MARKET OVERVIEW

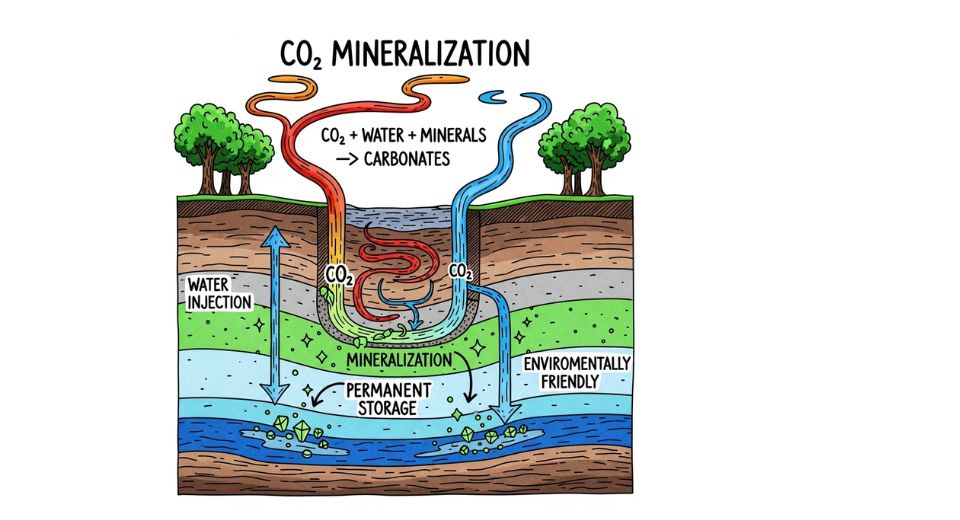

The global CO₂ mineralization market will redefine industry management of carbon dioxide by converting emissions into permanent solids such as carbonates. In business, firms will spend money on technology that captures carbon dioxide and chemically reacts with minerals to form permanent, harmless substances. The method will use natural chemistry and factory by-products to trap CO₂ in a manner that remains secure for centuries.

In future years, scientists will investigate new feedstocks beyond conventional basalt, such as industrial waste slags or streams from steel and cement factories. Such materials will provide rich supplies of calcium or magnesium that can combine with CO₂ under low-pressure conditions. Engineers will develop reactors in which gas, water, and pulverized minerals will react to create solid carbonates that can be sequestered or even utilized as building materials. Pilot plants will show how waste that has been treated will acquire new value instead of loading up landfills.

Firms will collaborate with governments and universities to pilot new methods that accelerate the mineralization reactions at lower temperatures or pressures, minimizing energy inputs.

Groups will transition lab wins to demonstration plants, where actual streams of gas in operation like flue gas at power plants will supply the mineralization units. There, operators will experiment with continuous operation and observe how quickly CO₂ will react and what by-products will be produced. That data will flow into improvement loops, resulting in more effective designs in the future. Investment will go toward bringing mineralization systems into existing factory complexes.

This will make local waste management more robust and minimize transport requirements. Building companies may then utilize the solid carbonates as fillers or substitute aggregates, establishing a closed cycle wherein emissions become building materials. In a similar manner, mine workings will yield mine tailings that will acquire added value once treated with CO₂ and turned into stable solids. Such treated tailings will then be reused on-site or close to it, minimizing net environmental impact. As regulation and policy mature, rewards in the form of tax credits or carbon pricing schemes will encourage those operations that sequester CO₂ permanently. This will drive more innovation in the paths of mineralization, like electro-enhanced or biologically assisted reactions that will speed up CO₂ capture. Early movers will demonstrate the value that mineralization provides through the creation of saleable or recyclable solids instead of merely disposing of gas.

Public support will ensue as communities observe solid benefits: emissions that previously wafted into the air will now be hard stones helpful for roads, foundations, or filling up mines. School curricula and public education will describe how this process will allow communities to reduce waste while capturing carbon. In time, the industry will develop purification processes so that the solids will be of quality to be utilized for construction or for land reclamation.

