MARKET OVERVIEW

The global automated storage & retrieval system (ASRS) market will define how companies control inventory across sectors as automation continues to become more part of regular operations. Warehousing and order processing will be revolutionized by this industry through the adoption of systems that process items with high accuracy, efficiency, and very little human error. In future years, businesses will depend on technology that coordinates goods retrieval from dense storage, getting them to packing stations almost instantly. This strategy will minimize the labor needed while enhancing precision and sensitivity to demand from customers.

In future production, a maker may order pieces for assembly, and the system will present them in seconds, minimizing man searches. Retail warehouses will change in the same way, since scanners will scan barcodes and robotic shuttles will pick products without hesitation. The plant manager will track performance via dashboards, adjusting as shipment patterns change. As delivery windows close, systems will redirect products quickly, which will enable just-in-time delivery.

Integration with stock control software will ensure stock levels are always in view in real time. When demand spikes unpredictably, space will be dynamically allocated, positioning priority merchandise in the easiest location to grab. Sensor and log data will be fed into analytic engines, assisting planners in refining storage arrangements in the coming months. This minimizes dwell time and maximizes throughput, which is good for companies that care most about quick fulfilment.

Logistics services providers will implement modular storage arrays that can be expanded outward as new customers are brought on board. The modularity will allow facilities to expand without having oversized machinery, providing flexibility in leased spaces. In an environment where leasing expenses will change, having the ability to add or shed storage sections will become crucial. Installation timing will be aligned with off-peak periods to avoid disruption, and companies will schedule technicians and IT resources to go live smoothly.

Safety professionals will observe moving components and proximity sensors in order to safeguard personnel. Under normal maintenance, technicians will automatically shut down zones, run diagnostics, and power systems back up without stopping unrelated processes. Maintenance records will make the journey through the cloud, and alerts will signal engineers prior to wear becoming a problem. Downtime will be minimized and productivity preserved with predictive scheduling.

Storage hardware and robotics manufacturers will keep enhancing energy efficiency. New products will employ lighter materials and more efficient motors, consuming less power with each retrieval. As energy prices will increase steadily, this becomes more important than ever. Some centers will be utilizing renewable energy sources to run systems during peak times, managing demand and supply—and reducing utility bills.

Training schemes will change as well, since personnel will be taught to work with control interfaces, manage calibration, and fix warning alarms. Training will employ virtual simulations, allowing operators to rehearse reactions to abnormal situations prior to an actual event. With time, groups will grow self-assured in controlling automation without recourse to vendor technicians.

In all, the world Automated Storage & Retrieval System (ASRS) market will dictate the way organizations store, transport, and monitor products in the future. It will provide reliability, responsiveness, and flexibility, even in high-speed supply chains. Habits will change as systems get more powerful, and warehouses will be planned around smooth automation instead of manual picking lanes.

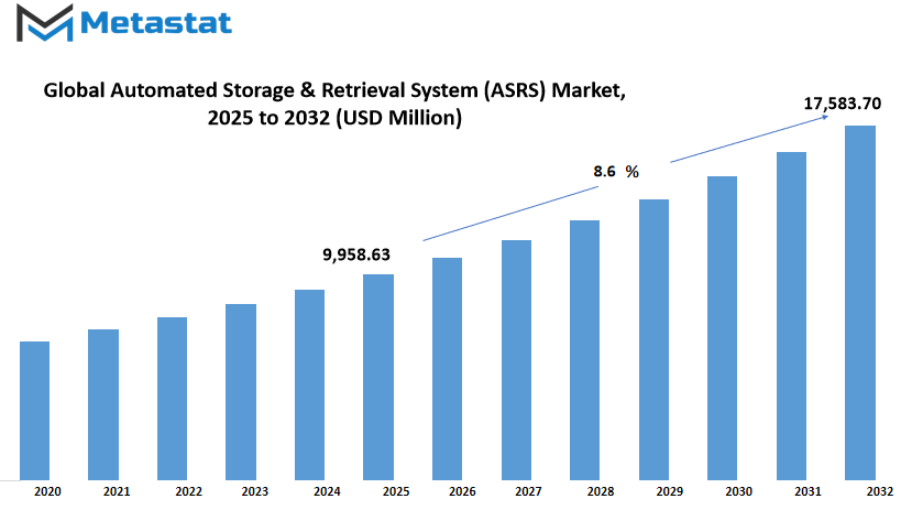

Global automated storage & retrieval system (ASRS) market is estimated to reach $17,583.70 Million by 2032; growing at a CAGR of 8.6% from 2025 to 2032.

