MARKET OVERVIEW

The Global Card Payment Processing Solutions Market covers many global financial technique areas, opening transactions for businesses and clients around the world. It focuses on all the technologies and services used for the authorization, clearing, and settlement of card payments. Future forms are developing around digital transactions. Financial institutions, businesses, and payment service providers will largely depend on sophisticated payment transactions to process them securely and efficiently.

While it encompasses a diverse range of channels such as online platforms, point-of-sale terminals, and mobile payment applications, the payment processing infrastructure is set up with global connectivity to enable transactions. The Global Card Payment Processing Solutions Market will serve even the smallest of businesses, offering systems to process credit, debit, and prepaid card transactions in real time. Speed, security, and reliability in payment processing are entirely dependent on how efficient solutions are, thus making them invaluable in achieving smooth checkout experiences for merchants.

The focus, as always, will remain on security, with card payment-processing solutions harnessing mechanisms of encryption, tokenization, and fraud detection to secure very sensitive financial data. Payment processors will have to adopt advanced security protocols to offer better protection in transactions as cyber threats have become increasingly sophisticated. Those will also change how these systems work as it will protect the environment which guarantees the compliance of their use to relevant financial laws and data protection guidelines.

Integration with banks and digital wallets will enrich the Global Card Payment Processing Solutions Market further and provide more convenience to consumers on ways to make payments. Such payment and processing solution interoperability across different financial institutions and payment networks will propel the growth of electronic transactions. Businesses will seek for solutions that offer a seamless connection to banking systems, thus minimizing transaction failures, and ensuring real-time payment confirmations.

Other considerations that will be taken into account when entering the market are customization and scalability since businesses will require payment processing solutions that can fit into their ways of doing business. For example, solutions will be sought by both small retailers and multinational corporations that can grow with increasing transaction sizes without compromising performance. More businesses will shift to cloud-based payment processing platforms, which promise on-demand scalability and improved access, enabling merchants to transact from any location.

The Global Card Payment Processing Solutions Market Evolution will continue exploring contact-less payments and biometric authentication. Emerging payment technologies will lead consumers to expect even more speed and convenience in the way they conduct cross-border transactions. Payment processors will likely create state-of-the-art solutions that respond to consumer demand. Real-time settlement of payments, blockchain-based processing, and AI-driven fraud detection will find an increasingly collaborative integration.

Further findings are expected from cross-border transactions whereby a merchant and consumer from different countries sell and buy, respectively. Payment processing solutions to enable..multiples of currency, dynamic currency conversion, and international financial regulations. Cross-border transactions are simplified to improve global trade and e-commerce, thus bringing more merchant adoption of international payment solutions.

The path of modernization that businesses and financial institutions are focusing on, Global Card Payment Processing Solutions Market will play a significant future in digital commerce. Driving advanced processing technology will not spare efficiency, security, and reliability when electronic payments become the central issue of financial transactions.

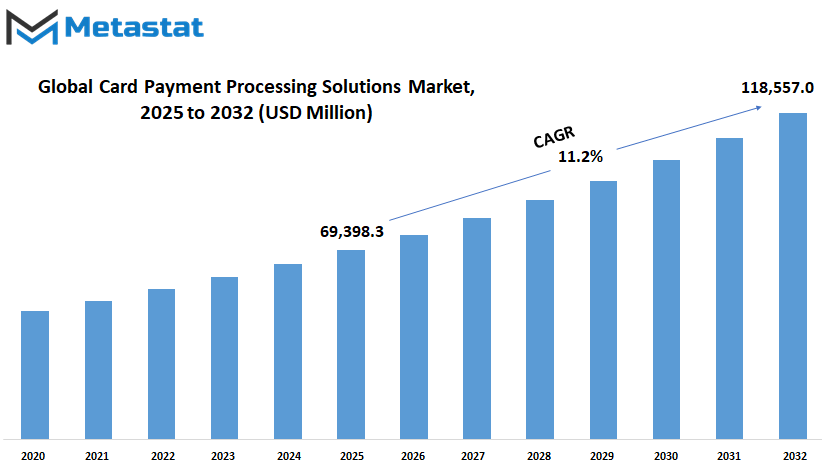

Global Card Payment Processing Solutions market is estimated to reach $ 118,557.0 Million by 2032; growing at a CAGR of 11.2% from 2025 to 2032.

GROWTH FACTORS

The Global Card Payment Processing Solutions market will continue to grow due to the shift toward e-payment transactions by businesses and consumers. With cashless payments now being the main option, current trends in payment processing service providers highlight emphasis on speed, security, and convenience. Online shopping has powered this shift, making it necessary that businesses of all sizes have an efficient payment processing system. Companies are increasingly investing in newer technologies that can deliver on customer expectations to ensure seamless transactions across channels.

