MARKET OVERVIEW

The europe orthopedic braces and aupports market will continue to shape the medical device business by its special role in non-surgical injury management and post-operative recovery. This segment of the healthcare market will not only continue to play a part in the practice of medicine but will grow to impact segments outside of standard medical application. While stabilization, protection, or musculoskeletal correction remains the primary function of Orthopedic supports and braces, increasingly in the future, an expanding impact will move well beyond treatment rooms.

In the next several years, the europe orthopedic braces and aupports market will integrate with developments in individualized health monitoring. Emerging wearable technologies are providing the platform for smart Orthopedic solutions that reach well beyond support of structure. Braces that incorporate sensors will offer real-time monitoring of data, which can enhance rehabilitation protocols by offering measurable feedback to practitioners and patients alike. The shift will enable more adaptive care tailored to each individual, so treatment becomes more flexible than rigid.

Optimization of performance will be a by-product of this market. Sports science and professional training centers are adopting Orthopedic support systems to prevent overloading and optimizing biomechanical fitting with each performance. The future for the market will meet these demands with products maximized not only to guard against injury but to perform. Lighter technologies, anatomically oriented structures, and custom fit specifically for the athlete will discover new avenues in sports usage.

Occupational health will also be a sector where these devices will find additional uses. Sectors using repetitive physical effort or prolonged standing will seek improved measures to reduce the long-term danger of injury to staff. As ergonomics becomes more central to work environment design, Orthopedic supports will be included in standard issue for the avoidance of physical decline and upkeep of productivity for much of industry, especially manufacturing and transport.

Furthermore, consumer attitudes towards active health care are also shifting. As people become more knowledgeable about posture, mobility, and longevity of the body, use of braces and supports outside the medical environment will become more mainstream. Lifestyle applications posture correction for computer users to joint stabilization for the elderly will carry the market into retail establishments and on websites, distant from conventional medical distribution venues.

Educational and awareness programs, especially internet-based ones, will drive increased awareness of these products among consumers who are not medical professionals. This shift in awareness will create new product categories aimed at prevention rather than correction. The europe orthopedic braces and aupports market will expand not only as a treatment aid but also as a wellness companion integrated into daily routines.

While clinical utility will remain strong, synergy and innovation in the next generation will make it possible for the europe orthopedic braces and aupports market to redefine its reach. It will become a more general ecosystem of human movement, protection, and performance far beyond surgical recovery or injury rehabilitation. This will not be merely a direct result of industry evolution but will determine the way support devices are perceived and used by society in the future.

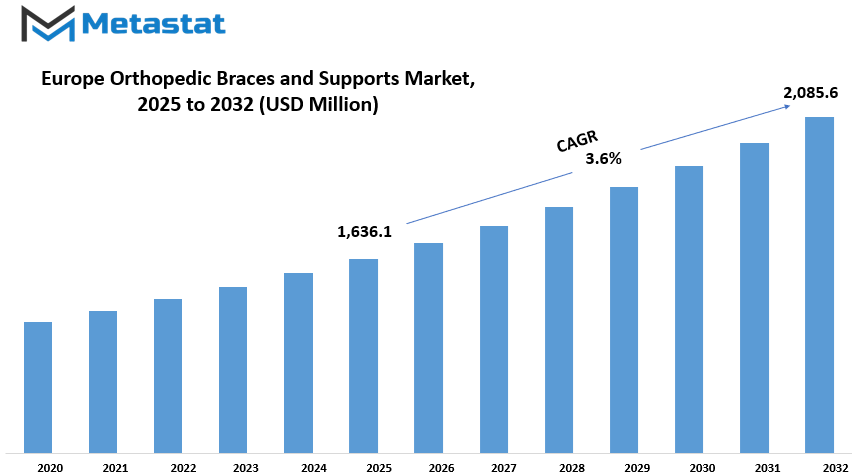

Europe orthopedic braces and aupports market is estimated to reach $2,085.6 Million by 2032; growing at a CAGR of 3.6% from 2025 to 2032.

