MARKET OVERVIEW

The global carbon credit market is illustrated with subtlety and depth, providing readers with a window into the forces influencing its modern landscape. Instead of reprising familiar ideas, this effort elegantly deconstructs the strategic currents at work in different parts of the world and markets. The global carbon credit market has moved much further on from its previous bases, into an age of change influenced by policy evolution, corporate re-evaluation, and the growing impact of cross-border carbon tactics. Perhaps one of the less overt changes in recent years has been that of diversification of engagement.

Where previously dominated by major industrial economies, recent trends have signaled increasing participation by developing nations. This development is not the result of externally imposed regulatory systems only, but a convergence of economic need, reputational calculation, and environmental pragmatism. Nations aiming for national growth while being environmentally conscious are increasingly finding themselves at this financial-environmental nexus, with localised sensibilities and creative blueprints for credit creation and assurance. On the corporate front, the market is no longer a passive compliance duty. Rather, it is being integrated into wider corporate planning, frequently tied to long-term sustainability narratives that merge financial returns with branding and investor confidence.

Sophistication around transactions has also increased; it is no longer merely a matter of buying credits and ticking the box. There is increasing demand for traceability, third-party verification, and verifiable community benefit, making each credit part of a larger story narrative. The Metastat Insight report reflects this change not only in tone but also in structural commentary. It alludes to the tacit evolution of methods, the legal reinterpretations playing out by jurisdiction, and the economic dynamic between voluntary and compliance-driven segments. These currents are altering perceptions regarding carbon offsetting, not so much as a balancing exercise, but as an asset class in its own right—liable to speculation, hedging, and portfolio diversification tactics. Market access, while ostensibly worldwide, is still unbalanced. Although new technological instruments such as blockchain have brought more transparency and automation, barriers to entry continue to exist, especially for small credit originators.

The cost of certification, the burden of registration, and the need for internationally recognized accreditation frequently keep out participants who could otherwise contribute meaningful offsets. This has, in several senses, opened the way for intermediary organizations, consultants, and technological platforms to thrive, offering to fill these gaps for a fee. Their emergence is both symptom and reinforcement of the structural nuance woven throughout the market. Financial institutions, for their part, are gaining new purpose here. Some are securitizing carbon assets into sellable products, while others are financing offset projects as part of ESG-compliant lending standards.

The marriage of finance and environmental responsibility is transforming the global carbon credit market into something greater than a reaction tool; it is evolving into a place where speculation and mitigation meet, where investment and impact converge, and where numbers often come before significance. One of the more subtle trends is the unobtrusive re-pivot of baselines. As the scientific underpinning of carbon sequestration becomes more refined, and as satellite surveillance becomes increasingly widespread, the standards regarding what makes for a respectable offset are being rewritten.

This is triggering revaluation of legacy credits, calling into question the validity of some vintage claims, and causing organizations to review their environmental portfolios through different eyes. The risk of reputation from dubious offsets is increasingly an issue, stimulating renewed attention on integrity and conformity with changing standards. There is a further emerging layer in the manner in which regional policy interactions are shaping flows. Whereas some jurisdictions are still reluctant to legislate in relation to carbon pricing mechanisms, others are putting in place frameworks that cause ripple effects outside of their territories. These choices, while frequently domestic in origin, have turned out international in impact, altering the patterns of supply and demand subtly yet fundamentally. This interplay highlights the interdependence at the center of the market, wherein no individual agent controls enough variables to be wholly independent.

