MARKET OVERVIEW

The Global DIY Spray Paint market and its industry will continue to take place with changes in consumer preferences and market dynamics. Indeed, the demand from the DIY painting aspect tends to enjoy increased intensity along with the advent of customizations in home improvements and creative expression. This, therefore, implies that as more people gravitate toward more personal-living spaces and unique design concepts, the market will serve their need for easy-to-use and flexible products to facilitate the enhancement of their projects. Over time, DIY spray paint will find use in other areas as well-from art and crafts to home decor and automotive refinishing.

In the near term, the DIY spray paint market's development will be in the context of home improvement and art supplies as a whole. The new market area would offer more diverse options in terms of colors, finishes, and special formulations to cater to specific consumer needs, be it subtle perfection with matte finishes or something bolder and mightier with gloss paints. The emergence of newer formulas in the market which will be environmentally friendly, medically coatomic as well as safe for indoor usage is predicted. As more stringent regulations are applied, decreased VOC levels will likely push the manufacturers to these product lines for the environmental-conscious consumers. This pattern will capture momentum in business regions where sustainability tops the list.

Along with these, the DIY spray paint market is likely to explore expansion opportunities through digital channels as well as online retail platforms. With the growing ubiquity of e-commerce, there will be a rise in online sales of spray paints by consumers, further towards ease of availability and access to a wider assortment of products. It's even more possible that product visibility could be enhanced via social media, where there are numerous DIY influencers sharing tutorials and projects that use spray paints for interested consumers to see and gather ideas. In doing so, this will be a boon to market awareness and subsequently demand for spray paint products that are either one-of-a-kind or cater to niche markets.

At the same time, advancement in technology will act as a catalyst to the industry. Spray paint products will, therefore, have more effective spray nozzle features designed to be precision applicator type to allow easy and clean application of paint by the end-users. Innovations in packaging will also enhance usability and assist in the reduction of waste. Along these lines, the current paint might involve ergonomic designs as well as features like in-built mixers ensuring the most effective consistency and application possible. Demand will definitely trend toward the creation of more friendly and efficient applications.

The social future that is to be expected is for the Global DIY Spray Paint market, which will certainly be dependent on demographic changes. For instance, the young generations, millennials and Gen Z, especially, will fuel such a cultural demand for creating their own intimate spaces where they usually have control over what goes in or doesn't, demand convenience, affordability, and diversity. Furthermore, since more and more of these young adults keep acquiring ownership of homes, they naturally will begin doing more projects, which include making furniture upcycling, home wares, and improvements on a small scale.

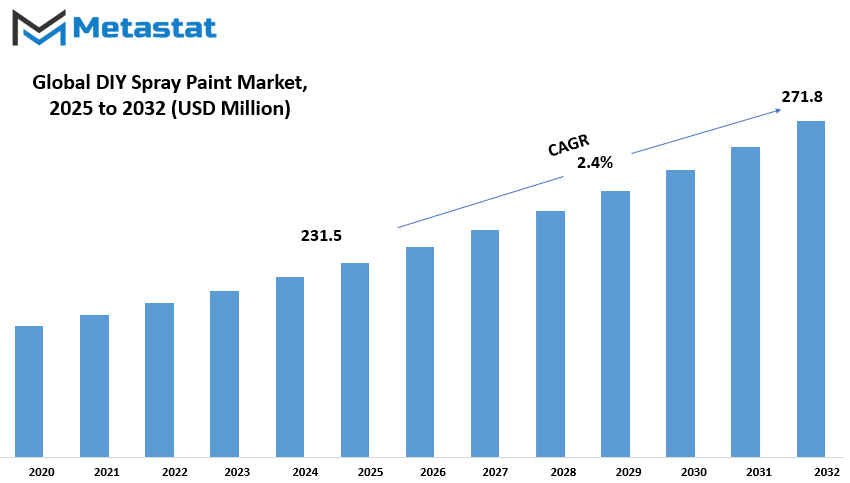

Global DIY Spray Paint market is estimated to reach $271.8 Million by 2032; growing at a CAGR of 2.4% from 2025 to 2032.