The emergence of contactless payments and the use of mobile wallets play an even more important demand-generating role in determining the future of the industry. Customers expect fast and seamless transactions, while businesses have been compelled to integrate safe and efficient payment options. Security-enhancing innovations such as encryption and tokenization work hand-in-hand to minimize the threats; biometric authentication and AI are being assessed for fraud reduction. Meanwhile, payment technology is fast evolving. Service providers are investing in solutions that enable real-time transaction monitoring and speedy processing to reinforce the level of confidence instilled in both businesses and consumers.

Nonetheless, certain challenges may arise that will impact the growth of this market. Data security still holds the top spot in concern, with increasing instances of payment fraud triggering stricter regulations. In order to adhere to the security standard, companies are burdened with an increase in operational costs. Further, fierce competition among service providers often imposes pricing constraints on profitability. Businesses have to balance providing competitive prices against safe and high-quality services.

In the coming years, the Global Card Payment Processing Solutions market shall have opportunities to expand further into industries that have been slow in adopting digital payments. The healthcare, transportation, and hospitality sectors are projected to embrace modern payment solutions, thereby carving out new revenue streams for providers. A greater shift from cash transactions among businesses will lead to higher demand for customizable payment solutions that address industry-specific needs.

Emerging economies also provide a seriously lucrative opportunity for growth. The improvement of digital infrastructure in these regions will allow more consumers to access card-based transactions, thus putting pressure on processing solutions. Against this backdrop, companies with an early-mover advantage have better prospects of succumbing to the pitfalls of localized payment systems and regulatory compliance.

Technology will continue to evolve and security will become even more ingrained in the fabric of this industry. Players that will manage to keep on top of all regulatory changes while providing seamless, secure, and cutting-edge payment solutions will find themselves the one step ahead. As more and more companies and consumers move into cashless mode, the need for reliable payment processing services will only be on the rise, assuring a steady increase in the market in the coming years.

MARKET SEGMENTATION

By Payment Mode

Changes in the payment process have been becoming quite noticeable as new technologies fold into business as they evolve along with consumer needs. The Global Card Payment Processing Solutions market will therefore expand in the future as almost every industry uses more digital transactions. Every company finds ways of speeding up and securing payments that are much easier for both businesses and their customers.

The rising trends of online shopping, contactless payment, and mobile transactions are forcing payment service providers to have effective systems that will help beautify the entire experience. These trends among consumers are causing major shifts in payment systems, adapting towards an increasingly digitized global society. Alongside that are security features that would define this market in the future. Companies improve their encryption methods and develop fraud detection systems to protect their users from the influences of data breach and fraud.

AI and machine learning capabilities are being embedded into these payment systems to monitor real-time transactions, flagging them as threats before they turn serious problems. Above security enhancement, this would facilitate companies in establishing trust with their customers. The Global Card Payment Processing Solutions market is also going to witness competition from multiple modes of payments. With increased advancements in technology, people are preferring eWallets as a viable option where one can save multiple payment options in a digital space.

However, credit cards and debit cards remain the most concentrated and by far the two most widely used forms of payment; they are also evolving with biometric authentication and tokenization integration for additional security. Automatic Clearing House transactions are also capturing attention, especially for businesses that need fast and reliable transfers of funds. Businesses will continue to expand with the emerging solutions that allow for seamless transaction processing over multiple platforms and devices.

Financial institutions and technology companies are collaborating to create systems with more efficiency and adaptability. Such a transaction time reduction coupled with greater transparency will be addressed by exploring the potential of blockchain technology. All these developments will lead to greater competition among payment service providers, encouraging them to innovate and offer newer features that make the user life easier.

However, moving toward a cashless society will bring changes in accepting demand and need for reliable payment solutions. To stay ahead, companies in this market must focus on security, speed, and user-friendly systems. The future of the industry will rely on continued technological advancements, changing consumer preferences, and the need for higher degrees of security. Adaptation and improvement will define how future generations of people and businesses will conduct digital transactions with one another.

By Deployment Mode

The Increasing demand for secure and efficient payment processing solutions will rely on businesses and consumers who will keep growing. The Global Card Payment Processing Solutions market is crucial for defining paymentways for institutes, giving flexible and reliable ways to process payment transactions. And now with new technology advancements, it will be faster, safer, and easier – all to please business and customers alike when using the service. Companies will have a very competitive space moving forward into improvements in security, speed, and ease of use with increasing online shopping and cashless transactions for customers.