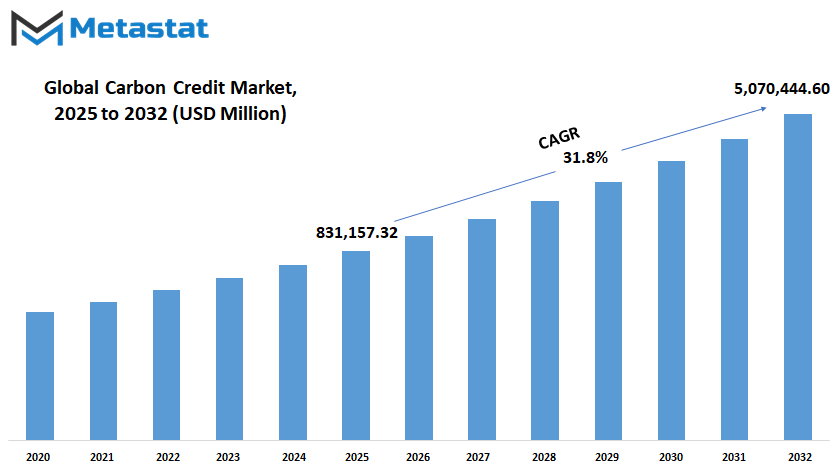

Global carbon credit market is estimated to reach $5,070,444.60 Million by 2032; growing at a CAGR of 31.8% from 2025 to 2032.

GROWTH FACTORS

The global carbon credit market is expected to grow steadily in the years ahead as more countries and companies focus on reducing carbon emissions. Governments are setting stricter environmental targets, and businesses are under increasing pressure to cut their carbon footprint. One major reason behind the growth is the rising awareness of climate change. People are becoming more conscious of their environmental impact, which leads to more support for cleaner solutions. As a result, the demand for carbon credits, which allow companies to offset emissions, is rising. Technological advancements in tracking and verifying emissions also support this growth. These innovations make it easier to measure and trade credits in a transparent way, giving more confidence to buyers and sellers. Another key driving factor is the growing participation of developing countries in carbon credit systems.

These countries are beginning to invest in renewable energy and sustainable farming practices, which can generate credits to be sold on the market. This not only brings income to these countries but also helps slow down the impact of pollution worldwide. Furthermore, large corporations are now including carbon credits in their sustainability plans, either to meet regulations or to appeal to environmentally conscious customers.

However, some issues might slow down the market’s progress. One challenge is the lack of common rules and standards across regions. Without clear and consistent guidelines, it becomes harder to ensure that carbon credits are trustworthy and not being misused. This uncertainty can make potential investors hesitant. In addition, the risk of fraudulent or poorly verified projects remains a concern. If buyers lose faith in the system, the market may struggle to grow as expected.

Still, there are promising signs for the future. The expansion of digital platforms and blockchain technology could help solve many of the current problems by improving the way credits are tracked and verified. With more reliable systems, buyers will feel more confident, and this will help push the market forward. Another promising area is the increased cooperation between governments and the private sector. As more partnerships are formed to tackle climate challenges, new opportunities will open up for the global carbon credit market.

Looking ahead, the global carbon credit market is likely to keep growing as part of global efforts to reduce carbon emissions. Although challenges exist, innovation and strong environmental goals will continue to drive the market, while new technologies and policies will help unlock further potential

MARKET SEGMENTATION

By Type

The global carbon credit market is steadily gaining importance as the world continues to focus more on addressing climate change. As countries and companies look for ways to meet emissions targets and environmental commitments, carbon credits offer a practical path forward. These credits work as a kind of tradeable permit that allows the holder to emit a specific amount of carbon dioxide. Over time, as the need to reduce emissions becomes more urgent, the demand for such credits is expected to grow significantly.

This market is divided into two key types: the Voluntary Carbon Market and the Compliance Carbon Market. The Voluntary Carbon Market allows businesses, organizations, or even individuals to buy credits on their own, without being required to by law. These buyers often want to support environmental projects, improve their public image, or show they are serious about sustainability. The Compliance Carbon Market, on the other hand, is driven by legal or policy-based requirements. In this part of the market, governments set limits on emissions, and companies that go over these limits must buy credits to cover the extra output. This system is usually more structured, with clear rules and regulations that companies must follow.

Looking ahead, the global carbon credit market will likely play a larger role in how both developed and developing countries manage their climate goals. As technologies improve, tracking and verifying carbon reductions will become easier and more reliable, which could build more trust in the market overall. Digital tools may also make it simpler for smaller businesses to take part, opening up more opportunities across different sectors.

