MARKET OVERVIEW

For some dynamic changes in the existing industry and Europe Alloy Wheels market will come in the coming years. Alloy wheels have been valued for their strength, durability, and style and have become almost inevitable in the automotive industry. Further development of European car manufacturers will cause additional increases in the demand for alloy wheels, paving the way for newer and better designs and manufacturing processes. Wheels made from different metal compositions, mainly aluminum and magnesium, which are lighter than conventional steel wheels, will also improve handling and fuel efficiency, making them even more attractive to customers.'

In the near future, the Europe Alloy Wheels market will experience significant progress in the portion of materials technology. The manufacturers will be looking for better ways of alloys which will produce the wheels that are lighter and stronger but with higher resistance attributes to corrosion. The course of development of newer alloys can change future wheels manufacturing methods to less-expensive and more durable wheels without compromising on performance. These changes will be an added attraction for alloy wheels, keeping in mind that automotive manufacturers increasingly focus more on sustainable and energy-efficient vehicles.

Customization is another feature that is intensifying within the European Alloy Wheels market. Personalization has become an essential feature for every consumer, and alloy wheels are one avenue through which the appearance of any vehicle can be enhanced. Eventually, customization is likely to include an even wider range of colors, finishes, and designs because the consumer base iw becoming more discerning. The sole growing emphasis on individuality will force the manufacturers to create aesthetically versatile products to meet different tastes and preferences across the continent.

Currently, all indications point towards electric vehicles (EVs) really having a significant impact on the future of the Europe Alloy Wheels market. The rising tide of EV popularity pushed car manufacturers into optimizing the weight of vehicles for better battery performance and increasing driving range. Alloy wheels would be a major component in realizing that goal since they are a significant contributor to the overall weight of vehicles. With the production and adoption of electric vehicles in Europe, demand will grow for lightweight, high-performance alloy wheels specifically meeting EV objectives, bringing the entire market further toward innovations.

Moreover, the European Alloy Wheels market will be significantly influenced by the regulatory environment. First of all, alloy wheels are emerging as a strong contributor to achieving such emission standards as they are being tightened by most Europe countries and increasingly focused on reduccbthe carbon footprint of the automotive industry. Hence, manufacturing towards eco-friendlier wheels by manufacturers would ensure adherence to these regulations and the attraction of eco-conscious consumers.

In the future, the European Alloy Wheels market will see stiffening competition among both established big players and newer entrants. While the erstwhile giants of the wheel manufacturing world continue to dominate the market, it will not be impossible for the smaller, nimbler companies that are focused on niche designs, or on discovering new ways of manufacture, to establish themselves by changing the rules for how alloy wheels are made. This will create further breathing space for technological advancement and thrall room for collaboration between automakers and alloy wheel producers.

In broad summary, the Europe Alloy Wheels market is set to change excitingly in many different directions. Emerging fields in materials science, a different focus on customization, and the increasing number of electric vehicles entering the market will probably bring several shifts to the manufacture and sale of alloy wheels as a whole. All these would culminate in co-benefits to manufacturers and customers in sharper and sharper markets in the future.

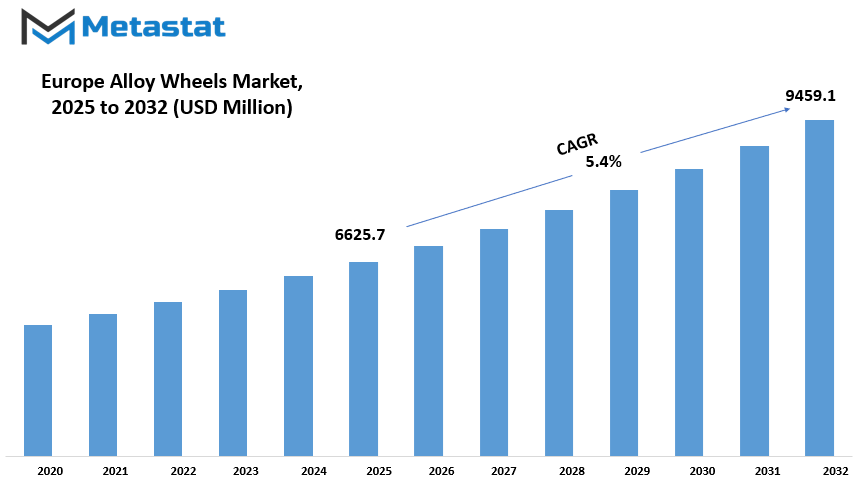

Europe Alloy Wheels market is estimated to reach $9459.1 Million by 2032; growing at a CAGR of 5.4% from 2025 to 2032.

