Global Cardiac Output Monitoring Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

How will rising innovations reshape the accuracy and accessibility of cardiac output monitoring as healthcare systems call for faster, more precise choice-making? Can evolving scientific wishes push the enterprise closer to answers that stability advanced era with affordability, particularly in areas wherein cardiac care stays uneven? As digital health keeps enlarging, will the integration of smarter, related tracking equipment redefine how clinicians interpret and reply to cardiovascular dangers?

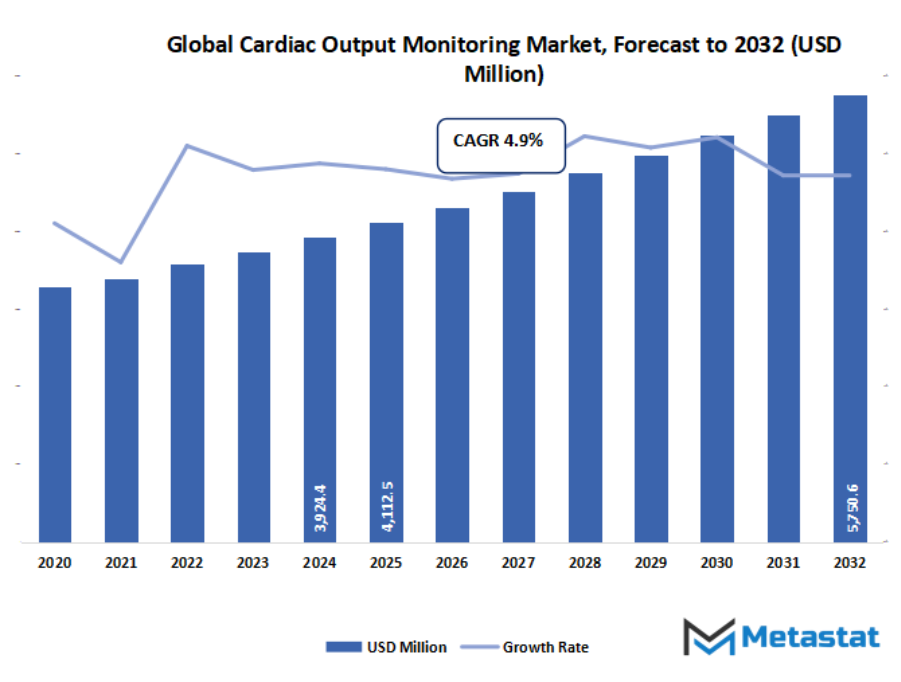

- The global cardiac output monitoring market valued at approximately USD 4112.5 million in 2025, growing at a CAGR of around 4.9% through 2032, with potential to exceed USD 5750.6 million.

- Invasive account for nearly 60.6% market revenues, driving innovation and expanding applications through intense research.

- Key trends driving growth: Growing number of high-risk surgeries and critically ill patients., Rising prevalence of heart failure and cardiovascular diseases.

- Opportunities include Integration with hemodynamic platforms for personalized, goal-directed therapy.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

The global cardiac output monitoring market and its industry will keep moving into a space where observation of patients will no longer be confined to traditional equipment or controlled hospital settings but will stretch toward a future shaped by deeper clinical understanding and the need for accuracy far beyond data collection. While healthcare systems will seek to respond more quickly and intelligently, this market will gradually shift its focus toward tools that connect physiological signals with meaningful decisions, enabling practitioners to anticipate complications rather than react to them.

In the years to come, this industry will not be viewed simply as a category of medical devices but as an ecosystem that will shape how treatment pathways are set up in hospitals. Technologies emerging out of it will seek to capture subtle cardiovascular changes previously overlooked and foster a more proactive style of care. It will inspire new types of collaboration among clinicians, engineers, and data specialists, each adding a layer of depth to a process that is going to prioritize clarity over volume.

