Global Synthetic Roofing Underlayment Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global synthetic roofing underlayment market has evolved from being a specialty technology for the building trade to a benchmarking characteristic of contemporary roofing systems. This started when the conventional felt papers began to exhibit weaknesses in durability and water resistance. Contractors and designers started looking for a material that could resist severe weather conditions and last longer. This quest initiated the process of bringing synthetic substitutes into being during the late 1990s, and it was a quiet but powerful change in roofing processes globally.

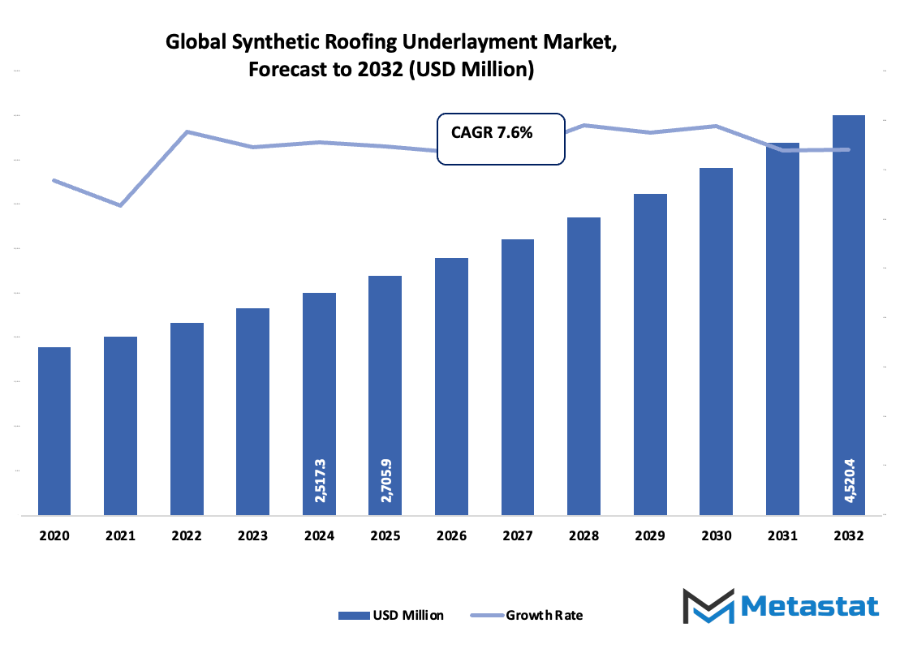

- Global synthetic roofing underlayment market size of around USD 2705.9 million in 2025, at a growth rate of nearly 7.6% from years 2032, with the ability to develop over more than USD 4520.4 million.

- Polypropylene (PP) holds a virtually 73.3% market share, leading to innovation and diversified application with rigorous research.

- Major driving trends: Increasing demand for durable and long-lasting roof systems in residential and commercial buildings, Greater demand for lightweight, simple-to-fit materials that save labour and time

- Chances are: Increased usage of energy-saving and technologically advanced roof systems in green building constructions

- Key takeaway: The market will increase exponentially in value over the course of the next decade, with considerable growth prospects.

Initial use was confined to high-end residential developments, where homeowners were open to trying new products. Gradually, the benefits of synthetic underlayment, such as light weight, tear resistance, and enhanced waterproofing, trickled down. By the mid-2000s, manufacturing processes had been developed so the products were simpler to install and more affordable. This widened the market beyond high-end construction to commercial and overall residential construction.

The growth of the industry after that was necessitated by necessity and innovation. Severe weather conditions, coupled with increasing desires for durable infrastructure, led roof specialists to use more durable materials. With environmental stewardship emerging as a primary focus in construction, manufacturers started using recyclable polymers and environmentally friendly additives into the products such that the products met new environmental regulations. Simultaneously, automated manufacturing equipment helped to control quality and accuracy, reducing performance variation between batches. Customer attitude shifts will also decide the destiny of the global synthetic roofing underlayment market. Builders and homeowners will seek products that not only keep them safe from water but also ensure energy efficiency and ease of maintenance. Green certification and regulations will decide how the products are manufactured and distributed by manufacturers, and innovation and transparency would be required. From its humble start as a felt alternative to an accepted element of contemporary roofing, the synthetic roofing underlayment market will continue to change. Its path demonstrates how technological advancements, environmental consciousness, and construction requirements can combine to turn a humble protective layer into a key basis for green building.

Market Segments

The global synthetic roofing underlayment market is mainly classified based on Material Type, Application, End-User.

By Material Type is further segmented into:

- Polypropylene (PP): The global synthetic roofing underlayment market will experience massive expansion in application of Polypropylene owing to exceptional tear-resistance and water-resistance. The product will provide light-weightiness and convenience of installation, and thus be ideal for various types of roofing jobs. Polymer technology improvement will also create durability and eco-friendliness, which will ensure longer lifespan for roofing systems.

- Polyethylene (PE): Polyethylene will remain in huge demand for the global synthetic roofing underlayment marketas it is affordable and flexible. Being water penetration- and UV ray-resistant, it will be a good choice for application under both hot and cold weather conditions. The boost in innovation will also focus on enhancing even more its insulation factor and recyclability to meet the specifications of today's construction.