GROWTH FACTORS

The europe orthopedic braces and aupports market is steadily increasing due to the effect of several major factors on supply, demand, and innovation. Aging has been the major cause of this growth. With age, the body acquires a greater propensity to develop joint and bone-related problems like arthritis, osteoporosis, and other musculoskeletal disorders. This clearly increases the demand for Orthopedic braces that allow the movement to and avert pain. Along with this, there is more awareness when it comes to preventive health care. People are more worried these days about maintaining their health at an early stage and avoiding large physical issues in the future. This shift in mindset is encouraging the application of braces both for rehabilitation purposes as well as prophylactically, generating higher demand both within hospitals and within homes.

Increased demand because of better technology is the second reason why the market is growing. Braces are becoming more comfortable, more flexible, and more customized to meet individual needs. Lighter materials are most commonly used to make new models, with comfort without compromising strength. Others even come with smart capabilities that track movement or recovery, so doctors and patients can more effectively control care. But even with this growth, there are some bumps in the road for the market. One of the biggest concerns is the price of upscale braces. They're pricey, and a lot of patients can't afford them, especially due to the fact that insurance tends to be limited or non-existent. This. This creates a gap between what patients need and what they can actually afford.

Adding to the problem of this gap, the strict medical device regulation in the European Union makes it difficult to bring new products into the market quickly. It takes a lot of time and money for firms to meet the required safety and quality standards, and this slows down innovation as well as limits options for patients. Despite these issues, positive things are on the horizon. For example, the medical systems within Eastern European nations are becoming better, which would raise access as well as demand for braces. Secondly, ongoing advancements in design are helping to create products that individuals will more likely wear on a regular basis, as long as they remain light and comfortable. This type of advancement will be able to generate increased sales while enhancing patient satisfaction, which makes it a good candidate for future investment and development.

MARKET SEGMENTATION

By Product

Europe is steadily increasing in orthopedic braces and support markets as more people are informed about the importance of mobility and prevention of injury. Braces and support are often used in recovery from injury, chronic disease or post-operative rehabilitation. They facilitate movement, reduce pain, and stabilize weak joints or muscles. With experience or age of physical stress caused by sporting activities or profession, the demand for these products rises. They are prescribed by medical practitioners for short-term and long-term prescription based on the situation. This sustained demand will continue with a rise in bone disorders and sports injuries in Europe.

In terms of products, a huge classification is available in the market. They have also been divided into ankle braces and support, priced at $503.3 million, foot walker and orthos, hip, back, and spine braces and supports, knee braces and supports, shoulder brace and supports, coil brace and supports, elbow brace and support, hand/wrist brace and supports and supports and supports and supports and supports and supports and supports and supports and supports and supports and supports and supports and supports and supports and supports and supports and supports We do. All are designed for a part of the body or any other, which help users to get task and prevent injury. Ankle and knee braces are particularly in demand because they are usually worn by people with athletes and arthritis or ligaments. Hip and back braces are also their market, especially with the problems of the posture or spine among the elderly.

Manufacturers are emphasizing comfort, ease of use and strength. Adjustable straps and respiratory fabrics are becoming standard features on most braces, which are less restrictive and more comfortable for everyday use. Buyers seek something supportive but not constricting, and new products are in the works to meet those needs. Doctors also want to be able to prescribe items patients will wear all the time, and that places pressure on both material and design innovation.

Hospitals, clinics, and even websites are now making these products more accessible. Increasingly, more and more people now like to buy them over the counter without a prescription, if only for superficial cuts or preventive use. But in such advanced situations, a doctor's advice is still required in order to be able to select the right product to apply.

As awareness grows and increasingly more people notice the worth of orthopedic braces and supports, the market will continue to grow even bigger. Increased innovation, enhanced access, and a growing elderly population will keep demand high for several years to come.

By Type

The europe orthopedic braces and aupports market are going to increase continuously as there is increasing awareness about joint health and high sports and accidents as well as age-related conditions, resulting in more injuries. With the rest of the remaining mobile and comfortable, the demand for orthopedic support products is steadily increasing. Orthopedic support products bring ease of surgery or injury after pain, stability and easily recovery. Most individuals are bent towards braces and support non-surgical, drug-free treatment options, especially for chronic conditions such as arthritis or joint dysfunction.

