MARKET OVERVIEW

The Europe Electronic Data Interchange (EDI) Solutions market, an integral part of the technology industry, is witnessing significant advancements as businesses increasingly adopt digital solutions to streamline their operations. EDI solutions in Europe facilitate the seamless exchange of business documents in a standardized electronic format between organizations, thus enhancing efficiency, accuracy, and speed in business transactions. This market encompasses a wide range of industries including retail, healthcare, manufacturing, and logistics, where the exchange of documents such as invoices, purchase orders, and shipping notices is crucial for daily operations.

As digital transformation continues to reshape the business landscape, the Europe EDI Solutions market will play a crucial role in supporting organizations' need for efficient data interchange systems. Companies in Europe are moving away from traditional paper-based processes, recognizing the benefits of EDI in reducing manual data entry errors, cutting operational costs, and improving overall productivity. This trend will be further driven by the increasing emphasis on compliance with regulations and standards that mandate the use of EDI for specific transactions, particularly in industries like healthcare and pharmaceuticals.

Moreover, the rise of e-commerce and the global supply chain’s complexity necessitate robust and scalable EDI solutions. Businesses will require systems that not only integrate seamlessly with their existing enterprise resource planning (ERP) systems but also offer flexibility to adapt to the dynamic market conditions. The Europe EDI Solutions market will thus see a growing demand for cloud-based EDI services that provide scalability, enhanced security features, and cost-effectiveness compared to traditional on-premises solutions.

In addition, the interoperability of EDI solutions with other business technologies such as blockchain, artificial intelligence (AI), and the Internet of Things (IoT) will open new avenues for innovation. Blockchain, for instance, will enhance the transparency and traceability of transactions, while AI can be leveraged to predict trends and automate decision-making processes. The integration of IoT devices will facilitate real-time data exchange, further optimizing supply chain operations. These technological advancements will be pivotal in driving the adoption of EDI solutions across various sectors.

Another significant trend in the Europe EDI Solutions market will be the increasing collaboration between EDI solution providers and other technology vendors. Partnerships and alliances will enable the development of comprehensive solutions that address specific industry needs, ensuring that businesses can implement EDI systems that are tailored to their unique requirements. Furthermore, as data security remains a top concern for organizations, EDI solution providers will continue to enhance their security protocols to protect sensitive business information from cyber threats.

The Europe EDI Solutions market will also benefit from the supportive regulatory environment. Governments and regulatory bodies in Europe will continue to push for the adoption of electronic invoicing and other EDI practices to improve transparency and efficiency in business transactions. Initiatives such as the European Union’s Digital Single Market strategy will further promote the use of EDI solutions, creating a more integrated and efficient digital economy across Europe.

The Europe Electronic Data Interchange (EDI) Solutions market is poised for significant growth and transformation. As businesses in Europe increasingly adopt digital solutions to improve their operational efficiency, the demand for advanced, secure, and interoperable EDI systems will continue to rise. The integration of emerging technologies, supportive regulatory frameworks, and strategic collaborations will be key drivers in shaping the future of this market, enabling businesses to achieve greater efficiency and competitiveness in the digital age.

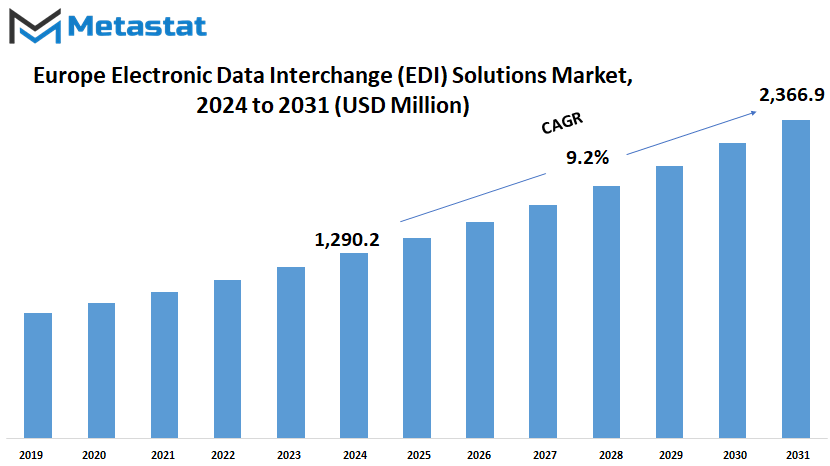

Europe Electronic Data Interchange (EDI) Solutions market is estimated to reach $2,366.9 Million by 2031; growing at a CAGR of 9.2% from 2024 to 2031.

