MARKET OVERVIEW

The Global Automotive Cables market stands at the forefront of the automotive industry, intricately woven into the fabric of modern vehicles. A vital component often overlooked, these cables serve as the lifeblood of automotive systems, connecting and powering various electronic components that propel vehicles into the future.

In the expansive landscape of automotive cables, diverse players come together to craft solutions that withstand the rigors of the road. From manufacturers crafting resilient wiring harnesses to suppliers delivering high-performance materials, the industry coalesces to ensure vehicles operate seamlessly in the ever-changing conditions they encounter.

One key aspect of the Global Automotive Cables market is its adaptability. As automotive technology advances, the demand for more sophisticated and specialized cables surges. These cables are not just conductors of electricity; they are enablers of innovation. Whether it's transmitting signals for advanced driver assistance systems, facilitating data exchange in autonomous vehicles, or powering electric propulsion systems, the role of automotive cables is pivotal in propelling the automotive industry forward.

In the automotive cables market, companies strive to outshine each other not only in terms of product quality but also in addressing the unique challenges posed by the modern automotive landscape. Challenges such as the need for lightweight materials, enhanced durability, and adherence to stringent safety standards drive innovation within the industry.

The Global Automotive Cables market, like an intricate web, connects manufacturers, suppliers, and consumers in a collaborative dance that ensures the efficient functioning of vehicles. This interconnected ecosystem demands precision and reliability, traits that define the very essence of automotive cables.

Moreover, as sustainability takes center stage globally, the automotive cables market plays a crucial role in the electric vehicle revolution. Electric vehicles rely heavily on intricate cable systems to power their motors, manage battery systems, and enable advanced communication between components. The market is thus instrumental in supporting the automotive industry's shift towards cleaner and greener transportation solutions.

The Global Automotive Cables market is not just a conduit for electricity; it is the unseen force that powers innovation within the automotive industry. From enhancing connectivity to driving the electric vehicle revolution, the impact of automotive cables transcends their physical presence. As the automotive landscape continues to evolve, the industry remains steadfast, weaving the threads that connect the vehicles of today and tomorrow.

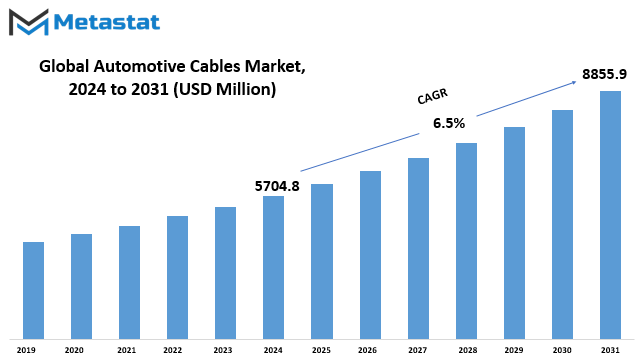

Global Automotive Cables market is estimated to reach $8855.9 Million by 2031; growing at a CAGR of 6.5% from 2024 to 2031.

GROWTH FACTORS

In the Global Automotive Cables market, several key factors drive its growth. One prominent catalyst is the escalating demand for advanced safety features and electronic components integrated into modern vehicles. This surge in demand is fundamentally reshaping the automotive industry, necessitating the use of high-quality automotive cables to ensure the efficient performance of these sophisticated features.

Furthermore, the burgeoning electric vehicle market plays a pivotal role in propelling the growth of the automotive cables sector. Electric vehicles, with their sustainable and eco-friendly appeal, require robust and reliable cables to function optimally. As the adoption of electric vehicles continues to gain momentum, the market for automotive cables experiences a parallel upswing.

Despite these growth factors, the industry grapples with challenges that could impede its trajectory. Fluctuations in raw material prices emerge as a notable hurdle, directly impacting the overall cost of automotive cable production. The sensitivity of the market to these price fluctuations introduces an element of uncertainty, necessitating adaptability within the industry to navigate such challenges.

In addition to volatile raw material prices, stringent regulations and standards for automotive cable manufacturing pose another set of challenges. Compliance with these regulations not only adds complexity to the production process but also requires industry players to invest in meeting these stringent criteria. Negotiating this intricate regulatory landscape becomes imperative for sustained growth and market relevance.

Amidst these challenges, a promising horizon unfolds with the rising trend towards autonomous and connected vehicles. This paradigm shift in the automotive landscape opens new avenues for innovative and sophisticated automotive wiring solutions. The integration of advanced technologies in vehicles, such as autonomous driving capabilities and seamless connectivity, creates a demand for intricately designed wiring systems.