GROWTH FACTORS

The primary growth factors for Europe alloy wheels market in are high-performance vehicles and luxury car trends. Consumers of such vehicles expect alloy wheels to be outstanding in quality as well as highly durable, for not only do these wheels improve the aesthetics of the vehicles, they also enhance the performance of the vehicles. However, there still exists the ongoing phenomenon of aesthetic modification targeting consumer vehicles. Many owners want to personalize their rides to be unique, and alloy wheels represent the best choice for such modifications. Alloy wheel customization projects an image of individuality and affluence, letting one appeal to consumers who appreciate both individuality and style.

These impediments, therefore, interfere with the full realization of market growth potential. The most prominent roadblocks that come up in the way include raw material price fluctuation, very well impacting the production cost of alloy wheels. A resultant problem is faced by manufacturers to keep such products' pricing policies intact. To that, strict environmental regulations on the manufacturing processes enter and complicate things even more. Companies are therefore forced to invest heavily in modern and sustainable processes of production, which may incur more operational costs.

The end result is that; it makes other companies keep compliance with all such laws and fighting all forms of legal actions. However, they have been limited in terms of flexibility in production processes. But, on the other side, the market is full of opportunities that might further fuel the growth. This is one of its excellent methods for reveiew: ELECTRIC VEHICLES, which have now become a dominant trend in the world.

The adoption of electric vehicles will use increasing numbers of consumers. This increase in numbers will result in electric vehicles that need lightweight and durable alloy wheels for efficient performance. Technologies developing lightweight alloys might also pave the way for better fuel economy. Alloy wheels give better overall performance, including mass weight. The demand for alloy wheels is expected to be higher in the future as the automotive industry focuses on increasing efficiency and striving for a cleaner environment.

The Europe alloy wheels market is being molded by the combination of all these high decisions towards the demand for high-performance vehicles, customer preferences for personalization, and new opportunities arising from adaptations by electric vehicles and technology. Though some challenges such as fluctuations in raw material prices and the imposition of strict environmental regulations exist, the market has great potential for growth as the technologies and trends continue to develop.

MARKET SEGMENTATION

By Type

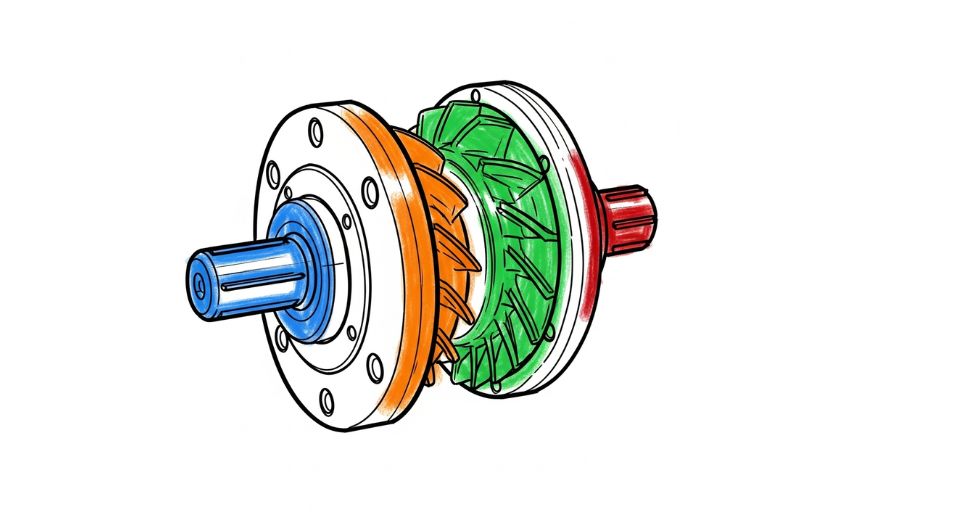

As of October 2023, alloy wheels are seeing steady growth in Europe as lightweight wheels that are durable yet aesthetically pleasing are becoming an ever hotter trend amongst car makers. This demand-influenced growth results from the automotive sector wanting to improve performance, fuel efficiency, and design of the vehicle being treated. Alloy wheels are categorized into types that each carry their share of benefits for different purposes.

