MARKET OVERVIEW

The Colombia Factory Automation and ICS market sheds light on the burgeoning industrial automation and control systems (ICS) within the Colombian market. This report provides a comprehensive overview of the current state of automation technologies and their adoption across various industries in Colombia.

In recent years, Colombia has witnessed significant growth in the adoption of factory automation and ICS solutions. This trend can be attributed to several factors, including the increasing focus on enhancing operational efficiency, improving productivity, and ensuring greater safety in industrial environments. The adoption of automation technologies has become imperative for Colombian industries seeking to remain competitive in the global market landscape.

One of the key drivers behind the growth of the factory automation and ICS market in Colombia is the rapid industrialization taking place across the country. With sectors such as manufacturing, mining, oil and gas, and utilities experiencing substantial growth, there is a growing need for advanced automation solutions to streamline processes, optimize resource utilization, and minimize downtime.

Furthermore, the Colombian government’s initiatives to promote industrial development and modernization have also played a crucial role in fueling the demand for automation technologies. Policies aimed at attracting foreign investment, promoting innovation, and fostering partnerships between the public and private sectors have created a conducive environment for the adoption of factory automation and ICS solutions.

The report highlights the various automation technologies that are gaining traction in the Colombian market, including robotics, programmable logic controllers (PLCs), distributed control systems (DCS), supervisory control and data acquisition (SCADA) systems, and industrial cybersecurity solutions. These technologies are being deployed across a wide range of industries, including automotive, food and beverage, pharmaceuticals, chemicals, and logistics, among others.

One notable trend in the Colombia Factory Automation and ICS market is the increasing adoption of Industry 4.0 principles and technologies. Industry 4.0, also known as the fourth industrial revolution, emphasizes the integration of digital technologies, data analytics, and connectivity to create smart, interconnected manufacturing systems. Colombian industries are embracing concepts such as the Industrial Internet of Things (IIoT), artificial intelligence (AI), machine learning, and predictive analytics to drive greater efficiency, flexibility, and innovation in their operations.

The report also delves into the challenges and opportunities facing the Colombia Factory Automation and ICS market. While the adoption of automation technologies offers numerous benefits, including improved productivity, quality, and safety, it also presents certain challenges, such as the need for skilled workforce, cybersecurity risks, and upfront investment costs. However, these challenges are outweighed by the opportunities for growth and innovation that automation technologies bring to Colombian industries.

The Colombia Factory Automation and ICS market report by Metastat Insight provides valuable insights into the current trends, drivers, and challenges shaping the industrial automation landscape in Colombia. As Colombian industries continue to embrace automation technologies to enhance their competitiveness and sustainability, the future looks promising for the growth and evolution of the factory automation and ICS market in the country.

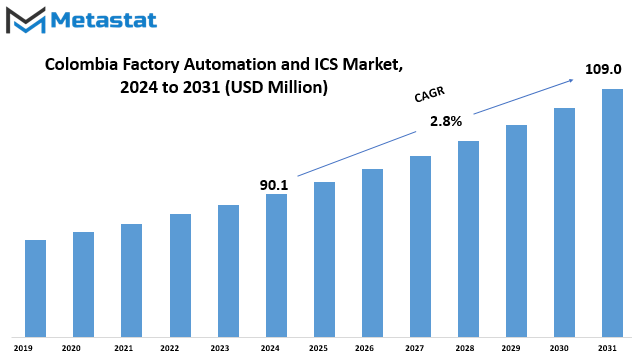

Colombia Factory Automation and ICS market is estimated to reach $109.0 Million by 2031; growing at a CAGR of 2.8% from 2024 to 2031.

GROWTH FACTORS

The Colombian factory automation and industrial control systems (ICS) market exhibit various factors driving its growth, encountering hurdles, and presenting opportunities for expansion.

One significant driver propelling the market forward is the heightened emphasis on operational efficiency. Industries are increasingly recognizing the importance of streamlining their processes to enhance productivity and reduce costs. Automation and ICS solutions offer the means to achieve these objectives by optimizing workflows, minimizing downtime, and improving overall operational effectiveness. This focus on efficiency serves as a catalyst for the adoption of automation technologies across various sectors in Colombia.

Another key driver is the support provided by the government for the modernization of manufacturing facilities. Recognizing the potential of automation and ICS in fostering economic development and competitiveness, the Colombian government has initiated policies and incentives to encourage investment in these technologies. By offering financial assistance, tax incentives, and regulatory support, the government aims to facilitate the adoption of advanced manufacturing practices, thereby boosting the growth of the automation and ICS market in the country.

