MARKET OVERVIEW

The global airline ancillary services market will maintain its identity as an essentially niche segment within the larger Aviation and Travel Services Industry. This market environment is created for making revenue through an airport authority or airlines by provisioning ancillary services, apart from the sale of standardized flight tickets. As airlines seek to enhance their financial state by alternative means, they will increasingly seek to offer value through the myriad types of ancillary services that are developed depending upon the changing needs of air travelers.

The airlines functioning in this niche will come up with ancillary services that will provide differentiations in the passenger experience from being mundane at one moment to highly convenient and personal from another. Ancillary options may include anything from baggage fees to seat upgrades to purchasing access to inflight entertainment systems or an exclusive airport lounge. The industry covers any opportunities in addition to booking a seat on a flight where an airline can provide value-added services, mostly unbundled so that passengers can customize their travel experience according to their preferences and willingness to pay.

Carriers operating in this segment will purposefully organize and launch services that improve the passenger experience, make it more convenient, and make it more personal. Services may range from baggage fees and seat enhancements to inflight entertainment access and exclusive airport lounge advantages. Outside of the first transaction, the purchase of a seat, this marketplace will capitalize on each opportunity where an airline can provide additional value, usually unbundled services where the traveler gets to personalize their travel experience according to their needs and price sensitivity.

What will set the global airline ancillary services market apart is the fact that it will be in sync with evolving customer behavior and attitudes. Passengers will no longer think of flying as a means of transport; they will be searching for experiences combining comfort, convenience, and efficiency. Airlines will retaliate by streamlining their ancillary programs, employing data insights to forecast buying behavior and designing personalized offers across the different touchpoints of the travel experience, pre-flight and in-flight. This will create new streams of revenue not otherwise typical of the inbuilt nature of flying.

The industry will see a move towards online interaction as the main method of offering ancillary goods. The technology platforms will be the key to how airlines package and offer services on a changing level. Carriers will provide bundled and al a carte packages through mobile apps, web sites, and automated platforms to address the increasingly sophisticated needs of international travelers. This digital revolution will also enable airlines to track real-time consumer behavior, refine price strategies, and best time offers for maximum engagement and conversion.

In the coming years, the global airline ancillary services market will likewise mirror broader trends in the way individuals travel by air. Sustainability issues, wellness-oriented travel, and corporate duty of care requirements will shape the sorts of ancillary services airlines will promote. For instance, carbon offsetting programs, health-oriented travel insurance, and augmented onboard wellness packages will be increasingly prominent elements of the product palette.

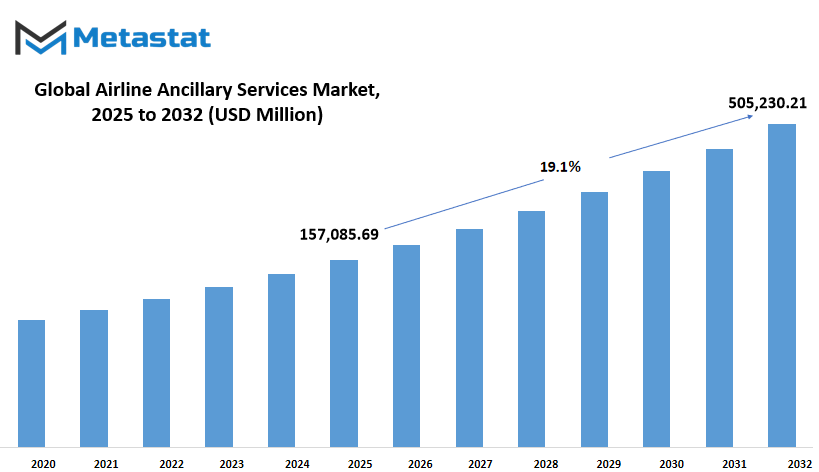

Global airline ancillary services market is estimated to reach $505,230.21 Million by 2032; growing at a CAGR of 19.1% from 2025 to 2032.

GROWTH FACTORS

The global airline ancillary services market that cater to airline passengers, and it would grow steadily over the coming years while airlines keep adapting to consumer expectations as they evolve. One of the key reasons for this growth might be travelers' increasing wants for more customized and premium services. People do not view flying simply as a method of transport from point A to point B anymore; they want to have a say in their journey, from choosing increased-legroom seats to getting a special meal or access to a luxury lounge. This change in passenger expectations prompted airlines to start offering an array of ancillary services to enrich the travel experience.

