MARKET OVERVIEW

The Global Video Management Software Market and industry will go through remarkable changes pertaining to applications and perception in surveillance and security in the not-so-distant future. With the perpetual evolution of digital ecosystems into environments that shape the processes of capturing, interpreting, and utilizing data, the role of video management software (VMS) will evolve far beyond its traditional roles in surveillance and control rooms.

In the coming years, the Global Video Management Software Market will transition from being just a support tool for physical security to being a linchpin of the digitally orchestrated concepts of integrated infrastructure strategies. It will align itself with harassment demands for data intelligence, seamless integration, and smart automation. Organizations will then start to perceive video content not only in historic terms but also as a real-time asset to be referred to during decision-making across various spectrums, such as health care, education, transport, retail, and public safety.

The change herein will be catalyzed by how video content is processed, and actionable insight is derived. Instead of simply being a repository for the stored footage, the software platforms will start to be focused on streaming analytics, behavior modeling, and triggering automated workflows instead. The specialization in solution development will likely thrive in an industry-centric manner, with each industry having its requirements for operation. For example, in healthcare, the VMS would be used for Remote Patient Monitoring, coordinating response efforts in emergency situations, meanwhile in retail spaces helping businesses design customer service areas and incidents that take place within the store by studying consumer movement trends.

Digital transformation is taking place at an unprecedented rate on a global scale; this transition of the Global Video Management Software Market will bridge the gap between the physical and digital spaces. Video streams will not stand in isolation anymore; they shall be interconnected with sensor data, biometric systems, and AI-driven decision engines. This inter-connectivity would go on to build a responsive ecosystem. Integration of VMS with third-party systems controlling access, generating alarms, or evaluating supply chain contingences, which would enable an agile and aware management of operations.

Added to this would be a factor that will give a new exercise to be defined under changing privacy laws and ethical use of data. Compliance standards require tightening up in jurisdictions today; therefore, VMS providers must redesign the platforms to include tools for data governance or consent tracking and the capability to anonymize. The days of transparency and accountability that will shape software solutions for architecture will implant user-centricity and compliance philosophy in design.

Also, the lines will need to maintain shifts in user expectations with a need for intuitive interfaces and predictive maintenance features and scalable deployment models that need to function within on-premises and cloud environments.

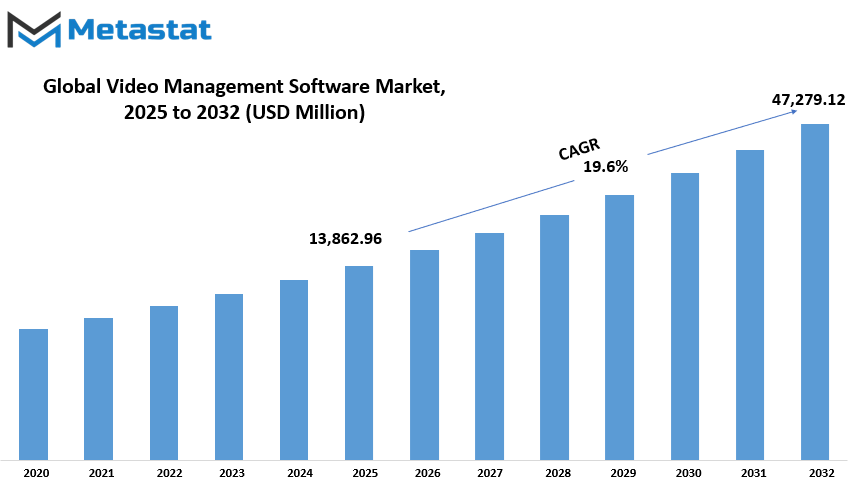

Global Video Management Software market is estimated to reach $47,279.12 Million by 2032; growing at a CAGR of 19.6% from 2025 to 2032.

GROWTH FACTORS

The global video management software market is growing consistently due to various major factors that keep such demand pushing. One of such factors is the proliferation and adoption of IP-based video surveillance systems replacing an existing dial-up system, as its features include great access to remote surveillance, scalability, and quality of videos. As one could reasonably expect, security and monitoring would be improved within organizational premises and governmental establishments, hence bringing forth these systems that would require advanced video management programs to run effectively. This is complemented by the increase in demand for real-time analysis based on video data; it will help corporations and security agencies act fast on the information recorded with the aid of their surveillance system. Video management software, which provides alerts, threat detection, or tracking movements based on real-time raw data analysis, becomes important in public safety, retail, and traffic management.

