Global Cocoa Beans Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global cocoa beans market and industry will keep pushing past traditional limits, remolding itself into more than mere exchange of farm products. This marketplace can be appeared as a cultural and monetary strength inside the future, no longer just affecting the meals enterprise but additionally sectors which includes health, life-style, and sustainability. Cocoa beans, hitherto taken into consideration just a raw material for making chocolate, can even gather a much wider identification in phrases of demand for products that reply to ethical sourcing, environmentalism, and wellness traits.

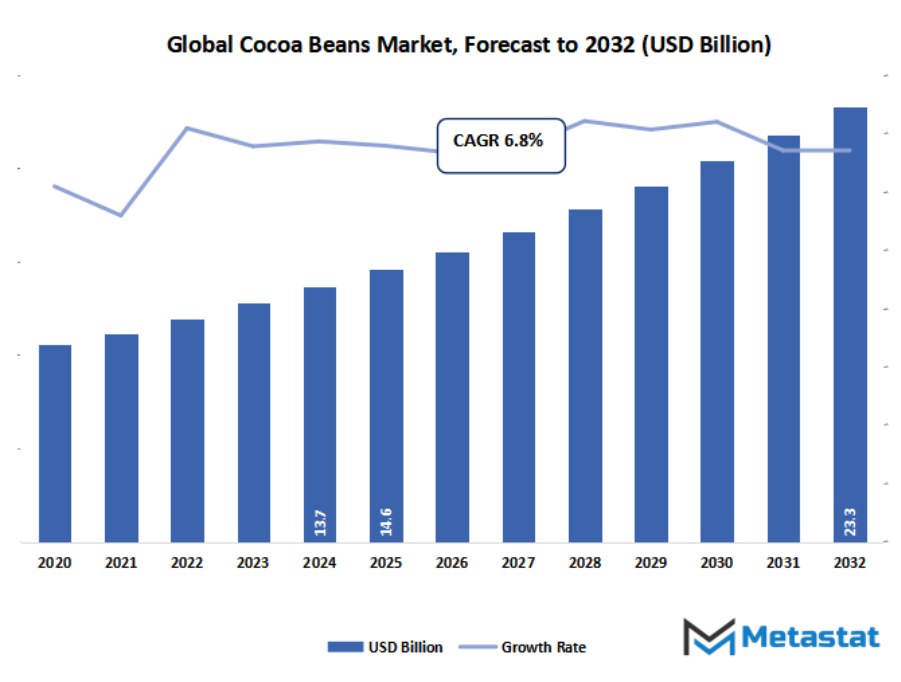

- Global cocoa beans market valued at approximately USD 14.6 billion in 2025, growing at a CAGR of around 6.8% through 2032, with potential to exceed USD 23.3 billion.

- Roasted Cocoa Bean account for nearly 85.1% market revenues, driving innovation and expanding applications through intense research.

- Key trends driving growth: Consistently high global demand for chocolate and cocoa-based products., Growing consumer interest in premium, single-origin, and dark chocolate.

- Opportunities include Expansion into value-added products (e.g., specialty cocoa, cocoa-based cosmetics).

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

How will transferring client alternatives closer to top class and ethically sourced chocolate reshape the call for cocoa beans within the coming years? Can technological improvements in sustainable farming practices conquer the uncertainties posed by way of weather change and supply chain disruptions? To what extent will rising markets and alternative applications of cocoa power clean possibilities past conventional confectionery demand?

With technological progress, the global cocoa beans market will more and more undertake digital traceability systems, where each bean's adventure from the farm to the shop shelf is traced. This will redefine consumer confidence so that individuals will be able to make decisions that will engage them closer to producers. Farmers will also have opportunities in this change, since direct trade systems and equitable partnerships will provide them with more exposure and stability. Beyond indulgence and taste, the business will be attached to stories of responsibility and global cooperation.

Over the next few years, cocoa beans will have newer uses other than chocolate. Nutraceuticals, cosmetic use, and even craft drinks will turn their attention to the natural properties of cocoa, broadening this market into new and unexpected areas. This increase will carry diversity to the industry and encourage innovation for numerous agencies of clients.

Market Segmentation Analysis

The global cocoa beans market is mainly classified based on Product Type, Bean Type, Nature, Application.

By Product Type is further segmented into:

- Roasted Cocoa Bean - The roasted cocoa bean category in the global cocoa beans market will benefit destiny interest as new roasting technologies will improve taste fine and consistency. Increased purchasers call for complete-bodied-flavoured chocolate and cocoa-primarily based drinks will assure regular desire for this product segment in international markets, especially in premium merchandise.

- Unroasted Cocoa Bean - Unroasted cocoa beans in the global cocoa beans market will offer opportunities for uncooked and natural product classes. Increasing recognition of minimally processed meals will heighten dependence on unroasted varieties. This fashion will benefit especially health-orientated customers seeking out dietary content material, antioxidants, and true taste profiles without delivered processing.

