MARKET OVERVIEW

The Europe Braided Composites market stands as a dynamic sector within the broader composite materials industry. With a focus on intricate weaving techniques, these composites offer a unique blend of strength, flexibility, and durability. The industry encompasses a wide array of applications across various sectors, including aerospace, automotive, marine, and sports equipment.

In the aerospace sector, Europe Braided Composites are poised to play a pivotal role in the development of next-generation aircraft. Manufacturers are exploring innovative braiding methods to create lightweight yet robust components for aircraft structures, leading to enhanced fuel efficiency and performance. These composites offer superior resistance to fatigue and corrosion, making them ideal for use in critical aerospace applications.

Similarly, the automotive industry is witnessing a surge in the adoption of Braided Composites for lightweighting initiatives. European automakers are increasingly incorporating these materials into vehicle components to reduce overall weight and improve fuel efficiency. From body panels to interior trim, Braided Composites offer designers greater flexibility and creativity in crafting vehicles that are both aesthetically pleasing and environmentally sustainable.

In the marine sector, Europe Braided Composites are revolutionizing the construction of boats and yachts. By leveraging their high strength-to-weight ratio, these composites enable the production of vessels that are not only faster and more maneuverable but also more fuel-efficient. Moreover, their resistance to corrosion ensures longevity, even in harsh marine environments, making them an attractive choice for boat builders across Europe.

Sports equipment manufacturers are also tapping into the potential of Braided Composites to enhance the performance of their products. From tennis rackets to bicycle frames, these materials offer athletes greater control, power, and durability. By incorporating advanced braiding techniques, European companies are pushing the boundaries of innovation in sports equipment design, giving athletes a competitive edge on the global stage.

As the demand for lightweight, high-performance materials continues to grow, the Europe Braided Composites market is poised for significant expansion in the coming years. Technological advancements in braiding machinery and materials are driving innovation and opening up new opportunities for growth across various industries. With a focus on sustainability and efficiency, European manufacturers are at the forefront of this revolution, driving the development of next-generation Braided Composites that will shape the future of industries worldwide.

The Europe Braided Composites market represents a dynamic and rapidly evolving sector within the composite materials industry. With applications spanning aerospace, automotive, marine, and sports equipment, these materials offer unparalleled strength, flexibility, and durability. As technological advancements continue to drive innovation, European manufacturers are well-positioned to lead the way in shaping the future of Braided Composites and their impact on industries around the globe.

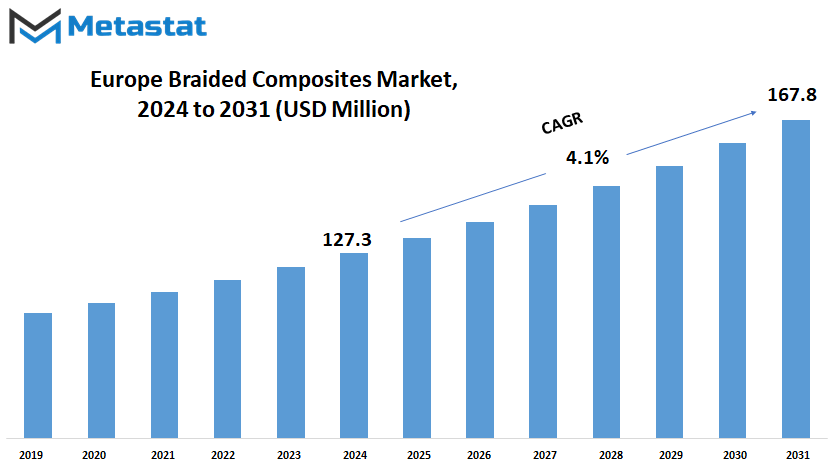

The Europe Braided Composites market is estimated to reach $167.8 Million by 2031; growing at a CAGR of 4.1% from 2024 to 2031.

GROWTH FACTORS

The Europe Braided Composites market is experiencing significant growth, driven by a rising demand for lightweight and high-performance materials across various industries such as aerospace, automotive, and sports. Braided composites, with their exceptional strength-to-weight ratio, are increasingly being favored for structural components in these sectors. Additionally, advancements in braiding techniques and materials are enabling the production of complex shapes and tailored properties, further enhancing their suitability for specific applications.