Cast Alloy Wheels are one sizable segment of the European alloy wheels market. By having a revenue of $3782.3 million, it has its preeminence in the alloy wheel market. The cast alloys are characterized by versatility and can be employed to manufacture wheels either for vehicles intended for high performance or for normal everyday use.

The process involves pouring molten metal into a mold, which helps it to shape with a tremendous amount of precision with respect to the designed product and then forms a strong valid product resistant to normal stresses. Due to the fact that mass production of cars generally prefers cost and time-efficient solutions, the casting applied in making these wheels is widely used in the automobile manufacturing industry.

In addition to cast alloy wheels, Forged Alloy Wheels exist in the market. Forged alloy wheels are created when metal is subjected to pressure within a mold and are thought to have a greater strength-to-weight ratio than cast variants. Except for a few racing applications, most forged wheels are utilized in higher-end vehicles due to their ability to sustain greater forces whilst minimizing any additional weight. Forged alloy wheels are lighter and sturdier, thus greatly favored by performance and durability enthusiasts.

Another notable type in the market is Flow-Formed Alloy Wheels. Flow forming involves both the stretching and compressing of the wheel, making for a lightweight-yet-strong wheel. This process combines the advantages of forged wheels at a lower price point. The flow-forming process has a greater level of precision whereby it balances strength and lightness, thus making it attractive for automakers who have a performance-oriented and cost-based requirement.

The European market has the unique type of alloy wheels to satisfy other special needs, which may require wheels meant for certain vehicles, like SUVs, trucks, or luxury cars, or wheels that incorporate touches of peculiar materials or manufacturing techniques to achieve specific performance targets.

The European alloy wheels market stands vastly diversified, clearly defining the advantages of its type with specific regards to cost, strength, weight, and performance requirements.

By Rim Size

With a wide variety of applications and implementations, we have various market segments for alloy wheels in Europe based on rim size, with each segment playing its own role in the automotive industry. In this regard, we speak of four divisions namely: 13 to 16 inches, 17 to 19 inches, 20 to 22 inches, and above 22 inches. Each division encompasses a range of sizes which speak for small compact cars, large sedans, SUVs, and luxury applications. Workers in the industry, retailers, and consumers themselves need this knowledge for evaluating alloy wheel demand in reference to different ranges of vehicles.

The rim-size category of 13 to 16 inches is primarily aimed toward small, economical cars. Performance and aesthetics take second place to the priorities of fuel efficiency and low cost. This particular size of alloy wheels is now in demand mostly because of its looks and for being light in weight which also helps enhance the fuel efficiency and offer better handling. In Europe, continuous demand for compact cars should ensure steady demand for this segment.

The 17 to 19 inches rim sizes constitute mid-size sedans, hatchbacks, and a smattering of crossovers. These are the vehicles that promise the best performance with a really good bit of comfort, and the alloy wheels from this selection are chosen for glamour and utility. Alloy wheel sales in this segment will be boosted by the ever-growing interest among consumers in sportier cars along with better driving dynamics. Increased demand for 17 to 19 sizes rim tires will also be supported by the fact that they will allow wider tires to be fitted, therefore improving handling and road stability.

The 20 to 22 inches rim size category is mainly oriented toward SUVs, crossovers, and high-performance vehicles. Larger rims of this size are widely acknowledged for additional aesthetic appeal, making them work for a more aggressive, stylish look on the affected vehicles. Demand for these larger alloy wheels is expected to be on the rise, as an increasing number of consumers are looking for premium add-ons and better aesthetics for their vehicle. Larger rims also benefit cornering and stability, thus catering to sport-oriented vehicles.