The industry is divided into three types: soft and elastic braces, hinged braces and hard braces. Soft and elastic braces are employed at a large scale for mild to moderate support. They are easy to wear, easy to use, and mostly prescribed in patients who have muscle sprains, light joint inflammation, or swelling. These braces are hinged and are often worn when physical activity is being performed or in activities of daily living for preventing further injury. Hinged braces are designed especially to offer controlled movement and are mostly recommended for the treatment of moderate to severe joint problems. They are usually used after surgeries or in the case of conditions like ligament damages, especially of knees. Braces maintain movement while still being flexible, which promotes healing. Hard braces, on the other hand, offer rigid support and are used where immobilization is essential. They are mainly recommended in cases of serious injury or fractures and also serve an important role in offering complete support and protection.

The increase in orthopedic ailments in the elderly populace is also a major force behind this market. Elderly individuals tend to develop joint ailments that require extra attention and care.At the same time, fashion for fitness exercises and sports in all age groups also increases the possibility of sprains and injuries, thus high demand for braces and support. In addition, progress in product and material design has increased the comfort and effectiveness of these products, encouraging more individuals to adopt them.

As European healthcare systems improve and more of the population become eligible for orthopedic and physical therapy, braces and supports will remain popular. The market will continue to grow as people spread the word and more seek to protect and support their joints without succumbing to surgery right away.

