MARKET OVERVIEW

The global critical illness insurance market, part of the broader health and life insurance category, will continue to be in focus as medical bills rise and procedures get more complex. The industry is concentrating on insurance policies created with the exclusive aim of providing economic protection for those suffering from severe and expensive medical illnesses such as cancer, stroke, or organ failure. These products are distinct from standard health insurance, as they are intended to offer a lump sum payment upon diagnosis of a covered illness, allowing policyholders to have flexibility in treating expenses not covered by standard medical treatment. Policy design within the global critical illness insurance market will vary significantly with regard to geographic regulation, the presence of the healthcare infrastructure, and consumer behavior.

While certain jurisdictions will concentrate on coverage of few high-risk diseases, others will expand policy products to a wide range of conditions, occasionally crafted to mirror local medical data and actuarial research. As the insurance industry introduces more technology into the cycle of writing, issuing, and paying policies, this market will accept innovations enhancing the speed and precision of service production. The incorporation of advanced diagnostics and predictive analysis will also hold a voice on how insurers calculate risk, quote premiums, and design coverages. The global critical illness insurance market will respond to demographic shifts, access to healthcare, and rising stress from non-communicable diseases on different continents. While some countries will see more policy uptake through employer-sponsored plans, others will shift towards direct-to-consumer sales.

Insurers in this segment will adjust their distribution platforms to address differences in consumer trust, literacy, and access across various regions. Mobile-first platforms, for example, will be popular where smartphones are the key financial service access device. As chronic diseases continue to affect working-age populations, the global critical illness insurance market will witness product structuring and trigger of benefits adjusted. Policyholders will expect greater transparency and flexibility, prompting insurers to roll out modular products with ancillary benefits, second opinion in healthcare, and value-added services such as counseling or rehabilitation support. Such add-ons will move beyond simple reimbursement and will play a more holistic part in the consumer health experience.

The sector will also witness increasing demand for faster settlement of claims, which will prompt insurers to invest in more advanced automation equipment and adopt electronic health record systems to reduce processing time. The regulatory guidance will be a defining element of how the Global Critical Illness Insurance sector frames its future directions. Insurers must balance national healthcare agendas, consumer protection laws, and solvency requirements with competitiveness in a changing environment. Regulators will determine product disclosure, standardization of claims processes, and standards for determining covered illness.

In the long run, the global critical illness insurance market will evolve in design, distribution, and technological sophistication. Since the cost of serious diseases remains a real concern in communities, this sector will remain a crucial safety net, bridging the gap between medical needs and economic preparedness. The future of this segment will be determined by how it strikes a balance between innovation and compliance and accessibility and sustainability.

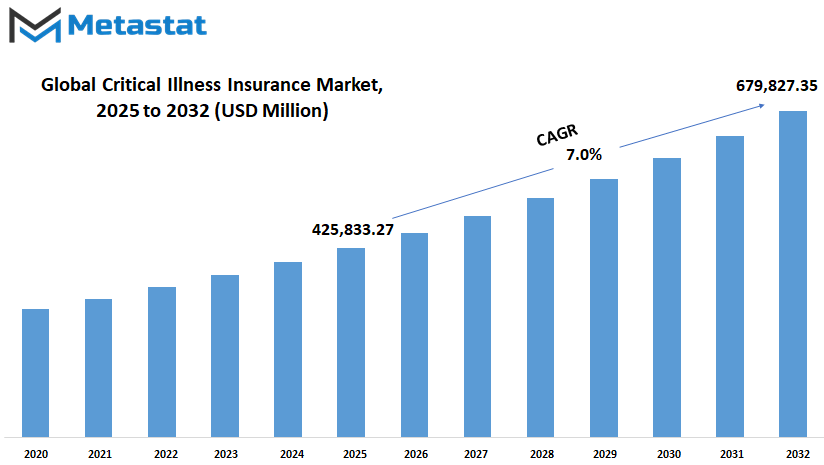

global critical illness insurance market is estimated to reach $ 679,827.35 Million by 2032; growing at a CAGR of 7.0% from 2025 to 2032.

