MARKET OVERVIEW

The Global CMOS Image Sensor Used in Laser Triangulation market is witnessing growth and transformation. As one of the most innovative and cutting-edge technologies in the field of imaging and measurement, CMOS image sensors have become an indispensable component in laser triangulation systems, facilitating precise 3D scanning and measurement in a wide range of applications. In this essay, we will delve into the applications and significance of CMOS image sensors in the laser triangulation market, highlighting their role in enabling highly accurate and efficient 3D scanning processes.

CMOS (Complementary Metal-Oxide-Semiconductor) image sensors have become the preferred choice for laser triangulation applications due to their exceptional characteristics. Unlike traditional CCD (Charge-Coupled Device) sensors, CMOS image sensors offer several advantages, including lower power consumption, faster readout speeds, and the ability to integrate additional functionalities on the same chip. These attributes are pivotal in laser triangulation, where real-time data acquisition and processing are essential.

The primary application of CMOS image sensors in laser triangulation is in 3D scanning systems, which are widely used in industrial, automotive, healthcare, and robotics sectors, among others. In manufacturing industries, these sensors are employed for quality control and inspection purposes. They enable the rapid and accurate measurement of complex surfaces and components, ensuring that products meet the highest quality standards. Moreover, CMOS image sensors play a crucial role in ensuring the efficiency and precision of automated robotic systems, such as those used in assembly lines and material handling.

Another noteworthy application of CMOS image sensors in laser triangulation is in autonomous vehicles, where these sensors are integrated into LiDAR (Light Detection and Ranging) systems. LiDAR technology relies on laser triangulation to create detailed 3D maps of the surrounding environment, enabling autonomous vehicles to navigate safely and make real-time decisions. CMOS image sensors, with their ability to capture high-resolution images at high frame rates, contribute significantly to the success of LiDAR systems, thereby promoting advancements in the realm of self-driving cars.

Furthermore, the medical field benefits immensely from CMOS image sensors in laser triangulation applications. In minimally invasive surgical procedures, these sensors provide accurate depth information, facilitating precise guidance and navigation. They also play a pivotal role in the development of advanced medical imaging equipment, aiding in the early detection and diagnosis of various medical conditions.

The Global CMOS Image Sensor Used in Laser Triangulation market is experiencing remarkable growth, driven by the widespread adoption of CMOS image sensors across various industries. Their unparalleled characteristics, including low power consumption, high-speed image acquisition, and integration capabilities, make them an ideal choice for laser triangulation applications. From manufacturing and automotive to healthcare and defense, CMOS image sensors are pivotal in ensuring highly accurate 3D scanning, measurement, and navigation. The continuous evolution of CMOS technology promises even more advanced and versatile sensors, further expanding their influence in the ever-evolving landscape of laser triangulation applications. As technology continues to progress, CMOS image sensors will remain at the forefront of innovations, transforming the way we perceive and interact with the three-dimensional world.

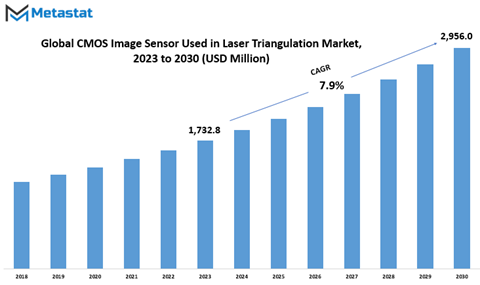

Global CMOS Image Sensor Used in Laser Triangulation market is estimated to reach $2,956.0 Million by 2030; growing at a CAGR of 7.9% from 2023 to 2030.

GROWTH FACTORS

The CMOS Image Sensor Used in Laser Triangulation market is experiencing increased demand in various industries like automotive, aerospace, and construction. These industries are seeking advanced technologies to improve product quality, reduce production time, and increase efficiency. This demand is primarily driven by the need for precise measurements and quality control in manufacturing processes, including defect inspection, accurate part dimensions, and tolerance verification. CMOS Image Sensors are crucial in reverse engineering, where objects are scanned to create CAD models for manufacturing. These sensors are gaining popularity due to their ability to quickly and cost-effectively capture accurate and high-resolution 3D images. Advancements in CMOS technology, such as increased sensitivity and reduced noise, have further boosted their demand. The automotive and aerospace sectors have been early adopters, using CMOS Image Sensors for faster and more accurate measurements of critical components. Additionally, the construction industry relies on 3D measurement systems for applications like building information modeling. This growing demand for 3D measurement systems is expected to continue driving the CMOS Image Sensor Used in Laser Triangulation market in the future.

