MARKET OVERVIEW

The Global Automotive Camshaft Market is one of the important elements in the automotive industry, with significant contributions to the performance and efficiency of engines. The future of camshaft technology will most probably be determined by innovation, technology, and performance standards as better vehicle development emerges and stricter emission regulations are set in place as well as consumers demanding fuel-efficient engines. The automotive camshaft is a very critical part of internal combustion engines, ensuring proper regulation of the timing and movement of engine valves, thereby ensuring the best possible functioning of the engine. With further progress in the market, the engine performance and efficiency of the vehicle will be enhanced by advancements in materials, designs, and manufacturing processes.

As a result of the shift toward cleaner, greener technologies, manufacturers within the Global Automotive Camshaft Market will probably look toward the production of camshafts that help in low-emission engines. The future trend is probably to design lightweight, high-strength materials to reduce the weight of the engine for improved fuel efficiency. Camshafts will also be included in the advanced engine systems like turbocharged and hybrid engines to contribute to the performance of the engine by carrying on with proper valve timing, that is very indispensable to efficiency in different engine speeds.

With the increasing intensity of electric vehicles into the market, it could potentially either influence the Global Automotive Camshaft Market in different ways. Generally, EVs don't require camshafts; however, an increasing presence will drive the quest for alternative technologies and types of engines that can potentially benefit from a camshaft design. Hybrid vehicles combining traditional combustion engines with electric motors will also ensure continued demand for advanced camshaft solutions that could optimize performance and fuel consumption. Manufacturers will try to design camshafts that accommodate the complexities of these hybrid systems, making combustion and electric power integration seamless.

The autonomous vehicle is going to shape the future of camshaft technologies. With widespread autonomous driving systems, there is a demand for better engine control and performance. As autonomous cars are dependent upon high-tech sensors and software, real-time decision making will need an engine which, in this regard, can rely on extremely reliable and precision-controlled camshaft functions. That should result in a more highly advanced camshaft to interact with more sophisticated automobile control systems without creating any jarring disintegration between mechanical and electronic components.

Sustainability also shall be seen more in the Global Automotive Camshaft Market:. With the car industry trying to meet global targets for emissions reductions and reducing the carbon footprint associated with its own operations, designs and production will increasingly focus on the reduction of negative environmental impacts as camshafts are designed. Future camshaft products will increasingly be made with sustainable materials; manufacturing processes are expected to shift towards waste-reduction and minimal energy consumption methods. Also, these developments would be accompanied by an emphasis on the general longevity and life span of camshafts so that they are both efficient and effective for the whole life cycle of a vehicle.

In conclusion, the Global Automotive Camshaft Market will experience a revolution in the years to come. This will be influenced by technology, regulatory issues, and increased efficiency. As the industry evolves, camshaft technology will be an essential component of vehicle performance, which would adapt to new automotive trends and contribute to cleaner, more efficient, and reliable engines. The future of the Global Automotive Camshaft Market would surely mirror the broader changes happening in the automotive industry, from sustainability and innovation to striving for higher standards in performance.