However, despite the favorable conditions, the market faces certain restraints that impede its progress. One significant challenge is the high initial investment costs associated with implementing automation and ICS solutions. While these technologies offer long-term benefits in terms of efficiency and cost savings, the upfront investment required can be substantial, especially for small and medium-sized enterprises (SMEs). This financial barrier often deters organizations from embracing automation, slowing down the pace of market growth.

Additionally, the lack of a skilled workforce poses a significant obstacle to the widespread adoption of automation and ICS in Colombia. Implementing and managing automation technologies require specialized knowledge and expertise, which is currently in short supply in the country. The shortage of skilled professionals proficient in automation and control systems hampers the deployment and maintenance of these solutions, limiting their penetration into the market.

Nevertheless, amidst these challenges, the Colombian factory automation and ICS market present promising opportunities for expansion. One such opportunity lies in the rising demand for smart manufacturing solutions. As industries seek to enhance their competitiveness and adapt to evolving market dynamics, there is a growing interest in integrating intelligent automation technologies into their operations. Smart manufacturing solutions, enabled by advanced sensors, analytics, and connectivity, offer capabilities such as predictive maintenance, real-time monitoring, and data driven decision-making, which are increasingly sought after by Colombian manufacturers.

The Colombian factory automation and ICS market are influenced by a combination of drivers, restraints, and opportunities. While factors such as increased focus on operational efficiency and government support for manufacturing modernization propel market growth, challenges such as high initial investment costs and the lack of skilled workforce pose significant barriers. However, the rising demand for smart manufacturing solutions presents avenues for future expansion, indicating a promising outlook for the automation and ICS market in Colombia.

MARKET SEGMENTATION

By Product

The Colombia Factory Automation and Industrial Control Systems (ICS) market can be divided into various segments, with one of them being the product segment. Within this segment, there are two main categories: Field Devices and Industrial Control Systems (ICS). Field Devices refer to the physical devices used in automation processes, such as sensors, actuators, and transmitters. Industrial Control Systems (ICS) encompass the software and hardware systems that monitor and control industrial processes.

In 2023, the Field Devices segment of the Colombia Factory Automation and ICS market was valued at 62.4 USD Million. This indicates the significant role that these devices play in the automation industry in Colombia. Field Devices are crucial components in industrial automation, as they gather data from the physical environment and transmit it to control systems, enabling real-time monitoring and decision-making.

The value of the Field Devices segment reflects the growing adoption of automation technologies across various industries in Colombia. As companies strive to improve efficiency, reduce costs, and enhance productivity, they increasingly rely on Field Devices to streamline their operations. These devices help businesses optimize processes, minimize downtime, and ensure consistent quality in production.

Moreover, the demand for Field Devices is driven by factors such as advancements in sensor technology, the rise of the Internet of Things (IoT), and the increasing focus on data-driven decision making. Companies are leveraging Field Devices to collect data on machine performance, environmental conditions, and product quality, enabling them to optimize processes and improve overall performance.

By Field Devices Type

The Colombia Factory Automation and Industrial Control Systems (ICS) market is segmented based on field devices types, which include Machine Vision, Robotics, Sensors, Variable Frequency Drives (VFDs), Low Voltage Drives (LVS), Servo Motors, AC Motors, and Other Field Devices. In 2023, the Machine Vision segment held a value of 8.74 USD Million, Robotics segment amounted to 7.57 USD Million, Sensors reached 21.5 USD Million, VFDs accounted for 6.12 USD Million, and other field devices contributed to the market as well. These segments represent key components of the factory automation and ICS market, reflecting the diverse technologies employed in industrial settings to enhance efficiency and productivity.

Machine Vision, a vital component of factory automation, encompasses technologies that enable machines to visually perceive and interpret their surroundings, facilitating tasks such as quality control, inspection, and robotic guidance. With an increasing focus on precision and accuracy in manufacturing processes, the demand for machine vision systems continues to grow, driving market expansion.

Robotics play a pivotal role in automating various tasks within industrial environments, ranging from assembly and material handling to welding and packaging. The robotics segment, valued at 7.57 USD Million in 2023, reflects the significant adoption of robotic solutions by manufacturers seeking to streamline operations and improve production output.

Sensors serve as the sensory organs of industrial automation, detecting and measuring various parameters such as temperature, pressure, and proximity to enable real-time monitoring and control of processes. With industries increasingly embracing data-driven decision-making and predictive maintenance strategies, the demand for sensors remains robust, as evidenced by the segment’s valuation of 21.5 USD Million in 2023.