GROWTH FACTORS

The global critical illness insurance market is gradually picking up pace as people start understanding the economic consequences that come with serious illness. As more and more people are coping with lifestyle and chronic diseases, there is greater awareness about the importance of a safety net. Ailments such as cancer, stroke, and heart disease are no longer unusual, and many families are having a hard time keeping up with the unforeseen costs that ensue from a dire diagnosis. This growing need for financial protection is most probably going to propel the market in the coming years. The shift in public perception is another compelling reason for this expected growth.

People are becoming more conscious of the fact that life is uncertain and are taking steps to prepare for it. Insurance is not considered an unnecessary added cost anymore, but a wise decision that can protect savings and prevent long-term financial strain. Though education and increasing awareness will certainly drive the take-up, there will be a point that increasingly people will look at the value of critical illness cover, especially as they see others short-changed. However, some barriers may stifle the pace of growth at which the global critical illness insurance market grows. Among them is the cost of the cover.

Comprehensive policies, which provide coverage for a broad spectrum of serious illnesses, may be costly. For most individuals, particularly those in low-income brackets, these premiums may seem unaffordable. To add to that, there is also a general ignorance regarding how such policies function and what they provide. This comparative lack of awareness can lead to reluctance to invest in something that one is not quite sure of, and even discourage some from getting coverage that they need. Despite these hurdles, there are indicators that imply that the future for the global critical illness insurance market holds favorable changes. Internet platforms are opening up new avenues by opening up insurance to everyone. These sites are facilitating it for people to compare policies, customize plans according to their unique needs, and purchase insurance.

With technology, insurers can now reach more people and offer flexible solutions that were previously not possible. As technology continues to improve, the insurance experience will also become increasingly consumer-friendly, something that can make it more attractive to a broader population and create more confidence in these products. In the long run, all these can strengthen the market and offer services to more people.

MARKET SEGMENTATION

By Type

The global critical illness insurance market is likely to grow steadily as individuals become increasingly aware of how expensive and unpredictable medical conditions can impact their lives. As more individuals realize the importance of insuring themselves and their families, insurance covering serious health issues is gradually becoming a significant aspect of financial planning. This sort of coverage allows individuals to anticipate medical conditions that not only have an impact on health but also on finances. These policies give a lump-sum payment if someone develops a chronic illness covered by the policy. That money may then be utilized for anything treatment, transportation, pay, or even ongoing expenses while an individual remains ill and can't work. One of the central reasons that this market will be likely to grow is the increasing focus on health by citizens and governments.

Humans are living longer, but in doing so may have more severe health issues. Because of this, demand for coverage that provides for extended recovery or treatment is expected to become increasingly significant. In the times to come, this market would experience increased activity with more individuals opting for plans that fit into their personal or family life situation and not fundamental, one-for-all plans. Segmentation by type comes to play here very significantly. global critical illness insurance market by type is segregated into Individual Insurance and Family Insurance. Individual Insurance is designed to cover a single individual and has complete control at the individual level over their plan, payment, and benefits.

This type of plan may appeal to people who live alone, those just starting out in their careers, or even older adults who are looking to secure peace of mind for their later years. On the other hand, Family Insurance is built for households. It provides coverage for more than one person under a single plan, often making it easier and more affordable to manage compared to separate policies. Families with elderly parents or young children may view it as a means to cover multiple members without the need to purchase multiple individual policies. In the future, these two categories will likely be more individualized and adaptive. With time and advancing data and technology, insurance firms could potentially provide more specialized choices based on varying requirements, incomes, and medical histories. This development will likely propel more robust market growth and assist more individuals to get the type of coverage they require in a time where one's health might fluctuate in a split moment and prices increase suddenly.

