is based on improved human needs by many manufacturers these days. As technology would advance further, the need for fancier, smarter automated solutions in filling would increase. The return on investment with modern equipment will provide the investors with a multiply return, high efficiency, low cost, and better product quality. The future of the global filling equipment market is, with some giant names in sustainability and innovation, highly promising in providing solutions that support growth and efficiency across multiple industries.

Filling Equipment Market Key Segments:

By Equipment Type

- Aseptic

- Rotary

- Net Weight

- Volumetric

- Others

By Mode of Operation

- Automatic

- Semi-automatic

By Product Type

- Solid

- Semi-solid

- Liquid

By End-user Industry

- Food

- Beverage

- Pharmaceutical

- Personal Care

- Chemical

- Others

Key Global Filling Equipment Industry Players

- Krones AG

- Tetra Pak International S.A.

- Pneumatic Scale Angelus

- GEA Group AG

- Serac Group

- ProMach Inc.

- Coesia S.p.A.

- KHS GmbH

- Synerlink

- IMA Group

- Ronchi Mario S.p.A.

- Accutek Packaging Equipment Companies, Inc.

- SIG

- E-PAK Machinery, Inc.

- SACMI Group

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383