MARKET OVERVIEW

The global electronic sensors market will define the way devices communicate with the physical world, and the sector will innovate new methods to sense light, movement, chemicals, touch, and sound. In what will be a story about tools that sense, upcoming innovators will design sensors that observe more than they merely observe they will whisper information into networks, instructing equipment to react, forecast, and learn.

This year's sensor producers already are working on next-generation models that will be slimmer, wiser, and more aware of context. Their designers will embed sensing layers in fabrics so your clothes will one day detect changes in temperature or posture and send discreet alerts or make tiny adjustments. In manufacturing plants, equipment will detect micro-vibrations and movements, and machines will begin flagging maintenance requirements before anything fails, making industrial processes into vigilant guardians of uptime.

Urban spaces will not be fixed constructions they will breathe and exist with built-in sensors. Streetlights will shift in accordance with live traffic and pedestrian movement, and environmental sensors will detect early warning signs of pollution or micro-climate change so city planners will respond in useful ways. Agriculture will also adopt this transition: crops will have moisture and nutrient sensors buried in them that provide immediate feedback to agricultural systems, meaning irrigation and fertilization will be precise, timely, and frugal. Medical devices will contribute to the sensing revolution in quiet fashion. Wearables will capture biochemical cues like hydration or blood-sugar wander, transmitting signals to apps or care providers. Minimally-invasive implants can track biomarkers and trigger alerts ahead of symptoms, making personal health a real-time, gentle wake-up system. The global market for electronic sensors will support all of these innovations.

In transport, vehicles and aircraft will have sensor arrays that can detect micro-cracks, material wear, and environmental changes, making for safer rides. Drones will be able to detect obstacles, wind shear, or toxic materials during flight, resulting in almost instinctive navigation and decision-making. The sector will integrate hardware and AI as well, so sensor information will feed learning systems, allowing vehicles to not only perceive but also anticipate perilous situations based on patterns in the environment.

At home, sensing will be unseen. Windows will be aware of light and adapt opacity; kitchens will detect expired foods or gas leaks; living rooms will detect occupancy and vary comfort level or lighting tone giving living areas the appearance of being responsive without switches or wires. These advancements will be supported by the global electronic sensors market and its changing supply chains.

Whatever field one chooses health, industry, urban living, agriculture, transport, home this sector will integrate sensors into surfaces and spaces, making objects sentient. Sensor manufacturers and systems integrators will redefine how humans engage with things in their midst. Devices no longer will simply be present; they will hear, sense, and respond.

Briefly, the future era will be one of sensing and responding environments and objects that are inspired by developments in the global market of electronic sensors. The sector will redefine perceptions from static instruments to interactive companions, and living will become softly more sensitive to hints previously hidden. That change will be underwritten by the sensors industry's imperative to embed, shrink, and network, ultimately allowing our world to feel itself and to respond with generosity.