Transparency in reporting will engender trust in the permanence and safety of such mineralized products. By combining environmental stewardship with pragmatic reuse, the industry of worldwide co₂ mineralization market will revolutionize emission management. What started as a treatment process will break out into a service capturing CO₂ and providing enduring materials. Ultimately, this industry will prove that carbon can be transformed into something solid, useful, and enduring while releasing atmospheric pressure.

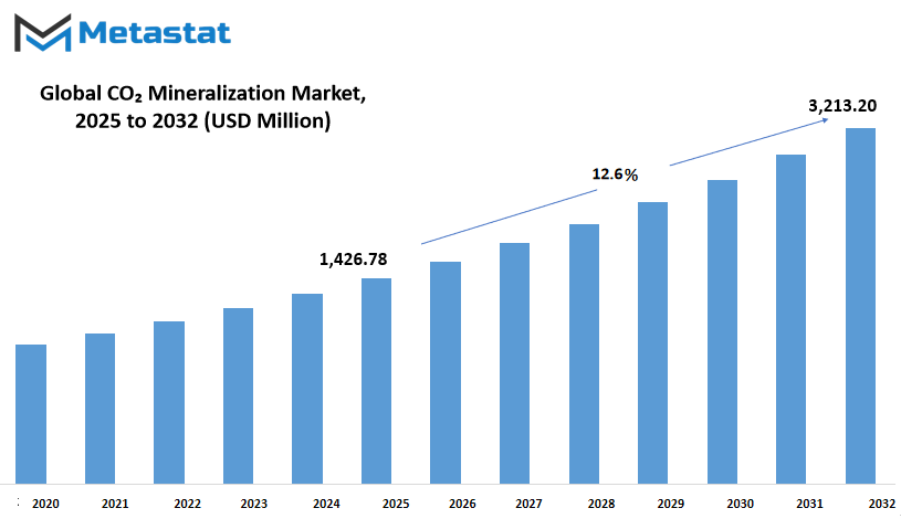

Global CO₂ mineralization market is estimated to reach $3,213.20 Million by 2032; growing at a CAGR of 12.6% from 2025 to 2032.

GROWTH FACTORS

The global CO₂ mineralization market will be influenced by a number of forces that drive adoption forward. Growing concern over climate change will drive demand for technologies that remove carbon dioxide from the air. Greater pressure from governments to achieve net-zero goals will result in policies in favor of adoption of mineralization techniques. From the supply side, improvements in material science and process technology will reduce costs, enabling operations to be more efficient and affordable. Easier availability of inexpensive raw materials and catalysts will enable small pilot operations to be scaled up to large operations. Increased industry research collaboration will enhance innovation and reduce the journey from laboratory to plant. Strong demand by heavy industries to eliminate carbon permanently will provide a stable customer pool. These factors combined will bring higher confidence into the market and induce public and private investors to fund it.

Yet, challenges to the global CO₂ mineralization market will be there to slow things down. Significant capital investments for large facilities will serve as an entry hurdle for smaller companies. Limited storage and handling infrastructure for mineralized carbon will create early roll-out logistical bottlenecks, particularly in off-grid locations. Uncertainty regarding permitting and long-term site liability of mineralization will delay projects and increase perceived risk. There will be no comparison basis for standardized measurement of the verification of the quantity of CO₂ secured as a result of this, which will make comparison more difficult and win less credit market trust. Fears of oxygen depletion in the region's environment or unforeseen chemical side reactions will fuel public apprehension in certain areas.

On the positive side, the global CO₂ mineralization market shall experience promising opportunities in the forthcoming years. Growth into emerging economies with high-emitting and big industrial bases will create demand for regional carbon capture. Partnerships with construction sector participants will provide channels for mineralized carbon products as construction materials, converting captured CO₂ into value-added feedstock. Modular mineralization unit development, deployable on industrial sites, will reduce transport costs and enhance responsiveness. Carbon-taking role as a service model will unlock recurring revenue streams and engage corporate carbon offset program buyers. Tie-up with renewable energy sources will facilitate carbon removal to operate on clean power, enhancing sustainability and lowering operational emissions. All these prospects will facilitate the scaling of the global CO₂ mineralization market and ensure that technologies will increase steadily, providing greater impact to climate mitigation efforts.

