MARKET OVERVIEW

The Europe Pension Software market is evolving into a niche segment within the financial technology arena, rather than specifically designed to meet the unique needs of pension management. The market represents a fusion of advanced digital solutions crafted to automate, streamline, and enhance the management of pension funds across such varied stakeholders as private and public organizations, pension administrators, and government agencies of Europe. The pension sector, dealing with massive amounts of money and stringent laws, is under pressure to update their systems; thus pension software is important for efficiency and regulatory compliance.

The demographic-related issues remain in Europe – Europe Pension Software market will, therefore develop solutions tailored for the demographic-specific needs and regulations. Greater flexibility of the software will be offered, not only to respond to shifting regulations from one country to another but also to the ever-increasing volume of pension transactions. The rules of pensions vary across regions in Europe, requiring such flexibility and customization of software for conformity with different national standards. Europe Pension Software would witness providers invest in ‘adapt and modify’ software that can easily be adapted with multiple international requirements, ensuring an organization’s needs are covered from different borders while gaining the benefit of having fewer administrative costs in managing pensions across many regions.

Migrating from old-line paper-based pension administration systems to solutions using software highlights the sector-wide push toward digital transformation. An important focus in the Europe Pension Software market will be a self-service platform for the end-users: easy to use, so that they would be able to access pension information and track contribution levels in a form to make more informed decisions regarding retirement planning. These will be accessed securely-from an end-user perspective, mobile-friendly and ideally designed for a digitally immersed generation entering the workforce, so that the retiree can easily access his or her pension information, irrespective of where they are. This will definitely redefine the delivery of pension services and align with the broader fintech trend of placing financial control directly in the hands of the individual.

Another strong driver in the Europe Pension Software market is artificial intelligence and machine learning. Such predictions would be on trends in retirement planning as well as investment. Organizations can utilize these technologies and therefore provide data-driven decisions that can optimize the performance of pension funds. For instance, with the use of AI, one can analyze risks based on prevailing market conditions and then provide actionable insights to enable pension administrators to make the most suitable investment choices for their clients. Machine learning algorithms can, by-and-large, fortify pension systems’ security in light of fraud detection being better and more efficient than any other, thus able to safeguard pension funds against cyber attacks.

Cloud-based services are expected to emerge as much more relevant in the Europe Pension Software market. Cloud would be both cost-effective as well as scaleable storage solutions. This would enable pension administrators to store and process large volumes of data without having to make massive investments in physical infrastructure. These solutions would ensure smooth access to data, encourage collaboration, and facilitate remote management for administrators as well as users, especially as work environments continue to shift toward flexible arrangements.

This market for Europe Pension Software is set to change into a very adaptive and highly tech-driven sector, dedicated to creating the efficiencies and security of pension fund management across diverse European markets. This market will continue to develop in respect of constantly shifting demographics, regulatory needs, and emerging technologies, all based on its core: digital innovation. The Europe Pension Software market would empower its users and administrators, bringing a transparent and efficient future for retirement planning throughout the continent. As these technological breakthroughs advance, the market would play a deep role in redefining the playing field of retirement savings and pension management in Europe.

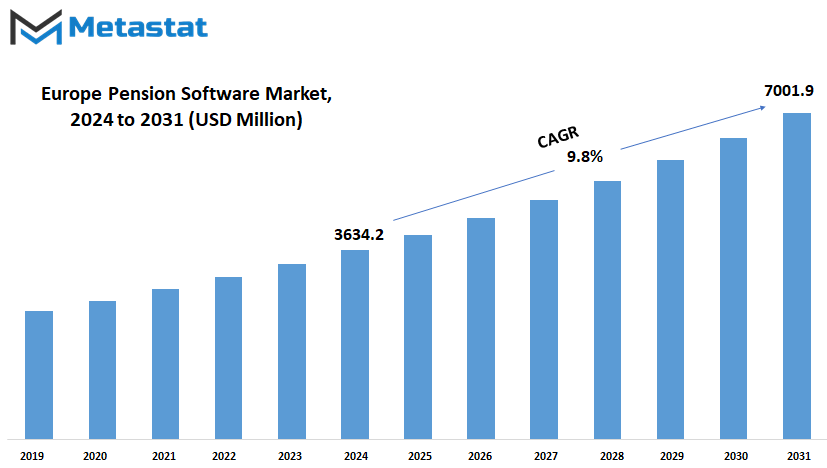

Europe Pension Software market is estimated to reach $7001.9 Million by 2031; growing at a CAGR of 9.8% from 2024 to 2031.