GROWTH FACTORS

The global automated storage & retrieval system (ASRS) market is defining the future of warehouse modernization through the provision of cutting-edge solutions that enhance storage efficiency, accuracy, and speed of operations. The fast-paced growth of technology, coupled with the ever-present demand for optimal inventory management, has made this market a key component of the supply chain and logistics sector. The increasing demand for effective warehouse management solutions is generating high demand for automated systems that can execute intricate tasks with accuracy and dependability. The increasing usage of e-commerce and omnichannel retailing has further hastened the significance of automated storage and retrieval systems.

The persistent growth in online buying activities has compelled companies to deal with growing inventories and quicker fulfillment operations. Automated systems are now being applied to distribution centers in order to minimize human error, save time, and keep pace with the demands of faster deliveries. These systems are allowing companies to optimize processes while enhancing accuracy in processing orders, which will continue to be a key driver of market growth in the future years. In spite of huge growth opportunities, the high cost of initial investment to implement automated storage facilities continues to be a deterrent to many companies. Complexity in making new systems compatible with legacy warehouse facilities also creates operations challenges, often resulting in implementation delays. These considerations could gradually decelerate the rate of adoption, particularly by small- and medium-sized companies, which are highly vulnerable to operational and cost risks.

The worldwide automated storage & retrieval system (ASRS) industry will experience greater investment in research and development, with a big push towards developing cost-efficient solutions that are easily customizable and integratable. Through integrating automation with analytics and connectivity, future warehouses will be more productive and profitable, creating a steady growth in demand for innovative storage and retrieval solutions.

MARKET SEGMENTATION

By Type

The global automated storage & retrieval system (ASRS) market will continue to grow as industries worldwide seek faster, smarter, and more efficient storage solutions. With the rapid expansion of e-commerce, manufacturing, and distribution networks, automated systems will become an essential part of modern warehousing and inventory operations. These systems will not only improve accuracy and productivity but will also reduce labor costs and optimize space utilization, making them an ideal investment for companies looking to stay competitive in the future.

The global automated storage & retrieval system (ASRS) market by type is segmented into unit load, mini load, vertical lift module, carousel, mid load, and other solutions. Unit load systems will play a key role in handling heavy and bulky items, supporting industries such as automotive, heavy machinery, and large-scale manufacturing. Mini load systems will gain more attention due to their suitability for smaller items, which will be in high demand as online retail and small parcel distribution continue to rise. Vertical lift modules will stand out for their ability to save floor space while offering efficient and organized storage, making them highly appealing to companies operating in urban areas where space is limited.

Carousel systems, known for their speed and accuracy in picking operations, will find increased adoption in facilities that prioritize high throughput and quick order fulfillment. Mid load systems will serve as a bridge between unit load and mini load, offering flexibility for medium-sized goods that require efficient handling and retrieval. Other emerging solutions in the global automated storage & retrieval system (ASRS) market will bring innovative features tailored to industry-specific needs, such as robotics integration and artificial intelligence-driven management platforms.

Technological advancements will push the global automated storage & retrieval system (ASRS) market toward greater efficiency and sustainability. Smart software powered by data analytics will allow real-time inventory tracking and automated adjustments to demand fluctuations. Energy-efficient designs and the integration of renewable energy sources will also become common as businesses aim to reduce operational costs and meet environmental goals.

