MARKET OVERVIEW

The global process automation and instrumentation market in the industrial automation sector is an advanced and broad industry aimed at optimizing operational effectiveness using superior control systems and accurate instrumentation. The global process automation and instrumentation market will continue to facilitate industries like oil and gas, manufacturing, chemicals, pharmaceuticals, and energy make a switch from manual to intelligent and automated systems aimed at improving accuracy, safety, and consistency within production processes. Instead of just being used for mere machine control, it will provide a single platform upon which software and hardware solutions complement each other perfectly to provide accurate data for making well-informed decisions. In the days to come, the global process automation and instrumentation market will be defined by the growing demand for integrated solutions that provide process reliability coupled with minimizing the involvement of humans.

As industries move towards increased standards of operation, this market will offer technologies and tools that observe, manage, and optimize manufacturing processes with unheard-of accuracy. The use of distributed control systems, programmable logic controllers, and advanced measurement equipment will become a mandatory across several sectors. These systems not only will automate processes but will also scrutinize information in real-time to determine inefficiencies, detect impending failure, and ensure uniform output quality. A characteristic feature of this market will be its capacity to provide customized automation solutions particular to the requirements of different industries. For instance, in manufacturing, automatic control systems will have strict control over sophisticated assembly lines, while in the energy sector, instrumentation will protect critical power plant and renewable facility processes.

This market will become a focal point of technological innovation where smart devices interact with each other via secure, high-speed networks, providing real-time information on operating conditions. Such is the ability that will enable industries to predict problems before they occur, with minimal downtime and increased productivity. In the years to come, the global process automation and instrumentation market will be the foundation of digital transformation initiatives for all enterprises. Automation would no longer be considered a luxury item but an integral part to ensure competitiveness in more complicated global supply chains. Instrumentation, especially, will be more than measurement; it will provide diagnostic data that is input to centralized systems that can perform predictive maintenance operations and process optimizations.

This transition will push industries to invest in solutions that fill the space between physical operations and digital control. In addition to that, this market will drive the integration of operational technology with information technology, dissolving silos that previously isolated production environments from enterprise management systems. Through this combined integration, organizations will realize new heights of transparency and operational harmony, where data from instrumentation devices are the driving force for business strategy and automation systems implement them with accuracy. Consequently, businesses will leverage the entire power of networked operations to supply goods and services faster, safer, and more confidently. Ultimately, the global process automation and instrumentation market will define the way industries function, dictating everything from supply chain logistics to environmental monitoring. Its ongoing development will not only redefine operational standards but also establish new standards for efficiency and reliability in industrial processes globally.

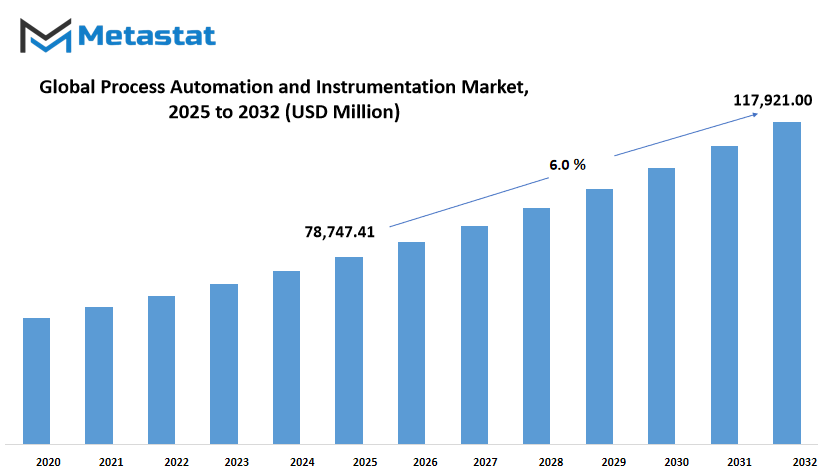

Global process automation and instrumentation market is estimated to reach $117,921.00 Million by 2032; growing at a CAGR of 6.0% from 2025 to 2032.