GROWTH FACTORS

The DIY Spray Paint market has largely boomed in past years and there are factors driving this better-than-expected rise on the market as it has changed the course of consumerism. The biggest factor attributing to this upsurge is increased interest in home improvement and personalization activities, whereby individuals search for ways to fully involve themselves in upgrading their spaces at home. Among the widely sought-after items is spray paint, which makes home decorations and renovations easy. It remains one of the tops 'most wanted' tools and materials because spray paint can be used on any surface, which makes it a must-have item for DIY hobbyists.

Another driving factor for the market growth happens to be the growing DIY culture among the Millennials and Gen Z. These generations prefer to put together things themselves, whether it is constructing or doing a DIY project just for saving money, fulfilling their creative side, or frankly just having the satisfaction of being able to do things themselves. Making it even better is the advantage of social media and those online communities that showcase people's work and motivate others to join. This cultural shift has made DIY products, especially spray paints, more viable for wider audiences and more appealing as well.

But there are challenges to be considered, even with market growth. One such challenge is aerosol emissions' health and environmental concerns. Spray paints are commonly amalgamated with chemicals whose implications to the environment and man cannot be overlooked. As a result, the customers' and regulatory agencies' caution has brought heightened pressure on manufacturers to adopt much safer and eco-friendly alternatives for their products. Fluctuating prices of raw materials present yet another market constraint. The cost of producing spray paint is determined by the prices of raw materials used in production, which are highly variable. Therefore, an increase in price by these materials presents a serious concern while maintaining an equilibrium in production levels and profit margins.

There are plenty of growth opportunities within the market. One is the introduction of eco-friendly and low-VOC spray paints. The greener consumers become, the more they demand such products that are less harmful to the environment. Hence, investing in such innovative products would cater to the demand of more green-minded consumers in turn increasing revenues and market shares. Emerging markets are another critical opportunity for growth. The rapidly growing DIY culture and developing markets are home to a very high potential to grow as more and more people start doing things for themselves and using spray paint products to bring things to life.

MARKET SEGMENTATION

By Type

Consistent with growing numbers of consumers taking up projects on DIY at home, as well as crafting and personalizing their items, the global DIY spray paints market is steadily expanding. There are various kinds of spray paints in the market catering to different needs and preferences. One of them comprises acrylic spray paints that are valued at $86.2 million. They have been quite a commodity because of their versatility, quick-drying property, and the smooth finish it gives. Acrylic spray paints can be used for purposes ranging from refinishing furniture to arts and crafts.

Another significant type of spray paint available in the market is epoxy spray paints. These types of spray paints are generally strong and withstanding for extreme conditions, making them an excellent choice for the kind of project which requires a strong, uninterrupted finish. They are particularly convenient for use in coating metal surfaces to avoid corrosion and rust, thus proving to have lengthy and durable finishes. In fact, epoxy spray paints give the areas a smooth and glossy finish that serves effective and aesthetic purposes, thus making them a usual choice for DIYers trying to do something on an outdoor or industrial project.

Waterborne spray paints are being widely accepted, especially because they are eco-friendly and less toxic than traditional oil-based spray paints. The best part of these paints is that they can be cleaned with water or soap. Hence, clutter free use at home becomes much more possible. Waterborne spray paints available on the market also give several colors and finishes, allowing users to achieve their desired look in all environmentally friendly conditions. The rising sustainability and health-conscious choices have thus added to the demand for waterborne spray paints.

Yet, oil-based spray paints are still quite relied on in the market. Their durability and excellent finish are the main contest winners. The effective smooth coat could be applied over many surfaces, such as wood, metal, and plastic. In a very simpler context, oil-based spray paint ends up being used as it gives long-lasting outcomes as it becomes tested against all wear. Of course, these paints take a little longer time in drying and require higher maintenance efforts for cleanup, but still, do-it-yourself enthusiasts have preference for them for projects where tough, long-lasting finishes are important.

