MARKET OVERVIEW

The global automotive 4-wheel lighting market, based in the broader automotive parts industry, will keep growing as lighting technology becomes increasingly entrenched in safety regulation as well as design terminology. While vehicles change form, purpose, and driver-aid technologies, four-wheeler lighting assumes more utilitarian relevance beyond sheer visibility. The market will be a complex dialogue of regulatory needs, technology progress, and increased demand for brand-animated vehicle appearances.

Four-wheel automobile lighting systems will no longer be an afterthought. The systems will be made up of various components like headlamps, taillights, brake lights, indicator lamps, and interior ambient lighting each performing various vehicle communication and road presence functions. global automotive 4-wheel lighting market will be governed by globally driven factors of vehicle safety regulation and design sensibilities that are geographically prevalent or imposed. As manufacturers experiment with fresher design personas and user experiences, the light space will be transformed as an interface of emotion and functionality. The global automotive 4-wheel lighting market will grow to encompass innovations fitting into the trend of autonomous cars and driver-assistance systems.

Next-generation lighting systems will see more sensor-based and adaptive functions, enabling cars to adjust dynamically in real time based on road conditions, driver activity, and environmental input. The application will extend beyond the traditional night driving purpose, possibly even to the transmission of communication signals to other vehicles and pedestrians through the use of lighting effects and light patterns. Besides that, the future of the global automotive 4-wheel lighting market will be an excellent example of powertrain architecture revolution of automobiles.

With electric cars becoming more and more popular, energy-efficient and space-efficient lighting systems will make their introduction. Electric vehicles need to have lighting systems low in energy as well as give the highest luminosity. For these uses, LED- and laser-based lighting units will replace existing units in mass-market vehicles as well as luxury cars. The movement towards car platforms will also necessitate the integration of more advanced control modules for supporting personalized lighting features. Another highly influential realm that will determine the scale of this market includes aftermarkets demand and car customization. Both passenger car as well as commercial vehicle owners will increasingly search for lighting solutions that provide personalization or performance enhancement. This trend will drive a sub-segment where original equipment manufacturers as well as third-party firms bring in modular or plug-and-play solutions to meet niche needs.

The global automotive 4-wheel lighting market will also be influenced by cross-industry collaboration, especially with digital display, materials science, and microelectronics fields. The intervention will enable the combination of light technologies that are more thinner, lighter, and responsive to satisfy both technical need and aesthetic want.

As vehicle connectivity penetrates further and regulatory regimes for road safety become more prescriptive, strategic change will characterize this market. It will not merely react to compliance requirements but will start to drive them, setting new standards in visual communication, safety signaling, and driving experience.

So the Global Automotive 4-Wheel Lighting industry will create its own niche within the automobile sector. It will establish its future on adaptive innovation, customized design, and growing importance of light as an utility or brand car.

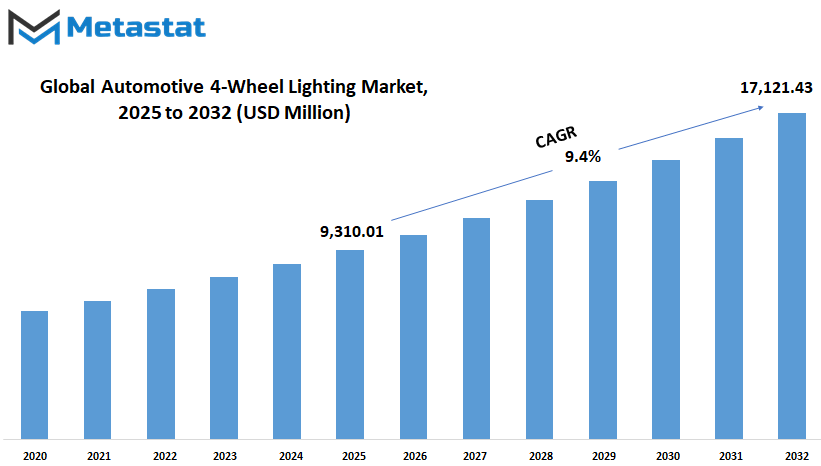

Global automotive 4-wheel lighting market is estimated to reach $17,121.43 million by 2032; growing at a CAGR of 9.4% from 2025 to 2032.