MARKET SEGMENTATION

By Technology

The global CO₂ mineralization market invites a glimpse into an optimistic future. Vision centers on technology advancement that will shape sustainable pathways. Emerging focus lies in two main approaches: Direct Aqueous Mineralization and Indirect Mineralization. Direct Aqueous Mineralization will use liquid solutions to convert carbon dioxide into solid minerals. Anticipated enhancements could include accelerated reaction rates, improved energy efficiency, and scalable systems for industrial deployment. Liquid-based methods may one day appear at industrial sites worldwide, integrated with power plants or manufacturing facilities. That scenario offers promise of turning carbon emissions into valuable byproducts, such as construction materials or soil amendments, through simple chemical reactions powered by environmentally friendly processes.

Indirect Mineralization will follow a different trajectory. That approach will capture carbon dioxide and convert it into intermediate forms, such as bicarbonates or carbonates in controlled settings. These forms then will solidify into stable minerals over time. In coming years, improvements in catalysts, reactor designs, and process optimization could deliver faster conversion cycles and lower energy consumption. Envisioned developments include mobile units that will travel to emission hotspots or distributed systems installed at agricultural or factory sites. Those setups may produce mineral products that help reduce reliance on traditional mining or concrete production, while storing carbon in durable form. Both approaches will operate side by side, offering flexibility in deployment. Direct Aqueous Mineralization will serve large-scale facilities; Indirect Mineralization will suit decentralized or modular implementations that can adapt to shifting emissions landscapes.

Projected synergy between both methods could enable integrated networks. Captured carbon will flow through pipelines or shared infrastructures, feeding mineralization hubs. Those hubs will transform captured carbon into usable solids, closing carbon loops and supporting circular economies. Over decades, widespread adoption may stabilize atmospheric carbon levels while generating economic returns. Emerging policies may support those pathways through incentives, subsidies, or carbon credits tied to mineral outputs and verified storage.

Long-term vision sees urban centers with built-in mineralization units, turning captured carbon into building blocks for roads or green infrastructure. Rural areas may host small-scale systems producing soil enhancers from captured carbon. Industry may benefit through raw materials sourced from emissions, reducing extraction footprint. That future scenario hinges on continued progress in Direct Aqueous Mineralization and Indirect Mineralization technologies. Growth in that field suggests real potential to transform emissions into value, shaping a cleaner, more resilient world.

By Type of Minerals

The global CO₂ mineralization market stands at a crossroads of innovation and necessity. Exploration of how different mineral types can help transform carbon dioxide into stable compounds offers hope for long-term climate solutions. Silicate Minerals and Carbonate Minerals and Oxides all play important roles in that transformation. Study of these three categories shows how each offers unique pathways to capture and store CO₂.

Silicate Minerals have been used for natural weathering processes. That process naturally draws CO₂ from the atmosphere and turns it into solid minerals over long periods. In an engineered context, acceleration of silicate weathering could speed up carbon removal. Laboratory experiments and field trials demonstrate that crushed silicate rock can react faster with CO₂ under certain conditions. Deployment of silicate-based reactors could be scaled to handle large volumes of gas, if challenges like energy use and transport can be managed effectively.

Carbonate Minerals give a direct outcome of CO₂ capture. Combining CO₂ with calcium or magnesium sources produces carbonates that are stable for geological time spans. That reaction can happen in open ponds or reactors where CO₂ gas bubbles through mineral-rich water. Advantages include simplicity and permanence, while drawbacks may include supply of reactive cations and water resource management. Integrating renewable energy sources to power mixing or capture systems can lower environmental footprint.

Oxides offer another pathway. Metal oxides such as those containing calcium oxide or magnesium oxide can react with CO₂ to form carbonates. That reaction is rapid and exothermic, making it attractive for industrial applications. That process can be incorporated into industrial exhaust systems to capture CO₂ before release. Challenges include sourcing oxide feedstock and managing heat release, but synergy with industrial waste heat can make that approach efficient.