Overall, the global DIY spray paint market is characterized by diversity and growth, spurred by dynamic developments in the home improvement industry as well as other creative projects. From acrylic to epoxy as well as in many water- and oil-based options, consumers should be able to find the appropriate spray paint for their specific needs. Likely, as more and more people embrace DIY culture and find ways to improve their living spaces and personal items, demand will continue to grow.

By Finish

The areas of DIY spray paint have been growing and expanding around the world; a trend fueled by the acceptance and adoption by people of benefits spray painting brings to DIY home improvements. This is even more pronounced with the increase in interest in personalized, cheaper ways of renewing and refreshing myriad items-from furniture to walls-in homes and businesses. One of the major drivers behind the development of this market has been the availability of various finishes for the consumer to choose the one ideal for his project: the available finishes are majorly classified into three main categories: glossy, matte, and satin.

Those who opted for glossy spray paints tend to highly prefer them for the way a glossy finish can give a surface shine while effectively making colors pop and really reflecting whatever is placed on its surfaces. Very suitable for that touch of elegance or brightness that is usually desired for surfaces, especially for those that are going to be considered as decorative pieces, picture frames, and the likes, to even doors and cabinets. Then again, that feature of being reflective highly renders the glossy surface so easy to wipe and clean, especially for those surfaces that are mostly touched and exposed to debris.

Matte paint types have always been for those wanting a less bright and soft surface, while being very much preferred to those people who want that soft, discreet look. This finish usually works best with furniture and accessorizing, where a more natural, rustic feel is desired. It is also the best choice for hiding many imperfections for items quite old, which may even show some visible defects. Furthermore, matte finishes easily put on a more sophisticated and modern look, which explains their great popularity in new interiors, since they show off a presence of their own not overshadowed by shine.

Satin paint is somewhere in between, with soft sheen that doesn't overpower, quite close to lustrous reflection, but less hopefully elegant. If you want a finish that is nice and subtle but definitely not glossy, satin is probably your best bet. Therefore, satin offers good for both furniture and walls because it brightens up vaguely without being overwhelming. Satin finishes are also a little easier to look after than matte finishes, since dirt and stains are less likely to adhere to such surfaces, but they're still way smarter than completely matte.

Thus, it can be established that the global DIY spray paint market depends on consumer preferences for different types of finishes. However, the consumer decides to go between the loudness of a glossy finish, the understated elegance of matte, or the balanced appeal of satin, each option is tailored with unique advantages to suit multiple project ideas and requirements.

By Distribution Channel

With growing consumer interest in DIY projects for decoration and home improvement, the DIY spray painting industry has taken huge strides. Considering how easy DIY spray paints are to spray, use, and clean, they are highly sought-after by those who want to rejuvenate a space, decor, furniture, or craft. Underpinning such trends are the DIY culture and movement that entails doing-it-yourself as opposed to hiring professionals.

As growth in this industry cannot be unwarranted without the distribution channels that ensure easy access of the products to the consumers, therefore, normally, the market distribution channels have bimodal distribution, i.e. the product is sold either in traditional, individual, and local stores or it can be marketed through e-commerce. The first or offline distribution encompasses all retail stores where customers are likely to find spray paints in hardware stores, home improvement stores, and specialty stores. The advantage these stores offer is that one can see the actual product before purchasing it, to ensure that what he eventually does buy is the spray paint he truly needs for his project. Furthermore, buyers shopping in-store can take away their products without any delays.

The online portals, however, are becoming more and more popular by the day, assisted by rising awareness about e-commerce-as-it's-changing-the-way-people-shop. A wide array of spray paints is now available on e-commerce sites, thereby making them a convenient mode of purchasing, most notably for a comparison between price, the reading of reviews, and the actual purchase from home. The convenience of online shopping against delivery to the home has certainly accelerated demand for this distribution channel. In addition, social media together with online communities have rampantly afforded people the ability not only to showcase their DIY projects but summon others to explore spray painting as an endless source of creativity; this boosts demand.