By Bean Type the market is divided into:

- Forastero - The Forastero bean range within the global cocoa beans market will hold dominating owing to its giant cultivation, hardiness, and suitability. Large-scale producers will preserve favouring Forastero beans for bulk manufacturing of candies and drinks, with the intention to make it a constant contributor to global manufacturing and underpin strong pricing styles.

- Trinitario - Trinitario beans will make their mark inside the global cocoa beans market as uniqueness and wonderful cocoa call for will increase. As a hybrid, it has both sturdiness and sophisticated flavour, making it an ability alternative for high-stop chocolate producers looking to attain customers who value flavour and authenticity in the future.

- Criollo - Criollo beans will remain the different and extraordinarily sought-after category in the global cocoa beans market. With subtle taste and confined deliver Criollo will ongoingly entice high-priced confectionery a Criollo will ongoingly attract luxury confectionery and uniqueness markets. Future development will hinge on conservation efforts and cautious cultivation to serve one-of-a-kind consumer tastes around the globe.

By Nature the market is further divided into:

- Conventional - The traditional segment of the global cocoa beans market will remain in dominance attributable to its affordability and common availability. Traditional farming practices and coffee costs will preserve to aid this section. Though organic demand could growth, conventional beans can be essential to pleasurable the mass needs of world cocoa manufacturing.

- Organic - Organic cocoa beans will develop regularly in the global cocoa beans market as easy-label merchandise upward thrust to prominence. Growing awareness concerning sustainable agriculture and client demand for chemical-unfastened alternatives will force demand. Certification and traceability will create added fee, driving adoption in food production and ethical sourcing applications in the future.

By Application the global cocoa beans market is divided as:

- Food & Beverages - Food and drinks will account for the biggest segment of the global cocoa beans market, boosted by increasing chocolate, bakery, and beverage intake globally. Cocoa-infused health snacks, functional beverages, and artisanal chocolate are future innovation trends that will build new opportunities for cocoa application beyond conventional products.

- Pharmaceutical - Pharmaceutical uses of the market will increase due to the bioactive ingredients of cocoa. Antioxidant-containing formulations might be extra generally applied in dietary supplements and healing merchandise geared toward cardiovascular and mind fitness. Increasing medical substantiation will underlie destiny adoption of cocoa extracts for pharmaceutical studies and drug product improvement.

- Cosmetics & Personal Care - The personal care and cosmetics phase of the market will develop as cocoa butter remains a crucial factor for hair care, lotions, and moisturizers. Natural skincare merchandise will continue to call for steady usage with developing consumer cognizance. Antioxidant advantages for anti-getting old and properly-being will dominate future innovations.

- Dietary Supplements - The dietary supplements will witness growth as cocoa is used for boosting strength, metabolism, and immunity. Capsules, powders, and nutraceutical blends will growth in call for. The trend in the direction of natural wellness answers will further raise the recognition of cocoa in supplement formulations amongst global health-aware populations.

- Sports Nutrition - Sports nutrients inside the market will develop as cocoa is liked for its power-boosting and restoration residences. Flavanol-rich products will be incorporated into protein powders, energy bars, and liquids. Demand for overall performance-based functional meals will further consolidate cocoa's position in aiding athletes and energetic clients globally.

- Others - Other makes use of the global cocoa beans market will be novel packages in biotechnology, crafts, and creative meals merchandise. Further research on cocoa's chemistry will power new product lessons.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$14.6 Billion |

|

Market Size by 2032 |

$23.3 Billion |

|

Growth Rate from 2025 to 2032 |

6.9% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

Geographic Dynamics

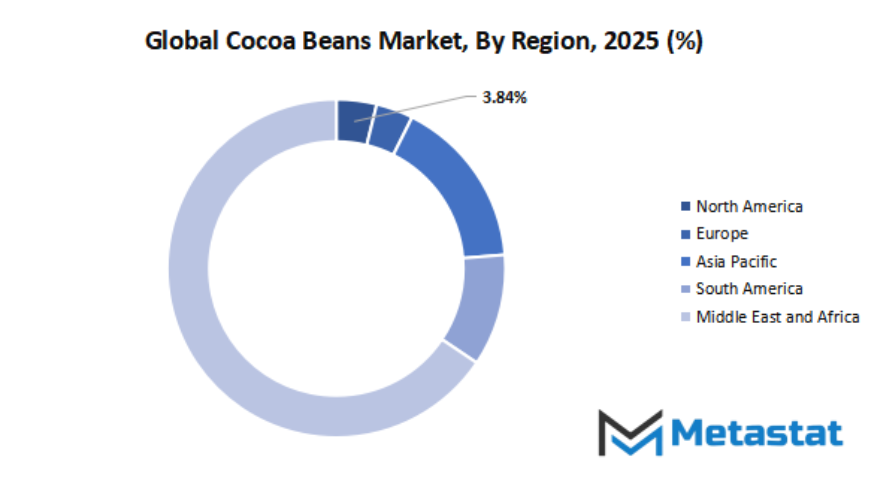

Based on geography, the global cocoa beans market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

