MARKET OVERVIEW

The China wound care management market will look beyond the contours of conventional medical supplies, paving the way for a future driven by technological advancements and shifting patient expectations. Although today's market has a predominant identification with bandages, dressings, and simple treatment products, the future years will guide it into a wider arena that remakes the healing process of wounds, their monitoring, and even prevention. This growth will not be limited to hospitals and clinics but will extend to homes, rehabilitation facilities, and online platforms that facilitate easy patient interaction.

One of the drastic adjustments may be in how progressive substances are used. The emphasis will shift from conventional gauze to bioengineered dressings and intelligent fabrics that could screen wound status in actual time. All these improvements will usher in a brand new paradigm for affected person care, in which the treatment will not simply get dressed the wound however will put together a platform for fast recuperation with a lower hazard of infection. Through this transition, the China wound care management market will become an industry that is efficient, innovative, and precise in healing.

Personalized treatment will also become a trend. Rather than presenting standardized solutions, goods will be created with tailored specifications according to age, state of health, and even genetic information. This is also going to apply in the digital health platforms where physicians and patients can instantly share updates, so interventions are quicker. These innovations will underscore the increasing incorporation of biotechnology and data-based solutions into wound treatment, defining a future when healing will be more certain and less unpredictable.

The other aspect that will extend the market beyond what it is today will be a focus on prevention. Contemporary ways of living and an aging population will cause an increase in chronic conditions that render individuals more susceptible to non-healing wounds. Rather than acting once the wound materializes, the China wound care management market will progress with innovations in protective equipment, skin-supporting products, and wearable technology that will prevent problems before they occur. The industry direction will thus no longer be about healing evident damage but moving into protecting skin health in advance.

Sustainability will also be an inescapable chapter of its growth history. Since the healthcare industry worldwide will come under pressure to minimize waste and environmental footprint, the Chinese industry will move towards biodegradable dressings, reusable technologies, and production processes that require less input. Not only will this address environmental issues, but it will also appeal to the aspirations of a new generation of healthcare providers and patients who care about responsibility as much as they care about efficacy.

In the future, the China Wound Care Management industry will not only provide healing products but develop into an ecosystem in which science, technology, and patient values will intersect. Its business will break free from conventional boundaries, mirroring a future that will guarantee safer, smarter, and greener wound care.

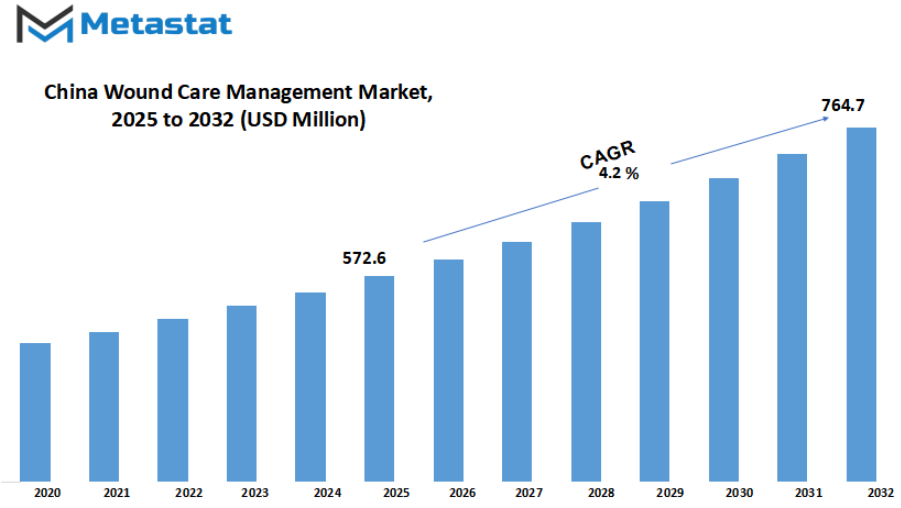

China wound care management market is estimated to reach $764.7 Million by 2032; growing at a CAGR of 4.2% from 2025 to 2032.

