MARKET OVERVIEW

The Elemental Impurities Testing Market under analytical chemistry and quality control plays an indispensable role in ensuring the safety and efficacy of pharmaceuticals and various consumer products. This market, often overlooked by the public, carries immense significance, importance, and the need for stringent testing procedures. It is a specialized field with applications in pharmaceuticals, food, cosmetics, and many industrial sectors.

The Elemental Impurities Testing Market is built upon the foundational concept that minute quantities of certain metallic elements, often considered impurities, can be potentially harmful when present in pharmaceuticals, foods, and other products. These elements, which include heavy metals like lead, mercury, arsenic, and cadmium, have been historically associated with severe health risks. Therefore, the market's primary function is to ensure that these elemental impurities are not present in excessive amounts, beyond the established regulatory limits.

The significance of the Elemental Impurities Testing Market becomes evident when considered the potential consequences of failing to detect and mitigate harmful elemental impurities. Pharmaceuticals, for instance, are designed to alleviate medical conditions and improve health. If these products contain excessive levels of heavy metals, they can lead to severe side effects and harm the very patients they are meant to heal. Thus, the market serves as a guardian, ensuring the safety and efficacy of medicines.

In the context of consumer products like cosmetics, the importance of elemental impurities testing extends to the protection of public health and well-being. Items applied directly to the skin or ingested can expose individuals to these hazardous elements. Thus, stringent testing in the cosmetics industry prevents consumers from unwittingly endangering themselves.

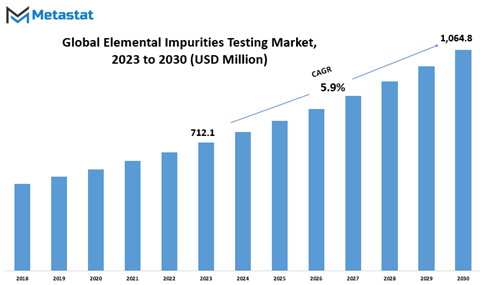

Global Elemental Impurities Testing market is estimated to reach $1,064.8 Million by 2030; growing at a CAGR of 5.9% from 2023 to 2030.

GROWTH FACTORS

The Elemental Impurities Testing Market is influenced by several significant factors that impact its growth. Some of the key driving factors include the need for ensuring product safety and quality in various industries. These industries, ranging from pharmaceuticals to food and beverages, rely on elemental impurities testing to meet regulatory requirements and maintain consumer trust.

Moreover, the growing awareness of the harmful effects of elemental impurities in products has prompted businesses to invest in testing services. This increasing awareness among manufacturers and consumers alike has created a demand for reliable testing methods, thus driving the market.

However, certain challenges might hamper the growth of this market. One such challenge is the complexity and cost associated with the testing process. Conducting elemental impurities testing can be a time-consuming and expensive endeavor, especially when dealing with a wide range of products. This can deter some companies from investing in such testing, particularly smaller businesses with limited resources.

Furthermore, regulatory requirements and guidelines governing elemental impurities testing can also pose a hurdle. Meeting these standards can be demanding and may require significant investments in equipment, expertise, and documentation.

Despite these challenges, the Elemental Impurities Testing Market holds promise and is expected to provide lucrative opportunities in the coming years. As industries continue to prioritize product safety and quality, the demand for testing services is likely to increase. This, in turn, will drive innovation in testing methods and technologies, making them more efficient and cost-effective.

MARKET SEGMENTATION

By Technique

The global Elemental Impurities Testing market has experienced significant growth in recent years, with various techniques being employed to ensure the safety and quality of products. Among these techniques, Plasma Mass Spectrometry (ICP–MS) has emerged as the leading method, boasting a valuation of 266.5 million USD in 2022. This technique's popularity can be attributed to its high sensitivity and accuracy in detecting elemental impurities.

Another widely used technique in this industry is Plasma Optical Emission Spectrometry (ICP–OES), which was valued at 209.4 million USD in 2022. It has gained recognition for its ability to identify and quantify multiple elements simultaneously while maintaining a cost-effective approach.

Additionally, the Flame Atomic Absorption Spectrometer (Flame AA) method has held its own in the market with a value of 105.9 million USD in 2022. This technique utilizes flame emission to determine the concentration of specific elements, offering users an affordable and straightforward option for impurity testing.

Other techniques within the Elemental Impurities Testing market have collectively been valued at 92.3 million USD in 2022. These various methods provide alternatives for different applications and budgets, catering to an assortment of requirements and preferences.

By Application

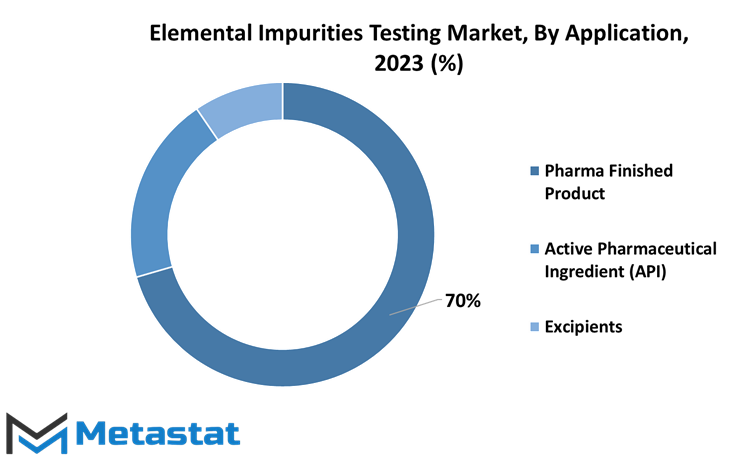

The global Elemental Impurities Testing market has seen significant growth in recent years, with applications spanning various segments of the pharmaceutical industry. There are three primary segments for this market: Pharma Finished Product, Active Pharmaceutical Ingredient (API), and Excipients.

