MARKET OVERVIEW

The global virtual networking market will transcend conventional frontiers in the years to come, redefining the imagination and realization of digital interactions. As the world moves further into a connected future, the concept of networking will no longer be limited to physical networks or hardware-based connections. Rather, it will extend to software-enabled environments where accessibility, scalability, and adaptability will reign supreme. The business will not merely be about connecting devices; it will create experiences in which communication, collaboration, and sharing of resources will become new and different.

The industry will progressively stand as a bridge between human aspiration and digital architecture. Where companies used to rely so much on physical cables and servers, they will now rely on unseen frameworks that live in purely digital layers. This change will have consequences that stretch beyond IT departments. Companies in the fields of healthcare, education, entertainment, and government will be impacted because the ability to build secure and responsive virtual networks will be larger. The sector not only will deliver technical efficiency but also will reframe the way economies operate, enabling data, services, and individuals to link up without the drag of geography.

The future of the global virtual networking market will be more than efficient. It will be about reimaging identity in the online world. People will not simply log onto systems; they will move through seamless virtual channels that adapt to their working, personal, and creative needs. In schooling, as an example, classrooms will no longer be confined by walls, as teachers and pupils will engage with tailored virtual spaces driven by these networks. In medicine, physicians will confer, diagnose, and even keep an eye on patients from different continents on highly resilient and safe platforms.

The sector will also have wider cultural impacts. Virtual communication will become identical to physical communication in most areas of work and life. International cooperation will no longer be viewed as remote but as a part of daily routine. The global virtual networking market will thus not only improve business effectiveness; it will foster a culture of inclusiveness by bringing together individuals who were otherwise left at the periphery of international communication.

The other aspect that will arise is sustainability. By lessening reliance on physical infrastructure, travel, and resource-intensive networking systems, the business will enable international objectives of reducing carbon footprints. Virtual networking will be an intangible but significant driver towards a cleaner economy. This environmental consideration, although secondary to the digital revolution itself, will nonetheless provide depth to its long-term importance.

In the end, the global virtual networking market will reach far beyond its status as a technological innovation. It will be a basis for new types of work, learning, and social interaction. As it continues to evolve, it will move from connectivity to creating entire ecosystems of possibility. Its future will not be measured by the devices it connects, but by the lives it enriches. This wider vision will make virtual networking not only a function of industry but a hallmark of global advance.

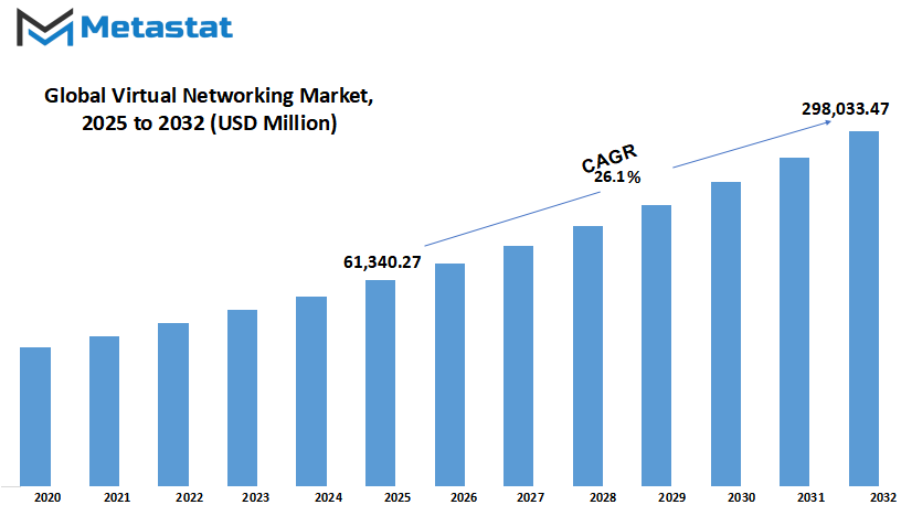

Global virtual networking market is estimated to reach $298,033.47 Million by 2032; growing at a CAGR of 26.1% from 2025 to 2032.

GROWTH FACTORS

The global virtual networking market is attracting robust interest as organizations from various industries transition to new modes of operation. The movement towards remote working and digital environments is among the primary drivers of this growth. Companies now need smooth communication tools that enable workers to reach out and exchange data in real time, whether across or within the organization. Virtual networking is at the forefront of enabling this with a solid and elastic foundation on which remote teams can operate efficiently. Concurrently, the widespread take-up of cloud-based services and virtualization technologies is further fueling the market as organizations seek cost-effective and elastic solutions capable of supporting the increasing number of data accesses and collaborative needs.

