MARKET OVERVIEW

The global buy now pay later market will inevitably transform the paradigm through which consumers interact with financial products, altering spending behavior and sectoral agency worldwide. The landscape will be highly contested and dynamic with more retailers and financial institutions competing with each other to put BNPL services on their menu of offerings to meet the rising demand for flexible payments. The use of BNPL will stretch behind the confines of just the e-commerce space and explode into a generic form of payment accepted across sectors of the economy: travel and entertainment, e-learning, healthcare, and many others.

In the future, global buy now pay later market would be sought by consumers for regular purchases, and more innovative models would emerge to address the varied need of consumers. This transition would allow consumers to save on convenience, thereby promoting financial inclusion by putting people who otherwise would have had no access to conventional credit facilities into the economy. It can thus be affirmed that, with advancing mobile technology and AI, BNPL services will turn more bespoke and be designed for each buyer according to his or her purchase patterns and current financial situation.

Regulatory frameworks on BNPL will be developed and updated so that consumer interests take precedence, given the government's pursuits of clearer rules and regulations as to how debt build-up ought to be dealt with most effectively.

Going forward, global buy now pay later market is expected to witness even greater acceptance in emerging markets, where digital payment infrastructures will fast take shape. Given this, emerging markets are well positioned to gain at however much increase rates in BNPL might bring to the scale of accelerated development in their geographies and income store power inside of that. As consumers get more aware of BNPL services, businesses will start to improve their offers in an attempt to capture this growing demand, and a number of new payment providers will be deployed to fill this niche.

In the end, the global buy now pay later market shall continue to see changes on account of the ongoing evolution of consumer behavior patterns, technological landscape, and new regulatory trends. Consumers shall then be offered the diversity and sophistication of the BNPL ecosystem that will do much more than just enable payment flexibility and create new avenues for financial services to reach out to the populace.

Designed to fulfill and satisfy an increasingly friction-less experiential demand, the industry has been honed to provide solutions that are more efficient, integrated, and customized for the modern-day shopper.

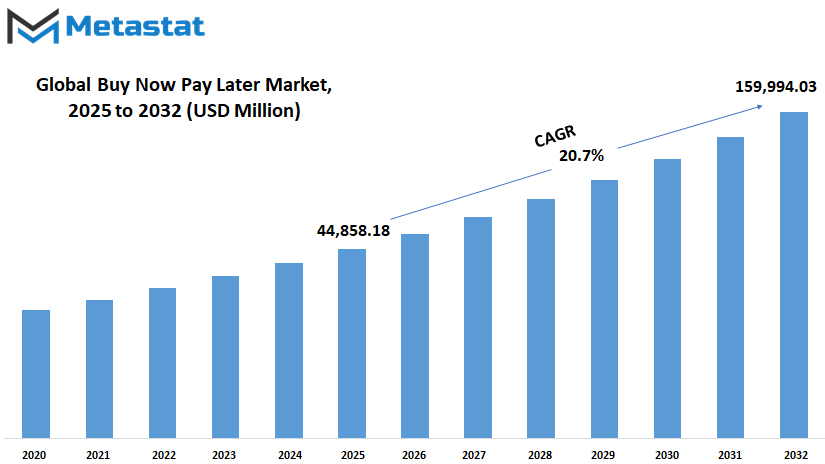

Global buy now pay later market is estimated to reach $159,994.03 Million by 2032; growing at a CAGR of 20.7% from 2025 to 2032.

GROWTH FACTORS

The global buy now pay later market is expanding rapidly since the majority of consumers have now begun looking for easy payment modes. BNPL is still the best way to make a purchase with the cost extended over a period of time. With that, the form of payments being incremental and turning liquid is providing much-needed ground for the BNPL choice to pick up pace across sectors because it is accessible to both the customer and shopkeeper.

One of the largest forces driving BNPL market expansion is internet shopping. As more and more consumers move away from physical retail channels to online shopping, the trend has gone on to boost BNPL adoption quite appreciably, thus fueling growth. Most customers nowadays prefer buying online, and BNPL services allow them to manage their finances seamlessly, hence making them more inclined to make online purchases more often. Since shopping is something everyone does online now, BNPL gets to meet a willing-to-change consumer and to provide elastic options for their convenient payment system. Nevertheless, as much as growth seems to be positive, there are plenty of other factors that would rein in market growth. This is the first issue with the BNPL operators being uncertainty from regulators.

A change in current law would place stricter terms on BNPLs, further restricting the way the BNPL functions. These regulatory shifts can affect the way BNPL providers will run their operations, making it more difficult to do business in certain markets. This uncertainty could delay market growth or potentially push businesses to conform to new legal frameworks impacting their business models. One additional factor hindering the expansion of BNPL market is the customer's competence in managing installment payments. Even as BNPL services are flexible and suitable for many customers, there might be some customers who fail to make timely payments, resulting in financial stress or even defaults. This would adversely impact BNPL services' reputation and lead new customers away from using them.

