MARKET OVERVIEW

The global bioethanol market will be at the crossroads of agriculture, energy, and sustainability, which will define societies' ways of dealing with alternative fuels during the next decades. Bioethanol, which is mainly derived from plants that are high in sugar or starch, will only continue to attract interest as not just a renewable fuel but as a strategic measure against a reliance on traditional petroleum. What is unique about this market is that it will integrate multiple industries, ranging from agriculture and biotech to transportation and energy infrastructure, into a matrix of innovation and policy changes that will influence its course. In contrast with other fuels that will require huge amounts of capital expenditures in drilling or mining, bioethanol will rely on crop production and the use of enzymatic or fermentation technology.

This farm base will provide the sector with some strength, as it will link the production of fuel to rural economies and food supply chains. The global bioethanol market will thus be influenced by the way that nations will balance their agricultural land use, how well they will implement new methods of processing, and the way that governments will oversee the balance between food security and fuel consumption. The story will not only be about fuel, but about the decisions societies will have to make in fueling both humans and machinery. As the industry continues, the global market will continue to be used as a case study of how renewable materials will disrupt the old models of energy. The innovation function will be pivotal, since future bioethanol production will come from non-food biomass, agricultural waste, and even urban waste.

This change will prove that future fuel systems no longer depend on productive cropland but utilize materials previously wasted. The effect will be tremendous, as it will redefine waste management operations and create opportunities for new industries founded on circular economy strategies. International debates on climate change will continue to call attention to the need for a shift towards cleaner energy, and bioethanol will be identified as one of the fuels that will span the immediate use of fossil fuels towards a low-carbon future. In contrast to electric power systems that will necessitate fundamental changes in grid infrastructure, bioethanol will be compatible with existing fuel distribution systems, enabling easier integration. This compatibility will make the global bioethanol market an attractive topic for nations that will be eager to move swiftly without revolutionizing whole infrastructures.

Its future will not just be a matter of energy substitution but also involve controversies surrounding land use, commerce, and rural transformation. Governments will take deals that will make or break the fate of whether bioethanol will become a pillar of energy security or a secondary option. To its producers, it will provide a mix of hope and burden, as sound methods have to be instituted to keep fuel manufacturing from harming biodiversity and water resources. Finally, the international bioethanol industry will demonstrate how policy, innovation, and sustainability will converge to form the future energy options. Because societies will look for alternatives that connect economic development with environmental stewardship, bioethanol will be a reminder that the future of energy will not be solely based on technology but also on farming knowledge and international collaboration.

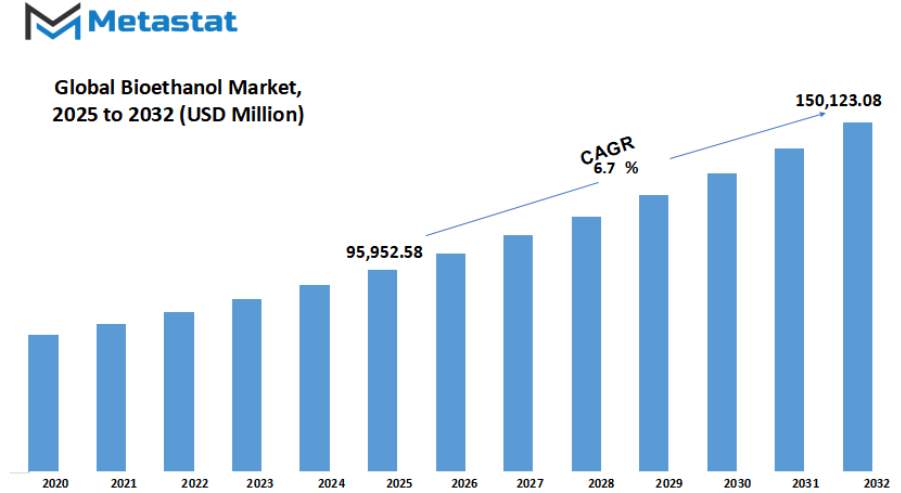

Global bioethanol market is estimated to reach $150,123.08 Million by 2032; growing at a CAGR of 6.7% from 2025 to 2032.

