MARKET OVERVIEW

The global electric arc furnace (EAF) transformer market report also lightly skims the changing expectations of end users and how these are indirectly shaping the design and delivery strategy embraced by transformer makers. It is not so much a matter of technical requirement but of greater integration with long-term infrastructure planning, particularly in industries where accuracy and strength are essential. With user needs becoming more differentiated in terms of performance thresholds, suppliers are forced to take account of novel materials, modular construction, and new test benchmarks.

The latest research report published by Metastat Insight provides a nuanced and in-depth examination of the trends of the global electric arc furnace (EAF) transformer market. Unlike cursory market descriptions, this report delves into the intangible patterns that define the industry. Investors and observers are treated to a realistic approach that breaks down trends into relevant observations, as opposed to sweeping generalizations. For that reason, it is addressed directly to those who require an advanced understanding of where this sector is going, and not merely what it does.

In different industrial sectors, the place of Electric Arc Furnace (EAF) Transformers has become highly specialized. Their purpose, while technical, also overlaps with larger economic and infrastructural narratives. One of the most significant factors influencing today's profile of the global electric arc furnace (EAF) transformer market is the far-reaching change in the use of energy and its sourcing. In turn, this has an effect on procurement behavior, project development cycles, and dependencies upon regions. The report eschews easy-to-use labels and, instead, captures these changes in context charting how geography intermingles with changes in manufacturing and industrial prioritization.

Supply chain recalibrations are also quietly noted in the report, especially in areas historically viewed as being manufacturing powerhouses. Those areas are having their value proposition recalculated, mostly in response to changing cost structures and investment patterns. Since EAF transformers are so integral to high-intensity industrial uses, their development pattern is indicative of broader discussions of sustainable expansion and operational flexibility. What is presented in the report is not a rote recitation of statistics but a story of change one that weaves together regulatory shifts, production issues, and long-term asset planning into a unified perspective.

Just as strong is how the report reports on the texture of competitive activity in the industry. Far from offering surface-level observation, it delves into how various participants react to shifting demand cycles, complexity of sourcing, and availability of talent. This order of attention discloses how industry players are not responding to change in the same way. Some areas are exhibiting strategic conservatism, prioritizing operational stability over growth, while others are venturing into newer material and operating models, thus altering the power balance subtly but powerfully.

Amidst this mosaic, it emerges that innovation is not just limited to the technical specification of the transformers. Increasing emphasis is placed on lifecycle value, integration with digital monitoring systems, and customization for client-specific industrial needs. The global electric arc furnace (EAF) transformer market, seen through this prism, is being influenced by incremental changes that have a ripple effect, impacting procurement strategies, regional policy discourse, and research projects.

Another subtle comment from the report concerns how outside interruptions be they geopolitical, environmental, or social are prodding industry players into developing resilience into their operational designs. This is not translating to a sudden change but a careful adjustment of logistics, vendor interaction, and contingency planning. The results describe these changes without giving exaggerated importance to fleeting interruptions. Rather, they are introduced as part of a larger trend of strategic discipline that is starting to define the industry more clearly than at any other time.

Financial conduct throughout the industry is also enlightened with nuance. Instead of concerned only with growth or contraction, the report looks at how money is being spent in the industry. Investment decisions are viewed as confidence or caution indicators, determined not merely by short-term predictions but by planning horizons extending several years. This type of observation is worth its weight in gold for those attempting to sense underlying attitudes, especially in an industry where capital investment usually comes before observable changes by a matter of quarters.

The more low-key but vital piece of observation from the report is the position played by knowledge transfer and technical training in the global electric arc furnace (EAF) transformer market. As products grow more complex and local requirements diverge and specialize, the capacity for organizations to share technical capabilities within is a subtle differentiator. Those that place the highest value on ongoing learning and internal capacity development will be likely to differentiate themselves not through megaphone-worthy innovations, but through steady implementation and fewer operational mishaps.

In conclusion, the in-depth report provided by Metastat Insight introduces a lucid, measured perspective regarding the forces determining the global electric arc furnace (EAF) transformer market. It eschews exaggeration and condenses a broad topic into digestible, interrelated themes. The report provides context and clarity to those involved in this niche segment and is an essential point of reference for anyone wishing to understand its present beat and direction of travel. Instead of presenting itself as a speculative prediction, the document is a realistic depiction of where the industry is at today and where its momentum quietly takes it.

