MARKET OVERVIEW

The Global Closed-System Transfer Devices (CSTD) market represents a specialized segment within the healthcare industry, focusing on advanced systems designed to ensure the safe handling of hazardous drugs. These devices play a crucial role in protecting healthcare workers, patients, and the environment from exposure to potentially dangerous substances used in chemotherapy and other medical treatments. As healthcare protocols continue to prioritize safety and efficacy, the demand for CSTDs is anticipated to increase significantly in the coming years.

Closed-System Transfer Devices are engineered to prevent the escape of hazardous drug vapors, aerosols, and liquids during the preparation, administration, and disposal of these medications. They employ mechanisms such as physical barriers and air-tight seals to contain the drugs within a closed system, thereby minimizing the risk of contamination and accidental exposure. The stringent safety requirements in healthcare settings necessitate the adoption of these devices, as they help to maintain compliance with occupational safety standards and regulatory guidelines.

The market for CSTDs is driven by the growing awareness of occupational hazards associated with the handling of cytotoxic drugs. Healthcare workers, including pharmacists, nurses, and technicians, are at significant risk of exposure to these drugs, which can lead to serious health issues such as cancer, reproductive problems, and genetic mutations. The implementation of CSTDs mitigates these risks, offering a safer working environment and ensuring the well-being of healthcare personnel.

Advancements in technology and materials science will shape the future of the Global Closed-System Transfer Devices market. Manufacturers are investing in research and development to create more efficient, user-friendly, and cost-effective devices. Innovations such as enhanced filter technologies, automated systems, and ergonomic designs are expected to improve the functionality and adoption of CSTDs. Additionally, the integration of digital solutions for tracking and monitoring drug transfers could further enhance safety protocols and operational efficiency in healthcare facilities.

Regulatory agencies around the world, including the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), will likely enforce stricter guidelines on the use of CSTDs. These regulations will drive the market growth by compelling healthcare institutions to adopt compliant devices. Furthermore, the increasing number of oncology treatments and the rising prevalence of chronic diseases will contribute to the expanding demand for CSTDs, as more healthcare settings will require robust safety measures to manage hazardous drugs effectively.

The geographical landscape of the Global Closed-System Transfer Devices market will be influenced by varying regulatory frameworks, healthcare infrastructure, and levels of awareness regarding occupational safety. North America and Europe are expected to dominate the market due to their advanced healthcare systems and stringent safety regulations. However, emerging economies in Asia-Pacific and Latin America will present significant growth opportunities as they continue to enhance their healthcare services and adopt international safety standards.

The Global Closed-System Transfer Devices market will experience substantial growth driven by technological advancements, regulatory mandates, and the increasing need for safer handling of hazardous drugs. As the healthcare industry evolves, the importance of CSTDs in ensuring the safety of healthcare workers and patients will become even more pronounced. Manufacturers and healthcare providers must collaborate to develop and implement innovative solutions that meet the highest safety standards and address the dynamic needs of the market. This collaboration will be key to fostering a safer and more efficient healthcare environment globally.

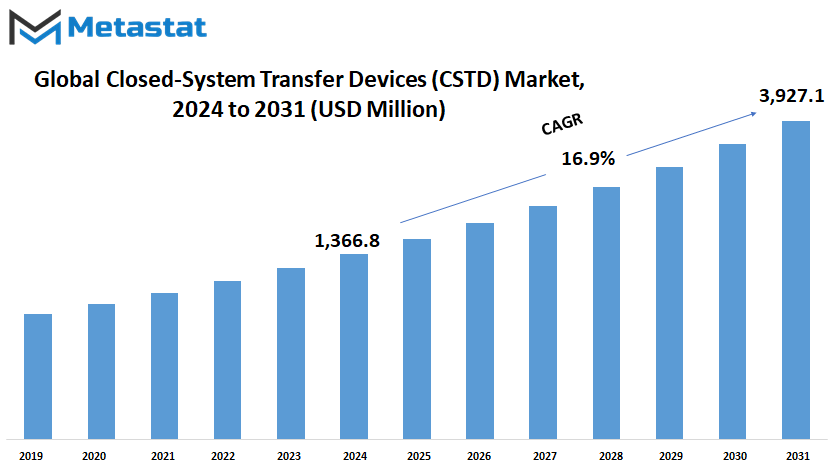

Global Closed-System Transfer Devices (CSTD) market is estimated to reach $3,927.1 Million by 2031; growing at a CAGR of 16.9% from 2024 to 2031.

