Global Bolting Tools Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global bolting tools market within the manufacturing sector will trace its ancestry from humble beginnings in machine workshops to being a staple element of modern production and construction. It will emerge during the early 20th century, when simple hand tools and torque tools first began to normalize fastening tasks. By the mid-20th century, the invention of hydraulic and pneumatic tools will create a tremendous transformation, which makes labor capable of handling heavier machinery with greater ease and precision. During this period, industrialization in automobile, aviation, and infrastructure constructions will drive the demand for more sophisticated bolting solutions.

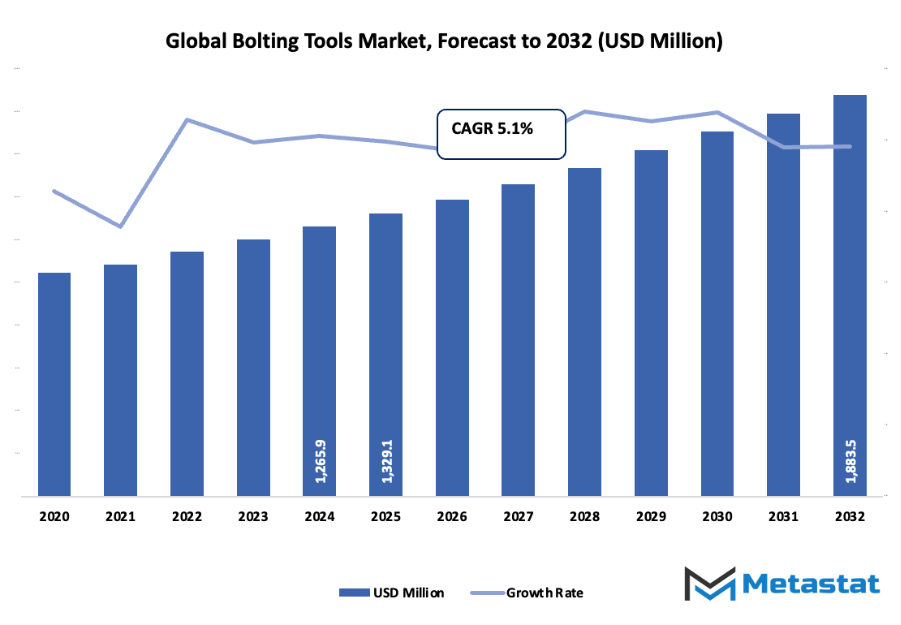

- Global bolting tools market worth about USD 1329.1 Million in 2025 and growing at a CAGR of about 5.1% from 2032 to the potential of exceeding USD 1883.5 Million.

- Mechanical holds about 15.1% market share and propels innovation and increasing applications through rigorous research.

- Major growth drivers: Increasing Infrastructure and Construction Activities

- Opportunities: Technological Innovation in Smart Bolting Tools

- Key insight: The market is on the verge of growing exponentially in value within the decade, revealing huge potential for expansion.

Throughout the final decades of the 20th century, battery and electric-powered machinery will gain increasing prominence, responding to demands for mobility, speed, and ergonomics-friendly operation. Firms will spend money buying technologies that improve torque control tools and safety features, taking Bolting Tools from mere utilities to very sophisticated equipment.

Simultaneously, the rise in quality demands and enforcement of safety regulations in industries will propel tool design and performance specifications. Such regulation will encourage manufacturers to adopt more stringent test procedures and incorporate high-end materials that have the capability to perform under extremely adverse operating conditions. Consumer behavior will also shift with a greater emphasis on accuracy, ease of use, and reliability. The global bolting tools market will see shifts as operators increasingly seek lightweight but effective tools, which can deliver consistent torque while being less fatiguing. Advances in digital torque measurement, computerized bolting systems, and built-in monitoring platforms will redefine the manner in which industrial players interact with bolting operations.

Companies will move into hybrid models that combine wireless connectivity with analytics to enable real-time monitoring and preventive maintenance. Sustainability initiatives and environmental issues will also drive the market's course. Greater focus on green production methods and energy efficiency will drive innovations in battery life, recyclable content, and low-emission production processes. As industries around the world keep competing to become leaner and more efficient, the global bolting tools market will occupy the intersection of traditional mechanical engineering and newer smart technologies to provide tomorrow's industrial requirements with higher accuracy, security, and efficiency.