GROWTH FACTORS

Several influential factors are shaping the future of the Europe Pension Software market, which is perceived to be growing quite appreciably. The transformation of industries into efficient, adaptable environments through the digital shift has helped simplify pension systems and allow organizations to perform the complex data pertaining to pensions in a much more efficient manner and automated administrative work. In this backdrop, a renewed drive for process streamlining by companies continues to spur demand for modern, efficient pension software. The quest for automating this has not only helped businesses save costs but also avoid human pitfalls by producing accurate and up-to-date pension calculations. Going forward, the market will continue to be in order with the demand of simple yet robust systems.

The Europe Pension Software market is additionally influenced by the rising awareness of organizations towards retirement planning. With European countries getting older, the management of pension funds thus becomes more crucial and plays a large role in how long retirees can sustain their finances. The growing uncertainties over future financial security make the people account for business organizations, which demand clear and safe pensioning solutions. It is this pressure from employees that makes the companies invest in the pension software that safely manages their retirement funds. This in turn boosts the pension industry growth.

However, despite these positive trends, some issues may hinder the growth of the market. Complex pension software has high set up costs for small enterprises that might look at the systems as financially burdensome. On the other side of the regulatory environment in Europe and tough data protection and privacy laws that can sometimes be cumbersome to the pension software vendors. The implementation and updates are sure to raise extra operational costs and the systems tougher to implement.

At the same time, these challenges offer opportunities in the market. More than ever, with advanced technology, emphasis is laid upon solutions that offer better security features and data protection compliance, yet can be achieved cost-effectively. Cloud-based pension software development might have advanced for organizations in their business to run an efficient and scalable process to manage their pension schemes without needing infrastructure on the ground. This trend will likely provide further opportunities for business entities to search for both secure and affordable solutions that may help accommodate employee expectations while conforming to particular regulatory standards.

But the quest for streamlined operations and better retirement planning does promise a promising figure for the Europe Pension Software market in closing. Indeed, forward progress will have its share of resistance from high implementation costs and regulatory requirements, but developments like cloud-based solutions and security features will provide some breather. In fact, market growth is likely to remain steady as demand rises to meet today's needs and prepare for the challenges of tomorrow in this ever-changing landscape of retirement management.

MARKET SEGMENTATION

By Deployment Type

The European pension software market is expected to witness radical growth with the advancement of digitalization in pensions, while aiming at better management, processing, and analysis of pensions. Traditionally, it had been an offbeat lot of paperwork; managing pensions involved manual data entry and arithmetical computations and increases the chances of error and time consumption. Pension software today has made this process much smoother by reducing errors and increasing the overall accuracy. This gives pension managers and beneficiaries better monitoring insight into the balance and estimates with a greater opportunity for more informed and reliable decisions.

The two most widely used types of deployment in this market are on-premise solutions and cloud-based solutions. In on-premise software, hosted locally on its own servers, businesses enjoy a degree of control and customization. Companies can tailor it according to their specific needs, so that they are assured of security and operational control. But on-premise solutions will cost more and require large quantities of IT resources, making them more suitable to large organizations with already established infrastructures. However, with such a list of challenges, there are some companies that prefer on-premise deployment due to data privacy, making sure all the information is stored and managed within the company’s premises securely.