GROWTH FACTORS

The global automotive 4-wheel lighting market is gradually transforming because of consumer demands and technology changes. The most important driver for such transformation involves the rising demand for more comfortable and secure vehicles. People are becoming more aware of the fact that they need to stay safe on the roads by calling for sophisticated driver-assistance systems. These systems are likely to rely on effective lighting in order to function correctly, which means that good quality vehicle lighting is even more important.

Other than this, the trend towards LED and adaptive light technologies is increasingly common in vehicles today. Not only are these lighting options more visible, but they also play a role in the overall aesthetics and efficiency of cars. LED lights are famous for their durability and power-saving features, which have made them a popular choice among the majority of manufacturers. Adaptive lighting adds the virtue of intelligence by adjusting its usage with driving situations to provide better safety and driving experience.

In spite of all these enhancements, the global automotive 4-wheel lighting market still has numerous challenges to overcome. The first and most crucial one is that improved lighting is very expensive. Generally, such lighting systems are offered in luxury class cars, hence restricting its applicability in low-cost variants. This implies not all users have access to the safety and comfort aspects provided by sophisticated lighting systems. Even the standards of lighting differ from area to area. This variation hinders manufacturers from making cars destined for global markets. They are also often needed to ensure that designs conform to local rules, which takes up time and costs money.

Fewer challenges loom on the horizon. There is growing interest in electric and autonomous vehicles that is stimulating new development in intelligent lighting technology. The lighting systems in these more-than-just-practical vehicles would also need to accommodate passengers' sensors - and communication devices like smartphones. For instance, headlights can be employed to talk to pedestrians or other vehicles in manners that create new avenues for road safety and vehicle communication. Ongoing technological advancements are bound to integrate lighting further and make it more responsive, and thus benefit drivers and manufacturers alike.

It will be all about innovation in the years ahead. As much as some of the roadblocks that exist are, the steady demand and requirement for better, smarter, and safer cars will drive the expansion of the global automotive 4-wheel lighting market. The companies and designers who will be able to adapt and deliver to those demands will help shape the future of the automobile business.

MARKET SEGMENTATION

By Type

The global automotive 4-wheel lighting market is predicted to undergo steady growth as technology continues to influence the way cars are manufactured and utilized. Lighting systems are no longer merely for visibility; they currently feature prominently in automotive safety, styling, and driver-vehicle communication. Manufacturers are putting increasingly greater importance on newer forms of lighting that do not only make driving more safe but also more to the overall experience of car ownership. From old bulbs to the new lighting technologies, the industry is moving towards longer-lasting, lower-power, and better-performing versions.

One of the most common forms still in use today is the halogen light. Although it has been around for an extremely long time, it is inexpensive and easy to replace. A lot of drivers still prefer it because of this, though, as the new versions become more accessible, the halogen bulbs will more and more be out of favor. LED is gaining popularity because it uses less power and lasts longer. It also gives car designers more freedom to play with shapes and arrangements, which can help make a car uniquely different. With the added advantage of quick reaction times, LED lights also help make the road a safer place.

Xenon lights, alternatively notorious for their whiteness and blueness, offer better night vision than halogen. They are most often employed in high-end vehicles and are prized for their penetrating, clear beam. But they are also more expensive and potentially more complicated to repair. Laser light is one of the new players to enter the global automotive 4-wheel lighting market. As yet in its infancy of use, this type of light has a very high level of brightness and a long visual distance. It is set to become more widespread in future models with increasing affordability of production.

There is also room for other forms of lighting that are likely to be incorporated into vehicles in the near future. These could be founded on more sophisticated systems that adapt themselves automatically to different driving conditions or even talk to other vehicles and traffic lights. With rising autonomous technology, light systems are likely to become even more important for signaling and communication, not just to drivers, but to pedestrians and infrastructure as well.