Looking ahead, this shift towards autonomous and connected vehicles not only addresses current challenges but also presents lucrative opportunities for the automotive cables market in the coming years. The evolution of vehicles into intelligent, interconnected entities aligns with dynamic consumer preferences and sets the stage for a transformative era in automotive technology.

The Global Automotive Cables market is propelled by the growing demand for advanced safety features, electronic components, and the surge in the electric vehicle market. However, challenges in the form of raw material price fluctuations and stringent regulations pose hurdles to the industry. Nevertheless, the advent of autonomous and connected vehicles emerges as a beacon of opportunity, promising a future where sophisticated automotive wiring solutions play a pivotal role in shaping the automotive landscape.

MARKET SEGMENTATION

By Type

The worldwide market for automotive cables is a dynamic landscape, with various factors influencing its trajectory. Delving into the specifics, the market can be dissected into different segments, offering a closer look at its intricacies.

One key facet is the categorization by type. The Jacket Type, a significant player in this arena, commanded a valuation of 2500.8 USD Million in the year 2023. This denotes its substantial presence and impact on the overall market dynamics. The jacket, being the outermost layer of the cable, plays a crucial role in providing protection and insulation, factors that contribute to its prominence in the market.

Moving along the spectrum, the Conductor Type is another pivotal segment in the global automotive cables market. In 2023, it held a value of 978.8 USD Million, underlining its substantial market share. The conductor responsible for carrying the electrical current is a critical component, and its significance is mirrored in its market valuation. This segment's performance is indicative of its widespread use and relevance in the automotive cable domain.

Simultaneously, the Insulation Type emerges as a significant player in shaping the market landscape. Valued at 1930.3 USD Million in 2023, this segment underscores the importance of insulation in ensuring the efficient functioning of automotive cables. Insulation acts as a protective barrier, preventing electrical leakage and enhancing the overall durability and reliability of the cables. The substantial market value attributed to Insulation Type is a testament to its integral role in the automotive cable ecosystem.

The global automotive cables market, when scrutinized by type, reveals the distinctive contributions of Jacket, Conductor, and Insulation types. Each segment's valuation reflects its unique role and impact on the overall market dynamics, collectively shaping the trajectory of this dynamic industry. As we navigate the ever-evolving automotive landscape, understanding these nuances becomes paramount for stakeholders aiming to thrive in this competitive market.

By Application

The global automotive cables market with diverse applications shaping its trajectory. When we consider the different uses, the market branches into various segments, each serving a unique purpose within the automotive landscape.

