MARKET OVERVIEW

The global aerial work platform rental market is a unique segment of the construction and industrial equipment industry that exists based on the demand for short-term height access solutions. Where the future of the industry is concerned, it will not only track in the same old ways but will be defined by exceptional challenges and opportunities that go beyond standard expectations. This market will no longer be characterized by availability of equipment or trends of usage but by how flexible it becomes in responding to the increasingly changing needs of users in various industries.

The global aerial work platform rental market in the next few years will walk through a complicated crossroads of safety standards, technological innovation, and logistical flexibility. As construction sites, maintenance work, and infrastructure projects all put more and more strain on secure height-access solutions, the rental platforms' role will be more in the forefront. But beyond run-of-the-mill market dynamics is the increasing embedding of these platforms in larger project planning and operational strategies. It will no longer be the issue of renting equipment it will be a planned, timed decision within the greater scheme of project efficiency and employee safety.

Additionally, the future will see a dramatic change in rental business operations. Online platforms will play a vital role in redefining how customers rent and deal with aerial equipment. The integration of real-time monitoring, scheduling of predictive maintenance, and utilization analytics will not only improve working efficiency but also create new opportunities for service tailoring. This shift will quietly change the expectations of customers, putting pressure on rental providers to provide not only tools but intelligent solutions as well.

As the world's infrastructure needs continue to shift, the global aerial work platform rental market will extend its scope to new, historically underserved areas. This spread will be more than geographical in nature, however affect localized equipment demand, climate, and compliance considerations as well. A flexibility and vision to accommodate regional project size variations, labor training needs, and equipment appetites will be required. Operators in the rental industry will have to plan not only for heightened demand, but also for sophisticated provision of services suited to each region's unique demands.

The story will also include greater sustainability focus. The future of market forces will be determined by the way rental companies react to environmental issues. Where much of the industry has concentrated on performance and utility, the next evolution will probably require cleaner, quieter, and more energy-efficient equipment. Meeting these anticipations without sacrificing safety or affordability will determine competitive advantage in the future.

In total, the global aerial work platform rental market is set to change in ways that go far beyond the size and growth of its current form. Its destiny will be determined by more than mere size and growth, but by how it repositions itself within the larger industrial network. Innovation, responsiveness, and understanding of local requirements will be the pillars of this change, permitting the market to prosper while having a well-balanced emphasis on performance, accountability, and user-driven expansion.

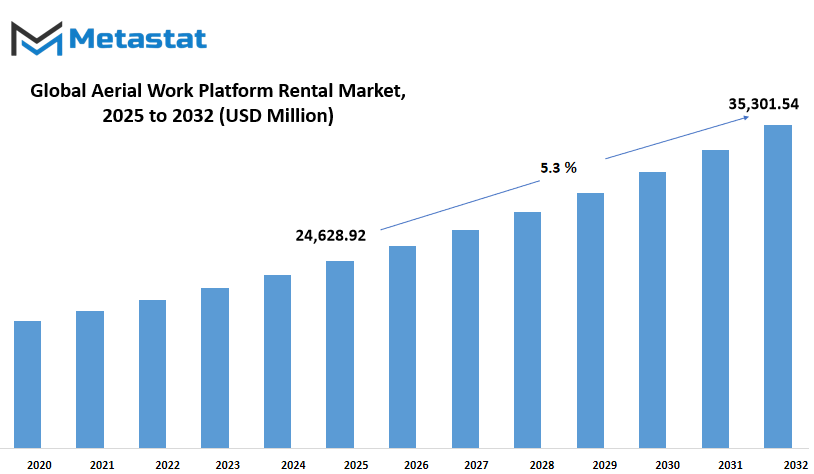

Global aerial work platform rental market is estimated to reach $35,301.54 Million by 2032; growing at a CAGR of 5.3% from 2025 to 2032.

GROWTH FACTORS

The global aerial work platform rental market, viewed through the eyes of Metastat Insight, remains in flux with evolving industry needs. Perhaps its most robust growth driver is the boom in infrastructure refurbishment and construction work throughout Europe. These projects not only provide a consistent aerial platform demand but also symbolize a larger trend towards urban revamp and contemporary project implementation based on agile access solutions.

