MARKET OVERVIEW

The Europe Pallets market stands as a dynamic sector within the logistics and supply chain industry, intricately woven into the fabric of efficient goods transportation. This market encapsulates a diverse range of pallets designed to meet the unique demands of European businesses, reflecting the evolving landscape of commerce and trade across the continent.

In logistics, the Europe Pallets market plays a pivotal role in streamlining the movement of goods from manufacturers to end consumers. These pallets, crafted from various materials such as wood, plastic, and metal, serve as the unsung heroes of supply chains, silently supporting the seamless flow of products across borders. Industry, defined by innovation and adaptability, continuously responds to the ever-changing demands of a dynamic market.

Wooden pallets, a stalwart in the Europe Pallets market, embody durability and cost-effectiveness. Manufacturers leverage the intrinsic properties of wood to create pallets that withstand the rigors of transportation while remaining economically viable. Plastic pallets, on the other hand, carve a niche for themselves with their lightweight nature and resistance to moisture and pests, offering a sustainable alternative in an era increasingly focused on environmental considerations.

The European pallet landscape mirrors the diversity of the businesses it serves. From traditional sectors like manufacturing and agriculture to the burgeoning e-commerce industry, each segment relies on pallets tailored to its specific needs. As businesses continually seek operational efficiency, the Europe Pallets market responds by providing custom solutions that enhance the effectiveness of supply chains.

In recent years, the Europe Pallets market has witnessed a surge in demand driven by the growth of cross-border trade. The interconnected nature of European economies has propelled the need for standardized and adaptable pallet solutions that facilitate the movement of goods across diverse terrains and regulatory environments. This demand has spurred innovation, with pallet manufacturers investing in technologies that enhance pallet tracking, improve load stability, and reduce overall transportation costs.

The Europe Pallets market, however, faces challenges in balancing the demands of sustainability with economic considerations. While there is a growing emphasis on eco-friendly pallet materials and recycling initiatives, businesses also grapple with the need for cost-effective solutions to remain competitive. Striking this delicate balance is imperative for the industry’s long-term viability, requiring ongoing collaboration between businesses, regulators, and pallet manufacturers.

The Europe Pallets market embodies the essence of adaptability and efficiency in the logistics and supply chain industry. Its significance transcends mere transportation aids, playing a crucial role in shaping the success of businesses across diverse sectors. As the market navigates the complexities of a dynamic business landscape, its resilience and commitment to meeting evolving demands position it as an indispensable component in the intricate dance of European commerce.

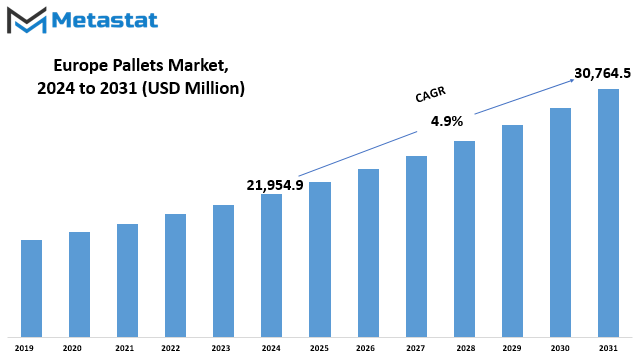

The Europe Pallets market is estimated to reach $30,764.5 Million by 2031; growing at a CAGR of 4.9% from 2024 to 2031.

GROWTH FACTORS

The European pallets market has witnessed notable growth, with various factors contributing to its expansion. One of the primary driving forces behind this upward trajectory is the increasing demand for efficient logistics solutions. As industries continue to evolve, the need for streamlined transportation and storage processes becomes paramount. The versatility and convenience offered by pallets address these requirements, making them a preferred choice in the European market.

Furthermore, the emphasis on sustainable practices has propelled the adoption of pallets, as they align with eco-friendly initiatives. Companies are recognizing the significance of reducing their environmental footprint, and pallets offer a reusable and recyclable solution in the realm of logistics. This environmentally conscious approach resonates with consumers and regulatory bodies alike, driving the market forward.