- Others: Synthetic Roofing Underlayment products by other global world products will include composite blends and polymer-based advanced underlayments. They will be formulated to satisfy specific performance requirements such as greater fire resistance and heat resilience. Sustainable materials development will fuel innovation in this segment, leading to more energy-efficient roofing systems.

By Application the market is divided into:

- Residential Roofing: The global synthetic roofing underlayment market will witness strong demand from residential roofing since homeowners will be demanding durable and low-maintenance products. Urbanization and smart home trends will see synthetic underlayments offering improved leak protection as well as weather damage resistance. Installation efficiency will also lead to greater adoption in new constructions.

- Commercial Roofing: Commercial roofing will continue to be a key driver for the global synthetic roofing underlayment market with expenditures on industrial complexes, malls, and offices on the rise. Synthetic underlayments will be selected because of their extremity to weather and resistance to heavy loads. The energy efficiency aspects shall be the focus of innovation in the coming years to aid in green building initiatives.

- Industrial Roofing: The Synthetic Roofing Underlayment industry will expand globally on an industrial roofing basis with increased numbers of warehouses and factories. The chemical stability and above-average strength of the material will provide protection and longevity. Long-term maintenance will be minimized and there will be constant improvement in performance under harsh weather conditions.

- Institutional Roofing: Institutional roof installations will also drive the expansion of the global synthetic roofing underlayment market. Government, healthcare, and educational buildings will embrace synthetic underlayments due to reliability and longevity. Next-generation building practices will involve top-quality materials guaranteeing safety, insulation, and up-to-date building code compliance.

By End-User the market is further divided into:

- Contractors: Contractors will be among the key players in defining the global synthetic roofing underlayment market through quality installations and embracing new products. Increased activity in construction will lead to product demand for convenience saving and offering durability. Training programs and sensitization campaigns will also enhance product choice among competent individuals.

- Homeowners: Homeowners will continue to be a significant end-use category in the global synthetic roofing underlayment market because of increased knowledge of long-term roof protection. There will be growing demand for low-cost yet durable materials improving energy efficiency in homes. There will also be a shift towards green products affecting material selection and market trends.

- Building Material Distributors: The global synthetic roofing underlayment market growth will be supported by building materials distributors, maintaining availability and introducing new products to the market. Distributors will utilize online platforms in order to effectively manage supply chains as construction activity increases. Strategic alliance with manufacturers will improve access to sophisticated underlayment products globally.

- Construction Companies: Construction firms will keep spearheading growth in the global synthetic roofing underlayment market through enormous housing and infrastructural development projects. Quality, affordability, and adherence to regulations will be prioritized. Smarter and sustainable material integration will be a popular trend that will propel future roofing applications.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$2705.9 Million |

|

Market Size by 2032 |

$4520.4 Million |

|

Growth Rate from 2025 to 2032 |

7.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

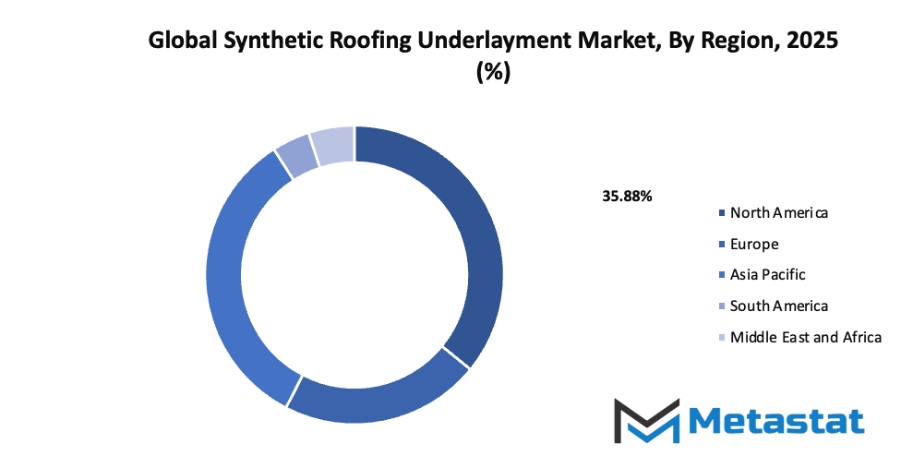

By Region:

- Based on geography, the global synthetic roofing underlayment market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Increasing demand for durable and long-lasting roofing solutions in residential and commercial construction: The global synthetic roofing underlayment market will grow as more construction projects focus on durability and efficiency. Synthetic materials will offer higher resistance to wear and tear, making them ideal for modern buildings that require long-term reliability. Developers and contractors will choose these materials to meet strict safety and quality standards. The use of synthetic underlayment will also support improved roof performance under changing weather conditions, encouraging greater adoption across housing and commercial sectors. This trend will play a major role in strengthening market demand in the future.