Pension software available through clouds has seen an enormous growth in this relatively recent period. It is an elastic and accessible system where the workers can reach information from anywhere through a device having internet connectivity, thus barring the geographical constraints which the traditional systems pose. Cloud-based applications are scalable, too, in order to meet the resultant high demands for pension software by an expanding company, with minimal hardware upgrades needed. As the technology in the field of cyber security evolves, so will be the embracing of cloud-based pensions for organizations that pay major emphasis on cost-effectiveness and adaptability.

Looking forward, it will continue changing and moving into the hearts of innovative methods in confronting the growing needs of all both working and retired individuals. This demographic change will also point towards the continuous increase in demand for an effective pension management system across Europe. The old population of Europe calls for more investment in modernized pension software. There could also be an integration of artificial intelligence and data analytics into the pension software to give advance predictive insights, hence companies will better predict retirement trends, thus managing fund distribution, which in turn improves the decision-making process. Thus, it transforms the handling of pensions in a more user-centric and responsive way to the market trends.

By Enterprise Size

The pension software market of Europe is in motion towards becoming one of the most vibrant sectors in the technology of finance. Its growth is triggered by the differing needs of businesses in different sizes. This market can be divided into two categories: enterprise size, which will include Small and Medium Enterprises and Large Enterprises, respectively, with each segment having different requirements that are likely to dictate the future path of pension software development and deployment in Europe.

Small to medium-sized enterprises in the European regions are now more than ever realizing the need to implement a pension software solution, which can make such retirement funds much easier to manage, associated administrative work simpler, and compliant with the changing stringent regulations. Most SMEs have limited resources, and therefore this puts them at great need for readily available and easy-to-use affordable software that can easily be introduced into the existing systems without added costs. Most SMEs also look for flexible solutions that will enable them to manage pension schemes quite efficiently and cater to unique needs of their employees. This will happen on a relatively greater scale with SMEs in the future; the software providers for pension schemes will, therefore, work towards developing scalable solutions targeting smaller enterprises, so the SME can keep up with the large organizations managing employee benefits.

However, big companies usually require a fairly elaborate and all-inclusive pension software solution. These are organizations that handle massive amounts of data, have varying needs among employees, and have stricter standards for compliance, thereby creating the need for higher features in pension software. It's likely that large enterprises will look for software solutions that support more enhanced data security, in-depth analytics, and rich reporting options so as to meet not only the needs of internal business processes but also the requirements of regulations. Therefore, henceforth, pension software vendors will focus more on developing highly customized solutions for large enterprises, which will integrate with other corporate systems for delivering advanced capability in processing complex data.