Increasingly, more companies are abandoning ownership paradigms for rentals. Behind this trend lies the cost-effectiveness and flexibility that rentals provide. Businesses are able to satisfy project needs without shouldering long-term expenses for equipment maintenance or storage, making rental a savvy option in both the short and long term. Contractors operating on diverse schedules and budgets are able to use resources effectively without sacrificing performance or safety.

But rental firms must contend with their own set of issues that can restrict profitability. Compressed maintenance and transportation expenses, particularly on bigger or more complicated equipment, tend to trim margins. These costs can escalate rapidly when equipment must be transferred in and out of job sites or across borders. In addition to this, compliance with stringent protection and environmental policies imposes further pressure. Following more recent guidelines is often a remember of making well timed improvements, having ordinary inspections, or even changing parts of the fleet at instances measures that are both resource-intensive and time-eating.

Despite these problems, there are nice signs for the future. One of the extra promising developments is increasing interest in electric powered and hybrid aerial equipment platforms. As sustainability will become an increasingly crucial attention across industries, demand for low-emission answers keeps to grow. This trend bodes well for the boom of environmentally pleasant condo fleets, setting up organizations to secure customers with environmental targets at the same time as additionally looking ahead to future regulatory necessities.

In the years to come, the global aerial work platform rental market will most probably develop in sync with these trends. It is no longer merely a question of fulfilling utilitarian necessities it's also about fulfilling them in a manner consonant with economic imperatives and green imperatives. Although some challenges exist, the prospects to transform and flourish make this market one to keep an eye on.

MARKET SEGMENTATION

By Product Type

The global aerial work platform rental market is projected to see steady growth as a result of increased demand for efficient and secure lifting tools in construction, maintenance, and industrial operations. With increasing urban density and upgraded infrastructure, companies are focusing on safety and efficiency when performing height-related work. Within this environment, aerial work platforms are no longer elective rather, they're indispensable equipment. Hiring these machines is now a popular choice among most businesses, particularly small and medium-sized enterprises, since it saves them from initial expenses and guarantees access to well-maintained and state-of-the-art machinery.

The many types of products available in the global aerial work platform rental market, boom lifts are significantly placed with an estimated value of $13,431.49 million. Boom lifts are normally decided on for packages calling for outreach and peak versatility, particularly in production regions and large homes. Scissor lifts, however, are desired for vertical elevations and are commonly used for indoor set up and upkeep paintings. Vehicle-set up structures are suitable for tasks that need mobility among locations and are therefore mainly applicable for software paintings or roadside operations. Other aerial platform types have their personal percentage in specialized programs primarily based on mission necessities and jobsite wishes.

The lease model is likewise complemented by way of the increasing demand for flexibility in operations. Most organizations presently select quick-term leasing to address seasonal or project-based totally wishes without the expenses of storage, protection, or depreciation. This isn't only pragmatic but also a wiser strategy in dealing with assets. Besides, continuous advancements in platform design, which include better maneuverability, wearing capacity, and protection features, will preserve to enchantment to clients looking for modern answers with out possession troubles.

As the sector will become extra city and workplace safety regulations continue to tighten, demand will only growth for reliable aerial structures. The rental solution slots neatly into this equation, providing convenience and flexibility. Boom lifts will lead the charge, with other varieties available to suit a wide variety of jobs, and the aerial work platform rental market will remain the go-to choice for many years to come.

By Propulsion Type

The global aerial work platform rental market, whilst visible thru the lens of propulsion types, is formed with the aid of realistic demands and changing options in work environments. This marketplace is split into three principal segments Diesel, Electric, and Hybrid each with its personal relevance relying on usage, area, and regulatory elements.

Diesel-powered systems have traditionally held a massive share of the condominium market. These machines are regarded for his or her power and reliability, in particular in outdoor production or industrial settings in which heavy-duty work is the norm. Their potential to function for longer hours without having frequent refueling has made them a dependable alternative for tasks that require constant performance. However, as cities and worksites circulate towards cleaner practices, this phase may face increasing pressure because of emissions and noise issues.

