MARKET OVERVIEW

In chemical engineering, the Global Chemical Process Simulation Software Market stands as a technological cornerstone, facilitating innovation and efficiency in the design and optimization of complex industrial processes. This specialized market caters to the distinctive needs of the chemical industry by providing advanced simulation tools that empower engineers to model and analyze intricate chemical processes with precision.

The Global Chemical Process Simulation Software Market serves as a nexus for cutting-edge technology, where software solutions are tailored to meet the unique challenges posed by chemical process engineering. These tools play a pivotal role in the development and refinement of processes, allowing engineers to simulate various scenarios, assess potential outcomes, and optimize operations in a virtual environment before implementation.

One of the primary applications of chemical process simulation software is in enhancing the safety and reliability of industrial processes. Engineers can simulate hazardous scenarios, assess potential risks, and devise effective safety measures, contributing to the overall risk management strategy of chemical plants. This not only safeguards personnel and assets but also ensures compliance with stringent industry regulations and standards.

Moreover, the Global Chemical Process Simulation Software Market fosters innovation by providing a platform for the exploration of novel process designs and technologies. Engineers can experiment with different parameters, evaluate their impact, and identify optimal conditions for enhanced productivity and resource utilization. This capability is instrumental in accelerating the research and development efforts within the chemical industry.

The market's significance extends to the realm of sustainability, where it plays a crucial role in minimizing the environmental impact of chemical processes. Through advanced simulation, engineers can analyze and optimize resource consumption, energy efficiency, and waste generation, contributing to the industry's broader goals of eco-friendly and sustainable practices.

Furthermore, the Global Chemical Process Simulation Software Market is instrumental in reducing time-to-market for new products and processes. By enabling engineers to quickly iterate through design variations and assess their viability, the software expedites the innovation cycle, allowing companies to stay competitive in a fast-paced industry.

The Global Chemical Process Simulation Software Market emerges as a vital component in the arsenal of tools available to chemical engineers. Its role in enhancing safety, fostering innovation, promoting sustainability, and expediting the development of new processes positions it as a cornerstone in the ever-evolving landscape of chemical engineering. As industries continue to rely on advanced technologies for efficiency and competitiveness, the significance of the Global Chemical Process Simulation Software Market is poised to grow, shaping the future of chemical process engineering.

Global Chemical Process Simulation Software market is estimated to reach $1534.8 Million by 2030; growing at a CAGR of 7.8% from 2023 to 2030.

GROWTH FACTORS

The Global Chemical Process Simulation Software Market is propelled by various growth factors that contribute to its expansion. One key driver is the increasing demand for enhanced operational efficiency in chemical processes. This software enables simulation and analysis, aiding in the optimization of processes, thereby enhancing overall efficiency. The emphasis on achieving cost-effectiveness and sustainability in chemical manufacturing further fuels the market's growth.

Additionally, the growing adoption of digitalization and automation in the chemical industry serves as another significant driving factor. As industries globally embrace digital transformation, the need for advanced simulation tools becomes paramount. Chemical process simulation software aligns with this trend, offering tools for modeling and analyzing processes in a digital environment.

While these factors drive market growth, challenges persist. Issues related to the complexity of integrating simulation software into existing systems can hinder the seamless adoption of these solutions. The learning curve associated with implementing such technologies may pose initial obstacles for industries aiming to incorporate them into their processes.

Moreover, concerns about data security and privacy represent another potential hurdle. As chemical process simulation involves handling sensitive and proprietary data, ensuring robust security measures becomes imperative. The reluctance to entrust critical information to digital platforms might impede the widespread adoption of simulation software.

Despite these challenges, the market holds promise, with emerging opportunities on the horizon. The continuous evolution of Industry 4.0 and the Internet of Things (IoT) presents a fertile ground for the growth of chemical process simulation software. Integrating these technologies with simulation tools opens avenues for smarter, more connected manufacturing processes.

The Global Chemical Process Simulation Software Market experiences robust growth driven by the increasing need for operational efficiency and the broader trend of digitalization in the chemical industry. While challenges related to integration complexity and data security exist, the potential for lucrative opportunities, especially through the convergence of simulation software with Industry 4.0 and IoT, paints a promising picture for the market's future.