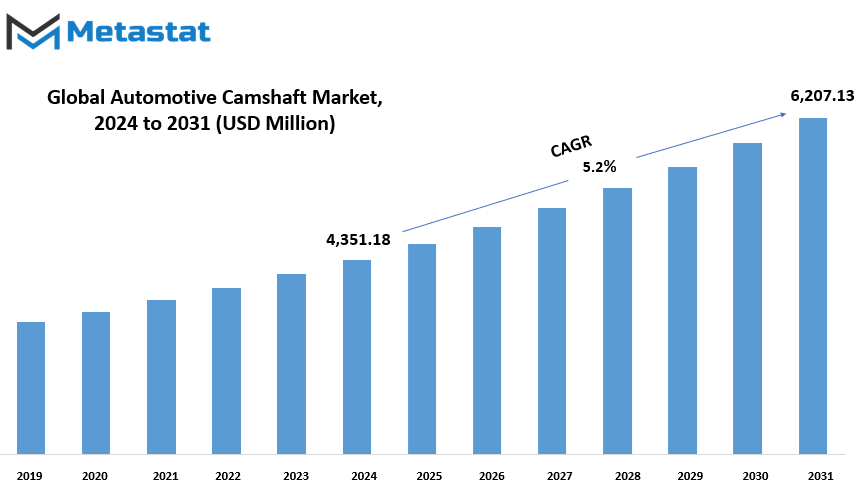

Global Automotive Camshaft market is estimated to reach $6,207.13 Million by 2031; growing at a CAGR of 5.2% from 2024 to 2031.

GROWTH FACTORS

The global automotive camshafts market experiences a variety of factors that help shape its track. These drivers, constraints, and opportunities create a significant influence on the market's growth and development. In terms of driving growth in the automotive camshaft market, significant technological advancements with respect to increasing engine efficiency play a pivotal role. As more complex and efficient engines are manufactured, the requirement for high-performance camshafts increases. Modern vehicles require camshafts to withstand the pressure of highly efficient engines, thus pushing innovation in camshaft design and materials.

This development is directly related to the increasing consumer demand for fuel-efficient vehicles. Drivers are searching for ways to minimize fuel consumption and reduce their environmental impact, and automotive manufacturers are meeting those needs by adding camshafts that improve engine performance. This increasing desire for fuel efficiency spurs the innovation and enhancement of camshafts by the manufacturing companies, hence expanding the market.

On the other hand, despite all the improvements in the automotive camshaft market, the market has to face serious restraints. Among the key ones is the cost of advanced materials used for camshaft production. For example, forged steel and high-performance alloys increase engine strength and performance, but their production is expensive. This increases the total cost of camshaft production and puts more financial stress on manufacturers to meet the increased demand for high-performance, advanced camshafts. The second constraint is strict emission regulations. With the strict regulations set by governments on the emissions of vehicles, manufacturers have to modify their engine designs to meet the standards. This often means redesigning camshaft systems, which is expensive and time-consuming, thereby limiting the growth potential of the market.

Despite these constraints, there are opportunities in the market. One of the most exciting prospects is the emergence of electric vehicles. As more consumers opt for electric vehicles, the demand for specific camshaft types, such as those that support hybrid engines, is expected to grow. This change means the camshaft has new market potential for application to electrically operated vehicles or those using this configuration as standard for power units. Furthermore, demand for less-weighty pieces is rising from automotive industries around the world as vehicle manufacturers start moving towards better efficiency in less heavy cars or units. Due to this concern, there arises an increasing market requirement for weight-effective cam designs to achieve and retain performance and output levels needed and necessary in a standard automotive product. It is an opportunity for new camshaft material and design to be developed under the influence of this trend.

Thus, several factors drive as well as challenge the development of the automotive camshaft market. Technological development and increasing demand for fuel efficiency from consumers lead to growth in the market. However, higher manufacturing costs and emission regulations stand as barriers in the market. The emergence of electric vehicles and the requirement of lightweight components in the vehicle add value to opportunities for market growth.

MARKET SEGMENTATION

By Type

The global automotive camshaft market has been categorized based on the various types available and each of the types contributes to significant market size. Amongst those, cast camshafts can be distinguished and have a value of $2,242.57 million in the market. Cast camshafts are mostly used in the automotive industry, as they have enough strength and endurance. The material is poured molten into the mold for preparing the camshafts, resulting in high accuracy and mass production. Due to its cost-efficiency, its usability is highly considered for carmakers with production aspirations but require output levels to still match the standards.

Cast camshafts, at $1,513.00 million, maintain the second position in terms of market presence. In casting, the metal takes the shape through high-pressure operations; hence cast camshafts are stronger and durable than forged ones. The increased strength and better ability to withstand wear make forged camshafts ideal for high-performance engines, especially in vehicles that require additional durability. This makes them a preferred choice in premium and performance vehicles, where engine performance is a priority.