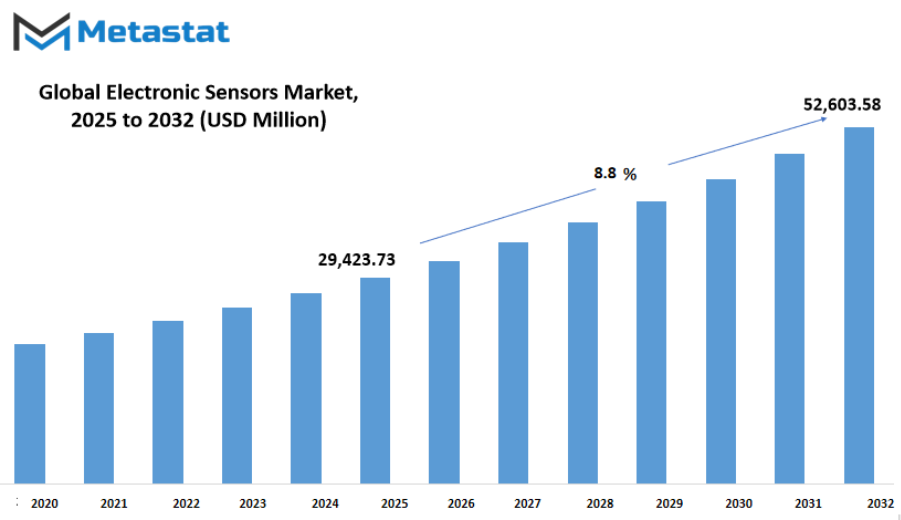

Global electronic sensors market is estimated to reach $52,603.58 Million by 2032; growing at a CAGR of 8.8% from 2025 to 2032.

GROWTH FACTORS

The global electronic sensors market is shifting towards predictive maintenance, robotics, and digitalized processes based on strong sensing solutions. Increased demand for electric and autonomous vehicles will also accelerate the development of sensors with high accuracy and faster response times. As artificial intelligence and machine learning keep evolving industries, sensors integration with them will improve data analysis, maximize performance, and reduce operation costs, thus rendering sensor innovation a primary driving force in industrial development. High production costs and technical complexities, however, could hinder the global electronic sensors market growth in the near future.

Constructing intelligent sensors will generally entail huge R&D expenditures, which small firms might find troublesome. Security and privacy issues in intelligent devices could also pose another obstacle to adoption in certain markets, particularly where the regulatory climate is still evolving. It will be essential to overcome such limitations in order to realize convergent global growth of the market. Technological advancements in miniaturization and energy-efficient technologies would present lucrative opportunities for the global electronic sensors market in the future. As businesses need devices with smaller sizes and longer lifespan, the producers will focus on creating sensors that provide durable performance while consuming less power.

Emerging markets such as smart healthcare, wearable technology, and green monitoring will present new opportunities for market growth as well. As the march toward sustainable answers gains pace, renewable energy system and smart grid sensors will gain great speed in step with the drive for cleaner energy and connectivity into the digital domain.

As a whole, the global electronic sensors market will chart industries of the future through increasingly networked, responsive, and productive systems. By continued innovation, strategic alliances, and growing emphasis on intelligent automation, the sector will remain one of the chief proponents of progress in technology-driven sectors across the world.

MARKET SEGMENTATION

By Type

The global electronic sensors market is likely to see tremendous growth as a result of rapid technology developments and growing demand in many industries. The market is divided based on type into pressure sensors, temperature sensors, motion sensors, image sensors, proximity sensors, and other specialized sensors. All these types are predicted to play a key role in shaping future innovations, particularly with industries shifting towards intelligent, interconnected systems. Current valuations indicate high growth potential, with pressure sensors valued at USD 6,173.48 million, temperature sensors at 4,725.44 million, motion sensors at 3,907.15 million, image sensors at 6,635.04 million, proximity sensors at 3,049.74 million, and other types of sensors at 4,932.88 million in 2025.

The growth has been due to increased use of sensors in industries such as healthcare, automotive, consumer electronics, and industrial automation. Pressure sensors will dominate monitoring systems and precision equipment, particularly where accuracy and safety are at issue. Temperature sensors will remain critical to energy management, manufacturing, and climate control technologies, both efficiency and sustainability aims. Motion sensors are emerging in security systems, robotics, and high-end user interfaces, with the possibility of broader deployment as artificial intelligence infiltrates operational processes. Image sensors will continue in a leading position due to the growing need for high-quality imaging in applications like autonomous cars, security, and advanced smartphones. Proximity sensors are facing increasing demand within automation and touchless systems owing to a growing trend towards contactless technology in industrial and commercial settings.

Other niche sensors will also grow steadily with industries looking for niche solutions that meet individual needs, such that no sector will stay stagnant in the future. Miniaturization, connectivity infrastructure, and the inclusion of advanced systems such as the Internet of Things (IoT) and machine learning will serve as the great drivers of the global electronic sensors market. Business sectors will pursue better accuracy, sturdiness, and energy-saving features in sensors, thus providing ample opportunity for innovation in application and design.

