MARKET OVERVIEW

The Collection Agency Services Market, sometimes referred to simply as the 'Debt Collection Industry,' is a dynamic ecosystem where organizations, known as collection agencies, are tasked with the responsibility of recovering overdue debts on behalf of creditors. These creditors can range from financial institutions and banks to retail businesses and healthcare providers. The market is not bound by geographical constraints, operating globally to cater to the extensive network of businesses and individuals facing debt-related challenges.

The Global Collection Agency Services Market is influenced by a myriad of factors. One of the pivotal drivers of this market is the global economic environment. Economic fluctuations, such as recessions, can lead to an increase in debt defaults, driving up the demand for collection agency services. Additionally, changes in consumer behavior, financial literacy, and regulatory policies all play a significant role in shaping the dynamics of the market.

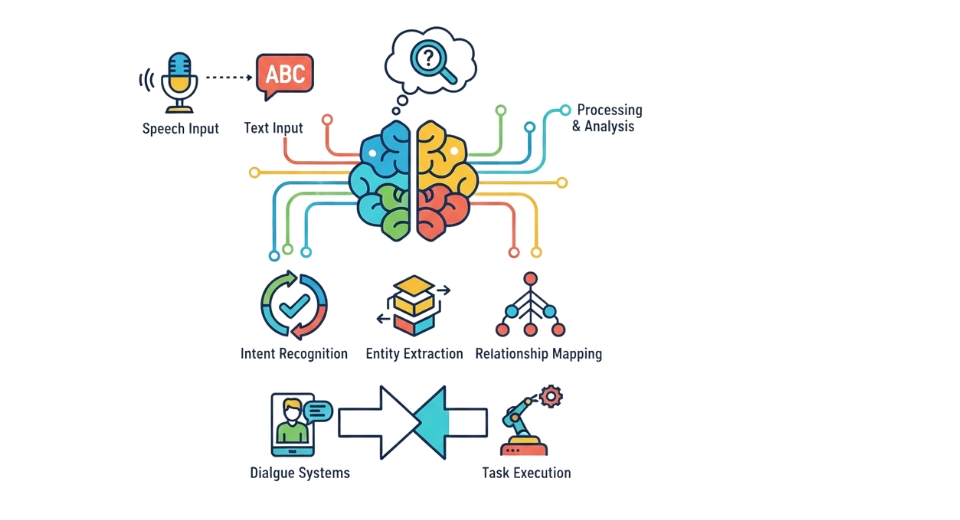

Technology has also become a transformative force within this industry. Automation and data analytics have revolutionized the way collection agencies operate. These technologies have made it possible to identify more efficient debt recovery strategies, improving the overall effectiveness of collection efforts.

The Global Collection Agency Services Market is a complex and ever-evolving segment of the financial industry. It serves as an indispensable bridge between creditors and debtors, helping to restore financial stability for both parties. The dynamics of this market are deeply influenced by economic conditions, technological advancements, and a stringent regulatory landscape. In an interconnected world where financial transactions are essential, the role of collection agencies remains pivotal in maintaining economic stability and financial integrity.

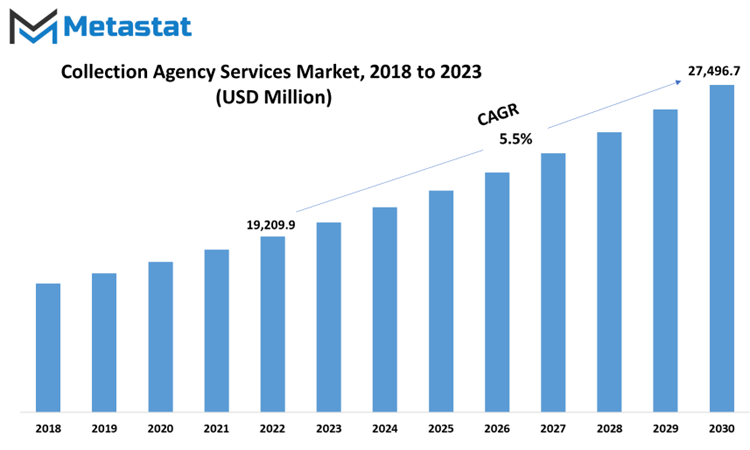

Global Collection Agency Services market is estimated to reach $27,496.7 Million by 2030; growing at a CAGR of 5.5% from 2023 to 2030.

GROWTH FACTORS

The increasing demand for collection services to improve debt recovery rates is driven by the challenges faced by banks and financial institutions globally. These challenges are a result of insufficient staff and resources for tracking loans. As the number of individuals and businesses failing to meet their loan commitments continues to rise, banks are increasingly turning to third-party collection agencies. These agencies are effective in promptly addressing non-payment through various means of communication. This, in turn, enhances loan recovery rates and helps banks maintain balanced monetary transactions. The need for collection agency services is further boosted by the pressure to reduce delinquent loans in the banking sector, resulting in positive market growth prospects.