By Type

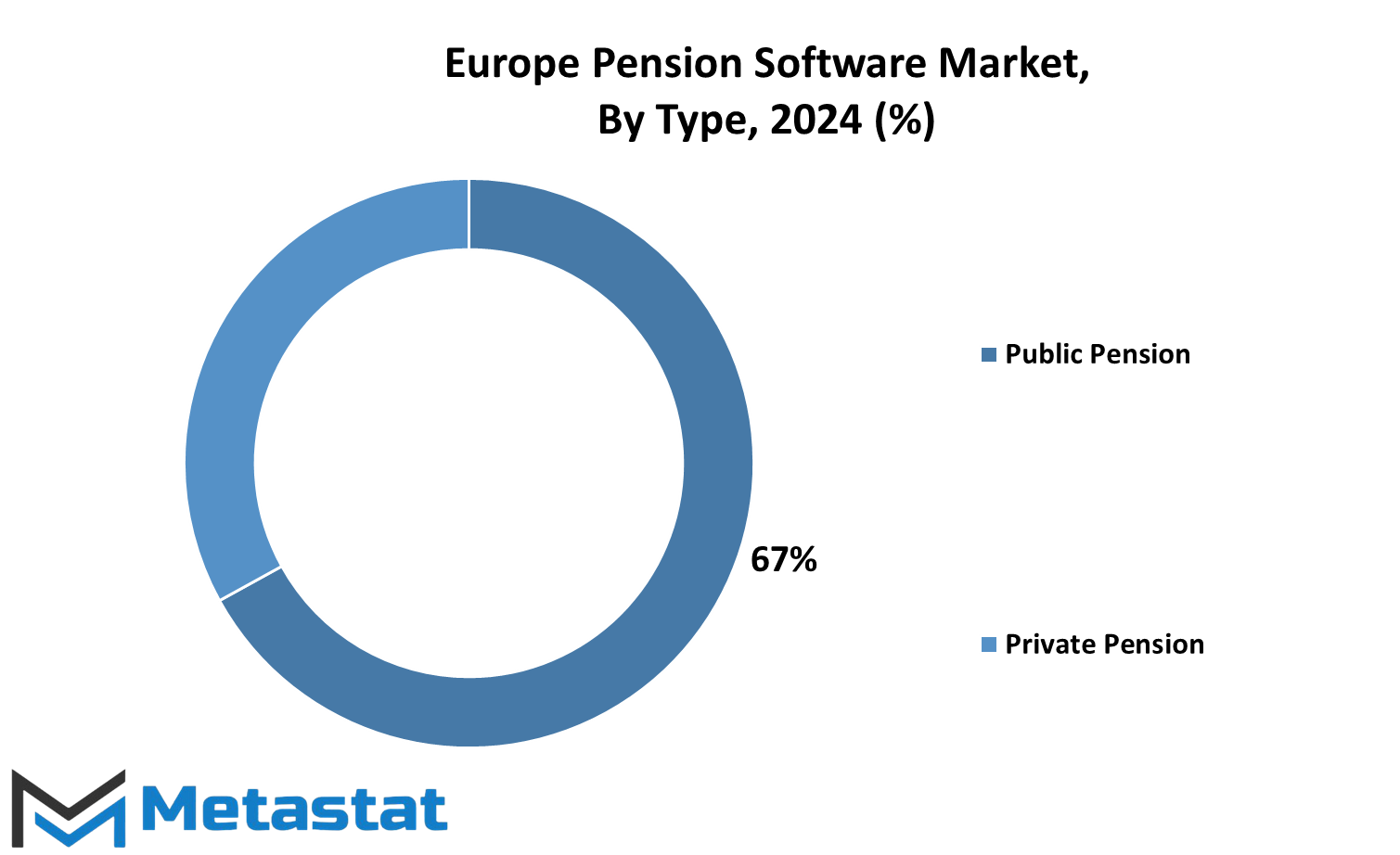

Technological advancement, changing regulations, and a growing requirement for streamlined pension management will drive the Europe Pension Software market in the near future. The increasing demand for streamlined pension management solutions is anticipated to propel the pension software market, as the process of digital transformation continues to progress across all industries, making pension software solutions an essential tool in the management of the complex needs of public pensions and private pensions. Companies, banks, and governments all are looking to make improvements to their pension systems: these improvements have directed the systems to better and more harmonious working, transparency, and customer experience.

The growth is also influenced by changes in the demographic scenario within Europe: an increase in an aging population with a corresponding expectation of increased longevity necessitates better pension management tools. The demographic trends concerning reliance on pensions for retirement have increased the demand for such software that supports better management of contributions, disbursements, and customer inquiries. This ranges from public to private pensions, though each segment must employ different approaches and features within the software because of differences in users' demands and regulatory instructions. Public pensions are administered by government bodies and thus need more data management regarding large numbers of contributors and beneficiaries.

This kind of pension software needs a critical focus that would be accurate, secure, and align with the changes of the regulatory requirements. The product/service solution that these governments are searching for to reduce manual processes, minimize errors, and provide users with a seamless experience. Selection of the application software is fundamentally based on service delivery improvement, security of pension payments, accuracy, and punctuality, as well as access to information of the beneficiary. Private pensions, however, serve other clients and are more flexible and offer some options to tailor the plan.

The private sector employer, fund manager, and financial consultant needs software that delivers superior analytics for investment tracking and higher usability. Therefore, the private pension segment tends to be more dynamic in its software needs, where individual users can choose and customize their pension plans based on specific fiscal goals. Consequently, increased companies are finding the advantages of digital pension management solutions and, therefore, a rising demand for these private pension software solutions.

