MARKET OVERVIEW

The global milk protein market is a niche and expanding category in the food, health, and nutrition industry that is drawing attention with its potential to meet multiple needs at once. Milk proteins are not just things we eat; they are also structural and functional parts that will affect how people think about dairy and new dairy products in the future. The market goes beyond regular milk and cheese products to include specialty areas like sports nutrition, infant nutrition, medical nutrition, and even high-protein snacks and drinks. As more scientific information continues to reveal the distinctive characteristics of casein and whey, the business world will welcome it with specially designed products to cover specific requirements, making milk protein a leading figure in food development and nutrient science.

Milk proteins will not only be found in foods but also in drug formulations, nutraceutical products, and even possibly in new markets such as bio-based packaging and cosmetics. This ability to fulfill multiple functions will make the market a central bridging agent between agriculture, health, and technological innovation. The flexibility of milk proteins makes them applicable to texture improvement, nutritional enrichment, and functional efficacy in product development, presenting opportunities for innovative possibilities to be delved into in the years to come.

Cultural diversity will also be the determining factor for the growth of the market. In Western countries, milk protein will come back in fortified drinks, protein shakes, and snacks for convenience and better performance. In the Asia-Pacific market, where dairy consumption trends are still developing, it will mostly be used in infant formula, medical food, and cheap protein fortification that meets both old and new dietary needs. Areas like Latin America and Africa will witness milk protein playing a role in filling nutritional gaps, providing access to high-quality protein ingredients in forms appropriate to local taste and affordability orientation. This worldwide penetration guarantees that milk protein will continue to be of interest across a broad range of markets and populations.

In addition to its present domain, the future of the global milk protein market will encompass innovation that meets performance, taste, and sustainability. Research will continue to optimize the extraction and purification process so that producers can get maximum protein yield with minimum waste and environmental concerns. In doing so, milk proteins will not only remain a trusted nutritional option but also an ethical one. As consumer attitudes change, the industry will focus on transparency, traceability, and ethics in sourcing, creating an additional layer of value for milk protein as an ingredient.

In summary, the global milk protein market is much more than a one-commodity transaction. It is an integrated arena in which nutrition, science, culture, and technology will meet to produce significant products for consumers all over the globe. By continuing to change and evolve, the market will be able to maintain its utility and set itself as a vital component of the international food and health system for years to come.

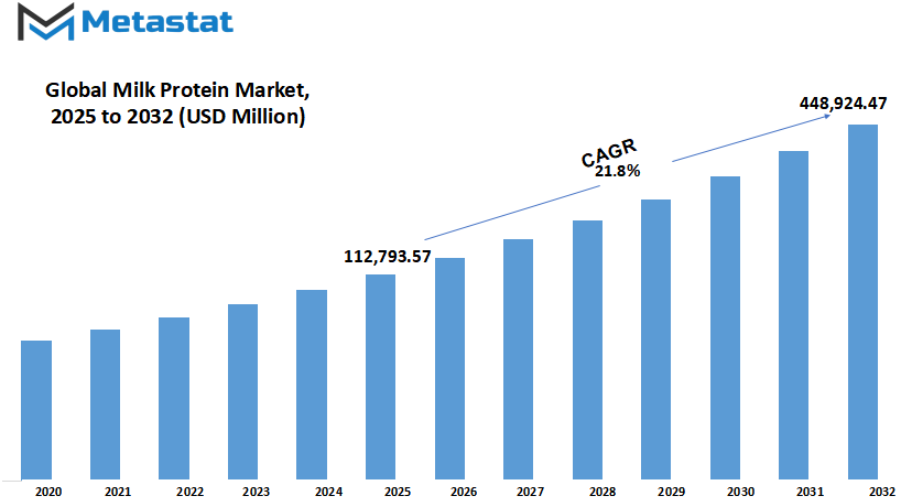

Global milk protein market is estimated to reach $448,924.47 Million by 2032; growing at a CAGR of 21.8% from 2025 to 2032.

GROWTH FACTORS

The global milk protein market will become more and more important. Milk proteins will continue to be a good source of nutrition because more people are looking for functional foods and balanced diets. Greater understanding of the value of protein consumption, not merely for sportspeople but also for general health, will drive the direction that this market is taking. Foods that are easy to incorporate into their diets, like protein powders, snack foods, or drinks with extra vitamins and minerals, will be sought after by consumers. The best way to add protein to foods and drinks will continue to be through milk proteins because of this trend. Therefore, companies producing foods and beverages will create products that taste great and are great for you.