Looking toward the future, global CO₂ mineralization market can benefit from integration of those three mineral types into hybrid systems. Smarter designs will combine silicate processes with carbonate conversion and oxide-based capture in a unified workflow. Research efforts continue to reduce energy demand and costs. Development of modular, mobile units that can operate near sources of silicate or oxide materials will help adoption. Funding and policy support will enable pilot projects to transition to full-scale deployment.

Progress in hyper-efficient reactors, improved mineral supply chains, and low-cost renewable energy could propel global CO₂ mineralization market into a key strategy for climate mitigation by the middle of this century. That shift promises not only technical viability but also economic opportunity in a world seeking stable carbon solutions.

By Application

The global CO₂ mineralization market will soon reshape how industry uses captured carbon to build sustainable futures. A vision emerges where captured CO₂ transforms into valuable minerals, providing solutions across diverse fields. Future scenarios focus on how captured carbon becomes part of building materials or soil enhancers, water cleaners, and energy solutions. This shift taps captured CO₂ not as waste, but as resource. global CO₂ mineralization market gains momentum through technology improvements that turn carbon into stable compounds. This approach supports low-carbon targets while providing new revenue streams.

Within the Construction Industry, captured carbon blends with cement or aggregates to form durable materials that store carbon permanently. The thought of walls, floors, or roads built with recycled CO₂ sparks excitement over reduced emissions and stronger structures. When carbon becomes part of the structure, stability and sustainability arrive together. Demand fuels research to scale this process for mass use in construction sites and factories. Construction Industry will benefit from suppliers offering carbon-infused concrete that performs well and uses less virgin material.

In the Mining Industry, efforts focus on using mineralizing reactions to treat mine tailings or waste rock. Captured CO₂ reacts with silicate minerals often found in mining sites. That reaction locks carbon into solid forms while stabilizing waste. Mining operators will achieve double goals: clean waste and store carbon. That approach could lower environmental liability and support long-term stewardship of mine sites.

Future agriculture will embrace soil amendments containing carbon mineral products. Soil holds nutrients and water better when minerals derived from CO₂ enter the mix. That means better crop yields and healthier soils. Farmers can adopt that product as a low-carbon fertilizer option. global CO₂ mineralization market will deliver soil-improving creations that support sustainable farming.

Energy Sector applications include reactive mineral coatings or substrates that support carbon capture on site. Carbon mineral products could store heat or act as catalysts in energy systems powered by renewable sources. Captured CO₂ becomes feedstock to enhance energy storage or conversion systems. That links carbon capture directly to cleaner energy generation.

Within Water Treatment, mineralized carbon enters treatment media to help remove pollutants or adjust pH. CO₂–derived minerals make filters that last longer and support cleaner water. Water systems gain resilience while contributing to carbon removal goals. All those application areas show how captured carbon becomes a useful building block rather than a burden. global CO₂ mineralization market will drive new products that cut emissions, support diverse sectors, and create a more circular future.

By End-user

Adoption of global CO₂ mineralization market solutions often reflects hopes for cleaner air and safer communities. Future thinking imagines cities and industries working together to lock away carbon dioxide in stable solid forms. Interest from Government and Municipal Bodies will grow as climate risks mount. Private Enterprises will invest in systems that turn captured emissions into minerals. Research Institutions will push science ahead, finding better ways to speed up the hardening of carbon-rich materials. NGOs will rally public support and guide fair policies while holding others accountable.

Support from Government and Municipal Bodies will shape planning and funding. City leaders will look for methods that turn captured carbon into stable stones or carbonates, using local waste streams or industrial by-products. Clear planning with long-range goals can spark pilot projects at power plants or cement factories. Private Enterprises will explore business models that use global CO₂ mineralization market technology to create building blocks or soil enhancements. Those products offer dual benefits: neutralizing CO₂ and adding value. Companies focused on heavy industry may see this as a way to reduce footprint without shutting down operations.

