MARKET OVERVIEW

The global polysilicon for electronics market will soon travel a road that reaches far beyond the normal expectation, heralding a low-key revolution within the electronics sector. Microelectronics becoming increasingly sophisticated will cause the market to start affecting aspects of innovation that are still not fully explored today. Now the semi-circulars are not limited to its use as an base material, polysilicon will be adapted to the technical aspirations of companies in search of re-invention, accuracy and scalability. This cool transition will not come as an overnight revolution, but will be a constant, intentional expansion of fuel from the ongoing need of cleaner, sharper and more reliable electronic components.

The focus of the industry will gradually shift toward the requirement of ultra-pure polysilicon something higher than existing standards as future microchips require outstanding uniformity in quality and structure. The consensus of the global polysilicon for electronics market will not be simply increasing production, but even fine-tuning the structural purity of the material itself, moving closer towards atomic-level uniformity. Such goals will not be driven merely by commercial demand, but by the scientific establishment's relentless pursuit of micro-level control. As chips become smaller and processing power intensifies, even the slightest inconsistency will disturb performance. The future will require not only polysilicon, but a reengineered version of it, specially adapted to meet the precise requirements of edge computing and artificial intelligence hardware.

In addition, the market will extend its reach through cross-disciplinary integration. Polysilicon will start experiencing new applications outside of silicon wafers perhaps in products that cross the lines between electronics and bio-compatible technology. Test implants, wearable sensors, and adaptive circuits will count on a material with stability and response capabilities at harsh operating environments. Within this environment, the global polysilicon for electronics market will be more than just manufacturers; it will softly root the plans of future product designers seeking new bases on which to construct.

Sustainability will, too, form its future character. Stakeholders will increasingly focus on cleaner production routes, not just in compliance with environmental regulations but to enable long-term material efficiency. There will be an investigation of circular supply chains and energy-efficient processing methods whereby the market will not only operate as a chain of manufacture but as an ecosystem of ethical engineering. The changes will take decades to occur, but their direction is already taking shape behind the scenes underpinned by a common perception that the future of the industry will be based on accountability as well as ingenuity.

What lies ahead for the global polysilicon for electronics market is not just expansion, but quiet transformation. It will stretch its purpose, adapt its purity, integrate across disciplines, and embed sustainability into its DNA. The electronics industry will not only rely on it it will eventually be redefined by it. This is not a brash vision of what is to come but a sure one in its intent, poised to unfold with each successive layer of silicon designed for the hidden needs of the future.

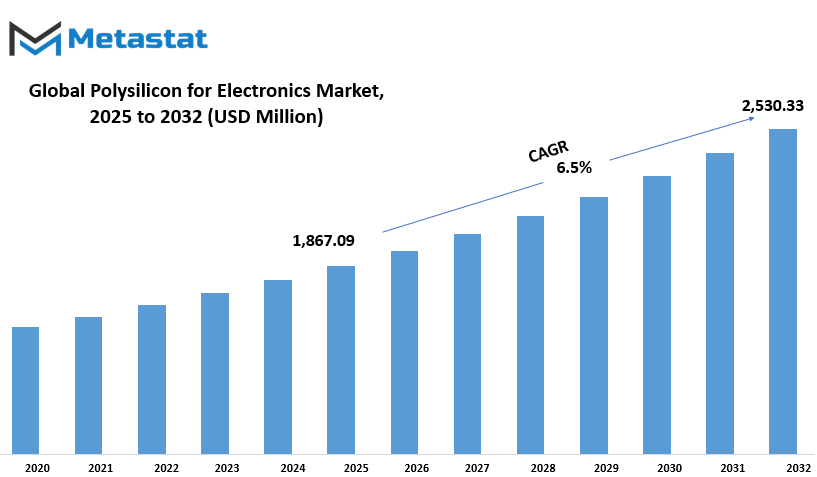

Global polysilicon for electronics market is estimated to reach $2,530.33 Million by 2032; growing at a CAGR of 6.5% from 2025 to 2032.

GROWTH FACTORS

The global polysilicon for electronics market has developed into a significant aspect of today's industrial and technological landscape. Since semiconductors and microelectronic components play more central roles in consumer electronics, as well as the automotive industry, high-purity polysilicon demand is likely to increase. From smart home devices and smartphones to driver-assistance systems within cars, all rely on small, dependable, and high-performance electronic devices. This demand conveniently pressures producers and suppliers to look for more stable sources of polysilicon with high purity levels demanded by precision electronics.