MARKET SEGMENTATION

By Type

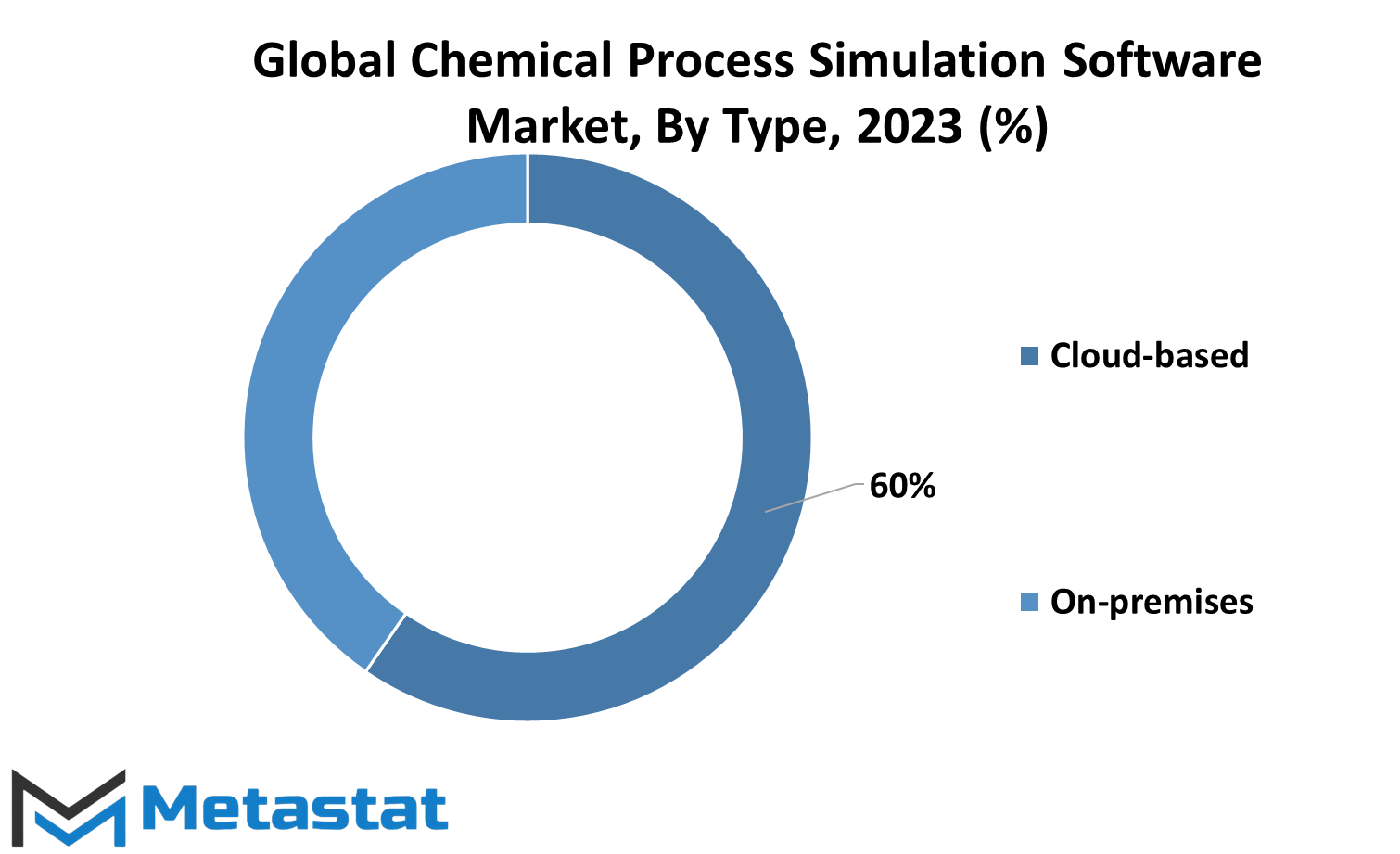

The Global Chemical Process Simulation Software Market, in its diverse landscape, is characterized by various types of software catering to the needs of the industry. One significant segmentation lies in the distinction between Cloud-based and On-premises solutions.

The Cloud-based option offers a flexible and scalable approach, leveraging the power of cloud computing to provide simulation capabilities. This allows for accessibility from anywhere, facilitating collaboration and ease of use. Users can harness the software's potential without the constraints of physical location or extensive hardware requirements.

On the other hand, On-premises solutions involve installing and running the software on local servers and computers. This traditional approach provides users with a certain level of control and security over their data and the software itself. It suits industries with specific privacy or regulatory concerns, where keeping data in-house is a priority.

Each type of software meets distinct needs, reflecting the varied preferences and requirements of users in the chemical processing domain. The Cloud-based option embraces flexibility and accessibility, while the On-premises solution emphasizes control and security. In essence, this segmentation ensures that the Global Chemical Process Simulation Software Market caters to a wide spectrum of user preferences, allowing industries to choose the type that aligns best with their operational priorities.

By Application

The Global Chemical Process Simulation Software Market unfolds with distinct applications, with a focus on meeting the needs of different business sizes. It’s a versatile landscape, and two primary categories shape its dynamics.