GROWTH FACTORS

The global process automation and instrumentation market is expected to witness steady growth in the coming years due to several important factors shaping industries worldwide. One of the main reasons for this expected growth is the increasing demand for process optimization and cost reduction. Businesses are always looking for ways to improve efficiency and reduce unnecessary expenses, and automation has proven to be one of the most effective methods to achieve these goals. Companies across various sectors understand that automating certain processes will help streamline their operations, improve accuracy, and reduce human error. As a result, more organizations are turning toward advanced automation solutions to maintain competitiveness and ensure smooth and reliable operations.

Another significant factor driving this market is the rise of smart factories and the ongoing shift towards digital transformation. As industries continue to modernize, the demand for more sophisticated automation tools grows. Smart factories use technology to connect systems, monitor production in real-time, and adjust processes as needed, which leads to better productivity and higher quality output. This growing trend encourages manufacturers and other industries to invest in more advanced process automation solutions that will support their digital strategies and future-proof their operations.

However, while the benefits of these technologies are clear, there are some challenges that might slow the growth of the global process automation and instrumentation market. One of the main issues is the high cost associated with implementing advanced automation systems. Smaller businesses, in particular, may struggle to afford these technologies, which can delay their adoption. Another challenge is integrating new automation solutions with existing legacy systems. Many companies still operate older equipment and systems that were not designed to work with modern technologies. This makes integration a complicated and time-consuming process that can require additional investment and expertise.

Despite these obstacles, the future of this market looks promising due to the opportunities presented by the integration of the Internet of Things (IoT) and Artificial Intelligence (AI). These technologies will allow automation systems to become more intelligent, capable of learning from data, and optimizing themselves without constant human input. This progress will create systems that can predict maintenance needs, reduce downtime, and improve efficiency even further. As these innovations become more accessible, businesses will be more willing to invest in them, opening up new opportunities for growth within the market. In the years ahead, the global process automation and instrumentation market will likely continue to evolve, helping industries achieve higher levels of performance and efficiency.

MARKET SEGMENTATION

By Component

The global process automation and instrumentation market is expected to see steady growth in the future as industries continue to prioritize efficiency, accuracy, and safety in their operations. This market is supported by various components, each playing a significant role in improving how industries function. The components include Sensors and Transmitters, Controllers and PLCs, Actuators, HMIs and SCADA Systems, Fieldbus and Networks, and Analyzers. These technologies are shaping the way factories and production units operate, making processes more reliable and reducing the need for human involvement in repetitive or hazardous tasks.

Sensors and Transmitters will continue to be important as they are responsible for collecting accurate data from machinery and production lines. This data is then used to monitor the condition of equipment, measure variables like temperature or pressure, and help ensure that everything runs smoothly. Controllers and PLCs, on the other hand, will allow systems to react quickly to changes by processing the information received from sensors. They can adjust operations in real time, which leads to more efficient processes and helps avoid downtime.

Actuators are the components that carry out actions based on instructions given by the controllers. Whether it is opening a valve or moving a part on an assembly line, actuators play a key role in turning digital decisions into physical actions. HMIs and SCADA Systems make it easier for human operators to interact with machines. These systems present data in a way that is easy to understand and allow workers to make informed decisions based on what they see. They will remain a critical part of the global process automation and instrumentation market as companies look for solutions that improve visibility and control over operations.

Fieldbus and Networks connect all these elements, allowing for smooth communication between devices and systems. As technology advances, these networks will become faster and more secure, which will further support the adoption of automation solutions. Finally, Analyzers help by examining the quality of materials and products, ensuring that standards are met and any issues are identified early.

Looking ahead, the global process automation and instrumentation market will likely grow as industries demand smarter, more connected systems. Companies will invest in these technologies to stay competitive and meet rising expectations for quality and efficiency. With the ongoing push toward automation, these components will remain at the heart of industrial progress, driving changes that make manufacturing and production more advanced and reliable.

By Technology

The global process automation and instrumentation market is expected to change the way industries work in the future. As technology continues to advance, more companies will turn to automation solutions to improve how they manage their production processes. Automation helps businesses control their operations better, reduce errors, and make sure that the quality of their products stays consistent. This will become more important in the years ahead as industries face growing demand for faster production and higher efficiency.