Many experts believe that in the next decade, this market will not only grow in size but will also become a more standard part of business operations. Companies may start including carbon credits as a regular line item in their budgets, just like electricity or raw materials. Governments may also tighten rules, which could push more businesses into the Compliance Carbon Market. Meanwhile, the Voluntary Carbon Market may become more attractive as consumers begin favouring products from companies with cleaner footprints.

While the road ahead has its challenges, including the need for better regulation and more consistent standards, the global carbon credit market shows clear promise. It offers a way to link environmental goals with economic activity, encouraging responsible choices while still allowing room for growth. This balance between sustainability and business interests is what will help the market expand in meaningful ways.

By Project Type

The global carbon credit market is becoming a growing part of efforts to reduce the impact of climate change. As more countries and businesses begin to focus on reducing their carbon footprints, carbon credits are expected to play a much larger role in the future. A carbon credit allows one party to emit a certain amount of carbon dioxide while another party reduces or removes that amount from the atmosphere. This system will give companies a way to meet environmental goals without having to completely overhaul their operations. Looking ahead, the demand for carbon credits is expected to grow steadily, especially as governments and industries tighten emission limits.

By project type, the market is mainly divided into Avoidance/Reduction Projects and Removal/Sequestration Projects. Avoidance or reduction projects are designed to prevent carbon from being released in the first place. These include activities like switching from coal to renewable energy or improving energy efficiency in buildings. Removal or sequestration projects, on the other hand, focus on pulling carbon dioxide out of the atmosphere. This can be done through natural processes, such as planting trees, or with new technology that captures and stores carbon underground. As innovation continues, both types of projects will likely become more advanced, making them more reliable and widely used.

In the future, technology will help the market grow by making it easier to measure and verify carbon reductions. With better tracking tools, buyers will feel more confident that the credits they purchase are actually leading to real-world benefits. Digital platforms could also make it simpler to connect buyers and sellers from different parts of the world, helping the market become more open and fair. At the same time, stricter rules and clear standards will help build trust and ensure that credits represent actual climate progress.

There is also growing interest in linking carbon credits to other sustainability goals, like protecting wildlife or supporting local communities. Projects that offer extra benefits could attract more buyers and help the market expand in new directions. Over time, the global carbon credit market will not only support emission reductions but also help build a more balanced and responsible approach to development.

As the world continues to face climate challenges, this market will likely shift from being optional to essential. It will help bring together businesses, governments, and communities in a shared effort to reduce emissions and create a cleaner future.

By End-use

The global carbon credit market is becoming a more important part of how countries and companies plan for a cleaner future. It gives businesses a way to meet environmental targets by allowing them to buy and sell carbon credits. These credits represent the right to release a certain amount of carbon dioxide into the atmosphere. As more governments set stricter limits on emissions, this system will play a larger role in helping industries stay within those limits while still being able to grow.