Advancements in CMOS technology have led to higher resolution and faster data processing, making CMOS Image Sensors an attractive choice for various applications. These improvements have resulted in sensors offering higher resolution, better image quality, and improved signal-to-noise ratios, even in low-light conditions. Faster data processing capabilities allow real-time data capture and analysis, benefiting industries such as manufacturing, healthcare, and transportation. The decreasing cost of CMOS technology is also driving its adoption, thanks to advances in manufacturing processes enabling cost-effective production. As the demand for high-quality 3D scanning and imaging continues to rise, the CMOS Image Sensor Used in Laser Triangulation market is expected to grow further, with continuous advancements in CMOS technology to meet this demand.

One significant restraint facing the CMOS Image Sensor Used in Laser Triangulation market is the high cost of CMOS image sensors compared to other sensor types used in 3D measurement systems. Despite significant advancements, the complex manufacturing process and the cost of raw materials involved make CMOS Image Sensors relatively expensive. This limits their use in applications where cost is a critical factor, and other sensor technologies like CCD, ToF sensors, and structured light sensors are preferred despite their lower resolution and slower data processing capabilities. Moreover, in applications requiring large arrays of sensors, the high cost of CMOS Image Sensors can make the overall system prohibitively expensive. Although the continuous advancements in CMOS technology and increasing demand for high-resolution 3D imaging and scanning are expected to drive the market, cost considerations will remain a significant factor in the selection of sensor technology.

The limited accuracy of CMOS Image Sensors in certain applications, especially in measuring shiny or transparent surfaces, is another restraint. Reflection of light from shiny surfaces can lead to errors in data capture, and transparent surfaces pose challenges as light passes through without reflection. In these situations, other sensor technologies are preferred, such as ToF sensors and structured light sensors. The limited accuracy of CMOS Image Sensors in some applications can lead to higher costs and reduced efficiency, as additional steps may be required to compensate for inaccuracies. Despite these limitations, CMOS Image Sensors remain popular due to their high resolution, fast data processing capabilities, and ability to capture accurate data from a wide range of surfaces. Researchers and manufacturers are continuously working on enhancing CMOS Image Sensor accuracy in challenging applications.

The growing adoption of 3D printing technology presents new opportunities for the CMOS Image Sensor Used in Laser Triangulation market. 3D printing technology is revolutionizing various industries by enabling the production of complex designs and components. Accurate measurement and scanning are crucial for successful 3D printing, and CMOS Image Sensors provide high-resolution and accurate 3D images. The adoption of 3D printing is increasing in aerospace, automotive, healthcare, and consumer goods industries, driven by the need for customized components, reduced production times, and cost-effective manufacturing processes. In the medical field, 3D printing is used for patient-specific implants and prosthetics, where CMOS Image Sensors ensure a perfect fit and improved patient outcomes. The demand for accurate measurement and scanning in 3D printing applications is expected to provide new opportunities for the CMOS Image Sensor market. Additionally, the adoption of Industry 4.0 and smart manufacturing technologies is expected to further utilize the technology for accurate and real-time data, improving production efficiency and reducing costs. In conclusion, the growing adoption of 3D printing technology and the increasing demand for accurate measurement and scanning in various industries provide new opportunities for the CMOS Image Sensor Used in Laser Triangulation market, with continuous advancements in CMOS technology expected to keep pace with the growing demand.

MARKET SEGMENTATION

By Type

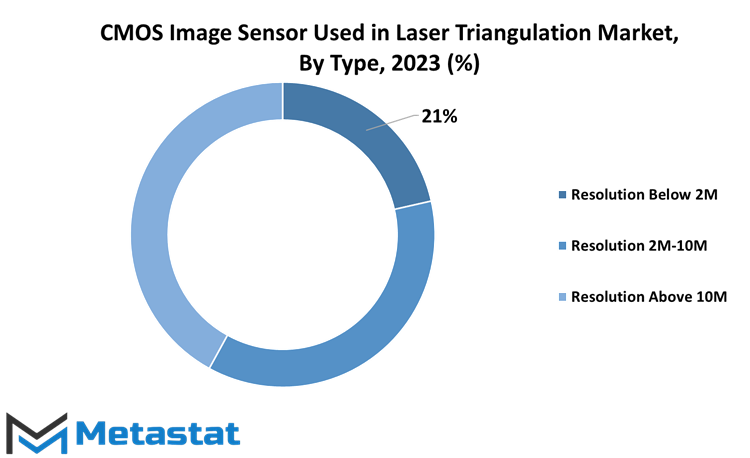

In the domain of the global CMOS Image Sensor, used in the Laser Triangulation market, a segmentation by type emerges. This segmentation delineates the sensor's resolution, an essential aspect defining its utility and value.

The Resolution Below 2M segment, a category valued at 347 USD Million in 2022. In essence, this segment encompasses sensors with resolutions below 2 megapixels. These sensors find their applications in scenarios where a lower level of detail suffices, serving admirably in various contexts, from basic image capture to certain measurement tasks.

Moving on, the Resolution 2M-10M segment stands as a significant player, valued at 585.6 USD Million in 2022. Here, the sensors step up a notch, providing resolutions between 2 to 10 megapixels. This segment's value reflects the demand for higher precision in imaging and measurement tasks across industries, where clarity and finer detail are prerequisites.