The future of payment processing in the world will be innovative. Most companies will adopt newer technologies with the aim of increasing security and efficiency when processing payments. Contactless payments will soon become the norm; biometric authentication and fraud detection through Artificial Intelligence will offer greater confidence to consumers in doing electronic transactions. There would come a time when there would be a shift in the delivery mechanisms for solution offerings in the market. There will always be on-premises and cloud-based options, which can stack advantages on one or the other. On-premises deployment will appeal more to businesses wanting to be in direct control of their payment systems for security and compliance reasons. Cloud-based will attract businesses that are flexible and scalable to business requirements without huge added investment in infrastructure.

The differences among companies will be in how they serve their customers across card payment processing. All customers across the different industries will thus have their own solutions from the multinational retailers to service providers and e-commerce solutions. Such companies will desire consumer-facing solutions that are highly integrated into their operations so that they can ensure seamless payment experiences. In fact, these two will add to the market by creating features that minimize transaction costs but also help to mitigate the chances of loss due to frauds and data breaches. With advancing digital payments, fast and not easily compromised are the transaction processing requirements necessary for the business unit to meet consumers.

AI and automation will be shaping the future of payment processing. AI will help fight reduced errors and measures to improve security. Fraudsters will be detected before initiating the act through unusual transaction patterns under AI-based analytics for businesses. Insight for the enterprise into current payment trends will be made available through real-time capabilities by cloud-based platforms for practical decision-making and enhanced optimization. Payment processing will also be subject to changes in compliance and seamless transaction experience possibly for end-users due to changes in regulation activities on the landscape.

The future indeed holds promise and continued evolution of the market with security, comfort, and efficiency being its primary impetus. Investment by companies on the technology that makes processing of transactions efficient will add value for all those concerned - businesses and consumers.

By End-User

The driving forces for growth in the Global Card Payment Processing Solutions market involve the emergence of digital transactions as a preferred and accepted method of purchase by consumers and businesses. In order to improve transaction speeds, enhance fraud protection, and increase user convenience, the industry focuses on technological advancements and secure and efficient payment solutions. Cashless payment accelerators will include growing e-commerce, contactless technology, and mobile wallets, which many businesses are adapting to provide seamless payment experiences to their clients in different industries.

Retail businesses will remain one of the largest utilization sectors for card payment processing solutions. These systems are therefore going to be used as online and physical stores strive to get good customer experience offerings fast and secure payments. There has been an increase ultimately in contactless and mobile transactions for these payments, enhancing convenience and minimizing waiting times. Guest satisfaction is paramount in hotels and restaurants as they continue to upgrade their payment processing systems for smooth transactions. These means would satisfy customers when needing extreme priority in making payments.

Another important space impacted by card payment processing solutions is healthcare. With a digital shift, healthcare providers will increasingly require secure payment solutions. Quick processing is desired by medical facilities, patients, and insurers alike, and this need will prompt the continued evolution of advanced payment processing solutions among healthcare providers. The automotive business would likewise be following suit, with digital payment offerings for services such as repairs, rentals, and vehicle purchases. Customers will have a larger say in transaction completion via contactless and online payment opportunities.

The entertainment and education sectors are also giving boosts to the market. The movie theaters, event venues, or streaming services are all hopping on some speedy payment methods to ease off the transactions. Educational institutions, that is, universities and online learning platforms, will be implementing secure payment systems for tuition and amounts payable. The good news to the industries is that advances in security and automation will keep coming forth to smoothen all financial activities.

As various types of businesses come on board with digital payments, competition amongst the service providers shall intensify. Companies continue investments in technologies such as artificial intelligence and blockchain to assure efficiency and security. Future developments will likely focus on minimizing fraud risks and guaranteeing seamless global transactions. The demand for real-time processing and personalized payment experiences will force further developments along the pipeline.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$ 69,398.3 million |

|

Market Size by 2032 |

$ 118,557.0 Million |

|

Growth Rate from 2025 to 2032 |

11.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The way of making payments is dramatically changing every writing moment, with digital transactions as the favored mode for business and consumer transactions. Continuous growth will be witnessed in the Global Card Payment Processing Solutions market, with the development of efficient payment systems to be adopted by the financial institutions, retailers, and service providers. With cashless transactions growing fast in demand, these companies must ensure that their solutions are secure, fast, and user-friendly. Emerging technologies such as artificial intelligence and blockchain will provide the backbone for fostering transaction security and efficiency, making card payments all the more secure.