Sports nutrition will continue to be a segment where milk proteins will continue to reign supreme. With fitness culture continuing to spread among youths and more diverse populations, the demand for products supporting recovery, muscle gain, and endurance will increase. Whey and casein, as functional products, will feature novel forms that accommodate vegan or hybrid users using plant-dairy combinations. This innovation will add a new aspect to the market, appealing to those who want more sustainable or lactose-neutral options without sacrificing performance. Medical nutrition will also be a key area of focus, where milk proteins will be used to assist patients with nutritional requirements, ranging from recovery diets to elderly nutrition.

The global milk protein market will have some challenges along the way as it expands. The reasoning behind price swings for milk will have consequences that go beyond changes in the price of raw materials, creating uncertainty for producers and price swings for consumers. Additionally, the market for plain milk proteins will not expand as quickly in some regions as it could be due to lactose intolerance and milk allergies. To reach more people, the market will make lactose-free and hypoallergenic versions.

In the upcoming years, new opportunities in functional foods and in plant-dairy hybrid foods will provide creativity. Sustainability, traceability, and cleaner production will be in the cards for brands, in response to the increasing consumer demand for ethically sourced food. This will keep milk proteins fresh, flexible, and in demand in the competitive food market. In the next few years, the global milk protein market will not just keep being around but expand in new directions to become a key part of the global health and wellness revolution.

MARKET SEGMENTATION

By Product

The global milk protein market will keep on expanding as milk protein concentrates, isolates, and hydrolyzed forms become inevitable in various industries. Concentrates will continue to be a preferred option because of their well-balanced nutrition, cost-effectiveness, and many manufacturers will be able to depend on a staple ingredient to improve protein in dairy beverages and products, snacks, and baked goods. Isolates will have value because they have very high protein with low fat and lactose, making they appropriate for meal replacements and sports nutrition powders, or medical diet and health-oriented products. Hydrolyzed milk proteins, already pre-digested as they are, are even more acceptable in medications and applications when very gentle digestion is important for infant formula or medical nutrition. These three product forms collectively will provide a series of solutions that address consumer needs for performance, quality, and flavor, and will enable innovation in food and health areas.

By Form

Segmented by form, the global milk protein market includes powder and liquid. Powdered milk proteins will lead the market due to their longer shelf life, convenience in storage, and flexibility in blending with dry mixes and processed foods. This type will continue to be the choice of preference for sports powders, baked goods, and meal replacements. Liquid milk proteins, although not as popular, will have significant usage in ready-to-drink liquid beverages and uses requiring instant processing. They will find use in fresh formulation where the natural traits of milk must be maintained.

Over the next few years, powdered milk proteins will gain enhanced solubility and improved flavor profiles and will be more convenient to use for manufacturers and more desirable to consumers. Liquid milk proteins will increasingly make their presence felt, particularly as cold-chain networks improve, which will simplify launching high-protein beverages and specialist nutritional drinks requiring fresh formats.

By Application

The application of milk proteins will be in dairy products, bakeries and confectionery, functional foods, beverages, infant formula, dietary supplements, animal nutrition/feed, and other uses. Dairy has historically and will continue to use milk proteins in cheese, yogurt, and fortified milk products; bakery and confectionery have historically used milk proteins for texture and nutrition. Functional foods, beverages, infant formulas, and dietary supplements will depend more upon milk proteins' nutrition or quality nutrition in a form that can be easily consumed. Infant formula and animal feed will utilize milk proteins to obtain maximum growth and health benefits. Potentially making it again commonplace and demonstrably useful to consumers or the entire population across the globe in the future, thus suggesting how common and widespread they shall become as the future of global nutrition.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$112,793.57 million |