Moreover, the increasing number dedicated online retailers in DIY supplies, including spray paints, has also contributed to the continuous increase in online shopping. Usually, these online stores have much wider ranges of colors and brands than conventional stores, thus appealing to much larger and more different sorts of consumers. Access to specialty spray paints is also made easier with online platforms, which otherwise will not be available in local stores within an adequate time frame.

As much as the growth of the DIY spray paint market is concerned, for the future, both offline and online distribution channels will continue to exist next to each other. While retail stores provide a tactile shopping experience to many consumers, online platforms provide the ultimate in ease and variety. Interestingly enough, these two will continue to complement each other perfectly, providing consumers with myriad options for the actual purchasing of spray paints for their DIY tasks.

By End-Users

The global DIY spray paint market is witnessing rapid growth due to its usage across different domains. This market, in turn, can be segmented into three major domains as per the end-users: residential/DIY users, professional painters, and industrial users. Each of these has a unique character in driving the demand for spray paint products.

Residential or DIY users represent a large share of the market. These are the individual users of spray paint for projects, home improvements, or decoration. What matters to this group is the convenience and ease that spray paint paints offer. Spray paints, for them, are a convenient way to refresh furniture, add color to a bedroom, or undertake some craftwork as they allow for quick application and a smooth finish. This segment is of increasing interest, as now more and more people prefer undertaking home projects themselves, customizing their homes, or building distinctive items at a minimal cost.

Professional painters are that subgroup that represents a bit more special segment of the market. That is, those working as professionals painting homes, offices, or larger infrastructure projects. Professional painters to some extent have the same reason in using spray paint: efficacy and accuracy but more importantly a quality finish. In other words, unlike DIY users occurring on controlled conditions, professional painters are working under harsher situations, where consistency and coverage matter; thus, this segment values products that stand for durability suitable for high-volume application in order to enable a smoother flow of work in relevant applications.

Industrial users are, in turn, third in line and embrace the large-scale manufacturers' and industries' needs, including automotive, construction, and machineries. Industrial spray paint is sturdily made to withstand harsher conditions and is used to cover large areas and specialized materials. For instance, industrial spray paint is used in those automotive industries that manufacture and repair vehicles. On the contrary, construction industries use them for their machinery and infrastructure projects. This segment requires paints with high durability, resistance to weather, and capability to withstand environmental stress, making industrial spray policy an integral part of their operation.

Therefore, the global DIY Spray Paint market is grounded in these three user categories, each with unique specifications and varying preferences. Pushing the growth of DIY projects further and making it apparent are the consolidation and expansion of professional and industrial sectors, which are bound to keep the growth steady in coming years. Each of these thus acts as its unique driver for any particular spray paint product, shedding different lights on how variedly the marketing needs of spray paint products could be catered.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$231.5 million |