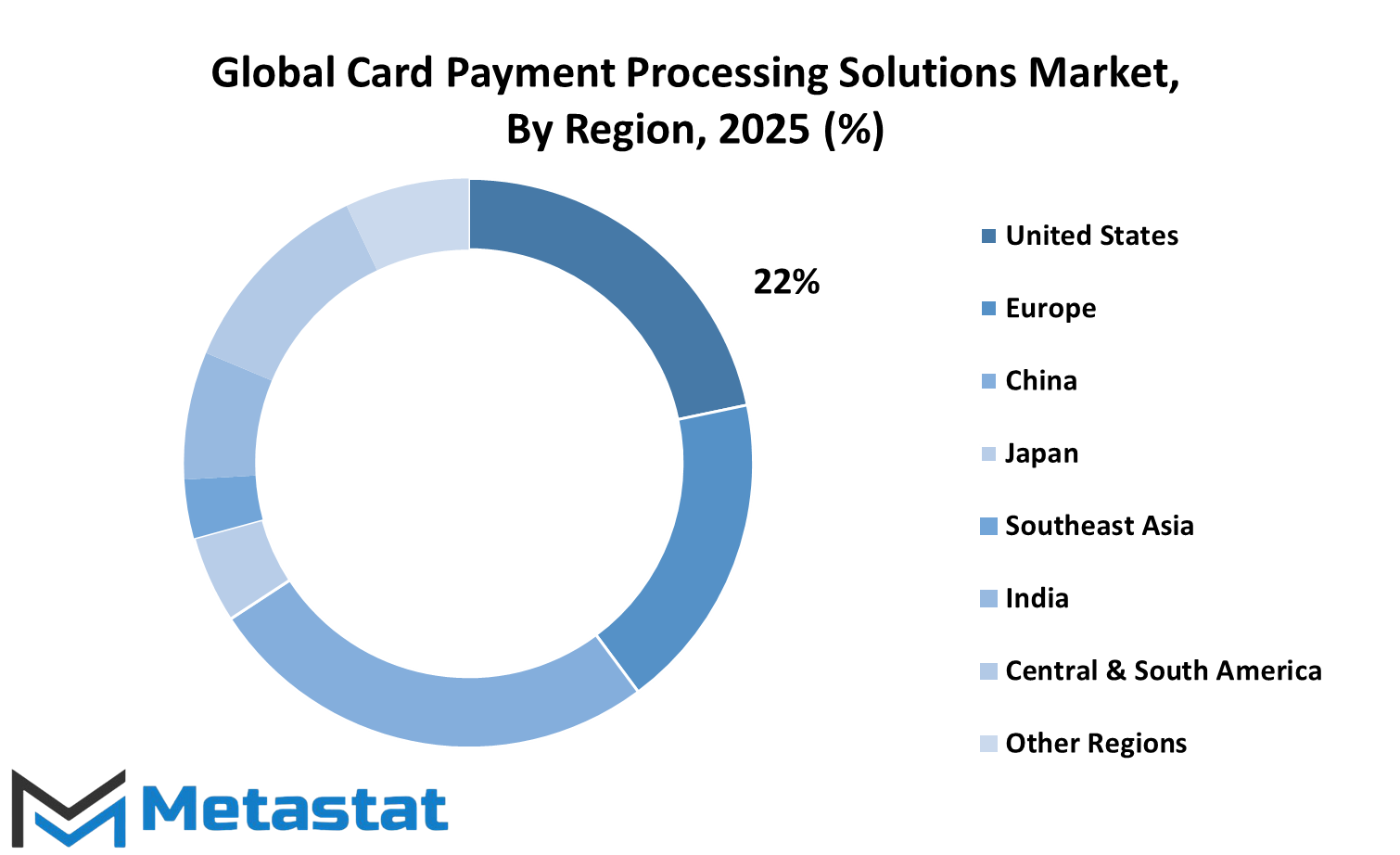

Growth in different regions will be there with different rates, depending on the respective government policies, technological advancements, and consumer choice. North America will continue to be a stronghold of card payment and processing solutions, with the U.S., Canada, and Mexico leading the charge for adopting advanced payment processing technologies. This region has a solid digital payment infrastructure and accepted the rise in contactless transactions; hence, the companies in this area will invest in secure and smooth payment solutions.

Europe will consistently grow, being led by countries such as the UK, Germany, France, and Italy. The region's emphasis on payment security and compliance with data protection regulations will motivate companies to upgrade their card processing systems. Due to digital wallets and online payments gaining prevalence, companies look to integrate new technologies for smoother payment experiences.