There are also assembled camshafts with a market size of $595.60 million. Assembled camshafts are produced when the different components are combined; some include a mixture of cast and forged materials. The production is, therefore, very efficient and offers a high-quality product. They tend to be utilized in more normal vehicles, not high-performance cars, but very reliable.

These three types - cast, forged, and assembled camshafts - are significant players in the automotive camshaft market. Cast cams have a dominant market share because of their low pricing and its mass production capacity. However, for consumers wanting better strength and performance, forged camshafts are more expensive but ultimately preferred for being used in high-performance vehicles. Assembled camshafts, balanced between cost and performance, are usually applicable to most vehicles. With the constant increase in demand for various kinds of engines, the market will continue to advance with different camshaft types responding to the respective needs of the automotive industry.

By Vehicle Type

The global automotive camshaft market is segmented into three major segments based on vehicle type: passenger cars, light commercial vehicles, and heavy commercial vehicles. These segments contribute differently to the overall market due to varying demand and applications across different regions.

The largest segment of the automotive camshaft market is passenger cars. As passenger vehicles are getting more in the roads and due to the huge demand for the fuel-efficient engines and high performance, the number of camshafts in a passenger vehicle has been increasing these days. These camshafts in passenger vehicles are very vital for controlling the timing of a car engine for better performance with optimal fuel consumption and reduced exhaust emissions. The advancements in engine technology continuously emerge; this includes the shift towards electrical and hybrid vehicles, thereby supporting the expansion of the camshaft market in this area.

Light commercial vehicles, which include vans, trucks, and buses, are the second most significant category within the market. These are often used to carry goods and persons over short to medium distances. A constant demand for camshafts exists because the demand for light commercial vehicles has been rising steadily in urban and suburban regions with increasing businesses and logistics demands. In this category, camshafts play an important role to ensure the efficient and potent functioning of the engine, which will be vital to the vehicle performance under varied loads.

The last category includes heavy commercial vehicles: large trucks, trailers, and heavy-duty buses. The demand for long-haul transportation will continue to require the use of camshafts designed to be capable of withstanding high pressure and stress over time. The rising global trade and e-commerce markets will further propel the demand for heavy commercial vehicles, thus pushing the demand for durable and high-performance camshafts. The camshafts used in these vehicles have been designed for optimum engine performance, fuel consumption, and minimization of the wear and tear that comes with heavy-duty applications.

Concluding, the global automotive camshaft market can be divided into three major groups of vehicles. These are passenger cars, light commercial vehicles, and heavy commercial vehicles. All these contribute to the total growth of the market and cater to different demands. The demand for the camshaft market is moving steadily across all vehicle categories as the technology advances and more efficiency and performance is demanded in vehicles.

By Engine Type

The global market for automotive camshafts is expected to grow immensely in the coming years because of growing demands and requirements for efficient and high-performance engines. This growth has been emanating from the development of engine technologies and a continuously increasing consumption tendency by consumers towards vehicles that provide more fuel efficiency, fewer emissions, and performance capabilities. Increased adoption of advanced camshaft technologies in various types of engine systems seems one of the key factors behind the expansion of the market.

Market Segmentation Based on Type of Engine In the market, three major categories of engine type are Inline Engine, V-engine, and Others. Inline engines are one of the most frequently used types of engines in cars because of their simplicity, affordability, and consumption of fuel with maximum efficiency. These engines deliver constant performance, and their wide application can be seen in various compact cars, sedans, and SUVs. The demand for inline engines remains on the increase due to consumers who look for more budget-friendly and fuel-efficient vehicles.

In contrast, V-engines, with better power output and performance, are applied to high-performance and luxury cars. In these types of engines, the V-configuration ensures proper balance and a smoother run as the engines produce more power and require higher acceleration. The adoption of V-engines would also increase due to the growth of consumers' demand for performance-oriented cars. This class will see much growth in the near future as car makers would be more concerned with providing better performing engines and innovative features.