As equally important is the concept that airlines now want to find revenue streams besides just selling tickets. Selling airline tickets is traditionally subject to price pressures, and hence these additional services have come to represent an important dimension of business strategy for most airlines. These include, but are not limited to, extra charges for baggage, seat selection, in-flight entertainment, and priority boarding. For the airlines, these offerings ensure alternative sources of revenue and provide a more stable income flow in a highly competitive scenario.

However, there are challenges that could slow down this progress. Strict regulations on how airlines price and advertise these services may prevent them from pushing certain offerings too aggressively. Authorities in many regions want to protect consumers from unfair or unclear charges, which means airlines must carefully consider how they present their ancillary options. Additionally, if airlines depend too heavily on these services, customers may begin to feel frustrated. Travelers often complain when they feel tricked into paying extra fees, especially when these costs are not clearly explained upfront. If airlines are not careful, this could hurt their reputation and weaken customer loyalty.

Looking ahead, the growing use of mobile apps and digital platforms is set to open up fresh opportunities within the global airline ancillary services market. Airlines can now use technology to better understand individual customer preferences and offer more tailored services throughout the journey. From booking to check-in to post-flight follow-ups, these digital tools make it easier to create a more personalized and satisfying experience. In the future, this will likely become a major focus for airlines looking to strengthen their relationships with passengers and find new ways to generate revenue through smarter and more thoughtful services.

MARKET SEGMENTATION

By Type

The global airline ancillary services market is expected to continue changing the way airlines operate and how passengers experience air travel. In the future, this market will likely become even more important as airlines search for new ways to improve their earnings beyond just selling flight tickets. The rise in demand for additional services shows that passengers today are looking for more choices and flexibility during their journey. This shift will push airlines to come up with more creative and personalized services that can help enhance customer satisfaction while also increasing revenue streams.

Looking ahead, baggage fees will probably remain one of the most common sources of extra income for airlines. More travelers are willing to pay for convenience, such as choosing how much luggage they carry and how it is handled. As technology improves, passengers might be able to track their bags in real time or choose special services related to baggage. These small but meaningful additions will keep baggage fees a steady contributor to the global airline ancillary services market.

Another area that will likely see growth is onboard retail and A-la-carte services. Passengers will expect more options tailored to their needs, whether it’s premium snacks, luxury items, or access to upgraded seating during the flight. Airlines will aim to make these offers as appealing as possible, using data and past purchase history to suggest what a traveler might want. This approach will not only make passengers feel valued but also encourage spending during flights.

Airline retail will continue to expand with more partnerships and exclusive products available only through certain carriers. This could include items like cosmetics, tech gadgets, or fashion products that are popular with frequent travelers. Airlines might also improve the shopping experience with digital tools, allowing passengers to browse and order items before or during their flight for delivery at home or at their destination. These developments will strengthen the role of airline retail in the global airline ancillary services market.

Frequent flyer program (FFP) miles sales will likely become even more popular as airlines look to build loyalty while creating new ways to generate income. Offering miles for purchases beyond flights, such as hotel stays or car rentals, will become more common. This expansion will make FFP miles more valuable and attractive to customers.

Finally, other services such as Wi-Fi access, seat selection, and airport lounge access will keep evolving. In the future, airlines may offer more packages or bundles combining these extras, giving travelers more reasons to spend while enhancing their journey from start to finish.

By Carrier Type

The global airline ancillary services market is expected to grow steadily in the future as airlines continue to seek new ways to increase their revenue beyond just selling tickets. These services are the extra features and products that passengers can choose when they fly, such as checked baggage, seat selection, in-flight meals, priority boarding, and even access to airport lounges. As people become more used to customizing their travel experience, airlines are likely to expand their range of these services to meet different needs and budgets. The market is often divided by carrier type, with the main categories being Full-Service Carriers and Low-Cost Carriers. Each has its own approach to how it offers and prices these services.

Full-Service Carriers are known for including many benefits within the ticket price, but in recent years, they have also started offering more optional extras to passengers who want more comfort or convenience. This helps them stay competitive and attract customers who are willing to pay for upgrades. For example, travelers might want to pay extra for more legroom, better meals, or faster security checks. These additional options allow the airlines to keep base fares attractive while still generating more revenue from those who are looking for something extra.

On the other hand, Low-Cost Carriers focus heavily on offering cheap base fares and then charging separately for almost every additional service. This model allows passengers to pick only what they need, keeping costs low unless they choose to add on more services. In the future, these airlines might become even more creative in what they offer, possibly adding partnerships with hotels, rental car companies, or insurance providers to expand their list of services. This approach will help them not only earn more but also give travelers greater flexibility and choice.