In assessment, electric aerial paintings systems have become more not unusual, specially in indoor environments or city areas with stricter emission rules. They are quieter, purifier, and regularly extra compact, making them perfect for warehouses, buying malls, and similar indoor places. Users are displaying growing interest in electric fashions because of their decrease environmental impact and simplicity of use. The protection charges are regularly lower too, which provides to their attraction in a condominium state of affairs wherein efficiency and reliability are crucial.

Hybrid aerial work platforms bring collectively the strengths of each diesel and electric powered systems. They provide flexibility for users who want a system that could perform across specific settings. These systems can transfer among power assets relying on the activity or environment, making them useful for lengthy-term tasks that contain each indoor and outdoor paintings. While the hybrid segment remains growing, it shows promise for renters who prioritize adaptability without compromising performance.

Rental agencies are increasingly specializing in retaining a well-balanced fleet that consists of all three propulsion sorts. This permits them to satisfy the various wishes of customers even as also preparing for future adjustments in worksite rules and environmental expectations. The choice of propulsion isn’t pretty much energy anymore it’s also approximately fitting into tighter spaces, cutting down on pollutants, and assembly price range requirements. As user priorities shift toward cleanser and greater bendy answers, the mix of diesel, electric, and hybrid structures within the condo market will possibly alter to reflect those evolving needs.

By Application

The global aerial work platform rental market is gradually transforming itself into an industry that mirrors the evolving demands of the construction, manufacturing, and utility industries. Such platforms leased rather than purchased are being increasingly selected for operations that require safe, flexible, and temporary height. As businesses transition towards more effective functioning, equipment leasing proves to be more convenient than purchasing, particularly when requirements are fleeting or project-specific.

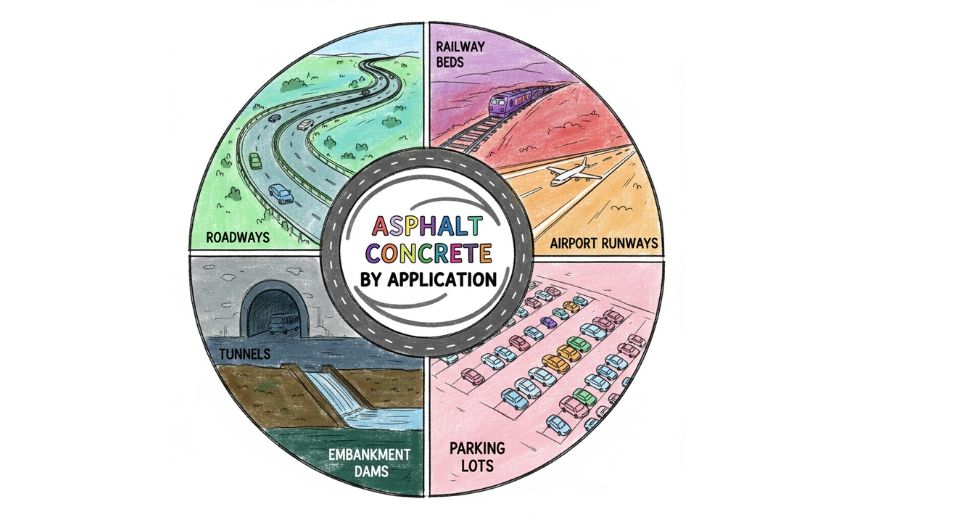

By application, the global aerial work platform rental market is further segmented into utility, manufacturing, construction, and others. Each of these sectors imposes its own kind of requirements that affect the utilization of aerial platforms. In utility applications, these platforms become essential in accessing electrical lines, streetlights, or similar installations where stability at height is essential. In production, they assist with maintenance and upgrading of facilities, allowing it to be more convenient to perform tasks at upper levels without risking safety. Construction remains one of the largest consumers, employing these platforms to work on structures, infrastructure, and large-scale endeavors that tend to be in constant motion. The 'others' category captures the smaller, usually underserved work sign installation, filming, or even stadium and warehouse maintenance where such platforms are just as convenient.