GROWTH FACTORS

The Global Closed-System Transfer Devices (CSTDs) market is witnessing significant growth, driven by various factors that shape its trajectory in the healthcare landscape. One of the primary drivers is the implementation of strict regulations and guidelines mandating the use of CSTDs in healthcare facilities. These regulations aim to ensure the safety of workers and compliance with occupational health standards, reflecting a growing concern for the well-being of healthcare professionals.

Moreover, there's a notable increase in awareness among healthcare professionals regarding the risks associated with exposure to hazardous drugs. This heightened awareness drives the demand for CSTDs as an effective means to mitigate these risks. As a result, healthcare facilities are increasingly adopting CSTDs to safeguard their staff and maintain a safe working environment.

However, the market faces certain challenges that could impede its growth. One such challenge is the high initial costs associated with implementing CSTDs. Additionally, there's a need for extensive training of healthcare staff on the proper use of these devices, which could deter adoption rates.

Resistance to change and reluctance among healthcare facilities to invest in new equipment due to budget constraints or perceived inefficiencies in existing systems also pose obstacles to market growth. Overcoming these challenges will require innovative solutions and strategies to demonstrate the value and effectiveness of CSTDs in improving workplace safety and efficiency.

Looking ahead, technological advancements are expected to play a crucial role in shaping the future of the CSTD market. The development of more user-friendly and cost-effective CSTD solutions will make them more accessible to a wider range of healthcare facilities and providers. This, in turn, will create lucrative opportunities for market growth in the coming years as the demand for safer and more efficient healthcare practices continues to rise.

While the Global Closed-System Transfer Devices market faces challenges such as high initial costs and resistance to change, the increasing emphasis on worker safety and technological advancements offer promising avenues for growth. By addressing these challenges and leveraging opportunities for innovation, the market is poised for significant expansion in the foreseeable future.

MARKET SEGMENTATION

By Type

In the ever-expanding landscape of healthcare technology, one area that continues to see significant growth is the market for Closed-System Transfer Devices (CSTDs). These devices play a crucial role in ensuring the safe transfer of hazardous drugs, thereby minimizing the risk of exposure for healthcare workers and patients alike.

The Global Closed-System Transfer Devices market encompasses a variety of types, each designed to address specific needs and challenges in the healthcare setting. One such type is Closed Vial Access Devices, which enable the safe withdrawal of medication from vials without the need for direct needle exposure. This not only reduces the risk of contamination but also enhances workflow efficiency.

Another important segment within the market is Closed Syringe Safety Devices. These devices are equipped with mechanisms that prevent needlestick injuries and accidental needle retraction, offering an added layer of protection for healthcare professionals administering injections or withdrawing fluids.

Furthermore, Closed Bag/Line Access Devices represent a critical component in the safe handling of intravenous medications and fluids. By creating a closed system for drug administration, these devices help prevent contamination and minimize the potential for drug exposure during the transfer process.

The adoption of CSTDs is driven by a growing awareness of the risks associated with handling hazardous drugs, as well as stringent regulatory requirements aimed at ensuring workplace safety in healthcare settings. As healthcare providers prioritize patient and staff safety, the demand for innovative solutions like CSTDs will continue to rise.

By Closing Mechanism

The Global Closed-System Transfer Devices market is segmented based on the Closing Mechanism into four categories: Push-To-Lock System, Click-To-Lock System, Luer Lock System, and Color-To-Color Alignment System. Each mechanism offers unique features and benefits, catering to different needs and preferences within the market.

The Push-To-Lock System, as the name suggests, involves a simple push motion to securely lock the transfer device. This mechanism provides convenience and ease of use, making it suitable for various applications where quick and efficient sealing is required. Users will find this mechanism particularly advantageous in fast-paced environments where time is of the essence.

On the other hand, the Click-To-Lock System utilizes a clicking mechanism to ensure a tight seal. This mechanism offers an audible confirmation of proper closure, enhancing user confidence and safety. With this system, users can rely on both tactile and auditory cues to ensure secure sealing, minimizing the risk of leaks or contamination.

The Luer Lock System is a widely used mechanism known for its reliable and leak-proof connection. It features a threaded design that requires twisting to secure the connection between components. This mechanism provides a robust seal, making it suitable for applications where precision and reliability are paramount. Users can trust the Luer Lock System to maintain integrity even under challenging conditions.