Nevertheless, immense growth opportunities are in store. Expansion in the emerging economies is a very significant possibility for the industry as a whole because the pattern for flexible payment options is expected to grow with rising economic activity in these economies. New options would be available before the BNPL providers, and this would be economically remunerative options for the market in the years to come to develop BNPL even more as a mainstream payment option for global consumers.

MARKET SEGMENTATION

By Channel

The global buy now pay later market is growing very quickly because consumer behavior continues to move in the direction of the latest technology, and online payment platforms continue to evolve. It's a market where consumers are allowed to purchase goods and pay later without any interest charged on the payment if the amount is paid in instalments within a period of time. As BNPL emerges as a more suitable alternative to the traditional credit accessible to increasingly more consumers to adapt to, even businesses are turning to the new payment model that can be accessed to optimize customers' experience and push their sales.

Enterprise size-based segmented BNPL Market Large Enterprises: They are firmly rooted businesses with an equally enormous financial basis. These organizations have an infrastructure that would be capable of seamlessly integrating BNPL facilities and hence providing a wide range of products and services to consumers.

They also have the ability to partner with BNPL providers to offer shoppers attractive terms and incentives. Big businesses, based on brand worth, are capable of presenting BNPL as a payment method from a well-known brand, appealing to a wider customer base. BNPL has therefore, for SMEs, been the cause of increased competitiveness and the holding of a more diversified customer base. The firms have less assets in large values compared to large enterprise firms but do often appear to possess agility and flexibility when it comes to new payment technologies adoption.

The buy now pay later products are being hailed across the board by SMEs for the purpose of inviting the young, technology-loving customers to get access to low-cost and hassle-free payment facilities. Moreover, simplicity and no upfront cost render BNPL a useful solution to many SMEs anticipating to augment their customer base.

By Enterprise Size

The global buy now pay later market is growing rapidly due to the fact that consumers' preferences are changing, and digital payment technologies are constantly improving. It is a market in which customers are allowed to purchase goods and then pay for them over time with no interest charge if the installments are made within a stipulated time. As BNPL gains the status of a more suitable alternative to the traditional credit that more and more consumers can adapt to, even businesses are switching to the new payment model that can be opted for improving customers' experience while propelling their sales.

Enterprise size-based segmented BNPL Market Large Enterprises: These are highly established businesses along with an equally huge financial base. These businesses have an infrastructure that could seamlessly integrate BNPL options and thus have a wide range of products and services available to their customers. They have the capacity as well to partner with BNPL providers to offer consumers attractive terms and benefits. Based on brand reputation, large enterprises can offer BNPL as a payment method from a trusted brand, increasing a larger customer base.

The buy now pay later has thus, for SMEs, become the source of increased competitiveness and attracting a more varied customer base. The firms have less in sizeable resources, as compared to large enterprise businesses but do often appear to have flexibility and agility with regard to the embracing of new payment technologies. The BNPL solutions are increasingly being adopted by SMEs to attract the young, tech-savvy customers who are looking for affordable and flexible payment options. Further, the ease of integration and low upfront costs make BNPL a feasible solution to many of the SMEs looking forward to expanding their customer base.

By End-use

Since the worldwide BNPL market is growing at an exponential rate, payment flexibility is offered by the market to the consumers and business enterprises. What powers this market is the attractiveness of the buy now pay later offer, which eases the purchase decision by presenting the consumers with some options for acquiring products and services and paying later. The markets have been split based on the end use into five categories: Retail, Healthcare, Leisure and Entertainment, Automotive, and Others. All of these sectors are fast-growing as BNPL services are being adopted across various industries.

Among the sectors, Retail stands at the largest when concerning global buy now pay later market. The Retail sector has an immense impact in reshaping how consumers shop. Due to the growth of E-Commerce, retailers have begun to include BNPL options within their payment structures so as to provide customers a little extra flexibility: customers can shop and pay in installments, especially during heavy sale periods and promotions. This form of purchase lends itself strongly to good consumer practice when it comes to money management.

In the Healthcare industry, BNPL services are currently being utilized for the facilitation of medical spending to make medical costs more accessible and affordable. From treatment expenses to medication purchases and even surgical procedures, BNPL is an alternative now available for anyone who cannot afford the healthcare process. BNPL service has made it easier for patients to pay their money in installments rather than facing a heavy, unmanageable medical bill. As healthcare costs continue to rise globally, the BNPL model offers a valuable solution for many.