Variable Frequency Drives (VFDs) represent a critical technology for controlling the speed and torque of electric motors, optimizing energy consumption and enhancing operational efficiency in industrial applications. The segment’s value of 6.12 USD Million underscores the significance of VFDs in modern manufacturing facilities seeking to reduce energy costs and improve sustainability.

In addition to these core segments, the Colombia Factory Automation and ICS market encompass other field devices such as Low Voltage Drives (LVS), Servo Motors, AC Motors, and various auxiliary components essential for automation and control tasks. Together, these devices form a comprehensive ecosystem that empowers industries to automate processes, enhance product quality, and meet evolving market demands.

The market dynamics driving the adoption of factory automation and ICS in Colombia are influenced by factors such as technological advancements, regulatory initiatives, and the pursuit of operational excellence by industry players. As businesses strive to remain competitive in a globalized economy, investments in automation and control technologies are expected to continue, driving further growth and innovation in the Colombia Factory Automation and ICS market.

The segmentation of the Colombia Factory Automation and ICS market by field devices types highlights the diverse array of technologies driving industrial automation and control. From machine vision and robotics to sensors and VFDs, these components play integral roles in enhancing productivity, efficiency, and competitiveness across various sectors. As Colombia’s industrial landscape evolves, continued investments in automation and control solutions are poised to unlock new opportunities for growth and development in the years ahead.