GROWTH FACTORS

The global bioethanol market has gained remarkable attention as the demand for cleaner and more sustainable sources of energy continues to rise. Bioethanol, being a renewable fuel, is expected to play a crucial role in reducing greenhouse gas emissions and supporting the shift toward greener energy solutions. The use of bioethanol in transportation, industrial applications, and even as a blending agent with gasoline is creating new possibilities for energy security and environmental safety. With governments across the world implementing stricter regulations to curb pollution and carbon footprints, the global market will continue to expand steadily in the future.

Growth factors such as the rising need for renewable fuel alternatives and the increasing concern for environmental preservation are key driving factors of the market. In addition, supportive policies and investments in biofuel production technology will further strengthen the global market. Growing urbanization and the rising consumption of energy, particularly in developing economies, will contribute to an even stronger demand. The expanding automotive industry and the rising adoption of eco-friendly vehicles will also add momentum to this market.

However, high production costs and dependency on raw materials might hamper market growth. The cost of feedstock and challenges related to land usage for biofuel crops are significant barriers that may limit large-scale production. Competition with food crops for land and resources could further restrict the growth rate of the global market. Limited awareness in certain regions and the availability of cheaper alternatives may also pose difficulties.

Despite these challenges, technological advancements and increasing investment in research will provide lucrative opportunities for the market in coming years. The development of second and third-generation bioethanol production methods, which use non-food crops and waste materials, will reduce the dependency on food-based resources and lower the cost of production. Advances in biotechnology and agricultural practices will also improve efficiency and yield, helping to meet the rising global demand. Moreover, international collaborations and the expansion of trade networks will encourage market penetration into new regions, creating fresh opportunities for long-term growth.

Looking ahead, the global bioethanol market is likely to witness strong progress as innovation and sustainability goals align. Cleaner energy solutions will remain a priority for both developed and developing economies, pushing the demand for bioethanol even higher. With continuous improvements in technology, infrastructure, and supportive government initiatives, this market will emerge as one of the key players in the future of renewable energy, offering both economic and environmental benefits.

MARKET SEGMENTATION

By Feedstock

The global bioethanol market is gaining attention as industries and governments continue to search for cleaner and more sustainable energy sources. With growing concerns over climate change and the heavy reliance on fossil fuels, bioethanol is becoming a strong alternative that will support the transition toward renewable energy. This fuel, which is derived from plant-based materials, offers benefits such as reduced greenhouse gas emissions and greater energy security. As the demand for environmentally friendly solutions rises, the global market will see steady expansion in the years ahead.

By feedstock, the global market is further segmented into starch based, sugar based, cellulose based, and others. Starch based feedstock, such as corn and wheat, has long been the most commonly used source due to the well-established production processes and relatively high yields. However, future growth will not rely only on starch-based feedstock. Sugar based sources, which include sugarcane and sugar beet, will also play a key role, especially in regions where these crops are abundant. The advantage of sugar-based feedstock lies in the simplicity of conversion, making it a cost-effective choice in the long run.

A major area of development will come from cellulose-based feedstock. This includes crop residues, wood, and grasses, which are widely available and do not compete directly with food crops. The use of cellulose based materials will address concerns about food security and land usage while also unlocking large untapped resources. Although current technology for cellulose conversion is more complex, ongoing research and innovation will improve efficiency and reduce costs, making it a promising segment for future expansion of the global market. The “others” category will include diverse raw materials such as algae or waste products, which could become increasingly important as industries look for alternative methods to further cut carbon emissions.

The global market will continue to benefit from policy support, technological innovation, and shifting consumer attitudes toward clean energy. Governments are setting stricter regulations on fossil fuel consumption and offering incentives for renewable alternatives, which will encourage investment in bioethanol production. Advances in biotechnology and engineering will also improve conversion methods, boost efficiency, and expand the use of non-traditional feedstock. With industries moving toward carbon neutrality and consumers showing greater preference for sustainable choices, the market will strengthen its role in the global energy mix.

Looking ahead, the global bioethanol market will stand as a crucial part of the transition toward a cleaner future. By exploring different feedstock sources and investing in advanced production methods, this industry will secure a strong position in meeting both energy demands and environmental goals.

By Fuel Generation

The global bioethanol market will continue to grow as countries seek cleaner energy options and reduce dependence on fossil fuels. Bioethanol, made from crops, waste, or algae, is being seen as a promising solution for the future of transportation and energy. Governments and industries around the world are pushing forward policies and investments that will encourage the use of bioethanol, making it a vital part of future energy planning. Rising demand for sustainable energy, along with concerns over climate change, will keep driving attention toward bioethanol as a reliable alternative.