In the coming years, the global automotive 4-wheel lighting market will undergo further developments that highlight safety, aesthetics, and the conservation of energy. With continued interest in smarter and more reliable technology, this area will remain a key part of how vehicles are made and used.

By Application

The global automotive 4-wheel lighting market will continue to experience amazing growth as car technology continues to advance. Lighting is a vital aspect not only in providing the security of cars but also in enhancing their design and functionality in general. With automobiles becoming more sophisticated, so does the call for enhanced and effective lighting. This is a broad market based on a number of applications such as headlights, tail lights, fog lights, signal lights, and interior lights, all of which will have varying developments in the future. Headlights will remain a significant part of this market.

They are essential to provide clear visibility during nighttime driving and inclement weather. With LED and laser technology refining itself, headlamps will be more energy-efficient but brighter and more intense in the beam. This will make night drives safer and see fewer units of energy being consumed by cars. Dynamic headlamps that adapt their direction and intensity based on road conditions will become the standard, mitigating the danger of nighttime driving. Tail lights will follow suit, placing greater focus on aesthetics and visibility. Tail lights are important for making braking and turning intentions known to fellow drivers, minimizing the likelihood of accidents. Next-generation advancements here will involve more customizable light patterns and colors to let manufacturers increase vehicle looks as well as safety. The use of smart technology will make tail lights interact with other cars or traffic infrastructures, enhancing road safety further.

Fog lights will still be an essential device for motorists to employ on passing through harsh weather conditions such as heavy rain, fog, or snow. The focus of this section will be on how to maximize light dispersion and reduce glare so that other motorists will not be blinded. New optical arrangements and materials will play a major role in the efficiency of fog lights so that they will produce the highest quality of light when needed.

Signal lights, including turn signals and hazard lights, will also be enhanced using technology. Their role of notifying other drivers of a vehicle's direction of movement is instrumental in preventing accidents. Signal lights will likely become brighter and more responsive, with higher blinking rates and visibility at many angles in the future. Integrating them into vehicle sensors and computerized systems will allow them to act more intelligently and enhance safety.

Interior lighting, while often overlooked, will become more important as interiors become more sophisticated. Interior lights not only will shine brighter for the passengers but also will make the entire driving experience better with customizable ambient light options. Interior lighting in the future will be designed to reduce driver fatigue and create a more comfortable environment inside the car.

Overall, the global automotive 4-wheel lighting market has a lot to benefit from continued innovation. It will be driven by the safety, energy efficiency, and appearance theme to create new products in every category of light. With more autonomous and connected technologies being integrated into cars, lighting will increasingly be a core part of the driving experience, contributing to vehicle safety and driver comfort over the next few years.

By End User

The global automotive 4-wheel lighting market is signaling good growth and change with the advancement in technology and the changing car designs too. Auto lights are no longer simple sight helpers; they have advanced to become central components that enhance safety, enhance appearance, and save energy. The future possibilities for this market to grow in leaps and bounds seem immense as the needs increase with various vehicles of different types, primarily personal vehicles and commercial vehicles.

Personal cars need to drive most of the growth within this market since companies are focusing increasingly on style and functionality. Future passenger cars will feature lighting technology that, in addition to enhancing road lighting, will be responsive to varying weather and traffic conditions. Automatically adjusting brightness and beam direction, adaptive headlights will be the norm, ensuring safer roads for motorists and pedestrians alike. In addition, using energy-efficient light sources will also lower overall vehicle power consumption, as part of the worldwide push to lower carbon emissions and ensure sustainability. Consumers are also becoming increasingly focused on how a car looks, and therefore lighting will be playing a greater role in making the vehicle more attractive and up-to-date in appearance.

Commercial vehicles, on the other hand, will also be an important aspect of the expansion of the global automotive 4-wheel lighting market. Commercial vehicles have fairly dissimilar lighting requirements than passenger cars. Durability, reliability, and performance are the most important factors for commercial transport. Truck, bus, and heavy vehicle lighting will try to offer ultimate visibility in an attempt to be safe when driving long distances and in harsh weather conditions. The combination of intelligent lighting systems that have the ability to interact with other parts of the vehicle or with external traffic management systems will also be at the top of the list. This will help a great deal in minimizing accidents and maintaining smoother traffic flow, particularly in urban congested traffic areas.