The Color-To-Color Alignment System offers a visual cue for proper alignment and closure. This mechanism utilizes color-coded indicators to guide users in aligning the components correctly before sealing. By matching corresponding colors, users can easily ensure a secure connection, reducing the risk of errors or misalignments. This system is particularly beneficial in environments where precision and accuracy are crucial.

In the ever-evolving landscape of closed-system transfer devices, the choice of closing mechanism will play a significant role in meeting the diverse needs of users across different industries and applications. Each mechanism offers its own set of advantages, ranging from simplicity and convenience to precision and reliability. As technology continues to advance, we can expect further innovations and enhancements in closing mechanisms, providing even greater versatility and performance in closed-system transfer devices. Ultimately, the market will continue to evolve to meet the evolving demands of users, driving innovation and advancement in this essential industry.

By Component

In the expansive world of technology, the Global Closed-System Transfer Devices market is a significant player. This market is segmented by Component, which includes Vial access components, Male Luers, Bag Spikes, Female Components, and Other Components.

Vial access components are crucial elements in closed-system transfer devices, providing a secure connection to vials for transferring liquids or medications. Male Luers, on the other hand, serve as connectors, facilitating the safe transfer of fluids between various medical devices. Bag Spikes are another essential component, enabling the puncturing of bags for fluid transfer. Female Components complement Male Luers, ensuring compatibility and efficiency in fluid transfer systems. Lastly, Other Components encompass various additional parts that contribute to the functionality and effectiveness of closed-system transfer devices.

The significance of these components lies in their role in enhancing safety and efficiency in medical procedures involving fluid transfer. As technology continues to advance, there will be a growing demand for closed-system transfer devices across various healthcare settings. This increased demand will drive the growth of the Global Closed-System Transfer Devices market.

One key factor contributing to this growth is the emphasis on patient safety and infection control. Closed-system transfer devices offer a sealed environment, minimizing the risk of contamination and infection during fluid transfer procedures. With healthcare providers increasingly prioritizing patient safety, the adoption of closed-system transfer devices will become more widespread

Additionally, advancements in medical technology and procedures will fuel the demand for closed-system transfer devices. As medical treatments become more complex and precise, there will be a greater need for devices that ensure accurate and safe fluid transfer. The versatility of closed-system transfer devices, coupled with their ability to accommodate a wide range of medical applications, will make them indispensable tools in modern healthcare.

Moreover, regulatory standards and guidelines will play a crucial role in shaping the Global Closed-System Transfer Devices market. Regulatory bodies will continue to enforce stringent requirements for medical devices, including closed-system transfer devices, to ensure their safety and efficacy. Compliance with these standards will be imperative for manufacturers seeking to maintain their market presence and meet the evolving needs of healthcare providers.

The Global Closed-System Transfer Devices market is poised for significant growth, driven by factors such as increasing emphasis on patient safety, technological advancements, and regulatory compliance. The diverse range of components within this market will cater to the evolving needs of the healthcare industry, ensuring safer and more efficient fluid transfer procedures in the future.

