MARKET OVERVIEW

The Global Aircraft Interior Sandwich Panel market stands apart from the aviation manufacturing industry. Aircraft designs will increasingly focus on reduced weight and high performance on the market for advanced materials for interiors. The contribution to the growth of engineered panels that comply with structural performance and the evolving safety and comfort standards will go beyond just satisfying basic design requirements. Comprising of outer thin skins bonded to a lightweight core, sandwich panels will provide the basic structural elements of a wide variation of interiors in aircraft, from floors and sidewalls to overhead bins and partition walls.

For the foreseeable future, Global Aircraft Interior Sandwich Panel markets will evolve beyond its traditional supply base. The future will see the competition for innovation led not only by the introduction of new materials but also by their integration within different concepts of cabin design. Manufacturers are going to stop using outdated honeycomb cores and start looking for composite alternatives that provide better thermal and acoustic insulation while also allowing structural integrity. The apparent changes that industries were currently making as optional considerations dependent on changing regulations or the desires of airlines will soon be joined by modifications that now cannot be called optional. To survive in this market, companies will need to rethink how they construct panels and how they source, test, and install them within the aircraft structure.

Customization fairly dominated the earlier decades, with far greater contributions anticipated in the future. Instead of going for generalized paneling solutions, firms aim to innovate panel configurations to meet individual airline criteria incorporating aesthetics, ease of maintenance, and eco-friendliness. This paradigm shift will have repercussions on production cycles, transforming them into ones reliant on digital design methods with the use of analytical simulation technologies to ensure precision and conformity before physical production of any proposed paneling. The possibility of anticipating the behavior of materials under different flight conditions would be at the core of the development process of future models, allowing for better matching with customer needs and regulatory expectations.

Strategically, the supply chain in the Global Aircraft Interior Sandwich Panel market will change. Given the growth rate of demand for newer, state-of-the-art panel types, companies may very well invest in localized production facilities and vertical integration strategies. This would reduce lead times and allow rapid adaptation to design or regulatory changes. In the same vein, sustainable production practices will no longer be an afterthought; they will become a core element of the operational model, influenced by environmental considerations and long-term cost-effectiveness.

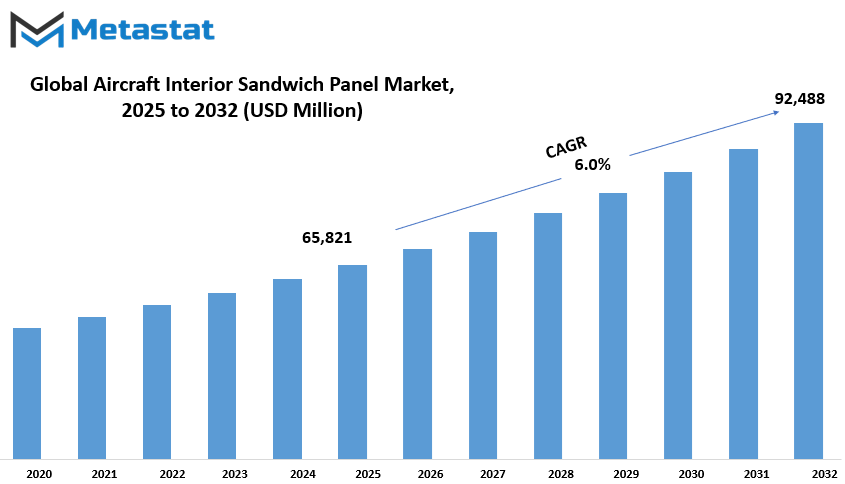

Global Aircraft Interior Sandwich Panel market is estimated to reach $92,488 Million by 2032; growing at a CAGR of 6.0% from 2025 to 2032.