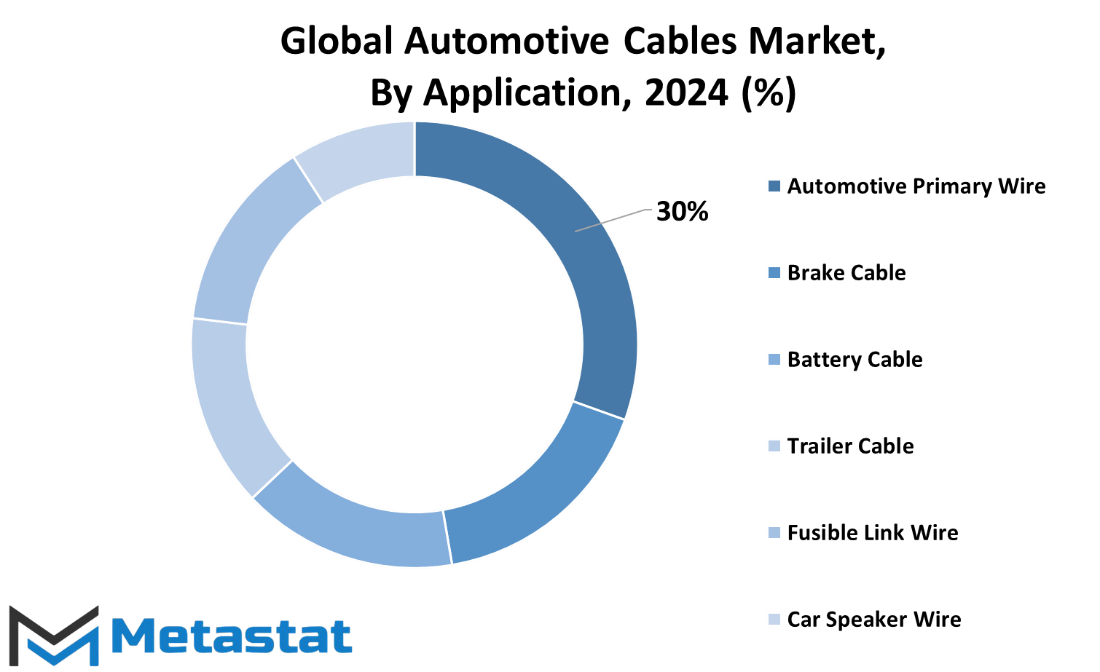

One crucial aspect of this market revolves around the applications of these cables. These applications essentially dictate the functions and roles these cables play in the automotive realm. Broadly categorized, the market includes automotive primary wire, brake cable, battery cable, trailer cable, fusible link wire, and car speaker wire.

Primary automotive wire forms the backbone of electrical systems in vehicles. It’s the fundamental conductor, transmitting power and signals throughout the automobile. This wire essentially acts as the lifeline for electrical components, ensuring smooth communication between different parts of the vehicle’s electrical network.

Moving on to brake cables, they take on a pivotal role in ensuring the safety of the vehicle. Connecting the brake pedal to the braking system, these cables facilitate the crucial task of slowing down or stopping the vehicle when needed. The significance of this application is evident in its direct impact on road safety.

Battery cables are another integral part of the automotive cables market. Serving as the conduit between the vehicle’s battery and the rest of its electrical system, these cables play a crucial role in supplying power to various components. A well-functioning battery cable is essential for the overall performance and functionality of the vehicle.

Trailer cables cater to the towing needs of vehicles. They provide the necessary connectivity between the towing vehicle and the trailer, enabling the transfer of signals and power. This application is particularly vital for those who frequently engage in towing activities, emphasizing the versatility of the automotive cables market.

Fusible link wires act as a protective component in the electrical system. In a short circuit or electrical overload, these wires are designed to break and interrupt current flow, preventing potential damage. This application showcases the market’s commitment to safety and reliability in automotive electrical systems.

Car speaker wires contribute to the audio experience within vehicles. Connecting the audio system to speakers, these wires enable the transmission of sound signals. While seemingly straightforward, the quality of these wires can significantly impact the overall audio performance in a vehicle.

The global automotive cables market is intricately woven into the fabric of the automotive industry, with its applications playing vital roles in ensuring the functionality, safety, and performance of vehicles. The diverse range of uses highlights the adaptability of these cables, showcasing their significance in various aspects of the automotive landscape. As technology continues to advance, the importance of reliable and efficient automotive cables becomes even more pronounced, reflecting the ongoing evolution of the automotive industry.

By Vehicle Type

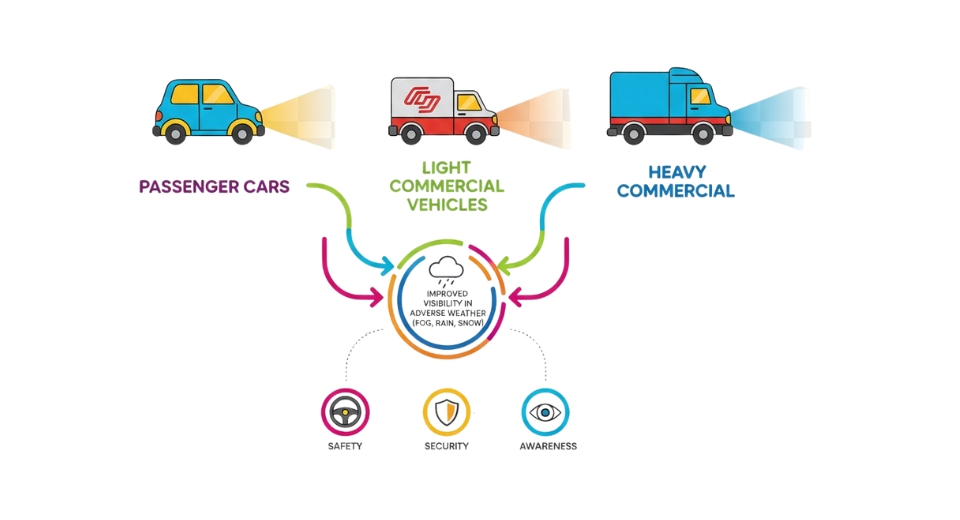

The global automotive cables market exhibits a diverse landscape, with a breakdown by vehicle type into three main categories: Passenger Vehicles, Light Commercial Vehicles, and Heavy Commercial Vehicles. Passenger Vehicles encompass a wide range of automobiles designed for personal transportation, from compact cars to SUVs. These vehicles play a pivotal role in meeting the varied needs of individual consumers, offering a blend of comfort, style, and performance.