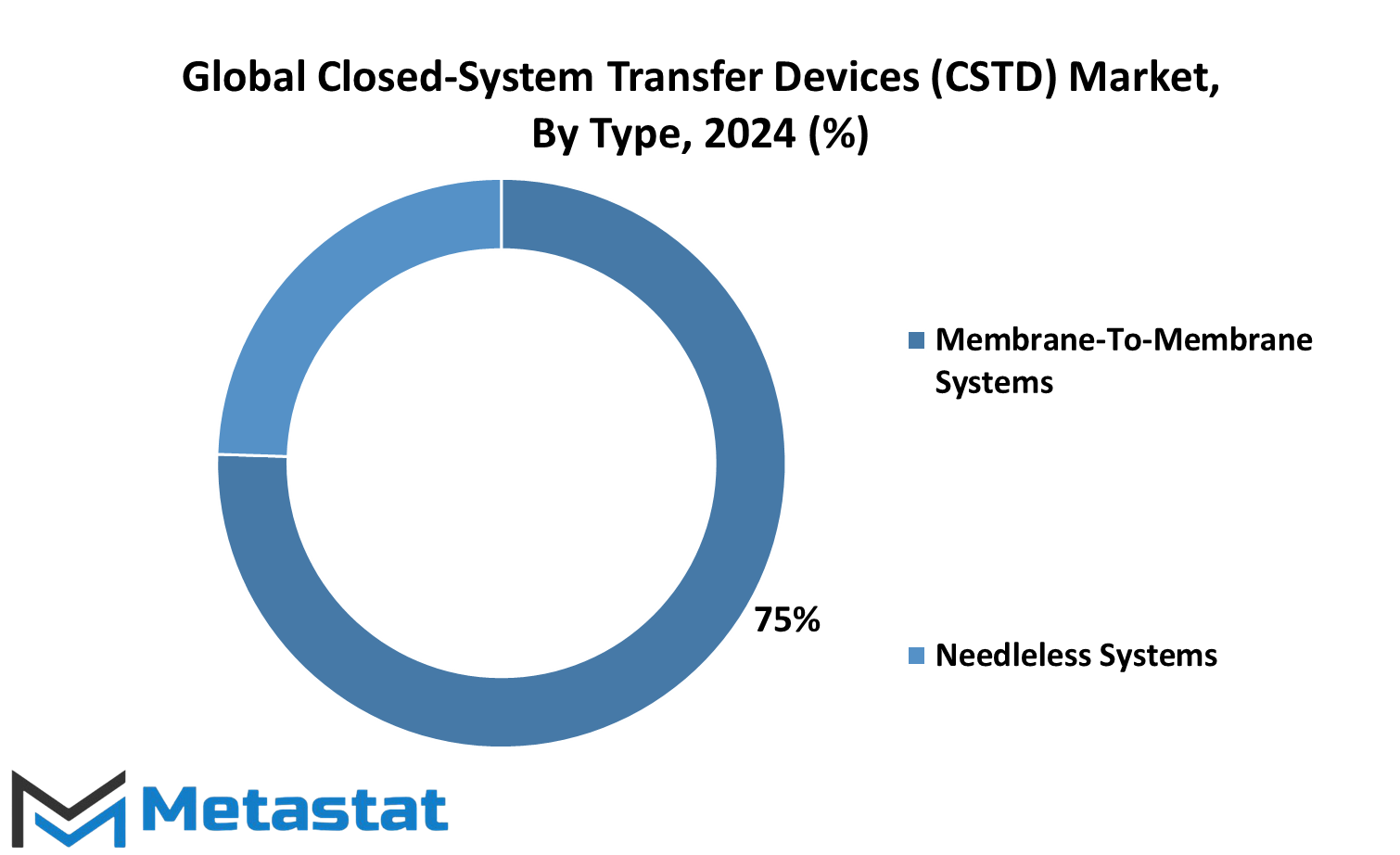

By Type

The global market for Closed-System Transfer Devices (CSTD) is segmented into two main types: Membrane-To-Membrane Systems and Needleless Systems. These systems play a crucial role in ensuring the safe transfer of hazardous drugs in various medical settings.

Membrane-To-Membrane Systems employ a barrier membrane to prevent the escape of harmful substances during drug transfer. This type of system provides a secure and reliable method for handling hazardous drugs, reducing the risk of exposure to healthcare workers and patients alike. By utilizing a membrane barrier, these systems effectively contain the drug within a closed environment, minimizing the potential for contamination and ensuring safe handling practices.

On the other hand, Needleless Systems eliminate the need for needles during drug transfer, further enhancing safety protocols in healthcare facilities. These systems utilize advanced technology to facilitate the transfer of medications without the use of needles, reducing the risk of needlestick injuries and potential exposure to hazardous drugs. Needleless Systems offer a convenient and efficient alternative to traditional methods, enhancing workflow efficiency while prioritizing the safety of healthcare workers.

The global market for Closed-System Transfer Devices is expected to witness significant growth in the coming years, driven by increasing awareness regarding the importance of safe drug handling practices and stringent regulations governing the handling of hazardous drugs. With a growing emphasis on patient and healthcare worker safety, healthcare facilities are increasingly adopting Closed-System Transfer Devices to minimize the risks associated with drug handling and administration.

In addition to healthcare facilities, the pharmaceutical industry will also play a key role in driving market growth, as the demand for Closed-System Transfer Devices continues to rise among drug manufacturers. With an increasing focus on quality assurance and regulatory compliance, pharmaceutical companies are investing in advanced drug handling technologies to ensure the safety and efficacy of their products.

REGIONAL ANALYSIS

The global market for Closed-System Transfer Devices (CSTD) is analyzed based on regional divisions, including North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further broken down into the United States, Canada, and Mexico. Europe comprises the United Kingdom, Germany, France, Italy, and the rest of Europe. Meanwhile, Asia-Pacific encompasses India, China, Japan, South Korea, and the rest of Asia-Pacific. South America includes Brazil, Argentina, and the rest of South America. Lastly, the Middle East & Africa region is divided into GCC Countries, Egypt, South Africa, and the rest of Middle East & Africa.