The "Others" category consists of many types of engines that include, for instance rotary engines and flat engines. These are relatively lesser in number but also possess a niche in the market. Although the adoption of these engine types is not as widespread as inline or V-engines, they do provide certain design and functionality advantages. The market for these alternative engine types will continue to grow slowly as they find their way into niche vehicle segments or specialized industries, such as sports cars or recreational vehicles.

Demand for various types of engines will be a key driver of the camshaft market in the coming years, as the automotive industry continues to innovate. New technologies, regulatory standards, and consumer preferences regarding performance, fuel efficiency, and sustainability in automotive engines will define the growth of the market. The growth of the automotive sector, particularly in emerging markets, will further spur demand for different types of engines, thus pushing the automotive camshaft market.

By Sales Channel

The global automotive camshaft market can be split in terms of the sales channels into two major divisions: Original Equipment Manufacturer (OEM) and Aftermarket. Each category has different functions in the automotive industry while serving different kinds of customers, thus ensuring an uplift in the camshaft market.

This division of camshafts includes only those that are manufactured by the companies and installed in the automobiles at the moment of assembly. Such camshafts are created to fulfill the exact requirement set by automobile manufacturers, and it is part of the original vehicle build. OEM camshafts play an important role in ensuring that vehicles operate efficiently while at the same time meeting government standards. They are designed with precision and quality in mind, often providing higher reliability and performance compared to other alternatives. The manufacturers in this segment are keen on providing camshafts that meet the specifications of different vehicle models, thus ensuring compatibility and optimal performance for consumers.

The Aftermarket segment caters to the demand for camshafts after the vehicle has been produced and sold. These camshafts have also been applied to the repairing and replacing or upgrading of a vehicle, providing the customers with added alternatives aside from the original equipment. Aftermarket camshafts are purchased by car owners, mechanics, and even repair shops to replace the old, broken, or just worn-out camshafts. It has camshafts that make the car better in performance, like racing camshafts, among others. There are also different types of aftermarket camshafts, which will give more choices for consumers who might be looking to replace or upgrade their camshafts.

Both segments contribute to the overall camshaft market, with OEM camshafts generally being associated with the manufacturing of new vehicles, while the Aftermarket segment provides replacement and enhancement options for existing vehicles. The demand for both types is influenced by various factors, such as vehicle production trends, consumer preferences, and the need for vehicle maintenance. Vehicle ownership is increasing, and the demand for vehicle repair and performance enhancement is also rising. This is expected to boost the camshaft market in both segments.

The future of the camshaft market will be determined by the OEM and Aftermarket sales channels as the automotive industry continues to evolve. Manufacturing leaders will indeed always depend on camshafts through OEM companies and will achieve proper production results because of such elements. Vehicles users and servicing parties will prefer OEM camshaft producers for only components that supplement further useful value addition over performance of products. That shall be in striking balance if Aftermarket achieves what OEM lacks regarding the need that vehicle user sees.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$7,360.31 million |

