MARKET OVERVIEW

Benelux Intralogistics market is the most advanced systems and technologies which manage the flow of goods and materials in internal warehouse, distribution center, and production facility in Belgium, the Netherlands, and Luxembourg. This is vital to the logistics and supply chain industries since its focus lies in maximizing its operations inside these facilities; that is, making sure the goods are stored, retrieved, and moved through various stages of production and distribution in the most efficient manner possible.

This includes all forms of automation, from the stock management software of warehouse management systems to the robotics and other technologies that enhance the efficiency of internal logistics operations. A report indicated that in the Benelux region-an important node for international trade-these technologies have been adopted in large numbers to solve the increased demands for faster, more accurate, and cost-efficient logistical operations. Here, intralogistics solutions are vital for competitiveness and meeting the objectives of a global supply chain in the region.

The Benelux Intralogistics market has wide applications in the manufacturing, retail, e-commerce, and food and beverage sectors. Toward this end, companies in these industries are concentrating on automated and digital systems that are supposed to provide stress-free internal logistics processes-from inventory management to complex order fulfillment tasks. Business has a need for flexible and scalable intralogistics solutions as it executes aggressive expansion processes across borders while meeting rising consumer demands and the imperative for sustainability.

Automation is one of the key drivers in the sector. Most organizations embrace AGVs, robotic arms, as well as conveyor systems to implement such solutions. Generally, such solutions help minimize manual work, increase speed and accuracy, and allow real-time control and monitoring of operations. Besides physical automation, it also encompasses critical software systems that include support for predictive analytics, data management, and operational control. Warehouse management systems (WMS) and enterprise resource planning (ERP) systems are being integrated with physical equipment to create fully optimized environments that support lean operations.

The future of the Benelux Intralogistics market is expected to grow in terms of usage of robotics and artificial intelligence in order-picking and sorting processes in the near term. These technologies, combined with advancements in machine learning and analytics of data, will enable corporations to exert much greater influence over their intralogistics activities. As e-commerce volumes increase, the demand for smart and agile solutions to process tremendous volumes of orders at very low error rates will rise even sharper. It is, therefore, incumbent upon companies to adopt systems that are more scalable and automated enough to meet these operational needs.

Energy consumption and carbon footprint further dictate the Benelux Intralogistics market, which companies implement to continue reducing their impacts on the environment. In the future, automated systems and intralogistics solutions will concentrate much more on energy efficiency and waste minimization as regulatory pressure and corporate social responsibility continues to emphasize sustainability practice.

The Benelux Intralogistics market is very significant for the expansion of businesses that are evaluating the means to optimize their internal logistics procedures. The intralogistics market will certainly and continuously evolve from the forces of technological development and the pressures of increasing efficiency in handling items within warehouses and other internal spaces. As the various industries transform the region, the Benelux intralogistics will remain an industry that is certainly needed by such sectors looking for innovative automated solutions.

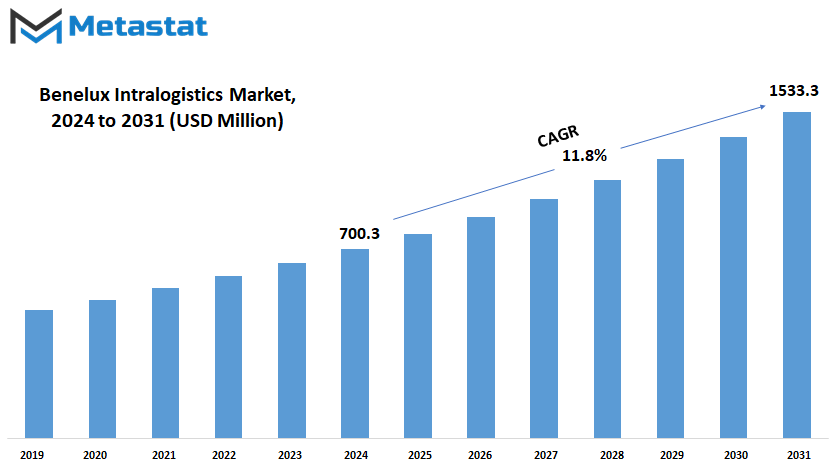

Benelux Intralogistics market is estimated to reach $1533.3 Million by 2031; growing at a CAGR of 11.8% from 2024 to 2031.