However, the market is also facing challenges. One notable obstacle is the high manufacturing costs associated with braided composite production processes. These costs stem from the need for specialized equipment and skilled labor, making widespread adoption across industries difficult. Moreover, the limited scalability and production capacity of braiding facilities pose another hurdle, hindering mass production and economies of scale for braided composite materials.

Despite these challenges, the future of the Europe Braided Composites market holds promise. Expansion of applications beyond traditional industries into emerging sectors like renewable energy, infrastructure, and medical devices is expected to open up new avenues for growth and diversification. As these industries increasingly recognize the benefits of braided composites, the market is likely to witness substantial expansion in the coming years.

The Europe Braided Composites market is poised for growth driven by growing demand and technological advancements. With opportunities emerging in new sectors, the market is expected to evolve and thrive, catering to a broader range of applications and driving innovation in the field of composite materials.

MARKET SEGMENTATION

By Product Type

In the vast landscape of composite materials, Europe stands as a significant player, particularly in the realm of braided composites. These materials, woven together with precision, offer a range of benefits across various industries. When we delve into the European market for braided composites, we find a diverse array of products segmented into different types, including biaxial, triaxial, and others.

Braided composites hold immense promise for the future, with advancements in technology and manufacturing processes continually pushing the boundaries of what is possible. As Europe moves forward, embracing innovation and sustainability, the market for these materials is expected to see substantial growth.

One of the key segments within the European market is based on the type of braided composite products available. Biaxial composites, characterized by fibers arranged in two directions, offer enhanced strength and stiffness. These materials find applications in industries ranging from aerospace to automotive, where performance and durability are paramount.

Triaxial composites, on the other hand, feature fibers woven in three directions, providing even greater structural integrity and versatility. This makes them suitable for applications requiring complex shapes and load-bearing capabilities. With advancements in manufacturing techniques, the cost-effectiveness of triaxial composites is expected to improve, further driving their adoption across various sectors

Beyond biaxial and triaxial composites, there exist other types of braided materials tailored to specific needs and requirements. These may include combinations of different fiber types, resin formulations, or weaving patterns, catering to niche markets and specialized applications. As industries continue to demand lightweight, high-performance materials, the versatility of braided composites will play a crucial role in meeting those needs.

By Fiber Type

In the European market for braided composites, various fiber types play a significant role in shaping its dynamics. These fiber types include carbon fiber, glass fiber, aramid fiber, and others. Understanding the distinctions among these fiber types is crucial for grasping their respective impacts on the market.

Carbon fiber stands out for its exceptional strength-to-weight ratio, making it a popular choice in industries where lightweight and robust materials are necessary. As technological advancements continue to push the boundaries of material science, carbon fiber is poised to maintain its dominance in high-performance applications such as aerospace, automotive, and sports equipment.

Glass fiber, on the other hand, is valued for its affordability and versatility. Although not as strong as carbon fiber, glass fiber still offers considerable strength and stiffness while being more cost-effective. Its widespread use in construction, transportation, and consumer goods is expected to persist as industries seek economical solutions without compromising performance.

Aramid fiber, renowned for its extraordinary strength and heat resistance, finds its niche in demanding applications where extreme durability is paramount. Industries such as military, defense, and aerospace rely on aramid fiber for its ability to withstand harsh conditions while providing excellent protection and structural reinforcement.

The category of others encompasses a diverse range of fiber types, each with its unique properties and applications. These may include natural fibers, hybrid composites, and emerging materials that offer innovative solutions to specific industry needs. As research and development efforts continue to push the boundaries of material science, the landscape of braided composites is likely to witness the emergence of novel fiber types with enhanced performance characteristics.

By Application

The European Braided Composites market is on a path of significant growth and diversification, showcasing a promising future. Divided into various applications, such as Automotive & Transportation, Aerospace & Defense, Electrical & Electronics, Wind Energy, Construction & Infrastructure, Pipes & Tanks, Marine, and Others, this market is poised to expand its reach across multiple sectors.