Light Commercial Vehicles, on the other hand, cater to businesses and industries, providing a versatile solution for transporting goods and services. These vehicles include vans, pickups, and small trucks, contributing significantly to the efficiency of logistics and delivery operations.

Heavy Commercial Vehicles form another crucial segment of the automotive cables market. This category involves large trucks and buses that play a vital role in transporting heavy loads and facilitating mass transit. The reliability and durability of cables in these vehicles are paramount for ensuring safe and efficient operations on the road.

The differentiation among these vehicle types underscores the diverse applications and requirements within the automotive cables market. As technology continues to advance, the demand for high-quality cables in each of these segments remains a constant, driven by the need for reliable and efficient electrical connectivity in modern vehicles.

The global automotive cables market's segmentation by vehicle type reflects the distinct needs and functions of Passenger Vehicles, Light Commercial Vehicles, and Heavy Commercial Vehicles. The continued evolution of automotive technology emphasizes the critical role that cables play in ensuring the smooth and reliable operation of vehicles across these diverse categories.

By Insulation Type

In the automotive industry, the global market for automotive cables is a crucial component. These cables play a pivotal role in ensuring the seamless functioning of various electronic systems within vehicles. The market is characterized by its division into different insulation types, each holding a distinct value in the overall scheme of things.

One significant insulation type in the global automotive cables market is Polyvinyl Chloride, commonly known as PVC. In the year 2023, the PVC segment commanded a value of 1944.2 USD Million. This indicates its substantial contribution to the market, reflecting its widespread use and reliability in automotive cable applications.

Another insulation type making its mark is Cross-Linked Polyethylene, abbreviated as XLPE. With a value of 554.6 USD Million in 2023, the XLPE segment stands as a noteworthy player in the automotive cables market. Its specialized properties make it a preferred choice in specific applications, contributing to its distinct market value.

Polypropylene, represented by the acronym PP, is yet another insulation type shaping the dynamics of the automotive cables market. In the year 2023, the PP segment recorded a value of 966 USD Million. This highlights its significance in the industry, catering to the diverse needs of automotive cable requirements.

Thermoplastic Elastomer, known as TPE, emerges as a key player in the insulation type repertoire of automotive cables. Valued at 645.3 USD Million in 2023, the TPE segment showcases its adaptability and versatility, meeting the demands of modern automotive systems.

Apart from these, there are other insulation types contributing to the global automotive cables market, including Halogen-Free Flame Retardant (HFFR), Silicone, and various others. These insulation types collectively create a diverse market landscape, accommodating the varied needs and specifications of different automotive applications.

The global automotive cables market's segmentation by insulation types of sheds light on the pivotal role played by each type in meeting the intricate requirements of the automotive industry. As vehicles continue to evolve with advancing technology, the significance of these insulation types in ensuring reliable and efficient electronic systems remains paramount.

REGIONAL ANALYSIS

The worldwide Automotive Cables market is categorized into distinct geographical regions, namely North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. In North America, the market is further subdivided into the U.S., Canada, and Mexico. Meanwhile, Europe comprises the UK, Germany, France, Italy, and the Rest of Europe. The Asia-Pacific region is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific. Turning our attention to South America, this market segment encompasses Brazil, Argentina, and the Rest of South America. Lastly, the Middle East & Africa region is characterized by GCC Countries, Egypt, South Africa, and the Rest of Middle East & Africa.

This division based on geography provides a comprehensive overview of the global landscape of the Automotive Cables market, allowing for a more nuanced understanding of the market dynamics in various regions. By dissecting the market in this manner, analysts and stakeholders gain valuable insights into the specific challenges, opportunities, and trends that may vary across different geographical locations.

North America, a key player in this market, is represented by the U.S., Canada, and Mexico. This region's diverse economic landscape and technological advancements contribute significantly to the dynamics of the Automotive Cables market. Similarly, Europe, with its prominent countries such as the UK, Germany, France, Italy, and the Rest of Europe, plays a pivotal role in shaping the market trends. The Asia-Pacific region, consisting of major economies like India, China, Japan, South Korea, and the Rest of Asia-Pacific, is a crucial contributor to the overall market growth, given its vast automotive industry and expanding infrastructure.