In 2022, the Pharma Finished Product segment held a substantial share of the market with a valuation of 474.7 million USD. This is primarily driven by the stringent regulations and standards in place for finished products, such as drugs and medications. Manufacturers must adhere to these guidelines to ensure that their offerings are safe and free from harmful impurities which could adversely impact the health of consumers.

Besides, the Active Pharmaceutical Ingredient (API) segment also plays a crucial role in this market, with a valuation of 134.7 million USD in 2022. APIs are the biologically active compounds within pharmaceuticals responsible for their therapeutic efficacy. Rigorous elemental impurities testing is required for APIs to guarantee their purity and prevent any contaminations from jeopardizing drug effectiveness or causing harmful effects on patients.

Moreover, the Excipients segment held a considerable share in the Elemental Impurities Testing market, valued at 64.8 million USD in 2022. Excipients refer to inert substances found in drug formulations that facilitate drug delivery or improve drug stability while not actively contributing to therapeutic benefits. Manufacturers must test excipients thoroughly for any elemental impurities, as these substances could affect drug performance or endanger patients' health if contaminated.

The global Elemental Impurities Testing market encompasses several vital segments within the pharmaceutical industry – Pharma Finished Product, Active Pharmaceutical Ingredient (API), and Excipients – each playing an essential role in ensuring safe and efficacious pharmaceutical products. With strict regulations and standards governing these areas, thorough testing is paramount to identify any potential impurities and ensure quality across all components of drug development and manufacturing processes.

REGIONAL ANALYSIS

Based on geography, the global Elemental Impurities Testing market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East and Africa. In these diverse regions, various industries find the need to ensure the safety and quality of their products by detecting and analyzing trace amounts of elemental impurities. Elemental Impurities Testing plays a critical role in maintaining compliance with international standards and protecting consumer health.

North America maintains a significant share in the global market due to its well-established pharmaceutical industry and developed healthcare infrastructure. Strict regulations in the United States and Canada encourage companies to adopt robust impurity testing standards, ensuring quality control and consumer safety.

In Europe, stringent regulations from organizations like the European Medicines Agency drive the demand for Elemental Impurities Testing. These high-quality testing requirements are essential to uphold consistent manufacturing practices across European countries, guaranteeing consumer protection from harmful substances in their products.

In the Asia-Pacific region, rapid industrialization and growing pharmaceutical markets contribute to an increasing demand for effective impurity testing solutions. Countries like China and India have made significant advancements in their regulatory frameworks to ensure product quality while catering to ever-growing populations.

Elemental Impurities Testing is an indispensable tool for industries worldwide. Diverse geographical regions understand its importance as they face varying degrees of challenges in upholding safety standards and maintaining product quality. Growth in various sectors drives an expanding global market that highlights the necessity of detecting elemental impurities across industries, ultimately ensuring better consumer protection and fostering trust between manufacturers and end-users.

COMPETITIVE PLAYERS

In the ever-changing landscape of the Elemental Impurities Testing industry, several key players have emerged as prominent and influential contributors. Among these leading organizations, SGS SA and ALS Global stand out as significant providers of vital testing services. By delving deeper into their background, services, and importance in the industry, we can gain valuable insights into their scope and impact within this field.

SGS SA, a multinational company established in 1878, has its headquarters in Geneva, Switzerland. With a rich and diverse history in inspection, verification, testing, and certification services, this organization has progressively made a mark in numerous domains traversing from agriculture to life sciences. Their expertise in Elemental Impurities Testing ensures that products adhere to international regulatory requirements and safeguard consumer safety. Additionally, SGS SA enables companies to optimize manufacturing processes by reducing impurities, thus boosting overall product quality.

ALS Global is another reputable and influential player operating in this industry. Founded in 1975 and based in Brisbane, Australia, the company provides a comprehensive suite of analytical testing services to various sectors such as pharmaceuticals and environmental resources. In the realm of Elemental Impurities Testing, ALS Global employs cutting-edge techniques like Inductively Coupled Plasma Mass Spectrometry (ICP-MS) to accurately determine trace element levels in samples. This reliable and advanced method helps businesses ensure product compliance while minimizing potential risks associated with elemental impurities.

Together, SGS SA and ALS Global have played significant roles in shaping the landscape of the Elemental Impurities Testing industry. They have set benchmarks for performance excellence through their rigorous methodologies and adherence to global standards. Both organizations have helped industries navigate through complex regulations by providing indispensable testing services that ultimately guarantee consumer safety and product integrity. SGS SA and ALS Global are integral components of the Elemental Impurities Testing domain. Across various sectors that require thorough analysis for regulatory compliance or enhanced product quality assurance, these firms have demonstrated unmatched proficiency and commitment to exceptional service delivery. By continually pushing the boundaries, they not only ensure the well-being of consumers through product safety measures but also contribute to the sustained growth and development of multiple industries in which they operate.

Elemental Impurities Testing Market Key Segments:

By Technique

- Plasma Mass Spectrometry (ICP–MS)

- Plasma Optical Emission Spectrometry (ICP–OES)

- Flame Atomic Absorption Spectrometer (Flame AA)

- Others

By Application

- Pharma Finished Product

- Active Pharmaceutical Ingredient (API)

- Excipients

Key Global Elemental Impurities Testing Industry Players

- SGS SA

- ALS Global

- EKG Labs

- Element Materials Technology

- Drug Development Solutions

- Intertek Group plc

- PerkinElmer

- BHP Laboratories

- Pace Analytical

- Regis Technologies

- Ampac Analytical

- Excite Pharma Services

- Lhasa Ltd

- Agilent Technologies, Inc.

- Eurofins Scientific

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252