In the realm of Automotive & Transportation, a sector that continues to push boundaries with innovations in electric and autonomous vehicles, braided composites are set to play a crucial role. With a valuation of 64.3 USD Million in 2021, this segment will witness continued growth as automakers increasingly integrate lightweight and durable materials to enhance fuel efficiency and overall performance.

Meanwhile, in Aerospace & Defense, where precision and reliability are paramount, braided composites are valued at 27.8 USD Million in 2021. As the aerospace industry embraces advancements in materials and manufacturing processes, these composites will find wider applications in aircraft components, offering a blend of strength, flexibility, and weight reduction.

The Electrical & Electronics sector, a cornerstone of modern society, is also embracing braided composites for their insulation and structural properties. As demands for smaller, lighter, and more efficient electronic devices increase, these materials will find expanded use in a myriad of applications, from consumer electronics to industrial machinery.

In the renewable energy sector, Wind Energy stands out as a key area for the adoption of braided composites. With the global shift towards sustainable energy sources, wind turbine manufacturers are turning to lightweight and corrosion-resistant materials to enhance the performance and longevity of their installations.

Moreover, in Construction & Infrastructure projects, braided composites offer durability and versatility, making them ideal for reinforcing concrete structures, bridges, and other critical infrastructure components.

The Pipes & Tanks industry also stands to benefit from the use of braided composites, as they offer corrosion resistance and structural integrity, particularly in harsh environments such as chemical processing plants and offshore oil rigs.

In the Marine sector, where vessels face challenging conditions at sea, braided composites provide lightweight solutions for hulls, masts, and other structural components, improving efficiency and performance while reducing maintenance requirements.

Overall, the future of the European Braided Composites market is bright, with continued advancements in material science and manufacturing techniques driving innovation and expansion across a diverse range of industries. As demand for lightweight, durable, and sustainable materials continues to grow, braided composites will play an increasingly integral role in shaping the technologies and infrastructure of tomorrow.

By Resin Type

The European market for braided composites is poised for growth, particularly in the realm of resin types. Within this market, braided composites are categorized by resin type into two main segments, thermoset and thermoplastic.

Thermoset braided composites have long been favored for their durability and heat resistance. These materials undergo a chemical reaction during curing that results in a hardened, irreversible state. This characteristic makes thermoset composites well-suited for applications where heat and harsh environmental conditions are prevalent, such as in aerospace and automotive industries. Additionally, thermoset composites offer excellent dimensional stability and corrosion resistance, further enhancing their appeal in various sectors.

On the other hand, thermoplastic braided composites are gaining traction due to their unique properties and processing advantages. Unlike thermoset composites, thermoplastics can be melted and reshaped multiple times without undergoing chemical changes. This property not only facilitates recycling and repair processes but also allows for complex shaping and joining techniques, leading to greater design flexibility and cost savings. As sustainability and environmental concerns continue to drive innovation, thermoplastic composites are anticipated to see increased adoption across industries seeking eco-friendly alternatives.

REGIONAL ANALYSIS

The Europe Braided Composites market is a dynamic landscape comprising the UK, Germany, France, Italy, and the Rest of Europe. This market is poised for growth and innovation in the coming years. Braided composites, known for their strength and lightweight properties, are finding applications in various industries, including aerospace, automotive, and sporting goods.

In the UK, the demand for braided composites is expected to rise steadily as industries seek lightweight and durable materials for their products. With advancements in manufacturing techniques and increased investment in research and development, the UK is well-positioned to emerge as a key player in the European braided composites market.

Germany, known for its engineering prowess, will continue to drive innovation in the braided composites sector. The country's strong automotive and aerospace industries will fuel demand for lightweight materials, creating opportunities for growth and expansion in the market.

France, with its focus on sustainability and technological innovation, will play a crucial role in shaping the future of the European braided composites market. As industries strive to reduce their carbon footprint and improve fuel efficiency, the demand for eco-friendly materials like braided composites will soar.