By Premium Mode

The global critical illness insurance market will also stay in the spotlight due to growing awareness of severe diseases and rising medical care expenses. People have grown more conscious of their own medical needs and understand that certain diseases not only destroy their health but also their wallets. Thus, the need for policies to cover them when such a case emerges is going to rise consistently. Insurance firms are adjusting their products to suit this change, and they are striving more to make their policies flexible and easy to understand. One important aspect that is shaping the market is the payment frequency of premiums.

Having a choice of determining how often one pays monthly, quarterly, half-yearly, or yearly gives power to the client. For most people, monthly payments are comfortable and enable them to keep their finances under control without worrying about a huge amount. Quarterly and bi-annual options might be appropriate for those wanting fewer transactions, but yearly payments usually have minor discounts and the satisfaction of knowing the next twelve months are covered. These decisions will become more sophisticated over time, particularly as insurers seek to provide convenience and transparency. Going forward, this market will continue to move towards personal plans.

Technology will come into play here since online platforms will allow easy comparison of different payment options and coverage features. People will demand easy access to information and even look forward to being reminded about outstanding payments or plan renewals. The simpler these systems become, the more confident people will be in choosing the kind of protection that is best suited to their situation. As living standards change, and medical treatment becomes more advanced but expensive, the worth of critical illness cover will increase.

The idea of paying a small amount regularly for protection against enormous, unexpected hospital bills is appealing. It brings not just funds, but a feeling of confidence and peace to families and individuals. Eventually, the global critical illness insurance industry will reflect a population that holds dear to the feeling of preparation ahead. The future sees insurers needing to be responsive and accommodating. The ease of receiving payment, open communication, and the flexibility to make payments will be key points in swaying one's decision. As more people start realizing the value of protecting themselves from serious health dangers, this market will grow in size and importance.

By Disease

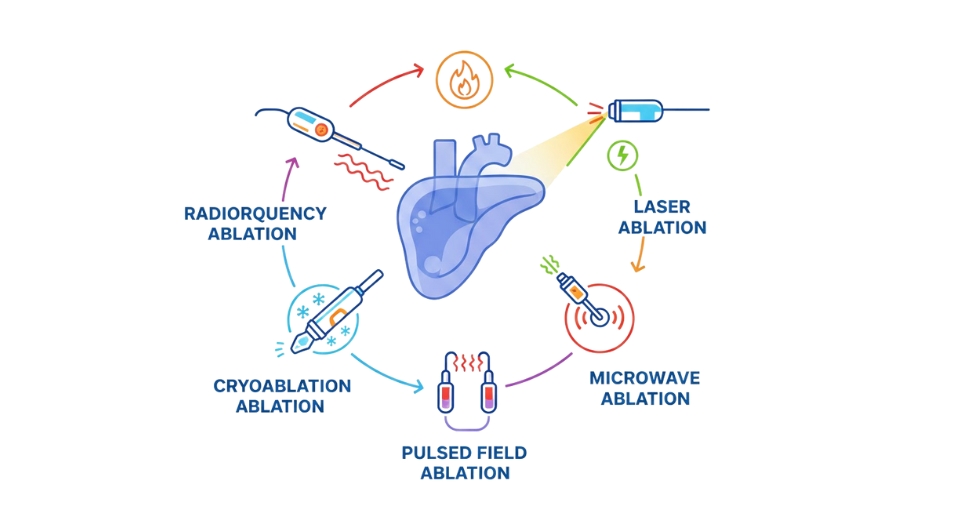

The global critical illness insurance industry will remain increasingly more involved in protecting healthcare, especially with increasing recognition of how costly and unpredictable big diseases are. As disease incidence moves in accordance with lifestyles altering, environmental considerations, and mounting pressure, more people become exposed to life-threatening illnesses such as stroke, cancer, and heart attack. These conditions not only impact physical health but also put a lot of financial strain. Critical illness insurance is becoming increasingly relevant because it acts as an umbrella during these trying times, providing financial assistance when individuals are unable to work or when treatments are expensive. In the years to come, the need for this kind of insurance will grow as medical technology advances.