Driving in the global aerial work platform rental market is a mix of need and flexibility. Businesses don't need the headache of long-term equipment storage or maintenance. Leasing provides them with access to new models without long-term obligations. And safety regulations are increasing in all industries. Employees require secure, up-to-date equipment compliant with today's standards and rentals typically hit that benchmark more effectively than older, owned machinery.

The global aerial work platform rental market presented by Metastat Insight will continue to respond to how industries grow and operate. What we’re seeing is a shift toward smarter choices in temporary infrastructure, especially where mobility, reach, and safety intersect. As companies push for greater efficiency and smarter project handling, the demand for rented aerial platforms will not only stay strong it will likely rise.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$24,628.92 million |

|

Market Size by 2032 |

$35,301.54 Million |

|

Growth Rate from 2025 to 2032 |

5.3% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

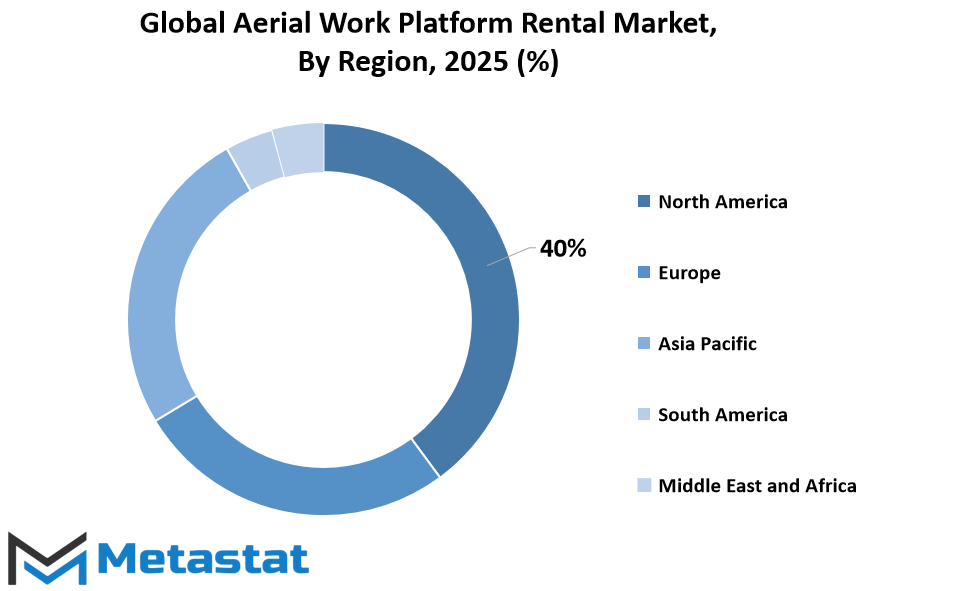

The global aerial work platform rental market is influenced by regional variations that determine availability, demand, and technology uptake. The industry is distributed across North America, Europe, Asia-Pacific, South America, and the Middle East & Africa, with each region playing its part in the overall framework. North America consists of the United States, Canada, and Mexico. Of these, the U.S. is likely to be at the forefront both in demand and innovation due to its large construction industry and ongoing maintenance activities across industries. Steadily increasing awareness of safety and efficiency of lifting operations is leading to the utilization of rented platforms in Canada and Mexico.

The European market consists of the UK, Germany, France, Italy, and Rest of Europe. This area has witnessed steady activity, particularly in nations such as Germany and the UK, where urban developments and infrastructure improvements keep fueling demand. The rental strategy is favored by most companies here because of cost benefits and the flexibility provided for short- and mid-term undertakings. France and Italy also record steady adoption, particularly in urban areas where compact and versatile equipment is necessary. Other regions of Europe contribute at a mixed rate, according to their individual economic and building cycles.

Shifting to Asia-Pacific, the region consists of India, China, Japan, South Korea, and the Rest of Asia-Pacific. It is among the most dynamic regions in terms of growth. China and India, with their high-value developments and growing industrial bases, are witnessing increased utilization of rented aerial equipment. Japan and South Korea, meanwhile, prefer high-tech equipment and systematic project planning, which facilitates regular use of the same. In the remainder of Asia-Pacific, urbanization and industry are still driving moderate but increasing demand.