While these are driving the market ahead, there are also issues that may restrain its rate of growth. One essential difficulty is the preliminary fee of deploying and integrating. It takes excessive-give up hardware, software, and information to assemble a virtual networking infrastructure, and this might be unaffordable for small and medium-sized groups. To top it all, security is also a big issue. As more information crosses virtual networks, breaches and network outages become a greater risk, and thus reliability and trustworthiness are key areas of concern. Such impediments will hinder adoption, particularly in businesses dealing with sensitive data.

In spite of these limitations, the global virtual networking market will keep creating new opportunities. The growth of 5G networks and the adoption of edge computing are set to dramatically enhance the speed and efficiency of virtual networks so they can more effectively deal with huge amounts of data without latency. Not only will this enhance the user experience, but also enable companies to execute more sophisticated applications in real-time, from video calls to sophisticated analytics. In addition, the growing applications of AI-powered network automation will lead to smarter and more autonomous systems. This will minimize human intervention and lower the risk of mistakes while making the networks more secure and adaptable.

Generally, the global virtual networking market will continue to advance as companies continue to look for technology capable of aiding collaboration, flexibility, and security in the digital era. Though cost and security issues can hold back adoption in a few regions, the advantages provided by newer technologies such as 5G, edge computing, and AI will overcome these issues. As businesses continue to adopt remote working and cloud infrastructure, the global virtual networking market will continue to be more influential in determining the future of how organizations communicate and function.

MARKET SEGMENTATION

By Deployment Mode

The global virtual networking market is reshaping how organizations deal with communication, data exchange, and connectivity. Companies at the moment are the use of virtual networks to lower infrastructure charges, decorate performance, and benefit elevated flexibility in operations. This marketplace is no longer limited to huge organizations; small- and medium-sized firms are actually adopting digital networking equipment to remain competitive and accommodate the extended call for for virtual transformation. As faraway paintings, on-line teamwork, and digital services growth, the demand for steady and scalable networking solutions will increase.

Deployment methods are at the heart of how firms embrace virtual networking technology. On premise deployment, worth $17,107.82 million, has been the traditional choice for organizations that desire ultimate control over systems and data. These arrangements enable organizations to have tight security controls as well as tailor the infrastructure to their unique demands. Yet, despite providing control and dependability, on premise deployments tend to involve high upfront costs in hardware, maintenance, and technical personnel.

Cloud deployment, however, has been picking up speed because it is cost-effective and flexible. Organizations are finding that making the transition to the cloud keeps physical hardware management loads light and makes networking services easily accessible from anywhere. This is especially attractive for remote-based organizations since it fosters smooth connectivity and collaboration across a mobile infrastructure. The cloud model also allows small organizations to benefit from sophisticated networking solutions without the initial costs associated with on premise systems.

On premise or cloud-based deployment is usually a choice that a company makes based on its size, industry, and vision for the future. Whereas most traditional industries will probably stick to on premise installation due to security and regulatory purposes, innovation and high-growth industries are gravitating towards cloud deployment. The equilibrium between the two forms will change over time as technology improves and companies cope with evolving market conditions. In the end, both deployment alternatives will dictate the development of the global virtual networking market, allowing companies to choose the solution that can best suit their business.

By Enterprise Size

The global virtual networking market is increasingly significant as companies continue to evolve into digital modes of working. Virtual networking enables organizations to link and pool resources without the restrictions of being bound to physical hardware, providing them with more flexibility and efficiency. As companies seek low-cost solutions and better means of communication, virtual networking will be an increasingly solid base for contemporary business operations. One of the strategies through which this marketplace is researched is by analyzing organization size, as the needs of massive organizations tend to be special from the ones of small and medium-sized organizations.

Large businesses are many of the earliest adopters of virtual networking because of their size and complexity of operations. These corporations generally have multiple workplace unfold over regions and require steady, strong, and reliable connections to maintain their systems in seamless operation. For them, virtual networking addresses expenses in infrastructure while accommodating high records transfer rates, collaboration, and protection. Such businesses as John Deere, Trimble Inc., and AGCO Corporation are among them, leveraging sophisticated networking gear to make certain endured productivity and more advantageous choice-making. Further growing reliance on cloud-based totally offerings and far off running environments will preserve larger organizations shifting toward greater sophisticated digital networking structures.