GROWTH FACTORS

The China wound care management market is going through a phase where lifestyle and demographic trends are defining its growth. Among the strongest drivers is the increasing incidence of chronic wounds, especially in the elderly population. With China going through demographic transition and a fast-growing elderly population, complications like pressure ulcers, diabetic foot ulcers, and venous leg ulcers are on the rise. This has generated a consistent need for products and services that will provide improved healing results and alleviate the patients' and caregivers' burdens. In addition to this, increasing demand for innovative wound care solutions is redefining the market environment. Today's dressings, negative pressure wound therapy, and products that enable accelerated recovery are gradually conquering traditional treatments, as healthcare professionals and patients alike seek options not just to heal wounds but enhance quality of life as well.

Although these drivers propel the market, there are evident challenges that still restrain it. Too much cost associated with treatment is a resultingly large hurdle, particularly for advanced wound care products. In a nation where a significant portion of the population still pays for medical treatment directly, cost is a significant issue. Most patients, especially those in underserved regions, are not able to access these solutions as a result of their financial constraints. In addition to cost, poor awareness within rural healthcare facilities limits adoption even more. While city clinics and hospitals are likely to possess the most updated generation, rural regions often lack skilled practitioners and the understanding vital to efficiently rent the ultra-modern strategies of wound care. This disparity produces a discrepancy between answer availability and use throughout the kingdom.

Opportunities exist which could assist near those gaps and power the marketplace into new regions concurrently. The growth of telemedicine and far flung monitoring of wounds is already bearing fruit, in particular in overlaying a long way-flung regions wherein there is a lack of specialized offerings. By permitting sufferers to speak with healthcare specialists remotely, telehealth answers can facilitate early prognosis, foremost treatment planning, and non-stop monitoring with out frequent visits to hospitals. This not handiest saves cash however also enhances compliance of sufferers.

Along with this, the rise within the use of bioengineered dressings and regenerative treatments is growing a new bankruptcy for wound care in China. These merchandise are more than mere covers for wounds; they actively facilitate tissue regeneration, resulting in faster and greater efficient healing. As product studies and improvement on this area continue to benefit traction, merchandise to begin with seemed as premium are possibly to become extra mainstream, spurring more usage. Collectively, these opportunities reflect the way in which the market will shift, with technology and innovation being married with enhanced accessibility to respond to the increasing healthcare demands of the population.

MARKET SEGMENTATION

By Type

The China wound care management market is becoming increasingly integral to the nation's healthcare infrastructure, driven by evolving patient requirements and medical treatment habits. Hospitals and clinics will increasingly depend on a combination of old and new solutions as demand for improved treatment rises. The market is not merely about quick relief but also enhancing long-term recovery and minimizing complications. In China, where the expenditures on healthcare are gradually rising, the industry will be at the center of managing both acute and chronic conditions.

Advanced wound dressings, one of the strongest features of this market, have already been valued at $264.0 million. These items will be crucial for the treatment of acute wounds that are in need of more than basic attention since they keep the moisture level in balance, shield from infection, and accelerate the healing process. This is complemented by conventional wound care products worth $161.6 million, which still remain relevant because they are affordable and easily available. Although these are not providing the same high-tech benefits, they continue to be heavily utilized in urban and rural care environments and thus are a part of the total system.

In addition to dressings, other product categories like closure devices and therapy wound devices are beginning to attract attention. Closure devices will gain importance as more surgical procedures are performed, leading to safer and faster recovery for the patient. Therapy equipment, meanwhile, will be viewed as sophisticated means for treating chronic wounds and pressure ulcers, promising uniform treatment results. These types of products capture the Chinese healthcare trend's gradual evolution, with innovation and technology increasingly being embraced together with conventional solutions.

Having both sophisticated and conventional products indicates an interesting dynamic in the Chinese marketplace. On one hand, there is increasing emphasis on technological solutions, whereas on the other, there is consistent dependency on affordable solutions. This blend enables healthcare professionals to adjust treatments to the exact needs of patients, be it advanced devices or basic, accessible products. With the market escalating further, this blend will shape the way wound care is provided in various parts of the nation.