In the coming years, intelligent lighting system installation will offer new prospects for passenger cars as well as business cars. These vehicles will not only light the road better but will also act as a communication method, warning other drivers and pedestrians differently. For example, the lights can change color or pattern to indicate sharp braking or lane transition. This kind of interaction will make driving better in terms of safety as well as predictability.

Overall, the global automotive 4-wheel lighting market will continue to expand as vehicles become smarter and more interconnected. Passenger vehicles and commercial vehicles will both gain advantage from advances in lighting technology, ensuring they are safer to drive on the roads and easier to use for transport. Continued innovation in this field promises thrilling developments that will revolutionize how we drive and interact with automobiles in the future.

By Sales Channel

The global automotive 4-wheel lighting market will witness tremendous growth as technology and customer needs keep evolving. Lighting for cars has always been critical for safety and seeing ahead, but today it is becoming a key component of automobile styling and innovation. The market encompasses different channels of sales, primarily segregated under OEM (Original Equipment Manufacturer) and aftermarket segments, both contributing significantly to making the future of car lighting.

OEM sales refer to lighting products that are fitted directly from the vehicle maker. Such products are anticipated to meet high-quality and safety standards and have a tendency to include the latest technologies. Car makers will seek to make their vehicles more efficient and safer, and in the process, they will seek to invest heavily in new lights. For instance, adaptive lighting systems that modify brightness and direction in response to driving conditions will become widespread. These technologies will improve driver experience as well as decrease accidents. Furthermore, automakers will emphasize power-saving lighting solutions, like LED and laser lights, which are power-hungry while offering improved brightness. This emphasis will help make automobiles greener.

Conversely, the aftermarket sales channel provides products of lighting that clients can purchase following the procurement of their automobile. The part of the market makes it possible for the owners of automobiles to install or replace their current lighting with better or personalized lighting. The aftermarket will expand as more motorists want to customize their vehicles with better lighting for aesthetics or improved performance. As technology becomes better, aftermarket products will also become advanced and more dependable. Attributes such as plug-and-play installation and support for varying vehicle models will appeal to more consumers. Furthermore, the increasing trend towards electric and autonomous vehicles will open up new avenues for aftermarket lighting products optimized to be compatible with these vehicles.

The future of the global automotive 4-wheel lighting market will be determined by increasing demand for safer, more efficient, and better-looking lighting. OEMs will keep innovating by incorporating sophisticated systems in new vehicles, while the aftermarket will provide varied choices for customization and upgrade. Both segments will complement one another, satisfying various customer segments and fueling overall industry growth. Lighting will not only remain a requirement but also a distinguishing feature that advances driving comfort, safety, and aesthetic appeal for the future as innovations keep advancing.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$9,310.01 million |