The global market by fuel generation is divided into First Generation, Second Generation, and Third Generation. First Generation bioethanol is produced from food crops such as corn, sugarcane, and wheat. Although this type has been widely used, it faces criticism for competing with food production and placing pressure on agricultural land. Despite this concern, it will continue to play a role because of established infrastructure and relatively lower production costs.

Second Generation bioethanol uses non-food biomass, including agricultural waste, forestry residues, and grasses. This approach reduces the challenge of food competition and makes better use of resources that would otherwise go unused. The global market will benefit from this generation as technology improves and production costs decrease. Many companies are investing in research to scale up second generation production, and in the future it is expected to gain stronger market share as governments support advanced biofuels.

Third Generation bioethanol is produced from algae, which offers the highest potential for efficiency and sustainability. Algae can grow quickly, require less land, and can be cultivated in environments unsuitable for farming. This makes third generation bioethanol highly attractive for long-term growth. While still at an early stage, advances in biotechnology and cultivation methods will allow algae-based bioethanol to become more competitive. The global market will likely see major breakthroughs in this segment as technology matures.

Future growth of the global market will depend on innovation, government support, and large-scale investment in infrastructure. Transition toward cleaner energy will keep encouraging the adoption of bioethanol across transport, power generation, and industrial use. With constant focus on reducing greenhouse gas emissions, the global bioethanol market will expand as a key player in the global energy shift. The balance between First Generation, Second Generation, and Third Generation fuels will change over time, with advanced generations expected to dominate in the years ahead.

By Fuel Blend

The global bioethanol market is gaining importance as countries and industries continue to search for cleaner and more sustainable energy sources. Bioethanol, made primarily from crops such as corn, sugarcane, and other biomass, is seen as a strong alternative to traditional fossil fuels. The growth of this market is tied to rising concerns over climate change, stricter environmental rules, and the increasing need for renewable energy solutions. Governments and private sectors are supporting research and production to make bioethanol more efficient and widely available, ensuring that it will play a larger role in the future of energy.

A major factor shaping the global market is the use of different fuel blends. By Fuel Blend the market is further divided into E5, E10, E15 to E70, E75 to E85, and others. These blends represent varying percentages of ethanol mixed with gasoline. E5 and E10 are the most common in many regions because they allow a smooth transition from gasoline to bioethanol without requiring significant changes in vehicle engines. E15 to E70 blends show a stronger commitment to renewable energy, while E75 to E85 blends are often used in flexible fuel vehicles designed to handle higher ethanol levels. Each category reflects how markets around the world adopt ethanol differently, influenced by infrastructure, consumer awareness, and government incentives.

Looking ahead, the global market will likely expand as technology advances. Improved methods of converting feedstock into ethanol will reduce costs and increase production efficiency. There is also growing interest in second-generation bioethanol, which uses non-food materials like agricultural waste, making the process more sustainable and less dependent on food crops. If such innovations continue, bioethanol could become a leading choice for reducing greenhouse gas emissions in transportation and other energy-heavy sectors.

Another factor driving the global market will be the global shift toward reducing oil dependence. As countries set stricter carbon reduction goals, biofuels like ethanol will be seen as practical solutions. Emerging economies with rising energy needs are expected to adopt bioethanol more aggressively, further pushing demand. Investments in distribution networks, fuel stations, and vehicle compatibility will make higher blend usage easier in the coming years.

The future of the global bioethanol market will not only be shaped by environmental concerns but also by economic opportunities. Farmers, energy companies, and governments stand to benefit from a stronger bioethanol industry. With technology, policy support, and growing global demand, the market will remain a crucial part of the clean energy transition.

By End User

The global bioethanol market is expected to play a major role in shaping a cleaner and more sustainable future. Growing awareness of environmental issues, along with the urgent need to reduce greenhouse gas emissions, will continue to drive demand for bioethanol as an alternative fuel. Governments and industries are making efforts to shift from fossil fuels to cleaner energy sources, and this shift will strengthen the position of bioethanol across different sectors. The move toward renewable energy will not only benefit the environment but also open new opportunities for industries that rely on sustainable fuel and chemical production.