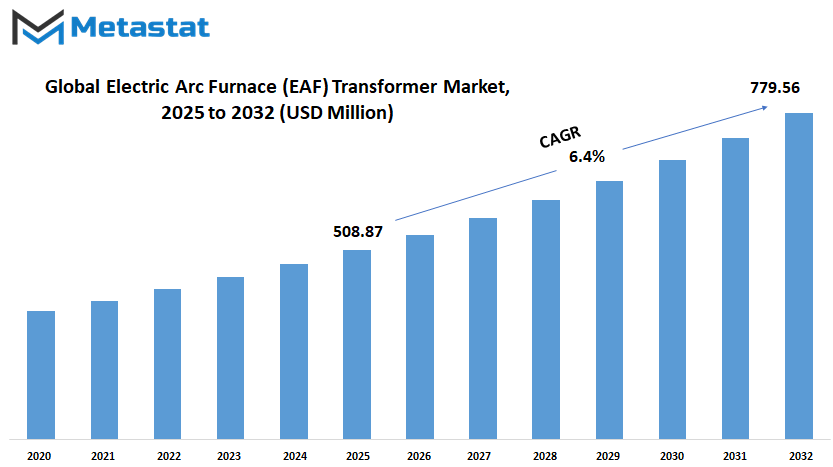

Global electric arc furnace (EAF) transformer market is estimated to reach $779.56 Million by 2032; growing at a CAGR of 6.4% from 2025 to 2032.

GROWTH FACTORS

The global electric arc furnace (EAF) transformer market is expected to witness noticeable progress in the coming years, driven by the steady increase in steel production and the rising need for energy-efficient solutions. These transformers play a vital role in converting electrical energy into the high current needed to melt scrap metal, making them essential in modern steel manufacturing. As countries focus more on recycling and reducing carbon footprints, the demand for electric arc furnaces is likely to grow, which in turn will support the rise of the EAF transformer market.

One of the main growth factors is the growing push towards environmentally friendly production methods. Governments and industries worldwide are making efforts to reduce emissions, and electric arc furnaces offer a cleaner alternative to traditional blast furnaces. Since EAFs rely heavily on the performance of their transformers, this shift boosts the demand for advanced transformer solutions. Additionally, expanding infrastructure and construction activities, particularly in developing regions, are increasing the global need for steel, further encouraging investment in electric arc furnace technologies.

Another key driver is the advancement in transformer technology itself. Manufacturers are developing more reliable and energy-efficient designs, which help reduce power losses and increase operational lifespan. This improvement in performance and cost-efficiency is prompting more companies to upgrade or install new EAF transformers, supporting market expansion.

However, the market might face challenges due to high initial costs associated with setting up electric arc furnace facilities. Small- and medium-sized companies may find these expenses difficult to manage. Also, the availability of raw materials and volatility in metal prices could influence production levels, indirectly affecting transformer demand. These factors might hold back the market from reaching its full potential quickly.

Despite these possible obstacles, there are promising opportunities ahead. Growing interest in smart grid technology and digital monitoring systems opens the door for more intelligent transformer designs. These systems will allow for real-time performance tracking, predictive maintenance, and improved energy management. As industries continue to adopt these technologies, the market will likely benefit.

Looking ahead, increasing urbanization, industrialization, and a strong focus on sustainability will continue to push the global electric arc furnace (EAF) transformer market forward. Companies that adapt to new technologies and changing needs will be better positioned to thrive. With these ongoing trends, the future of the EAF transformer market appears promising and filled with potential for growth and innovation.

MARKET SEGMENTATION

By Type

The global electric arc furnace (EAF) transformer market is showing strong signs of steady growth, with many factors influencing how it is expected to develop in the years ahead. As industries continue to shift toward more energy-efficient and cost-effective methods of steel production, electric arc furnaces are becoming a preferred option. These furnaces rely on powerful transformers to operate, which has led to a growing need for reliable and high-performance transformer solutions. This demand is not only rising due to current trends but is also likely to expand as countries push for cleaner manufacturing processes and more sustainable industrial practices.

When looking at this market by type, it is divided into AC Electric Arc Furnace Transformers and DC Electric Arc Furnace Transformers. AC types are the more traditional option and are still widely used because of their proven reliability and cost-effectiveness. On the other hand, DC types, although newer, offer certain advantages such as reduced power loss and lower maintenance requirements. As technology continues to improve, it is expected that the use of DC transformers will grow, especially in settings where energy savings and efficiency are top priorities. Many steel producers will likely consider switching to or incorporating DC transformers into their operations in the near future, as they look for ways to modernize and cut operating costs.