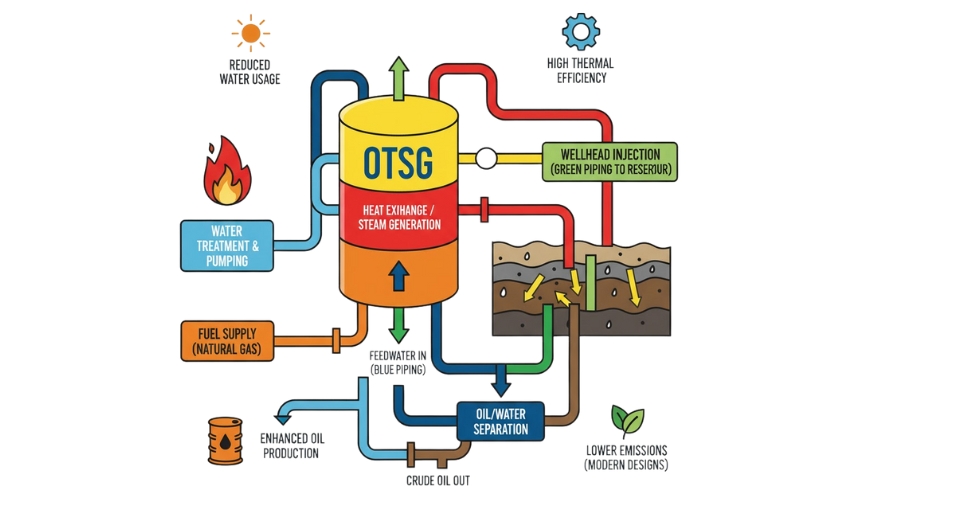

Looking ahead, the demand for carbon credits is likely to increase. More industries are expected to take part, especially those that are harder to make completely carbon-free. For example, the power and energy sectors have already started using carbon credits to balance their emissions while they switch to cleaner technologies. These sectors will continue to rely on this market as they work to lower their carbon footprint without hurting their ability to produce energy. Over time, improvements in renewable sources will lower the need for credits, but in the near future, the market will be a vital support.

The aviation and transportation sectors are also expected to see steady growth in their use of carbon credits. Planes and vehicles still depend heavily on fossil fuels, and while electric cars and biofuels are becoming more common, full replacement will take time. Until then, companies will use carbon credits to meet carbon reduction goals. As more people travel and the need for shipping goods grows, these industries will likely turn to the global carbon credit market to meet pressure from regulators and the public.

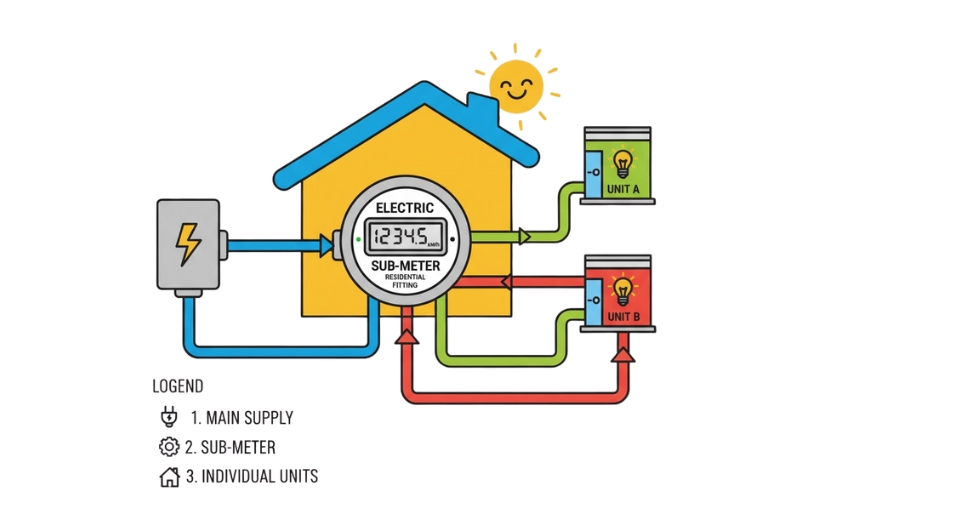

Buildings are another area where carbon credits will matter more in the coming years. As cities grow, the need for energy-efficient construction will rise. Developers and property owners might use carbon credits to offset the environmental impact of construction and operations. This will help them meet green building standards and attract environmentally conscious tenants.

Other sectors, including manufacturing and agriculture, will also play a role. Though their needs may vary, the common goal is to reduce total emissions while continuing to operate successfully. The global carbon credit market offers a flexible way to work toward that goal.

In the future, this market is likely to be shaped by new technologies, better tracking systems, and updated rules. As transparency improves, trust in the system will grow, encouraging more participation and helping the world move closer to climate goals.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$831,157.32 million |

|

Market Size by 2032 |

$5,070,444.60 Million |

|

Growth Rate from 2025 to 2032 |

31.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global carbon credit market is shaping up to be one of the most influential systems for addressing climate change, with its importance expected to grow significantly in the coming years. As the effects of pollution and greenhouse gas emissions continue to impact weather patterns, public health, and ecosystems, the need for practical and sustainable solutions becomes more urgent. One such approach is the carbon credit system, which allows countries and companies to offset their emissions by supporting environmental projects that reduce or absorb carbon dioxide. This approach not only promotes accountability but also encourages investment in cleaner technologies and greener practices.