|

Market Size by 2032 |

$17,121.43 Million |

|

Growth Rate from 2025 to 2032 |

9.4% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

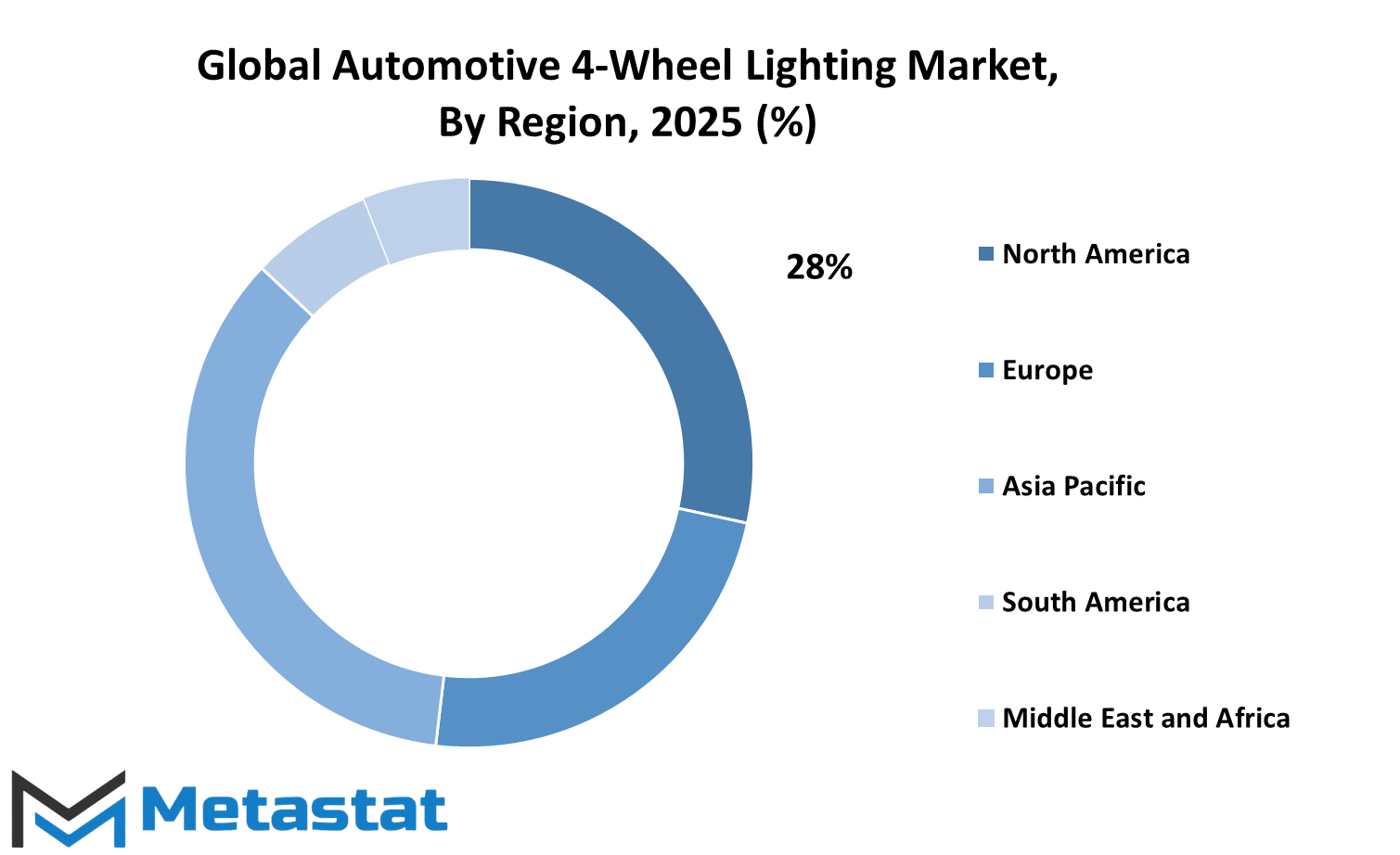

The global automotive 4-wheel lighting market is, to a large degree, affected by its geographic locations, each of which plays its own part in the overall industry growth and future direction. In the future, the different parts of the world will play differently in the manner the market evolves and reacts to new technology and shifting consumer demands. North America will maintain a strong hold on this market on account of its extremely well-developed automobile industry and increasing demand for state-of-the-art lighting systems that enhance car safety and beauty. The United States in particular will lead this growth with its focus on smart and energy-saving lighting systems, and Canada and Mexico will also support this growth with steady inputs from their automobile industries.

Europe also will be a major area for the global automotive 4-wheel lighting market, with countries like the UK, Germany, France, and Italy spearheading the calls for stricter vehicle safety and emissions regulations. This will result in producers embracing innovative lighting technologies that reduce energy consumption and increase visibility on the road. The emphasis of the region on innovation and sustainability will drive need for advanced lighting setups with enhanced performance and durability, such as LED-based and laser technology. In addition, Europe's diverse automotive market will continue to support various lighting systems, and thus it is a priority area for investment and development.