The Leisure & Entertainment sector has also benefited from BNPL options. Services such as travel, hotel bookings, and entertainment tickets now offer BNPL payments, where customers can enjoy an experience without any upfront financial pressure. This sector is growing robustly because a lot of consumers are looking to experience things, not own material goods, and BNPL now makes those experiences accessible to so many more consumers.

The Automotive industry is also not lagging behind and has accepted BNPL solutions for financing car buying, repair services, and auto accessories. An increase in prices of cars along with growing needs for automobile-related products is increasing the appeal for BNPL among this group of consumers. A larger and higher-priced purchase will be more easily managed by making payments.

Finally, the Others category captures any additional industries or services where BNPL is making an impact. It may include home improvement, education, and others that are not as mainstream but still benefit from the flexibility that BNPL provides.

In summary, the global buy now pay later market, categorized by end-use into Retail, Healthcare, Leisure & Entertainment, Automotive, and Others, has no signs of slowing down. Its flexibility to consumers and businesses is expected to continue its growth across various sectors with each benefiting in its own way.

|

Report Coverage |

Details |

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$44,858.18 million |

|

Market Size by 2032 |

$159,994.03 Million |

|

Growth Rate from 2025 to 2032 |

20.7% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

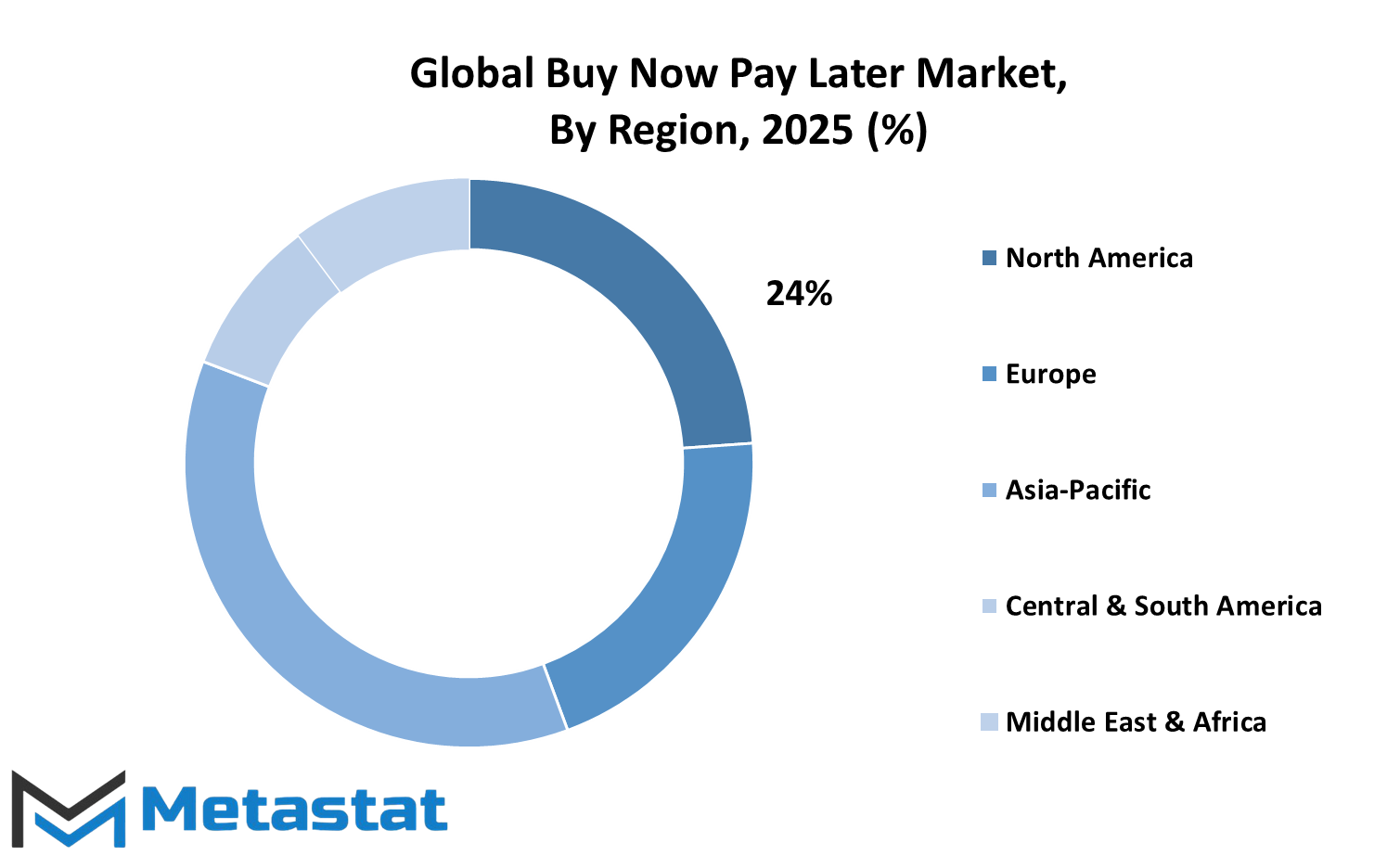

The global buy now pay later (BNPL) market is growing at a fast pace and divided into several geographical regions: North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Each of these areas has distinctive personalities and sets of markets contributing to the BNPL trend.