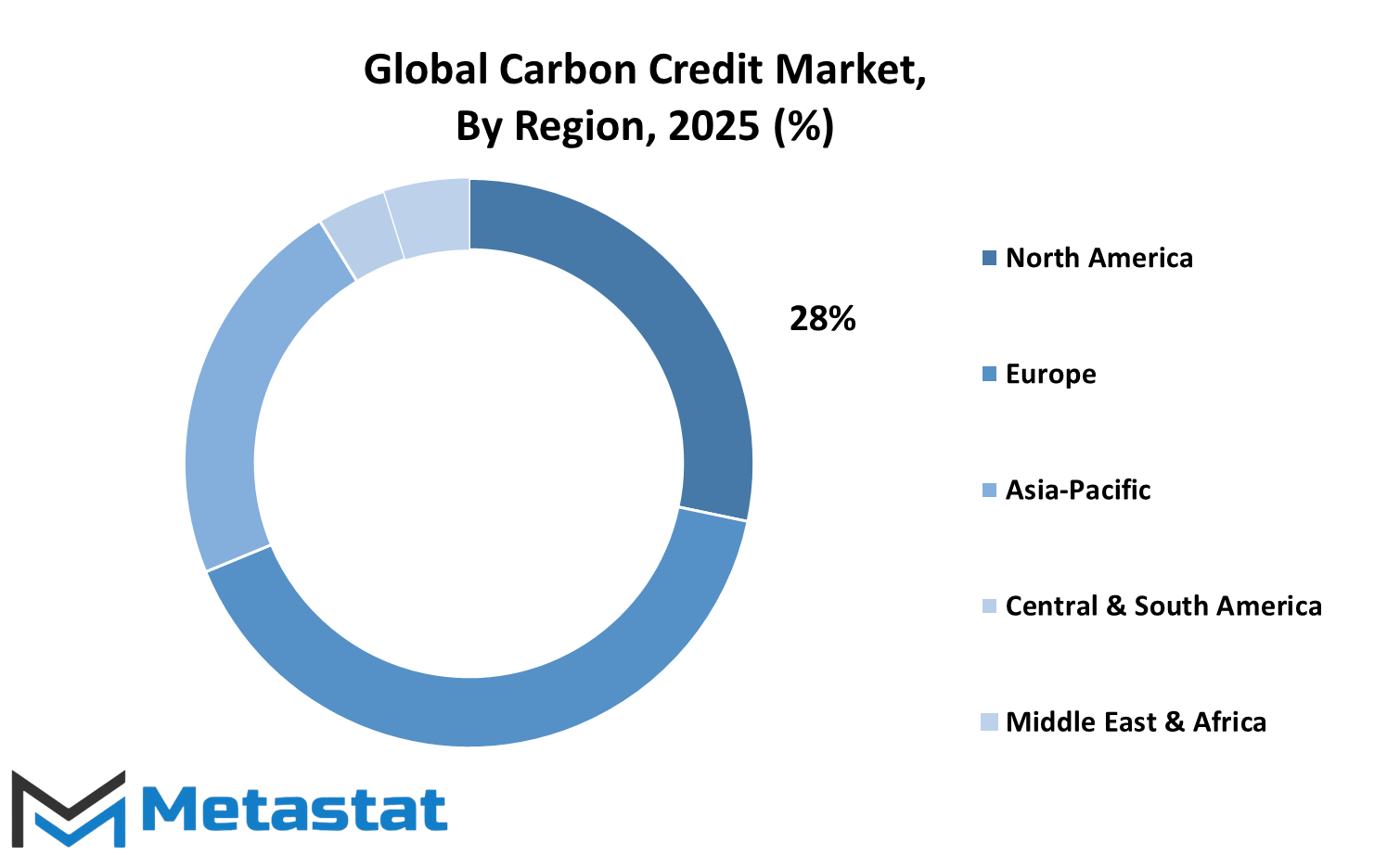

Geographically, the global carbon credit market is split into several key regions, each playing a unique role. North America is an active participant, with the United States, Canada, and Mexico all taking steps to either regulate emissions or engage in voluntary credit programs. The U.S. leads in technological innovation, which is expected to strengthen the market in the future. In Europe, countries like the UK, Germany, France, and Italy have set strict environmental goals and often lead in carbon credit adoption. Their early participation in climate agreements has pushed the market forward, and future developments will likely include broader partnerships and stricter emission targets.