Italy, renowned for its craftsmanship and expertise in manufacturing, will leverage its strengths to carve a niche in the braided composites market. The country's rich heritage in automotive design and engineering will drive demand for high-performance materials, leading to further advancements in the sector

The Rest of Europe, encompassing various countries with diverse industrial landscapes, will witness significant growth in the braided composites market. As awareness about the benefits of these materials grows and technological advancements continue, industries across the region will increasingly adopt braided composites in their products and applications

Overall, the Europe Braided Composites market is poised for rapid growth and innovation in the coming years. With advancements in manufacturing technologies, increased investment in research and development, and growing demand from key industries, the market will continue to expand and evolve. As countries across Europe embrace the potential of braided composites, they will drive forward progress and shape the future of the global composites industry.

COMPETITIVE PLAYERS

In the realm of the European Braided Composites market, various companies are engaged in competitive endeavors to establish their presence and capture market share. These players, ranging from A&P Technology to GKN Aerospace, are instrumental in shaping the landscape of braided composites within Europe.

A&P Technology, renowned for its innovative approach, stands as a significant contender in the market. Leveraging advanced techniques, they aim to push the boundaries of braided composites, offering solutions that meet the evolving needs of industries.

Action Composites GmbH, another key player, brings expertise in manufacturing and distribution, positioning themselves as a reliable partner for businesses seeking high-quality braided composite products. With a focus on efficiency and reliability, they strive to deliver value to their customers.

Solvay, with its extensive portfolio of composite materials, plays a pivotal role in driving innovation and sustainability in the braided composites sector. Their commitment to research and development ensures that they stay ahead of the curve, anticipating market trends and customer demands.

TCR Composites, Inc. brings a unique perspective to the table, specializing in customized solutions tailored to specific applications. By understanding the unique requirements of their clients, they can deliver bespoke braided composite solutions that address challenges and unlock opportunities.

Teijin Limited, a global leader in advanced materials, is actively involved in the European Braided Composites market, offering a diverse range of products and services. Their comprehensive approach, coupled with a focus on sustainability, positions them as a preferred choice for environmentally conscious consumers.

SGL and Owens Corning, both established names in the industry, continue to uphold their reputation for quality and reliability. With a strong emphasis on research and development, they remain at the forefront of technological advancements, driving growth and innovation in the braided composites market.

Plastic Reinforcement Fabrics Ltd and Munich Composites, with their expertise in manufacturing and engineering, contribute to the competitiveness of the European Braided Composites market. By leveraging their technical prowess, they enable the development of cutting-edge solutions that address the diverse needs of various industries.

China Jushi Co., Ltd. and Compagnie de Saint-Gobain S.A., with their global presence and extensive resources, play a significant role in shaping the dynamics of the market. Their strategic investments and partnerships ensure a strong foothold in Europe, driving growth and fostering competitiveness.

Composite Braiding Ltd. and Eurocarbon B.V., with their specialized capabilities in braiding technology, offer niche solutions that cater to specific market segments. By focusing on innovation and collaboration, they contribute to the overall vibrancy and diversity of the European Braided Composites market.

The competitive landscape of the European Braided Composites market is characterized by the presence of diverse players, each contributing their unique strengths and capabilities to drive innovation, growth, and competitiveness.

Braided Composites Market Key Segments:

By Product Type

- Biaxial

- Triaxial

- Others

By Fiber Type

- Carbon Fiber

- Glass Fiber

- Aramid Fiber

- Others

By Application

- Automotive & Transportation

- Aerospace & Defense

- Electrical & Electronics

- Wind Energy

- Construction & Infrastructure

- Pipes & Tanks

- Marine

- Others

By Resin Type

- Thermoset

- Thermoplastic

Key Europe Braided Composites Industry Players

- A&P Technology

- Action Composites GmbH

- Solvay

- TCR Composites, Inc.

- Teijin Limited

- SGL

- Owens Corning

- Plastic Reinforcement Fabrics Ltd

- Munich Composites

- China Jushi Co., Ltd.

- Compagnie de Saint-Gobain S.A.

- Composite Braiding Ltd.

- Hexcel Corporation

- Eurocarbon B.V.

- GKN Aerospace

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252