By Application

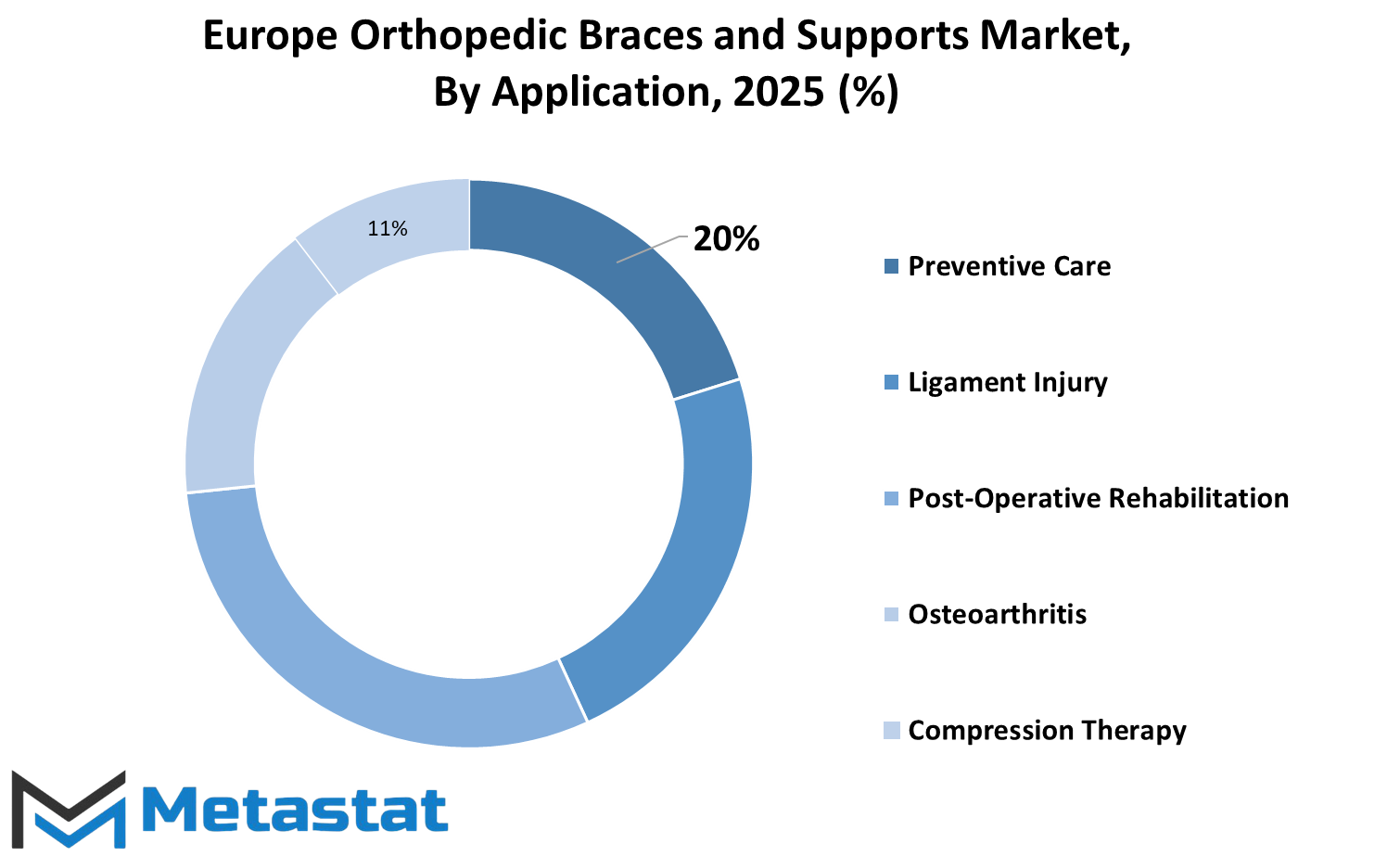

The demand for europe orthopedic braces and aupports market is constantly increasing with more people, which are to know the function of these products in various medical conditions. Support and braces are used to help patients cure, control chronic diseases or to prevent the progression of injury. They are often determined by doctors and physiotherapists as they provide additional assistance to the joints and muscles, which are able to move more comfortably and safely. The market is divided into several major applications such as preventive care, ligament injury, post-up rehabilitation, chronic osteoarthritis, compression therapy and various other diverse use.

Preventive treatment involves the use of braces to avoid injury, especially among athletes or individuals who perform physical exercises. These devices provide additional support and avoid the development of stress or injury while walking. In cases of ligament injuries, orthopedic braces play a major role in reducing pain and improving mobility. When a person receives a ligament injury, especially in the knee or ankle, the braces avoid the movement of the joint, which is able to easily heal the body.

For rehabilitation after surgery, these braces are worn after operations to stabilize the affected area and to guide the movement through the recovery process. They allow patients to resume their normal routine at a faster speed without subjugating the body's treatment part. Osteoarthritis is just one of the common joint disease conditions that affect many elderly people; it is another major reason why people use orthopedic braces. These types of products relieve stress on the joints, soften pain, and facilitate daily movement.

Compression therapy is another important segment, especially for those with swelling, circulation issues, or certain muscle ailments. Compression braces support by adding mild pressure, and this improves blood flow and reduces swelling. Aside from these big categories, the market also entails a set of other particular needs. This includes support for back pain, shoulder trauma, and conditions for the wrist or elbow.

With the increasing population of old people, increasing sports injuries, and an increasing awareness of recuperation and joint well-being, the demand for orthopedic bracing and supports in Europe is set to remain on the rise. Not only do these products help in recuperation but also let a person move about freely without having to worry about inflicting further damage. If a person is trying to prevent a problem or manage a chronic condition, supports and braces help improve quality of life.

By Distribution Channel

The europe orthopedic braces and aupports market is growing continuously, and understanding how such products reach the public is essential. The market is divided on the basis of how the supports and braces are supplied to users. These include orthopedic clinics and hospitals, websites, pharmacies and retailers, and other mediums like sporting stores. All these avenues are leveraged differently but play an important role in making it possible for individuals to reach what they need.

Orthopedic hospitals and clinics are the point of first contact where braces and supports are introduced to clients. These products are usually prescribed by specialists and physicians once a condition or injury is diagnosed. In an effort to take medical counsel, patients are likely to take the advice offered by physicians. Braces and supports provided through clinics and hospitals are mostly embraced right after surgery or utilized in the management of chronic illnesses, thus making this route a significant segment of the market.

Online retail platforms have also become the option for most, especially those who prefer it to shop at home. With one or two clicks, customers can compare offerings, read reviews, and have them delivered to their doorsteps. This is also helping customers who lack an easy access to the medical centers or stores. While online shopping may not offer direct medical advice, the widening range of choices and ease of services make it a convenient alternative for many.