Finally, the Resolution Above 10M segment emerges, representing the upper echelon in terms of resolution. This category boasted a value of 674.1 USD Million in 2022. These sensors, with resolutions exceeding 10 megapixels, cater to applications demanding the highest level of detail, precision, and clarity. Their utility spans a spectrum of domains, including industrial and scientific settings, where the need for impeccable image quality is paramount.

In the ever-expanding landscape of CMOS Image Sensors, the segmentation by resolution type illuminates the diverse requirements across industries and applications. Each segment has its unique role and value, aligning with the specific demands of various domains, from the straightforward to the intricately detailed, shaping the dynamic market for these sensors.

By Application

The global CMOS Image Sensor Used in Laser Triangulation market encompasses various applications. One such application is the Laser Pointing Device segment, which had a value of 670.1 USD Million in 2022. Another significant application is the Camera segment, which reached a value of 936.6 USD Million in the same year.

In the CMOS image sensors utilized in laser triangulation, these applications play pivotal roles. The Laser Pointing Device segment serves a multitude of purposes, including precise pointing and measuring distances. It finds applications in various fields, such as surveying and alignment, where accuracy is paramount.

On the other hand, the Camera segment is equally crucial. It caters to a wide array of applications, spanning from industrial automation to 3D scanning. These cameras capture images and data with high precision, aiding in the creation of detailed 3D models and accurate measurements.

Both segments, Laser Pointing Device and Camera, contribute significantly to the global CMOS Image Sensor Used in Laser Triangulation market. They are indispensable tools in fields where precise measurements, imaging, and 3D modeling are essential. The values attributed to these segments in 2022 reflect their substantial presence and importance in the market. As technology continues to advance, these applications are likely to play even more significant roles in various industries.

REGIONAL ANALYSIS

In analyzing the global CMOS Image Sensor Used in Laser Triangulation market, a key aspect to consider is its geographical segmentation. These geographic divisions play a significant role in shaping the market dynamics. North America, comprising countries like the United States and Canada, holds a substantial share of the global market. The presence of leading technology companies and a robust manufacturing sector in North America contributes to the market's growth. Moreover, the region's strong focus on innovation and research and development bolsters its position as a prominent player in the CMOS image sensor industry.

On the other hand, Europe, with countries such as Germany and the United Kingdom, is also a noteworthy contender in the global CMOS image sensor market. The region's advanced industrial base and a thriving automotive sector are instrumental in driving the demand for CMOS image sensors. Europe's commitment to sustainability and stringent quality standards further propels its market influence.

These geographical segments are not isolated entities but are interconnected through global trade and partnerships. They collectively influence the production, distribution, and adoption of CMOS image sensors used in laser triangulation systems. Understanding the dynamics within North America and Europe is essential for businesses operating in this market, as it enables them to tailor their strategies to meet the specific demands and trends within each region

COMPETITIVE PLAYERS

In the field of CMOS image sensors used in laser triangulation, there are key players making significant contributions. Notably, Teledyne Technologies Inc. and SK Hynix Inc. stand out in this industry. These companies have a substantial presence and influence in the development and production of CMOS image sensors for laser triangulation applications.

Teledyne Technologies Inc. has established itself as a prominent player in the industry. The company brings to the table a wealth of experience and expertise in imaging technology. Teledyne's CMOS image sensors are known for their precision and reliability, making them a preferred choice in various laser triangulation applications. They have a strong track record of delivering high-quality sensors that meet the exacting demands of industries relying on laser triangulation technology.

On the other hand, SK Hynix Inc. has made significant inroads in the CMOS image sensor market for laser triangulation. The company's commitment to innovation and research has led to the development of cutting-edge image sensor technology. SK Hynix's sensors are widely recognized for their efficiency and performance, catering to the diverse needs of industries utilizing laser triangulation for measurement and imaging applications.

Both Teledyne Technologies Inc. and SK Hynix Inc. play a pivotal role in driving advancements in CMOS image sensor technology. Their contributions are instrumental in enhancing the precision and capabilities of laser triangulation systems. These key players continue to shape the industry and offer solutions that meet the evolving demands of modern applications.

CMOS Image Sensor Used in Laser Triangulation Market Key Segments:

By Type

- Resolution Below 2M

- Resolution 2M-10M

- Resolution Above 10M

By Application

- Laser Pointing Device

- Camera

Key Global CMOS Image Sensor Used in Laser Triangulation Industry Players

- Teledyne Technologies Inc.

- SK Hynix Inc.

- ams-OSRAM AG

- Luxima Technology LLC

- Newsight Imaging

- Photonfocus AG

- Keyence Corporation

- Wenglor Sensoric Group

- MagikEye Inc.

- Semiconductor Components Industries, LLC (onsemi)

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252