One of the key technologies that will shape the future of this market is the Distributed Control System, often known as DCS. These systems allow industries to monitor and control different parts of their production lines from one central location. This makes it easier to manage large and complex facilities without depending on manual efforts. In the future, more companies will use DCS to cut costs and improve safety by reducing human error. Another major part of this market is the use of Programmable Logic Controllers, or PLCs. PLCs are already common in manufacturing but will continue to grow as they become more advanced and easier to use. They help automate routine tasks and can quickly adjust to changes in production needs.

Supervisory Control and Data Acquisition, better known as SCADA, will also play a larger role. SCADA systems help industries collect data in real-time and use that information to improve how their facilities run. This technology helps managers make quicker decisions and solve problems before they cause bigger issues. As data becomes more valuable to businesses, SCADA will become even more widely used.

The Industrial Internet of Things, or IIoT, is another technology that will push the global process automation and instrumentation market forward. IIoT connects machines and systems through the internet, allowing them to share data and work together more effectively. This leads to smarter factories where machines can predict when they need maintenance or adjust automatically to changes in production. Artificial Intelligence and Machine Learning will further strengthen this market. These technologies allow systems to learn from data and improve over time without being told exactly what to do. This makes processes more efficient and helps companies stay ahead of problems.

In the future, the global process automation and instrumentation market will continue to grow as these technologies become more advanced and more industries realize the benefits of automation. The combination of these tools will shape a future where businesses can work smarter, faster, and more safely.

By Application

The global process automation and instrumentation market is expected to keep growing as industries look for smarter and more efficient ways to manage their operations. In the future, this market will play a bigger role in helping companies handle complicated tasks with more accuracy and less effort. As technology keeps moving forward, the need for automation and instrumentation will become even more important. Many industries will depend on these solutions to improve the way they work, save energy, and avoid costly mistakes. Companies are already starting to invest more in systems that make their processes run smoothly, and this trend will continue as competition increases.

By application, this market is divided into several key areas. One of the most important is process control. This part helps industries maintain steady production levels by making sure machines and systems follow set rules. In the future, process control will become even more advanced, with technologies that can fix problems before they cause damage. Safety systems are another important part of this market. These systems protect both workers and equipment by detecting risks early and taking steps to prevent accidents. Companies will continue to invest in better safety tools as stricter regulations are put in place and as the value of protecting people becomes more widely recognized.

Monitoring and diagnostics is another growing area. In the years ahead, more businesses will use these tools to watch their systems in real-time and quickly find out when something isn’t working right. This will help them avoid breakdowns and keep their production running without unexpected stops. Predictive maintenance works in a similar way, using data to tell when a machine might fail so that repairs can be done before problems get worse. This will save companies a lot of money and reduce downtime, making it a valuable part of the global process automation and instrumentation market.

Energy management is also expected to grow in importance. With rising energy costs and a growing focus on sustainability, businesses will need systems that help them use less energy while still achieving their goals. These systems will not only track energy use but will also suggest ways to cut waste. Looking ahead, the global process automation and instrumentation market will continue to shape how industries operate by offering smarter, safer, and more efficient solutions across all these areas. This future-focused approach will help companies stay competitive while meeting the demands of a changing world.

By Industry

The global process automation and instrumentation market will continue to change how industries operate by helping businesses work more efficiently. This market focuses on technologies that allow companies to control and monitor different processes automatically, reducing the need for manual efforts. As technology keeps growing, companies are always looking for ways to make their operations faster, more reliable, and more cost-effective. Automation and instrumentation make this possible by providing solutions that help reduce errors, improve safety, and save both time and resources.

Looking ahead, the global process automation and instrumentation market will play an even bigger role in the future of manufacturing, energy, and other key sectors. The demand for smart factories is expected to rise as businesses aim to connect their machines, equipment, and systems through the use of advanced technologies. This will allow real-time data collection, which will help managers and workers make better decisions. With sensors, controllers, and automated systems working together, companies will be able to monitor every step of their production process without interruptions. This will not only help reduce waste but will also ensure that the quality of products stays high.