GROWTH FACTORS

The growth of the Europe Electronic Data Interchange (EDI) Solutions market is fueled by several key factors. One significant factor is the increasing adoption of automation and digitalization in supply chain management. As businesses seek to streamline communication and transactions, there is a rising demand for EDI solutions that can facilitate seamless data exchange between trading partners.

Additionally, compliance requirements and regulatory mandates across various industries are driving the adoption of EDI solutions. These solutions offer secure and standardized data exchange, helping businesses meet the necessary regulatory standards and ensure compliance with industry guidelines.

However, despite the benefits, there are challenges that may impede the growth of the EDI market. One such challenge is the high implementation and maintenance costs associated with EDI systems. For small and medium-sized businesses, these costs may be prohibitive, leading to reluctance in adopting EDI solutions.

Furthermore, integration challenges with existing legacy systems and trading partner networks can pose obstacles to the implementation of EDI solutions. Businesses may face difficulties in seamlessly integrating EDI systems with their current infrastructure, potentially slowing down the adoption process.

Looking ahead, the development of cloud-based EDI solutions presents promising opportunities for market growth. Cloud-based solutions offer scalability, flexibility, and ease of integration, making them attractive options for businesses of all sizes and across various industries. By leveraging cloud technology, EDI vendors can cater to a wider range of businesses and provide solutions that are tailored to meet their specific needs.

While there are challenges that may hinder the growth of the Europe EDI Solutions market, such as high costs and integration complexities, the increasing demand for automation and digitalization, as well as the development of cloud-based solutions, will likely drive market growth in the coming years. As businesses continue to prioritize efficiency and compliance, the adoption of EDI solutions is expected to increase, paving the way for further expansion and innovation in the market.

MARKET SEGMENTATION

By Type

The European Electronic Data Interchange (EDI) Solutions market is continually growing and diversifying. In 2021, the market was segmented into different types, each playing a crucial role in facilitating electronic data exchange. These segments include Electronic Data Interchange (EDI) VAN, Web Electronic Data Interchange (EDI), Electronic Data Interchange (EDI) Outsourcing, Electronic Data Interchange (EDI) Software, Direct Electronic Data Interchange (EDI), and Others.

Electronic Data Interchange (EDI) VAN, standing for Value-Added Network, is a significant segment in the market, valued at 298.1 USD Million in 2021. This type of EDI involves using a third-party network provider to facilitate data exchange between trading partners. It ensures secure and reliable communication, vital for businesses operating in a digital landscape.

Web Electronic Data Interchange (EDI), valued at 156.9 USD Million in 2021, is another crucial segment. It allows businesses to exchange electronic documents directly through web-based platforms, eliminating the need for specialized software or VAN services. This segment caters to the evolving needs of businesses seeking more accessible and cost-effective EDI solutions.

Electronic Data Interchange (EDI) Outsourcing, valued at 112.3 USD Million in 2021, offers businesses the option to outsource their EDI processes to specialized service providers. Outsourcing EDI functions can help companies streamline operations, reduce costs, and improve efficiency, particularly for those lacking in-house expertise or resources.

Electronic Data Interchange (EDI) Software, valued at 183 USD Million in 2021, provides businesses with dedicated software solutions to manage their EDI processes internally. These software solutions offer flexibility and customization options tailored to the specific needs of each organization, enabling seamless integration with existing systems.

Direct Electronic Data Interchange (EDI) refers to the direct exchange of electronic documents between trading partners without the need for intermediaries. While not as prevalent as other segments, it offers businesses greater control and autonomy over their EDI processes, promoting faster and more efficient data exchange

The remaining segment, Others, encompasses emerging EDI solutions and innovative technologies that are shaping the future of electronic data exchange. As technology continues to advance, new opportunities and challenges will arise, driving further innovation and growth in the European EDI Solutions market.

The European Electronic Data Interchange (EDI) Solutions market is dynamic and multifaceted, with various segments catering to the diverse needs of businesses across industries. As technology evolves, so too will the landscape of EDI, offering businesses new ways to streamline operations, enhance efficiency, and drive growth.

By Deployment

The European Electronic Data Interchange (EDI) Solutions market is seeing significant growth and development. One key aspect shaping this market is the various deployment options available to consumers, namely Cloud Based and On-Premise solutions.

Cloud Based deployment refers to the utilization of computing resources, such as servers and storage, hosted on the internet. This option offers flexibility and scalability, allowing businesses to easily adjust their usage based on their needs. Additionally, Cloud Based solutions typically require lower upfront costs compared to On-Premise alternatives. This cost-effectiveness appeals to many organizations, especially smaller businesses or those operating on tight budgets. Moreover, Cloud Based deployment enables remote access to data and services, promoting collaboration and accessibility among teams regardless of geographical location. As technology continues to advance, Cloud Based solutions are anticipated to become even more prevalent in the European EDI Solutions market.