Over time, the adoption of advanced systems will expand beyond large corporations to small and medium-sized businesses, supported by cost reductions and easier access to modern technologies. This shift will create a more connected and automated supply chain ecosystem that supports growth across multiple industries. With continuous innovation and the rising need for optimized storage solutions, the global automated storage & retrieval system (ASRS) market will shape the future of warehouse management and transform the way goods are stored, retrieved, and distributed worldwide.

By Function

The global automated storage & retrieval system (ASRS) market is shaping the future of industrial operations, with advancements that will continue to redefine efficiency and productivity. By function, the market is divided into assembly, distribution, kitting, order picking, storage, and others, each contributing to the transformation of material handling and logistics. With technology developing at a rapid pace, automated systems are becoming an essential part of modern warehouses, factories, and distribution centers, creating an environment where accuracy and speed are no longer optional but necessary for growth.

Assembly in the global automated storage & retrieval system (ASRS) market will experience significant improvements as industries adopt robotics and artificial intelligence. Automation in assembly processes will lead to faster production cycles, lower labor costs, and consistent quality control. The integration of sensors and data analytics will allow companies to monitor production in real time, enabling better decision-making and minimizing downtime.

Distribution will also play a key role in the growth of the global automated storage & retrieval system (ASRS) market. As online commerce expands, automated systems will manage high volumes of orders while reducing errors and handling times. Intelligent software combined with automated machinery will allow goods to be moved seamlessly from storage to delivery channels, ensuring efficiency and reducing operational costs.

Kitting within the global automated storage & retrieval system (ASRS) market will focus on precision and accuracy. Automated kitting will simplify the process of assembling individual components into ready-to-ship kits, reducing human error and saving time. As industries like manufacturing and healthcare adopt these systems, customized solutions will be developed to meet the unique requirements of different sectors.

Order picking is another function that will benefit from automation. The global automated storage & retrieval system (ASRS) market will see faster and more accurate order fulfillment as systems integrate machine learning and robotics. This will be particularly beneficial for industries that rely on speed, such as food distribution, pharmaceuticals, and retail.

Storage functions will become smarter with the integration of advanced software and real-time inventory tracking in the global automated storage & retrieval system (ASRS) market. Automated storage will help companies maximize warehouse space while reducing energy consumption and operational expenses.

Other functions in the global automated storage & retrieval system (ASRS) market will continue to adapt to meet industry demands. As businesses strive for greater efficiency, automation will not only enhance productivity but also provide data-driven insights to support strategic planning and operational improvements. The future of this market will be driven by innovation, with automation becoming a cornerstone of global supply chains.

By Industry Vertical

The global automated storage & retrieval system (ASRS) market will continue to show steady growth in the years ahead as industries seek advanced solutions for storage, inventory management, and material handling. Rapid advancements in technology, combined with the need for speed, efficiency, and accuracy, will shape how different sectors adapt to automation. The adoption of these systems will not only enhance operational performance but will also reduce labor costs and improve space utilization, making automation a critical investment for many industries.

In aviation, the demand for automated storage and retrieval will grow as airlines and maintenance facilities require precise and efficient handling of high-value parts. The automotive sector will also experience significant expansion, driven by the need for streamlined production lines and optimized supply chains. In the chemicals industry, safety and precision will make automation highly valuable, especially in managing sensitive materials. Retail and e-commerce will see strong adoption as companies aim to meet increasing customer expectations for faster order fulfillment and accurate inventory tracking, particularly with the growth of online shopping.

Food and beverages will benefit from ASRS solutions that maintain strict standards for storage conditions, ensuring quality and safety while supporting faster distribution. Healthcare and pharmaceuticals will increasingly rely on automated systems to manage sensitive products, maintain compliance, and support accurate, timely delivery to hospitals, pharmacies, and distribution centers. Metals and heavy machinery industries will use automation to handle bulky and heavy components more efficiently, improving safety and reducing manual labor requirements.

The semiconductors and electronics sector will continue to lead in adopting ASRS technology, as precise and controlled storage is vital for sensitive components. Other industries, such as textiles, logistics, and publishing, will also gradually integrate automation to enhance efficiency and competitiveness.