Nevertheless, some factors are holding the growth of the market in place. The main deterrent is the cost incurred in installing and integrating such systems. Business ventures or smaller companies with tight budgets will be reluctant to spend on advanced video management methods due to the high initial investment cost. This includes software licenses, server space, compatibility with hardware, and training staff. Another important issue to observe is data privacy and cybersecurity, as the digitalization of video surveillance and storage poses a high risk for data breaches and unauthorized access. There is always concern among customers and organizations regarding the manner in which their footage is stored and the people who have access to it. Hence, it necessitates the companies to adhere to strict security standards and maintain transparency in handling video data.

There are some potentials that would probably present an opportunity to the market in the next years. The most phenomenal was the concept of having artificial intelligence and deep learning involved in video analytics. With this, the possibility of video management software being able to do much more than store footage becomes a possibility. It can develop the ability to recognize patterns, faces, and people or spot abnormal behaviors. This will make such systems even more effective and useful across a variety of industries. One of the big opportunities is the worldwide emphasis on building smart cities. Most of these projects will be dependent on surveillance and data analysis in managing smart traffic systems, improving safety measures, and monitoring infrastructure improvement. As more cities plug into smart technology, the demand for more advanced video management tools will rise greatly.

MARKET SEGMENTATION

By Solution

The Video Management Software market has had steady growth owing to the growing needs of video surveillance solutions across different industries. The main driving force for this growth is the increasing concern for safety and security in public and private domains. From being alert for retail stores and office buildings to running a city-wide surveillance system, organizations are now investing heavily in smart video management tools that do much more than basic recording and playback. These new systems also do much more in terms of video data analysis, thereby assisting users to arrive at faster and more informed decisions.

Video management refers to remote viewing, recording, and playback of video footage and storing various camera feeds in one location. It allows users to access live feeds, review recordings, and respond more quickly to incidents. While VMS is witnessing a strong influx into video intelligence and analytics, analytics and video intelligence, in turn, help grow the market for Video Management Software. This segment was valued at $7,558.12 million, which shows just how important these smart features have become in this realm. Today, users employ these tools to detect abnormal behavior and track different types of objects, thus making more use of video than ever before. With such insight, video analytics can act to deter increased crime rates, improve response times, and better operational health.

Another crucial factor of the solution is Navigation Management, which eases the way users move through timelines of video and drill through camera feeds efficiently. Given the enormous amounts of video data now being accumulated on a daily basis, this feature of a VMS allows users to go straight and directly find moments or angles they need without wasting precious time. Equally important, Case Management provides organizations that often conduct investigations with a good way to collect, organize and review video evidence related to a specific case in a central spot. This would facilitate reporting and improve knowledge-sharing that would better facilitate collaboration within teams or with authorities.

Increased demand for smarter, reliable surveillance systems will likely bring about more changes and new developments in the Video Management Software markets. Usability, accuracy, and general ability to turn video footage into useful bits of information will mean new advancements in VMS will still be geared toward providing tangible existence. Advanced analytics, better navigation aids, and more agile case management are some other areas where VMS development will push to suit ever-changing needs of sustenance from private entities, governments, and public. It will therefore keep being an important entity in the safeguarding of life, property, and information in this digital world.

By Deployment Mode

Technically advanced security technologies, mobile applications, and increased awareness concerning security are the most significant factors driving the Video Management Software market. So, from this perspective, demand for the market will increase as more industries seek advanced monitoring tools. One of the major ways for the segmentation of this market can be called deployment mode, segmenting the market into On-Premises and Cloud Management Software. Each deployment mode offers a different set of benefits concerning its specific user or organizational needs.

On-Premise video management software is when a system is installed and operated from the user's own premises. This technique provides companies with a higher degree of control over their data and infrastructure, perhaps most important in industries where privacy and security are paramount. Organizations have an internal management structure and can customize setup according to specific needs. However, such customization, in most cases, can result in high initial expenses for hardware and IT resources maintenance, as well as on upgrades. Nevertheless, many companies continue to prefer this option for control and reliability.

The Cloud-Based video management software, observed in these days, is a viable and increasingly adopted option for organizations requiring flexibility and cost-efficiency. These systems are basically hosted on remote servers and via the Internet; hence the users need to invest less in physical infrastructure. They can scale the service as needed, adding or removing features based on current necessities. Cloud-Based ones are also convenient in terms of automatic updates, and ease of use from different locations. This is a boon to organizations having multiple locations or field staff. Potential disadvantages would include threats to privacy and dependent on an Internet connection that works. Improvements in cloud security and performance will solve the ongoing concerns.