Asia-Pacific is a region of high growth potential in the global automotive 4-wheel lighting market. China, India, Japan, and South Korea are among the nations that will make a substantial contribution towards this growth as their automobile industries expand and car owners increasingly become interested in vehicles that incorporate up-to-date lighting technology. Demand in this region will be spurred on by growing production and sales of the vehicles, coupled with governmental campaigns encouraging the use of safer and more efficient lighting. As production hubs, these countries will not only increase domestic consumption but will also feed into global supply chains that will have an impact on the market across the world.

Nations such as Brazil and Argentina in South America will lead the expansion of the market by strengthening their automobile manufacturing capacities and responding to heightened consumer demand for better vehicle illumination. Development of the region's infrastructure and the economy will provide for the new lighting technologies to find more extensive use. The Middle East and Africa, meanwhile, will be expanding slowly with rising car ownership and improvements in road safety features. The GCC nations, Egypt, and South Africa will drive market growth by investing in car enhancements with advanced lighting systems.

Across the world, the Automotive 4-Wheel Lighting market will be powered by these countries because each will progress in its own separate way. Collaboratively, their initiatives will contribute to the facilitation of innovation, new tech adoption, and growth of this market globally.

COMPETITIVE PLAYERS

The global automotive 4-wheel lighting market has developed over time and will continue to develop with newer innovations being produced. The market is interested in vehicle light systems, specifically those lighting up all four wheels. These light systems have an important function not only in safety but also in functionality and power efficiency. With the quest of car manufacturers to increase functionality and appearance, competition among companies in the market will continue to heat up.

There are several companies that are already well established in this field. Signify (Philips), OSRAM GmbH., and Lumax Industries Ltd. have a well-established customer base, with years of experience and innovation behind them. These companies invest heavily in research and development because they want to produce brighter, longer-lasting, and more energy-efficient lighting. Meanwhile, companies such as Fiem Industries Ltd. and Valeo SA will keep innovating, trying to create lighting that responds more to changing driving conditions and reduces energy consumption. Their products will become smarter, perhaps integrated with vehicle systems for increased safety and convenience.

Additionally, companies like HELLA GmbH & Co. KGaA and Stanley Electric Co., Ltd. will continue to improve in the areas of technology and design, offering ever more adaptable and stylish lighting products that will make people wanting their cars turn heads. The market will see higher usage of LED technology, a darling already because of its adaptability and energy efficiency. Multinational corporates like ZKW Group and Minda Industries Limited will bring in even more advanced lighting systems that are simple to install and maintain, helping automobile producers meet increasing safety standards across the world.

Other key players like Depo Auto Parts India and Hyundai Mobis will seek to expand their international presence by offering affordable solutions for lighting that are appropriate for the needs of different markets. Their focus on value and quality will allow them to capture a larger market share. Meanwhile, Everlight Electronics and Auxbeam Lighting Co. will work towards enhancing lighting performance and lifespan through the use of new materials and technologies that may revolutionize how automotive lighting works.

In the coming years, the global automotive 4-wheel lighting market will be shaped by these competitive firms as they vie to introduce smarter, more efficient, and more appealing lighting solutions. Not only will they improve road safety but also contribute to the overall driving experience, making automobiles smarter in order to cope with future demands. With changing consumer behavior towards more efficient and more environmentally friendly solutions, these companies will be at the forefront of propelling the market forward.

Automotive 4-Wheel Lighting Market Key Segments:

By Type

- Halogen

- LED

- Xenon

- Laser

- Others

By Application

- Headlights

- Tail lights

- Fog lights

- Signal lights

- Interior lights

By End User

- Passenger Cars

- Commercial Vehicles

By Sales Channel

- OEM (Original Equipment Manufacturer)

- Aftermarket

Key Global Automotive 4-Wheel Lighting Industry Players

- Signify (Philips)

- OSRAM GmbH.

- Lumax Industries Ltd.

- Fiem Industries Ltd.

- Valeo SA

- HELLA GmbH & Co. KGaA

- Stanley Electric Co., Ltd.

- ZKW Group

- Minda Industries Limited

- Depo Auto Parts India

- Hyundai Mobis

- Everlight Electronics

- Auxbeam Lighting Co.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252