|

Market Size by 2032 |

$271.8 Million |

|

Growth Rate from 2025 to 2032 |

2.4% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

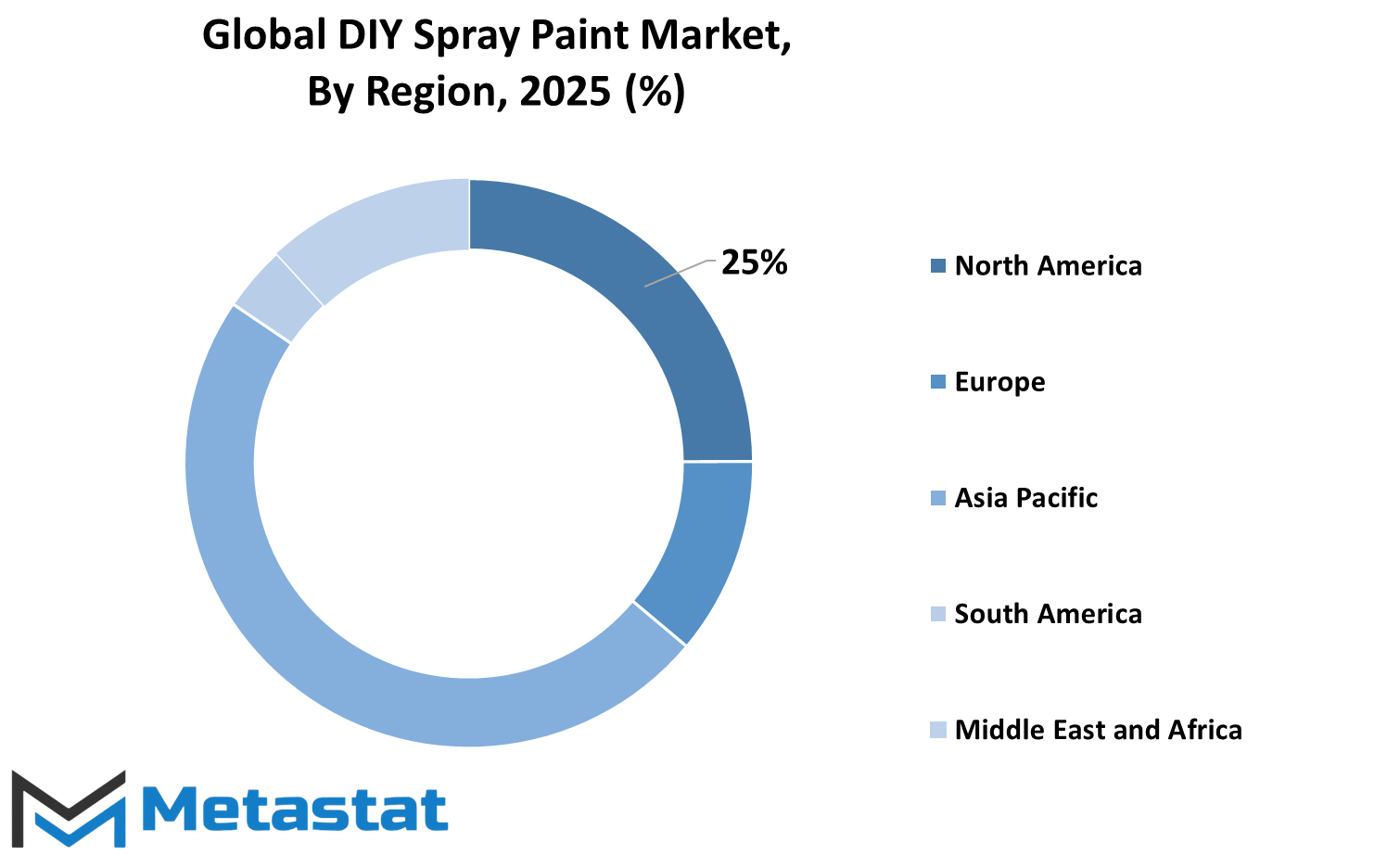

There are several regions into which geography divides the global market for DIY spray paints: North America, Europe, Asia-Pacific, South America, and the Middle East and Africa. North America is further classified into the U.S., Canada, and Mexico, while Europe consists of countries such as the UK, Germany, France, Italy, and sections of Europe grouped together as Rest of Europe. The Asia-Pacific classifies India, China, Japan, and South Korea into one segment, while all others in the region will together be called Rest of Asia-Pacific. Within South America, Brazil and Argentina will comprise the other countries included as Rest of South America. Lastly, the Middle East & Africa divides into the GCC countries, Egypt, South Africa, and the remainder of countries in the region will be categorized as Rest of Middle East & Africa.

The above division is helpful in understanding how DIY Spray Paint products have been spread and which areas have demand in their favor. The analysis of these areas allows the companies to identify the growth opportunities, the trends in the market, and the behavior of consumers unique to each area. The DIY market has seen much growth in countries in North America and Europe because of higher disposable income and spending on home improvement projects. Rapid growth in economies and rising demand for DIYs is likely to result in spectacular growth in markets of the Asia-Pacific in coming years. A similar case goes for potential emerging markets in South America and the Middle East & Africa, where growth should begin to take its course along with an increase in urbanization and the growth of DIY culture.