- Growing preference for lightweight, easy-to-install materials that reduce labor time and costs: The global synthetic roofing underlayment market will benefit from the rising preference for lightweight and easy-to-install roofing materials. These features will help reduce overall project timelines and labor expenses, making construction more efficient. Contractors will favor synthetic underlayment because it simplifies installation without compromising durability or safety. The time-saving advantage will be especially valuable in large-scale projects where efficiency determines profitability. As a result, lightweight synthetic materials will become a standard choice for roofing applications, driving future market expansion and broader industry acceptance.

Challenges and Opportunities

- Higher upfront cost compared to traditional felt underlayment: The global synthetic roofing underlayment market will face resistance due to higher initial investment requirements. Traditional felt underlayment will still attract price-conscious buyers, especially in markets with tight budgets. Although synthetic materials offer better durability and performance, the cost difference may discourage some contractors from immediate adoption. However, over time, the long-term savings from reduced maintenance and extended lifespan will outweigh the upfront expenses, gradually shifting consumer preference toward synthetic options. This balance between cost and value will shape purchasing decisions across various construction sectors.

- Limited awareness among small-scale contractors in developing regions: The global synthetic roofing underlayment market will encounter slower growth in regions where small-scale contractors remain unaware of the advantages of synthetic materials. Lack of product knowledge and limited exposure to modern construction technologies will hinder market penetration. Many contractors will continue using traditional underlayment due to familiarity and affordability. Increasing training programs and awareness campaigns will be essential to demonstrate the benefits of synthetic products. Once understanding improves, adoption will likely rise, supporting market expansion in emerging economies and smaller construction sectors.

Opportunities

- Rising adoption of energy-efficient and advanced roofing systems in green building projects: The global synthetic roofing underlayment market will expand as more green building initiatives promote sustainable materials. Synthetic underlayment will complement energy-efficient roofing systems by providing improved insulation, moisture protection, and longevity. Builders aiming for eco-certifications will prefer these products for their compatibility with modern design standards. The ongoing shift toward sustainable infrastructure will encourage continuous innovation, leading to stronger market competitiveness. As governments and organizations emphasize low-impact construction, synthetic roofing underlayment will emerge as a vital component in supporting global environmental goals.

Competitive Landscape & Strategic Insights

The global synthetic roofing underlayment market will continue to expand as both international industry leaders and emerging regional competitors play significant roles in shaping its future. Leading companies such as GAF Materials Corporation, Owens Corning, CertainTeed (Saint-Gobain), DuPont de Nemours, Inc., AvenEx Coating Technologies, Atlas Roofing Corporation, TARCO, IKO Industries Ltd., KPNE, Polyglass U.S.A., Inc., Thermakraft, Holland Manufacturing Company, GCP Applied Technologies Inc., Epilay Inc., UNDERLAYMENT SPECIALTIES PLUS, A.W. Graham Lumber, and Alpha ProTech will influence the direction of innovation, quality standards, and market growth. The presence of both established and newer players will encourage advancements in material performance, environmental sustainability, and cost efficiency.

As demand grows for more durable, weather-resistant, and energy-efficient roofing solutions, the industry will likely see rapid adoption of next-generation synthetic underlayment products. Companies will increasingly focus on integrating new technologies that enhance installation ease, reduce labour costs, and provide longer-lasting protection against extreme weather conditions. Regional competitors will also play a key role in addressing local market needs, offering tailored products that respond to specific climates and building regulations.

In the coming years, collaboration between global leaders and regional innovators will likely drive the development of smarter, more resilient roofing solutions. Investments in research and development will focus on materials that can withstand harsher environmental conditions, improve thermal insulation, and offer greater flexibility during installation. The market will witness competition not just in price and quality but also in sustainability initiatives, as eco-friendly solutions will become a priority for both businesses and customers.

Market size is forecast to rise from USD 2705.9 million in 2025 to over USD 4520.4 million by 2032. Synthetic Roofing Underlayment will maintain dominance but face growing competition from emerging formats.

Overall, the global synthetic roofing underlayment market will experience growth driven by technological innovation, strategic partnerships, and a balance between established and emerging competitors. Companies that prioritize product performance, durability, and environmental responsibility will define the future of the industry, shaping it into a market that meets both current and future demands.

Report Coverage

This research report categorizes the global synthetic roofing underlayment market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global synthetic roofing underlayment market.

Synthetic Roofing Underlayment Market Key Segments:

By Material Type

- Polypropylene (PP)

- Polyethylene (PE)

- Others

By Application

- Residential Roofing

- Commercial Roofing

- Industrial Roofing

- Institutional Roofing

By End-User

- Contractors

- Homeowners

- Building Material Distributors

- Construction Companies

Key Global Synthetic Roofing Underlayment Industry Players

- GAF Materials Corporation

- Owens Corning

- CertainTeed (Saint-Gobain)

- DuPont de Nemours, Inc.

- AvenEx Coating Technologies

- Atlas Roofing Corporation

- TARCO

- IKO Industries Ltd.

- KPNE

- Polyglass U.S.A., Inc.

- Thermakraft

- Holland Manufacturing Company

- GCP Applied Technologies Inc.

- Epilay Inc.

- UNDERLAYMENT SPECIALTIES PLUS

- A.W. Graham Lumber

- Alpha ProTech

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252