Concurrently, there is a clear worldwide trend toward renewable energy sources. Solar panels have become the focal point of clean energy initiative, especially in many countries. Since high-pure polysilicon is one of the primary photovoltaic cell materials, the increase in solar panel installation has inspired the same increase in the demand for polysilicon. The trend will remain strong as governments rapidly apply clean energy goals and individuals move towards permanent energy solutions for both homes and industries.

Despite such increasing demand, the industry suffers from various obstacles. A primary anxiety is a high cost of production. Polysilicon refining is an energy-intensive process, which increases the cost in addition to energy efficiency and environmental challenges. In addition, the supply chain of raw materials is not always stable. In recent times, global events and logistic issues have made it challenging to guarantee the continuous supply of the necessary inputs. This has given rise to the concerns of availability and the cost of ups and downs, making it difficult for producers to plan long-term production.

However, the future provides encouraging signs. Companies and governments are investing in better manufacturing methods that can reduce energy use and waste. Efforts to increase production as well as advance to refining technologies will help in low costs and meet the increasing global demand. These advances are likely to increase the stability of supply and quality, building a more strong market. In particular, investment in promoting production capacity and factory line upgrade can be a game-changer for some players to secure a deep position in electronics and renewable energy markets.

Generally, though, despite the challenges facing the global polysilicon for electronics market, the strong demand from technology-oriented industries combined with the increasing adoption of solar energy systems offers a compelling future. With more intelligent measures, creative production methods, and an obvious thrust into clean energy, this market will keep on growing in the future.

MARKET SEGMENTATION

By Technology

The global polysilicon for electronics market has been undergoing continuous change because of the increasing need for semiconductors and sophisticated electronic components. As companies strive to come up with smarter and more compact technologies, materials used in the manufacturing process have grown to be more specialized. Polysilicon, which is an important input in the process, remains to be at the forefront of fulfilling those requirements. In the electronic industry, the employment of high-purity polysilicon has grown much beyond its initial application. Now, it underpins the backbone of integrated circuits, solar cells, and high-end chips applied in everything from cell phones to electric cars.

Polysilicon is processed from a sophisticated yet standardized process for acquiring high purity levels needed for electronic-grade applications. The technology in this area is then subdivided into two separate categories: Polysilicon Rod and Polysilicon Chip. Each serves a specific function. Polysilicon Rods are primarily raw material for use in the Czochralski process to create monocrystalline silicon wafers. The rods are melted and pulled into crystals that will later be cut into wafers, which are essentially the building blocks of microprocessors and memory devices. Conversely, Polysilicon Chips, while smaller in dimension, are just as important. They are mostly used in specific niches of electronic manufacturing processes where there is a need for smaller-scale or high-efficiency structures.

What characterizes the global polysilicon for electronics market is the requirement for ultra-pure material. While the solar industry can absorb slightly lower levels of purity, electronic devices need a nearly perfect material structure in order to operate reliably. Contamination or impurity in any form can cause failure or compromised performance. This has prompted producers to spend on cleaner production plants and more exacting refining methods.

Another key consideration is how consumer trends affect this market. As more digital technology becomes integrated into everyday life, from wearable devices to intelligent homes, the requirement for reliable, high-performance chips will only rise. This, in turn, will continue the demand for both Polysilicon Rod and Polysilicon Chip technology. The manufacturers will try to balance scalability with quality, and the companies dealing in this sector will keep focusing on research into optimizing techniques, minimizing costs, and reducing wastes.

Despite the favorable prognosis, the global polysilicon for electronics market forecast by Metastat Insight is not free from challenges. Regulatory burden, ecological issues and initial setup costs can curb the entry of new players. Nevertheless, progress in cleaner production processes and recycling efforts indicates that these challenges are likely to be easy to handle in the future.

In general, the global polysilicon for electronics market will probably change the impact of technological innovations and global demand. As the world rapidly depends on the digital infrastructure, items running this trend-like will remain in high-purity polysilicon-lamplite.

By Application

The global polysilicon for electronics market remains to depict major change, especially in the manner it caters to various applications. The electronics industry has always required polysilicon owing to the requirement for high-purity material when manufacturing semiconductor wafers. As technology improves and the electronics sector becomes more accurate, the use of polysilicon becomes increasingly crucial in attaining the quality levels needed in devices now and in the future.