Although better treatments are available, they are also more expensive. This makes their need for insurance coverage that will be able to take care of families when they are in need even greater. Individuals are not just searching for simple plans anymore. They are looking for policies that are simple to understand, adaptable, and responsive to their individual needs. As word gets out, more people will begin to realize the importance of preparing for big illnesses. By illness, the global critical illness insurance market is primarily defined by protection against stroke, cancer, heart attack, and other chronic conditions. Cancer remains a top reason why individuals purchase this type of insurance.

The psychological and financial burden of cancer diagnosis can be crushing. With increasing cancer rates and complicated treatments, most will resort to insurance to ease the burden. Stroke too is being talked about more with its long-term impact and associated long-term care. Heart attacks too continue to be a major issue, thanks to rising stress and lack of activity levels. These circumstances are compelling more individuals to consider insurance not merely as a choice but as a requirement.

In the future, the global critical illness insurance market will become more focused on customized protection. Individuals will demand policies that take into account their health vulnerabilities, age, and way of life. The market could also experience a rise in digital platforms that allow for increased convenience in buying, managing, and claiming policies. As more individuals become interested in taking charge of their health and finances, this market will emerge as an integral aspect of financial planning in the future.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$425,833.27 million |

|

Market Size by 2032 |

$679,827.35 Million |

|

Growth Rate from 2025 to 2032 |

7.0% |

|

Base Year |

2024 |

|

Regions Covered |

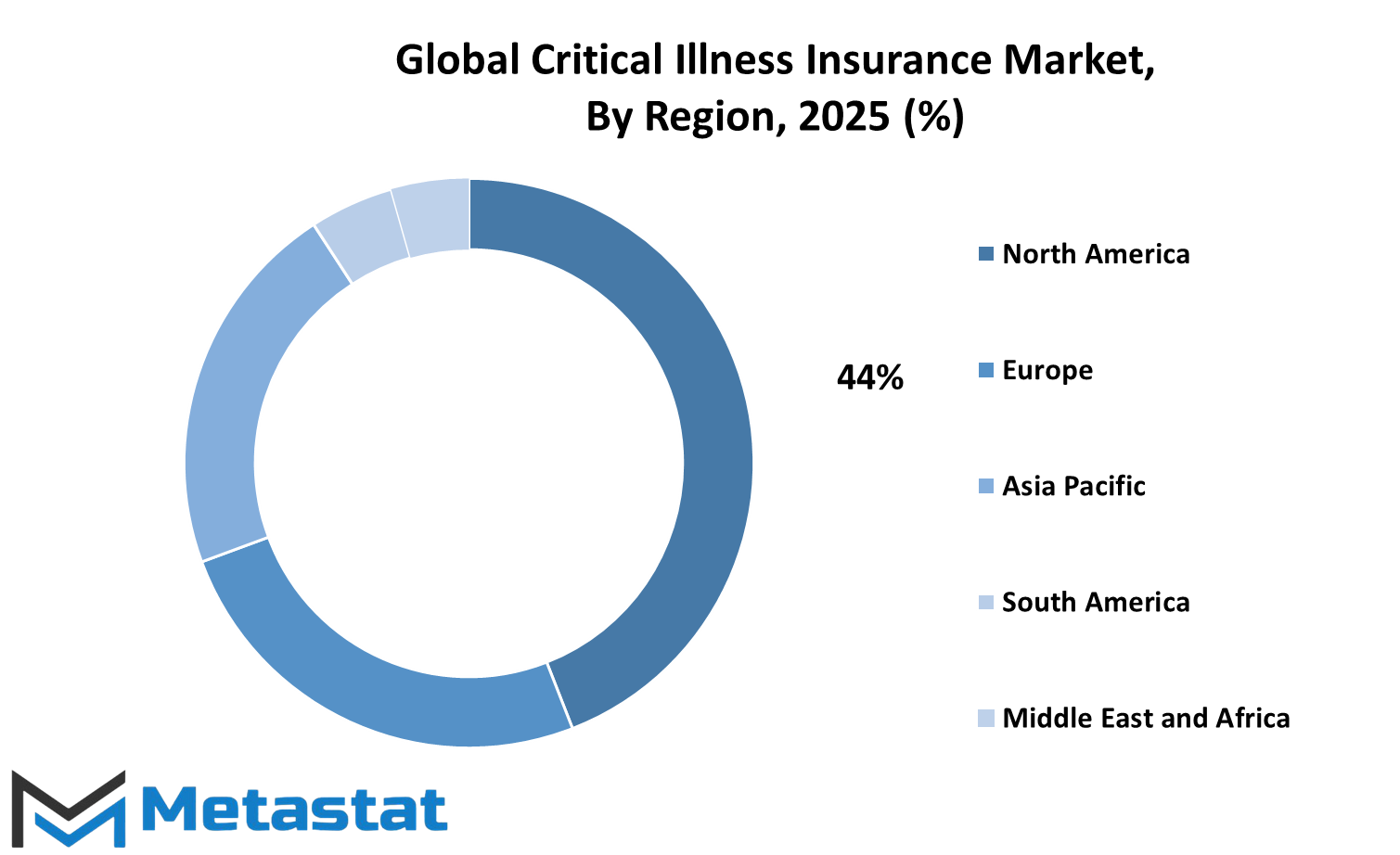

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global critical illness insurance market will keep on growing as health issues become larger and the level of awareness improves in various regions of the globe. There is a large role that regional variations play in developing this market, with every region exhibiting its own rate of development and special needs. In North America, the market will