GROWTH FACTORS

The Global Aircraft Interior Sandwich Panel market is on a steady climb, exponentially increasing with the growth of air passengers. With low costs and easy availability, airlines are putting misery aside for newer aircraft orders, which in turn translates into greater demand for interior components, including sandwich panels. These components are widely used in aircraft interiors because they are very strong and at the same time very lightweight. Besides that, airlines and aircraft manufacturers now focus more on the materials they could use to bring down the overall weight of the aircraft. A lighter aircraft will consume less fuel, which in turn cuts costs and helps to reduce carbon emissions. Fuel efficiency is one of the foremost reasons people have chosen sandwich panels as their light space-saving option while on board an aircraft.

Despite the benefits described, an overall market also holds some serious hurdles. The most important challenge is that it has scored high in the cost prices involved in manufacturing these panels. Such advanced materials and manufacturing processes generally inflate prices, making it difficult for some companies to go for mass usage. Moreover, the aviation industry happens to be the world's most stringently governed industry being one of safety. To be placed in an aircraft, every kind of material and component needs to meet the high stringent standards of safety. Necessarily required for making safety established, such rules sometimes slow down technological innovation. Most of the time, the manufacturers utilize a lot of time, effort, and energy in obtaining proof, which in turn causes delay in launching products.

Regardless of these barriers, the market is still open for growth opportunities. Continued advancements in new composite materials represent an extensive opportunity. For instance, the new materials can now be made stronger and flexible, thus providing designers with more opportunities in developing functional yet aesthetically appealing interiors. Retrofitting of the old aircraft also has great potential for growth. Many airlines are refurbishing existing interiors to make comfort for the user better in all aspects of modern living. This modernization with the possible retrofitting has an enormous opportunity for sandwich panel manufacturers.

This is how the Global Aircraft Interior Sandwich Panel market would continue expanding itself through time, notwithstanding a few hurdles along the way. The surge in efficiency, comfort, and safety in air travel will remain propellant to demography. With ongoing advancements in material science and increasing emphasis on upgrading interiors of aircraft, this market is poised to remain as a key participant in the progress of the aviation industry.

MARKET SEGMENTATION

By Type

The Global Aircraft Interior Sandwich Panel Market is expected to grow because air travel is becoming more ubiquitous as a means of transport, increasing the demand for safer, lighter, and more fuel-efficient aircraft design. Also, this type of application has different kinds of sandwich panels for interiors, which also contribute vastly to the growth of this market because these panels are not just materials; they have an importance in an overall aircraft performance and efficiency. A weight reduction translates directly into reduced fuel consumption and an improvement in performanced by lightweight materials. Among these many types of Sandwich panels, Nomex Honeycomb has shown a phenomenal market size of around $46,215 million. With the nature of its resistance to heat and fire, this lightweight and very strong material is ideally applicable in a wide array of interior applications such as flooring, ceilings, and sidewalls.

Another material that has found a wonderful application is Aluminium Honeycomb. It is heavier than Nomex but has high strength and durability. This means it is intended for applications where more support and structural integrity would be needed. Aluminium Honeycomb panels are most frequently used where reinforcements must be stronger without massively excessive weight being added. This very unique combination of strengths and weights keeps them in great demand, especially in applications like commercial and cargo aircraft. Besides these two materials, the category "Others" shall include various materials under research or development for specific applications. Examples could include advanced composite materials or newly engineered materials offering uniqueness such as advanced insulation, soundproofing, or environmental benefits.

These three elements are the prime movers of this market- increase performance; cost-reducing goals; and very strict safety parameters. Improvement would be in the form of methods under which the passenger experience in an aircraft enhances. Operating costs are always increasing. Strong and lightweight sandwich panels will make innovative interior layouts possible while still being made good strides in sustainable living. Apart from this, regulations in fire resistance and safety made it all the more plausible and necessary to consider the expensive materials such as Nomex and Aluminum Honeycomb.