GROWTH FACTORS

Several factors that reflect changes in the logistics and supply chain management landscape are to drive Benelux Intralogistics market through following years. As this market requires effective intralogistic solutions, a region of three countries – Belgium, the Netherlands, and Luxembourg-grabs this opportunity through several growth influencing the demand for these solutions.

The prime mover here is the rapid advancement of technology in the logistics sector. It changes the way goods are stored, managed, and distributed in the light of digitization and automation. In this regard, most companies today use automated systems that include the use of AGVs and robotics to make things operationally efficient for business supply chain optimization. Once these technologies begin to deploy, the labor cost can then be minimized, accuracy increased, and the process sped up, becoming the siren of company supply chain optimization.

The third vital factor driving the Benelux Intralogistics market is sustainability. There has been an increasing concern, not only on the consumers’ side but also among businesses, regarding the need to conserve the environment. Subsequently, companies will seek greener logistics solutions. It will result in the use of energy-efficient equipment and waste minimization, which will consequently reduce carbon footprint. As sustainability becomes more prominent, companies that invested in such eco-friendly intralogistics solutions will have an upper hand over other companies in the market.

E-commerce also recreates the dynamics in logistics. The more people who shop over the Internet, the more important order fulfillment and distribution solutions need to be. This inspires businesses to reconsider their intralogistics concepts in light of customers’ expectations about shorter response times. Companies that will effectively develop a seamless process flow will therefore manage to thrive in the evolving market.

However, despite these positive drivers, there is potential for facing a number of challenges that would stall growth in the market. Economic and supply chain disruptions due to geopolitical tensions or natural disasters may thus be portrayed as risks. Companies may find it difficult to respond to such changes promptly; this would stand against their overall efficiency and profitability.

Conversely, there are many prospects for growth in the medium run, such as artificial intelligence and Internet of Things (IoT). It further develops the decision-making skills with real-time data to rapidly react to changing market demands and enhance the way businesses run operations.

The Benelux Intralogistics market is at a tremendous moment in terms of growth factors driving its expansion. Challenges do exist, but this opportunity for innovation and adaptation will be thrilling for business players in the next coming years. Companies embracing these trends will be better positioned to succeed in this dynamic market.