increase gradually because of the increase in the cost of medical care and a special emphasis on preventive measures. The United States is foremost with a great demand for protection related to health, and Canada and Mexico are also witnessing a gradual increase in interest. Individuals are becoming increasingly conscious of how acute diseases can affect not only health but also financial security, which in turn is prompting more and more individuals to opt for this type of insurance coverage. European nations such as the UK, Germany, France, and Italy will further influence the market.

The need for critical illness cover within the region is being fueled by an aging population, as well as rising disease rates, including cancer and heart conditions. Governments in Europe are also trying to persuade individuals to make provision for unforeseen health costs, and this contributes to the market's potential. With healthcare systems under strain in much of Europe, greater numbers are likely to seek additional protection, to drive future growth. The Asia-Pacific region is going to be one of the fastest-growing regions for this market. India and China are experiencing solid economic transformation, as well as enhanced access to healthcare.

As incomes increase and awareness grows, additional individuals in this part of the world will purchase insurance that covers serious medical conditions. Japan and South Korea already have high-standard healthcare systems, and demand for additional financial security will continue to be strong. The region overall is heading toward a future in which more will see the importance of being prepared for unforeseen health issues. South America is also continuing growth, with Brazil and Argentina at the forefront. Changes in the economy and increased demand for improved healthcare alternatives are compelling individuals to seek out alternative insurance options. The Middle East & Africa area, including such countries as the GCC nations, Egypt, and South Africa, will be increasing at a gradual pace.

As knowledge expands and more people realize the risk associated with significant health conditions, this region might experience greater interest in critical illness insurance. Collectively, the worldwide Critical Illness Insurance market will expand with greater awareness, improved access to healthcare, and shifting regional requirements.