By end user, the global market is divided into transportation, alcoholic beverages, cosmetics, pharmaceuticals, and others. Transportation remains the leading segment as the push for biofuels in cars, trucks, and even aviation is gaining support. With governments promoting cleaner fuel blends, bioethanol will continue to be integrated into fuel systems, ensuring lower emissions without heavy changes to existing engines. This adoption will grow further as more nations put strict policies in place to cut carbon footprints in the coming decades.

The alcoholic beverages industry is another strong contributor, as bioethanol is widely used in the production of spirits and related products. This market will remain steady, with demand driven by consumer preference and global trade. Cosmetics also hold promising potential, as bioethanol serves as a natural base for perfumes, lotions, and personal care products. Growing awareness about sustainable ingredients will encourage cosmetic brands to use bioethanol as part of their production process, creating long-term demand.

Pharmaceuticals stand as another vital area where bioethanol plays a role in drug formulation and preservation. With the continuous expansion of healthcare systems worldwide, the need for bioethanol in this sector will remain significant. The "others" category, including cleaning products, industrial solvents, and household items, adds further stability to the global market by diversifying its end use.

Looking ahead, the global market will benefit from technological innovation and large-scale investment. Advancements in production methods, such as using agricultural waste and non-food crops, will reduce costs and expand supply. With industries and governments placing strong focus on green initiatives, bioethanol will move beyond being just an alternative fuel to becoming a cornerstone of sustainable industrial growth. As new markets emerge and policies continue to support renewable energy, the global bioethanol market will hold a central role in shaping a cleaner and more resource-efficient future.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$95,952.58 million |

|

Market Size by 2032 |

$150,123.08 Million |

|

Growth Rate from 2025 to 2032 |

6.7% |

|

Base Year |

2024 |

|

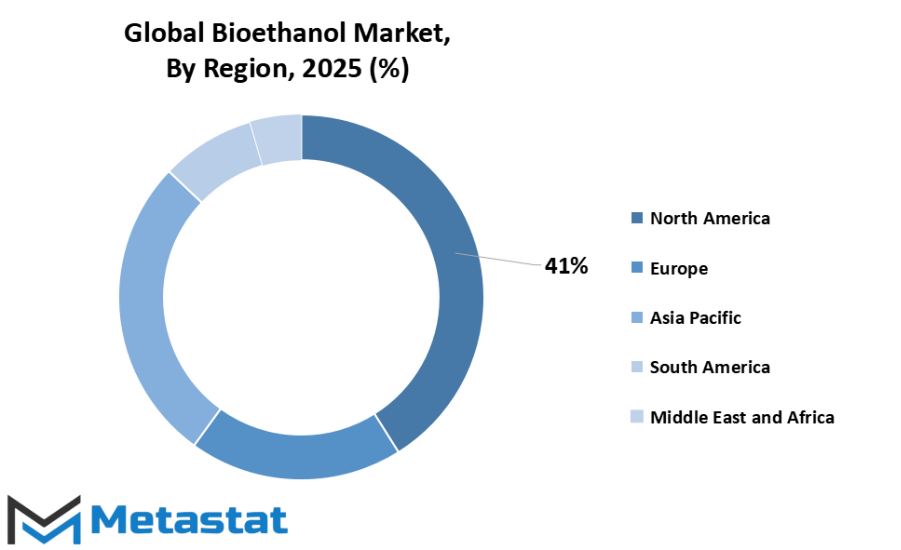

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global bioethanol market is expected to gain more importance in the years ahead as the search for cleaner and renewable energy sources continues to rise. Bioethanol, being a fuel made from natural materials such as crops and waste, is seen as a practical way to cut down on greenhouse gas emissions while also reducing dependence on fossil fuels. With governments, businesses, and communities paying more attention to climate concerns, this market will likely expand as policies and technologies move toward a greener future.

Based on geography, the global market is divided into several regions, each with its own growth drivers. North America, which includes the U.S., Canada, and Mexico, is currently a leading region due to strong government backing and high investments in renewable energy. The U.S., in particular, has large-scale production facilities and established mandates that push the demand for bioethanol in transportation. Canada and Mexico are also expected to strengthen their production and consumption, building a more sustainable energy system.

In Europe, which covers the UK, Germany, France, Italy, and the Rest of Europe, stricter environmental regulations and ambitious carbon reduction targets will drive the expansion of bioethanol usage. Germany and France are already moving forward with renewable fuel programs, while the UK and Italy are showing increased adoption in blending policies. Europe’s commitment to reducing emissions will ensure steady growth across the region.