Research Institutions will continue testing new catalysts, new mineral types, and new processes that will make the whole thing faster and cheaper. Lab discoveries could lead to on-site units that convert carbon emissions right at source. Academic work might cross borders, shared at conferences or in open publications, giving everyone better access to progress. NGOs will step in to explain benefits to local communities, raising awareness around how mineralization can lock carbon safely underground or in construction form. Advocacy groups may push for funding or legislation that helps roll out those technologies where they are needed most.

Looking ahead, global CO₂ mineralization market could become a normal part of city design, industry planning, and science agendas. When urban planners, business leaders, scientists, and community groups all align, captured CO₂ turns into opportunity instead of waste. That future will include materials that last generations, policies that guide fair use, and research that sharpens solutions over time. Every actor will play a role, turning carbon challenges into creative projects that protect the planet while building with purpose.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1,426.78 million |

|

Market Size by 2032 |

$3,213.20 Million |

|

Growth Rate from 2025 to 2032 |

12.6% |

|

Base Year |

2024 |

|

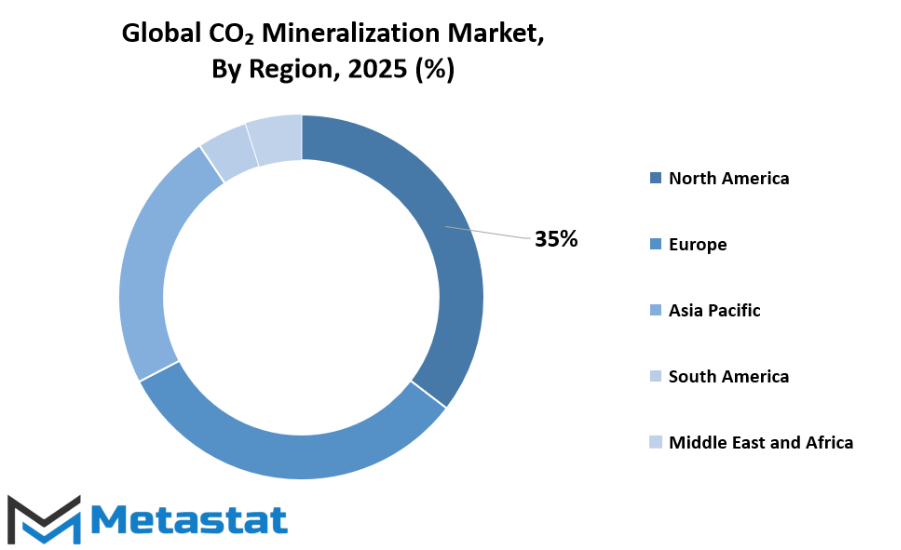

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global CO₂ mineralization market is gaining attention as industries and governments search for effective methods to tackle rising carbon emissions. This market focuses on transforming carbon dioxide into solid minerals, creating opportunities for reducing the harmful effects of greenhouse gases while also generating materials useful in construction, manufacturing, and other sectors. Technological advancements will continue to shape this market, making mineralization processes faster, more efficient, and scalable for industrial use. As research and investments grow, the market will likely expand and become a critical tool in achieving global emission reduction goals.

Geographically, the global CO₂ mineralization market is divided into several key regions, each contributing uniquely to its development. In North America, the market is segmented into the U.S., Canada, and Mexico. The U.S. will drive significant growth through advanced research programs and strong funding support from both government and private sectors. Canada will strengthen its position by integrating carbon mineralization with existing carbon capture technologies, while Mexico will gradually adopt innovative methods to support emission reduction strategies. In Europe, which includes the UK, Germany, France, Italy, and the Rest of Europe, strong regulatory frameworks and sustainability goals will keep encouraging investments in mineralization technologies. Germany and the UK will likely lead in terms of technological adoption, while France and Italy will steadily increase efforts to integrate these solutions into industrial processes.