Another driver is the need for better utilization of time and resources. With the expansion of banking institutions in various parts of the world, including rural and remote areas, and the growing scope of services, the challenge lies in having a dedicated workforce for timely loan collection. Banks are finding it difficult to allocate their resources solely to this task. Collection agencies step in by employing staff trained in debt recovery, allowing banks to focus on other vital aspects of their operations. This leads to increased demand for collection agency services, saving time and resources.

One significant restraint is the presence of stringent federal regulations and high staff costs. Federal regulations closely monitor debt collection agencies to prevent the use of coercive force or unlawful means in their operations, prioritizing the protection of individual rights. These regulations, especially in developed countries, can limit the operational capabilities of collection agencies and hinder service demand. Additionally, the need for a strong workforce and regular training sessions for employees to enhance their communication skills with the public results in higher salaries and staff costs, which can impede collection agency operations and growth.

A promising opportunity lies in the gradual rise of collection agency services in emerging nations. The rapid urbanization and industrialization in developing countries has led to an increase in loan defaults and delinquent debts. The demand for timely debt recovery in a friendly and hassle-free manner has surged, creating new opportunities for collection agency services. As new banks and financial institutes are established in these regions with government support, the demand for collection agencies will rise to prevent early bank dissolution due to bad debts. The cooperative nature of government regulations in emerging countries will foster positive relationships between agencies and banks. Additionally, the establishment of micro and small-scale banks in remote areas will offer collection agencies new possibilities for business growth in developing regions.

MARKET SEGMENTATION

By Type

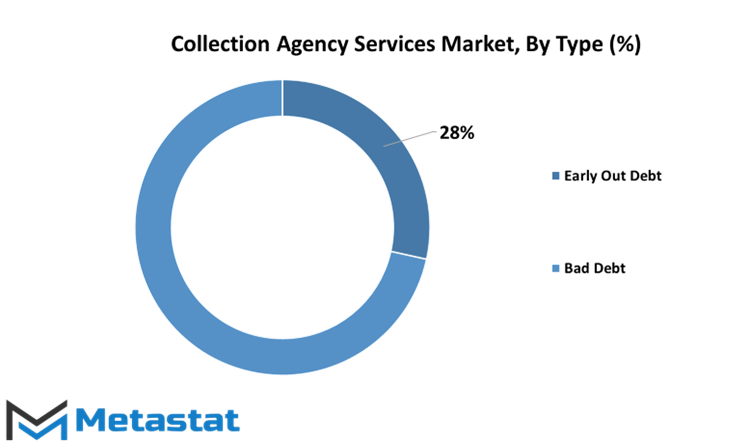

The global Collection Agency Services market encompasses various types, each playing a specific role within the financial ecosystem. Two significant segments within this market are Early Out Debt and Bad Debt. In 2021, Early Out Debt had a value of 4931.5 USD Million, while the Bad Debt segment was valued at 12241.5 USD Million.

Early Out Debt services are a crucial component of the Collection Agency Services market. They come into play at the initial stages of debt recovery. When individuals or businesses start falling behind on their payments, early out debt services step in to remind them of their financial obligations. These services aim to prevent debts from escalating into bad debt by acting as a gentle reminder to borrowers.

On the other hand, Bad Debt services are more advanced and are activated when debts have reached a critical stage. Bad debt signifies that efforts to recover the owed funds have been unsuccessful, and the debt is considered unlikely to be repaid. This segment involves more intensive collection efforts, which may include legal actions, negotiations, or debt settlements.

The difference in the value of these segments, with Bad Debt having a considerably higher value than Early Out Debt, reflects the substantial sums involved in dealing with debts that have become extremely challenging to recover. It also indicates the scale of the issue of unpaid debts in the global financial landscape.

These values are not only a testament to the significance of Collection Agency Services in managing financial risk but also a reflection of the intricate dynamics between borrowers, lenders, and collection agencies. The effectiveness of these services can significantly impact the financial stability of individuals, businesses, and the broader economy. It highlights the critical role collection agencies play in helping to recover funds that might otherwise be lost, ultimately contributing to a healthier financial ecosystem.

By Application

The global Collection Agency Services market encompasses a wide array of applications. These applications are essential components of the market, each contributing significantly to its overall value. The market, in this regard, is multifaceted, catering to diverse sectors.

The Healthcare segment is a substantial part of the market. In 2021, it held a valuation of 6478.2 USD Million. This segment deals with the crucial task of managing and recovering debts within the healthcare industry, which can often be intricate due to the complexities of medical billing and insurance claims.