By End User

Europe Pension Software market is expected to grow by leaps and bounds as there is a growing need for proper retirement planning and management of funds. This factor has created greater demands because a more significant percentage of the population in Europe is reaching the retirement age, and subsequently, government and private institutions are under pressure to make pension fund management better. With pension software, these institutions have more scope to manage pension funds, monitor contributions, and give real-time information to recipients. This digitization saves time but also restricts the scope of error in administering funds-an important consideration in delivering dependable returns for retirees.

For government organizations, pension software simplifies management complexities involved with public pension schemes. Such organisations usually oversee huge and large contributors, and accuracy in record management is essential in maintaining public confidence. Pension software will allow government bodies to track long-term contributions, monitor investment in the funds, and keep administrative expenses at reasonable levels. This efficiency will have a crucial need in an increase in life expectancy, where a retiree will live longer on pensions, and thus, demands for sustainable fund management will increase. Private organizations are the other significant players in the Europe Pension Software market.

Offering pension plans forms part of the benefits provided to staff in most organizations. An effective management of the pension plan for the various talents in the diverse workforce is crucial. Pension software enables private organizations to provide transparent access to pension information, thereby enabling clarification of every information relating to an employee’s savings status and his or her respective options available for retirement. Furthermore, the workplace becoming digital means that employees must have ready access to tools of financial planning that will guide them in making information-driven decisions about retirement. Advanced pension software platforms can meet such an expectation and empower employees to take a proactive approach to retirement planning. Another important user group for Europe Pension Software is the pension fund administrators.

These managers oversee the day-to-day account of pension funds, thereby ensuring that contributions are kept on record, investments allocated properly, and payments made at the right time. Comprehensive pension software access means for administrators that operations tend to be smoother and data analysis better for optimizing fund performance. With advanced technologies in the country, pension software can now integrate analytics tools such that the trend of the funds can be foretold, the investment evaluated for risk, and the security of the funds in general enhanced. In the forward direction, Europe Pension Software would be integrated with artificial intelligence and data analytics to make pension management more adaptive towards economical shifts and individual needs. Advances in technology integration into financial services would place pressures on pension software to evolve constantly with user-friendliness, enhanced security, and more accurate forecasting to make sure that this giant retirement system within Europe stays resilient and most responsive to emerging demands.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$3634.2 Million |

|

Market Size by 2031 |

$7001.9 Million |

|

Growth Rate from 2024 to 2031 |

9.8% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The Europe pension software market is in development and evolved through demographics and technological change. The geography segments of this market are North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. North America includes the U.S., Canada, and Mexico; whereas Europe's segment specifically includes countries like the UK, Germany, France, Italy, and the Rest of Europe. The demand for pension software in Europe will be rising because financial planning has become more crucial to respond to the urgency of a graying population's needs and the need to make the pension sector more efficient digitally.

The Europe pension software market has significant growth potential to shine through, its growth based on the economy of the region, policy shifts, and the increasing retirement age population in the region. As more European countries experience population aging, the pension age continues driving people to rely on pension systems and, therefore, seek increased management of data both efficiently and effectively by financial services. The trend will be much more apparent in augmenting the demand for advanced pension software with their roles to help organizations streamline pension management, provide transparency, and ensure compliance with regulations in every country. In the coming years, there are likely to be more demands for adaptive pension software systems that are easy to use and functional on various devices and platforms.

Demand in Germany. The German market is one of Europe's powerhouses, and companies are sure to look out for solutions that would improve administrative efficiency along with precise forecasts of their pensions for administrative and forecasting purposes. In addition, because the UK has an aged pension sector, the country will require more innovative software solutions since it is embracing cloud technology and data analytics in the sector as ways of improving decision-making as well as personalization of pension plans. France and Italy are going to be part of the market expansion through regulatory adjustments and a growing trend towards embracing digital transformation in order to meet the emergent expectations of consumers.