On the other hand, On-Premise deployment involves hosting computing resources locally within the organization's premises. While this option may require higher initial investment in infrastructure and maintenance, it offers greater control and customization over the EDI system. Some businesses prefer On-Premise solutions due to data security concerns or regulatory requirements that mandate keeping sensitive information within company premises. Additionally, On-Premise deployment allows organizations to tailor the EDI system to meet specific needs or integrate it seamlessly with existing software and infrastructure. Despite the growing popularity of Cloud Based solutions, On-Premise deployment will continue to have its place in the European EDI Solutions market, particularly among larger enterprises with complex IT environments or stringent compliance requirements.

By Size

In today's digital age, the European Electronic Data Interchange (EDI) Solutions market is a significant player in facilitating seamless communication and data exchange between businesses. This market, categorized by size into Large Enterprises and Small and Medium Enterprises (SMEs), plays a crucial role in enhancing efficiency and streamlining operations across various industries.

Large Enterprises, characterized by their substantial scale and extensive resources, will continue to drive substantial demand for EDI solutions. These enterprises operate on a grand scale, necessitating sophisticated EDI systems to manage their vast networks of suppliers, distributors, and partners. The adoption of EDI solutions enables large enterprises to automate processes, minimize errors, and improve overall operational efficiency. Additionally, these enterprises often have complex supply chains spanning multiple regions, further emphasizing the need for robust EDI solutions to facilitate seamless communication and data exchange across borders.

On the other hand, SMEs, despite their comparatively smaller size, will increasingly recognize the value of EDI solutions in optimizing their business processes. As the market evolves, SMEs will increasingly leverage EDI technology to enhance their competitiveness, streamline operations, and unlock new growth opportunities. With advancements in technology and increasing affordability of EDI solutions, SMEs will find it easier to adopt and integrate these systems into their operations.