Despite these positive trends, challenges exist that may impede the growth of the European pallets market. Economic uncertainties and fluctuations can pose obstacles, impacting the overall demand for goods and subsequently affecting the need for pallets. Additionally, stringent regulations pertaining to the use of certain materials in pallet manufacturing can present hurdles for industry players. Navigating these challenges requires adaptability and strategic planning to maintain market stability.

However, amidst the hurdles lie opportunities that could further propel the market's expansion. Technological advancements play a pivotal role in shaping the future landscape of the pallet industry. Integration of smart technologies, such as IoT-enabled tracking systems, enhances the traceability and management of pallets throughout the supply chain. This not only addresses logistical challenges but also opens doors to innovative solutions, thereby fostering growth.

Furthermore, the rise of e-commerce has significantly impacted on the logistics sector, creating a surge in demand for efficient packaging and transportation solutions. As the e-commerce landscape continues to flourish, the need for pallets to facilitate organized storage and transportation of goods becomes increasingly pronounced. This trend presents a lucrative opportunity for the European pallets market to cater to the evolving needs of the retail and e-commerce sectors.

MARKET SEGMENTATION

By Type

The European pallets market, with its diverse segments, showcases a dynamic landscape in terms of materials and their respective values. In the year 2022, the Wood segment stood out with a significant valuation of 15056.4 USD Million. This underscores the enduring popularity and widespread usage of wooden pallets in the region. Their durability and traditional appeal contribute to their continued prominence in various industries.

Following closely is the Plastic segment, valued at 3194.9 USD Million in 2022. The market’s inclination towards plastic pallets is notable, reflecting a shift towards lighter and potentially more sustainable options. Plastic pallets offer advantages such as ease of handling and resistance to weather conditions, making them a preferred choice in certain applications.

Metal pallets, with a valuation of 1193.7 USD Million in 2022, carve out their niche in the market. While not as prevalent as wood or plastic, metal pallets find favor in specific industries where their robustness and load-bearing capabilities are paramount. This segment’s value speaks to the enduring demand for metal pallets in specialized applications.

The Corrugated Paper segment, valued at 698.4 USD Million in 2022, represents a distinctive category within the market. Corrugated paper pallets, known for their lightweight nature and recyclability, appeal to industries with a focus on sustainability. Although their market share might not be as substantial as other materials, the upward trajectory of their valuation suggests a growing recognition of the environmental benefits they offer.

As we navigate the intricacies of the European pallets market, it becomes evident that each material segment serves specific needs and preferences across industries. The market’s dynamics are shaped by factors such as durability, cost-effectiveness, and environmental considerations. The diverse range of materials underscores the adaptability of the pallet industry to cater to various requirements.

Beyond these, other factors contribute to the overall landscape of the European pallets market. Supply chain dynamics, regulatory influences, and technological advancements play pivotal roles in shaping the industry’s trajectory. The interplay of these elements reflects the ever-changing nature of the market, with stakeholders adapting to evolving demands and opportunities.

The European pallets market is a tapestry of material diversity, reflecting the nuanced preferences and requirements of industries across the region. The Wood, Plastic, Metal, and Corrugated Paper segments, each with their unique attributes, collectively contribute to the market’s vibrancy. As industries continue to evolve and embrace sustainable practices, the pallet market stands poised for further innovation and adaptation to meet the demands of a dynamic business landscape.