Market Segments

The global bolting tools market is mainly classified based on Type, Application, Distribution Channel

By Type is further segmented into:

- Mechanical: The mechanical segment in the global bolting tools market will be for tools that operate under manual or mechanical force. The tools will be simple to operate and widely used in industries where precision and durability count. The mechanical tools will offer cost-effective options for various bolting applications.

- Hydraulic: Hydraulic equipment within the market will use fluid pressure to provide high torque and power. The equipment will be applied in heavy-duty applications where repeat performances and efficiency are required. Hydraulic Bolting Tools will ensure quick and reliable operations with minimal effort needed for large projects.

- Pneumatic: Compressed air will drive pneumatic equipment in the market to exert force. Pneumatic equipment will be lightweight and suited for repetitive bolting operations with consistent speed. Pneumatic equipment will offer efficient and safe performance where electrical or hydraulic systems are not more suited.

- Electric: Electric tools within the global bolting tools market will be driven by electricity and give precise control. The tools will be designed for industries where there is a demand for efficiency and less human labor. Electric Bolting Tools will give repeat performance and can be suited to varying torque specifications for various industrial applications.

By Application the market is divided into:

- Mining: In Mining Applications within the global bolting tools market, there will be a need for tools that have the ability to handle tough conditions and tough materials. The tools to be used in mining will prioritise reliability and toughness in order to meet safety and functionality needs. Mining will remain a critical application for the application of Bolting Tools.

- Construction: The construction use of the market will utilize tools that provide accuracy and quickness. These tools will be invaluable for structure, machinery, and framework assembly effectively. Construction will be facilitated by Bolting Tools that reduce labor and enhance project completion time.

- Blasting: Blasting activities in the market will demand tools that ensure safe fastening with high levels of stress. Tools in blasting activities will ensure stability as well as safety in operations. Bolting Tools for blasting will focus on rugged performance and integrity under hostile conditions.

- Other: Other application in the market will be in manufacturing, maintenance, and repair work. Equipment for such applications will be used to fulfill a wide variety of operating needs. Such tools will be versatile, dependable, and provide consistent performance across industries.

By Distribution Channel the market is further divided into:

- Direct Sales: Direct sales in the global bolting tools market will highlight communications between end customers and manufacturers. Direct sales will help companies provide tailor-made service and ensure product availability. Direct sales will establish relationships and enhance customer satisfaction through direct contact.

- Distributors and Retailers: Distributors and retailers in the market will act as middlemen, delivering tools to broad sections of customers. This channel will enable access to different types and brands of tools. Distributors and retailers will supply consistent supply and support to companies of all sizes.

- Online Sales: Online sales in the global bolting tools market will enable convenient purchase through digital means. This channel will provide instant access to product information, reviews, and shipping information. Online sales will enable longer reach, reduce geographical barriers, and make tools easily accessible to various customers.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1329.1 Million |

|

Market Size by 2032 |

$1883.5 Million |

|

Growth Rate from 2025 to 2032 |

5.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

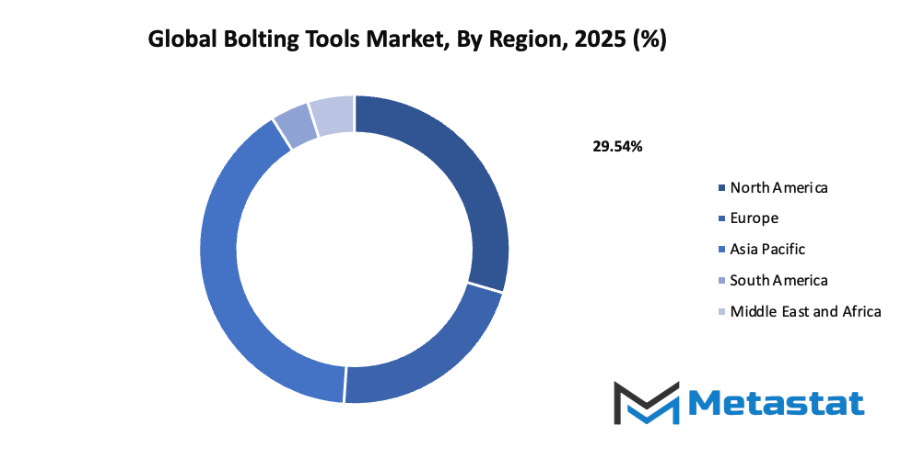

By Region:

- Based on geography, the global bolting tools market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Rising Infrastructure and Construction Activities: The global bolting tools market will benefit from the growth in infrastructure and construction projects. Rapid urbanization and government initiatives for building roads, bridges, and commercial facilities will increase the demand for reliable Bolting Tools. Projects in both developed and developing regions will drive continuous sales.