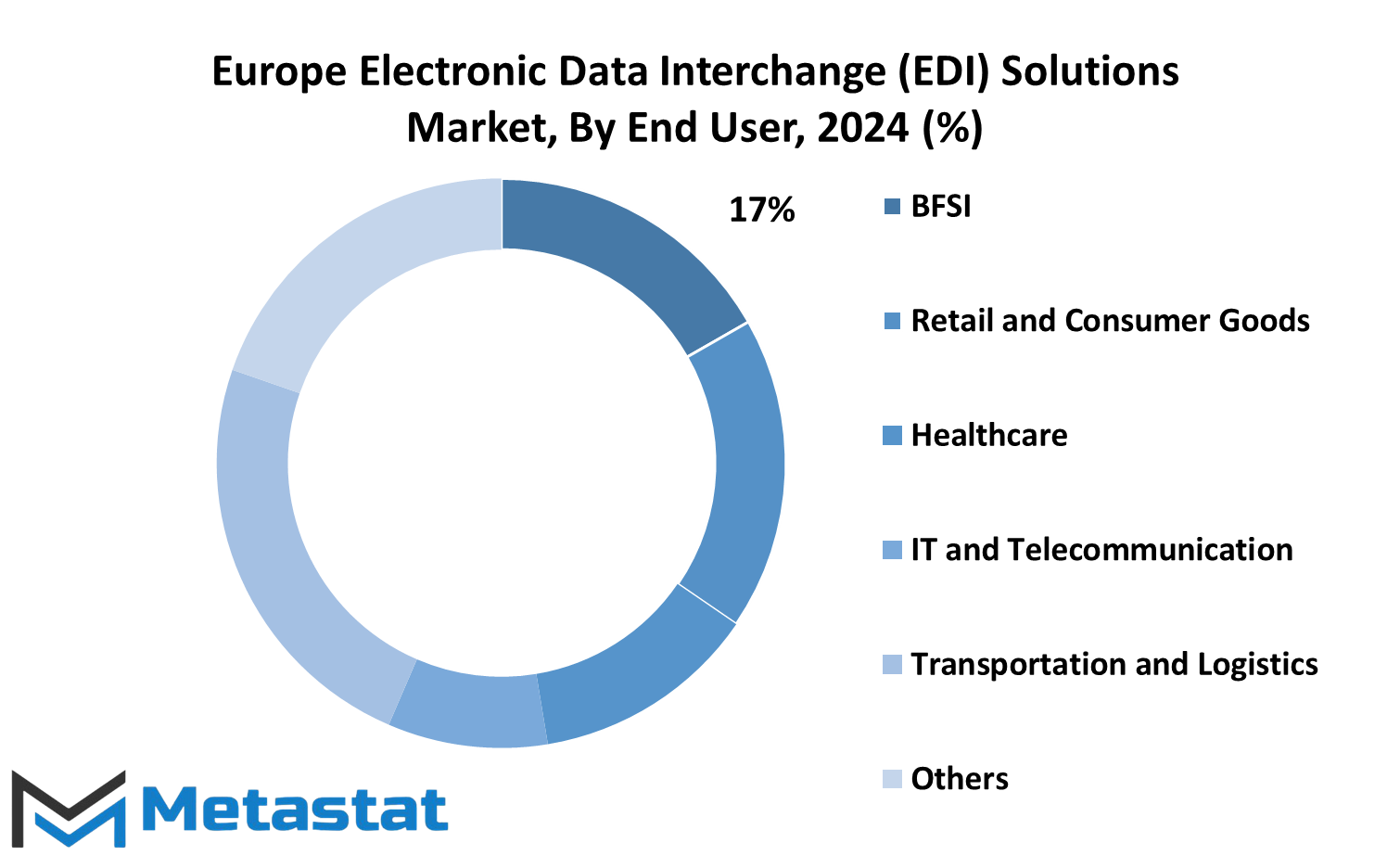

By End User

The Europe Electronic Data Interchange (EDI) Solutions market, segmented by End User, comprises various sectors like BFSI, Retail and Consumer Goods, Healthcare, IT and Telecommunication, Transportation and Logistics, and Others. Each sector plays a pivotal role in shaping the landscape of the market, influencing its growth trajectory and technological advancements.

In the banking, financial services, and insurance (BFSI) sector, EDI solutions streamline transactions, enhance security, and improve operational efficiency. As financial institutions continue to embrace digital transformation, the demand for EDI solutions in BFSI will likely soar, driven by the need for secure and efficient data exchange

Retail and consumer goods industries are witnessing a paradigm shift towards digitalization and automation. EDI solutions facilitate seamless communication between retailers, suppliers, and distributors, enabling real-time inventory management, order processing, and supply chain optimization. With the rise of e-commerce and omnichannel retailing, the adoption of EDI in this sector will only intensify.

In the healthcare sector, EDI solutions play a crucial role in improving patient care, enhancing data accuracy, and ensuring compliance with regulatory standards such as HIPAA in the United States or GDPR in Europe. Electronic exchange of medical records, claims, and billing information accelerates administrative processes, reduces errors, and lowers operational costs, thereby benefiting both healthcare providers and patients.

The IT and telecommunication sector relies heavily on EDI solutions for seamless integration of diverse systems, networks, and applications. As businesses strive for interoperability and connectivity, EDI serves as a foundational technology for data exchange, collaboration, and interoperability across various platforms and devices.

Transportation and logistics companies leverage EDI solutions to streamline supply chain operations, optimize freight management, and enhance visibility and tracking capabilities. By automating processes such as order fulfillment, shipment tracking, and customs clearance, EDI helps companies reduce transit times, minimize costs, and improve customer satisfaction.

Furthermore, other industries such as manufacturing, utilities, and government sectors also benefit from EDI solutions, albeit to varying degrees. These industries utilize EDI for procurement, invoicing, regulatory compliance, and information sharing, among other purposes.

The Europe Electronic Data Interchange (EDI) Solutions market is characterized by its diverse end-user segments, each with unique requirements and opportunities. As technology continues to evolve and businesses embrace digital transformation, the demand for EDI solutions across various industries will continue to grow, driving innovation and shaping the future of electronic data exchange.

REGIONAL ANALYSIS

The Europe Electronic Data Interchange (EDI) Solutions market is a significant aspect of the region's technological landscape. It encompasses countries such as the UK, Germany, France, Italy, and the Rest of Europe. Each of these countries contributes uniquely to the market's dynamics.

The United Kingdom, with its thriving technological ecosystem centered around cities like London and Manchester, will likely serve as a key hub for EDI adoption and innovation. Its robust infrastructure and advanced IT services will fuel the growth of EDI solutions, catering to various industries ranging from finance to healthcare.

Germany, renowned for its engineering prowess and industrial strength, will play a pivotal role in shaping the EDI landscape. With a focus on efficiency and precision, German companies will embrace EDI solutions to streamline their supply chains and enhance operational agility. This adoption will extend across sectors, from automotive manufacturing to pharmaceuticals.

France, known for its rich cultural heritage and technological advancements, will integrate EDI solutions into its diverse economy. The country's emphasis on innovation and digital transformation will drive the adoption of EDI across industries such as retail, aerospace, and telecommunications. French companies will leverage EDI to optimize their business processes and gain a competitive edge in the global market.