The global DIY spray paint market being geologically segmented thus enables effective targeting of strategies by companies and investors. It helps them understand the local dynamism of relevant markets and then embark on decisions in line with the regional demands. It also provides scope for organizations to respond to the unique needs of each market, either via customized marketing campaigns, amended product features, or adapted distribution strategy. These regions are likely to pave a road for the DIY spray paint industry throughout the years ahead based on successiveness factors.

COMPETITIVE PLAYERS

Over time, the DIY spray paint industry around the world has dramatically expanded due to the rising wave of home improvement and personalization projects. This market consists of various players from various industries who contribute to the growth of this market with fresh product launches and strong brand presence. Some major players in the DIY spray paint industry are well-established companies such as Montana Colors S.L., Nippon Paint Holdings Co., Asian Paints Limited, Dupli-Color, PintyPlus (Novasol Spray), Plutonium Paint, Plasti Dip UK Ltd, Seymour of Sycamore Inc., The Sherwin-Williams Company, Krylon, Rustoleum Corporation, Kilz (Masterchem Industries LLC), Valspar, Behr Process LLC, and ColorShot.

Montana Colors S.L. is one company that made an impactful contribution toward establishing a recognizable market with credible products: a wide range of quality spray paints renowned for their vivid colors and versatility. This uniquely corresponds to the payoff of both pros and amateurs when it comes to durability and usability of the products. Likewise, Nippon Paint Holdings Co., Ltd. and Asian Paints Limited are the competitors who capitalize on their distribution networks and market knowledge to bring affordable yet efficient spray-paint solutions. Both have been acknowledged for their ability to offer excellent coverage and finish among various customers involved in home renovation and artwork.

Dupli-Color, PintyPlus (Novasol Spray), and Plutonium Paint concentrate on specialized spray paints to cater from automotive customizations to home décor. Their offerings include finishes available only in certain colors, such as metallic or matte. In voiding the traditional spray-painting route in automotive or industrial application, Plasti Dip UK Ltd, with its rubberized coating, created its niche market. Besides, Seymour of Sycamore Inc. adds value with high-end spray paints that are resistant to harsh conditions, appealing to DIYers and professionals alike.

These three companies—Sherwin-Williams Company, Krylon, and Rustoleum Corporation—constitute the giants in the world DIY spray paint market. These companies have a long-standing history in the paint industry and have successful expanded their product lines to fulfill the growing demand for DIY spray paints. On the other hand, Kilz (Masterchem Industries LLC), Valspar, Behr Process LLC, and ColorShot offer a wide range of spray paint products from very basic to premium selections, leaving the decision on to the client based on needs from the project and their budget. All these companies continue to innovate and upgrade with changing customer needs in the DIY spray market.

Thus, it can be said that the global DIY spray paint market is filled with several established and new players, all trying to cater to the needs of customers looking for the best quality, versatile, and affordable spray paint solutions for their home improvement, craft, and automotive needs.

DIY Spray Paint Market Key Segments:

By Type

- Acrylic Spray Paints

- Epoxy Spray Paints

- Water-Based Spray Paints

- Oil-Based Spray Paints

By Finish

- Glossy

- Matte

- Satin

By Distribution Channel

- Offline (Retail Stores)

- Online

By End-Users

- Residential/DIY Users

- Professional Painters

- Industrial Users

Key Global DIY Spray Paint Industry Players

- Montana Colors S.L.

- Nippon Paint Holdings Co., Ltd.

- Asian Paints Limited

- Dupli-Color

- PintyPlus (Novasol Spray)

- Plutonium Paint

- Plasti Dip UK Ltd

- Seymour of Sycamore Inc.

- The Sherwin-Williams Company

- Krylon

- Rustoleum Corporation

- Kilz (Masterchem Industries LLC)

- Valspar

- Behr Process LLC

- ColorShot

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383