MARKET SEGMENTATION

By Type of Equipment

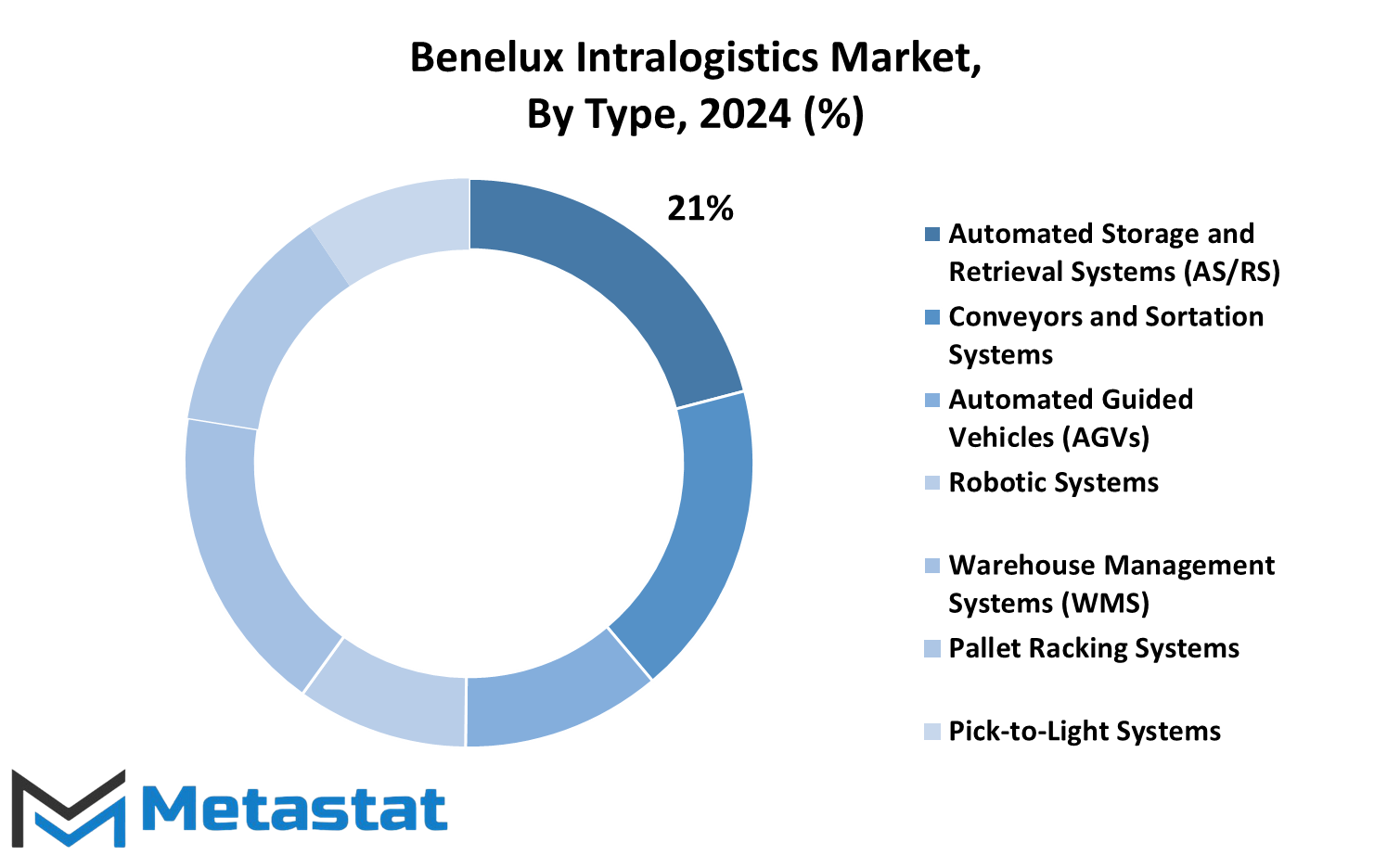

The high-growth sector in the Benelux Intralogistics market was partly fueled by huge technological advancements, which are partly driven by the growing and arising need for efficient supply chain management. The increasing operational efficiency in Belgium, the Netherlands, and Luxembourg continues to raise the demand for innovative intralogistics solutions. Intralogistics is all equipment that helps in the smooth movement of goods in warehouses and distribution centers toward improvement in productivity and cost reduction.

One of the most essential types of this equipment is Automated Storage and Retrieval Systems, or AS/RS. This sort of technology allows companies to store and retrieve their wares automatically without requiring as much human intervention as before, optimizing available storage space. AS/RS not only accelerates the process involved in fulfilling orders but also reduces error, making them a good choice for businesses that want to eliminate redundancy in any area of operation.

Conveyors and sortation systems also take an extremely important role in the Benelux market for Intralogistics. This is because higher efficiency in material handling is assured as it allows all goods to be moved quickly around a facility. The business enhances workflow by automating the sorting and movement of their products, which gives greater delivery speed and satisfies customers better. About future demand, this may increase with the growth of e-commerce.

Then, of course, come Automated Guided Vehicles or AGVs. These vehicle assets run automatically and transport goods around a facility. This reduces their reliance on humans. Advances in AGV technology will surely lead to really advanced and flexible solutions that are ready to adapt to changing business demands. This will actually enable optimized logistics with minimal operational costs.

Another revolution taking place is in the Benelux Intralogistics market by the help of robotic systems. It is a system that will allow an entity to perform several activities, such as picking and packing, hence saving cost on labor and increasing efficiency. In the future, as the world continues to advance its robotics technology, more complex systems will be implemented by businesses to take up more workloads and to do them more accurately.

These WMS have proven highly relevant for inventory management and optimizing warehouse functions. They impart an actuality of time to operations and analytics for businesses that help them make intelligent decisions to increase efficiency. In this context, with the growing reliance of firms on data to make decisions, the future for WMS looks quite promising.

The same Benelux Intralogistics market is seeing a growth in the Pallet Racking Systems as well as in the Pick-to-Light Systems. These improve space utilization and order accuracy, respectively, and further the cause of operational efficiency. Later, as companies in the region continue their investments in such technologies, the Benelux Intralogistics market is expected to shape up towards providing innovative solutions that answer the growing requirements of the industry.