In South America, the emphasis is on Brazil, Argentina, and the Rest of South America. Brazil is the leading country here, boosted by size and the amount of construction and industrial work it does. Argentina then comes second, but on a lesser scale, and the remainder of the region contributes based on domestic projects and flows of investment. Generally, the rental model is finding traction in this region as companies seek to maintain costs without compromising on quality equipment.

Lastly, Middle East & Africa consists of GCC Countries, Egypt, South Africa, and the Rest of Middle East & Africa. GCC Countries, spurred by infrastructure-intensive economies such as the UAE and Saudi Arabia, are avid adopters of rental platforms. High-rise buildings and oil-and-gas projects frequently demand access to machinery without the ownership cost over an extended period. Egypt and South Africa have also been gaining momentum, with more organized rental services coming into the picture. The remainder of the region, while fairly uneven in terms of development, holds promise as industrial activities broaden.

Each has its own distinct strengths and weaknesses in the aerial work platform rental market. This geographic framework illustrates not just how geographically vast the market is but how local dynamics influence how rental services develop and evolve.

COMPETITIVE PLAYERS

The global aerial work platform rental market has been quietly revolutionizing the way industries deal with access and elevation solutions. From maintenance and construction to warehousing and movie production, the need for flexible, efficient, and safe lifting gear has developed a robust market for rentals as opposed to outright purchase. More and more companies are opting for short-term access to high-price machinery so that they can keep their core activities running while the maintenance, storage, and technical administration are left to rental suppliers.

This preference change isn't solely for saving money it's also convenience and flexibility. Companies are frequently presented with shifting project needs, and having a large inventory of platforms for each potential application just isn't feasible. Renting enables them to align the precise type of equipment to the job at hand, whether that's a scissor lift for a work environment inside or a boom lift for uneven ground outside. It also provides them with access to advanced technology without the burden of continuous capital outlay. With tightening safety regulations and increasing specificity, rental companies are responding with well-maintained and certified equipment that is at least equal to or higher than regulatory standards.

Against this background, the global aerial work platform rental market leader companies are making a tangible contribution. Major players in the global aerial work platform rental market are United Rentals, Ashtead Group (Sunbelt Rentals), AFI Uplift, Speedy Hire, Herc Rentals, Cramo (A Boels Company), Kiloutou, Mateco Group, TVH Group, Riwal, and HKL BAUMASCHINEN. These vendors are not simply providing machines they're creating systems of service, maintenance support, training, and even digital platforms for clients to monitor equipment usage and optimize deployment. Most relevantly, many of them are also increasing their fleets and bases to enable cross-border works and time-sensitive operations.

Most notable about this industry is the way it is customized to fit local conditions. For instance, operators often use small steering platforms with electric drives in cities to cope with noise and emission standards, whereas in remote or mountainous areas typically require diesel drives with steering ranges that are longer. Seasonal demand also comes into play, with requirements for certain types of equipment changing at different seasons of the year. Keeping in touch with customer demand and local regulations, rental companies continue to optimize their products and remain competitive.

Forward-looking, the global aerial work platform rental market will continue to expand due to increasing infrastructure projects, urbanization, and industrial upgrade. While so, environmental factors and regulatory pressures will compel businesses to switch to cleaner, safer, and more efficient equipment. Rental companies that remain forward-thinking flowning fleets, training personnel, and leveraging technology for smarter service will lead the way. As increasing numbers of industries realize that leasing is superior to owning, the Aerial Work Platform Rental sector will continue to be a robust, adaptable solution to working at height problems.

Aerial Work Platform Rental Market Key Segments:

By Product Type

- Boom

- Scissor

- Vehicle Mounted Platforms

- Others

By Propulsion Type

- Diesel

- Electric

- Hybrid

By Application

- Utility

- Manufacturing

- Construction

- Others

Key Global Aerial Work Platform Rental Industry Players

- United Rentals

- Ashtead Group (Sunbelt Rentals)

- AFI Uplift

- Speedy Hire

- Herc Rentals

- Cramo (A Boels Company)

- Kiloutou

- Mateco Group

- TVH Group

- Riwal

- HKL BAUMASCHINEN

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252