|

Market Size by 2031 |

$11,367.35 Million |

|

Growth Rate from 2024 to 2031 |

6.4% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

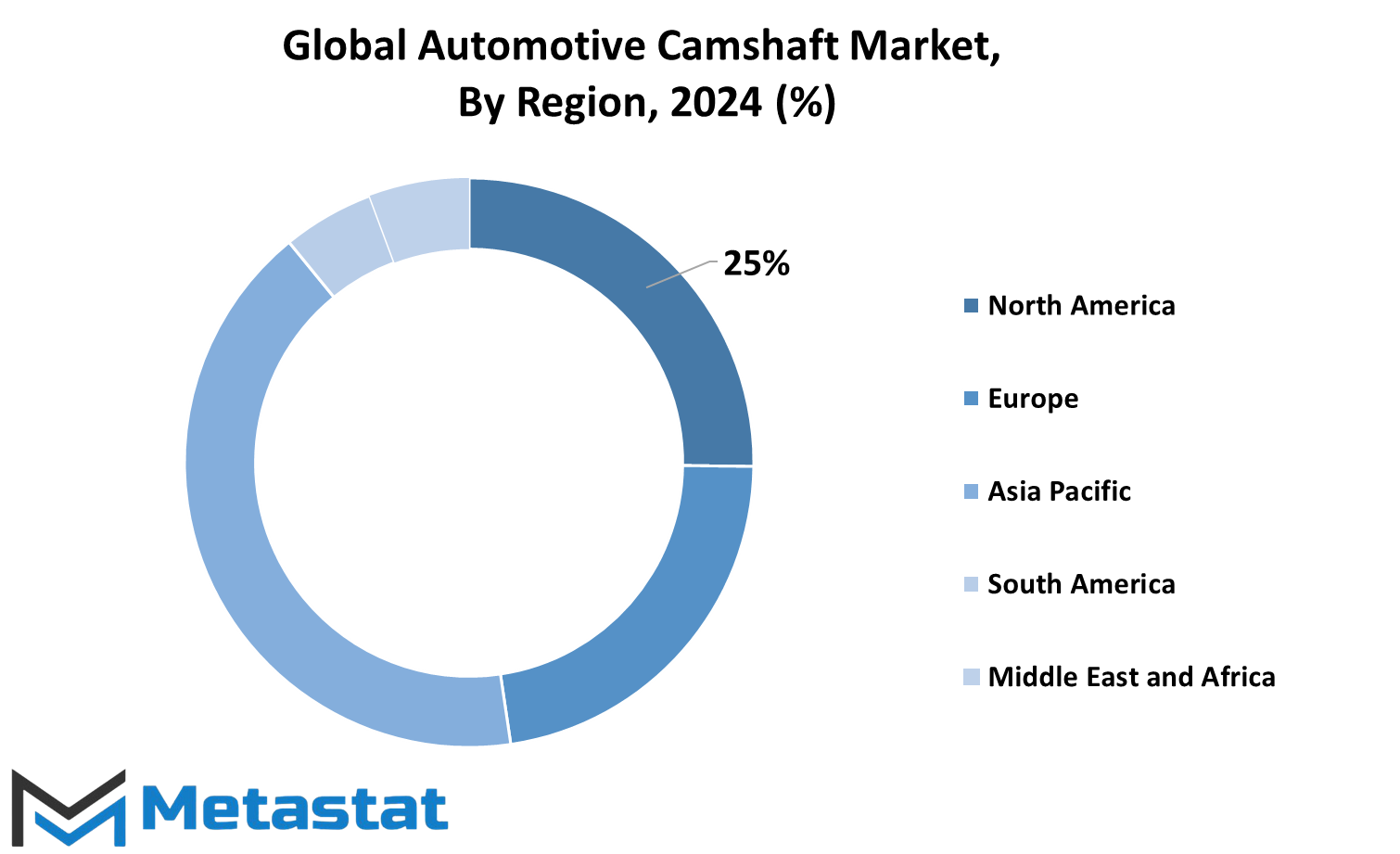

The Automotive Camshaft market is classified, based on geography, into a number of important regions each having its individual features. It includes North America further divided into the U.S., Canada, and Mexico and making different contributions to the automobile sector. Europe is also broken down into key countries, which include the UK, Germany, France, and Italy, among others, which fall under the Rest of Europe. In Asia-Pacific, the market is categorized into key players such as India, China, Japan, South Korea, and other countries within the Rest of Asia-Pacific, showing the leading position of these countries in the global automotive market.

South America is split into Brazil, Argentina, and other countries in the Rest of South America, showing the increasing automobile industry in this region. The Middle East and Africa region is split into the GCC Countries, Egypt, South Africa, and the Rest of Middle East & Africa, all contributing in their own way to the automotive sector in these regions. Such districts perform a vital function in the progression and development of the global market for Automotive Camshaft, hence with different demand and trends building the overall dynamism of this marketplace.