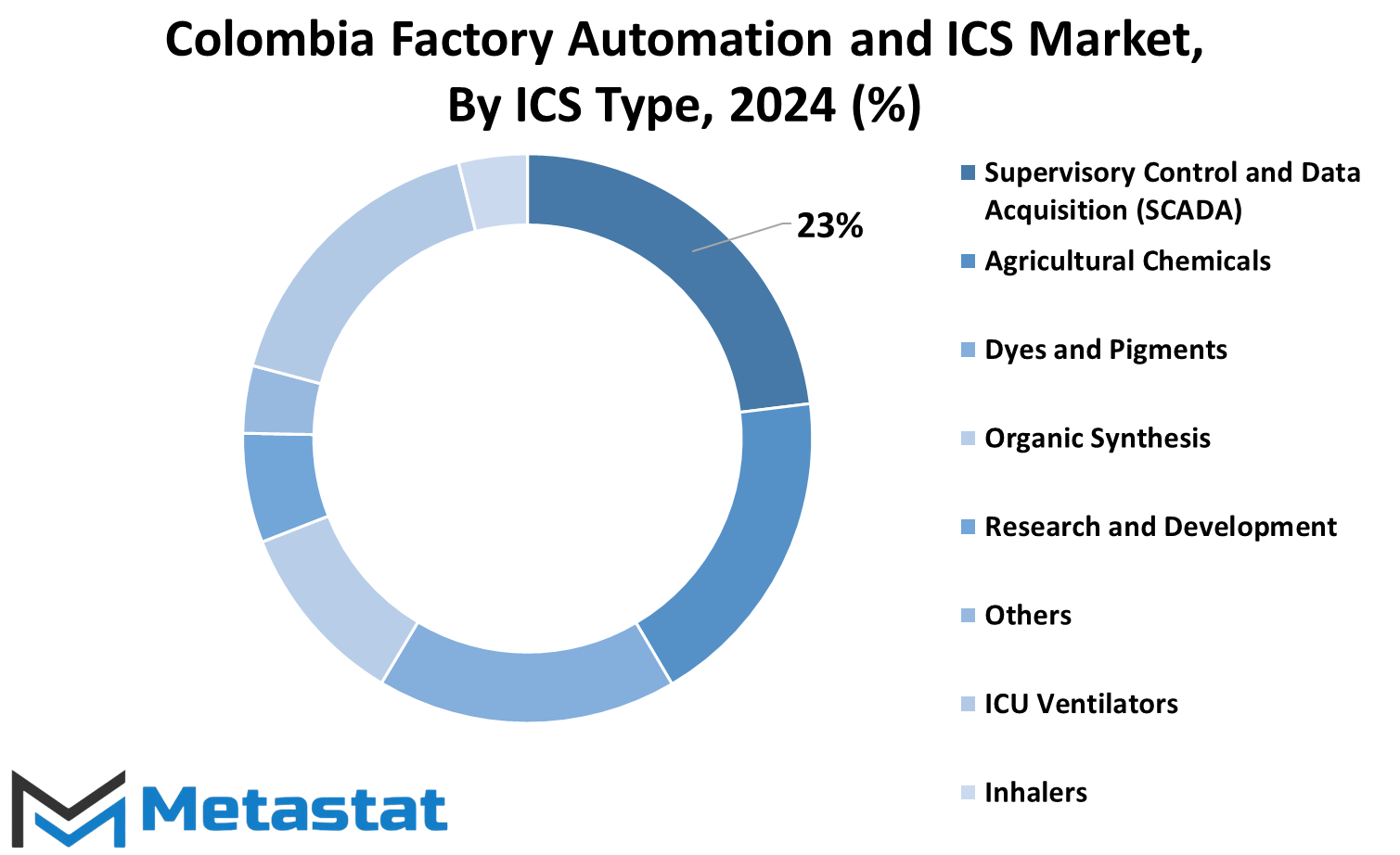

By ICS Type

The market for factory automation and industrial control systems (ICS) in Colombia is a dynamic landscape, characterized by various technologies and systems aimed at enhancing productivity and efficiency in industrial processes. Within the ICS segment, different types of systems play vital roles in managing and controlling operations.

One of the primary divisions within the ICS market is based on the type of control systems employed. These include Supervisory Control and Data Acquisition (SCADA), Distributed Control Systems (DCS), Programmable Logic Controllers (PLC), Manufacturing Execution System (MES), Product Lifecycle Management (PLM), Enterprise Resource Planning (ERP), Human Machine Interface (HMI), and Other Control Systems.

SCADA systems are widely used to monitor and control industrial processes, allowing operators to remotely supervise and manage various aspects of production. DCS, on the other hand, provides a centralized control system for large-scale industrial processes, ensuring seamless coordination and optimization of operations.

PLCs are programmable devices that automate the control of machinery and processes in manufacturing environments. MES systems facilitate the execution and management of manufacturing operations, including production scheduling, quality management, and resource allocation.

PLM systems are essential for managing the entire lifecycle of a product, from design and development to production and disposal. ERP systems integrate various business processes, including inventory management, procurement, and financials, to streamline operations and enhance decision-making.

HMIs serve as the interface between humans and machines, allowing operators to interact with control systems and monitor processes in real-time. Other control systems encompass a range of specialized technologies and solutions tailored to specific industrial applications.

The adoption of these control systems in the Colombian market is driven by several factors, including the need to improve productivity, ensure product quality, and comply with regulatory requirements. Industries such as manufacturing, oil and gas, utilities, and transportation are among the key sectors leveraging these technologies to optimize their operations.

Furthermore, advancements in automation technologies, such as the Internet of Things (IoT), artificial intelligence (AI), and cloud computing, are reshaping the landscape of factory automation and ICS in Colombia. These technologies enable real-time data analytics, predictive maintenance, and remote monitoring, thereby enhancing efficiency and competitiveness in the industrial sector.

The factory automation and ICS market in Colombia is characterized by a diverse range of technologies and systems aimed at improving productivity, efficiency, and competitiveness in various industries. The adoption of SCADA, DCS, PLC, MES, PLM, ERP, HMI, and other control systems underscores the importance of automation in driving economic growth and development in the country. With continued advancements in technology, the Colombian industrial sector is poised to benefit from further innovation and transformation in the years to come.

By End-user Industry

The Colombia Factory Automation and Industrial Control Systems (ICS) market caters to various industries, each with its unique needs and requirements. These industries include Automotive, Chemical and Petrochemical, Utility, Pharmaceutical, Food and Beverage, Oil and Gas, Electronics, Mining, Water, and other sectors.

In Colombia, the Automotive industry plays a significant role in the economy, driving demand for factory automation and ICS solutions to improve efficiency and productivity in manufacturing processes. Automation technologies help streamline production lines, reduce manual labor, and enhance quality control measures, thereby boosting overall operational effectiveness.

Similarly, the Chemical and Petrochemical sector relies heavily on automation and ICS systems to ensure the safety and efficiency of complex manufacturing processes. These industries deal with hazardous materials and require precise control and monitoring mechanisms to prevent accidents and optimize production output.

The Utility industry, which encompasses electricity, water, and gas utilities, also benefits from factory automation and ICS solutions. These technologies help utilities manage infrastructure more effectively, optimize resource allocation, and enhance service delivery to consumers.

In the Pharmaceutical industry, strict regulatory requirements and quality standards necessitate advanced automation and ICS solutions for manufacturing processes. Automation helps pharmaceutical companies maintain consistency, traceability, and compliance throughout the production cycle, ensuring the safety and efficacy of pharmaceutical products.

The Food and Beverage sector utilizes automation and ICS technologies to improve food safety, increase production efficiency, and meet growing consumer demands. Automated systems enable manufacturers to scale operations, reduce waste, and maintain product quality while adhering to stringent regulatory standards.