Looking ahead, technology will play a big role in shaping how these services are offered and delivered. Personalized offers through mobile apps or loyalty programs might become more common, as airlines use data to understand passenger preferences better. This means passengers could see tailored packages that suit their habits and travel history, making it easier to pick and pay for what they want. The global airline ancillary services market will likely keep growing as more travelers seek control over their journey and as airlines find new ways to meet those expectations while boosting their profits

By Travel Type The global airline ancillary services market will continue to grow as the travel industry changes to meet the expectations of future passengers. These services will not only help airlines increase their profits but will also improve the overall experience for travelers. People are becoming more aware of the value of personalized services, and airlines will focus on offering options that cater to different types of travelers. By travel type, the market is divided into international and domestic, and both areas will see growth but for different reasons.

International travel will drive demand because people are traveling farther and more often for both business and leisure. Airlines will look for ways to make long flights more comfortable and enjoyable through additional services like extra legroom, upgraded meals, and entertainment packages. Passengers flying internationally usually look for more comfort during their journey, and this is where ancillary services will play a bigger role. These services will not only be about luxury but also about convenience. Things like fast-track security, lounge access, and baggage delivery will become more common as airlines compete to attract frequent international travelers. Travelers will likely choose airlines not just for ticket prices but for the extra benefits they receive.

Domestic travel, on the other hand, will fuel growth in the global airline ancillary services market through different strategies. Short-haul flights will focus more on services that make trips smoother and save time. With many people flying domestically for work or quick vacations, airlines will offer more flexible booking options, priority boarding, and even customized in-flight entertainment. These services will be designed to reduce travel stress and make passengers feel more valued. Domestic travelers may not demand luxury, but they will appreciate convenience, speed, and flexibility.

As technology continues to develop, both international and domestic airlines will use digital platforms to offer tailored ancillary services. From booking to arrival, passengers will have more control over their journey through mobile apps and online portals. This shift will help airlines collect data to understand customer preferences better, which will lead to even more personalized offers in the future. Over time, the global airline ancillary services market will reflect how people’s expectations evolve when it comes to travel. The focus will move towards creating a travel experience that feels easy, enjoyable, and worth paying extra for. Airlines that can adapt to these future demands will be the ones that succeed.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$157,085.69 million |

|

Market Size by 2032 |

$505,230.21 Million |

|

Growth Rate from 2025 to 2032 |

19.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

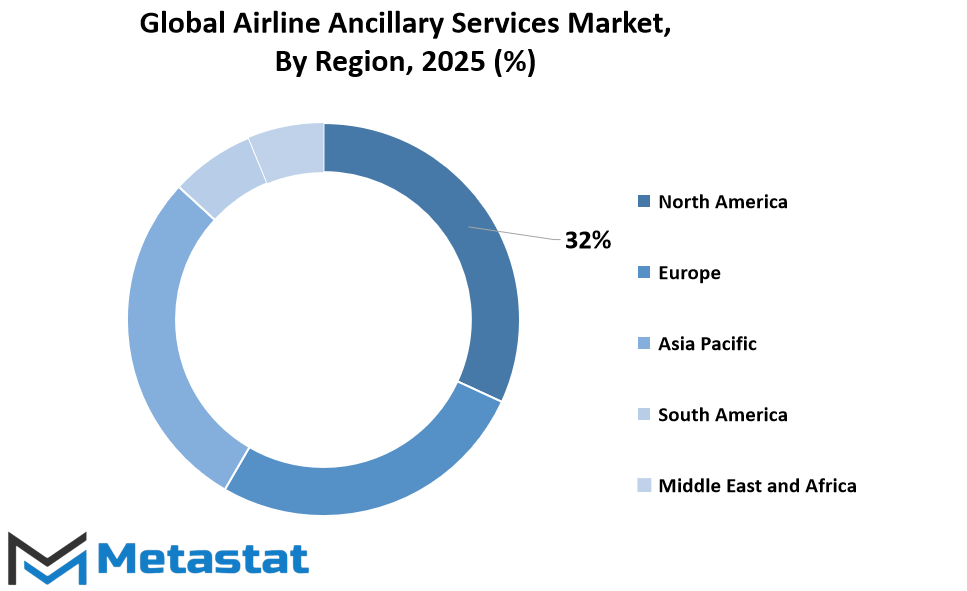

REGIONAL ANALYSIS

The global airline ancillary services market is shaped by a variety of regional factors, each contributing in unique ways to its growth and future potential. Looking at this market from a geographical perspective helps in understanding how consumer behavior, technological progress, and economic trends differ from one region to another. North America, for example, is one of the most developed markets in this space, with the United States, Canada, and Mexico playing key roles. The demand for additional services beyond just air travel, such as extra baggage, seat selection, and inflight meals, is well-established in these countries. Airlines here have been quick to adopt digital platforms that make purchasing these services easier, reflecting the tech-savvy nature of their customers.