North America is one the major consumers for automotive products based on innovation as well as a technological approach in the market. Europe leads the market because of its premium automobile companies, whereas the Asia-Pacific region remains in a growth mode as there is a growing demand for automobile all around the emerging markets of China and India. The automotive market in South America continues its growth trend, with Brazil and Argentina growing, as car production and demand have grown in those nations.

The Middle East and Africa region, while not as large as others, is expected to witness steady growth, particularly in the GCC countries where automotive demand is driven by both consumer interest and large-scale industrial projects. Knowledge regarding the geographical analysis of the Automotive Camshaft market provides a key understanding of distinct drivers of demand and innovation throughout different regions around the world. The market continues to evolve region-by-region, making way for strong established players while allowing new companies to enter.

COMPETITIVE PLAYERS

The global automotive industry highly relies on the automotive camshaft market, since camshafts are critical internal combustion engine parts. These help control the opening and closing of the engine's intake and exhaust valves, making it possible for an engine to function efficiently. Therefore, with growth in the automotive industry, demand for high-performance camshafts is also expected to increase. Drivers of the market include advancements in engine technology, increasing popularity of fuel-efficient vehicles, and growing demand for enhanced engine performance.

Major companies currently contributing to the growth of the global automotive camshaft market are Schaeffler Group and Thyssenkrupp AG. The group provides a complete range of camshaft products suitable for conventional vehicles as well as electric vehicles, while Thyssenkrupp AG offers solutions that enhance efficiency, fuel economy, and performance in terms of emissions. These companies heavily invest in research and development to improve the durability and performance of their camshaft products.

OTHER CONTRIBUTING CAMSHAFT & CHILLED CAST Dana Incorporated is also playing an important role with a brand that produces a lot of precise-engineered camshaft components in a precision-manufacturing mode, thus resulting in producing powerful camshafts which further helps increase the efficiency and performance of vehicles.

Hirschvogel Holding GmbH, Mahle GmbH, and Federal-Mogul Corporation are additional key companies shaping the automotive camshaft market. Hirschvogel is known for its innovative production techniques, while Mahle offers a variety of camshaft solutions tailored to meet the demands of today’s automotive market. Federal-Mogul, with its extensive portfolio, provides camshaft components that meet rigorous industry standards.

Precision Camshafts Ltd. has its expertise in high-precision camshafts of various engines, while the Camshaft Machine Company specializes in state-of-the-art camshaft technologies. Companies such as JTEKT Corporation, Mubea, and Melling Engine Parts also come in handy for delivering high-performance camshaft products for efficient and reduced emission from vehicle engines. Hitachi Automotive Systems also excels at developing advanced solutions for the automobile world, designed to enhance performance and sustainability with products in the camshaft segment.

The overall global automotive camshaft market thrives on this kind of innovation by key industry players who ensure constant invention to match the evolving demands of the automobile sector. These companies then are constantly out to give customers just the high-quality camshaft parts that, when implemented, will induce efficiency, performance, and sustainability in engines. As the automotive industry is going to continue growing, the organizations will play an important role in determining the future of automotive engineering.

Automotive Camshaft Market Key Segments:

By Type

- Cast Camshaft

- Forged Camshaft

- Assembled Camshaft

By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Engine Type

- Inline Engine

- V-engine

- Others

By Sales Channel

- Original Equipment Manufacturer

- Aftermarket

Key Global Automotive Camshaft Industry Players

- Schaeffler Group

- Thyssenkrupp AG

- ESTAS CAMSHAFT & CHILLED CAST

- Dana Incorporated

- Hirschvogel Holding GmbH

- Mahle GmbH

- Federal-Mogul Corporation

- Precision Camshafts Ltd.

- Camshaft Machine Company

- JTEKT Corporation

- Mubea

- Melling Engine Parts

- Hitachi Automotive Systems

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383