Retailers and pharmacies are a good source of obtaining orthopedic supports and braces. They commonly have materials used in everyday use and are available for everyday use. Patients who do not mind buying a brace without visiting a hospital or looking at what the internet offers might use this source. Pharmacies tend to be found in neighborhoods, so accessing one is easy. The ability to see an attendant who can offer general guidance is also available.

Other channels of distribution, such as sports shops, also come into the picture. Sportsmen and those who enjoy an active way of life tend to seek out braces that offer additional support while they exercise. These shops typically carry items that are designed for performance and comfort and do well among individuals who understand their requirements.

All the channels offer different advantages based on what a person is looking for either professional guidance, ease of access, or specific product attributes. Together, they cater to the increasing need in the europe orthopedic braces and aupports market, making them accessible for multiple types of users.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1,636.1 million |

|

Market Size by 2032 |

$2,085.6 Million |

|

Growth Rate from 2025 to 2032 |

3.6% |

|

Base Year |

2024 |

COMPETITIVE PLAYERS

Europe is increasing awareness about the aging awareness about musculoskeletal health and an aging population in the Europe orthopedic braces and support market, requiring reliable joint and muscle support. People are more active today than ever and find ways to manage injuries or prevent them completely, especially as age. This has more demanded products that provide support, comfort and mobility. Orthopedic braces and supports are designed to help people with conditions such as arthritis, sprains, ligament injuries and post -surgery recovery. These products provide stability and reduce pain, making it easier for individuals to move around and continue their daily activities.

The market is also inspired by the increasing number of sports injuries and accidents, which have motivated many people to rely on braces and support during recovery. These products are not only for professional athletes, but are widely used by everyday people who want to be active when managing physical stress. The advances in materials and product design have made the braces more light, breathless and comfortable, which encourages people to use continuously. As healthcare becomes more personal, individuals are looking for products that meet their specific requirements. Whether someone needs a knee brace for walking or a wrist support to work on the desk, such solutions are available that provide the right balance of support and flexibility.

Many famous companies are involved in the production and distribution of these products across Europe. Among the prominent players in the Orthopedic Bracese and Support Industry, Alkaire Company, Ltd., Assent Meditech Limited, Baker Orthopedic, BSN Medical, Bauurfind AG, Deroyal Industries, Inc., DJO, LLC, McDawid, Frank Stubs Stabs Company Ink, MULR Sports Medicine, Ink, Oskin, Incin, O Orthopedic LP DBA Hely & Weber, Medi GMBH & Co. KG, Nippon Sigmax Co., Ltd., Ultra Ankle, Bettraguards Technology GMBH, CEP, Medical Specialty Inc., 3M Company, Bird & Chronic LLC, ThuS, Trulif, and sporlastic GMBH. These companies are continuously working on improving their product lines to match the increasing expectations of consumers. With strong competition in the market, people will continue to focus on innovation, comfort and effectiveness to help people live a healthy, more active life.

Europe Orthopedic Braces and Supports Market Key Segments:

By Product

- Ankle Braces and Supports

- Foot Walkers and Orthoses

- Hip, Back, and Spine Braces and Supports

- Knee Braces and Supports

- Shoulder Braces and Supports

- Elbow Braces and Supports

- Hand/Wrist Braces and Supports

- Facial Braces and Supports

By Type

- Soft and Elastic Braces

- Hinged Braces

- Hard Braces

By Application

- Preventive Care

- Ligament Injury

- Post-Operative Rehabilitation

- Osteoarthritis

- Compression Therapy

- Others

By Distribution Channel

- Orthopedic Clinics and Hospitals

- E-Commerce Platforms

- Pharmacies and Retailers

- Others (Sports Retail, etc.)

Key Europe Orthopedic Braces and Supports Industry Players

- Alcare Co., Ltd

- Ascent Meditech Limited

- Becker Orthopedic

- BSN medical

- Bauerfeind AG

- DeRoyal Industries, Inc

- DJO, LLC

- McDavid

- Frank Stubbs Company Inc.

- Mueller Sports Medicine, Inc.

- Oppo Medical Inc

- Össur

- Ottobock SE & Co. KGaA

- Weber Orthopedic LP. DBA Hely & Weber

- Medi GmbH & Co. KG

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383