Future trends for pension software in Europe would focus on an increased use of AI and ML in assisting in the more accurate computation of retirement demand and smoother administration through automatic, minimal human interaction processing. Pension planning, with the help of AI and ML, may also be more personalized to various individuals' retirement goals balanced by life expectancies and other factors. This will eventually translate to pension software providers ensuring that their architectures are secure enough to protect the sensitive financial information placed within them and therefore building trust with the users.

As technology becomes advanced, the Europe pension software market is a landscape of moving technological shores that each country in the region would ultimately follow differently as it reflects the personal needs and regulatory standards. This generation promises more efficiency, data-driven insights, and flexibilities -- making Europe a critical player in global pension software. The organization will advance from years of practice adaptation to new demographic trends and consumer expectations, making pension software a cornerstone for helping individuals build a secure financial future in retirement.

COMPETITIVE PLAYERS

The European pension software market is growing rapidly along with the combination of economic factors, regulatory changes, and shifts toward digital transformation in financial services. The necessity to adapt more to the pension systems that are increasingly coming under pressure in Europe in the wake of an aging population has created a demand for advanced software solutions that will streamline pension management and enhance transparency and user experience. Some of the major players in this market include Oracle Corporation, Lumera AB, Sapiens International, Capita plc, Aon plc, and Willis Towers Watson among others creating solutions to address the needs in the region. Smaller companies like NES TECH A/S and Heywood Limited provide specific services creating an extremely rich competitive environment.

Probably one of the most important factors driving the growth of the European pension software market is the increasing adoption of cloud-based solutions. To date, many organizations have recognized and appreciated advantages provided by cloud technology, such as scalability, accessibility, and security. Thus, pension funds and employers are now focusing on making things more efficient and look forward to replacing existing silos of paper spreadsheets or outdated house-specific systems with cloud-based portals that integrate easily with other financial tools and systems. Some of the companies are leaders in this trend, including companies like Smart Pension Ltd., Civica Group Limited, and Edlund A/S, which provide solutions for easy handling of pension plans while also ensuring remote access with opportunities to collaborate between relevant stakeholders. Regulations also impact the market since a high level of transparency and reporting is required.

New tools are being developed by the organizations - such as Equiniti, Festina Finance, and Levi, Ray & Shoup Inc. - that ease compliance, make the data reliable, and reduce the burden of auditing. With European governments imposing more regulations for the safe servicing of pension funds and sustainable funding of these funds, new solutions become necessary. At this point, automation of pension management is gaining importance due to the ability to reduce manual errors, save time, and decrease operational costs. Moving ahead, AI and data analytics will dominate the European pension software market. The companies are investing in AI-driven tools - Visma Idella, Keylane BV and VERMEG Ltd - pension providers will likely gain predictive analytics for more accurate forecasting and decision-making. AI will help with personalization services through machine learning algorithms that analyze user data for customized pension plans fit to one's needs.

Overall, the European pension software market appears to be quite promising because this falls into the backbone of the financial sector, ready to support not only large corporate users but the individual user as well.

The continuous development of innovative tools and adherence to changes in regulation will ensure that this market will continue to be dynamic and responsive, playing an essential role in properly managing Europe's pensions. The industry is better equipped than ever to provide solutions that will be robust, yet touch the lives of those looking for pensions for years to come-with increased focus on technology, transparency, and customization.

Europe Pension Software Market Key Segments:

By Deployment Type

- On-premise

- Cloud-based

By Enterprise Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Type

- Public Pension

- Private Pension

By End User

- Government Organizations

- Private Organizations

- Pension Fund Administrators

Key Europe Pension Software Industry Players

- Oracle Corporation

- Lumera AB

- Sapiens International

- Capita plc.

- Aon plc

- Willis Towers Watson

- Smart Pension Ltd.

- Civica Group Limited

- Milliman, Inc.

- Edlund A/S

- Equiniti

- Festina Finance

- Levi, Ray & Shoup Inc.

- NES TECH A/S

- Heywood Limited

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252