Looking toward the future, integration with artificial intelligence and data-driven decision-making will push the global automated storage & retrieval system (ASRS) market forward. Predictive analytics will enable systems to forecast demand and adjust storage operations automatically, while robotics and advanced sensors will enhance accuracy and reliability. As industries strive for higher productivity and sustainability, the adoption of energy-efficient and space-saving automated solutions will rise sharply.

Overall, the global automated storage & retrieval system (ASRS) market will become a cornerstone of industrial transformation. By combining automation with innovation, industries will meet rising demands for efficiency, accuracy, and speed, creating a foundation for smarter, more adaptable operations across diverse sectors.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$9,958.63 million |

|

Market Size by 2032 |

$17,583.70 Million |

|

Growth Rate from 2025 to 2032 |

8.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

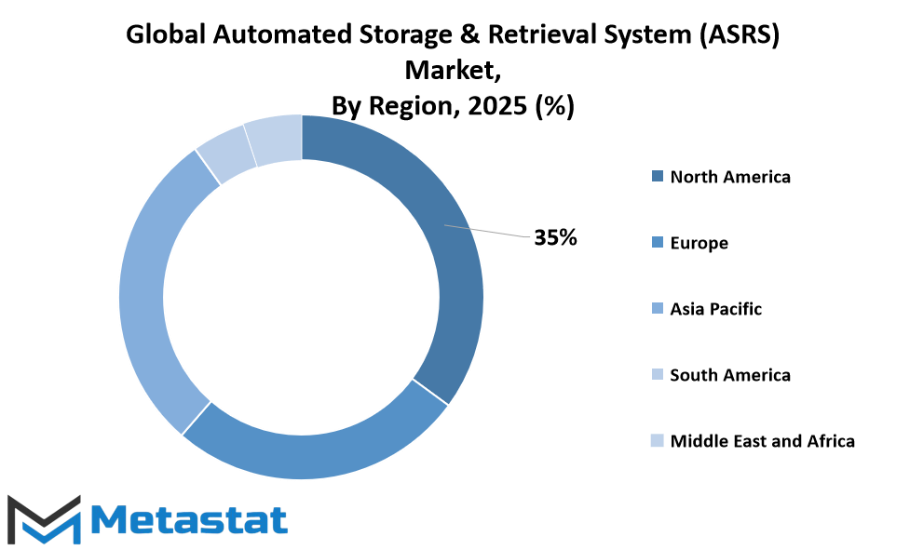

The global automated storage & retrieval system (ASRS) market is expected to grow steadily in the coming years as industries continue to prioritize efficiency, accuracy, and automation. Technological advancements, along with the rising need for faster and more reliable storage solutions, will drive strong adoption across various regions. The demand for automated systems in logistics, manufacturing, and retail is shaping a future where smart warehouses and intelligent storage solutions will become standard across industries.

Growth in North America will remain strong, supported by advanced infrastructure, high adoption of automation in the U.S., and increased demand for efficient supply chain systems in Canada and Mexico. The focus on optimizing warehouse space and reducing labor costs will further strengthen the region’s position as a leader in adopting automated solutions. In Europe, countries such as the UK, Germany, France, and Italy will continue to expand the use of these systems, driven by rapid advancements in technology and strong support for automation in industries such as automotive, healthcare, and food processing. The rest of Europe will also witness growth as smaller markets gradually embrace automated solutions to improve productivity.

Asia-Pacific will witness the fastest growth in the global automated storage & retrieval system (ASRS) market due to expanding manufacturing hubs, booming e-commerce platforms, and government initiatives that support automation and smart industry projects. Countries like China, Japan, and South Korea are investing heavily in modernizing their storage and retrieval facilities, while India and other nations in the region are beginning to adopt these systems at a faster pace to meet increasing industrial and consumer demands.