By Application

The Benelux Intralogistics market is undertaking extraordinary changes under the influence of new technologies and expectations of final consumers in the market. The three countries include Belgium, the Netherlands, and Luxembourg. Demand for efficient logistic solutions across various sectors has led to this growth. Most businesses are trying to reduce their operational costs to be more efficient, thus ending up driving the market into creating a promising future.

One of the major application areas in this market would be in e-commerce and retail. Electronically processed shopping has completely changed the way goods are to be warehoused and dispatched. Companies are adopting automated systems increasingly to manage their stocks better and reduce costs of order fulfillment. In light of such accelerating growth for online sales, the need to have more efficient intralogistics solutions would propel to even greater heights, forcing companies to invest in more sophisticated technologies that can weather the storm of rapid order processing.

Another major industry being catered to is food and beverages. Food and beverages are very complex in terms of their logistics requirements as products need to be handled without damaging their quality and safety. Automation and robotics will manage the flow of perishable goods and adhere to the very stringent regulations and guidelines of the sector. The Benelux Intralogistics market will also address the demand for consumers’ need toward convenience and quality.

Pharmaceuticals is another huge category. Advanced intralogistics solutions will make deep inroads in this space, especially the critical parts relating to medical equipment and medicines. The requirement in this space will mean companies invest more in temperature-controlled storage and distribution facilities where products are kept effective and safe to consume.

The automotive industry is a significant player in the intralogistics market in the Benelux region. Due to increased usage of electric and smart cars, the automotive companies must efficiently optimize their supply chain operations to stay ahead in the race. Innovations within the intralogistics sector shall thus assist it in reacting quickly to the innovations creeping in and appropriate inventory optimization, and shortening lead times.

The important sectors that will still continue growing in intralogistics solutions include consumer electronics, logistics and warehousing, and manufacturing. Within these sectors, companies will look for increasing productivity and, therefore, look towards automation and data-driven technologies for insights about their operations.

In summary, the Benelux Intralogistics market is promising in a wide range of applications. The future of this sector will be characterized by efficiency and adaptability, and to support this, investment by companies into advanced logistics solutions that contribute towards an evolving landscape of a market will be continuous. And thus, with these key areas in focus, they will find their ways in a competitive environment.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$700.3 million |

|

Market Size by 2031 |

$1533.3 Million |

|

Growth Rate from 2024 to 2031 |

11.8% |

|

Base Year |

2022 |

|

Regions Covered |

Belgium, Netherlands, Luxembourg |

REGIONAL ANALYSIS

Benelux Intralogistics essentially represents Belgium, the Netherlands, and Luxembourg. Collectively, these three represent a strong logistical backbone with strengths carried by each nation in Benelux. With good infrastructure and its location, Belgium eventually projects as an ideal hub for international trade. Its ports, particularly the port of Antwerp, allow the unloading and loading of cargo in and out of Europe, making Belgium a strong player in intralogistics. With focus on efficiency and innovation, Belgium will expand its intralogistics by bringing state-of-the-art technology to boost productivity and the resilience of supply chains.

One of the most developed transportation networks in the world, the Netherlands today enjoys facilitation for fast-paced transportation of goods. Dutch logistics companies rely increasingly on automation and digital solutions to bring up the level of productivity while curtailing the costs of operation. This trend will only be on the rise in the future when the Netherlands invests in new smart logistics technologies, including artificial intelligence and data analytics, for optimizing their supply chain business. Other factors would be those on the sustainability of commitment in the Netherlands. In such a market, sustainability is emerging as the new challenge for businesses in the intralogistics market because they want to reduce their carbon footprint through greener practices and innovative logistics solutions.

Luxembourg is relatively small but has entered into the sector of logistics in a significant manner by capitalizing on its favorable location and perfect business environment. The country has developed an increasingly efficient logistics ecosystem, attracting multinational companies desiring to have a central European base of operations. Luxembourg will prove its commitment to technological advancement in the development of the Benelux Intralogistics market, as automation and digitalization are leading priorities. In carrying out these changes, Luxembourg will finally respond to the dynamics of e-commerce and adapt its logistics strategies according to fast and reliable deliveries requirements.