Moving to South America, the market is influenced by countries like Brazil and Argentina, each with its unique market characteristics. Lastly, the Middle East & Africa region, encompassing GCC Countries, Egypt, South Africa, and the Rest of Middle East & Africa, introduces a distinct set of factors that impact the Automotive Cables market within this territory.

Understanding the regional disparities becomes imperative for businesses and investors seeking to navigate the intricacies of the Automotive Cables market. Each region brings forth its own set of challenges and opportunities, shaped by local regulations, economic conditions, and consumer preferences. Consequently, a comprehensive analysis of the market on a global scale necessitates a keen examination of these regional dynamics.

The geographical segmentation of the global Automotive Cables market facilitates a more granular exploration of its dynamics. By delving into the specific regions, stakeholders can gain valuable insights that contribute to informed decision-making, ultimately fostering a more robust and adaptable market strategy.

COMPETITIVE PLAYERS

The global automotive cables market is a dynamic and competitive landscape with key players driving innovation and shaping the industry's trajectory. Among these influential figures are companies such as Yazaki Corporation, Sumitomo Electric Industries, Ltd., Gebauer & Griller, Furukawa Electric Co., Ltd., Molex LLC, Prysmian Group, Coroplast Fritz Müller GmbH & Co. KG, Champlain Cable Corporation, Nexans, LS Cable & System Ltd., Coficab Group, Kromberg & Schubert GmbH Cable & Wire, Fujikura Ltd., Huber+Suhner AG, Proterial, Ltd., PKC Group (DixieWire), Lapp Group, and TE Connectivity.

Yazaki Corporation, a prominent player in the automotive cables market, stands as a testament to the industry's commitment to excellence. Their contributions to advancing cable technology and ensuring reliable connectivity have positioned them as a leader in the field. Similarly, Sumitomo Electric Industries, Ltd., brings a wealth of expertise to the market, contributing to the overall growth and efficiency of automotive cable systems.

Gebauer & Griller and Furukawa Electric Co., Ltd., play crucial roles in shaping the industry landscape, showcasing dedication to quality and reliability in their cable solutions. Molex LLC, with its innovative approach, has significantly impacted the automotive cables market, offering solutions that cater to the evolving needs of the automotive sector.

The Prysmian Group and Coroplast Fritz Müller GmbH & Co. KG exemplify a commitment to providing diverse and reliable cable options. Champlain Cable Corporation and Nexans bring their own strengths, contributing to the market's vibrancy with a focus on technological advancements.

LS Cable & System Ltd., Coficab Group, and Kromberg & Schubert GmbH Cable & Wire are key players that underline the global nature of the automotive cables market. Their reach and influence extend across borders, reflecting the interconnectedness of the automotive industry on a global scale.

Fujikura Ltd. and Huber+Suhner AG showcase the importance of adaptability and resilience in the face of evolving market demands. Proterial, Ltd., and PKC Group (DixieWire) emphasize the significance of staying ahead in technological advancements, ensuring that their cable solutions align with the fast-paced developments in the automotive sector.

In this competitive arena, the Lapp Group and TE Connectivity emerge as pivotal entities. Their contributions span a spectrum of applications, emphasizing the versatility required in automotive cables to meet the diverse needs of manufacturers and end-users alike.

The collective presence of these key players forms the backbone of the global automotive cables market, fostering a climate of innovation, reliability, and connectivity. As they continue to push boundaries and elevate industry standards, the automotive cables market remains a vibrant and evolving domain, driven by the expertise and dedication of these influential players.

Automotive Cables Market Key Segments:

By Type

- Jacket Type

- Conductor Type

- Insulation Type

By Application

- Automotive Primary Wire

- Brake Cable

- Battery Cable

- Trailer Cable

- Fusible Link Wire

- Car Speaker Wire

By Vehicle Type

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Insulation Type

- PVC (Polyvinyl Chloride)

- XLPE (Cross-Linked Polyethylene)

- PP (Polypropylene)

- TPE (Thermoplastic Elastomer)

- HFFR (Halogen-Free Flame Retardant)

- Silicone

- Others

Key Global Automotive Cables Industry Players

- Yazaki Corporation

- Sumitomo Electric Industries, Ltd.

- Gebauer & Griller

- Furukawa Electric Co., Ltd.

- Molex LLC

- Prysmian Group

- Coroplast Fritz Müller GmbH & Co. KG

- Champlain Cable Corporation

- Nexans

- LS Cable & System Ltd.

- Coficab Group

- Kromberg & Schubert GmbH Cable & Wire

- Fujikura Ltd.

- Huber+Suhner AG

- Proterial, Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252