|

Market Size by 2032 |

$448,924.47 Million |

|

Growth Rate from 2025 to 2032 |

21.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

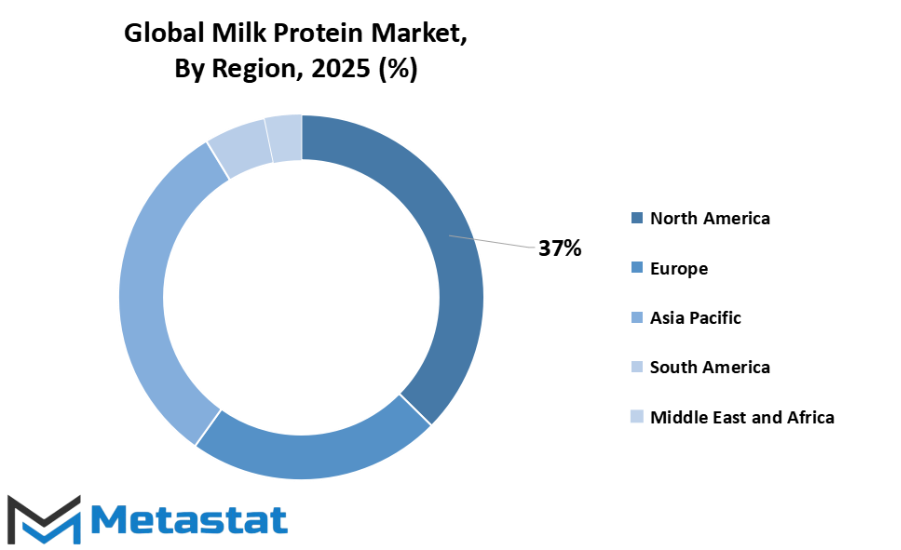

REGIONAL ANALYSIS

The global milk protein market will be geographically dispersed widely, with different regions contributing differently depending on consumption habits, food habits, and industrial development. In North America, the U.S., Canada, and Mexico, milk protein will remain in demand for sports nutrition, fortified drinks, and functional foods. The U.S. will be the driver with innovation in high-protein snacks, clinical nutrition, and ready-to-drink shakes, with Canada and Mexico contributing through increasing health awareness and embracement of protein-enriched food. The region will continue to be a product innovation and cutting-edge processing technology hub.

Europe encompassing the UK, Germany, France, Italy, and Rest of Europe will continue to be a dominant player in the Global Milk Proteins market due to its consolidated dairy culture and increasing penchant for healthy foods. Germany and France will be at the forefront of scientific research and development and introducing high-tech protein formats into the market. The UK and Italy will drive demand via functional beverages, bakery, and sports nutrition categories, whereas the Rest of Europe will experience increasing consumption of milk protein within dietary supplements and convenience foods.

Asia-Pacific, which includes India, China, Japan, South Korea, and the Rest of Asia-Pacific, is likely to be one of the most vibrant performers in the future. Rising disposable incomes, increased awareness of the benefits of protein, and rapid urbanization have added more significance to protein as consumers increasingly search for quality sources of it. Infant formula and functional beverages will lead in China, while Japan and South Korea will emphasize innovation in sports nutrition and offer clinical products. India will develop high interest in protein powders, fortified milk, and bakery items as dietary patterns transition towards more protein consumption. South America, dominated by Brazil and Argentina, will take up milk protein for sports nutrition and mass-market dairy fortification and the Rest of South America will increasingly use it in value health and wellness products. Middle East & Africa, comprising GCC Countries, Egypt, South Africa, and the Rest of the region, will be dependent on milk protein for nutrition solutions as well as innovative premium dairy for health-conscious consumers and expanding food processing businesses.

COMPETITIVE PLAYERS

The global milk protein market will be further influenced by major companies that provide innovation, research, and capacity for large-scale production. Luxlait and Sachsenmilch Leppersdorf GmbH will become stronger through stable supply and an emphasis on quality, acting as consistent contributors to the growth of the industry. Arla Foods Ingredients Group and FrieslandCampina Ingredients will spearhead state-of-the-art product development and robust international distribution networks, making milk proteins accessible in both developed and emerging economies. Lactalis Ingredients and Ingredia Dairy Experts will further maximize the extent of offerings, especially in areas where demand for unique formulations is expanding.

Armor Proteines, MILEI GmbH, and Glanbia plc will be key players, with skills in whey and casein processing and providing solutions specifically to functional foods, beverages, and sports nutrition. Valio Oy and Eurial Ingredients & Nutrition will center on innovation in clean-label and quality protein solutions and trend tracking with consumers wanting natural and traceable products. Kerry Group plc and Saputo, Inc will be contributors by incorporating milk protein into more food applications for broader access in different categories like bakery, snacks, and beverages.

Actus Nutrition, Idaho Milk Products, and Vitalis Nutrition are also significant contributors who will benefit niche markets and provide flexibility to product tailoring. Fonterra Co-Operative Group Limited and Groupe Lactalis, being prominent international dairy companies, will remain at the core of ensuring massive production, fulfilling international demand, and competitive pricing. In combination with these players, innovation, sustainability initiatives, and the future of the global milk protein market will be driven by investments in technology and adapting to evolving consumers on a global scale.

Milk Protein Market Key Segments:

By Product

- Concentrates

- Isolates

- Hydrolyzed

By Form

- Powder

- Liquid

By Application

- Dairy Products

- Bakery & Confectionery

- Functional Foods

- Beverages

- Infant Formula

- Dietary Supplements

- Animal Feed

- Others

Key Global Milk Protein Industry Players

- Luxlait

- Sachsenmilch Leppersdorf GmbH

- Arla Foods Ingredients Group

- FrieslandCampina Ingredients

- Lactalis Ingredients

- Ingredia Dairy Experts

- Armor Proteines

- MILEI GmbH

- Glanbia plc

- Valio Oy

- Eurial Ingredients & Nutrition

- Kerry Group plc

- Saputo, Inc

- Actus Nutrition

- Idaho Milk Products

- Vitalis Nutrition

- Fonterra Co-Operative Group Limited

- Groupe Lactalis

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252