With future changes in technology and customer expectations, internal cabin designs will carry increasing requirements from aircraft manufacturers in the coming years. The major area they would be focused on will be making the materials reliable, safe, and efficient. Even in such a situation, sandwich panels will continue to play a crucial part, and one can expect a slow but stable growth in the market of all kinds, particularly Nomex Honeycomb, over the next few years.

By Application

It will not only likely grow further in terms of market by applications, but also by manufacture. The global aircraft interior sandwich panel market has been held in fastened developments owing to the growing demands for such space-efficient yet durable materials in the aviation industry. The principal reason behind this growth is concocted as introduction into efficiency and reduction of the overall weight of aircraft without offensively affecting the safety or comfort of the craft. Sandwich panels, made of strong but light materials, effectively do that. Such panels are used in the various components of the interior including walls, ceilings, flooring, and separately as they are lightweight and provide strength without hammering the structure too much.

Based on application, the segments include Narrow Body Aircraft, Wide-Body Aircraft, Regional Aircraft, and Others. Each category has its unique contribution toward the entire demand for sandwich panels. Narrow-body aircraft mainly serve routes of short and medium-hauls generally with narrow-body production growing steadily with the rise in low-cost airlines and increase in domestic travel. Being used very often and requiring a very short turnaround time, these planes drive manufacturers to easily maintain durable interiors.

Long-haul international flights typically increase the complexity of interiors of an aircraft, such as wide-bodied aircraft, which usually operates on international routes. This airplane has more passengers and cargo, so the interior materials should be more high-performing in weight-wise, insulation-wise, and fire-resistant wise. Hence sandwich panels will serve the application to such aircraft. Regional aircraft with the routes going shorter distances and working more commonly in places like smaller airports where access may be limited also favor these sandwich panels due to the lower weight and to ensure proper space utilization.

The "Others" above relate to specialized aircraft types that may not fit into the standard definitions but still need some interior solutions, which would be safety and performance-related. Sandwich panels add flexibility and reliability to such kinds.

The overall support for the Global Aircraft Interior Sandwich Panel market is made due to the unrelenting thrust in fuel savings, environmental regulations, and passenger comfort. As airlines look to modernize their fleets and transform their model for operation efficiencies, the demand for high-tech interiors such as sandwich panels is expected to increase. Each segment, whether narrow body, wide body, regional, or other types of aircraft, is contributing to this ever-expanding market and making these panels an essential part of the aviation interiors of tomorrow.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$65,821 million |