Together, the Benelux countries will further optimize their market position in intralogistics through cooperation and innovation. Interchanging best practices and investing in technology will make them better prepared for the challenges of the future. So much is revealed in the regional analysis of the Benelux Intralogistics market: huge growth opportunities are waiting to be seized, especially driven by the fruits of technical achievements, sustainable actions, and orientation towards efficiency. As these countries grow, their collective endeavors are bound to put the Benelux region in a rightful position as one of Europe’s major logistics destinations.

COMPETITIVE PLAYERS

The Benelux Intralogistics market, which at a glance of the situation in Belgium, the Netherlands, and Luxembourg presents dynamic activity on the path to successful movement and handling of goods through warehouses and distribution centers, is characterized primarily by the developed technological solutions that help optimize intralogistic processes. The higher demand for intralogistics systems, thanks to increased productivity and cost savings on the part of enterprises, has been one of the key drivers in this sector. This trend is expected to continue, with companies streamlining their operations and improving service delivery.

Key contributors to the Benelux Intralogistics market are dominated by Kardex Holding AG and Swisslog Holding AG, companies that specialize in modern automated storage and retrieval technologies. These are designed to better manage an organization's supply chain inventory and minimize labor hours while maximizing a company's operational efficiencies. A few other contributors that have influenced the sector are Element Logic AS and Kion Group AG. The former offers a vast array of customized automated solutions to customers, while the latter produces a vast range of customized automated solutions to various customers according to their specific requirements.

Another player that is worth mentioning is Daifuku Co., Ltd., which is known for its powerful conveyor systems as well as sorting technologies. These will allow the free flow of goods in warehouses, which is vital for a healthy supply chain. The Dematic Group is unique with its all-inclusive intralogistics solution, including software systems that seamlessly go with hardware to maximize workflow.

In this highly competitive market, the one that stands is Honeywell International Inc. and SSI SCHÄFER GmbH & Co KG, focusing on smart technologies. Honeywell industrial automation and data analytics developments enable companies to realize insights in decision-making and efficiency. It's the modular systems of SSI SCHÄFER, which are easily adaptable to different warehouse arrangements, that make the company more appreciated.

Other players like Vanderlande Industries B.V., and System Logistics S.p.A, among others, also bring some of the most advanced solutions that optimize sorting, storage, and dispatch of products. High-speed automation solutions of the TGW Logistics Group outshine in drastically increasing throughput in logistics operations.

Prospects of Benelux Intralogistics: The outlook remains brighter as we go into the future and this market for Benelux Intralogistics will continue its evolution. All the innovations in artificial intelligence and the IoT are here to change the very face of logistics systems, thereby making warehouses smarter and more responsive. Efficiency will not be alone to enhance but also allow businesses to compete with the increasingly demanding consumers. The innovation is continuous in traditional companies such as Interroll Holding AG, Bastian Solutions, LLC, Beckhoff Automation GmbH & Co. KG, SICK AG, Festo AG & Co. To that effect, KG as well as Crown Equipment Corporation shall be the foundation upon which the future landscape of intralogistics in the Benelux region will be influenced, and the region would hence maintain its position among the leading logistics solutions providers worldwide.

Benelux Intralogistics Market Key Segments:

By Type of Equipment

- Automated Storage and Retrieval Systems (AS/RS)

- Conveyors and Sortation Systems

- Automated Guided Vehicles (AGVs)

- Robotic Systems

- Warehouse Management Systems (WMS)

- Pallet Racking Systems

- Pick-to-Light Systems

By Application

- E-commerce and Retail

- Food and Beverage

- Pharmaceuticals

- Automotive

- Consumer Electronics

- Logistics and Warehousing

- Manufacturing

- Others

Key Benelux Intralogistics Industry Players

- Kardex Holding AG

- Swisslog Holding AG

- Element Logic AS

- Kion Group AG

- Daifuku Co., Ltd.

- Dematic Group

- Honeywell International Inc

- SSI SCHÄFER GmbH & Co KG

- Vanderlande Industries B.V.

- System Logistics S.p.A.

- TGW Logistics Group

- Interroll Holding AG

- Bastian Solutions, LLC

- Beckhoff Automation GmbH & Co. KG

- SICK AG

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383