In Europe, countries like the UK, Germany, France, and Italy are strong contributors. European travelers are known for their interest in customization and comfort, leading airlines to offer a wide range of services aimed at enhancing the travel experience. While the core of this market is mature, there is still room for innovation, especially with the integration of AI and data analytics that can help airlines better predict what services passengers are likely to purchase. Even though Europe shows steady growth, there are opportunities for companies to expand their offerings as consumer expectations continue to evolve.

The Asia-Pacific region is showing some of the most exciting prospects for the global airline ancillary services market. With countries like China, India, Japan, and South Korea leading the way, the demand here is driven by a growing middle class, rising disposable incomes, and a strong appetite for travel. Airlines in this region are expanding their service options rapidly, recognizing that travelers are becoming more willing to pay for convenience, comfort, and entertainment. As digital adoption continues to rise, so too does the ease with which consumers can access and purchase these services.

South America, particularly Brazil and Argentina, is gradually increasing its influence on this market. Economic fluctuations might have slowed growth in the past, but improving stability and an expanding tourism sector suggest better prospects ahead. Airlines are beginning to explore more targeted offers to capture additional revenue.

Finally, the Middle East and Africa present a mixed picture. Countries like those in the GCC, Egypt, and South Africa are showing promising growth due to increasing air traffic and tourism development. Airlines here are investing in technology and partnerships to boost their ancillary revenues. Looking ahead, every region will likely contribute to shaping the future of the global airline ancillary services market through continuous innovation and an ongoing focus on customer experience.

COMPETITIVE PLAYERS

The global airline ancillary services market is expected to see significant growth in the future as airlines continue to find new ways to increase revenue beyond ticket sales. This market is shaped by the efforts of various competitive players who are constantly looking for opportunities to enhance customer experience while also boosting their profit margins. Companies like Deutsche Lufthansa AG, Delta Air Lines, Inc., American Airlines, Inc., Alaska Air Group, Inc., United Airlines, Inc., Southwest Airlines Co., Ryanair DAC, EasyJet PLC, Air France-KLM, Air Canada, Hong Kong Express, and JetBlue are key players in this space. They are not only competing on routes and fares but also on the added services they can provide to travelers.

As the travel industry becomes more customer-focused, these airlines will likely keep expanding their ancillary services to meet growing demands for convenience and personalization. Services such as seat selection, baggage fees, in-flight meals, Wi-Fi, priority boarding, and lounge access have become common sources of extra revenue. In the future, we can expect airlines to go beyond these traditional offerings. They might develop more flexible booking options, exclusive travel experiences, and enhanced loyalty programs. Some carriers may also form partnerships with tech companies to offer digital services that make the journey smoother from start to finish.

The global airline ancillary services market is moving towards a future where data plays a large role in shaping these services. Airlines will use customer data to create more targeted offers, predicting what services passengers are likely to purchase before they even book a flight. This personalized approach is expected to improve customer satisfaction while giving airlines a clearer path to increasing revenue. The competition between these key players will push the market to innovate continuously. Each company will want to stay ahead by offering unique services that appeal to travelers of all kinds, from business flyers to families on vacation.

Technology will continue to be a strong driving force. With advancements like mobile apps, artificial intelligence, and automation, airlines can deliver services more efficiently and with greater precision. This will make ancillary services not just a side option but a central part of how airlines operate and compete. In this competitive space, the companies mentioned earlier will likely lead the way, shaping the direction of the market and influencing how the future of air travel looks for both airlines and passengers.

Airline Ancillary Services Market Key Segments:

By Type

- Baggage Fees

- Onboard Retail & A-La-Cart

- Airline Retail

- Airline Retail & FFP Miles Sale

- Others

By Carrier Type

- Full-Service Carrier

- Low-Cost Carrier

By Travel Type

- International

- Domestic

Key Global Airline Ancillary Services Industry Players

- Deutsche Lufthansa AG

- Delta Air Lines, Inc.

- American Airlines, Inc.

- Alaska Air Group, Inc.

- United Airlines, Inc.

- Southwest Airlines Co.

- Ryanair DAC

- EasyJet PLC

- Air France-KLM

- Air Canada

- Hong Kong express

- JetBlue

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252