Finally, the above 22-inch rim size category would usually be oriented toward luxury cars, sports cars, and high-end SUVs. Most times, the choice will be made based upon their stunning looks and performance. Most of the products in this category come fitted with very sophisticated and advanced features and the alloy wheels form a key aspect of their overall design. With increased demand in Europe for luxury and performance cars, this segment is anticipated to grow significantly.

In summary, the segmentation of the European alloy wheels market by rim size indicates that every segment addresses different vehicle types with performance, aesthetic appeal, and functional requirements. The market will be ever-changing, with consumer trends and the latest in the automotive industry shaping it.

By Material

The demand for lightweight, durable and attractive wheels is on the rise and is expected to spur steady growth in the Europe Alloy Wheels market. Alloy wheels have gained much popularity among consumers, particularly obvious in the global automotive industries, as the wheels prompted better performance and great appearance appeal. Typically, markets are segmented into two sections: based on the material composition of wheels, which plays a key role in performance and cost. Most alloy wheels comprise aluminum and other alloys with distinct advantages.

Aluminum alloy wheels are mostly in demand owing to the mixed traits of being light, strong, and rustproof. Consumers looking forward to performance in vehicles generally prefer these kinds of wheels as these wheels support weight reductions resulting in the reduction of fuel expenses and better handling. It also proves to be more flexible in design, meaning wheels can be made more suitable and aesthetically appealing in the eyes of the customer. As a result, aluminum alloy wheels are provided in both premium and mass-market vehicles.

Other alloys are not as popular as aluminum but can also be found in the market. They usually consist of combinations that include magnesium and titanium-eluded very superior strength withstanding extreme environment, while these kinds of wheels are quite often found from high-performance vehicles or luxury cars-and these are made for cut-throat prices-these wheels lessen weight but increase the durability in addition to other profitable functions that include better heat resistance and support for mounting oversized tires improving traction and performance.

This upsurging customer's need towards lightweight and durable wheels will likely steer the Europe Alloy Wheels market into further innovations on the kinds of material that will be utilized. Manufacturers are actively developing new alloys in keeping up with the ever-evolving demands of the automotive industry regarding uses such as the growing popularity of electric-powered vehicles, which require stronger wheels to carry the heavier battery packs. In this respect the competition between different materials will fuel further improvement, increasingly so to achieve better realities in fuel economy, safety, and overall vehicle performance.

This means that Europe Alloy Wheels will still rely on a combination of material properties, design trends, and user preferences. Aluminum alloy wheels will still remain the most prevalent option owing to their availability and diverse range of benefits. Other alloys will eventually penetrate niche markets driven mostly by high-performance vehicles. Technology will evolve to create much wider options in future.

By End-Use

Three sections of Europe alloy wheels market are based on end-use: automotive manufacturers, automotive repair and maintenance, and the automotive aftermarket. All of these segments serve very important roles in the future of alloy wheels market in Europe.

Alloy wheels are one of the three largest markets clamored by automotive manufacturers. They make use of alloys to manufacture lightweight and durable features in their vehicles. Such wheels prove better in fuel efficiency and handling, not to mention their presentation. And now that car manufacturers are targeting advanced designs as well as improvement in the features of their models, the demand for high-quality alloy wheels is expected to boom-even more, because wheels have become essential parts of vehicle design both in function and aesthetics. Nowadays, to attract customers and stay in the competitive race in the market, more car manufacturers are considering alloy wheels as a bright spot to focus their marketing.

Besides auto manufacturers, another substantial contributor to the Europe alloy wheels market is the automotive repair and maintenance sector. Eventually, vehicles must undergo repairs and maintenance, including wheel replacements due to damage or wear. Most of the alloy wheels consumed in the market will most probably be damaged due to an accident or due to general wear and tear.

Therefore, most of the repair shops and maintenance centers deal with alloy wheel replacement services from time to time. This increasing number of vehicles and the increasing trend of alloy wheels among consumers are expected to increase the demand for alloy wheel replacement services. Also, customers frequent repair shops for alloy wheel refurbishment/upgrading, in addition to damage replacement services.