|

Market Size by 2032 |

$92,488 Million |

|

Growth Rate from 2025 to 2032 |

6.0% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

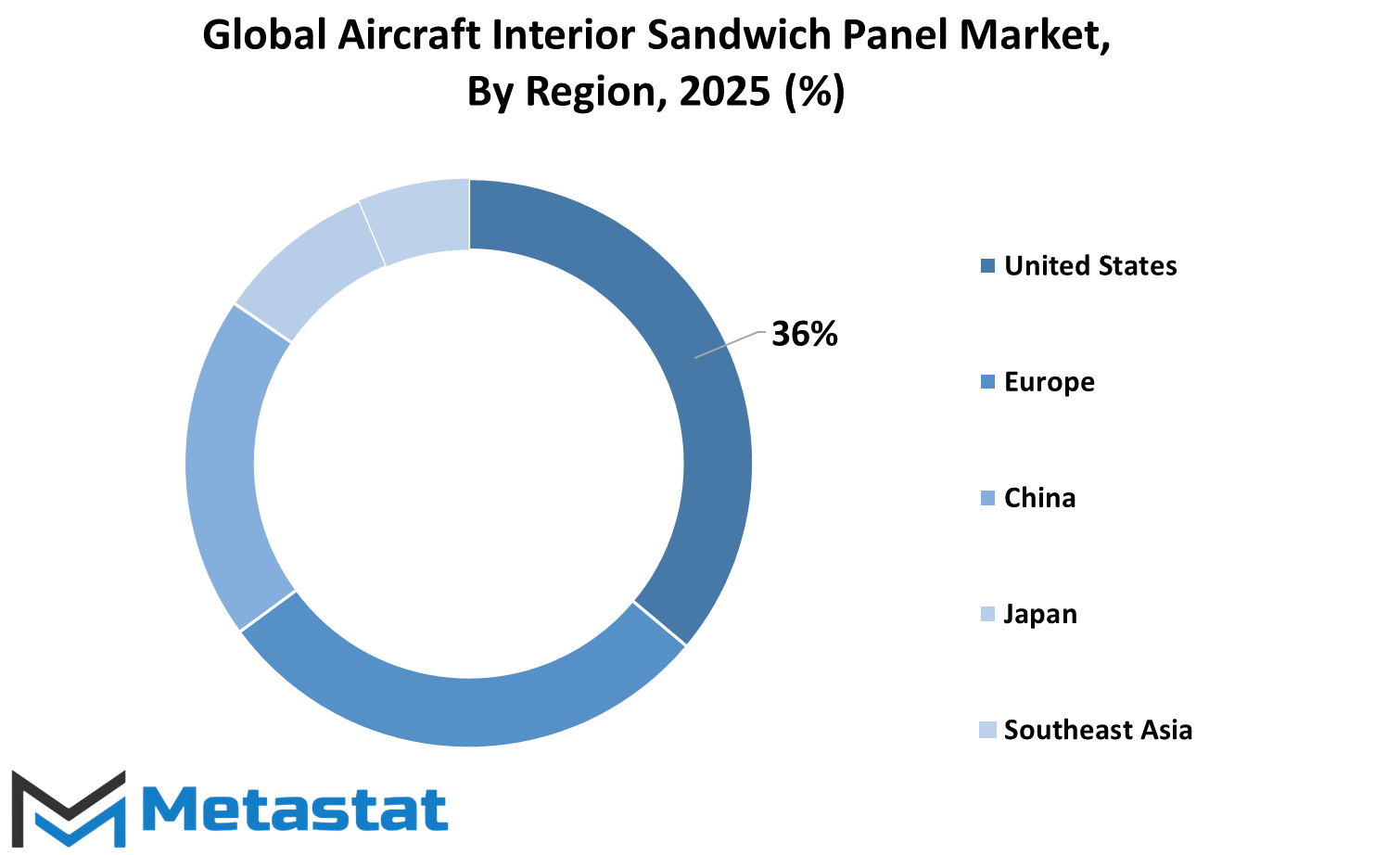

Globally, the Aircraft Interior Sandwich Panel market is segmented based on geography into North America, Europe, Asia-Pacific, South America, and the Middle East and Africa. The regions significantly contribute to the global market according to their demand, technological advancement, and industrial regulations. North America constitutes the U.S., Canada, and Mexico. The United States heads the list in production and innovations because of its aviation industry and those investments in R&D. Canada and Mexico onboard advancement in the region through joint transformation and widening airline networks. The European market comprises the market from the UK, Germany, France, Italy, and the Rest of Europe. Germany and France are already known for their advanced engineering competencies and established aircraft manufacturers. The UK and Italy also contribute through focused improvements regarding lightweight materials and cabin design that improve fuel efficiency and passenger comfort.

The Asia-Pacific region where India, China, Japan, and South Korea are developing at a faster speed is now prepared to grow at a very fast pace. China and India step up investments for domestic aviation infrastructure, which in turn stimulates the demand for advanced materials for interiors. After Japan and South Korea follow, developing a technology-focused industry that champions innovation in lightweight, durable panels. However, the rest of Asia-Pacific would like to be brought into line with this burgeoning trend as fleet modernization across the region and enhanced inter-regional travel creates demands. South America is dominated by Brazil and Argentina. Brazil, in particular, is getting a positive thrust based on a burgeoning domestic aircraft manufacturing base and an emerging airline industry. Argentina and the rest of South America support the market through sustained improvements in air travel and tourism.