Large Enterprises, a substantial player in this market, boasted a valuation of 509.6 USD Million in 2022. These industry giants leverage chemical process simulation software to streamline complex operations, optimize efficiency, and ensure seamless workflows. The application of such software in large enterprises resonates with their extensive and intricate processes, aiming for enhanced productivity.

On the other side of the spectrum, we have SMEs, a segment that carved its niche with a value of 275.7 USD Million in 2022. Small and Medium-sized Enterprises, while not as massive as their larger counterparts, find immense value in chemical process simulation software. For them, this technology acts as a catalyst for efficiency, helping them compete in dynamic markets by refining their processes and decision-making.

The significance of this segmentation lies in its reflection of the adaptability of chemical process simulation software. It caters to the diverse needs of both large enterprises and smaller players in the business landscape. While large enterprises seek optimization in their intricate operations, SMEs utilize the software to enhance their agility and competitiveness.

The Global Chemical Process Simulation Software Market is not a uniform entity but a dynamic ecosystem catering to different business sizes. Whether it's streamlining operations in a large corporation or empowering agility in a small business, the applications of this software resonate across the business spectrum, showcasing its relevance and impact in diverse operational landscapes.

REGIONAL ANALYSIS

The global Chemical Process Simulation Software market undergoes regional analysis to discern its geographical distribution. This examination unveils distinct market trends and dynamics across various regions. Two significant players in this geographical spectrum are North America and Europe.

North America, a key participant, brings substantial influence to the Chemical Process Simulation Software market. Its technologically advanced landscape and robust industrial infrastructure contribute significantly to the demand for simulation software. The region's proactive approach towards adopting innovative technologies further propels the market, making it a noteworthy player in the global scenario.

Similarly, Europe plays a pivotal role in shaping the landscape of the Chemical Process Simulation Software market. With a well-established industrial base and a focus on sustainability, European industries exhibit a growing reliance on simulation software for optimizing their chemical processes. This regional market's emphasis on eco-friendly practices aligns with the broader global trend, fostering the adoption of simulation tools for enhanced efficiency and reduced environmental impact.

Together, North America and Europe form integral segments of the global Chemical Process Simulation Software market, each contributing to its vibrancy and growth. Their distinct industrial landscapes and technological inclinations shape the demand for simulation software, reflecting the dynamic nature of the market on a regional scale.

COMPETITIVE PLAYERS

The Global Chemical Process Simulation Software Market is a dynamic landscape where key players are instrumental in shaping the industry's trajectory. Among these players, Fives ProSim and Aspen Technology Inc. stand out, contributing significantly to the advancements in chemical process simulation.

Fives ProSim, as a key player, brings expertise and innovation to the forefront of the Chemical Process Simulation Software Market. The company's commitment to excellence is reflected in its contributions to enhancing simulation capabilities, providing tools that empower chemical engineers and professionals in optimizing processes and achieving operational efficiency.

Similarly, Aspen Technology Inc. plays a crucial role in driving advancements within the industry. With a focus on cutting-edge solutions, Aspen Technology Inc. leverages its technological prowess to deliver simulation software that caters to the evolving needs of the chemical process sector. Their contributions extend beyond mere software provision, encompassing a commitment to pushing the boundaries of what is achievable in process simulation.

These key players not only provide essential software solutions but also serve as industry influencers. Their active involvement and contributions in research and development have a ripple effect, influencing the standards and practices adopted by professionals in the field. The impact of these players is not confined to their products alone; it extends to shaping the overall landscape of chemical process simulation.

In the Global Chemical Process Simulation Software Market, Fives ProSim and Aspen Technology Inc. are more than entities delivering software solutions—they are catalysts for progress and innovation. Their roles go beyond market competition; they actively contribute to the evolution of simulation technologies, playing a vital part in defining the benchmarks for efficiency, accuracy, and adaptability within the chemical process industry.

As the industry continues to advance, the contributions of key players like Fives ProSim and Aspen Technology Inc. become increasingly pivotal. Their commitment to pushing the boundaries of what is achievable in process simulation sets the tone for the entire sector, influencing how professionals approach challenges and opportunities in this dynamic and crucial field.

Chemical Process Simulation Software Market Key Segments:

By Type

- Cloud-based

- On-premises

By Application

- Large Enterprises

- SMEs

Key Global Chemical Process Simulation Software Industry Players

- Fives ProSim

- Aspen Technology Inc

- Chemstations Inc.

- Siemens AG (Culgi)

- Futurism Technologies, Inc.

- ANSYS, Inc

- Schneider Electric

- PSEforSpeed

- WinSim Inc.

- Schlumberger Technology (VMG)

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383