- Increasing Automotive and Industrial Manufacturing Demand: Expanding automotive and industrial manufacturing sectors will boost the global bolting tools market. Rising production of vehicles, machinery, and equipment requires efficient assembly solutions. Factories will focus on high-performance tools to improve productivity, accuracy, and safety in assembly processes, contributing to steady market growth over time.

Challenges and Opportunities

- High Equipment Costs and Maintenance Requirements: High costs and maintenance needs will limit the growth of the global bolting tools market. Advanced Bolting Tools require significant investment, and regular upkeep will increase operational expenses. Small and medium enterprises may hesitate to adopt these tools due to financial constraints, slowing adoption rates in certain regions.

- Volatility in Raw Material Prices: Fluctuating raw material prices will affect the global bolting tools market. Steel, aluminum, and other metals used in tool manufacturing will impact production costs. Supply chain disruptions and global price swings will create challenges for manufacturers, influencing final product pricing and market stability.

Opportunities

- Technological Advancements in Smart Bolting Tools: Innovation in smart Bolting Tools will create opportunities in the global bolting tools market. Tools with digital torque monitoring, connectivity, and automation features will improve efficiency and safety. Adoption of such technology will attract manufacturers aiming for precision and productivity, strengthening the market presence and future growth potential.

Competitive Landscape & Strategic Insights

The global bolting tools market includes both established international industry leaders and emerging regional competitors, creating a diverse and competitive environment. Major players such as Atlas Copco, Enerpac Tool Group, ITH Bolting Technology, HYTORC, SPX Flow, TorcUP, PLARAD, Chicago Pneumatic, RAD Torque Systems, Ultra Torq, Momento, HTL Worldwide, Norwolf Tools, Torcstar, AIMCO Global, Powermaster Engineers, Shingare Industries, Gedore Torque, Hi-Force, and ASMI ENGINEERING have set high benchmarks in terms of product quality, technological innovation, and service delivery. These companies consistently invest in research and development to introduce tools that increase efficiency, reliability, and safety in industrial operations.

Looking ahead, the competitive landscape is expected to become more dynamic as regional players adopt advanced manufacturing techniques and innovative solutions to capture market share. Companies will need to focus on developing smart Bolting Tools that integrate digital monitoring, predictive maintenance, and data-driven performance insights. Such strategic innovation will not only improve operational efficiency but also enhance safety standards, addressing increasing industrial demands for precision and reliability.

Market strategies will likely evolve to include stronger global collaborations, acquisitions, and partnerships. This will allow companies to expand their distribution networks, access new technology, and respond quickly to shifting market requirements. Additionally, the ability to adapt to local regulations, offer customized solutions, and maintain strong after-sales support will remain a key differentiator in sustaining competitive advantage.

Market size is forecast to rise from USD 1329.1 Million in 2025 to over USD 1883.5 Million by 2032. Bolting Tools will maintain dominance but face growing competition from emerging formats.

As industrial sectors continue to prioritize automation and digital transformation, bolting tool manufacturers that embrace these changes early will be better positioned to lead. Companies investing in smart technologies, eco-friendly operations, and robust customer engagement will gain recognition for forward-thinking strategies, setting new standards for the industry. The future will reward those that combine innovation, operational excellence, and strategic insight to maintain leadership while responding to evolving customer needs.

Report Coverage

This research report categorizes the global bolting tools market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global bolting tools market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global bolting tools market.

Bolting Tools Market Key Segments:

By Type

- Mechanical

- Hydraulic

- Pneumatic

- Electric

By Application

- Mining

- Construction

- Blasting

- Other

By Distribution Channel

- Direct Sales

- Distributors and Retailers

- Online Sales

Key Global Bolting Tools Industry Players

- Atlas Copco

- Enerpac Tool Group

- ITH Bolting Technology

- HYTORC

- SPX Flow

- TorcUP

- PLARAD

- Chicago Pneumatic

- RAD Torque Systems

- Ultra Torq.

- Momento

- HTL Worldwide

- Norwolf Tools

- Torcstar

- AIMCO Global

- Powermaster Engineers

- Shingare Industries

- Gedore Torque

- Hi-Force

- ASMI ENGINEERING

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252