Based on application, the global polysilicon for electronics market is segmented into 300-mm Wafer, 200-mm Wafer, and Others. Of these, the 300 mm wafer segment will dominate the future. The larger wafer size enables more chips to get from a single wafer, making it cheap and efficient in manufacturing per unit. It also adjusts the new chip design, which are rapidly required for everything from high performance computing to sophisticated sensors. As the manufacturers keep scale down and get more powerful equipment, the 300 mm wafer will possibly increase its appearance in manufacturing work.

The 200 mm wafer remains relevant, especially in some heritage systems and for some components where steps for large wafers have not yet been fully achieved. It provides an agreement between performance and value in many applications. Meanwhile, 'other' category, small wafers and new formats, which serve top markets or emerging technologies. They may not dominate the volume, yet they still play a role in innovation for applications such as MEMS or power devices.

As electronics are minimized in size but maximized in ability, producers will increasingly depend on high-quality polysilicon to uphold performance levels. Competition between wafer sizes will not be merely price-driven, however, but also dependent on the manner in which each size accommodates future design needs. This continued demand for efficiency, accuracy, and reliability will dictate the direction the polysilicon industry goes during the next few years.

By End-user

The global polysilicon for electronics market is slowly changing in directions that foretell a broader transformation in industries that depend on sophisticated materials. Since the need for cleaner energy, smarter gadgets, and smaller high-performance technologies keeps rising, polysilicon's role in defining these products will only intensify. Its value rests on the purity that it provides a requirement in semiconductor production that enables everything from ordinary gadgets to sophisticated industrial systems.

By end-user, the global polysilicon for electronics market is further segmented into Automotive, Aerospace, Solar Energy, Electronics, and Others. Polysilicon is applied in each sector with some definite purpose, but all require reliability, efficiency, and long-term performance. In the automotive sector, for instance, next-generation vehicles require parts that manage high-speed computing, energy conversion, and driver-assist technologies. Polysilicon makes these systems viable through facilitating microchip production with high accuracy and endurance.

In aerospace, where reliability and weight is paramount, the aircraft depend on electronics materials that can withstand extraordinary conditions. The stability of polysilicon under pressure, temperature and electric load provides the type of display profit that makes such high pressure applications possible. This is why investment in research with this material is expected to continue in both defense and commercial aviation initiatives.

When it comes to solar energy, polycylicon has long been one of the primary materials in photovoltaic cells. Although other technologies will affect cost and competition market decisions, increasing demand for renewable energy will make polysilicon a viable option with solid opportunities. Most solar panels are based on silicon wafers produced from high -purity polysilicon, making them capable of converting sunlight into energy with better performance. This development is not only important for large-scale solar farms, but also for small, off-grid solutions to be more popular in emerging economies.

The electronics segment remains on the epicenter. Polysilicon device enables producers to stay on top of trends such as small, strength efficiency and computing power. Whether for smartphones, computers, industrial equipment, or smart home devices, the material continues to enable fast, strong and small parts to enable. Since there is a change in innovation in consumer electronics, what consumers expect from hardware need to be reliable. Polysilicon enables it to do so, especially where thermal management, conductivity and signal loyalty are essential.

Other sectors those outside of the consumer or industrial technology space are likewise poised to adopt or increase usage of polysilicon, particularly where automation or digital upgrades are occurring. From telecommunication towers to control panels in heavy equipment, there is an increasing need for sophisticated materials that will perform without constant repair or failure.

As producers look to the future, the global polysilicon for electronics market used in electronics will mirror larger trends in the way technology is being constructed and consumed. Nations spending capital on clean energy and internet infrastructure will set the tone for market movement. Supply chains can traverse borders, but emphasis will continue on improving quality, reducing waste, and responding to new forms of demand. The future of this material is not only about being employed more it's about being employed smarter, for uses that enable sustainability, efficiency, and advancement.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1,867.09 million |