The Oil and Gas industry relies on automation and ICS solutions for various applications, including exploration, production, refining, and distribution. Automation technologies enable remote monitoring and control of critical processes, enhancing safety, operational efficiency, and environmental sustainability in the oil and gas sector.

Electronics manufacturing requires precision and speed, making automation essential for meeting market demands and maintaining competitiveness. Factory automation and ICS solutions help electronics manufacturers optimize production lines, minimize defects, and accelerate time-to-market for new products.

Mining operations utilize automation and ICS systems to increase productivity, improve worker safety, and optimize resource utilization. Automated equipment and control systems enable mining companies to operate more efficiently in challenging environments while reducing operational costs and environmental impact.

Water treatment and management facilities rely on automation and ICS technologies to ensure the quality and reliability of water supply systems. Automation solutions enable real time monitoring, control, and optimization of water treatment processes, helping utilities meet regulatory requirements and address growing water scarcity challenges.

Other end-user industries, including textiles, construction materials, and consumer goods manufacturing, also benefit from factory automation and ICS solutions to enhance productivity, quality, and competitiveness in the Colombian market.

The Colombia Factory Automation and ICS market serve a diverse range of industries, each with specific needs and challenges. By leveraging advanced automation technologies, businesses can improve efficiency, safety, and competitiveness in their respective sectors, driving economic growth and development in Colombia.

COMPETITIVE PLAYERS

In the Colombia Factory Automation and ICS market, there are several prominent companies driving competition. Among these players are ABB Ltd, Emerson Electric Co., Endress+Hauser, and Honeywell International. These companies play a significant role in shaping the landscape of factory automation and industrial control systems (ICS) in Colombia.

ABB Ltd is one of the leading companies in the industry, offering a wide range of automation solutions and services. With its innovative technologies and global presence, ABB has established itself as a trusted partner for many businesses in Colombia. The company's expertise in robotics, power, and automation enables it to deliver efficient and reliable solutions to its customers.

Emerson Electric Co. is another key player in the Colombia Factory Automation and ICS market. Known for its advanced automation technologies and engineering expertise, Emerson provides solutions for various industries, including oil and gas, chemicals, and manufacturing. The company's focus on innovation and customer satisfaction has helped it maintain a competitive edge in the market.

Endress+Hauser is a renowned provider of measurement and automation solutions. With its comprehensive portfolio of products and services, Endress+Hauser caters to the diverse needs of industries such as water and wastewater, food and beverage, and pharmaceuticals. The company's commitment to quality and reliability has earned it a strong reputation among customers in Colombia.

Honeywell International is a global conglomerate that offers a wide range of industrial automation and control solutions. Leveraging its extensive experience and technological expertise, Honeywell delivers innovative products and services that enhance efficiency, safety, and productivity in various industries. The company's strong focus on research and development ensures it remains at the forefront of technological advancements in factory automation and ICS.

These competitive players in the Colombia Factory Automation and ICS market are constantly striving to innovate and improve their offerings to meet the evolving needs of customers. By investing in research and development, expanding their product portfolios, and strengthening their customer relationships, these companies are driving growth and shaping the future of the industry in Colombia.

Colombia Factory Automation and ICS Market Key Segments:

By Product

- Field Devices

- Industrial Control Systems (ICS)

By Field Devices Type

- Machine Vision

- Robotics

- Sensors

- VFDs (Variable Frequency Drives)

- LVS (Low Voltage Drives)

- Servo Motors

- AC Motors

- Other Field Devices

By ICS Type

- Supervisory Control and Data Acquisition (SCADA)

- Distributed Control Systems (DCS)

- Programmable Logic Controllers (PLC)

- Manufacturing Execution System (MES)

- Product Lifecycle Management (PLM)

- Enterprise Resource Planning (ERP)

- Human Machine Interface (HMI)

- Other Control Systems

By End-user Industry

- Automotive

- Chemical and Petrochemical

- Utility

- Pharmaceutical

- Food and Beverage

- Oil and Gas

- Electronics

- Mining

- Water

- Other End-user Industries

Key Colombia Factory Automation and ICS Industry Players

- ABB Ltd

- Emerson Electric Co.

- Endress+Hauser

- Honeywell International

- Kuka AG

- Robert Bosch GmbH

- Rockwell Automation

- Schneider Electric

- Siemens AG

- Yokogawa Electric Corporation

- Mitsubishi Electric

- FANUC America Corporation

- Festo SE & Co. KG

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252