By Application

The global electronic sensors market will continue to grow at a steady rate with increased need for sophisticated technology in every industry. The sensors are becoming more and more central to everyday applications as they are able to capture and transmit information efficiently. Electronic sensors' application, from industrialization to personal devices, will dictate the operation of systems with more precision and speed. Companies are investing generously in research and development to miniaturize sensors, make them faster and less power-hungry, driving innovation and expanding the scope of applications. Based on application, the Global Electronic Sensors industry is classified into environmental monitoring, home appliances, wearable technology, and other emerging applications.

Environmental monitoring will see strong demand as companies and governments seek enhanced tools to track air quality, water quality, and climate conditions. They will be used mainly for pollution detection, natural resource management, and provision of data to support sustainable operations. The need for real-time data will spur more enhancement of advanced environmental sensors that provide accurate results even in challenging environments. In home appliances, sensors will dominate the pace of intelligent technology development. From refrigerators that learn cooling by usage to washing machines that balance energy and water consumption, electronic sensors are making life simpler and more efficient. As more devices get connected in the home, this category will see sustained growth led by rising demand for smart homes and power-saving devices. Wearable technology will remain one of the fastest-growing segments of the global electronic sensors market. Smartwatches, health trackers, and fitness trackers are now a part of everyday life, and the demand for even more accurate and reliable sensors will keep on growing. Future sensors will track a greater range of health parameters, including advanced biometric readings, that will further improve personal health management and medical research.

Other applications for electronic sensors will expand with advancement in the automotive, agricultural, and manufacturing industries. For transport, sensors will facilitate autonomous car travel and enhanced safety measures. For agriculture, sensors will track the condition of the soil, health of crops, and weather, increasing productivity and reducing waste. Sensors with instant feedback will assist manufacturing and save time, as well as increase efficiency.

In the coming times, the global electronic sensors market will be driven by innovation and convergence with next-gen technologies like artificial intelligence and the Internet of Things. As information becomes more valuable, sensors will be a key facilitator for connecting devices, decoding data, and enabling better-informed decision-making. The future is sensors becoming low enough in cost and ubiquitous in reach to extend adoption across industries and increase performance in millions of applications worldwide.

By End-use Industry

The global electronic sensors market will continue to grow at a massive rate as businesses adopt more intelligent and efficient technologies. Technological innovations in automation, artificial intelligence, and data-based systems will drive high demand for sensors across industries. For monitoring changes in the environment and enhancing the performance of machines, sensors will be the star of the show in shaping the future of industrial and consumer use. With continuous innovation, greater accuracy, and higher connectivity, the sector will see steady growth and wider adoption worldwide. The auto sector will remain a powerful growth driver. Autos will have more and more sensors for safety, navigation, and optimization of performance. Electric and self-driving cars will fuel this growth further, as they depend on advanced sensing technologies to operate successfully and safely. This strong demand will encourage manufacturers to create sensors that are faster, more reliable, and can handle intricate information in real-time.

Consumer electronics will also see growing utilization of sensors, as items become smarter and more interactive. Devices used in everyday life like smartphones, wearables, and home systems will rely more on sensors for enhanced functionality. The movement towards smart homes and personalized experience will force companies to develop cost-effective, energy-efficient, and miniaturized sensors to facilitate the growing needs of consumers.

Industrial applications will experience strong growth as industries move towards smart manufacturing and predictive maintenance. Sensors will monitor equipment condition, production volumes, and energy consumption, allowing industries to reduce downtime and improve productivity. Putting sensors together with industrial IoT platforms will also allow factories to become more agile and intelligent, allowing for more efficient operations and optimal cost management.

In healthcare, sensors will be at the center of patient diagnostics and care innovations. Wearable monitoring devices, advanced imaging technology, and remote health monitoring will rely on precise and dependable sensing systems. The ability to gain real-time information regarding a patient's health will improve patient outcomes and allow physicians to make more rapid and precise decisions.