By Application

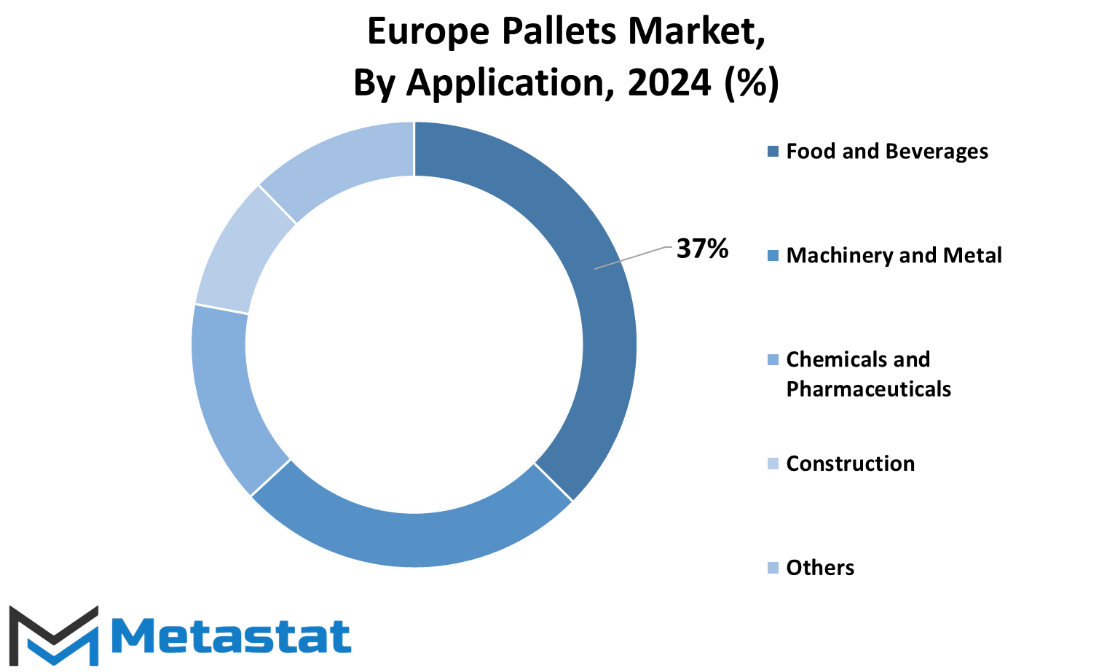

In dissecting the European pallets market, one cannot ignore its diverse applications. These applications play a pivotal role in shaping the demand and dynamics of the market. Categorically, the market branches into key applications, namely Food and Beverages, Machinery and Metal, Chemicals and Pharmaceuticals, Construction, and Others.

Among these applications, the Food and Beverages sector emerges as a cornerstone of the pallets market. The demand for efficient and reliable pallet solutions in the transportation and storage of food products has been a driving force. The Food and Beverages application has been a major contributor to the overall growth, with a substantial share in the market’s valuation.

Simultaneously, the Machinery and Metal segment occupies a significant space within the European pallets market landscape. The need for robust pallets capable of withstanding the weight and dimensions of machinery parts and metal products has fueled the demand in this segment. The intricate requirements of this application have spurred innovation in pallet design and materials, reflecting the adaptability of the market to specific industry needs.

Chemicals and Pharmaceuticals form another critical application segment. The stringent regulations and sensitivity associated with transporting chemicals and pharmaceutical products necessitate specialized pallet solutions. The market, recognizing this demand, has witnessed the development of pallets tailored to meet the safety and integrity requirements of these industries.

The Construction sector, while not the largest contributor, remains an essential component of the European pallets market. Pallets play a crucial role in the logistics of construction materials, facilitating the efficient movement and storage of various components. The symbiotic relationship between the construction industry and the pallets market highlights the interconnected nature of these sectors.

Beyond these core applications, the Others segment emerges as a versatile category encompassing diverse industries and applications. The valuation in 2022 reflects the widespread utility of pallets in sectors beyond the primary categories. This segment acts as a reservoir for the unique and varied demands of industries not explicitly outlined in the major application categories.

The European pallets market, with its diverse applications, paints a comprehensive picture of its significance in supporting various industries. The nuanced needs of each sector contribute to the ongoing evolution of the market, ensuring that pallet solutions continue to adapt and cater to the ever-changing demands of the European logistics landscape.