Asia-Pacific is projected to experience rapid growth, with countries like India, China, Japan, and South Korea showing strong interest in adopting mineralization technologies. China will focus on large-scale industrial applications, while Japan and South Korea will emphasize innovation and research partnerships. India will gradually scale its adoption, driven by growing awareness of the need for cleaner industrial practices. The Rest of Asia-Pacific will follow this trend, supported by collaborative projects and policy initiatives. South America, led by Brazil and Argentina, will explore the potential of mineralization in sectors such as mining and agriculture. These countries, along with the Rest of South America, will seek to balance economic growth with sustainable practices.

The Middle East & Africa, segmented into GCC Countries, Egypt, South Africa, and the Rest of the region, will also witness gradual growth. GCC Countries will leverage existing infrastructure to support large-scale implementation, while South Africa and Egypt will explore projects aimed at both environmental and economic benefits. Future developments in the global CO₂ mineralization market will depend on ongoing innovation, strategic collaborations, and supportive regulations, ensuring that this emerging market plays a vital role in reducing global carbon emissions and promoting sustainable growth.

COMPETITIVE PLAYERS

The global CO₂ mineralization market will shape a future in which carbon dioxide becomes a building block instead of a burden. The journey begins with innovative firms such as Carbon Upcycling Technologies and Carbon8 Systems, moving toward solutions that transform greenhouse gas into solid materials. Neustark will push boundaries by turning emissions into usable products, and Blue Planet will offer new materials sourced from the capture of carbon. CarbonCure Technologies will provide methods that inject captured carbon into concrete, rewiring the building process. Heirloom Carbon Technologies will speed up natural chemical reactions, helping carbon turn to stone more quickly. Blue Skies Minerals and Green Minerals will mine new opportunities by using carbon-bearing compounds as feedstock. Rushnu and Paebbl will take a leap by creating carbon-based products that integrate into everyday life. Carbfix will use underground rock formations to lock away carbon for centuries. MCi Carbon (Mineral Carbonation International) will scale up large mineralization projects to make a measurable impact.

When technology continues to improve, carbon capture will become part of standard operations in factories and power plants. Mineralization will become not just a method for handling emissions but also a source of useful materials. Cement and building materials will include carbon that once floated in the air. Products that now rely on fossil fuels for material input will shift toward carbon-based components created by these technologies. This transition will create a new kind of supply chain in which captured carbon moves from source to solid product with minimal waste.

As investment flows into the global CO₂ mineralization market, economies will benefit. Jobs in engineering, geology, finance, and construction will grow. Research labs will explore faster conversion methods and better mineral inputs. Soon, carbon-rich rocks might be mined and then used to store more carbon, making extraction and storage part of the same cycle. Pilot projects, small now, will expand into operations that rival conventional material production. A shift in policy will guide incentives, steering progress toward a system where emissions meet industry, not conflict.

A glance ahead shows a world where carbon becomes a resource. Progress by Carbon Upcycling Technologies, Carbon8 Systems, Neustark, Blue Planet, CarbonCure Technologies, Heirloom Carbon Technologies, Blue Skies Minerals, Green Minerals, Rushnu, Paebbl, Carbfix, and MCi Carbon will drive the global CO₂ mineralization market forward. This vision is a future in which carbon dioxide will no longer be a problem but rather a tool for growth.

CO₂ Mineralization Market Key Segments:

By Technology

- Direct Aqueous Mineralization

- Indirect Mineralization

By Type Of Minerals

- Silicate Minerals

- Carbonate Minerals

- Oxides

By Application

- Construction Industry

- Mining Industry

- Agriculture

- Energy Sector

- Water Treatment

By End-user

- Government and Municipal Bodies

- Private Enterprises

- Research Institutions

- Non-Governmental Organizations (NGOs)

Key Global CO₂ Mineralization Industry Players

- Carbon Upcycling Technologies

- Carbon8 Systems

- Neustark

- Blue Planet

- CarbonCure Technologies

- Heirloom Carbon Technologies

- Blue Skies Minerals

- Green Minerals

- Rushnu

- Paebbl

- Carbfix

- MCI Carbon (Mineral Carbonation International)

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252