One important factor driving this market is the need for better energy management. Companies want to reduce energy costs and lower their carbon footprint. Automation and instrumentation provide the tools to monitor energy usage closely and make changes where needed to improve efficiency. In the future, this will likely become a standard part of how industries operate. Businesses will depend more on automated systems to help them meet environmental regulations and maintain a positive reputation.

Another area where this market will grow is in safety improvements. Automated systems can detect problems early and even shut down processes when there is a risk of failure. This helps protect workers and prevents expensive damage to equipment. As industries move forward, the need for safer, more reliable systems will push the growth of automation and instrumentation solutions.

The global process automation and instrumentation market will also support the growth of artificial intelligence and machine learning. These technologies will help systems learn from past actions and make smarter decisions over time. This means businesses will have more control and flexibility than ever before. Overall, the future of this market looks strong as companies continue to focus on improving performance, cutting costs, and staying competitive through automation and smart technology.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$78,747.41 million |

|

Market Size by 2032 |

$117,921.00 Million |

|

Growth Rate from 2025 to 2032 |

6.0% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

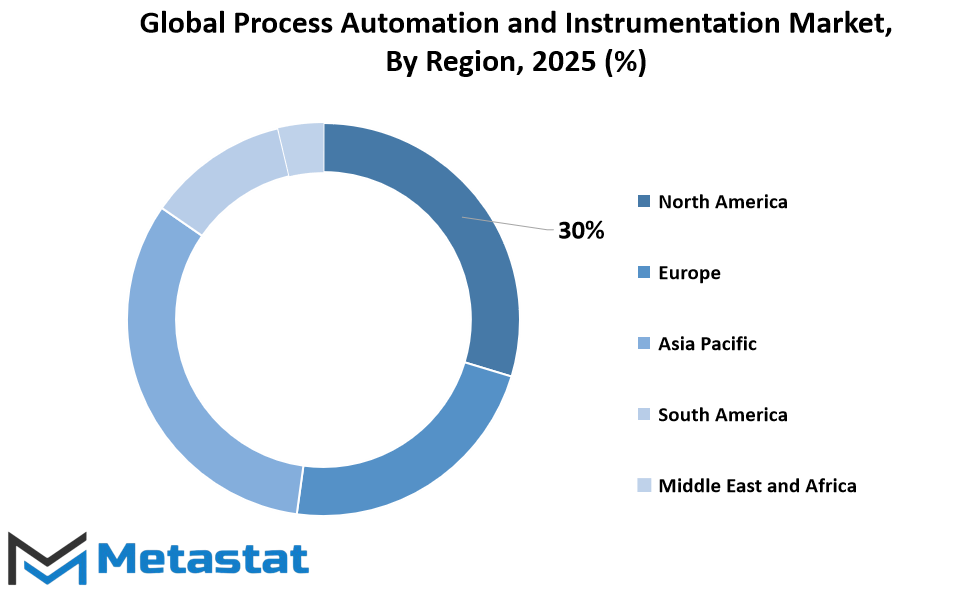

The global process automation and instrumentation market is growing steadily and is expected to shape the future of industries across various regions. This market is divided based on geography, covering North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Each of these regions plays a vital role in contributing to the market’s growth and development. North America, for instance, is split into the U.S., Canada, and Mexico. These countries are known for their advanced technology infrastructure and consistent investment in automation, which helps drive the demand for process automation solutions. Companies in these regions continue to focus on increasing productivity and efficiency through advanced instrumentation, which further pushes the market forward.

In Europe, countries such as the UK, Germany, France, and Italy, along with the Rest of Europe, have been witnessing rising adoption of automated technologies. This adoption is not just limited to manufacturing but is expanding into sectors like energy, pharmaceuticals, and chemicals. Europe’s strong industrial foundation and focus on sustainable solutions make it a key player in this market. Governments and organizations in this region are encouraging industries to adopt smart technologies to improve operational safety and reduce environmental impact.

Asia-Pacific is seen as one of the most promising regions for the future of the global process automation and instrumentation market. Countries including India, China, Japan, and South Korea are making significant advancements in their industrial sectors. With the growing demand for high-quality products, industries in these nations are leaning towards automation to enhance accuracy, reduce costs, and meet international standards. As these countries continue to modernize their manufacturing processes, the need for reliable and advanced instrumentation is becoming more apparent.

