Sep 02, 2025

A well-rounded analysis of the evolution in the sector has come out in the form of the recent Global Hydrodynamic Couplings Market Report by Metastat Insight, providing a cogent account that offers insights into recent developments and nuanced trends in the global hydrodynamic couplings market. This report presents insights without falling into the trap of general statements, highlighting detailed changes in technology, uptake, and industrial use through a critical eye.

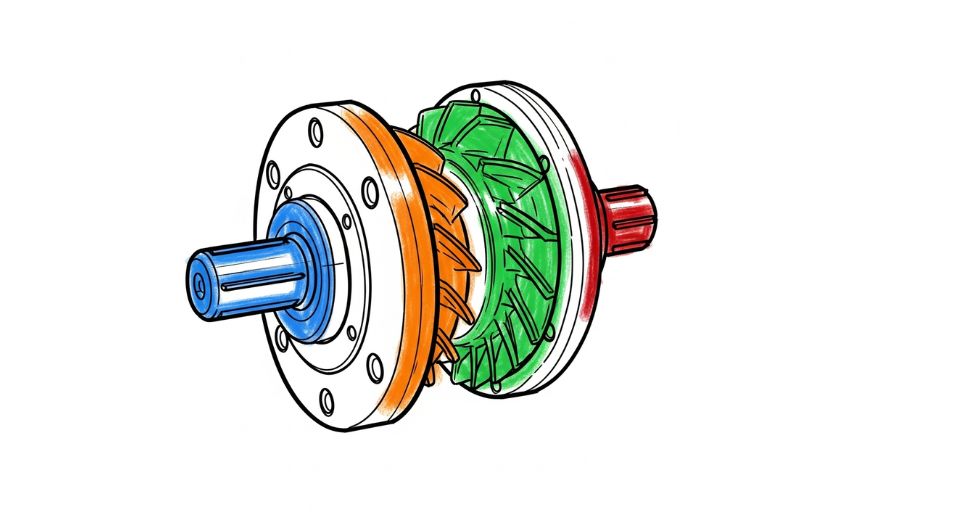

In industrial transmissions and fluid power systems, the refinement of production methods and material application has developed in ways little told with such detail. Metallurgical and polymer science advancements have produced more efficient torque transfer and better reliability under stressful operations. Production processes have evolved, streamlining internal fluid dynamics to reduce losses and thermal stress. This has created units that can operate longer without loss of performance under stress. Early-stage studies and lab tests, attracted to the general debate by the report, uncover test configurations balancing tightness with effectiveness advances that rarely gain recognition beyond techno specialist communities. Focus on sector-specific performance has become more acute.

Heavy machinery used in construction and mining shows a bias towards couplings resilient to harsh environments. At the same time, maritime and offshore uses favour units that are resistant to corrosion, vibration, and pressure. Refinements specific to these niches are now surfacing, fine-tuning fluid channel geometry and seal configurations to provide reliable operation even when other components fail. Climate-driven requirements, be they scorching heat or corrosive salt exposure, have forced the choice of materials not just for strength but longevity in corrosive or abrasive environments. These improvements hold the suggestion that maintenance intervals lengthen, and operational confidence increases. At the generation side of energy, uptake into renewable-bonded drive systems has created increased interest, particularly where silky starts are important under changing load conditions. Installed base in hydropower, wind turbines, and forthcoming tidal uses has commenced to incorporate designs focused on smoother engagement, which guards generators and minimizes shock loads.

These advances are a response to system stress and a push towards maintaining component life. Vibration data and reliability tests from field deployments support such engineering aspirations, showing less wear and fewer interruptions. Such results suggest wider deployment across nearby industries. Integration modalities continue to evolve. Mounting techniques now result in compact installations, allowing for retrofits in constricted areas without requiring significant redesign. Modular construction practices come into play, allowing for rapid replacement of worn components and minimizing downtime.

This translates to equipment uptime that is high, pleasing maintenance crews and operations managers equally. Serviceability advantages result from carefully planned port configurations and standardized cartridge modules, making interventions predictable and efficient. Supply chain modifications are warranted, particularly with regard to raw material procurement and component quality. Relationships with specialty foundries and seal manufacturers have yielded operating synergies. Level-stabilized inputs assist in maintaining level quality levels and minimizing variation between batches of production. This stability is seen in the consistency of delivered torque and service intervals across a variety of installations.

With quality control systems, this collaboration enhances customer confidence in product reliability and lowers unforeseen failure. Environmental consciousness also influences trends. Lubricants specifically developed for hydrodynamic couplings now trend towards bio-origin or lower-environmental-impact products. Sealants and gland products have also experienced replacement of harmful chemicals with environmentally friendlier options, reflecting larger sustainability practices. These developments result in a reduced footprint throughout lifecycle phases and reflect trends in surrounding mechanical products pursuing sustainable operation without loss of performance.

End-user services and aftermarket strategies demonstrate another evolving stratum. Field diagnostics and remote monitoring have become more cost-effective, enabling vibration and temperature to be monitored in real-time. Cloud-based analytics signal anomalies before they occur, converting into predictive maintenance that avoids downtime.

This journey toward condition-based maintenance reduces unplanned outages. Training modules specific to field technicians demonstrate increasing knowledge, preparing teams with troubleshooting protocols based on observed performance instead of generic processes. Feedback loops between operations and engineering capture real-world usage data and feed ongoing enhancements. Market exposure has been enhanced through mutual data sharing between industries. Case histories now record gains in new performance, such as in energy conservation, maintenance cuts, and business continuity. Such stories appeal to new users, presenting concrete examples of benefits. Sharing knowledge from one industry to another manufacturing to shipping, energy to materials handling improves design thinking and expands application potential.

The report pulls those stories into focus, presenting a mosaic that presents actual results rather than hypothetical projections. Regulatory and standards convergence has taken place. Certification organizations have upgraded test protocols to cover endurance under fluctuating torque inputs and high temperature cycling. Results from the field now affect updates of performance standards and installation instructions. This type of convergence promotes acceptance by specification engineers and buyers. Products that meet or exceed upgraded standards further build confidence in performance consistency. Financial models based on total cost of ownership now include maintenance cycles and energy savings from reduced torque transfer roughness.

Users estimating lifecycle cost view the newer designs favourably since decreases in unscheduled downtime and increased efficiency equate to operating cost savings. Leasing agreements and warranty periods now take into consideration reliability in products, transferring risk from operators to suppliers. Emerging research efforts foretell of future transitions. Universities and industrial research labs investigate hybrid couplings those that link magnetic or electro-mechanical staging with hydrodynamic buffering to achieve ultra-smooth interaction in delicate systems. While not yet commercially prevalent, pilot projects confirm that there are still open boundaries for innovative integration. The report identifies such pioneering activities, revealing a preview of what subsequent generations may entail.

In summary, contemplation of findings summarized by Global Hydrodynamic Couplings Market Report issued by Metastat Insight is a telling dive into the subtle innovations that are defining contemporary and future uses within the global hydrodynamic couplings market. The story focuses on ongoing honing in terms of materials, design, sustainability, serviceability, and integration machinery advancement founded on reality conditions rather than theoretical guarantees.

Drop us an email at:

Call us on:

+1 214 613 5758

+91 73850 57479