Middle East & Africa consists of GCC Countries, Egypt, South Africa, and Rest of the region. High-end interior materials are in demand in the GCC Countries, famous for pouring in investments into luxury airlines and a flurry of new aircraft orders. At the same time, Egypt and South Africa are ramping up their aviation sectors in support of the market while the rest of the region is gradually entering the scene. Each one of these regions adds to the global market at their own pace and area of emphasis. The combined efforts of the regional developments are certain to carve the way for the future of the Aircraft Interior Sandwich Panel market on a global scale.

This entry is useful in the scenarios of the world's prepared countdown, in particular when it comes to geographical, multi-national, and global markets from the point of an aircraft interior sandwich panel.

COMPETITIVE PLAYERS

Global market aircraft internal sandwich panels are being formed alongside the increasing demand for lightweight advanced materials from the aviation segment. The panels mainly find application in the interiors of an aircraft in walls, ceilings, floors, and storage compartments. These panels contribute to the aircraft's reduced weight while maintaining strength and safety, thereby increasing fuel efficiency and performance. The growing fleet modernization by airlines raises the demand for advanced material technologies that impart durability while also being lightweight. This has further opened the doors for research and innovation on new designs and manufacturing of sandwich panels.

Typically, a hollow core is sandwiched by two outer layers. This structure imparts strength while reducing overall weight. The manufacturers are trying to find ways to make the best use of aluminum honeycomb, foam, and many other composite materials to satisfy the market requirements. These materials are lightweight and fire and impact resistant, which makes them ideal candidates for aircraft interiors. Recently, with the coming of stringent safety regulations, a fair share of companies started paying attention to fire and smoke resistance-enhancing their products.

At present, the major companies in the Aircraft Interior Sandwich Panel segment are AIM Altitude (AVIC International), B/E Aerospace (Rockwell Collins), Diehl Aerosystems, EnCore Group, Euro-Composites Corp., Hexcel Corporation, Jamco Corporation, Plascore Incorporated, The Gill Corporation, Triumph Composite Systems (Triumph Group), Yokohama Aerospace America Inc., and Zodiac Aerospace (Safran SA). Investment is directed into the development of research and manufacture aimed at producing panels strong and yet light and credible environmentally. The focus is also moving to recycling materials and processes that take waste minimization through production into account.

Then, henceforth will all airlines streamline internal travel in the entire aviation industry concentrating more on comfort, efficiency, and innovation following turmoil in international travel. Airlines look for substitutes as far as the overall fuel cost is concerned along with a better passenger experience. Sandwich panels form, bridge the function of form and function. This also allows modification of the panel design with respect to various aircraft models such that it has more aesthetic value.

Teenage aircraft interior design and material-sciences trends and phenomenal developments are of paramount importance. This would be the avenue through which the companies will push themselves to be trendsetters into the future via sneakers and innovations in materials. In broad strokes, the Aircraft Interior Sandwich Panel industry is on a growth path across the world, and this growth is expected to continue in the foreseeable future as aircraft manufacturers and airlines drive safety, efficiency, and sustainability.

Aircraft Interior Sandwich Panel Market Key Segments:

By Type

- Nomex Honeycomb

- Aluminum Honeycomb

- Others

By Application

- Narrow-Body Aircraft

- Wide-Body Aircraft

- Regional Aircraft

- Others

Key Global Aircraft Interior Sandwich Panel Industry Players

- AIM Altitude (AVIC International)

- B/E Aerospace (Rockwell Collins)

- Diehl Aerosystems

- EnCore Group

- Euro-Composites Corp.

- Hexcel Corporation

- Jamco Corporation

- Plascore Incorporated

- The Gill Corporation

- Triumph Composite Systems (Triumph Group)

- Yokohama Aerospace America Inc.

- Zodiac Aerospace (Safran SA)

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252