Small and medium-sized companies (SMEs), but, are embracing digital networking for relatively one of a kind reasons. Many of them have confined budgets and are looking for options that limit expenditure without sacrificing performance. Virtual networking gives these agencies an possibility to go into the market on an equal footing with the large gamers via offering get right of entry to to tools and services that would otherwise be prohibitively luxurious. It allows SMEs to run easily, utilize sources successfully, and stay dynamic in rapidly converting markets.

The segmentation of the global virtual networking market by company size indicates how both large companies and SMEs are benefitting, albeit in different ways. Bigger groups are worried approximately capability, manage, and safety, at the same time as their SME counterparts want to balance affordability and versatility. As technology advances, the divide between the two will shrink as more superior capabilities turn out to be inexpensive for the smaller enterprise and value performance becomes increasingly essential for the bigger one. This balance will enable digital networking to unfold across sectors in order that it becomes the center of the way organizations of all sizes will function in the future.

By Application

The global virtual networking market is shifting towards becoming a core component of the way industries operate nowadays. With groups always that specialize in flexibility, value-effectiveness, and quicker verbal exchange, virtual networking has end up more than an auxiliary tool—it has emerge as the spine of the corporation. By cutting the reliance on bodily infrastructure, agencies are finding new ways to attach, grow, and feature without constraints. This transformation isn't restricted to a unmarried industry; it runs across industries, with every imposing it in a way that excellent suits their requirements.

In the banking, economic offerings, and coverage (BFSI) industries, virtual networking is being hired to increase security, facilitate ease of transactions, and enable faster connectivity among worldwide branches. The private quarter, but is employing it to enhance administrative communication, resource smart town tasks, and offer residents with faster get right of entry to offerings. Manufacturing industries rely on it for near real-time sharing of records across production lines and delivery chains to make sure greater coordination and performance. These illustrations depict how virtual networking is not limited to one sector but keeps evolving as per industry-specific requirements.

The hospitality sector is making effective use of virtual networking through smooth guest services and uptime systems for bookings, digital check-in, and customer service. IT and telecommunication organizations too are at the center of this revolution, as they not only employ virtual networks but also offer the technology and support that enables others to make the switch. For them, it is a business opportunity and a solution. Healthcare institutions, on the other hand, are using virtual networking for telemedicine, secure sharing of patient data, and enhanced collaboration between physicians and specialists across borders.

Other sectors, ranging from retail to education, are also looking into the opportunities of virtual networking. For teaching, it has introduced the possibility of virtual classrooms and shared research projects, and in retailing, it facilitates smoother supply chain management and more effective online customer interaction. The range of applications demonstrates how large the market has become and how much larger it will continue to expand as more organizations realize its potential. The Global Virtual Networking industry, thus, is neither an ephemeral fad nor a momentary phenomenon, but rather a sustainable transformation in the way industries interact, function, and grow in the internet era.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$61,340.27 million |

|

Market Size by 2032 |

$298,033.47 Million |

|

Growth Rate from 2025 to 2032 |

26.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

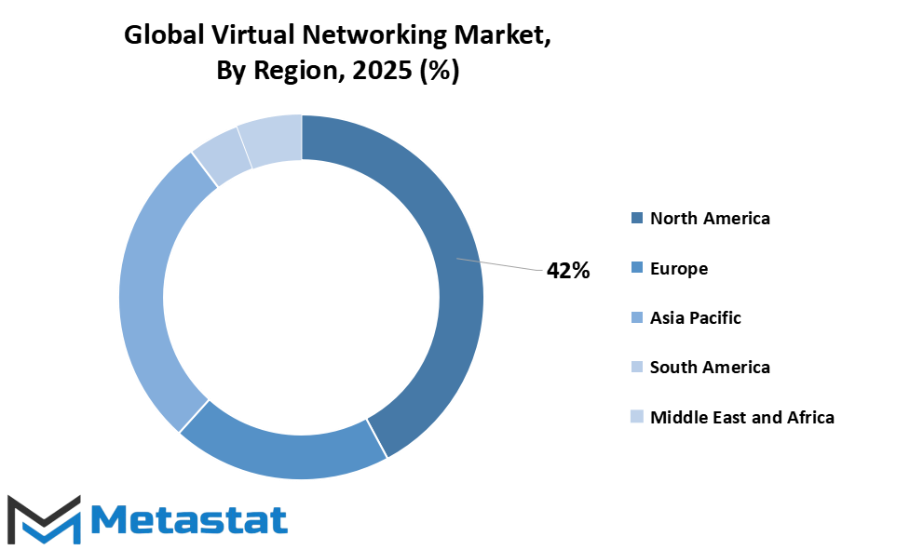

The global virtual networking market across different regions, with each region exhibiting specific trends influenced by digital uptake, infrastructure, and business demands. North America is the leading region, driven by robust technology ecosystems in the United States, Canada, and Mexico. The U.S., specifically, enjoys a concentration of top technology companies and a culture for quick adoption of state-of-the-art networking solutions, with Canada and Mexico building out their digital infrastructure to support virtualized-based businesses as well. These nations will remain significant contributors as more sectors turn to cloud-based models.