Thus, both deployment models are likely to grow the video management software market. Between On-Premise and Cloud-Based applications, a business will look at what product suits its goals, constraints, and operational style. By the way, with advancing technology and subsequent adoption of more traditional industries into digital solutions concerning security and monitoring, the demand for video management software-whether on premise or cloud will only increase. The ultimate choice between the two will depend on the degree to which control, flexibility, and support from the system are needed by the organization.

By Technology

The mainstream reason behind increased demand and steady growth of the Video Management Software (VMS) market over the past years is the security needs and surveillance purposes in different sectors. The specific areas include businesses to public spaces, where the increasing demand for efficiency in video monitoring comes in, and it is believed that VMS implementation would suffice as it would serve a major part in keeping video feeds so organized while viewing, recording, and managing through this software. It is using areas such as retail, transportation, banking, government, and educational institutions. Also, it progressing with developing technology, VMS became smart offering features such as motion detection, real-time alerts, and access remotely by smartphones and computers.

The Video Management Software market can be classified from a technology perspective into. Apart from the above, one can realize that it is classified into Analog Based video management Software and IP Based video management Software. The analog systems are classical types since they rely on analog cameras, which transmit their video directly to a recording device. These systems are normally cheap, and still found in places where modernization is not possible or priority. However, they generally have limitations in image quality and intelligent features. In contrast, IP-based video management software is a far superior system; it relies on network-based cameras that feature high resolution and provide a wide range of intelligent tool support. Such systems are easily scalable; with the addition of a camera to the network, the user can also access the program from a distance. All these advantages tend to shed light on the fact that now IP-based solutions get most of the attention worldwide, coming from specific establishments that look for top-quality images and want to gain control.

The drive towards progress in this market is the progress in smart city initiatives, the increasing need for crime sustainability, and real-time requirements. Thus, many investments flow from governments and private organizations, setting up new-age video surveillance capabilities, thus enabling better software solutions development. Also brought about by the introduction of cloud systems, automatic backup and access to information from anywhere have now made video management easy.

As improving awareness on safety and technological innovations continues to rise, the Video Management Software market will continue to expand. There will be some diversion as more advancements are inclined toward user-friendliness, security features, and flexibility within which both analog and IP-based systems will serve different user needs, with IP-based options likely to lead the way in future developments.

By Vertical

The global Video Management Software market underwent steady progress with applications spread all across many industries. These include Banking, Financial Services and Insurance (BFSI), Government, Healthcare and Life Sciences, Manufacturing and Automotive, Retail, Transportation and Logistics, Media and Entertainment, and others. All these industries use video management tools to optimize processes on storing, managing, and analyzing video content. In BFSI, the video management software helps in monitoring transactions, preventing fraud, and enhancing security. These systems enable banks and financial institutions to monitor physical branches and online activity closely, allowing them to respond faster to threats.

It is also helpful for governmental agencies, whereby it is used in applications such as public safety, traffic control, and surveillance of sensitive areas. The implementation of a reliable system makes a significant difference, whether it is monitoring a public event or reviewing security footage in an investigation. In healthcare and life sciences, video management software is used to monitor patients, train staff, and secure hospitals and research labs. Given the sensitivity of such environments, having a clear video trail helps guarantee safety and smooth operations.

Surely, the Manufacturing and Automotive would also use this to control production lines, detect faults, and help with worker safety. It is valuable to have a system for recording, storing, and reviewing clips in real-time when a piece of equipment requires maintenance or review of an incident. Within retail, video management helps retailers minimize theft, understand customer behavior, and improve the shopping environment. In influencing all aspects of decision-making from product placement to staff scheduling, this is beneficial to store proprietors.

Transportation and Logistics firms rely on video management software to oversee cargo, monitor driver behavior, and enhance the safety of these actions on the road or at shipping points. The kind of insight provided by such tools may assist in avoiding accidents and delays. Media and entertainment organizations use the same software for content management, security, and live broadcast support.