COMPETITIVE PLAYERS

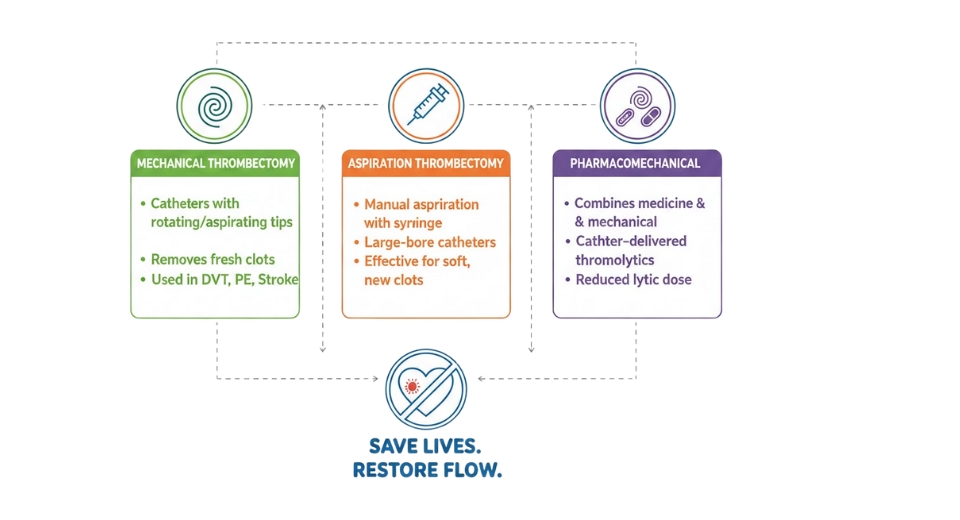

The global critical illness insurance market will be transformed dramatically in the near future as health issues increase, and medical expenses keep increasing. More individuals are realizing the economic effect that serious illness can have, not only on themselves, but on their loved ones as well. With the consistent increase in life-threatening and chronic diseases, most are now looking at critical illness insurance as an essential cover. This shift in perception is bound to drive demand further, and consequently, leading insurance companies are gearing up to modify their strategies to address these new requirements. Firms like AIA Group, Manulife Hong Kong, Chubb, and Allianz will have an important position in molding the direction of this market.

These companies' capacity for adjustment will establish the benchmark for others to follow. These companies, plus Prudential Hong Kong, China Life Insurance, and Aviva, will be expected to concentrate on providing more flexible, customer-oriented options. This might involve streamlined claim processes, online platforms for convenient policy management, and customized plans that fit individual health histories or lifestyles. As individuals seek more control and reassurance during unsettled times, the sector must become more transparent and responsive. Technology will also impact the global critical illness insurance market significantly. Wearable fitness devices, AI-powered risk assessments, and digital health monitoring tools can soon assist insurance providers in learning more about the behavior of their policyholders' health.

This could result in more targeted pricing and quicker claims resolution. Data security will still be a priority, but most providers will likely leverage such tools to enhance customer experience and build confidence. The position of regional players like LIC, ICICI Prudential Life Insurance, and Fubon Life Insurance is likely to increase as they look to address local needs through affordable choices. Players like Sun Life Asia, AXA Asia, MetLife, Tokio Marine Holdings, and Axis Max are also expected to increase their reach by tapping into untapped markets and collaborations that provide value beyond the policy.

In the future, the Global Critical Illness Insurance industry is expected to be more prevention-oriented, detection-oriented early, and assistance-oriented during treatment. Instead of merely offering financial support following diagnosis, the business may begin providing resources and tools that enable individuals to remain healthier for a longer period.

Critical Illness Insurance Market Key Segments:

By Type

- Individual Insurance

- Family Insurance

By Premium Mode

- Monthly

- Quarterly

- Half Yearly

- Yearly

By Disease

- Stroke

- Cancer

- Heart Attack

- Others

Key Global Critical Illness Insurance Industry Players

- AIA Group

- Manulife Hong Kong

- Chubb

- Allianz

- Prudential Hong Kong

- China Life Insurance

- Aviva

- Aegon Asia

- AXA Asia

- Sun Life Asia

- ICICI Prudential Life Insurance

- MetLife

- Tokio Marine Holdings

- Axis Max

- Fubon Life Insurance

- LIC (Life Insurance Corporation)

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252