In Europe, nations like the UK, Germany, France, and Italy are strengthening their positions in digital transformation. Enterprises and governments in these countries are actively investing in safe and effective networking systems, particularly in sectors like finance, healthcare, and manufacturing. France and Germany have been leading markets for industrial and enterprise applications, while the UK remains ahead in service-oriented virtual networking adoption. The Rest of Europe is also a major contributor, as nations are upgrading their IT infrastructure to meet local standards and international competitiveness.

Asia-Pacific is also a vital center, with India, China, Japan, and South Korea propelling high demand. Japan's emphasis on smart technologies and the bid by China for extensive digital infrastructure are framing the market direction in the region. India's increasing IT services industry and South Korea's robust internet penetration increasingly underscore the promise of broad virtual networking adoption. Other Asia-Pacific regions also continue to expand steadily, with companies seeking cost-efficient and agile networking solutions to keep pace with the rapidly evolving digital economy.

South America and the Middle East & Africa are slowly making inroads in the international market. Brazil and Argentina are driving South America's expansion with companies emphasizing enhancing connectivity and remote access to ensure business continuity. In the Middle East & Africa region, the GCC nations are at the forefront with significant investments in technology-enabled infrastructure, and Egypt and South Africa are increasingly expressing interest in using advanced networking tools. The Rest of Middle East & Africa is also adhering to this trend as it realizes the need for secure virtual networking in sustaining economic growth and digital inclusion.

COMPETITIVE PLAYERS

The global virtual networking market is transforming the manner in which businesses, organizations, and individuals interact within the online space. Due to an increased number of companies based on cloud computing and distributed work environments, demand for sophisticated networking solutions has grown exponentially. Virtual networking provides the ability to manage systems without being bound to hardware, making it simple for companies to expand operations, protect data, and reduce expenses. This transformation will continue to redefine the way industries handle communication and information transfer, as virtual networks introduce flexibility and efficiency into spheres that previously relied significantly on fixed infrastructure.

Pioneering firms are doing their share of creating this market by coming up with technologies that increase performance and security. Cisco Systems, Inc., VMware, Inc., and Microsoft Corporation have taken the lead in innovation, providing solutions that enable companies to have seamless operations while dealing with extensive amounts of data. Huawei Technologies Co., Ltd., Juniper Networks, Inc., and IBM Corporation have also launched sophisticated products that enable automation and minimize the challenges posed by conventional networking. All these firms are not only enhancing connectivity but also setting the stage for networks that will maintain the pace with the increasing demand of online services globally.

The sector is also being supported by firms such as Oracle Corporation, Dell Technologies, Inc., and Nutanix, Inc., which are assisting organizations in shifting to more agile environments by means of software-driven networks. Verizon and Ericsson AB are extending virtual networking with their experience in communication technologies, allowing for the integration of high-speed connectivity and updated network management. Security vendors like Fortinet, Inc. have also added value to the market by providing assurance that virtual networks are safe from increasing cyber threats.

Smaller but significant names like 6WIND and Remo have lent their support through the provision of niche technologies that prioritize speed, ease of deployment, and ease of use. They join the ranks of others to make up a diverse portfolio that caters to enterprises of all sizes. The global virtual networking market will continue to expand as these players advance the capabilities of networks, building smarter, faster, and more secure systems in line with global digital transformation pace.

Virtual Networking Market Key Segments:

By Deployment Mode

- On Premise

- Cloud Based

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By Application

- BFSI

- Public sector

- Manufacturing

- Hospitality

- IT and Telecommunication

- Healthcare

- Others

Key Global Virtual Networking Industry Players

- Cisco Systems, Inc.

- VMware, Inc.

- Microsoft Corporation

- Huawei Technologies Co., Ltd.

- Juniper Networks, Inc.

- IBM Corporation

- Oracle Corporation

- 6WIND

- Dell Technologies, Inc.

- Verizon

- Remo

- Nutanix, Inc.

- Fortinet, Inc.

- Ericsson AB

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252