Global Digital Advertising Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global digital advertising market grew from a isolated set of early web banners to one of the most dominant forces in today's communication. Its timeline began in the mid-1990s when the first clickable web ad went onto the internet, a quiet but revolutionizing moment in ad history. Early days saw advertisers merely acclimatizing to the potential of the web, a world where consumer attention seemed to work in ways entirely disconnected from traditional media. With the spread of internet penetration across homes and offices, marketers discovered that online media offered not just visibility but measurable interaction something that television and print could never offer.

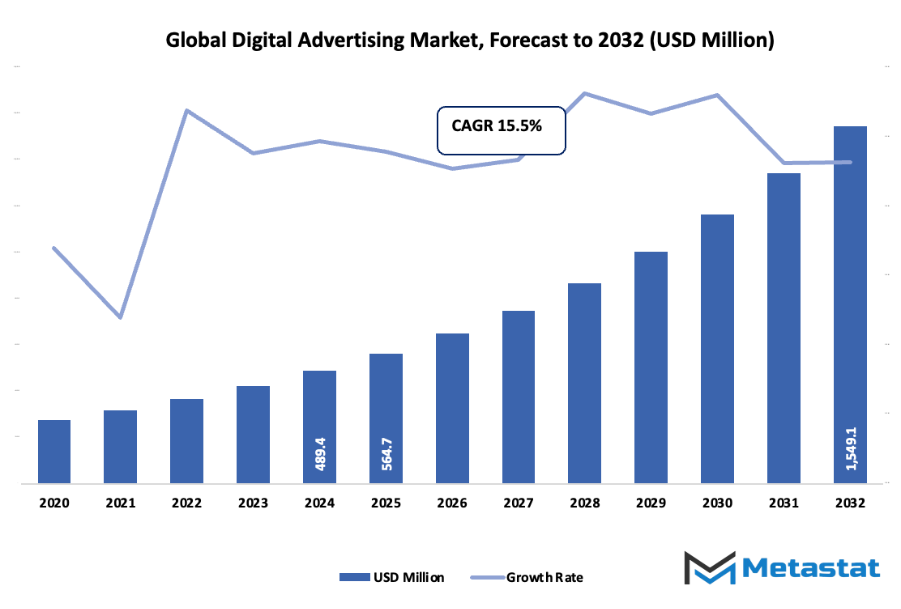

- Global digital advertising market size of approximately USD 564.7 million in 2025 at a CAGR of roughly 15.5% over the forecast period 2032 and has the potential to grow beyond USD 1549.1 million.

- Computer occupy approximately 26.2% market share and are instrumental in the task of innovation and driving applications with large-scale research.

- Major trends driving growth: Increase in internet penetration, Mobile advertisement trend

- Opportunities are: Personalized advertising

- Key takeaway: The industry will grow exponentially in worth over the coming decade, with immense growth potential.

- The early 2000s brought us search advertising, a game-changer that revolutionized the way brands interacted with intentful audiences.

Google's AdWords system pushed the emphasis from static display ads to dynamic keyword-targeted campaigns. Social media followed, recasting engagement again. Sites such as Facebook and YouTube introduced behavior-driven targeting, whereby history of browsing, interests, and location determined where ads were posted with unquestioning precision. This was a revolution from mass reach to story-targeting. Cellular technology brought another sea change. As phones became appendages of human activity, ads followed consumers into every pocket and palm. Video, influencer collaborations, and programmatic automation then re rewrote the scene again, blurring the line between entertainment and advertising.

All of these changes signaled a fundamental change in consumer expectations consumers no longer tolerated intrusive or irrelevant messaging; they demanded authenticity, imagination, and value. Over the last few years, there were privacy laws such as GDPR and data openness legislations that began questioning how advertisers operated. It caused businesses to reevaluate data ethics and develop new methods of keeping personalization and user consent in balance.

The global digital advertising market in the future will continue to change against advances in artificial intelligence, immersive media, and decentralized technology. Its transformation from banner ads to algorithmic stories is not so much a representation of an industry adapting but an on-going negotiation between innovation, human behavior, and ethical responsibility that will shape its future account.

Market Segments

The global digital advertising market is mainly classified based on Platform, Format, Offering, Type.

By Platform is further segmented into:

- Computer: The computer component of the global digital advertising market continues to be an important vehicle for online promotions. People using desktops and laptops like to engage with rich ads and longer content formats, thus making the platform ideal for rich product promotions. Marketers use cookies and browsing history to develop targeted adverts that match particular user interests.

- Smartphone: The smartphone market has become one of the most potent drivers of the market. The mobile phone allows businesses to engage customers in real time through apps, social networks, and search engines. Broader usage of mobile internet and location-based targeting allows advertisers to craft targeted campaigns, driving engagement and conversion rates.

- Other devices such as tablets, smart TVs, and wearables are also a part of the market. They provide access to other channels of delivering ads to consumers in a way that is engaging and visually enticing. As technology keeps advancing, the exposure and impact of advertising on such devices will keep increasing further.