In the coming years, the China wound care management market will further evolve in response to growing expectations in healthcare. With its multi-segmented nature—ranging from advanced wound dressings to traditional products, closure devices, and therapy systems—the market is particularly poised to cater to varied needs of patients. Through this multi-layered methodology, not only will it provide instant treatment for wounds, but also foster long-term healing solutions, making it an integral component of the healthcare trajectory of China.

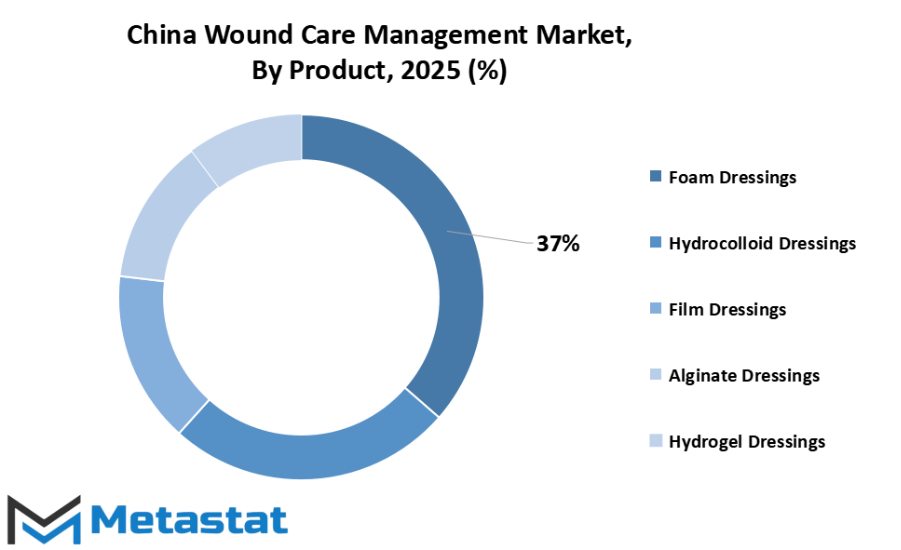

By Product

The China wound care management market is increasingly taking on significance as the need for improved medical solutions remains on the rise. As the nation's healthcare system expands and there's more emphasis placed on cutting-edge treatment techniques, products facilitating wound healing are gaining greater acceptance. Patients, hospitals, and clinics are resorting to better dressing materials that not only safeguard wounds but also aid in quick recovery and lower the chance of infection. This growing awareness and availability are dictating the manner the market will grow in destiny years.

Based on product type, the marketplace is segmented into foam dressings, hydrocolloid dressings, movie dressings, alginate dressings, hydrogel dressings, collagen dressings, and others. Foam dressings are often selected for his or her capability to soak up a excessive quantity of wound fluid at the same time as preserving the vicinity wet, that is favorable for recuperation. Hydrocolloid dressings are esteemed for their cushioning and defensive houses, which render them useful to be used on fragile wounds. Film dressings, because of their transparency and skinny nature, are preferred in situations in which it's miles vital to reveal the wound but now not interfere with the dressing. Alginate dressings, which can be certainly derived from seaweed, are hired inside the manage of heavily exuding wounds due to their excessive absorption houses. Hydrogel dressings are outstanding through their cooling and comforting impact, which renders them beneficial for the treatment of burns or painful wounds. Collagen dressings help in the promotion of tissue increase and are often utilized in chronic wound control, whereas different merchandise introduce additional alternatives to cope with various patient desires.

The variety of available products provides Chinese healthcare practitioners with the ability to select dressings according to wound type, severity, and stage of healing. Such diversity is important since it enables more customized treatment, which enhances recovery and comfort for the patient. The growing consumption of contemporary wound dressings also indicates the way medical practice in China is departing from the conventional approach towards science-based solutions that have research-based backing and clinical efficacy.

In the years to come, as more hospitals, nursing homes, and home healthcare agencies embrace advanced products, the China wound care management market will certainly experience increased acceptance of these dressings. The full-size availability of diverse options ensures that acute and chronic wounds may be dealt with more ease, with restoration times decreased and nice of life improved for sufferers. This combo of increasing focus stepped forward merchandise, and more desirable medical infrastructure will result in a extra demand for solutions related to wound care inside the usa.