Another significant end user in the alloy wheels market is the automotive aftermarket. This is primarily the end user in the sector where customers buy such products for personalization of vehicles or modifications to higher performance standards. In fact, giving or improving the performance of their cars is a common use for aftermarket products-honestly, as much as spending on the aftermarket for alloy wheels is attributed to car enthusiasts.

The increased interest in fully customizable wheels-which can offer a variety of styles, finishes, and sizes-has also proved itself beneficial to the market. The demand for aftermarket alloy wheels is also high and expected to increase as more car owners prefer personalizing their vehicles.

In a nutshell, the Europe alloy wheels market is divested into three broad end-use segments: automotive manufacturers, automotive repair and maintenance, and the automotive aftermarket. It is pretty much obvious that each of these end sectors will continue to influence the market's growth curve in the upcoming years.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$6625.7 million |

|

Market Size by 2032 |

$9459.1 Million |

|

Growth Rate from 2024 to 2031 |

5.4% |

|

Base Year |

2024 |

COMPETITIVE PLAYERS

Ronal Group AG, Enkei International, Inc., and KW Automotive GmbH are some of the key names that lead the European alloy wheel market segment, an important segment in the automotive sector driven by the demand for stylish high-performance vehicles and lightweight durable components. These companies have carved a niche for themselves with a revolutionary range of alloy wheels for all kinds of vehicles-from passenger cars and trucks to racing.

Ronal is famous for delivering alloys that possess performance and geometrical designs; hence, it has gained a sound quality reputation in the market. Enkei International Inc. is another leading player that integrates cutting-edge designs and wheel technology into conventional and high-performance applications. KW Automotive GmbH is another major player involved in the development of turnkey solutions for suspension and wheel applications within the automotive field. This combination of performance and aesthetics gave these companies a viable entry point into the industry.

O.Z. S.p.A., Howmet Aerospace Inc. (Alcoa), RAYS Co. Ltd. form other notable companies. O.Z. S.p.A. is famous for high-performance wheels for motorsports and luxury cars, whereas Howmet Aerospace (Aloca) is famous for state-of-the-art manufacturing processes and aluminum wheel production. RAYS Co. Ltd. holds a key market position for wheels in the racing world, offering lightweight, durable, high-performance wheels for competitive motorsports.

Topy Industries Ltd. and Borbet GmbH are other alloy wheel manufacturers with considerable presence in European markets. These manufacturers are recognized for mass production capabilities, fulfilling the growing demand for alloy wheels. Aftermarket firms including Aftermarket Performance Express Inc. and HRE Performance Wheels offer solutions for car enthusiasts, targeting those individuals who prefer to have their vehicles customized into unique, personalized designs.

The other key players are MOMO s.r.l., Maxion Wheels, Foshan Nanhai Zhongnan Aluminum Wheel Co, Ltd., CMS Automotive Trading GmbH, and G.M.P. GROUP srl. These companies further contribute to the market by providing an extensive selection of alloy wheels to meet various customer preferences. With advanced production techniques, quality standards, and continuous innovation, these companies thrive in being an integral part of the continued development of the European alloy wheels market.

Europe Alloy Wheels Market Key Segments:

By Type

- Cast Alloy Wheels

- Forged Alloy Wheels

- Flow-Formed Alloy Wheels

- Other Types of Alloy Wheels

By Rim Size

- 13 to 16 Inches

- 17 to 19 Inches

- 20 to 22 Inches

- Above 22 Inches

By Material

- Aluminum Alloy Wheels

- Other Alloys

By End-Use

- Automotive Manufacturers

- Automotive Repair and Maintenance

- Automotive Aftermarket

Key Europe Alloy Wheels Industry Players

- Ronal Group AG

- Enkei International, Inc.

- KW Automotive GmbH.

- O.Z. S.p.A.

- Howmet Aerospace Inc. (Alcoa)

- RAYS Co., Ltd.

- Topy Industries Ltd.

- Borbet GmbH

- Aftermarket Performance Express Inc.

- HRE Performance Wheels

- MOMO s.r.l.

- Maxion Wheels

- Foshan Nanhai Zhongnan Aluminum Wheel Co., Ltd.

- CMS Automotive Trading GmbH

- G.M.P. GROUP srl

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252