North America is one of the largest regions for the Buy Now Pay Later business, comprising the United States, Canada, and Mexico. The North American market grew steadily as more and more consumers adopted BNPL services with the need for flexible payment options. It is also beneficial to use BNPL schemes mainly for smaller purchases in countries such as the United States, where people are slowly getting used to the convenience of using these services online and in-store.

The European region contributes significantly to the global buy now pay later market with its top-line players scattered across the UK, Germany, France, Italy, and other regional countries. Since the alternative credit solutions are witnessing increased demand, the European market is now on the rise. BNPL is growing popular in Europe particularly in retail and e-commerce channels. The regulatory environment is diverse across European countries.

On the other hand, Asia-Pacific is another strong growing region with interest continuing to build for BNPL in countries like India, China, Japan, and South Korea. It is merely the convenience extended to the consumers without having to pay in full at the time of purchase for online consumers increasing in large numbers in all of these markets, and where, as a rule, consumerist expansion would bring about larger numbers of potential customers. The popularity of BNPL is also driven by the increase of e-commerce websites and digital payments in this market.

Other key markets for BNPL service include Brazil and Argentina and a few other South America nations. With the infantile stages that BNPL is still in within this region, penetration is set to be boosted given how individuals grow up fond of BNPL services in the future. In the future, its expansion within South America will largely be informed by internet penetration rates as well as overall digital payment infrastructure adoption in the context of e-commerce usage.

Middle East & Africa comprises nations such as the GCC nations, Egypt, South Africa, and many others. In the Middle East & Africa region, BNPL services are yet to come of age but have enormous growth potential, particularly because increasingly more individuals from the Middle East and Africa are using digital payments for transactions. The market will grow as additional businesses and consumers become aware of the benefits of BNPL services.

The buy now pay later industry across the world is divided into regions with varying growth rates and behavior. On this note, with the progressive character of digital payments and increasing consumer demand, the BNPL industry will grow significantly in all these regions.

COMPETITIVE PLAYERS

The global buy now pay later market has been on an upward trajectory as consumers increasingly use flexible payment solutions while shopping. This trend has seen the emergence of some major players in the market, each with their own services and terms to entice customers. Affirm, Inc., Afterpay, and Klarna have been the BNPL brand names. These services allow users to pay in installments manageable by them. PayPal has joined the market, leveraging its massive customer base to provide BNPL with its other products. Other notable players are Sezzle, Splitit, and Zip Co, each with its strategy for BNPL.

The firms allow customers to pay the bill for their purchases over a period of months, hence making them able to purchase other items easily. Another firm in the same league is Zilch Technology Limited. It has interest-free installment payments for all, and Latitude Financial Services, a consumer finance solutions provider firm, has incorporated BNPL as one of its products because individuals are looking more and more for different means of payments. Humm is another company which is working in the BNPL space and has its sights set on providing interest-free installment plans to such customers. Similarly, Perpay targets customers who have reduced access to credit; it allows them to buy then pay off later in installments. Uplift primarily serves the travel sector and allows customers to finance their vacations by paying for it in installments over time.

Some of the other popular companies having a presence in the BNPL industry are postpay, bread, bill ease, and Cashalo. These companies are making the customer base larger because they give customers attractive offers and a very smooth shopping experience. Whether it is groceries, electronic goods, or travel, everyone wishes to save some amount through the ease with which BNPL services can save.

As the buy now pay later sector expands, there is anticipation for further entrants seeking to take advantage of this demand for flexible payment options. The resultant competition would drive further innovation and services to the benefit of consumers who are seeking further control over their spending.

Buy Now Pay Later Market Key Segments:

By Channel

- Online

- POS

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By End-use

- Retail

- Healthcare

- Leisure & Entertainment

- Automotive

- Others

Key Global Buy Now Pay Later Industry Players

- Affirm, Inc.

- Afterpay

- Klarna

- PayPal

- Sezzle

- Splitit

- Zip Co

- Zilch Technology Limited

- Latitude Financial Services

- Humm

- Perpay

- Uplift

- Postpay

- Bread

- BillEase

- Cashalo

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383