In South America, countries such as Brazil and Argentina will see steady growth fueled by the modernization of supply chains and increased demand for efficient distribution networks. The rest of South America will gradually follow as businesses look for ways to enhance operational efficiency and remain competitive. The Middle East & Africa will also emerge as a promising region, with the GCC countries leading the way through investments in modern logistics hubs and technology-driven storage systems. Egypt, South Africa, and other nations in the region will slowly integrate these systems to support growing industrial sectors and improve storage efficiency.

As automation becomes more affordable and scalable, the global automated storage & retrieval system (ASRS) market will continue to transform industries worldwide. Increased innovation, along with a focus on sustainability and efficiency, will ensure that these systems play a key role in shaping the future of industrial and commercial storage solutions.

COMPETITIVE PLAYERS

The global automated storage & retrieval system (ASRS) market is set to experience significant transformation as industries continue to prioritize efficiency, speed, and cost-effectiveness in material handling and inventory management. Automation is no longer viewed as an option but as a necessity, as companies seek to keep up with rising demands for faster order fulfillment and seamless operations. The steady growth of this market is being driven by sectors such as e-commerce, manufacturing, retail, pharmaceuticals, and food and beverage, where precision and streamlined storage solutions are essential for success.

Advanced systems are shaping the future of warehouses and distribution centers, offering higher storage density, real-time tracking, and faster retrieval of goods. The focus is shifting toward innovative solutions that integrate robotics, artificial intelligence, and data analytics to enhance performance. As technology evolves, the global automated storage & retrieval system (ASRS) market will continue to adapt, ensuring that automation aligns with both operational needs and sustainability goals. These advancements will lead to reduced energy consumption, optimized space utilization, and greater accuracy in managing inventory.

Key players in the automated storage & retrieval system (ASRS) market, including Daifuku Co., Ltd., SSI SCHAEFER, viastore SYSTEMS GmbH, Knapp AG, Murata Machinery, Ltd., TGW Logistics Group, Vanderlande Industries, Swisslog Holding AG, Dematic (Kion Group AG), System Logistics Spa, Bastian Solutions, Inc., Westfalia Technologies, Inc., CIM Corp, Mecalux, S.A., Honeywell Intelligrated, Fives Group, and Kardex Group, are focusing on advanced automation solutions to address changing market needs. These companies are investing in research and development to deliver systems that are smarter, faster, and more sustainable. Partnerships and collaborations are also emerging as strategies to combine expertise and create innovative products for industries worldwide.

The future of the global automated storage & retrieval system (ASRS) market will be defined by flexibility and customization. Solutions will be tailored to fit diverse operational scales, from small warehouses to large distribution hubs, ensuring that businesses of all sizes can leverage automation. Integration with digital platforms will also become more seamless, allowing managers to make data-driven decisions that improve efficiency and reduce operational costs.

Sustainability will remain a key factor, with an emphasis on energy-efficient systems and environmentally friendly materials. As the demand for faster, more reliable supply chains grows, the global automated storage & retrieval system (ASRS) market will continue to expand, setting new benchmarks for automation in the years ahead.

Automated Storage & Retrieval System (ASRS) Market Key Segments:

By Type

- Unit Load

- Mini Load

- Vertical Lift Module

- Carousel

- Mid Load

- Others

By Function

- Assembly

- Distribution

- Kitting

- Order Picking

- Storage

- Others

By Industry Vertical

- Aviation

- Automotive

- Chemicals

- Retail & E-Commerce

- Food & Beverages

- Healthcare & Pharmaceuticals

- Metals & Heavy Machinery

- Semiconductors & Electronics

- Others

Key Global Automated Storage & Retrieval System (ASRS) Industry Players

- Daifuku Co., Ltd.

- SSI SCHAEFER

- viastore SYSTEMS GmbH

- Knapp AG

- Murata Machinery, Ltd.

- TGW Logistics Group

- Vanderlande Industries

- Swisslog Holding AG

- Dematic (Kion Group AG)

- System Logistics Spa

- Bastian Solutions, Inc.

- Westfalia Technologies, Inc.

- CIM Corp

- Mecalux, S.A.

- Honeywell Intelligrated

- Fives Group

- Kardex Group

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383