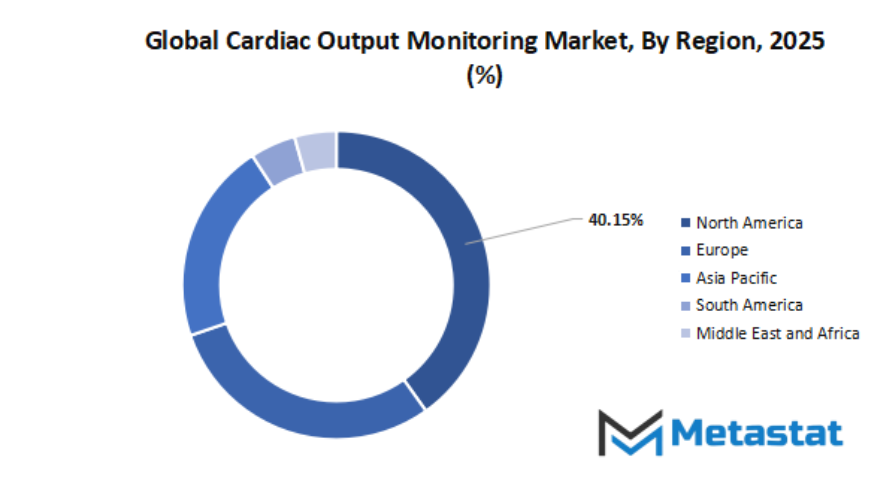

Geographic Dynamics

Based on geography, the global cardiac output monitoring market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

Market Segmentation Analysis

The global cardiac output monitoring market is mainly classified based on Product Type, End User.

By Product Type is further segmented into:

- Invasive

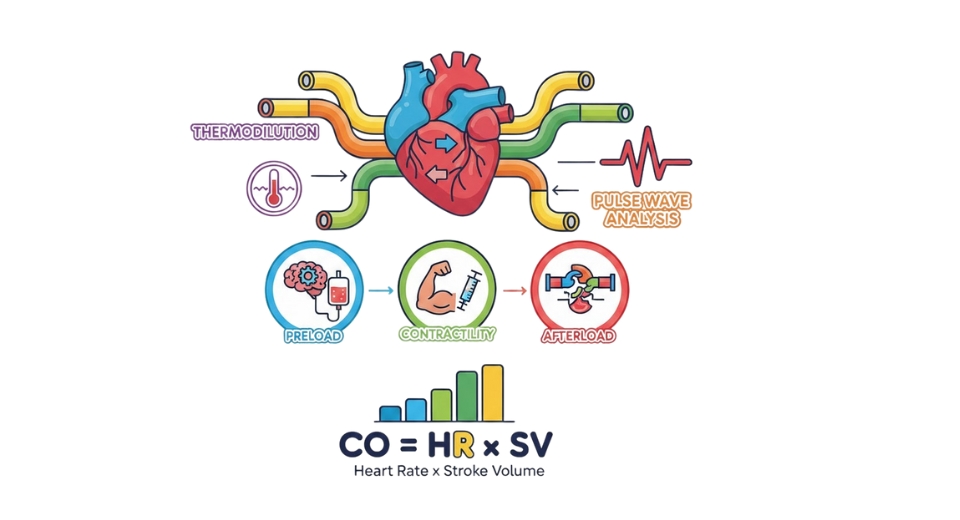

The global cardiac output monitoring market will see steady attention toward invasive methods as healthcare setups continue to trust direct measurement for accurate cardiac assessment. Invasive systems will maintain importance due to their ability to offer consistent data during critical procedures, shaping future clinical decisions with more precise monitoring methods that support improved patient outcomes.

- Non-invasive

The global cardiac output monitoring market will further advance with the wider diffusion of non-invasive devices for safer and quicker cardiac evaluations. The rising preference for comfort-oriented monitoring in the future will guide innovations toward encouraging systems that reduce patient risk while still supporting reliable tracking of cardiac functions in various medical settings independent of surgical entry.

By End User the market is divided into:

- Hospitals

The global cardiac output monitoring market will retain to assist infrastructures in hospitals as the demand for accurate cardiovascular tracking, both in emergencies and throughout long-time period care, increases. The want to make sure dependable insights that enhance treatment planning and assist professionals take care of complicated cardiac situations with greater self assurance will preserve to make gadget that lets in designated tracking a priority in hospital environments.

- Ambulatory Surgical Centers

The global cardiac output monitoring market will influence ambulatory surgical centers, driving them toward compact, efficient monitoring tools adapted for short-duration procedures. Facilities depend on systems designed for mobility, speed, and minimal preparation that help teams maintain smooth workflows while still achieving dependable cardiac assessments during outpatient care.

- Clinics

The global cardiac output monitoring market will guide clinics toward accessible monitoring options that support routine cardiovascular evaluations. Clinical setups are looking for devices with quick setup and clear readings, allowing early detection of heart-related issues and, by extension, timely intervention that fortifies long-term patient management within regular healthcare visits.