In South America, Brazil and Argentina, alongside the Rest of South America, are gradually embracing automation. Although the adoption rate may not be as fast as in other regions, there is a clear shift towards modernization, driven by the need to stay competitive and improve production capabilities. Similarly, the Middle East & Africa, which includes GCC Countries, Egypt, South Africa, and others, is focusing on automation, particularly in oil, gas, and water treatment sectors. These industries are looking to automation to improve efficiency and reduce operational risks.

Looking ahead, the global process automation and instrumentation market will continue to expand as industries across these regions realize the importance of automation in achieving long-term success. With technology advancing at a rapid pace, the market holds promising opportunities for growth and transformation.

COMPETITIVE PLAYERS

The global process automation and instrumentation market is expected to experience significant developments in the future, largely driven by advancements in technology and the rising demand for efficient industrial processes. Companies operating in this industry are focusing on creating smarter, more reliable solutions to improve production performance, safety, and overall operational efficiency. Key players like ABB Ltd., Siemens AG, Emerson Electric, Rockwell Automation, Honeywell International, Yokogawa Electric Corporation, and others have been at the forefront of this change. These companies continue to invest in innovation to provide advanced products that can meet the growing expectations of modern industries.

Looking ahead, competition among these leading companies will likely intensify as industries across the world aim to enhance productivity through automation. Firms such as Endress+Hauser, Schneider Electric, Pepperl+Fuchs, Hach, Fluke Corporation, B\&R Automation, Phoenix Contact, Turck, IFM Efector, Sick AG, and Omron Industrial Automation are expected to shape the future of this market by bringing forward solutions that are more user-friendly and capable of handling complex tasks with ease. These companies understand the increasing demand for systems that allow industries to monitor and control processes with greater accuracy, reduce downtime, and enhance safety standards.

The push for digital transformation across manufacturing and other sectors will play a key role in shaping the strategies of these competitive players. It is anticipated that automation and instrumentation solutions will evolve with technologies such as AI, machine learning, and advanced data analytics. These advancements will allow industries to make smarter decisions, minimize human errors, and achieve higher efficiency. As a result, the global process automation and instrumentation market is likely to see a shift toward solutions that not only automate tasks but also provide insights that help businesses optimize their operations.

Furthermore, companies will focus on offering more flexible and scalable solutions to meet the unique needs of different industries. This means future systems will be designed to easily integrate with existing infrastructure while offering the possibility to expand as business needs grow. The competition among these players will likely encourage further investment in research and development, pushing the boundaries of what automation and instrumentation can achieve.

In the coming years, the influence of these key players will shape not only the future of automation but also how industries operate on a daily basis. The global process automation and instrumentation market will continue to grow as companies strive to lead the way with smarter, safer, and more efficient solutions.

Process Automation and Instrumentation Market Key Segments:

By Component

- Sensors & Transmitters

- Controllers & PLCs

- Actuators

- HMIs & SCADA Systems

- Fieldbus & Networks

- Analyzers

By Technology

- Distributed Control Systems (DCS)

- Programmable Logic Controllers (PLCs)

- Supervisory Control and Data Acquisition (SCADA)

- Industrial Internet of Things (IIoT)

- Artificial Intelligence (AI) and Machine Learning

By Application

- Process Control

- Safety Systems

- Monitoring and Diagnostics

- Predictive Maintenance

- Energy Management

By Industry

- Oil & Gas

- Chemicals & Petrochemicals

- Food & Beverage

- Pharmaceuticals

- Water & Wastewater

- Power Generation

- Manufacturing

Key Global Process Automation and Instrumentation Industry Players

- ABB Ltd.

- Siemens AG

- Emerson Electric

- Rockwell Automation

- Honeywell International, Inc.

- Yokogawa Electric Corporation

- Endress+Hauser

- Schneider Electric

- Pepperl+Fuchs

- Hach

- Fluke Corporation

- B&R Automation

- Phoenix Contact

- Turck

- IFM Efector

- Sick AG

- Omron Industrial Automation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383