By Sales Channel

The China wound care management market is becoming increasingly significant with improving healthcare standards and patient awareness regarding treatment options. As there is greater emphasis on quicker healing and infection prevention, various sales channels are playing an important part in making these products more ubiquitous. Hospitals and clinics tend to favor organized supply channels that guarantee convenient access to sophisticated wound care products, whereas patients outside hospitals seek easy avenues of purchase for dressings, bandages, and associated products. This equilibrium between institutional purchase and individual demand determines the market's operational pattern.

Direct tenders are among China's most significant modes of distribution, particularly in public hospitals and large health centers. By entering into direct contracts with suppliers, these institutions obtain a consistent stream of advanced wound care products, whereby both emergency requirements and long-term treatment needs are fulfilled without any interruption. This reduces not only cost pressures for the healthcare providers but also ensures the quality assurance and regulatory compliance. The increasing number of hospitals and their growing in-patient intake will further firm up this channel in the years to come.

Retail pharmacies, however, serve individuals who treat wound care in the home, such as those recovering from surgery or those with chronic wounds such as ulcers and diabetic wounds. Pharmacies provide trusted access, where patients can inquire of professional expertise from pharmacists when buying needed care supplies. This channel is important in bridging healthcare products to individuals residing in smaller cities and towns, where access to a hospital is not always instant. As more citizens become concerned about their health and spend money on preventive care, pharmacies will be the next best place to buy wound care solutions.

Internet systems have end up a powerful and speedy-increasing channel for sales, especially in a country like China wherein digital penetration may be very high. Caregivers and patients experience the convenience of searching, evaluating, and putting orders for wound care merchandise from domestic. Web systems also allow global and nearby manufacturers to increase their reach, providing a extra range of options for customers. As the younger technology prefers on-line purchases and domestic delivery services, the channel will see regular growth. The convenience of buying, type of products, and accessibility will turn on line income into a primary driving force for destiny growth within the marketplace.

Overall, the China wound care management market will continue to enjoy its several sales channels, each serving a different set of consumer and institutional requirements. Direct tenders provide a stable supply to hospitals, retail pharmacies enhance coverage for individuals, and digital platforms widen reach by convenience. The intersection of these three channels generates a level system that will be in support of the advancement of the market as healthcare standards increase and patient demand for high-quality wound care solutions keeps on expanding.

By End Users

The China wound care management market is gradually taking shape as health needs continue to grow and diversify in the nation. With increasing awareness of advanced treatments, hospitals are the dominant area for wound care solutions, with a diverse product and procedure offering meant for both acute and chronic care. Hospitals benefit from experienced professionals and facilities that facilitate the use of advanced wound management systems. Chronic condition patients like those with diabetes, pressure ulcers, or surgical wounds tend to rely on hospital-based care, so this segment is a steady driver of market expansion.

In addition to hospitals, specialty clinics are starting to contribute more, particularly in urban areas where consumers seek faster, concentrated treatments. These clinics specialize in custom remedies and applying advanced wound care era in an intense way. Their extended popularity may be attributed to patients wanting quicker recovery intervals and fewer visits to the medical institution. Their specialization permits them to set up high-quality reputations, mainly in treating complicated instances like burns or diabetic ulcers.

The home healthcare enterprise is likewise assuming importance in China as greater individuals want treatments that allow them to heal in their personal homes. Thanks to the resource of portable system and streamlined wound care merchandise, patients are now able to get right of entry to quality care with out the necessity of recurrent hospitalization. This trend isn't always handiest within your budget but additionally complements the comfort of patients, mainly the aged or the ones suffering from mobility issues. Home-based totally care is expected to turn out to be increasingly more customary as virtual monitoring and telemedicine offerings become extra giant.

Ambulatory surgical facilities are some other phase including to the marketplace, imparting day-care techniques that involve wound care earlier than and after the techniques. Such facilities entice patients searching for price-powerful and time-saving care. With their emphasis on outpatient care, they fill the space among hospitals and domestic care, ensuring best remedy without the overhead of prolonged hospital remains. This positions them as an essential issue of China's wound care control framework, helping different cease customers' services.