- Others

The global cardiac output monitoring market will expand into other healthcare settings, where flexibility in monitoring is necessary. Increasing adoption in rehabilitation centers, emergency units, and specialty care will drive the use of flexible equipment that can suit different medical routines and allow for uninterrupted access to critical cardiac information outside the walls of a hospital or clinic.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$4112.5 Million |

|

Market Size by 2032 |

$5750.6 Million |

|

Growth Rate from 2025 to 2032 |

4.9% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

Competitive Landscape & Strategic Insights

Characterized by a broad mix of large, established international manufacturers and smaller participants who are steadily growing their market presence, this creates a dynamic mix that will continue to affect the nature of industry growth. As hospitals and clinicians seek tools that help them understand heart performance with greater accuracy and facility, this mix will continue to shape the nature of industry growth. Companies in this space are moving steadily toward technology that will provide quicker readings, smoother workflows, and systems that fit naturally into the modern healthcare setting and will support the market's future direction.

Major players updating this progress include companies like Koninklijke Philips N.V., Abbott, Baxter, Edwards Lifesciences Corporation, ICU Medical, Masimo, Osypka Medical, TRIHEALTH, GE HealthCare, Medtronic, Retia Medical Systems, Inc, Boston Scientific Corporation, Nihon Kohden Corporation, Medizinische Messtechnik GmbH, Caretaker, and Biotronik. With years of experience and a strong presence in the global market, they are able to launch devices that most healthcare teams rely on. The listed companies will further work on perfecting their monitoring solutions to make them as reliable, minimally invasive, and caregiver-friendly as possible across various medical environments.

Meanwhile, the emergence of regional manufacturers will be a significant factor contributing to this competition. Their emergence promotes novelty, affordability, and technologies addressing local needs. The presence of both established players and regional players will keep the market dynamic as different health systems worldwide seek novel ways through which cardiac output could be monitored more effectively. As more countries invest in better care in hospitals, the market will move naturally toward devices that offer stronger accuracy, while the comfort of patients is never compromised.

As technology marches on, the market is bound to witness systems that work at faster speeds and connect seamlessly with digital records. The presence of such strong participants fosters steady improvements, making the ecosystem more supportive for healthcare professionals who need reliable tools. This combination of leadership by global names and energy from growing regional firms will continue to influence cardiac output monitoring's path forward in the coming years, enabling hospital care to be delivered in a manner that is both responsive and knowledgeable.

Market Risks & Opportunities

Restraints & Challenges:

High cost and invasiveness of the gold-standard monitoring systems.

Many high-end cardiac output analysis tools rely on procedures that require sophisticated equipment, specially trained staff, and stringent clinical environments. These demands will put financial burdens on healthcare units looking to increase monitoring capabilities. Consequently, the future boom of the global cardiac output monitoring market will see slower adoption in price-touchy regions.

Limited accuracy and adoption of much less-invasive opportunity technology.

While many of those less-invasive alternatives nevertheless cannot fit the consistency predicted in vital care, constrained precision will create hesitation amongst hospitals in pursuit of dependable records for high-danger decisions. This hesitance will mirror in adoption styles inside the global cardiac output monitoring market and could gradual transition towards simplified monitoring pathways.

Opportunities:

Integration with hemodynamic structures for personalised, aim-directed remedy.

Advancing structures will connect cardiac output gear with broader hemodynamic systems, allowing clinicians to make remedy choices based on continuous, unified data. Such integration will aid tailored remedy strategies and increase clinical self belief, strengthening the long-term outlook for the global cardiac output monitoring market through smarter, connected care solutions.

Forecast & Future Outlook

- Short-Term (1-2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3-5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6-10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 4112.5 million in 2025 to over USD 5750.6 million by 2032. Cardiac Output Monitoring will maintain dominance but face growing competition from emerging formats.

Beyond what it currently touches, the market will create innovations to support remote evaluations, personalized care models, and seamless coordination across departments handling critical cases. This shift will enable professionals to integrate cardiac readings with other general health indicators, thereby transforming them from mere numbers into actionable insights. As this transition unfolds, the market is bound to influence the training standards, treatment philosophies, and diagnostic expectations in ways that will really redefine what modern cardiovascular management will look like.

Report Coverage

This research report categorizes the global cardiac output monitoring market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global cardiac output monitoring market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global cardiac output monitoring market.

Cardiac Output Monitoring Market Key Segments:

By Product Type

- Invasive

- Non-invasive

By End User

- Hospitals

- Ambulatory Surgical Centers

- Clinics

- Others

Key Global Cardiac Output Monitoring Industry Players

- Koninklijke Philips N.V

- Abbott

- Baxter

- Edwards Lifesciences Corporation

- ICU Medical

- Masimo

- Osypka Medical

- TRIHEALTH

- GE HealthCare

- Medtronic

- Retia Medical Systems, Inc

- Boston Scientific Corporation

- Nihon Kohden Corporation

- Medizinische Messtechnik GmbH

- Caretaker

- Biotronik

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252