Another integral application is Student Loans. In the same year, this segment accounted for a value of 4430.3 USD Million. It focuses on the retrieval of overdue student loans, a task of importance given the rising costs of education and the financial implications for both students and institutions.

The Financial Services segment, with a 2021 valuation of 2265.7 USD Million, plays a pivotal role in recovering debts related to financial transactions. Given the intricacies of the financial world, this sector's contribution to the collection agency services market is significant.

Government institutions also rely on collection agency services. The Government segment, valued at 1598.3 USD Million in 2021, handles the retrieval of debts owed to governmental entities, which can range from taxes to fines and fees.

Furthermore, the Retail segment is a notable component, contributing a value of 588 USD Million in 2021. Retail businesses often encounter challenges in debt collection from customers, and this segment addresses those challenges.

The Telecom and Utility segment, valued at 997.6 USD Million in 2021, deals with the retrieval of unpaid bills and debts from customers in the telecommunications and utility sectors. It's a vital part of ensuring the financial stability of these service providers.

Furthermore, the Mortgage and Others segment, valued at 814.8 USD Million in 2021, covers a wide array of miscellaneous debt collection services, including mortgage arrears and other forms of financial recovery

In essence, the global Collection Agency Services market is a dynamic landscape with various applications, each serving a unique purpose in the recovery of debts across different sectors. These applications collectively drive the market's value, highlighting the significant role collection agency services play in maintaining the financial health of diverse industries.

REGIONAL ANALYSIS

The global Collection Agency Services market is divided into various geographical segments, each with its unique characteristics and market dynamics. Understanding these segments is crucial for comprehending the global landscape of Collection Agency Services.

One of the key geographical segments is North America. In 2017, the North America Collection Agency Services market was estimated to be valued at 8548.3 USD Million. This significant valuation reflects the demand and utilization of Collection Agency Services in this region. North America, comprising countries such as the United States and Canada, is known for its robust financial and commercial sectors. This economic activity generates a need for Collection Agency Services to manage and recover debts effectively.

Another notable geographical segment is Europe. In 2017, the Europe Collection Agency Services market was estimated to be valued at 4844.1 USD Million. Europe, with its diverse economies and financial systems, presents its unique challenges and opportunities for Collection Agency Services. This market valuation indicates the substantial demand for debt collection and recovery services in European countries.

The differences in market valuations between North America and Europe can be attributed to variations in economic activities, debt management practices, and regulatory frameworks. While North America has a larger market size, Europe also represents a significant market for Collection Agency Services.

COMPETITIVE PLAYERS

The global Collection Agency Services market is a diverse landscape, where various entities operate to facilitate the recovery of outstanding debts. Key players in this industry are Encore Capital Group, Inc., and PRA Group, Inc. These companies play pivotal roles in the world of debt collection.

The Collection Agency Services market is an essential component of the financial sector. It operates as an intermediary between creditors and debtors, working to recover delinquent debts. Debt collection is a complex process that demands expertise and adherence to regulations. Key players like Encore Capital Group, Inc., and PRA Group, Inc., are well-versed in these dynamics.

Encore Capital Group, Inc., is a prominent entity in the Collection Agency Services market. They specialize in debt purchasing and recovery, acquiring delinquent consumer debts and aiming to resolve them efficiently. Their operations are driven by data and analytics, enabling them to make informed decisions and enhance debt recovery rates.

PRA Group, Inc., is another significant player in the industry. They are recognized for their global footprint and expertise in acquiring and managing non-performing loans. PRA Group, Inc., employs advanced technology and a skilled workforce to pursue debt recovery, serving the interests of both creditors and debtors.

These key players understand that effective debt collection goes beyond mere financial transactions. It involves compliance with legal frameworks, respect for consumer rights, and the use of ethical practices. In the ever-evolving financial landscape, Encore Capital Group, Inc., and PRA Group, Inc., adapt their strategies to ensure efficient debt recovery while upholding the highest ethical standards. Their operations help maintain the balance between creditors' interests and debtors' rights, ensuring a fair and equitable process.

Collection Agency Services Market Key Segments:

By Types

- Early Out Debt

- Bad Debt

By Applications

- Healthcare

- Student Loans

- Financial Services

- Government

- Retail

- Telecom and Utility

- Mortgage and Others

Key Global Collection Agency Services Industry Players

- Encore Capital Group, Inc.

- PRA Group, Inc.

- Intrum AB

- Cerved Group S.p.A.

- EOS Holding GmbH

- Hoist Finance AB

- B2Holding ASA

- Arrow Global Limited

- Lowell

- KRUK S.A.

- iQera

- TCM Group International ehf.

- Axactor ASA

- Transworld Systems Inc.

- GC Services

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252