By Format the market is divided into:

- Text: Text advertising in the global digital advertising market focuses on written promotional messages that appear on search engines and websites. These short and direct ads aim to attract attention through relevant keywords. Text ads remain cost-effective and allow businesses to reach potential customers actively searching for related products or services.

- Image: Image advertising uses visual elements to grab attention and communicate messages quickly within the market. Advertisers use attractive graphics, product photos, and brand visuals to influence customer decisions. Visual ads are highly effective in creating brand recall and delivering a message in a short time frame.

- Video: Video advertising has become one of the most engaging formats in the market. Through creative storytelling and visuals, brands connect with viewers emotionally and deliver detailed information in an appealing way. Platforms like YouTube and social media have made video content an essential tool for marketers.

- Others: Other ad formats, including audio and interactive content, are gaining recognition within the market. These formats allow for unique engagement by combining creativity with audience participation. As innovation continues, these alternative advertising forms will help brands maintain attention and stand out in crowded markets.

By Offering the market is further divided into:

- Solution: The solution segment in the global digital advertising market includes tools, platforms, and software that help businesses plan and manage campaigns. These solutions support functions such as data analytics, automation, and performance tracking. Companies rely on these technologies to improve accuracy, optimize spending, and achieve measurable marketing results.

- Services: The services segment of the market provides expert guidance and campaign management for businesses. Agencies and specialists handle creative design, strategy building, and performance evaluation. These services ensure that advertising efforts align with brand goals and reach the target audience efficiently across different platforms.

By Type the global digital advertising market is divided as:

- Search Advertising: Search advertising in the global digital advertising market helps brands appear in search results when users look for related products or services. This form of advertising focuses on keywords to ensure visibility and relevance. Businesses benefit from high-intent audiences who are actively searching for what they offer.

- Banner Advertising: Banner advertising uses graphical ads displayed on websites and apps to attract user attention. Within the market, banners remain popular for brand awareness and product visibility. Well-designed banners with appealing visuals encourage users to click through to company websites or promotional pages.

- Video Advertising: Video advertising plays a crucial role in driving engagement within the market. By combining motion, sound, and storytelling, brands deliver impactful messages that capture audience interest. This format is highly effective in improving brand perception and generating stronger emotional connections with consumers.

- Social Media Advertising: Social media advertising has transformed the market by allowing businesses to connect directly with target audiences. Platforms such as Facebook, Instagram, and LinkedIn provide advanced targeting options. This enables brands to reach users based on interests, demographics, and behaviour, improving campaign performance and awareness.

- Native Advertising: Native advertising in the market integrates promotional content naturally within the platform it appears on. It matches the look and feel of the surrounding content, making it less intrusive. This approach enhances user experience and improves the chances of audience engagement with the message.

- Interstitial Advertising: Interstitial advertising refers to full-screen ads that appear between content transitions, such as between app screens or website pages. In the global digital advertising market, this type of ad effectively captures attention due to its prominent placement. However, successful execution depends on maintaining balance to avoid disrupting user experience.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$564.7 Million |

|

Market Size by 2032 |

$1549.1 Million |

|

Growth Rate from 2025 to 2032 |

15.5% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

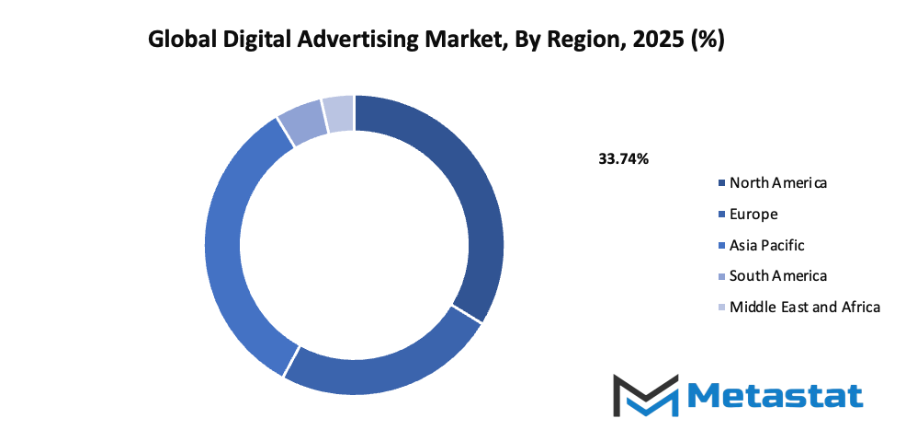

By Region:

- Based on geography, the global digital advertising market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Increasing internet penetration: The steady growth of internet users across the world directly influences the global digital advertising market. Affordable data plans and improved connectivity in both urban and rural areas allow brands to target broader audiences. This growing accessibility encourages more businesses to invest in digital promotions, driving consistent market expansion and engagement.