|

Market Size by 2032 |

$2,530.33 Million |

|

Growth Rate from 2025 to 2032 |

6.5% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

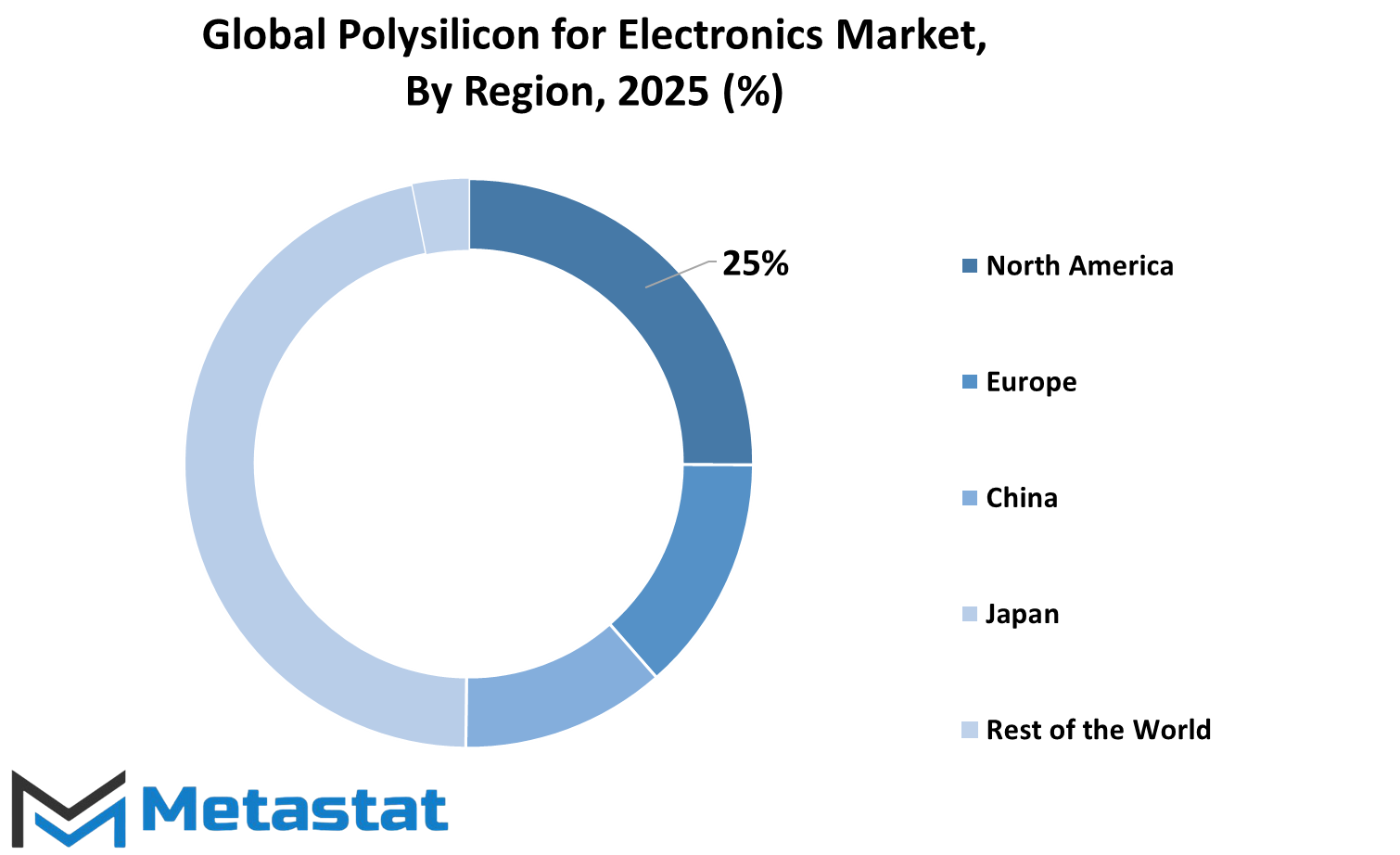

The global polysilicon for electronics market has witnessed aggressive activity across regions, driven both by manufacturing capacity as well as increasing demand from various hubs of electronics production. From a geographical perspective, the market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. North America comprises the U.S., Canada, and Mexico, where steadfast innovation and semiconductor demand will remain driving market behavior. The U.S., being a proven tech base, will probably continue to be at the forefront of regional consumption and use of electronic-grade polysilicon.

Europe's contribution is seen in nations such as the UK, Germany, France, and Italy, and the Rest of Europe. These countries will continue their position in both R&D and high-tech manufacturing. With an equal emphasis on sustainability and precision electronics, the European market is set to remain stable, though policy changes and energy issues can introduce moderate changes in the outlook of production.

