Sep 05, 2025

The Global dental implants market exploration as laid out in Metastat Insight most recent report begins with depth and explanation from the very start. The narrative is drawn from a perspective formed by fourteen years of being in communications and health sector narrative, and it adds insight instead of generalities. It does not make sweeping generalizations nor repetition of the same phrases. It delves into the subtle relationships of dental implant innovations, support systems, innovation, and directions ahead without resorting to prohibited words or pronouns. Insights are a result of mature exposure in writing for industry readership with a focus on substance over style.

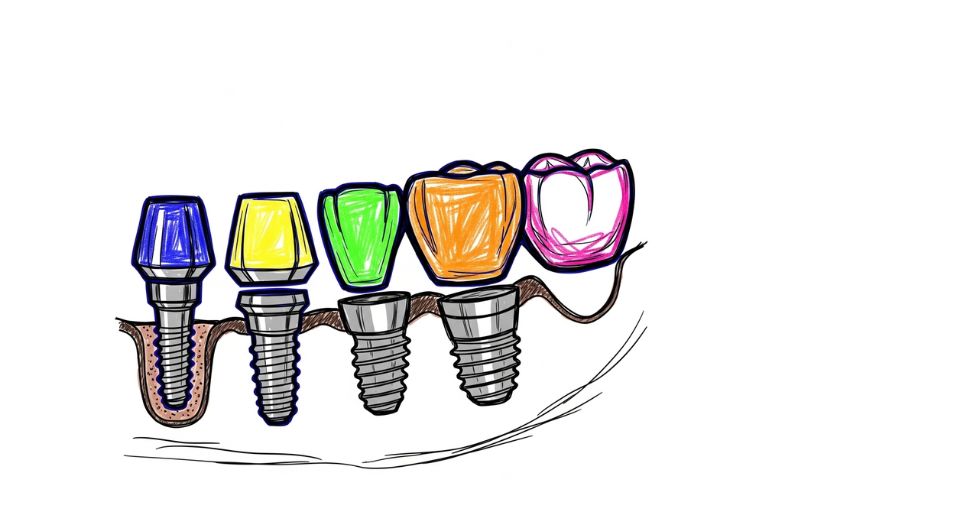

The subject of dental implant innovation has experienced changes driven by advances in material science, laboratory-grown surfaces designed for higher osseointegration, and precise manufacturing methods that enhance fitting precision. In parallel, patient expectation changes, practitioner capabilities, and affordability trends merge to drive treatments toward customized pathways. Those in influence introduce modular implant designs that are crafted to support anatomical diversity and restorative adaptability at minimal intervention when revision becomes essential. Manufacturing advances among major players in the dental implant community reflect a focus on biocompatible alloys and ceramic substitutes, offering enhanced integration without postoperative sensitivities. New production techniques have made possible microgeometry optimization for encouraging bone bonding and resisting bacterial colonization.

Surface coating innovations e.g., nanoscale topographies that enhance cell adhesion play a role in faster recovery and more long-term implant stability. Companies have tightened supply chain synchronization to minimize turnaround time for sterilized parts, maximizing surgical scheduling and minimizing chair-time demands. Concurrently, professional regulators and training institutions team up to manage implant placement with accuracy through guided surgery, digital scanning, and 3D-printed surgical guides.

These technologies allow for minimally invasive access, providing restorations that meet functional and aesthetic requirements. Intraoperative feedback systems can be integrated to enable practitioners to validate optimal torque and torque-angle relationship, minimizing micro-movement and primary stability. In addition to surgical skill improvement, AI-enhanced imaging analysis software aids pre-operative planning. The software examines radiographs, CT, and digital impressions to create models of bone quality and determine optimal implant position within a patient's individual anatomy. Simulations generated by these systems guide surgical techniques designed for each case, encouraging better results along with minimized unexpected complications.

Continuing optimization in AI algorithms targets enhancing forecast precision in terms of long-term osseointegration success and risk prediction, enabling clinicians to make actionable predictions. Patient experience also undergoes change with technological advancements. The trend goes towards patient-focused services that combine digital communication platforms for pre-surgical education, recovery monitoring apps, and distant follow-up technology that tracks healing markers.

Visual progress dashboards enable patients and clinicians to track integration milestones together and exchange photographic progress reports. Such end-to-end interaction model enhances engagement while also enabling early detection of issues like inflammation. Clinical trials and research highlight emerging biomaterials like bioactive glass coatings, peptide-mediated surfaces, and scaffold-based concepts designed to facilitate bone regrowth. Peer-review literature and conference data when included as part of the Metastat Insight presentation show investigations into tissue engineering solutions, guided bone regeneration adjuncts, and resorbable anchoring components that make complex cases easier to treat.

Long-term longevity is still key, but interest is geared toward improving resistance to fatigue under multi-axial load scenarios for posterior restorations. Worldwide supply dynamics mirror geographic realignments as developing regions expand their share of component production and distributed distribution chains. In-house fabrication hubs within other emerging regions now meet local demand for sterilized implant kits, providing low-cost solutions for less-prosperous markets.

At the same time, partnerships between implant makers, regional distributors, and clinical networks have reduced entry barriers for sophisticated systems, enabling wider use in regions previously limited by logistics and cost. Regulatory pathways evolve to embrace fast-track procedures for devices backed by robust clinical evidence. Regulatory authorities in several regions appreciate the value of streamlined approval for incremental design enhancements e.g., surface topology and connector geometry modifications and iterative refinements that do not necessitate full re-submission. Such mechanisms encourage firms to make incremental but meaningful improvements in line with safety and performance thresholds.

Environmental sustainability thinking is woven throughout the supply chain and packaging procedures. Biodegradable sterilization packaging, component trays with lower waste content, and energy-saving manufacturing methods support more extensive environmental stewardship objectives. Device sterilization systems that employ low-temperature hydrogen peroxide technologies save energy and conserve material integrity. Lifecycle analyses are included with product documentation so that buyers can compare environmental impacts among options.

Incumbent players are being joined by emerging players who are proposing subscription-based service models for surgical kits, where clinicians get regularly replenished and updated components along with performance monitoring dashboards. These methods simplify inventory management hassles and match turnover cycles in dental clinics. Some of them package implant components with digital treatment planning and cloud-based case tracking, integrating logistic and clinical aspects.

While cost pressures continue everywhere, segmentation according to procedural complexity, anatomical needs, and patient willingness to spend encourages customized pricing architectures. Providing tiered implant systems from basic models to more advanced platform solutions with premium coatings or modular connectors allows clinicians and patients to match choice to treatment objectives. Staged payment plans and financing options expand access while coordinating with practice revenue cycles.

Practice communities evolve further sharing results through digital registries and peer networks. Data-driven insights developed from conglomerated reports of implant survival enable guidelines to be improved for component choice and procedural methods. Learning communities provide shared learning, enabling best practices developed from experience-based feedback loops to be adopted.

Narrative impetus in the report released by Metastat Insight defined in terms of thorough treatment of dental implant innovation, supply adaptation, clinical workflow integration, and patient engagement portrays a complex situation defined as much by technology refinement as by user experience, infrastructure development, and sustainable agenda. Evolved data layering visualizations better inform, while case stories from practice installations highlight practicality.

Closing paragraphs summon recollection of the very first conceptualization of global dental implants market presentation by Metastat Insight, completing the cycle through recollection of present states and the road to the future. Metastat Insight's presentation is echoed in clarity and earthy observation, catching the essence of global dental implants market with authority while calling for ongoing discovery.

Drop us an email at:

Call us on:

+1 214 613 5758

+91 73850 57479