Other industries are also adopting video management software for their specified requirements, evidencing the adaptability and usefulness of this technology. As video becomes increasingly integral to daily operations across industry lines, the demand for trustworthy and user-friendly video management software will continue to increase. Each sector is thus demonstrating the growing importance of this software in ensuring safer, smarter, and more efficient working environments.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$13,862.96 million |

|

Market Size by 2032 |

$47,279.12 Million |

|

Growth Rate from 2025 to 2032 |

19.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

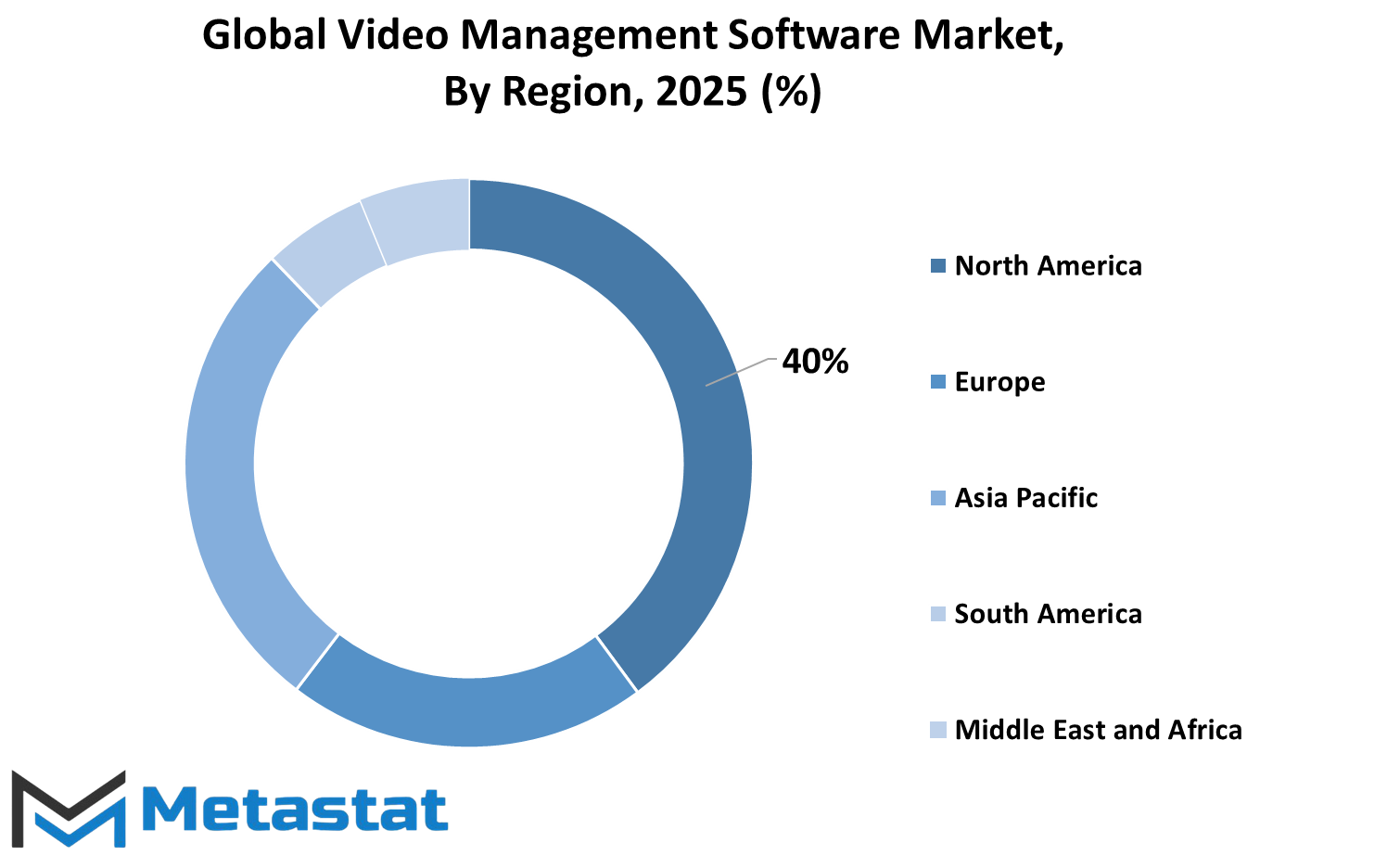

REGIONAL ANALYSIS

To monitor and manage video systems, the market is sectionalized globally into different dynamic regions that exhibit varying degrees of demand and growth rates. Within these macro-regions, we have North America: USA, Canada, and Mexico; Europe: UK, Germany, France, Italy, and Rest of Europe; Asia-Pacific: India, China, Japan, South Korea, and the Rest of Asia Pacific; South America and Middle East. Steady growth in recent years has been due to increased demand for advanced security solutions and rapid-paced adoption of cloud-based technologies. The significant presence of tech companies in the public and private sector does help in certain aspects in the efficient functioning of the market of VMS with respect to video surveillance systems.