Hospitals, specialty clinics, home healthcare, and ambulatory surgical centers together form the varied routes whereby wound care solutions are touching lives of patients in China. All of them have strengths in their own rights, and as the need for patient-friendly and effective solutions increases, all of them will continue to contribute significantly to the way in which the wound care management market in China is evolving.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$572.6 million |

|

Market Size by 2032 |

$764.7 Million |

|

Growth Rate from 2025 to 2032 |

4.2% |

|

Base Year |

2024 |

COMPETITIVE PLAYERS

The China wound care management market is attracting more interest as the demand for improved healthcare services and sophisticated treatment options keeps increasing. With a rise in chronic diseases, surgical interventions, and an ageing population, the requirement for effective wound care products will keep on rising. Hospitals, clinics, and home health facilities are putting more emphasis on solutions that have the ability to shorten recovery time, minimize infection risks, and enhance patient comfort. This trend is opening up opportunities for domestic and international firms that are making efforts to establish innovative dressings, devices, and therapies customized for local healthcare conditions.

Having major international players like B. Braun SE, Smith & Nephew PLC, Essity AB, Coloplast Ltd, ConvaTec Inc., and 3M Company also indicates the significance of the Chinese market in their global strategy. They are investing in partnerships and research to make their products meet local requirements while providing innovative wound healing solutions. Simultaneously, Jiangsu Guangyi Medical Dressing Co., Ltd., Nanjing 3H Medical Products Co., Ltd., and Winner Medical Co., Ltd. are creating a solid foundation by offering affordable and available products to all types of healthcare facilities. The perfect blend of global innovation and local flexibility is driving competition in significant dimensions.

Innovation will be at the forefront of the way that the market evolves in the next few years. Firms such as Mölnlycke Health Care AB, Medtronic PLC, Lohmann & Rauscher GmbH, and Johnson & Johnson (Ethicon) are already concentrating on sophisticated wound dressings, negative pressure wound therapy, and intelligent monitoring solutions that can monitor healing. These developments are not just focused on hospitals but home care as well, since patients increasingly seek convenient and less hospital-intensive treatment. Local companies are also rising to the challenge, developing cost-effective yet effective alternatives in response to the needs of rural and urban healthcare systems.

The expansion of the China wound care management market will not only be driven by technology but also by availability and consciousness. Although urban hospitals enjoy easy access to high-end products, rural healthcare professionals are generally plagued by both supply and affluence. With increasing consciousness of wound care amongst patients and physicians, there will be increased acceptability of newer therapies. This incremental but consistent advancement, underpinned by firms like Hartmann Group, Hollister Incorporated, Afimilk Ltd., DeLaval, Heliospectra AB, Lely Group, and Valmont Industries, will define a market that is equitable in terms of meeting sophisticated innovation as well as pragmatic solution imperatives to a great and multicultural population.

China Wound Care Management Market Key Segments:

By Type

- Advanced Wound Dressings

- Traditional Wound Care Products

- Wound Closure Devices

- Wound Therapy Devices

By Product

- Foam Dressings

- Hydrocolloid Dressings

- Film Dressings

- Alginate Dressings

- Hydrogel Dressings

- Collagen Dressings

- Others

By Sales Channel

- Direct Tenders

- Retail Pharmacies

- Online Platforms

By End Users

- Hospitals

- Specialty Clinics

- Home Healthcare

- Ambulatory Surgical Centers

Key China Wound Care Management Industry Players

- B. Braun SE

- Smith & Nephew PLC

- Essity AB

- Coloplast Ltd

- ConvaTec Inc.

- Hartmann Group

- Hollister Incorporated

- Johnson & Johnson (Ethicon)

- Lohmann & Rauscher GmbH

- Medtronic PLC

- Mölnlycke Health Care AB

- Jiangsu Guangyi Medical Dressing Co., Ltd

- Nanjing 3H Medical Products Co., Ltd.

- Winner Medical Co., Ltd.

- 3M Company

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252