The aerospace and defense sector will also keep demanding high-performance sensors to be used in navigation, safety, and communications. These sectors will require sensors that function under severe conditions but remain reliable and accurate. The agricultural sector will also benefit from sensors that help in precision farming to track crops better, analyze soils, and manage resources more efficiently to increase productivity without increasing cost.

As demand grows in these sectors, the global electronic sensors market will respond by offering the smart, faster, and power-efficient solutions necessary. The continued push for innovation, combined with advancements in connectivity and data analytics, will provide strong growth and an exciting future full of promise for sensor technology.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$29,423.73 million |

|

Market Size by 2032 |

$52,603.58 Million |

|

Growth Rate from 2025 to 2032 |

8.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global electronic sensors market is expected to experience steady growth as technology continues to shape industries and consumer needs. Growing adoption of smart devices, automation, and advancements in artificial intelligence will continue to drive demand for electronic sensors across various sectors. These sensors are widely used in applications such as automotive systems, healthcare equipment, consumer electronics, and industrial automation, making them essential components for future innovations.

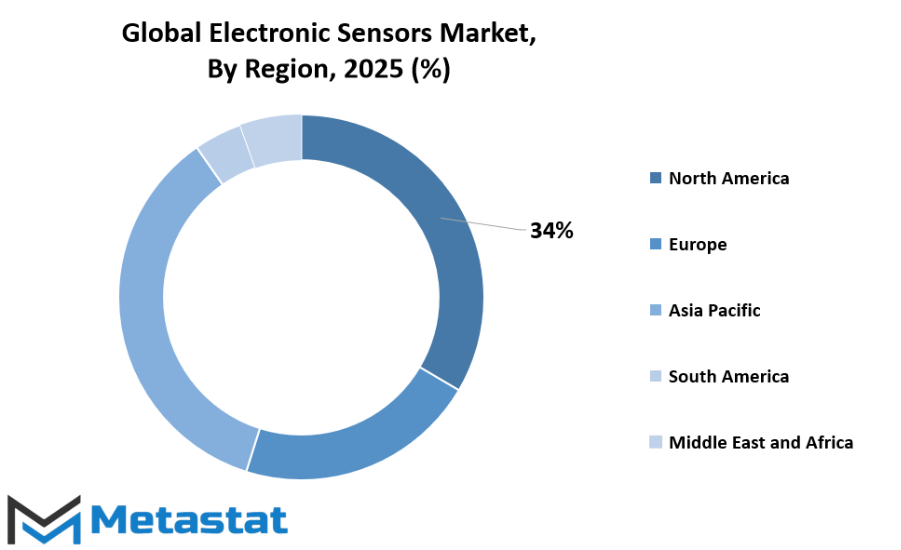

Based on geography, the global electronic sensors market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. North America, which includes the U.S., Canada, and Mexico, will maintain a significant share due to advanced manufacturing facilities and high investments in research and development. Europe, with key markets such as the UK, Germany, France, Italy, and the Rest of Europe, will focus on integrating advanced sensor technologies into automotive and industrial systems to support sustainability and energy efficiency initiatives.

Asia-Pacific, segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific, is expected to record the highest growth. Expanding manufacturing industries, growing use of connected devices, and rising demand for electric vehicle will fuel significant opportunities in this region. China and India, in particular, will contribute heavily to market expansion as industrial automation and smart city projects gain momentum. Japan and South Korea will also play important roles by leveraging advancements in robotics and consumer electronics to create innovative applications for electronic sensors.

In South America, countries such as Brazil, Argentina, and the Rest of South America will gradually expand adoption, supported by advancements in industrial production and increased use of digital technologies. The Middle East & Africa, categorized into GCC Countries, Egypt, South Africa, and the Rest of Middle East & Africa, will see growing investments in infrastructure, energy projects, and connected systems, creating steady opportunities for sensor integration.