Asia-Pacific holds significant potential due to its large industrial base and rapid growth. Countries such as China and India are both major emitters and key players in climate negotiations. As they continue to industrialize, the pressure to cut emissions will rise. Japan and South Korea are focusing on clean energy technologies, and this push will likely increase demand for carbon credits. The rest of the Asia-Pacific region may follow as infrastructure develops and environmental awareness increases.

South America, led by Brazil and Argentina, has a valuable role in forest conservation and biodiversity. Protecting rainforests and reforestation projects make this region vital to the future of carbon offsets. These efforts are expected to grow as international funding and support become more accessible. In the Middle East and Africa, countries like the UAE, Egypt, and South Africa are beginning to recognize the value of carbon trading. With many of them investing in renewable energy, the market is likely to expand steadily across these areas.

As environmental regulations tighten worldwide, the global carbon credit market will not only encourage greener business practices but also shape how nations cooperate on climate goals. It offers a path that balances economic growth with environmental care, which will be crucial for future generations.

COMPETITIVE PLAYERS

The global carbon credit market is expected to play a major role in the future of climate action. As more countries and companies commit to reducing emissions, this market will continue to grow in both importance and value. A carbon credit allows organizations to offset their emissions by supporting projects that reduce or remove greenhouse gases from the atmosphere. These credits have become a tool for businesses to meet environmental goals while also investing in cleaner, more sustainable practices. Over time, the market has shifted from being a secondary consideration to a central part of many corporate sustainability strategies.

Looking ahead, the global carbon credit market will likely become more structured and transparent. As environmental concerns rise, regulations will push industries to either reduce emissions directly or invest in offsets that meet strict standards. This demand is already influencing the way businesses operate. With carbon accounting becoming more precise, the pressure to verify and track credits properly is increasing. Buyers are now looking for high-quality credits that show clear environmental benefits. This shift will bring new expectations to those who issue and trade credits.

Several major players are helping shape the direction of this market. Companies such as South Pole, Verra, Gold Standard, and Climate Impact X are involved in setting standards, measuring impact, and creating trust in the system. Platforms like AirCarbon Exchange and Carbon Trade Exchange make trading easier, while others such as Indigo Ag and ClimatePartner focus on linking agriculture and business with emissions reductions. ClearSky Climate Solutions and Sylvera are helping buyers understand the value and risks of different credits. Meanwhile, Anew Climate, Terrapass, and Finite Carbon support various offset projects from forest conservation to renewable energy. Groups like Carbon Credit Capital and 3Degrees work closely with businesses to develop offset strategies that match their long-term goals. EKI Energy Services Ltd. and South Pole Group have expanded global operations, making these tools more available across borders.

In the future, more companies will likely enter this space, bringing technology and innovation that improves how credits are created and tracked. Artificial intelligence, satellite monitoring, and better data collection will give this market more credibility. As awareness of climate change continues to grow, the global carbon credit market will become not just an option but a necessity. This change will not happen overnight, but as pressure builds from both governments and the public, the market is set to expand and evolve to meet the demands of a changing world.

Carbon Credit Market Key Segments:

By Type

- Voluntary Carbon Market

- Compliance Carbon Market

By Project Type

- Avoidance/Reduction Projects

- Removal/Sequestration Projects

By End-use

- Power

- Energy

- Aviation

- Transportation

- Buildings

- Others

Key Global Carbon Credit Industry Players

- South Pole

- Verra

- Gold Standard

- Climate Impact X (CIX)

- AirCarbon Exchange (ACX)

- Carbon Trade Exchange (CTX)

- Indigo Ag

- ClimatePartner

- ClearSky Climate Solutions

- Sylvera

- Anew Climate

- Terrapass

- Finite Carbon

- Carbon Credit Capital

- 3Degrees Group, Inc.

- EKI Energy Services Ltd.

- South Pole Group

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252