From a future-focused viewpoint, this market will likely keep expanding as more developing countries invest in infrastructure and industrial capacity. Urban growth, especially in parts of Asia, Africa, and Latin America, is expected to lead to a higher need for steel, which in turn drives the need for electric arc furnaces and their transformers. In addition, efforts to reduce environmental impact will push more industries to turn away from traditional blast furnaces and adopt electric methods that are less polluting. These changes are already underway and will likely shape how the market grows moving forward.

Another important factor is the focus on automation and smart energy use. As the technology behind electric arc furnaces evolves, transformers will also need to support these advances. This includes better monitoring systems, improved control features, and the ability to work with energy management tools. These upgrades are not only helpful for performance but also make operations more cost-effective and safer for workers. In short, the global electric arc furnace (EAF) transformer market will continue to grow as industries look for smarter, cleaner, and more efficient ways to produce the materials they need.

By Phase Configuration

The global electric arc furnace (EAF) transformer market is expected to see noticeable growth in the years ahead. As industries continue to rely on steel production, especially through electric arc furnaces, the demand for reliable transformers that can handle heavy loads and frequent operations is likely to rise. These transformers are essential for converting electrical energy into the power needed to melt scrap metal, and they play a key role in modern steelmaking. As the world shifts toward more efficient and sustainable manufacturing practices, the market for these transformers will continue to grow and adapt.

Looking forward, the focus will likely be on improving energy efficiency and reducing environmental impact. With industries under pressure to cut emissions, manufacturers of electric arc furnace transformers are expected to explore new technologies and materials that reduce energy waste. This shift may not happen all at once, but small improvements over time will create more advanced and longer-lasting equipment. Governments in many countries are also introducing stricter regulations for industrial energy use, which will likely push the market further toward innovation. These changes will not only benefit the environment but will also lower energy costs for companies, making investment in high-efficiency transformers a smart long-term decision.

By phase configuration, the market is divided into single-phase and three-phase transformers. Single-phase transformers are typically used in smaller operations or specific tasks where full-scale power is not required. These units are easier to maintain and can be more cost-effective for particular applications. On the other hand, three-phase transformers are used in larger-scale facilities where continuous high power is needed. These types are more common in modern steel plants due to their ability to handle heavy electrical loads efficiently. As production methods evolve and larger plants become the norm, three-phase transformers will likely become more widely used.

In the future, we can expect further customization and digital monitoring features to be built into these transformers. With the development of smart technologies, operators will have better control and insight into how the transformers perform. Real-time data and predictive maintenance tools could help avoid breakdowns, increase safety, and reduce downtime. As this kind of technology becomes more affordable, even smaller operations will benefit from features that were once only available to large-scale industries.

In short, the global electric arc furnace (EAF) transformer market is on a steady path forward, driven by both environmental needs and technological progress. The changes that lie ahead will shape a more efficient and reliable future for steel production worldwide.

By Application

The global electric arc furnace (EAF) transformer market is expected to play a major role in the future of industrial power solutions. With energy needs growing and industries focusing more on cleaner, efficient methods of production, the demand for electric arc furnace transformers is steadily increasing. These transformers are essential in converting electrical energy into the high-power input required to melt scrap metal, making them a key part of modern industrial processes. As industries move toward more sustainable production methods, the importance of this equipment will only grow.

By application, the market is mainly divided into steel production, ferroalloy production, and other uses. Steel production is currently the largest segment, and this trend is likely to continue. Countries around the world are looking to improve their infrastructure and build smarter cities, which means more demand for steel. Electric arc furnaces, powered by these transformers, offer a way to produce steel with less environmental impact compared to older methods. These systems allow for the use of recycled materials, reducing waste and energy use. As nations push toward greener building practices, this method will likely become even more common.

In ferroalloy production, the transformers also serve a vital role. Ferroalloys are used in making high-strength steel and other alloys needed for advanced machinery and vehicles. With the push for electric vehicles and more durable transportation materials, this part of the market is also likely to grow. The use of electric arc furnace transformers allows for better control over the production process, leading to improved quality and energy efficiency. This kind of precision will be increasingly important as global standards for emissions and efficiency become stricter.

The "others" category includes various applications like waste treatment and non-ferrous metal processing. As technology develops, it’s likely we’ll see more uses appear, especially in smaller or emerging industries. The move toward cleaner industrial practices is not limited to just steel and alloy production. Companies are exploring how electric arc furnaces can be adapted for other purposes, and this could open new opportunities for the transformer market.