Competitive Landscape & Strategic Insights

The global cocoa beans market has been significant in the past as the underpinning of the chocolate industry and as a large Agri cornerstone commodity that holds sway on trade across continents. Cocoa beans are cultivated primarily in tropical areas, with West Africa being in dominance of production after which processed and furnished to deal with the ever-developing demand of confectionery, beverage, and beauty industries globally. With changing client tastes toward extraordinary chocolate and sustainable sourcing, the call for a consistent and trustworthy cocoa supply has become even greater urgent. It isn't simply a question of uncooked beans however of the price chain it produces, from farmers and cooperatives to processors and worldwide suppliers.

The area is an amalgamation of both worldwide enterprise titans and growing regional challengers. Big boys which include Barry Callebaut AG, Cargill, Incorporated, Olam International Limited, and Archer Daniels Midland Company manipulate worldwide change and processing, leveraging their length and resources to guide robust distribution channels. In addition to those massive boys are companies like ECOM Agroindustrial Corp. Limited, SUCDEN, and Fuji Oil Holdings Inc., which also play an essential function by way of targeting niche processing and local deliver. These players will continue to be instrumental in figuring out how cocoa beans are sourced, processed, and shipped to producers that rely upon strong great.

Regional players also enjoy growing prominence in the market. Guan Chong Berhad, Cemoi SAS, and COFCO International Limited, for instance, are consolidating their presence by catering to regional needs while opening up their global footprint. Their tactics may involve getting closer to farmers on the ground, implementing traceability schemes, and encouraging sustainable agricultural methods. This blending of global and nearby strategies serves to stability a marketplace in which demand is high however problems including supply volatility and environmental problems must be managed.

How efficiently companies meet sustainability challenges and evolving consumer expectancies will determine the destiny of the market. With greater attention regarding ethical sourcing, infant exertions worries, and environmental degradation, global leaders and smaller domestic businesses alike might be required to put money into obvious supply chains and farmer guide schemes. Concurrently, growing call for chocolate in emerging economies will provide new opportunities for increase. As each long-mounted leaders and up-and-coming entrants hold to shape this area, the global cocoa beans market will evolve with innovation, responsibility, and the not unusual aim of making cocoa a dominant thing of world change and intake.

Market Risks & Opportunities

Restraints & Challenges:

Price volatility due to climate change, crop diseases, and geopolitical instability in growing regions. - The market will remain uncertain with unforeseen weather conditions, increased crop infections, and political upsets in producing nations resulting in unstable supply. This uncertainty can have an immediate effect on pricing dynamics, rendering forecasting for gamers intricate and hard lengthy-term making plans for organizations counting on cocoa.

Increasing scrutiny and regulations on ethical and sustainable sourcing practices. - The market may be prompted by means of extra stringent regulations on honest trade, toddler exertions issues, and environmentally pleasant agriculture. As issue for moral sourcing keeps making bigger, producers will realign supply chains to global standards as a way to enhance the cost of doing business however also reestablish enterprise credibility and accept as true with.

Opportunities:

Expansion into value-added products (e.g., specialty cocoa, cocoa-based cosmetics). - The market will unlock new avenues of increase through innovation in specialty. From superior cocoa lines designed for top-of-the-range chocolate to extracts applied in cosmetics and nutraceuticals, diversification will offer possibilities beyond conventional intake. Such increase will decorate resilience and offer new sales streams for manufacturers and investors.

Forecast & Future Outlook

- Short-Term (1–2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3–5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6–10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 14.6 Billion in 2025 to over USD 23.3 Billion by 2032. Cocoa Beans will maintain dominance but face growing competition from emerging formats.

In the cease, the global cocoa beans market might be acknowledged not merely for what it produces however additionally for what it means stories of tradition, creativity, and persistence. Its power will expand far past traditional consumption, shaping conversations about the ways agriculture, change, and sustainability meet on the worldwide stage.

Report Coverage

This research report categorizes the global cocoa beans market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global cocoa beans market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global cocoa beans market.

By Product Type:

- Roasted Cocoa Bean

- Unroasted Cocoa Bean

By Bean Type:

- Forastero

- Trinitario

- Criollo

By Nature:

- Conventional

- Organic

By Application:

- Food & Beverages

- Pharmaceuticals

- Cosmetics & Personal Care

- Dietary Supplements

- Sports Nutrition

- Others

Key Global Cocoa Beans Industry Players:

- Barry Callebaut AG

- Cargill

- Incorporated

- Olam International Limited

- Archer Daniels Midland Company

- ECOM Agroindustrial Corp. Limited

- SUCDEN

- Fuji Oil Holdings Inc.

- Guan Chong Berhad

- Cemoi SAS

- COFCO International Limited

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252