- Shift towards mobile advertising: A significant part of the market is now focused on mobile advertising. The wide use of smartphones has shifted consumer attention to mobile screens. Businesses prefer mobile-friendly ads, social media marketing, and app-based promotions to reach users instantly. This shift increases brand visibility and strengthens customer interaction.

Challenges and Opportunities

- Ad blocking technologies: Ad blocking tools present a major challenge to the global digital advertising market. Many users install software that removes or hides advertisements, reducing the effectiveness of campaigns. This issue pushes companies to develop more engaging and less intrusive ad formats, ensuring that marketing efforts continue to reach the intended audience successfully.

- Privacy concerns and regulatory restrictions: Privacy issues and data protection laws greatly affect the market. Stricter regulations demand better handling of personal information and transparent marketing practices. Businesses must comply with legal requirements while maintaining consumer trust. Adapting strategies to meet privacy expectations ensures ethical and sustainable growth within digital advertising spaces.

Opportunities

- Personalized advertising: Personalized advertising is a strong opportunity within the market. By analyzing user data, businesses can create targeted messages that match specific interests and behaviours. Customized content increases relevance and user response, building stronger connections between brands and audiences while improving the overall efficiency of marketing campaigns.

Competitive Landscape & Strategic Insights

The global digital advertising market is rapidly transforming into one of the most dynamic sectors in the modern economy. This transformation is being driven by technological progress, data-driven strategies, and the continuous shift toward online platforms. The industry is a mix of both international industry leaders and emerging regional competitors, creating a highly competitive and innovative environment. Major participants such as Google, Meta, Amazon, Microsoft Advertising, Verizon Media, X Corp. (Twitter), AOL (Yahoo), Pinterest, Baidu, ByteDance, Adobe Advertising Cloud, Taboola, Outbrain, The Trade Desk, MediaMath, Dentsu Inc., Disruptive Advertising, Tencent Holdings Ltd., WebFX, Silverback Strategies, and Perfect Search Media have shaped much of the market through advanced technologies and strategic innovation.

The expansion of digital platforms has redefined how businesses interact with audiences, making personalized advertising more precise and measurable. Companies now focus on understanding consumer behaviour through artificial intelligence, big data, and machine learning. These tools are helping advertisers deliver relevant messages to users across devices, creating seamless and engaging experiences. With the growing adoption of smart technologies, the future of advertising will likely be built around predictive analytics, automation, and augmented reality-based campaigns. These innovations are expected to help brands reach customers more efficiently while maintaining transparency and trust.

In the years ahead, competition among leading corporations and regional players will intensify as newer technologies reshape marketing models. Google and Meta will continue to dominate due to their vast user bases and data resources, while companies like ByteDance and Tencent Holdings Ltd. will influence the industry through short-form video and social media advertising. Meanwhile, emerging players such as WebFX and Silverback Strategies will strengthen their presence by offering creative, performance-driven approaches that appeal to small and medium enterprises.

The focus of future digital advertising will not only be on reaching a global audience but also on maintaining relevance through responsible data use and user privacy. Governments and regulators across regions are implementing stricter data protection laws, pushing companies to find ethical ways to target consumers. This shift will lead to a more transparent advertising environment where trust and authenticity are central to long-term success.

Artificial intelligence will play a vital role in optimizing marketing budgets and predicting campaign outcomes. Voice search, visual advertising, and immersive experiences will become central strategies. As the digital landscape continues to evolve, partnerships among advertising platforms, analytics providers, and technology companies will become more common. These collaborations will help in sharing expertise, expanding global reach, and introducing innovative ad formats tailored to new digital spaces such as virtual reality and connected devices.

Market size is forecast to rise from USD 564.7 million in 2025 to over USD 1549.1 million by 2032. Digital Advertising will maintain dominance but face growing competition from emerging formats.

Overall, the market is heading toward a more connected, intelligent, and responsible future. The combined efforts of established leaders and growing competitors will shape an industry that is flexible, data-driven, and highly responsive to technological shifts. As consumer expectations rise, the digital advertising sector will continue to reinvent itself to create more engaging, personalized, and meaningful interactions across the digital world.

Report Coverage

This research report categorizes the global digital advertising market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global digital advertising market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global digital advertising market.

Digital Advertising Market Key Segments:

By Platform

- Computer

- Smartphone

- Others

By Format

- Text

- Image

- Video

- Others

By Offering

- Solution

- Services

By Type

- Search Advertising

- Banner Advertising

- Video Advertising

- Social Media Advertising

- Native Advertising

- Interstitial Advertising

Key Global Digital Advertising Industry Players

- Meta

- Amazon

- Microsoft Advertising

- Verizon Media

- X Corp. (Twitter)

- AOL (Yahoo)

- Baidu

- ByteDance

- Adobe Advertising Cloud

- Taboola

- Outbrain

- The Trade Desk

- MediaMath

- Verizon Media

- Dentsu Inc.

- Disruptive Advertising

- Tencent Holdings Ltd.

- WebFX

- Silverback Strategies

- Perfect Search Media

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252