Looking ahead, the global electric arc furnace (EAF) transformer market will likely expand as industries modernize and seek better ways to meet both production and environmental goals. Continued investments in research and energy infrastructure will help support this growth, making these transformers a valuable part of future industrial systems.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$508.87 million |

|

Market Size by 2032 |

$779.56 Million |

|

Growth Rate from 2025 to 2032 |

6.4% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global electric arc furnace (EAF) transformer market is steadily moving toward a future shaped by industrial modernization, clean energy goals, and smarter manufacturing systems. As more countries look for energy-efficient solutions to reduce carbon emissions, the demand for electric arc furnaces, supported by reliable transformers, will likely increase. These transformers play a key role in powering steel-making operations, and with steel remaining a foundational material in construction and infrastructure, the market is expected to keep growing.

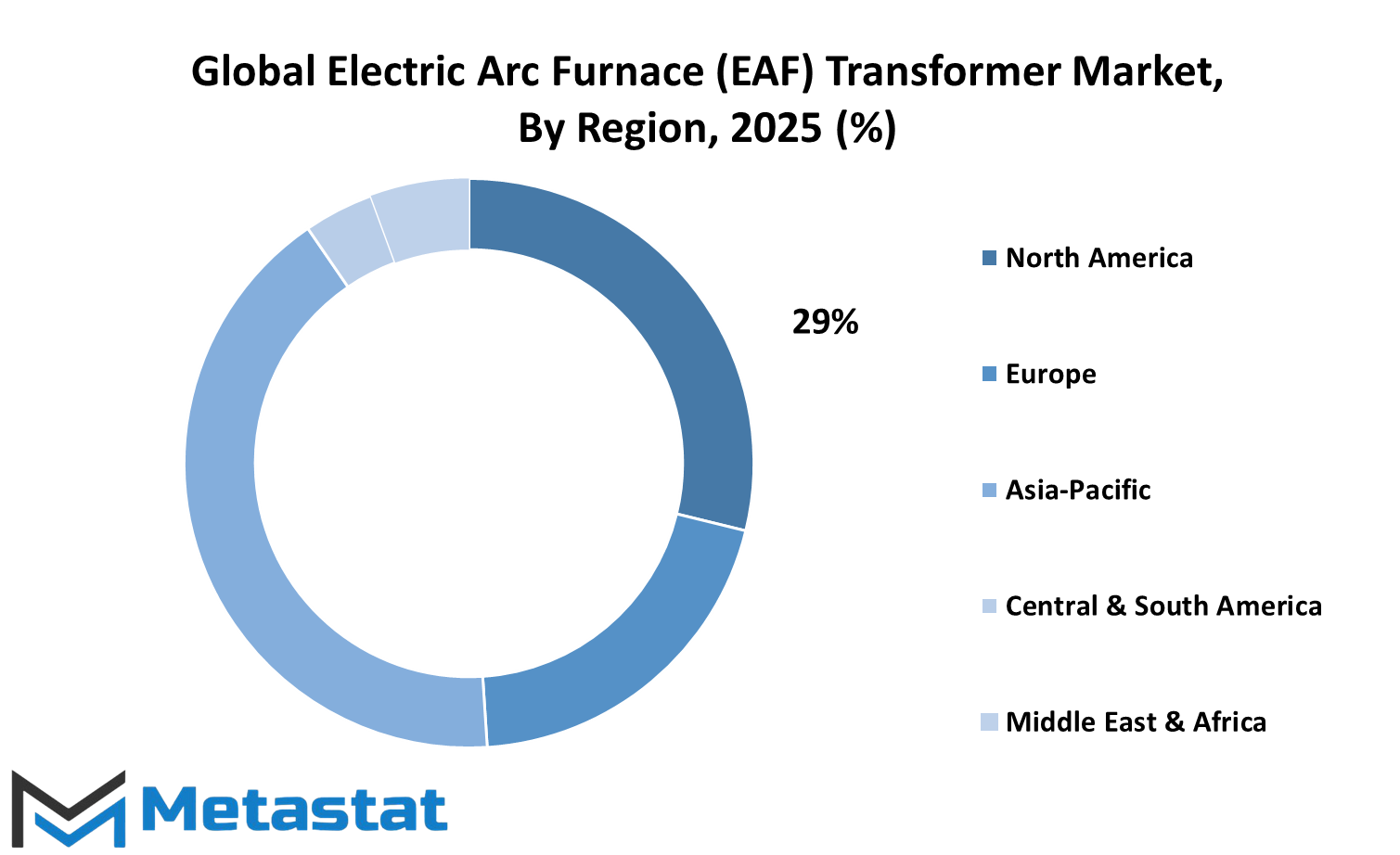

This growth is not limited to one location. Based on geography, the global electric arc furnace (EAF) transformer market is split into several main regions. North America includes the U.S., Canada, and Mexico. The U.S. is focusing on upgrading aging power infrastructure, which will support the growth of this market. In Canada and Mexico, efforts to improve local manufacturing are leading to a rise in demand for reliable electric systems. Europe includes the UK, Germany, France, Italy, and the Rest of Europe. These countries are pushing for cleaner industrial practices, and that push supports increased interest in energy-efficient transformer solutions.