Prominently in the Asia-Pacific, the markets of India, China, Japan, and South Korea are upon massive growth. The rise of e-commerce, smartphone penetration, and government initiatives for digital payments will widen opportunities for payment solution providers. Cashless strategy is the key trend for businesses and consumers; cashless strategies will lead company operations toward innovating solutions that would cater to the growing demand for swift and secure transactions.

South America, particularly Brazil and Argentina, will be braced for the shift into modern payment methods-as more people are gaining exposure to digital banking. Cash transactions are bound to stay for some time, though payment solutions will expedite greater formal adoption amongst financial institutions and fintech companies through enhanced infrastructure and a secure processing network.

Meanwhile, the Middle East and Africa are also moving forward, with countries like the GCC nations, Egypt, and South Africa investing in digital payment systems. Governments and business cooperatives will expand financial access and encourage digital transaction utilization so as to bring card payment solutions into the masses. As technology advances, countries across the globe will focus on bettering transaction security, combating fraud, and facilitating seamless transaction experiences for end-users and businesses alike.

COMPETITIVE PLAYERS

Thus, the Global Card Payment Processing Solutions market is expected to continue growing with the increasing spread of digital transactions. Consumers and businesses are increasingly turning away from cash and towards cashless payment options based on their need for convenience, security, and technology. Companies operating in this industry are gearing themselves up to become more successful, efficient, secure, and accessible payment systems as online shopping, contactless transactions, and mobile payments increase in popularity. The challenges of fulfilling consumer demand for seamless, instant transactions will inspire companies to churn out novel solutions catering to various industries and different customer preferences.

Digital payments will go up, and security will still be the priority. Increasing online fraud coupled with cyber threats has necessitated all companies to beef up their encryption methods and fraud detection systems. A number of companies have invested in real-time detection systems of suspicious activities using artificial intelligence and machine learning. With these steps, users are guaranteed security in any form of transaction, and more confidence will be boosted for online transactions. It will not be long before companies develop and implement ways that ease cross border payments so that customers and businesses do not feel the burden of accessing send and receive funds at exorbitant fees and inordinate delays.

The competition for the Global Card Payment Processing Solutions market was getting really intense as companies would do everything possible to provide better services. Meanwhile, specific companies such as Wirecard AG, Naspers Limited, Visa Inc., and Jack Henry & Associates Inc. have all given up on competition among the established players in the industry by having advanced technology and networking. Other significant players include PayPal Holdings, Inc., Global Payments Inc., and First Data Corporation, which are contributing towards building safer and easier platforms. Newer entrants and smaller companies, like Aeropay, Dwolla, and Finix Payments, are looking towards offering newer ideas and specialized offerings to meet the adaptive needs of customers.

With the growth of mobile payments, Alipay, PhonePe, and Razorpay have increased their service offerings to making payments more accessible. Digital wallets, customers will have a more straightforward and modern approach to do transactions and may not have to rely too much on traditional banking methods to perform transactions. Stripe, Worldline, and Adyen N.V. are working toward ensuring quicker payment processing and reduced transaction costs to support the increase in future customers. Meanwhile, the other companies, such as Paysafe Group Limited, ACI Worldwide, and Authorize.Net, are developing hyper-advanced security features that will prevent such frauds but still allow smooth transactions.

Innovations such as blockchain and biometric authentication will shape the future of this industry. These technologies will build the payment infrastructure faster, safer, and more transparent. Competitive players should continuously innovate to ensure reliable, secure, and efficient solutions in card payment processing for businesses and consumers.

Card Payment Processing Solutions Market Key Segments:

By Payment Mode

- eWallet

- Credit Card

- Debit Card

- Automatic Clearing House

- Others

By Deployment Mode

- On-Premises

- Cloud-Based

By End-User

- Retail Industry

- Hospitality

- Healthcare Industry

- Automotive Industry

- Entertainment Industry

- Education Industry

- Other Industries

Key Global Card Payment Processing Solutions Industry Players

- Wirecard AG

- Naspers Limited

- Visa Inc.

- Jack Henry & Associates Inc.

- PayPal Holdings, Inc.

- Global Payments Inc.

- First Data Corporation

- Square Inc.

- Adyen N.V.

- Paysafe Group Limited.

- ACI Worldwide

- Aeropay

- Alipay

- Authorize.Net

- BlueSnap

- CCBill

- Due

- Dwolla

- Finix Payments

- FIS

- MasterCard

- Modulr

- MuchBetter

- PayU

- PhonePe

- Pineapple Payments

- Razorpay

- SignaPay

- Stripe

- Worldline

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252