In Asia-Pacific, segmentation into India, China, Japan, South Korea, and Rest of Asia-Pacific indicates a scene that will propel a majority of the future demand. China and South Korea, as market leaders in chip production, will keep dominating consumption trends. Japan's historic strength in the field of materials science will drive innovation, while India's emerging electronics industry will gradually transition from its demand-driven nature to making increasingly greater contributions on the supply side too. This region will be at the heart of redefining how polysilicon is sourced, processed, and utilized.

South America, broken down into Brazil, Argentina, and the Rest of South America, will continue to be a modest contributor based on volume. But increased interest in the manufacture of electronics and assembly of technology will gradually increase the region's importance in the larger market. Brazil's industrial base will act as a stepping stone for increasing localized demand and future prospects for investments in polysilicon processing.

Middle East & Africa is divided into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa. Although not a significant producer or consumer at present, the region has long-term potential, particularly in clean energy projects that indirectly aid electronic supply chains. Infrastructure development and digitalization gathering momentum, future growth can result in greater participation from these nations in the global marketplace.

Through every region, the market will be a blend of established demand and new contributions, both influenced by their own pace of industrialization, policy regimes, and technology adoption. The geography spread indicates that the global polysilicon for electronics market is not only sensitive to trends in consumer electronics and semiconductors but also closely connected to local capacity and cross-border trade links.

COMPETITIVE PLAYERS

The global polysilicon for electronics market is heading towards a future dominated by increasing demand, technological innovation, and corporate strategies aimed at establishing their position in this highly technical industry. This market revolves around the creation of high-purity polysilicon, a central material used for semiconductors and other electronics. As technology keeps evolving, the demand for ultra-pure materials becomes increasingly paramount, prompting companies to increase their production levels and ensure consistency in product quality.

Polysilicon for electronics is very different from that for solar applications. The electronic-grade type has to be subject to much more stringent standards, and this is evident in the way the market functions. Only a few manufacturers possess the technical ability and facilities to be able to fulfill these criteria. Some of the leading manufacturers are Tokuyama Corporation, Mitsubishi Materials, Wacker Chemie, Hemlock Semiconductor, and Huanghe Hydropower. Not only have these companies established reputations but have also spent considerable amounts on keeping purity levels intact so that high-end electronic products can be produced.

The fact that REC Silicon, GCL-Poly Energy, and OCI COMPANY Ltd. operate there further highlights the industry's size and competitiveness. Their ongoing efforts to develop more advanced manufacturing methods and increase output capacities will also be expected to impact the way the market will change in the next few years. In the same vein, Yichang CSG, High-Purity Silicon America Corporation, and Tongwei Group Co., Ltd. are propelling themselves by using cleaner technologies and tighter quality controls, enabling them to keep up with the increasing demands of electronics makers.

Much of the momentum in the global polysilicon for electronics market also relies on players such as Xinte Energy Co., Ltd, and DAQO NEW ENERGY CO., LTD, to take a long-term approach to supply agreements and raw material procurement enhancements. These actions will ensure more stable pricing models and more robust global supply chains, particularly as electronic technology becomes more sophisticated and prevalent across various industries.

As the industry continues to advance, process innovation, purification, and environmental control will continue to be the hub of activity for these companies. With the tightening of regulations and growing demand for accuracy in electronics, each phase of polysilicon production will face greater scrutiny. The firms that are best able to balance cost-effectiveness with unparalleled quality will be the ones leading the way into the future.

The global polysilicon for electronics market, as introduced by Metastat Insight, will keep changing with the efforts of these key players. Their investment choices, investments, and innovations will not only define the supply chain but influence how technologies of the future are constructed. In a global arena where micro-level accuracy is the benchmark of success, the capability to deliver impeccable material will make the leader and the follower.

Polysilicon for Electronics Market Key Segments:

By Technology

- Polysilicon Rod

- Polysilicon Chip

By Application

- 300-mm Wafer

- 200-mm Wafer

- Others

By End-user

- Automotive

- Aerospace

- Solar Energy

- Electronics

- Others

Key Global Polysilicon for Electronics Industry Players

- Tokuyama Corporation

- Mitsubishi Materials

- Wacker Chemie

- Hemlock Semiconductor

- Huanghe Hydropower

- REC Silicon

- GCL-Poly Energy

- OCI COMPANY Ltd.

- Yichang CSG

- High-Purity Silicon America Corporation

- Tongwei Group Co., Ltd

- Xinte Energy Co., Ltd

- DAQO NEW ENERGY CO., LTD.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252