Asia-Pacific, which includes India, China, Japan, South Korea, and the Rest of Asia-Pacific, is likely to lead in terms of both production and consumption. These countries have a high demand for steel in housing, transportation, and energy projects. They are investing in modern plants, which will drive the need for better transformer systems. As industries there focus on energy savings and lowering environmental impact, the global electric arc furnace (EAF) transformer market in the region is set to benefit.

In South America, which includes Brazil, Argentina, and the Rest of South America, the market will see a gradual rise. Economic development and urban expansion will require more steel, pushing forward the use of EAFs and transformers. Lastly, in the Middle East & Africa, especially in GCC Countries, Egypt, South Africa, and the Rest of the region, development plans aimed at building stronger local industries and infrastructure are likely to create more opportunities. These areas may rely more on modern electric furnace setups due to their lower energy needs compared to traditional methods.

In the coming years, automation, digitization, and energy control will shape this industry further. With many regions improving their manufacturing abilities and environmental policies, the global electric arc furnace (EAF) transformer market will likely see a steady and promising rise worldwide.

COMPETITIVE PLAYERS

The global electric arc furnace (EAF) transformer market is expected to experience steady development in the years ahead, driven by growing steel production demands, energy efficiency needs, and ongoing shifts in industrial practices. These transformers are a vital part of modern steel manufacturing, where high currents are needed to melt scrap metal. With industries aiming to reduce waste and lower emissions, electric arc furnaces are becoming more common, and their transformers must keep pace in terms of efficiency, reliability, and adaptability.

As industries move toward more sustainable operations, there is a clear shift in investment toward technologies that align with energy-saving goals. EAF transformers, with their ability to handle sudden load changes and high power levels, are well suited for this transformation. This creates strong opportunities for those involved in designing, producing, and maintaining these units. The rise in global infrastructure development and urbanization will continue to push steel demand higher, which in turn will support steady demand for EAF transformers.

One of the most important aspects of this market’s future lies in the progress made by competitive players. Companies such as General Electric Company and Hitachi Energy are actively working on ways to make transformers more efficient and easier to maintain. Their investments in digital technology, predictive maintenance tools, and smarter insulation methods could lead to a new standard in how transformers are made and operated. At the same time, firms like Makpower Trans Systems and HANI Metallurgy are finding ways to make production more cost-effective while maintaining quality and durability. These efforts are setting the stage for future growth across all regions.

Other contributors, including Barbrik Transformers Products, S.E.A. Società Elettromeccanica Arzignanese S.p.A., and Ingeteam Power Technology, are expected to play a part in shaping a competitive landscape where innovation and customer support go hand in hand. Smaller companies like Mirzapur Electrical Industries Ltd and Ningbo Tianan (Group) Co., Ltd may focus on regional markets or custom solutions, but their presence still adds value by introducing new ideas and keeping prices competitive. As environmental rules become stricter and technology continues to advance, the global electric arc furnace (EAF) transformer market will likely see a stronger push for smarter, safer, and more energy-conscious solutions. The path ahead is marked by opportunity, and the companies willing to adapt will shape the future of this industry.

Electric Arc Furnace (EAF) Transformer Market Key Segments:

By Type

- AC Electric Arc Furnace Transformers

- DC Electric Arc Furnace Transformers

By Phase Configuration

- Single-phase Transformers

- Three-phase Transformers

By Application

- Steel Production

- Ferroalloy Production

- Others

Key Global Electric Arc Furnace (EAF) Transformer Industry Players

- General Electric Company

- Makpower Trans Systems

- HANI Metallurgy

- S.E.A. Società Elettromeccanica Arzignanese S.p.A.

- Hitachi Energy

- Barbrik Transformers Products

- Ningbo Tianan (Group) Co.,Ltd

- Mirzapur Electrical Industries Ltd

- Transformers & Rectifiers (I) Limited

- Ingeteam Power Technology

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252