The Asia-Pacific region, which includes India, China, Japan, South Korea, and the Rest of Asia-Pacific, is expected to show rapid growth as energy needs rise along with population and industrial expansion. China and India are focusing on cutting oil imports while improving energy security, which will push for higher bioethanol production. Japan and South Korea are likely to adopt advanced technologies and focus on innovative methods for bioethanol production, making the region highly promising for long-term development.

South America, with Brazil, Argentina, and the Rest of South America, has already shown strong bioethanol adoption. Brazil, in particular, is one of the largest producers, relying heavily on sugarcane-based ethanol. The country’s strong infrastructure and government policies will keep it as a leader in production and exports. Argentina is also growing its role in the sector, adding to the region’s importance.

The Middle East & Africa, including GCC Countries, Egypt, South Africa, and the Rest of Middle East & Africa, is expected to rise more slowly but still has potential. With abundant land and growing interest in diversification away from oil, countries in this region may begin to invest more in bioethanol projects in the future.

Overall, the global bioethanol market will continue to expand as energy systems around the world move toward more sustainable solutions. Investments, technological progress, and government policies will play a central role in shaping this growth, making bioethanol a vital part of the global energy transition.

COMPETITIVE PLAYERS

The global bioethanol market is gaining attention as governments, businesses, and consumers look for energy sources that are cleaner and more sustainable than traditional fossil fuels. Bioethanol, made mainly from crops like corn, sugarcane, and other biomass, is expected to play a greater role in the shift toward renewable energy. With rising concerns over climate change and increasing demand for greener transportation, the future growth of this sector appears promising. Policies promoting low-carbon energy alternatives will encourage investment and expansion, making bioethanol a strong competitor in the energy landscape.

Competitive players in the global market are working to strengthen their positions through innovation, efficiency, and partnerships. Companies such as POET, LLC. and Valero Energy Corporation are focusing on advanced technologies that improve production efficiency and reduce costs. Archer Daniels Midland Company (ADM) continues to expand its capabilities with research into sustainable feedstocks, while Green Plains Inc. is aiming to transform operations by incorporating carbon capture strategies. Alto Ingredients Inc. is investing in diversification by producing not only bioethanol but also related high-value products. Each of these strategies reflects how competition will shape the market’s direction.

Other players are also contributing to the growth of the global bioethanol market. Abengoa and Blue Biofuels Inc. are developing second-generation biofuels that rely less on food-based crops, helping address sustainability concerns. Cenovus Inc. and Cristalco are leveraging their global networks to expand distribution channels, ensuring wider market reach. Cropenergies AG is strengthening its position in Europe, while Ethano Technologies and Granbio Investimentos SA are pushing advancements in technology that will help reduce emissions and improve output efficiency. Henan Tianguan Group Co. Ltd is another major participant, particularly in Asia, where rising energy demand is creating new opportunities for bioethanol adoption.

The global bioethanol market will continue to grow as more companies seek to balance profitability with environmental responsibility. With the backing of government policies, technological progress, and consumer demand for cleaner fuels, competition among key players will likely intensify. The future of this market will not only depend on lowering costs and increasing production efficiency but also on addressing issues like food security and land use. Success will favor those companies that can innovate while keeping sustainability at the center of their strategies. As a result, the global bioethanol market is expected to remain a vital component of the global energy mix, driving both economic growth and environmental progress.

Bioethanol Market Key Segments:

By Feedstock

- Starch Based

- Sugar Based

- Cellulose Based

- Others

By Fuel Generation

- First Generation

- Second Generation

- Third Generation

By Fuel Blend

- E5

- E10

- E15 to E70

- E75 to E85

- Others

By End User

- Transportation

- Alcoholic Beverages

- Cosmetics

- Pharmaceuticals

- Others

Key Global Bioethanol Industry Players

- POET, LLC.

- Valero Energy Corporation

- Archer Daniels Midland Company (ADM)

- Green Plains Inc.

- Alto Ingredients Inc.

- Abengoa

- Blue Bio Fuels Inc.

- Cenovus Inc.

- Cristalco

- Cropenergies AG

- Ethano Technologies

- Granbio Investimentos SA

- Henan Tianguan Group Co. Ltd

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252