REGIONAL ANALYSIS

Europe, being a diverse and expansive region, exhibits a nuanced Pallets market scenario. Factors such as economic conditions, industrial activities, and trade dynamics contribute to the market's regional variations. Understanding these intricacies is crucial for stakeholders seeking to navigate the market effectively.

One noteworthy aspect is the economic landscape's impact on the Pallets market. Different countries within Europe experience varying economic conditions, leading to distinct market trends. For instance, countries with robust industrial sectors may witness a higher demand for pallets due to increased logistics and transportation activities.

Industrial activities play a pivotal role in shaping the demand for pallets across Europe. As industries grow and diversify, the need for efficient storage and transportation solutions rises. Pallets, being a fundamental component of logistics, become integral to streamlining supply chains and optimizing storage spaces.

Trade dynamics also exert a significant influence on the Europe Pallets market. The interconnectedness of European countries through trade agreements and partnerships creates a ripple effect on pallet demand. Increased cross-border trade may necessitate a higher volume of pallets to facilitate the smooth movement of goods.

It is essential for businesses operating in the Europe Pallets market to stay attuned to regional dynamics. A tailored approach that considers the unique conditions of each European region can enhance market penetration and overall business success. As industries evolve and economic landscapes shift, the adaptability to regional variations becomes a key factor in sustaining growth and competitiveness.

The Europe Pallets market is a multifaceted arena influenced by diverse regional factors. Businesses navigating this market should embrace a nuanced approach that accounts for the distinct economic, industrial, and trade conditions across various European regions. This adaptability will not only foster market resilience but also position companies for sustained success in the ever-changing European Pallets landscape.

COMPETITIVE PLAYERS

The Pallets industry in Europe is marked by a dynamic landscape, with various key players contributing to its growth and development. Among these, AUER Packaging GmbH and CABKA Group GmbH stand out as significant participants, adding value to the market.

AUER Packaging GmbH has emerged as a notable player in the European Pallets market. The company's strategic approach and commitment to quality have positioned it as a reliable contributor to the industry. AUER Packaging GmbH's impact on the market is evident in its ability to cater to diverse needs, reflecting the dynamic nature of the Pallets sector.

Similarly, CABKA Group GmbH plays a vital role in shaping the competitive dynamics of the European Pallets market. With a focus on innovation and customer satisfaction, CABKA Group GmbH has established itself as a key player in the industry. The company's presence has brought about positive developments, contributing to the overall evolution of the Pallets market in Europe.

The significance of these key players lies in their ability to adapt to the changing demands of the Pallets market. AUER Packaging GmbH and CABKA Group GmbH, along with other players in the market, play a crucial role in meeting the diverse needs of consumers. Their strategies, whether focused on quality, innovation, or customer satisfaction, contribute to the overall vitality of the European Pallets industry.

As the Pallets market in Europe continues to evolve, these key players navigate the challenges and opportunities presented by the dynamic business environment. AUER Packaging GmbH and CABKA Group GmbH exemplify the resilience and adaptability required in the competitive landscape. Their contributions extend beyond mere market presence, influencing the industry's direction and growth.

In conclusion, the European Pallets market is shaped by the presence and actions of key players, including AUER Packaging GmbH and CABKA Group GmbH. Their impact goes beyond financial figures, influencing the industry's dynamics and contributing to a thriving and competitive market.

Pallets Market Key Segments:

By Type

- Wood

- Plastic

- Metal

- Corrugated Paper

By Application

- Food and Beverages

- Machinery and Metal

- Chemicals and Pharmaceuticals

- Construction

- Others

By Structural Design

- Block

- Stringer

- Others

Key Europe Pallets Industry Players

- AUER Packaging GmbH

- CABKA Group GmbH

- Rotom Cargopak Ltd

- Casadei Pallets Srl

- Craemer GmbH

- LPR (La Palette Rouge)

- DOLAV Plastic Products

- Falkenhahn AG

- HG Timber Ltd

- Imbal Legno Snc

- Nefab AB

- Palettenwerk Kozik Sp. z o.o.

- Brambles Ltd

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252