Italy, with its tradition of craftsmanship and a burgeoning tech scene, will witness a gradual uptake of EDI solutions. Italian businesses, particularly in sectors like fashion, automotive, and food, will adopt EDI to modernize their operations and improve collaboration with partners and suppliers. This adoption will be driven by a growing awareness of the benefits of digitalization and the need to stay competitive in a rapidly evolving market.

The Rest of Europe, comprising countries like Spain, the Netherlands, and Switzerland, will also contribute significantly to the EDI market. These countries, characterized by diverse economies and technological ecosystems, will adopt EDI solutions tailored to their specific needs and priorities. Whether it's optimizing logistics networks or streamlining procurement processes, organizations across the region will leverage EDI to drive efficiency and innovation.

The Europe Electronic Data Interchange (EDI) Solutions market is poised for substantial growth, driven by the collective efforts of countries like the UK, Germany, France, Italy, and the Rest of Europe. As businesses across various sectors recognize the value of digital transformation, the adoption of EDI will continue to expand, shaping the future of commerce and collaboration in the region.

COMPETITIVE PLAYERS

In the ever-evolving landscape of the Europe Electronic Data Interchange (EDI) Solutions market, several competitive players vie for prominence. These key entities play pivotal roles in shaping the trajectory of the industry and influencing its dynamics.

Among the prominent participants in the Electronic Data Interchange (EDI) Solutions sector are Comarch SA, Unifiedpost Group, Generix Group, Boomi, Tangentia Inc., EDITEL, HubBroker ApS, Cleo, IBM Corporation, SPS Commerce, Inc., Mulesoft, LLC, TrueCommerce Inc., The Descartes Systems Group Inc., EDICOM, and Data Interchange PLC.

Each of these entities brings its unique set of capabilities, resources, and expertise to the table. They compete not only in terms of the quality and efficacy of their EDI solutions but also in terms of market reach, innovation, and customer service.

Comarch SA, for instance, is known for its comprehensive suite of EDI solutions tailored to the specific needs of various industries. Unifiedpost Group distinguishes itself through its robust network and seamless integration capabilities. Generix Group is recognized for its agility and adaptability, catering to the evolving demands of the market.

Boomi, Tangentia Inc., and Cleo are renowned for their user-friendly interfaces and advanced integration capabilities. EDITEL and HubBroker ApS excel in providing secure and reliable EDI solutions, crucial for industries dealing with sensitive data.

IBM Corporation, SPS Commerce, Inc., and Mulesoft, LLC leverage their technological prowess and global presence to offer scalable and innovative EDI solutions. TrueCommerce Inc. and The Descartes Systems Group Inc. are known for their comprehensive supply chain solutions, integrating EDI seamlessly into the broader logistics ecosystem.

EDICOM and Data Interchange PLC specialize in providing EDI solutions that comply with industry standards and regulations, essential for businesses operating in regulated sectors.

As the Europe Electronic Data Interchange (EDI) Solutions market continues to evolve, these competitive players will play a pivotal role in driving innovation, shaping industry standards, and meeting the diverse needs of businesses across various sectors.

Their ongoing efforts to enhance interoperability, streamline processes, and improve the overall efficiency of EDI solutions will not only benefit their respective clients but also contribute to the growth and development of the broader European business ecosystem. With each player bringing its unique strengths and capabilities to the table, the competitive landscape of the Europe EDI Solutions market promises to remain vibrant and dynamic in the years to come.

Europe Electronic Data Interchange (EDI) Solutions Market Key Segments:

By Type

- Electronic Data Interchange (EDI) VAN

- Web Electronic Data Interchange (EDI)

- Electronic Data Interchange (EDI) Outsourcing

- Electronic Data Interchange (EDI) Software

- Direct Electronic Data Interchange (EDI)

- Others

By Deployment

- Cloud Based

- On-Premise

By Size

- Large Enterprises

- SMEs

By End User

- BFSI

- Retail and Consumer Goods

- Healthcare

- IT and Telecommunication

- Transportation and Logistics

- Others

Key Europe Electronic Data Interchange (EDI) Solutions Industry Players

- Comarch SA

- Unifiedpost Group

- Generix Group

- Boomi

- Tangentia Inc.

- EDITEL

- HubBroker ApS

- Cleo

- IBM Corporation

- SPS Commerce, Inc.

- Mulesoft, LLC

- TrueCommerce Inc.

- The Descartes Systems Group Inc.

- EDICOM

- Data Interchange PLC

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252