The division of the global Closed-System Transfer Devices market into these regions provides insights into the varying dynamics and factors influencing market growth across different geographical areas. Each region presents unique opportunities and challenges for market players, influenced by factors such as regulatory frameworks, healthcare infrastructure, economic conditions, and technological advancements.

North America, comprising the United States, Canada, and Mexico, is expected to witness significant growth in the CSTD market due to factors such as increasing healthcare expenditure, rising adoption of advanced medical technologies, and the presence of key market players. Europe, with countries like the United Kingdom, Germany, and France at the forefront, is also projected to experience substantial growth driven by initiatives aimed at enhancing healthcare facilities and increasing awareness about safety measures in medication handling.

In the Asia-Pacific region, countries like India, China, and Japan are anticipated to emerge as lucrative markets for Closed-System Transfer Devices, supported by rapid urbanization, expanding healthcare infrastructure, and growing investments in healthcare innovation. Similarly, South America, led by Brazil and Argentina, is poised for growth fueled by improving healthcare access and rising demand for safer medication handling practices.

The Middle East & Africa region, encompassing GCC Countries, Egypt, and South Africa, presents opportunities for market expansion due to increasing healthcare investments and a growing focus on enhancing healthcare quality and patient safety.

Overall, the regional analysis of the global Closed-System Transfer Devices market highlights the diverse landscape of opportunities and challenges across different parts of the world, shaping the strategies of market players and influencing the trajectory of market growth in the coming years.

COMPETITIVE PLAYERS

In the Closed-System Transfer Devices (CSTD) market, there exist several prominent players vying for dominance. These companies, including Becton, Dickinson and Company, ICU Medical, Equashield, B Braun Melsungen, Needleless Corporation, Simplivia Healthcare, Corvida Medical, Yukon Medical, CODAN, Caragen, Vygon SA, Terumo Corporation, Epic Medical, West Pharmaceutical Services, Inc., Grifols International S.A., Baxter International Inc., and Fresenius Kabi, form the competitive landscape of the industry.

Each of these entities brings its own set of capabilities and offerings to the table, contributing to the diversity and dynamism of the market. Becton, Dickinson and Company, for instance, is known for its innovative solutions in healthcare, while ICU Medical specializes in developing products for infusion therapy and critical care applications. Equashield, on the other hand, focuses on providing closed-system drug transfer devices designed to ensure the safe handling of hazardous drugs, thus catering to the specific needs of healthcare professionals.

In this ever-evolving market, competition is fierce as companies strive to differentiate themselves and capture market share. Product innovation, quality assurance, and strategic partnerships are just some of the avenues through which these players seek to gain a competitive edge. For instance, B Braun Melsungen emphasizes continuous research and development to stay ahead of the curve, while Needleless Corporation leverages its expertise in needle-free technology to offer unique solutions to healthcare providers.

Moreover, as the demand for closed-system transfer devices continues to rise, fueled by growing concerns regarding drug safety and contamination risks, the competitive dynamics of the market are expected to intensify further. With advancements in technology and the emergence of new players, the industry landscape is likely to witness significant shifts in the coming years.

The Closed-System Transfer Devices market is characterized by a diverse array of competitive players, each striving to carve out its niche and secure a foothold in the industry. Through innovation, collaboration, and a relentless pursuit of excellence, these companies will continue to shape the future of healthcare delivery and patient safety.

Closed-System Transfer Devices (CSTD) Market Key Segments:

By Type

- Closed Vial Access Devices

- Closed Syringe Safety Devices

- Closed Bag/Line Access Devices

By Closing Mechanism

- Push-To-Lock System

- Click-To-Lock System

- Luer Lock System

- Color-To-Color Alignment System

By Component

- Vial access components

- Male Luers

- Bag Spikes

- Female Components

- Other Components

By Type

- Membrane-To-Membrane Systems

- Needleless Systems

Key Global Closed-System Transfer Devices (CSTD) Industry Players

- Becton, Dickinson and Company

- ICU Medical

- Equashield

- B Braun Melsungen

- Needleless Corporation

- Simplivia Healthcare

- Corvida Medical

- Yukon Medical

- CODAN

- Caragen

- Vygon SA

- Terumo Corporation

- Epic Medical

- West Pharmaceutical Services, Inc.

- Grifols International S.A.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383