The European market includes the UK, Germany, France, Italy, and the Rest of Europe, where huge investments have been made into smart city projects and modern surveillance infrastructure. Government support and awareness of safety are driving demand for video management solutions. In particular, Germany and the UK have been at the forefront of analytics-driven video systems, applying such systems in many contexts for both commercial and public safety purposes. Increased opportunities for automation and real-time monitoring have emerged in this area.

Comprising India, China, Japan, South Korea, and the rest of Asia Pacific, Asia-Pacific is expected to grow rapidly during the forecast period. Some of the key factors responsible for growth include growing urbanization, increasing spending on public safety, and growing interest of most governments in crime and security. China and India continue to be the largest contributors in terms of investment in the smart surveillance technologies landscape. As the cities develop with the government focusing on safety, the demand for an efficient and scalable video management system will still be growing in a short time period.

South America consists of Brazil, Argentina, and the rest of South America. Its market is relatively smaller compared with those of other regions, but interest in the region is growing to get better surveillance systems. Meanwhile, Brazil is leading with an increasing number of public and private security projects, in search for better crime prevention tools.

The Middle East and Africa include GCC Countries, Egypt, South Africa and the rest of the Middle East and Africa. Their growth is majorly driven by smart infrastructure development in UAE and Saudi Arabia. As the governments continue to improve their systems, it is evident that demand for advanced video management software will further be increased in the future across the region.

COMPETITIVE PLAYERS

The Video Management Software (VMS) market continues to enjoy consistent growth, creating room for an ever-expanding market in effective video surveillance applications. Whether in business, area safety, or transportation networks, VMS collects, organizes, and stores video data effectively and reliably. This software allows users to monitor live activities, access video footage remotely, and improve security operations. Making VMS most handy would be the fact that it can be integrated with other systems, like alarms, access controls, and sensors. Therefore, the preference for VMS as an appropriate choice by organizations around it in ensuring security works with huge volumes of content.

Many industries have switched to video management software because of its flexibility and easy use. Unlike legacy systems, current VMS can now be installed in-house or through cloud platforms, allowing the user to pick the application that best suits his needs and budget. It can easily scale, so both SMEs and large corporations take advantage of it. Another advantage of this was that it supports HD and 4K video, thus making better identification of details when using review footage. Furthermore, features such as motion detection, video analytics, and AI-based alerts enhance VMS intelligence and effectiveness compared to traditional video systems.

Milestone Systems, Hanwha Techwin Co., Avigilon, Axis Communications, Honeywell Security, Bosch Security Systems, Axxonsoft, eInfochips, Verkada, Salient Systems, Cisco Systems, NEC Corporation, Tyco Integrated Security, 3xLOGIC, Indigovision, Verint Systems, Camcloud, and Pelco are some of the key players operating in the Video Management Software industry. These companies focus on developing software solutions that can cater to modern technology and the increasing need for efficient surveillance and improve the way security is handled, ultimately ensuring an easier response to incidents in business enterprises and governments.

As safety worries increase, the idea of using a VMS will likely become the norm. It reduces human error, enhances awareness, and serves detailed records for review when needed. The VMS market will flourish as every day more people and organizations understand the importance of recording events through video. With the active players continuous improvement and feature addition, video management software can expect even larger roles in the modern security strategy.

Video Management Software Market Key Segments:

By Solution

- Video Intelligence/Analytics

- Navigation Management

- Case Management

By Deployment Mode

- On-Premises

- Cloud-Based

By Technology

- Analog Based Video Management Software

- IP Based Video Management Software

By Vertical

- Banking

- Financial Services and Insurance (BFSI)

- Government

- Healthcare and Life Sciences

- Manufacturing and Automotive

- Retail

- Transportation and Logistics

- Media and Entertainment

- Others

Key Global Video Management Software Industry Players

- Milestone Systems

- Hanwha Techwin Co

- Avigilon (a Motorola Solutions company)

- Axis Communications

- Honeywell Security

- Bosch Security Systems

- Axxonsoft

- eInfochips

- Verkada

- Salient Systems

- Cisco Systems

- NEC Corporation

- Tyco Integrated Security

- 3xLOGIC

- Indigovision

- Verint Systems

- Camcloud

- Pelco

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383