Looking ahead, the global electronic sensors market will be shaped by rapid innovations in wireless technologies, edge computing, and the Internet of Things. As industries focus on automation and data-driven operations, demand for high-performance and energy-efficient sensors will rise. Continuous improvement in production processes and the development of smaller, more efficient sensors will open doors to new applications, from smart healthcare devices to autonomous transportation. Regions with strong research ecosystems and manufacturing capabilities will hold a competitive advantage, while emerging markets will benefit from increased technology adoption and foreign investments. This evolving landscape will ensure that the market remains a critical driver of technological growth and innovation worldwide.

COMPETITIVE PLAYERS

Advances in the global electronic sensors market will shape how devices sense surroundings, report data, and support decision-making. Future trends will drive demand for smaller, smarter, and more energy-efficient sensors. Companies such as Technologies AG, Analog Devices, Inc., NXP Semiconductors, Omron Corporation, Siemens AG, Sensata Technologies, Murata Manufacturing Co., Ltd., Panasonic Corporation, Amphenol Corporation, Keyence Corporation, Legrand, Balluff GmbH, Yokogawa Electric Corporation, TDK Corporation, and Rockwell Automation, Inc. are making important strides toward next-generation sensing solutions. Each of those organizations is poised to push sensing capability forward.

Technologies AG will explore new materials and designs to make sensors thinner and more responsive. Analog Devices, Inc. will focus on combining precision measurement with low power use, so wearables, smart appliances, and industrial systems become more reliable. NXP Semiconductors will work on integrating sensing functions with secure communication technology to support connected environments. Omron Corporation will enhance sensor durability and add self-testing features that reduce maintenance needs for factories. Siemens AG will contribute by expanding sensor networks for smart infrastructure, enabling buildings and transportation systems to adjust automatically. Sensata Technologies will develop sensors capable of monitoring critical parameters under harsh conditions, from pressure and temperature to vibration. Murata Manufacturing Co., Ltd. will aim for ultra-compact modules suitable for medical devices and mobile gadgets. Panasonic Corporation will push for versatile sensor arrays that combine motion, light, and chemical detection. Amphenol Corporation will concentrate on reliable sensor connectors to support heavy-duty applications. Keyence Corporation will introduce high-speed, high-resolution optical sensors that enable precise quality control in manufacturing. Legrand will embed sensing into building systems to optimize energy use, lighting, and security. Balluff GmbH will enhance industrial automation by creating sensors that can communicate through open standards. Yokogawa Electric Corporation will build sensors that integrate directly with controllers for streamlined process control. TDK Corporation will research novel magnetic and inertial sensors for robotics and navigation. Rockwell Automation, Inc. will speed up industrial digital transformation by offering complete sensing-to-control solutions.

The vision of the future sees sensor technology becoming nearly invisible, yet incredibly powerful. Seamless environment sensing will improve safety, efficiency, health, and sustainability. The evolution of the global electronic sensors market will bring smarter spaces, more responsive machines, and devices that adapt in real time. Innovations from leading players such as those listed will guide that change and open new possibilities for sensing everywhere.

Electronic Sensors Market Key Segments:

By Type

- Pressure Sensor

- Temperature Sensor

- Motion Sensor

- Image Sensor

- Proximity Sensor

- Other

By Application

- Environmental Monitoring

- Home Appliances

- Wearable Devices

- Other

By End-use Industry

- Automotive

- Consumer Electronics

- Industrial

- Healthcare

- Aerospace and Defense

- Agriculture

- Other

Key Global Electronic Sensors Industry Players

- Honeywell International Inc.

- STMicroelectronics

- TE Connectivity

- Texas Instruments Incorporated

- Robert Bosch GmbH

- Infineon Technologies AG

- Analog Devices, Inc.

- NXP Semiconductors

- Omron Corporation

- Siemens AG

- Sensata Technologies

- Murata Manufacturing Co., Ltd.

- Panasonic Corporation

- Amphenol Corporation

- Keyence Corporation

- Legrand

- Balluff GmbH

- Yokogawa Electric Corporation

- TDK Corporation

- Rockwell Automation, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383